Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Libro 1

Cargado por

Ale AliTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Libro 1

Cargado por

Ale AliCopyright:

Formatos disponibles

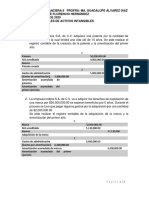

Estado de la situacion financiera de la empresa n

2019

ACTIVOS

Activos corrientes

efectivo S/. 44,600.00

cuentas por cobrar S/. 57,100.00

inventarios S/. 88,700.00

gastos pagados por adelantado S/. 15,700.00

total activo corriente S/. 206,100.00

activos no corrientes

terreno S/. 61,000.00

edificio y equipo S/. 212,900.00

menos: depreciacion acumuladad S/. 88,100.00

intangibles S/. 18,000.00

total activos no corrientes S/. 203,800.00

TOTAL ACTIVOS S/. 409,900.00

PASIVO Y PATRIMONIO

pasivos

cuentas pagar S/. 61,600.00

impuestos por pagar S/. 15,400.00

otros pasivos devengados S/. 22,000.00

total pasivo corriente S/. 99,000.00

bonos por pagar S/. 66,000.00

total pasivos S/. 165,000.00

patrimonio

acciones preferentes S/. 30,000.00

acciones comunes S/. 70,000.00

capital adicional S/. 90,000.00

utilidades retenidas S/. 54,900.00

total patrimonio S/. 244,900.00

TOTAL PASIVO Y PATRIMONIO S/. 409,900.00

Estado de resultados de la Empresa Nacional

Ventas S/. 502,500.00

Costos de ventas S/. 324,900.00

Margen bruto S/. 177,600.00

Gastos de operacion

De ventas S/. 90,700.00

De administracion S/. 41,140.00

Total de gastos de operación S/. 131,840.00

Utilidades de operación S/. 45,760.00

Gastos de interes S/. 7,260.00

Utilidades antes de impuesto S/. 38,500.00

Impuesto (40%) S/. 15,400.00

Utilidad neta S/. 23,100.00

Analisis de ratios financieros:

ratios de liquidez

Ratios de liquidez general= activo corriente /pasivo corriente 2.08

prueba acida= (activo corriente- inventarios y anticipos)/pasivo corriente 1.03

prueba defensiva= (efectivo +VN)/pasivo corriente 0.45

capital de trabajo= activo corriente-pasivo corriente S/ 107,100.00

ratios de endeudamiento

grado de endeudamiento= pasivo total/activo total

grado de la propiedad=patrimonio/activo

laverage=pasivo total/patrimonio

ratios de gestion:

rotacion CxC en veces al año= ventas/CxC 8.80

rotacion CxC en dias= 360/(ventas/CxC) 41

calcular las compras= inv inicial +costo de ventas-inv. Final S/. 322,100.00

rotacion de CxP en veces al año= compras/CxP

rotacion de CxP en dias= 360/(compras /CxP)

rotacion de los inventarios al año=costo de ventas /inventarios

rotacion de inventarios en dias= 360 /(costo de ventas / inventarios)

Margen de CxC= CxC/ventas

ratios de rentabilidad

ROA=utilidad neta/ total activos

ROE=utilidad neta/ patrimonio

margen bruto=utilidad bruta /ventas

margen neto=utilidad neta/ ventas

ciclo operativo=P.R. Inv.+P.R. CxC 40.9

ciclo del efectivo=ciclo operativo- P.R.CxP 40.9

on financiera de la empresa nacional SAC

2018 ANALISIS HORIZONTAL

Nominal %

2019-2018 (2019-2018)/2018

S/. 42,300.00 S/. 2,300.00 5.4%

S/. 49,800.00 S/. 7,300.00 14.7%

S/. 85,900.00 S/. 2,800.00 3.3%

S/. 15,300.00 S/. 400.00 2.6%

S/. 193,300.00 S/. 12,800.00 6.6%

S/. 61,000.00 S/. - 0.0%

S/. 199,100.00 S/. 13,800.00 6.9%

S/. 79,400.00 S/. 8,700.00 11.0%

S/. 20,000.00 -S/. 2,000.00 -10.0%

S/. 200,700.00 S/. 3,100.00 1.5%

S/. 394,000.00 S/. 15,900.00 4.0%

S/ 54,900.00 S/. 6,700.00 12.2%

S/ 14,000.00 S/. 1,400.00 10.0%

S/ 19,600.00 S/. 2,400.00 12.2%

S/ 88,500.00 S/. 10,500.00 11.9%

S/ 72,000.00 -S/. 6,000.00 -8.3%

S/. 160,500.00 S/. 4,500.00 2.8%

S/ 30,000.00 S/. - 0.0%

S/ 70,000.00 S/. - 0.0%

S/ 90,000.00 S/. - 0.0%

S/ 43,500.00 S/. 11,400.00 26.2%

S/. 233,500.00 S/. 11,400.00 4.9%

S/. 394,000.00 S/. 15,900.00 4.0%

S/. 480,000.00 S/. 22,500.00 4.7%

S/. 319,600.00 S/. 5,300.00 1.7%

S/. 160,400.00 S/. 17,200.00 10.7%

S/. 76,300.00 S/. 14,400.00 18.9%

S/. 41,180.00 -S/. 40.00 -0.1%

S/. 117,480.00 S/. 14,360.00 12.2%

S/. 42,920.00 S/. 2,840.00 6.6%

S/. 7,920.00 -S/. 660.00 -8.3%

S/. 35,000.00 S/. 3,500.00 10.0%

S/. 14,000.00 S/. 1,400.00 10.0%

S/. 21,000.00 S/. 2,100.00 10.0%

(liquidez = efectivo)

