Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Semana 5 Tir y Van

Cargado por

andreita0 calificaciones0% encontró este documento útil (0 votos)

10 vistas1 páginaactualizacion y verificacion

Título original

SEMANA 5 TIR Y VAN

Derechos de autor

© © All Rights Reserved

Formatos disponibles

XLSX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoactualizacion y verificacion

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como XLSX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

10 vistas1 páginaSemana 5 Tir y Van

Cargado por

andreitaactualizacion y verificacion

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como XLSX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 1

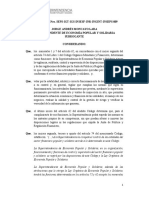

tabla de amortizacion

Datos inicial

Deuda $500,000

Plazo 5

tasa efectiva 8%

Frecuencia de pagos anual

Periodo Pago anual interes (8%) Amortizacion saldo deuda

sobre saldo

0 $500,000

1 $125,228 $40,000 $85,228 $414,772

2 $125,228 $33,182 $92,046 $322,726

3 $125,228 $25,818 $99,410 $223,316

4 $125,228 $17,865 $107,363 $115,953

5 $125,228 $9,276 $115,952 $1

Total $126,141 $499,999

Datos Iniciales

Monto $42,000,000

Plazo meses 12

Tasa anual 3.50%

tasa mensual 0.29%

Periodo Pago mensual Interes (3,5 anual) Amortizacion Saldo Deuda

Sobre el Saldo

0 $42,000,000

1 $3,566,708 $122,500 $3,444,208 $38,555,792

2 $3,566,708 $112,454 $3,454,254 $35,101,537

3 $3,566,708 $102,379 $3,464,329 $31,637,209

4 $3,566,708 $92,275 $3,474,433 $28,162,775

5 $3,566,708 $82,141 $3,484,567 $24,678,208

6 $3,566,708 $71,978 $3,494,730 $21,183,478

7 $3,566,708 $61,785 $3,504,923 $17,678,555

8 $3,566,708 $51,562 $3,515,146 $14,163,409

9 $3,566,708 $41,310 $3,525,399 $10,638,010

10 $3,566,708 $31,028 $3,535,681 $7,102,329

11 $3,566,708 $20,715 $3,545,993 $3,556,336

12 $3,566,708 $10,373 $3,556,336 $0

Suma $42,000,000

También podría gustarte

- Procedimiento de Transporte de CargaDocumento3 páginasProcedimiento de Transporte de Cargajudy espinosaAún no hay calificaciones

- Desarrollo Habilidades para El Aprendizaje Semana 2Documento5 páginasDesarrollo Habilidades para El Aprendizaje Semana 2Michael CortesAún no hay calificaciones

- Contrato de Arrendamiento de Un Lote de Terreno ConstanteDocumento8 páginasContrato de Arrendamiento de Un Lote de Terreno ConstantejairoAún no hay calificaciones

- El Orden Criminal Del MundoDocumento5 páginasEl Orden Criminal Del MundoJoshua Diaz Calizaya100% (1)

- Estudio - Tarea 2Documento1 páginaEstudio - Tarea 2andreita100% (1)

- Tarea6 CortoDocumento8 páginasTarea6 Cortoandreita100% (3)

- Estudio - Tarea 2Documento1 páginaEstudio - Tarea 2andreitaAún no hay calificaciones

- SEMANA 8 ExamenDocumento8 páginasSEMANA 8 ExamenandreitaAún no hay calificaciones

- Ejercicios Semana 4Documento5 páginasEjercicios Semana 4andreitaAún no hay calificaciones

- Paisajismo Areas Verde GreengrassDocumento7 páginasPaisajismo Areas Verde GreengrassandreitaAún no hay calificaciones

- Informe Laboratorio 1Documento7 páginasInforme Laboratorio 1juan camilo gutierrez buitrago100% (1)

- Reseña - EconomiaDocumento2 páginasReseña - EconomiaNayara cardenas garciaAún no hay calificaciones

