Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Liq Platino Santander

Liq Platino Santander

Cargado por

joel.sal9603Descripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Liq Platino Santander

Liq Platino Santander

Cargado por

joel.sal9603Copyright:

Formatos disponibles

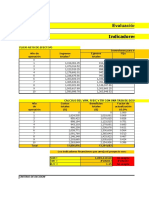

SIMULADOR CREDITO HIPOTECARIO HIPOTECA SANTANDER 8 de marzo de 2024

Regresar Imprimir

Hoja 2/2

1. Datos del Solicitante

Nombre del cliente

Atendido por Teléfono

Su crédito se amortizará en 20 años

CAT Promedio 10.1% Sin IVA Informativo

Calculado al 08 mar 2024 .Para fines informativos y de comparación. Efecto en Pagos anticipados

Tabla liquidez

Pagos Anticipados

Tasa de Interés Saldo al Final del

Periodo Intereses Amortización Pago de Crédito Seguro Vida IVA de intereses Pago Total Selecciona efecto y

Anual Ordinaria Periodo

captura Monto

1,850,000.00

1 9.30% 14,337.50 2,666.03 17,003.53 953.49 2,294.00 20,251.02 1,847,333.97

2 9.30% 14,316.84 2,686.69 17,003.53 952.12 2,290.69 20,246.34 1,844,647.27

3 9.30% 14,296.02 2,707.52 17,003.53 950.73 2,287.36 20,241.63 1,841,939.76

4 9.30% 14,275.03 2,728.50 17,003.53 949.34 2,284.01 20,236.87 1,839,211.26

5 9.30% 14,253.89 2,749.65 17,003.53 947.93 2,280.62 20,232.08 1,836,461.61

6 9.30% 14,232.58 2,770.96 17,003.53 946.51 2,277.21 20,227.26 1,833,690.65

7 9.30% 14,211.10 2,792.43 17,003.53 945.08 2,273.78 20,222.39 1,830,898.22

8 9.30% 14,189.46 2,814.07 17,003.53 943.64 2,270.31 20,217.49 1,828,084.15

9 9.30% 14,167.65 2,835.88 17,003.53 942.19 2,266.82 20,212.55 1,825,248.27

10 9.30% 14,145.67 2,857.86 17,003.53 940.73 2,263.31 20,207.57 1,822,390.41

11 9.30% 14,123.53 2,880.01 17,003.53 939.26 2,259.76 20,202.56 1,819,510.40

12 9.30% 14,101.21 2,902.33 17,003.53 937.78 2,256.19 20,197.50 1,816,608.08

13 9.30% 14,078.71 2,924.82 17,003.53 936.28 2,252.59 20,192.41 1,813,683.26

14 9.30% 14,056.05 2,947.49 17,003.53 934.77 2,248.97 20,187.27 1,810,735.77

15 9.30% 14,033.20 2,970.33 17,003.53 933.25 2,245.31 20,182.10 1,807,765.44

16 9.30% 14,010.18 2,993.35 17,003.53 931.72 2,241.63 20,176.88 1,804,772.09

17 9.30% 13,986.98 3,016.55 17,003.53 930.18 2,237.92 20,171.63 1,801,755.54

18 9.30% 13,963.61 3,039.93 17,003.53 928.62 2,234.18 20,166.33 1,798,715.61

19 9.30% 13,940.05 3,063.49 17,003.53 927.06 2,230.41 20,161.00 1,795,652.12

20 9.30% 13,916.30 3,087.23 17,003.53 925.48 2,226.61 20,155.62 1,792,564.89

21 9.30% 13,892.38 3,111.16 17,003.53 923.89 2,222.78 20,150.20 1,789,453.74

22 9.30% 13,868.27 3,135.27 17,003.53 922.28 2,218.92 20,144.74 1,786,318.47

23 9.30% 13,843.97 3,159.56 17,003.53 920.67 2,215.03 20,139.24 1,783,158.91

24 9.30% 13,819.48 3,184.05 17,003.53 919.04 2,211.12 20,133.69 1,779,974.86

25 9.30% 13,794.81 3,208.73 17,003.53 917.40 2,207.17 20,128.10 1,776,766.13

26 9.30% 13,769.94 3,233.60 17,003.53 915.75 2,203.19 20,122.47 1,773,532.53

27 9.30% 13,744.88 3,258.66 17,003.53 914.08 2,199.18 20,116.79 1,770,273.88

28 9.30% 13,719.62 3,283.91 17,003.53 912.40 2,195.14 20,111.07 1,766,989.97

29 9.30% 13,694.17 3,309.36 17,003.53 910.71 2,191.07 20,105.31 1,763,680.60

30 9.30% 13,668.52 3,335.01 17,003.53 909.00 2,186.96 20,099.50 1,760,345.60

31 9.30% 13,642.68 3,360.85 17,003.53 907.28 2,182.83 20,093.64 1,756,984.74

32 9.30% 13,616.63 3,386.90 17,003.53 905.55 2,178.66 20,087.74 1,753,597.84

33 9.30% 13,590.38 3,413.15 17,003.53 903.80 2,174.46 20,081.80 1,750,184.69

34 9.30% 13,563.93 3,439.60 17,003.53 902.05 2,170.23 20,075.81 1,746,745.09

35 9.30% 13,537.27 3,466.26 17,003.53 900.27 2,165.96 20,069.77 1,743,278.83

36 9.30% 13,510.41 3,493.12 17,003.53 898.49 2,161.67 20,063.68 1,739,785.71

37 9.30% 13,483.34 3,520.19 17,003.53 896.69 2,157.33 20,057.55 1,736,265.51

38 9.30% 13,456.06 3,547.48 17,003.53 894.87 2,152.97 20,051.37 1,732,718.04

39 9.30% 13,428.56 3,574.97 17,003.53 893.04 2,148.57 20,045.15 1,729,143.07

40 9.30% 13,400.86 3,602.67 17,003.53 891.20 2,144.14 20,038.87 1,725,540.40

41 9.30% 13,372.94 3,630.60 17,003.53 889.34 2,139.67 20,032.55 1,721,909.80

Pagos Anticipados

Tasa de Interés Saldo al Final del

Periodo Intereses Amortización Pago de Crédito Seguro Vida IVA de intereses Pago Total Selecciona efecto y