2.18

*capital que requiero para poder funcionar

analisis vertical

2019 2018

10.88% 11% 0.14%

13.93% 13% 1.29%

21.64% 22% -0.16%

3.83% 4% -0.05%

50.28% 49% 1.22%

14.88% 15% -0.60%

51.94% 51% 1.41%

21.49% 20% 1.34%

4.39% 5% -0.68%

49.72% 51% -1.22%

100.00% 100% 0.00%

15.03% 14% 1.09%

3.76% 4% 0.20%

5.37% 5% 0.39%

24.15% 22% 1.69%

16.10% 18% -2.17%

40.25% 41% -0.48%

7.32% 8% -0.30%

17.08% 18% -0.69%

21.96% 23% -0.89%

13.39% 11% 2.35%

59.75% 59% 0.48%

100.00% 100% 0.00%

64.7% 66.6% 1.9%

35.3% 33.4% -1.9%

18.0% 15.9% -2.2%

8.2% 8.6% 0.4%

26.2% 24.5% -1.8%

9.1% 8.9% -0.2%

1.4% 1.7% 0.2%

7.7% 7.3% -0.4%

3.1% 2.9% -0.1%

4.6% 4.4% -0.2%

También podría gustarte

- Actividad N 1 Conta Gubernamental TardeDocumento7 páginasActividad N 1 Conta Gubernamental TardeJose carlos GarciaAún no hay calificaciones

- Preguntas Capitulo 4Documento4 páginasPreguntas Capitulo 4sadia camposAún no hay calificaciones

- Flujo de Caja-ESAN PDFDocumento40 páginasFlujo de Caja-ESAN PDFRomel Mejia Colonia100% (1)

- Asientos Contables de Activos IntangiblesDocumento2 páginasAsientos Contables de Activos Intangiblesjose100% (3)

- Ejercicios de Elaboración de Estados FinancierosDocumento9 páginasEjercicios de Elaboración de Estados FinancierosSebastian Solis MirandaAún no hay calificaciones

- Examen Gerencia Financiera I - C1 Unidad 1 RespuestasDocumento7 páginasExamen Gerencia Financiera I - C1 Unidad 1 RespuestasDiana Rueda MardiniAún no hay calificaciones

- Capital de TrabajoDocumento5 páginasCapital de TrabajoKaty Casas0% (1)

- Recopilación MF 3 PruebaDocumento159 páginasRecopilación MF 3 Pruebavictor muñozAún no hay calificaciones

- Trabajo Academico FinalDocumento15 páginasTrabajo Academico FinalAle AliAún no hay calificaciones

- Gerencia de Proyectos 5Documento34 páginasGerencia de Proyectos 5Ale AliAún no hay calificaciones

- Chocolates SumaqDocumento23 páginasChocolates SumaqAle AliAún no hay calificaciones

- Trabajo Final Gerencia de ProyectosDocumento33 páginasTrabajo Final Gerencia de ProyectosAle AliAún no hay calificaciones

- Proyecto Cerveza ArtesanalDocumento6 páginasProyecto Cerveza ArtesanalAle AliAún no hay calificaciones

- Chocolates SumaqDocumento23 páginasChocolates SumaqAle AliAún no hay calificaciones

- Plan de Negocio-Trabajo AcademicoDocumento22 páginasPlan de Negocio-Trabajo AcademicoAle AliAún no hay calificaciones

- Trabajo Del JuevesDocumento8 páginasTrabajo Del JuevesAle AliAún no hay calificaciones

- Trabajo Academico 3Documento25 páginasTrabajo Academico 3Ale AliAún no hay calificaciones

- 28 EstadísticaDocumento2 páginas28 EstadísticaAle AliAún no hay calificaciones

- Trabajo de Metodologia de La InvestigacionDocumento18 páginasTrabajo de Metodologia de La InvestigacionAle AliAún no hay calificaciones

- Boleta NotasDocumento4 páginasBoleta NotasEdyto JaraAún no hay calificaciones

- AUDITORIA MunicipalidadDocumento8 páginasAUDITORIA MunicipalidadAle AliAún no hay calificaciones

- Sumaq A E DDocumento8 páginasSumaq A E DAle AliAún no hay calificaciones

- 28 EstadísticaDocumento2 páginas28 EstadísticaAle AliAún no hay calificaciones

- Licores y CompañiaDocumento5 páginasLicores y CompañiaAle AliAún no hay calificaciones