- La Regulacion de Los Algoritmos AranzadiDocumento16 páginasLa Regulacion de Los Algoritmos AranzadifuckAún no hay calificaciones

- Plantilla Manual Excel IntermedioDocumento108 páginasPlantilla Manual Excel IntermedioEstratagema De NegociosAún no hay calificaciones

- Informe Los LaurelesDocumento11 páginasInforme Los Laurelespatricia perezAún no hay calificaciones

- Sistema de Adquisicion, Supervicion y Monitoreo de Datos (Scada)Documento24 páginasSistema de Adquisicion, Supervicion y Monitoreo de Datos (Scada)Juanka Montero100% (1)

- GloriaDocumento2 páginasGloriaYesenia SanchezAún no hay calificaciones

- Biodisponibilidad y Bioequivalencia - Parte 3Documento13 páginasBiodisponibilidad y Bioequivalencia - Parte 3GUICELASAIGUAAún no hay calificaciones

- Entrega 1 - Gerencia de Proyectos IiDocumento22 páginasEntrega 1 - Gerencia de Proyectos Iijohn narvaezAún no hay calificaciones

- Memorias de Calculo (Casa Lote 72)Documento2 páginasMemorias de Calculo (Casa Lote 72)Sergio DominguezAún no hay calificaciones

- Examen MediosDocumento5 páginasExamen MediosJOHAN SEBASTIAN BASTO PEREZAún no hay calificaciones

- Test Ejercicios InformaticaDocumento7 páginasTest Ejercicios InformaticaGary Mauricio Chura CarrilloAún no hay calificaciones

- La Forma en La Donación Propter NuptiasDocumento2 páginasLa Forma en La Donación Propter Nuptiascatherine curo lizanaAún no hay calificaciones

- Dictamen Ministerio Del Trabajo ORD. N 26019Documento4 páginasDictamen Ministerio Del Trabajo ORD. N 26019reivin_fraighalAún no hay calificaciones

- Organización de Las BrigadasDocumento2 páginasOrganización de Las BrigadasYhony Narvaez TtitoAún no hay calificaciones

- Transporte Tarea5Documento6 páginasTransporte Tarea5paulina ceballos75% (4)

- Antecedentes de Un BoutiqueDocumento5 páginasAntecedentes de Un BoutiqueMarsAún no hay calificaciones

- UTP Ejercicios de Laboratorio 14 HITD (Soto)Documento20 páginasUTP Ejercicios de Laboratorio 14 HITD (Soto)Jhon Kenedy Rosvelt WhashitonAún no hay calificaciones

- Evaluacion InformaticaDocumento47 páginasEvaluacion InformaticaLucio MiguelAún no hay calificaciones

- Reglamento Usso Maquinaria AgricolaDocumento6 páginasReglamento Usso Maquinaria AgricolaYOSOYEXITOSO100% (1)

- Programa Bioseguridad 2021Documento78 páginasPrograma Bioseguridad 2021Hector A RamirezAún no hay calificaciones

- Tarea 3.1 Manejo de Base de Datos Interna-Osorio Marin Fernanda LizetteDocumento3 páginasTarea 3.1 Manejo de Base de Datos Interna-Osorio Marin Fernanda LizetteFernanda Lizette Osorio MarinAún no hay calificaciones

- Resol Seps Igt Igs Insesf Inr Ingint Inseps 009 Norma de Canales ElectronicosDocumento19 páginasResol Seps Igt Igs Insesf Inr Ingint Inseps 009 Norma de Canales Electronicosadamaris AzaAún no hay calificaciones

- Diagrmas A UML - Infografía - Horacio Montoya MarquezDocumento1 páginaDiagrmas A UML - Infografía - Horacio Montoya MarquezHoracio MontoyaAún no hay calificaciones

- INDUCCIÓNDocumento40 páginasINDUCCIÓNhseqAún no hay calificaciones

- Sintesis Mapa ConceptualDocumento7 páginasSintesis Mapa ConceptualElmosAún no hay calificaciones