Anual Ordinaria Periodo

captura Monto

42 9.30% 13,344.80 3,658.73 17,003.53 887.47 2,135.17 20,026.17 1,718,251.07

43 9.30% 13,316.45 3,687.09 17,003.53 885.59 2,130.63 20,019.75 1,714,563.98

44 9.30% 13,287.87 3,715.66 17,003.53 883.69 2,126.06 20,013.28 1,710,848.32

45 9.30% 13,259.07 3,744.46 17,003.53 881.77 2,121.45 20,006.76 1,707,103.86

46 9.30% 13,230.05 3,773.48 17,003.53 879.84 2,116.81 20,000.18 1,703,330.38

47 9.30% 13,200.81 3,802.72 17,003.53 877.90 2,112.13 19,993.56 1,699,527.66

48 9.30% 13,171.34 3,832.19 17,003.53 875.94 2,107.41 19,986.88 1,695,695.47

49 9.30% 13,141.64 3,861.89 17,003.53 873.96 2,102.66 19,980.16 1,691,833.57

50 9.30% 13,111.71 3,891.82 17,003.53 871.97 2,097.87 19,973.38 1,687,941.75

51 9.30% 13,081.55 3,921.98 17,003.53 869.97 2,093.05 19,966.55 1,684,019.77

52 9.30% 13,051.15 3,952.38 17,003.53 867.94 2,088.18 19,959.66 1,680,067.39

53 9.30% 13,020.52 3,983.01 17,003.53 865.91 2,083.28 19,952.72 1,676,084.38

54 9.30% 12,989.65 4,013.88 17,003.53 863.85 2,078.34 19,945.73 1,672,070.50

55 9.30% 12,958.55 4,044.99 17,003.53 861.79 2,073.37 19,938.69 1,668,025.51

56 9.30% 12,927.20 4,076.34 17,003.53 859.70 2,068.35 19,931.59 1,663,949.17

57 9.30% 12,895.61 4,107.93 17,003.53 857.60 2,063.30 19,924.43 1,659,841.25

58 9.30% 12,863.77 4,139.76 17,003.53 855.48 2,058.20 19,917.22 1,655,701.48

59 9.30% 12,831.69 4,171.85 17,003.53 853.35 2,053.07 19,909.95 1,651,529.64

60 9.30% 12,799.35 4,204.18 17,003.53 851.20 2,047.90 19,902.63 1,647,325.46

61 9.30% 12,766.77 4,236.76 17,003.53 849.03 2,042.68 19,895.25 1,643,088.70

62 9.30% 12,733.94 4,269.60 17,003.53 846.85 2,037.43 19,887.81 1,638,819.10

63 9.30% 12,700.85 4,302.69 17,003.53 844.65 2,032.14 19,880.32 1,634,516.42

64 9.30% 12,667.50 4,336.03 17,003.53 842.43 2,026.80 19,872.76 1,630,180.39

65 9.30% 12,633.90 4,369.64 17,003.53 840.19 2,021.42 19,865.15 1,625,810.75

66 9.30% 12,600.03 4,403.50 17,003.53 837.94 2,016.01 19,857.48 1,621,407.25

67 9.30% 12,565.91 4,437.63 17,003.53 835.67 2,010.54 19,849.75 1,616,969.62

68 9.30% 12,531.51 4,472.02 17,003.53 833.39 2,005.04 19,841.96 1,612,497.61

69 9.30% 12,496.86 4,506.68 17,003.53 831.08 1,999.50 19,834.11 1,607,990.93

70 9.30% 12,461.93 4,541.60 17,003.53 828.76 1,993.91 19,826.20 1,603,449.33

71 9.30% 12,426.73 4,576.80 17,003.53 826.42 1,988.28 19,818.23 1,598,872.53

72 9.30% 12,391.26 4,612.27 17,003.53 824.06 1,982.60 19,810.19 1,594,260.25

73 9.30% 12,355.52 4,648.02 17,003.53 821.68 1,976.88 19,802.10 1,589,612.24

74 9.30% 12,319.49 4,684.04 17,003.53 819.29 1,971.12 19,793.94 1,584,928.20

75 9.30% 12,283.19 4,720.34 17,003.53 816.87 1,965.31 19,785.72 1,580,207.86

76 9.30% 12,246.61 4,756.92 17,003.53 814.44 1,959.46 19,777.43 1,575,450.94

77 9.30% 12,209.74 4,793.79 17,003.53 811.99 1,953.56 19,769.08 1,570,657.15

78 9.30% 12,172.59 4,830.94 17,003.53 809.52 1,947.61 19,760.66 1,565,826.21

79 9.30% 12,135.15 4,868.38 17,003.53 807.03 1,941.62 19,752.18 1,560,957.83

80 9.30% 12,097.42 4,906.11 17,003.53 804.52 1,935.59 19,743.64 1,556,051.72

81 9.30% 12,059.40 4,944.13 17,003.53 801.99 1,929.50 19,735.03 1,551,107.59

82 9.30% 12,021.08 4,982.45 17,003.53 799.44 1,923.37 19,726.35 1,546,125.14

83 9.30% 11,982.47 5,021.06 17,003.53 796.87 1,917.20 19,717.60 1,541,104.08

84 9.30% 11,943.56 5,059.98 17,003.53 794.29 1,910.97 19,708.79 1,536,044.10

85 9.30% 11,904.34 5,099.19 17,003.53 791.68 1,904.69 19,699.90 1,530,944.91

86 9.30% 11,864.82 5,138.71 17,003.53 789.05 1,898.37 19,690.95 1,525,806.20

87 9.30% 11,825.00 5,178.54 17,003.53 786.40 1,892.00 19,681.93 1,520,627.66

88 9.30% 11,784.86 5,218.67 17,003.53 783.73 1,885.58 19,672.84 1,515,408.99

89 9.30% 11,744.42 5,259.11 17,003.53 781.04 1,879.11 19,663.68 1,510,149.88

90 9.30% 11,703.66 5,299.87 17,003.53 778.33 1,872.59 19,654.45 1,504,850.01

91 9.30% 11,662.59 5,340.95 17,003.53 775.60 1,866.01 19,645.15 1,499,509.06

92 9.30% 11,621.20 5,382.34 17,003.53 772.85 1,859.39 19,635.77 1,494,126.73

93 9.30% 11,579.48 5,424.05 17,003.53 770.07 1,852.72 19,626.32 1,488,702.67

94 9.30% 11,537.45 5,466.09 17,003.53 767.28 1,845.99 19,616.80 1,483,236.59

95 9.30% 11,495.08 5,508.45 17,003.53 764.46 1,839.21 19,607.21 1,477,728.14

96 9.30% 11,452.39 5,551.14 17,003.53 761.62 1,832.38 19,597.54 1,472,177.00

97 9.30% 11,409.37 5,594.16 17,003.53 758.76 1,825.50 19,587.79 1,466,582.84

98 9.30% 11,366.02 5,637.52 17,003.53 755.88 1,818.56 19,577.97 1,460,945.32

99 9.30% 11,322.33 5,681.21 17,003.53 752.97 1,811.57 19,568.08 1,455,264.11

100 9.30% 11,278.30 5,725.24 17,003.53 750.04 1,804.53 19,558.10 1,449,538.88

Pagos Anticipados

Tasa de Interés Saldo al Final del

Periodo Intereses Amortización Pago de Crédito Seguro Vida IVA de intereses Pago Total Selecciona efecto y