- En El PerúDocumento2 páginasEn El PerúAle AliAún no hay calificaciones

- Sistemas Funcionales de NegociosDocumento1 páginaSistemas Funcionales de NegociosAle AliAún no hay calificaciones

- Ambient AlDocumento26 páginasAmbient AlAle AliAún no hay calificaciones

- Boleta NotasDocumento4 páginasBoleta NotasEdyto JaraAún no hay calificaciones

- Sumaq A E DDocumento8 páginasSumaq A E DAle AliAún no hay calificaciones

- Boleta NotasDocumento4 páginasBoleta NotasEdyto JaraAún no hay calificaciones

- Facultad de Ciencias Empresariales Y Educación Escuela Profesional de Administración Y Negocios InternacionalesDocumento12 páginasFacultad de Ciencias Empresariales Y Educación Escuela Profesional de Administración Y Negocios InternacionalesTimo Calderon LetonaAún no hay calificaciones

- BVCI0005712Documento2 páginasBVCI0005712Ale AliAún no hay calificaciones

- EjerciciosDocumento1 páginaEjerciciosAle AliAún no hay calificaciones

- Que Es RSEDocumento6 páginasQue Es RSEJaneth TrujilloAún no hay calificaciones

- Caso Coca ColaDocumento2 páginasCaso Coca ColaAle AliAún no hay calificaciones

- Caso Coca ColaDocumento2 páginasCaso Coca ColaAle AliAún no hay calificaciones

- Informe Inventario CuscoDocumento47 páginasInforme Inventario CuscoMadelein GisselAún no hay calificaciones

- Estados ContablesDocumento5 páginasEstados Contablescai_2014Aún no hay calificaciones

- Cartilla - Estados FinancierosDocumento45 páginasCartilla - Estados FinancierosSonniaEdithSanchezAún no hay calificaciones

- Actividad Final PresupuestosDocumento4 páginasActividad Final Presupuestoserika peñaAún no hay calificaciones

- ESCISION de SociedadesDocumento23 páginasESCISION de SociedadesNancy Maribel Leiva ValenzuelaAún no hay calificaciones

- Laboratorios SudamericanosDocumento20 páginasLaboratorios SudamericanosPaola Llanos CarrilloAún no hay calificaciones

- Registros Contables CocaDocumento7 páginasRegistros Contables Cocasirley borjaAún no hay calificaciones

- El SamaritanoDocumento11 páginasEl SamaritanoJosé Ramón Martínez plataAún no hay calificaciones

- IANSADocumento31 páginasIANSAmatiaaasdAún no hay calificaciones

- Generalidades Sobre Las FinanzasDocumento6 páginasGeneralidades Sobre Las FinanzasFelipe Campos PulgarAún no hay calificaciones

- EJERCICIO BALANCE GENERAL (Para Sesión Balance General)Documento4 páginasEJERCICIO BALANCE GENERAL (Para Sesión Balance General)JUAN MOISES PU IXCOTOYACAún no hay calificaciones

- Unidad 5Documento62 páginasUnidad 5Juan Pablo BusteloAún no hay calificaciones

- Recuperatorio Primer Parcial Práctico 2° Cuat 2021Documento3 páginasRecuperatorio Primer Parcial Práctico 2° Cuat 2021Milagros GomezAún no hay calificaciones

- CONTABDocumento24 páginasCONTABErickAún no hay calificaciones

- Matriz Marco ConceptualDocumento9 páginasMatriz Marco ConceptualYaki Montiel NietoAún no hay calificaciones

- Caso Unidad 2 Analicis FinancieroDocumento7 páginasCaso Unidad 2 Analicis FinancieroYesica Paola Uribe CastellanosAún no hay calificaciones

- Analisis - Finanzas CorporativasDocumento12 páginasAnalisis - Finanzas CorporativasCarlos MarriagaAún no hay calificaciones

- Valdivia Zuta If 2019Documento103 páginasValdivia Zuta If 2019Maria ManrriqueAún no hay calificaciones

- Cierre Contable - La Importancia Del Balance de ComprobaciónDocumento10 páginasCierre Contable - La Importancia Del Balance de ComprobaciónLya SilvaAún no hay calificaciones

- Plantilla Fonade EjemploDocumento7 páginasPlantilla Fonade EjemploJORGE ARMANDO AVENDANO CHAPARRO100% (1)

- Estructura de Cédulas PresupuestalesDocumento7 páginasEstructura de Cédulas PresupuestalesLEIDY YOANAAún no hay calificaciones

- Plantilla Hotel Amazonas HotelAmazonasDocumento17 páginasPlantilla Hotel Amazonas HotelAmazonasAlejo HualpaAún no hay calificaciones

- Gloria y Laive 2018-2021Documento64 páginasGloria y Laive 2018-2021MIGUEL ANGEL GUZMAN CASTROAún no hay calificaciones