Anual Ordinaria Periodo

captura Monto

101 9.30% 11,233.93 5,769.61 17,003.53 747.09 1,797.43 19,548.05 1,443,769.27

102 9.30% 11,189.21 5,814.32 17,003.53 744.12 1,790.27 19,537.93 1,437,954.95

103 9.30% 11,144.15 5,859.38 17,003.53 741.12 1,783.06 19,527.72 1,432,095.57

104 9.30% 11,098.74 5,904.79 17,003.53 738.10 1,775.80 19,517.43 1,426,190.77

105 9.30% 11,052.98 5,950.55 17,003.53 735.06 1,768.48 19,507.07 1,420,240.22

106 9.30% 11,006.86 5,996.67 17,003.53 731.99 1,761.10 19,496.62 1,414,243.55

107 9.30% 10,960.39 6,043.15 17,003.53 728.90 1,753.66 19,486.10 1,408,200.40

108 9.30% 10,913.55 6,089.98 17,003.53 725.79 1,746.17 19,475.49 1,402,110.42

109 9.30% 10,866.36 6,137.18 17,003.53 722.65 1,738.62 19,464.80 1,395,973.25

110 9.30% 10,818.79 6,184.74 17,003.53 719.48 1,731.01 19,454.02 1,389,788.51

111 9.30% 10,770.86 6,232.67 17,003.53 716.30 1,723.34 19,443.17 1,383,555.83

112 9.30% 10,722.56 6,280.98 17,003.53 713.08 1,715.61 19,432.23 1,377,274.86

113 9.30% 10,673.88 6,329.65 17,003.53 709.85 1,707.82 19,421.20 1,370,945.20

114 9.30% 10,624.83 6,378.71 17,003.53 706.59 1,699.97 19,410.09 1,364,566.50

115 9.30% 10,575.39 6,428.14 17,003.53 703.30 1,692.06 19,398.89 1,358,138.35

116 9.30% 10,525.57 6,477.96 17,003.53 699.98 1,684.09 19,387.61 1,351,660.39

117 9.30% 10,475.37 6,528.17 17,003.53 696.65 1,676.06 19,376.24 1,345,132.23

118 9.30% 10,424.77 6,578.76 17,003.53 693.28 1,667.96 19,364.78 1,338,553.47

119 9.30% 10,373.79 6,629.74 17,003.53 689.89 1,659.81 19,353.23 1,331,923.73

120 9.30% 10,322.41 6,681.12 17,003.53 686.47 1,651.59 19,341.59 1,325,242.60

121 9.30% 10,270.63 6,732.90 17,003.53 683.03 1,643.30 19,329.86 1,318,509.70

122 9.30% 10,218.45 6,785.08 17,003.53 679.56 1,634.95 19,318.04 1,311,724.62

123 9.30% 10,165.87 6,837.67 17,003.53 676.06 1,626.54 19,306.13 1,304,886.95

124 9.30% 10,112.87 6,890.66 17,003.53 672.54 1,618.06 19,294.13 1,297,996.29

125 9.30% 10,059.47 6,944.06 17,003.53 668.99 1,609.52 19,282.04 1,291,052.23

126 9.30% 10,005.65 6,997.88 17,003.53 665.41 1,600.90 19,269.85 1,284,054.35

127 9.30% 9,951.42 7,052.11 17,003.53 661.80 1,592.23 19,257.56 1,277,002.24

128 9.30% 9,896.77 7,106.77 17,003.53 658.17 1,583.48 19,245.18 1,269,895.47

129 9.30% 9,841.69 7,161.84 17,003.53 654.50 1,574.67 19,232.71 1,262,733.63

130 9.30% 9,786.19 7,217.35 17,003.53 650.81 1,565.79 19,220.14 1,255,516.28

131 9.30% 9,730.25 7,273.28 17,003.53 647.09 1,556.84 19,207.47 1,248,243.00

132 9.30% 9,673.88 7,329.65 17,003.53 643.34 1,547.82 19,194.70 1,240,913.35

133 9.30% 9,617.08 7,386.45 17,003.53 639.57 1,538.73 19,181.83 1,233,526.90

134 9.30% 9,559.83 7,443.70 17,003.53 635.76 1,529.57 19,168.87 1,226,083.20

135 9.30% 9,502.14 7,501.39 17,003.53 631.92 1,520.34 19,155.80 1,218,581.81

136 9.30% 9,444.01 7,559.52 17,003.53 628.06 1,511.04 19,142.63 1,211,022.28

137 9.30% 9,385.42 7,618.11 17,003.53 624.16 1,501.67 19,129.36 1,203,404.17

138 9.30% 9,326.38 7,677.15 17,003.53 620.23 1,492.22 19,115.99 1,195,727.02

139 9.30% 9,266.88 7,736.65 17,003.53 616.28 1,482.70 19,102.51 1,187,990.37

140 9.30% 9,206.93 7,796.61 17,003.53 612.29 1,473.11 19,088.93 1,180,193.77

141 9.30% 9,146.50 7,857.03 17,003.53 608.27 1,463.44 19,075.25 1,172,336.73

142 9.30% 9,085.61 7,917.92 17,003.53 604.22 1,453.70 19,061.45 1,164,418.81

143 9.30% 9,024.25 7,979.29 17,003.53 600.14 1,443.88 19,047.55 1,156,439.52

144 9.30% 8,962.41 8,041.13 17,003.53 596.03 1,433.99 19,033.55 1,148,398.40

145 9.30% 8,900.09 8,103.45 17,003.53 591.88 1,424.01 19,019.43 1,140,294.95

146 9.30% 8,837.29 8,166.25 17,003.53 587.71 1,413.97 19,005.21 1,132,128.70

147 9.30% 8,774.00 8,229.54 17,003.53 583.50 1,403.84 18,990.87 1,123,899.17

148 9.30% 8,710.22 8,293.31 17,003.53 579.26 1,393.63 18,976.43 1,115,605.85

149 9.30% 8,645.95 8,357.59 17,003.53 574.98 1,383.35 18,961.87 1,107,248.27

150 9.30% 8,581.17 8,422.36 17,003.53 570.68 1,372.99 18,947.20 1,098,825.91

151 9.30% 8,515.90 8,487.63 17,003.53 566.33 1,362.54 18,932.41 1,090,338.28

152 9.30% 8,450.12 8,553.41 17,003.53 561.96 1,352.02 18,917.51 1,081,784.86

153 9.30% 8,383.83 8,619.70 17,003.53 557.55 1,341.41 18,902.50 1,073,165.16

154 9.30% 8,317.03 8,686.50 17,003.53 553.11 1,330.72 18,887.37 1,064,478.66

155 9.30% 8,249.71 8,753.82 17,003.53 548.63 1,319.95 18,872.12 1,055,724.84

156 9.30% 8,181.87 8,821.67 17,003.53 544.12 1,309.10 18,856.75 1,046,903.17

157 9.30% 8,113.50 8,890.03 17,003.53 539.57 1,298.16 18,841.27 1,038,013.14

158 9.30% 8,044.60 8,958.93 17,003.53 534.99 1,287.14 18,825.66 1,029,054.21

159 9.30% 7,975.17 9,028.36 17,003.53 530.37 1,276.03 18,809.93 1,020,025.84

Pagos Anticipados

Tasa de Interés Saldo al Final del

Periodo Intereses Amortización Pago de Crédito Seguro Vida IVA de intereses Pago Total Selecciona efecto y

Anual Ordinaria Periodo

captura Monto

160 9.30% 7,905.20 9,098.33 17,003.53 525.72 1,264.83 18,794.09 1,010,927.51

161 9.30% 7,834.69 9,168.84 17,003.53 521.03 1,253.55 18,778.12 1,001,758.67

162 9.30% 7,763.63 9,239.90 17,003.53 516.31 1,242.18 18,762.02 992,518.76

163 9.30% 7,692.02 9,311.51 17,003.53 511.54 1,230.72 18,745.80 983,207.25

164 9.30% 7,619.86 9,383.68 17,003.53 506.75 1,219.18 18,729.46 973,823.57

165 9.30% 7,547.13 9,456.40 17,003.53 501.91 1,207.54 18,712.98 964,367.17

166 9.30% 7,473.85 9,529.69 17,003.53 497.03 1,195.82 18,696.38 954,837.49

167 9.30% 7,399.99 9,603.54 17,003.53 492.12 1,184.00 18,679.65 945,233.94

168 9.30% 7,325.56 9,677.97 17,003.53 487.17 1,172.09 18,662.80 935,555.97

169 9.30% 7,250.56 9,752.97 17,003.53 482.19 1,160.09 18,645.81 925,803.00

170 9.30% 7,174.97 9,828.56 17,003.53 477.16 1,148.00 18,628.69 915,974.44

171 9.30% 7,098.80 9,904.73 17,003.53 472.09 1,135.81 18,611.43 906,069.71

172 9.30% 7,022.04 9,981.49 17,003.53 466.99 1,123.53 18,594.05 896,088.21

173 9.30% 6,944.68 10,058.85 17,003.53 461.84 1,111.15 18,576.53 886,029.37

174 9.30% 6,866.73 10,136.81 17,003.53 456.66 1,098.68 18,558.87 875,892.56

175 9.30% 6,788.17 10,215.37 17,003.53 451.44 1,086.11 18,541.07 865,677.19

176 9.30% 6,709.00 10,294.53 17,003.53 446.17 1,073.44 18,523.14 855,382.66

177 9.30% 6,629.22 10,374.32 17,003.53 440.86 1,060.67 18,505.07 845,008.34

178 9.30% 6,548.81 10,454.72 17,003.53 435.52 1,047.81 18,486.86 834,553.62

179 9.30% 6,467.79 10,535.74 17,003.53 430.13 1,034.85 18,468.51 824,017.88

180 9.30% 6,386.14 10,617.39 17,003.53 424.70 1,021.78 18,450.01 813,400.49

181 9.30% 6,303.85 10,699.68 17,003.53 419.23 1,008.62 18,431.38 802,700.81

182 9.30% 6,220.93 10,782.60 17,003.53 413.71 995.35 18,412.59 791,918.21

183 9.30% 6,137.37 10,866.17 17,003.53 408.15 981.98 18,393.67 781,052.04

184 9.30% 6,053.15 10,950.38 17,003.53 402.55 968.50 18,374.59 770,101.66

185 9.30% 5,968.29 11,035.25 17,003.53 396.91 954.93 18,355.37 759,066.41

186 9.30% 5,882.76 11,120.77 17,003.53 391.22 941.24 18,336.00 747,945.64

187 9.30% 5,796.58 11,206.95 17,003.53 385.49 927.45 18,316.48 736,738.69

188 9.30% 5,709.72 11,293.81 17,003.53 379.72 913.56 18,296.80 725,444.88

189 9.30% 5,622.20 11,381.34 17,003.53 373.89 899.55 18,276.98 714,063.55

190 9.30% 5,533.99 11,469.54 17,003.53 368.03 885.44 18,257.00 702,594.01

191 9.30% 5,445.10 11,558.43 17,003.53 362.12 871.22 18,236.87 691,035.58

192 9.30% 5,355.53 11,648.01 17,003.53 356.16 856.88 18,216.58 679,387.57

193 9.30% 5,265.25 11,738.28 17,003.53 350.16 842.44 18,196.13 667,649.29

194 9.30% 5,174.28 11,829.25 17,003.53 344.11 827.89 18,175.52 655,820.04

195 9.30% 5,082.61 11,920.93 17,003.53 338.01 813.22 18,154.76 643,899.11

196 9.30% 4,990.22 12,013.31 17,003.53 331.87 798.43 18,133.83 631,885.80

197 9.30% 4,897.11 12,106.42 17,003.53 325.67 783.54 18,112.75 619,779.38

198 9.30% 4,803.29 12,200.24 17,003.53 319.43 768.53 18,091.49 607,579.14

199 9.30% 4,708.74 12,294.79 17,003.53 313.15 753.40 18,070.08 595,284.34

200 9.30% 4,613.45 12,390.08 17,003.53 306.81 738.15 18,048.50 582,894.26

201 9.30% 4,517.43 12,486.10 17,003.53 300.42 722.79 18,026.75 570,408.16

202 9.30% 4,420.66 12,582.87 17,003.53 293.99 707.31 18,004.83 557,825.29

203 9.30% 4,323.15 12,680.39 17,003.53 287.50 691.70 17,982.74 545,144.90

204 9.30% 4,224.87 12,778.66 17,003.53 280.97 675.98 17,960.48 532,366.24

205 9.30% 4,125.84 12,877.69 17,003.53 274.38 660.13 17,938.05 519,488.55

206 9.30% 4,026.04 12,977.50 17,003.53 267.74 644.17 17,915.44 506,511.05

207 9.30% 3,925.46 13,078.07 17,003.53 261.06 628.07 17,892.66 493,432.98

208 9.30% 3,824.11 13,179.43 17,003.53 254.32 611.86 17,869.71 480,253.55

209 9.30% 3,721.97 13,281.57 17,003.53 247.52 595.51 17,846.57 466,971.98

210 9.30% 3,619.03 13,384.50 17,003.53 240.68 579.05 17,823.26 453,587.48

211 9.30% 3,515.30 13,488.23 17,003.53 233.78 562.45 17,799.76 440,099.25

212 9.30% 3,410.77 13,592.76 17,003.53 226.83 545.72 17,776.08 426,506.49

213 9.30% 3,305.43 13,698.11 17,003.53 219.82 528.87 17,752.22 412,808.38

214 9.30% 3,199.26 13,804.27 17,003.53 212.76 511.88 17,728.18 399,004.11

215 9.30% 3,092.28 13,911.25 17,003.53 205.65 494.77 17,703.94 385,092.86

216 9.30% 2,984.47 14,019.06 17,003.53 198.48 477.52 17,679.53 371,073.80

217 9.30% 2,875.82 14,127.71 17,003.53 191.25 460.13 17,654.92 356,946.09

218 9.30% 2,766.33 14,237.20 17,003.53 183.97 442.61 17,630.12 342,708.89

Pagos Anticipados

Tasa de Interés Saldo al Final del

Periodo Intereses Amortización Pago de Crédito Seguro Vida IVA de intereses Pago Total Selecciona efecto y

Anual Ordinaria Periodo

captura Monto

219 9.30% 2,655.99 14,347.54 17,003.53 176.63 424.96 17,605.12 328,361.35

220 9.30% 2,544.80 14,458.73 17,003.53 169.24 407.17 17,579.94 313,902.61

221 9.30% 2,432.75 14,570.79 17,003.53 161.79 389.24 17,554.56 299,331.83

222 9.30% 2,319.82 14,683.71 17,003.53 154.28 371.17 17,528.98 284,648.11

223 9.30% 2,206.02 14,797.51 17,003.53 146.71 352.96 17,503.20 269,850.60

224 9.30% 2,091.34 14,912.19 17,003.53 139.08 334.61 17,477.23 254,938.41

225 9.30% 1,975.77 15,027.76 17,003.53 131.40 316.12 17,451.05 239,910.65

226 9.30% 1,859.31 15,144.23 17,003.53 123.65 297.49 17,424.67 224,766.43

227 9.30% 1,741.94 15,261.59 17,003.53 115.84 278.71 17,398.09 209,504.83

228 9.30% 1,623.66 15,379.87 17,003.53 107.98 259.79 17,371.30 194,124.96

229 9.30% 1,504.47 15,499.06 17,003.53 100.05 240.71 17,344.30 178,625.90

230 9.30% 1,384.35 15,619.18 17,003.53 92.06 221.50 17,317.09 163,006.72

231 9.30% 1,263.30 15,740.23 17,003.53 84.01 202.13 17,289.68 147,266.49

232 9.30% 1,141.32 15,862.22 17,003.53 75.90 182.61 17,262.04 131,404.27

233 9.30% 1,018.38 15,985.15 17,003.53 67.73 162.94 17,234.20 115,419.12

234 9.30% 894.50 16,109.03 17,003.53 59.49 143.12 17,206.14 99,310.08

235 9.30% 769.65 16,233.88 17,003.53 51.18 123.14 17,177.86 83,076.20

236 9.30% 643.84 16,359.69 17,003.53 42.82 103.01 17,149.37 66,716.51

237 9.30% 517.05 16,486.48 17,003.53 34.39 82.73 17,120.65 50,230.03

238 9.30% 389.28 16,614.25 17,003.53 25.89 62.29 17,091.71 33,615.78

239 9.30% 260.52 16,743.01 17,003.53 17.33 41.68 17,062.54 16,872.77

240 9.30% 130.76 16,872.77 17,003.53 8.70 20.92 17,033.15

TOTALES 2,230,847.94 1,850,000.00 4,080,847.94 148,358.58 356,935.67 4,586,142.19

ESTE DOCUMENTO NO ES UNA OFERTA VINCULANTE

Este documento es únicamente de carácter informativo y para fines ilustrativos por lo que no implica asunción de obligación ni compromiso por parte de Banco Santander México S.A., ni de Entidad alguna referida en el presente

documento, integrante o no del Grupo Financiero Santander México.

Las condiciones del producto, criterios de elegibilidad, planes, importes de beneficios y políticas de crédito que se refieren en el simulador están sujetas a cambio sin previo aviso.

La autorización del crédito es una facultad discrecional de la entidad emisora del producto de que se trate por lo que se reserva el derecho de otorgarla o negarla.

La entidad emisora del producto de que se trate, se reserva el derecho de solicitar información adicional y/o restringir parámetros de enganche, monto, plazo o tasa en función de las características específicas del solicitante y del

inmueble.

Los productos hipotecarios son emitidos por Banco Santander México, S.A., Institución de Banca Múltiple, Grupo Financiero Santander México

El cálculo en el Seguro de referencia es única y exclusivamente con fines informativos e ilustrativos. La calidad en la prestación de los servicios y responsabilidad en el otorgamiento de los mismos es responsabilidad directa de

Zúrich Santander Seguros México S.A. y/o de la aseguradora con la que contrate estos seguros.

NOTAS

* Los periodos para el cálculo de intereses se consideran de 30 días.

También podría gustarte

- Tablas y Tarifas ISR 2020Documento49 páginasTablas y Tarifas ISR 2020Dom DomAún no hay calificaciones

- Liquidacion de Mercancia ImportacionDocumento8 páginasLiquidacion de Mercancia ImportacionOrlando DiazAún no hay calificaciones

- Tablas y Tarifas ISR 2020Documento51 páginasTablas y Tarifas ISR 2020eduardoAún no hay calificaciones

- Liquidez ViviendaDocumento3 páginasLiquidez Viviendajoel.sal9603Aún no hay calificaciones

- Calculadora IsrDocumento5 páginasCalculadora IsrSerrano GuillermoAún no hay calificaciones

- Bon Research ActionDocumento1 páginaBon Research ActionCarlos VargasAún no hay calificaciones

- Tablas y Tarifas ISR 2019Documento51 páginasTablas y Tarifas ISR 2019Julz MtzAún no hay calificaciones

- Caso 2Documento9 páginasCaso 2Nataliia PajaAún no hay calificaciones

- Tablas y Tarifas ISR 2019Documento48 páginasTablas y Tarifas ISR 2019Jose CortesAún no hay calificaciones

- Tablas - Tarifas ISR 2019Documento49 páginasTablas - Tarifas ISR 2019Hugo DuranAún no hay calificaciones

- Calculo de Sueldos Enero 2020 Uma 84.49 123.22Documento6 páginasCalculo de Sueldos Enero 2020 Uma 84.49 123.22cpyanezyasociadosAún no hay calificaciones

- 02.valoracion de Empresas - flujOSDocumento12 páginas02.valoracion de Empresas - flujOSmiguel huillcamiza parejaAún no hay calificaciones

- 02.valoracion de Empresas - flujOS 1Documento6 páginas02.valoracion de Empresas - flujOS 1miguel huillcamiza parejaAún no hay calificaciones

- EXALMAR Ratios (Final)Documento12 páginasEXALMAR Ratios (Final)Alejandra FloresAún no hay calificaciones

- Tablas y Tarifas ISR 2022Documento48 páginasTablas y Tarifas ISR 2022Jorge Franco FAún no hay calificaciones

- Caso ZumikpDocumento3 páginasCaso Zumikpfelipe pumayallaAún no hay calificaciones

- ConvexidadDocumento5 páginasConvexidadRonal RomeroAún no hay calificaciones

- Resumen de Descuentos Consorcio BalsamoDocumento2 páginasResumen de Descuentos Consorcio BalsamoTalento Humano MLGAún no hay calificaciones

- Tablas y Tarifas ISR 2022 (Anexo 8 Versión Anticipada)Documento49 páginasTablas y Tarifas ISR 2022 (Anexo 8 Versión Anticipada)ANAAún no hay calificaciones

- Informe de Gastos Con Tabla DinamicaDocumento1 páginaInforme de Gastos Con Tabla DinamicaServicios Gerenciales Integrales C.A.Aún no hay calificaciones

- ESTADOS FINANCIEROS. - Sistema Clase.Documento15 páginasESTADOS FINANCIEROS. - Sistema Clase.roxan guzmanAún no hay calificaciones

- Calculo de Sueldos Enero 2020 Uma 84.49 Frontera 185.56Documento6 páginasCalculo de Sueldos Enero 2020 Uma 84.49 Frontera 185.56cpyanezyasociadosAún no hay calificaciones

- Papel de Trabajo - Katty - 2 - Declaración Provicional - 2022Documento49 páginasPapel de Trabajo - Katty - 2 - Declaración Provicional - 2022Aka RojaAún no hay calificaciones

- Calculo Isr Retenciones X Salarios 2021Documento5 páginasCalculo Isr Retenciones X Salarios 2021Gibran JalilAún no hay calificaciones

- Tabla Isr 23Documento4 páginasTabla Isr 23Gab CondeAún no hay calificaciones

- Copia de 06.cronograma Valorizado Cascajal InicioDocumento14 páginasCopia de 06.cronograma Valorizado Cascajal InicioAJ095Aún no hay calificaciones

- Ta4 - Molitalia S.ADocumento8 páginasTa4 - Molitalia S.AMili FloresAún no hay calificaciones

- TERPELDocumento16 páginasTERPELLaraAún no hay calificaciones

- Retencion Salarios 2023Documento5 páginasRetencion Salarios 2023Amor Intención PasiónAún no hay calificaciones

- 7.00 Practica de Flujo y Estados FinancierosDocumento37 páginas7.00 Practica de Flujo y Estados FinancierosShalon HCAún no hay calificaciones

- Cronograma Servicio Deuda FinanDocumento19 páginasCronograma Servicio Deuda FinanNatalia CastañosAún no hay calificaciones

- Trabajo Final GfaDocumento43 páginasTrabajo Final GfaPilar SilvaAún no hay calificaciones

- Carta de Compromiso de Póliza CarDocumento27 páginasCarta de Compromiso de Póliza CarIMel NcAún no hay calificaciones

- Tablas ISR 2018Documento46 páginasTablas ISR 2018Carlos FloresAún no hay calificaciones

- Interes Compuesto de CotpsDocumento3 páginasInteres Compuesto de CotpsClaudioAún no hay calificaciones

- Ejemplo VanDocumento12 páginasEjemplo VanPavlov Garcia MelgarejoAún no hay calificaciones

- Resolución Análisis Vertical y HorizontalDocumento8 páginasResolución Análisis Vertical y HorizontalJimmy SanchezAún no hay calificaciones

- Van y TirDocumento3 páginasVan y TirSair Granada GarzonAún no hay calificaciones

- 3.1) Tarifas Isr 2022Documento5 páginas3.1) Tarifas Isr 2022Alain RiveroAún no hay calificaciones

- Tarifa-Para-El-Calculo-Del-Impuesto-Correspondiente-Al-Ejercicio-23 2Documento1 páginaTarifa-Para-El-Calculo-Del-Impuesto-Correspondiente-Al-Ejercicio-23 2Jennifer RiveraAún no hay calificaciones

- Liq CotpsDocumento1 páginaLiq CotpsVETERINARIA ANIMAL CLINICAún no hay calificaciones

- Actividad 3 Sueldos y Salarios 2021Documento21 páginasActividad 3 Sueldos y Salarios 2021daniel rodriguezAún no hay calificaciones

- XXXXX Datos AnaliticosDocumento3 páginasXXXXX Datos AnaliticosErika Galicia GonzalezAún no hay calificaciones

- Tarea Analisis FinancieroDocumento6 páginasTarea Analisis Financierosandra ramirezAún no hay calificaciones

- Ejecución Presupuesto General de La NaciónDocumento1 páginaEjecución Presupuesto General de La NaciónChristian CardenasAún no hay calificaciones

- Tablas y Tarifas ISR 2022Documento37 páginasTablas y Tarifas ISR 2022Miguelina TorresAún no hay calificaciones

- Balance General 2019Documento9 páginasBalance General 2019Luis FortichAún no hay calificaciones

- Costos Educativos 2022 2023 Colegio San Jose BarranquillaDocumento2 páginasCostos Educativos 2022 2023 Colegio San Jose BarranquillaMery Ann Rojano CanchilaAún no hay calificaciones

- Trabajo Auditoria Detpa FurnitureDocumento13 páginasTrabajo Auditoria Detpa FurnitureMARIA DEL PILAR ROBLES LOPEZAún no hay calificaciones

- Tablas y Tarifas ISR 2017 (Anexo 8 RMF 2017)Documento47 páginasTablas y Tarifas ISR 2017 (Anexo 8 RMF 2017)Oscar CastroAún no hay calificaciones

- Tarifa Del ISR Mensual (Publicado en El DOF Del 12 de Enero de 2022)Documento4 páginasTarifa Del ISR Mensual (Publicado en El DOF Del 12 de Enero de 2022)Mai siuuuAún no hay calificaciones

- P2 Decisiones Inv - Lesmes MariaDocumento13 páginasP2 Decisiones Inv - Lesmes MariaNicolas MorenoAún no hay calificaciones

- Resultado de Las Cajas Municipales Abril 2023 - Equilibrium FinancieroDocumento77 páginasResultado de Las Cajas Municipales Abril 2023 - Equilibrium FinancieroEmilianoAún no hay calificaciones

- Tarea Isr SolucionDocumento45 páginasTarea Isr SolucionMIGUEL ANGEL SANTIAGO CERVANTESAún no hay calificaciones

- Tablas ISR 2023 Expide Tu Factura 1 - RemovedDocumento18 páginasTablas ISR 2023 Expide Tu Factura 1 - RemovedMonserrat KumulAún no hay calificaciones

- Tarifa para El Cálculo Del Impuesto Correspondiente Al Ejercicio 2023Documento3 páginasTarifa para El Cálculo Del Impuesto Correspondiente Al Ejercicio 2023Carla HernandezAún no hay calificaciones

- Juan PendientesDocumento14 páginasJuan PendientesJuan MontelongoAún no hay calificaciones

- Solucion 34Documento3 páginasSolucion 34Valeria CuriocaAún no hay calificaciones

- Tarea Modulo 5Documento13 páginasTarea Modulo 5andres arguetaAún no hay calificaciones

- Evaluación financiera de proyectos - 2da ediciónDe EverandEvaluación financiera de proyectos - 2da ediciónAún no hay calificaciones

- Plan Quincenal 12Documento8 páginasPlan Quincenal 12joel.sal9603Aún no hay calificaciones

- Boleta 2023 07 26Documento1 páginaBoleta 2023 07 26joel.sal9603Aún no hay calificaciones

- Flyer A5 Paseador de Perros Animado Rosa y VerdeDocumento3 páginasFlyer A5 Paseador de Perros Animado Rosa y Verdejoel.sal9603Aún no hay calificaciones

- Liquidez ViviendaDocumento3 páginasLiquidez Viviendajoel.sal9603Aún no hay calificaciones

- Presentacion Opciones OficinasDocumento7 páginasPresentacion Opciones Oficinasjoel.sal9603Aún no hay calificaciones

- CV Andrea I. Sánchez MartínezDocumento2 páginasCV Andrea I. Sánchez Martínezjoel.sal9603Aún no hay calificaciones

- Lona de 300 Por 60 DyoDocumento1 páginaLona de 300 Por 60 Dyojoel.sal9603Aún no hay calificaciones

- Lona 2por 1 Dobladillo y Ojillo Por FavorDocumento1 páginaLona 2por 1 Dobladillo y Ojillo Por Favorjoel.sal9603Aún no hay calificaciones

- Promoción y Merchadising - Definiciones y Desarrollo ALARCÓN ANTHONYDocumento6 páginasPromoción y Merchadising - Definiciones y Desarrollo ALARCÓN ANTHONYAnthonyAún no hay calificaciones

- Robinson Eduardo Suriel Santos - 100505480 SUPERIOR IIDocumento5 páginasRobinson Eduardo Suriel Santos - 100505480 SUPERIOR IIalvaro nuñezAún no hay calificaciones

- BCRP La Oferta CompetitivaDocumento3 páginasBCRP La Oferta CompetitivajuliomedranovhotmailAún no hay calificaciones

- Evidencia 5 Conceptos Marketing DigitalDocumento3 páginasEvidencia 5 Conceptos Marketing DigitaljohnarimAún no hay calificaciones

- ¿Cómo Ha Evolucionado La PublicidadDocumento3 páginas¿Cómo Ha Evolucionado La PublicidadJohnny AriasAún no hay calificaciones

- Ejercicio 2 Ecuación PatrimonialDocumento1 páginaEjercicio 2 Ecuación PatrimonialisabelAún no hay calificaciones

- Glosario de MercadotecniaDocumento3 páginasGlosario de MercadotecniaMonse BastoAún no hay calificaciones

- La Relación Entre La Cultura Corporativa y La Percepción de Los Colaboradores Sobre El Cliente - Caso TottusDocumento31 páginasLa Relación Entre La Cultura Corporativa y La Percepción de Los Colaboradores Sobre El Cliente - Caso TottusTomás LSAún no hay calificaciones

- Iniciacion A La Bolsa (WWW - Invertirenbolsa.info)Documento22 páginasIniciacion A La Bolsa (WWW - Invertirenbolsa.info)Maria A Diaz FernandezAún no hay calificaciones

- Fase de Análisis Iii El Análisis InternoDocumento19 páginasFase de Análisis Iii El Análisis InternoHicler Rimarachin campos100% (1)

- Trabajo Final Cabañas Eco ParkDocumento19 páginasTrabajo Final Cabañas Eco ParkFranklin Elías CórdobaAún no hay calificaciones

- Localizacion Industrial 2292016Documento47 páginasLocalizacion Industrial 2292016OlivaAún no hay calificaciones

- Examen ParcialDocumento7 páginasExamen Parcialsheilypoccoflores19Aún no hay calificaciones

- Cpcrvaca PDFDocumento10 páginasCpcrvaca PDFrichard vacaAún no hay calificaciones

- Glosario de Marketing DigitalDocumento11 páginasGlosario de Marketing DigitalEsther LarrandaAún no hay calificaciones

- Caso Práctico EFEDocumento8 páginasCaso Práctico EFEErik CalvarioAún no hay calificaciones

- Sesión 8 - Maximización de BeneficiosDocumento15 páginasSesión 8 - Maximización de BeneficiosJorge SamameAún no hay calificaciones

- Laboratorio de Integración II Exportaciones Índice FinalDocumento53 páginasLaboratorio de Integración II Exportaciones Índice Finalmauricio ricardoAún no hay calificaciones

- Guía de Preparación Certamen Nº1Documento2 páginasGuía de Preparación Certamen Nº1anon_893025504Aún no hay calificaciones

- Actividad 1 Compras y Manejo de InventariosDocumento16 páginasActividad 1 Compras y Manejo de InventariosJENNIFERAún no hay calificaciones

- Sabio Nacional Antunez de Mayolo: 1 Origen de La ContabilidadDocumento10 páginasSabio Nacional Antunez de Mayolo: 1 Origen de La ContabilidadSarai HabAún no hay calificaciones

- PC1 - Dinamica-1Documento8 páginasPC1 - Dinamica-1nery andrea humberth mariateguiAún no hay calificaciones

- Ingeniería Industrial QFD10Documento35 páginasIngeniería Industrial QFD10juanquirizAún no hay calificaciones

- Taller Compañía Zeta Ltda 2020 DayanaDocumento11 páginasTaller Compañía Zeta Ltda 2020 Dayanadayana0% (1)

- 1591738157ebook - Todo Sobre La Gestion de Leads PDFDocumento30 páginas1591738157ebook - Todo Sobre La Gestion de Leads PDFAngel De Las HerasAún no hay calificaciones

- EL PLAN GENERAL DE CONTABILIDAD DE PYMES (Resumen)Documento5 páginasEL PLAN GENERAL DE CONTABILIDAD DE PYMES (Resumen)LUCIA IZQUIERDOAún no hay calificaciones

- Ct-Ge-001-Mapa de Procesos-V2Documento2 páginasCt-Ge-001-Mapa de Procesos-V2lizetaAún no hay calificaciones

- 1.5 Cartera Vencida - Ejercicio ResueltoDocumento7 páginas1.5 Cartera Vencida - Ejercicio ResueltoVIDAL FERNANDEZAún no hay calificaciones

- Microeconomia Correccion Formato BDocumento6 páginasMicroeconomia Correccion Formato BAna Paula GarzonAún no hay calificaciones

- Caso. Glovo. Expandiendo El Quick CommerceDocumento33 páginasCaso. Glovo. Expandiendo El Quick CommerceMajito CandongaAún no hay calificaciones