Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Estados Financieros Frisby

Estados Financieros Frisby

Cargado por

Andres Felipe Muñoz Ramirez0 calificaciones0% encontró este documento útil (0 votos)

282 vistas10 páginasDerechos de autor

© © All Rights Reserved

Formatos disponibles

XLSX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

© All Rights Reserved

Formatos disponibles

Descargue como XLSX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

282 vistas10 páginasEstados Financieros Frisby

Estados Financieros Frisby

Cargado por

Andres Felipe Muñoz RamirezCopyright:

© All Rights Reserved

Formatos disponibles

Descargue como XLSX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 10

AÑO

2020

2019

2018

2017

Frisby S.A. (Colombia)

Fuente:

Tipo de Estado Financiero

Fecha final del período

Unidades

Cifras re expresdas en millones de COP constantes de 2020

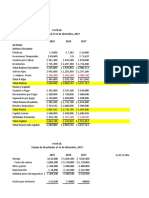

Estado de Resultados 2020 2019

Total Ingreso Operativo 358,210 422,293

Ingresos netos por ventas 355,134 418,349

Costo de mercancías vendidas -146,279 -180,978

Utilidad bruta 208,855 237,371

Gastos de venta y distribución -167,126 -188,407

Gastos administrativos -17,721 -21,217

Otros resultados operativos netos -804 -321

Otros ingresos operativos 3,077 3,944

Otros gastos operativos -3,881 -4,265

Ganancia operativa (EBIT) 23,205 27,425

EBITDA 63,563 71,631

Resultado financiero -2,653.19 -3,890.88

Ingresos financieros 677.23 847.92

Gastos financieros -3,330 -4,739

Ganancias antes de impuestos 20,551 23,534

Impuesto a la renta -7,012 -9,563

Ganancias después de impuestos 13,539 13,972

Ganancia (Pérdida) Neta 13,539 13,972

Balance General 2020 2019

Activos Totales 280,333 275,772

Activos no corrientes 215,593 218,873

Propiedad, planta y equipo 180,116 182,781

Activos financieros a largo plazo 0.00 201.73

Otros activos financieros no corrientes 0.00 201.73

Activos diferidos 35,278.76 35,890.64

Activos no corrientes por impuesto diferido 35,278.76 35,890.64

Otros activos no corrientes 197.97 0.00

Activos Corrientes 64,740 56,899

Inventarios 10,734 8,947

Comerciales y otras cuentas a cobrar 18,468 21,717

Cuentas comerciales por cobrar 11,276 13,458

Créditos de impuestos 7,191.74 8,258.91

Activos financieros de corto plazo 27,447.59 15,536.47

Otros activos financieros corrientes 27,447.59 15,536.47

Efectivo o Equivalentes 8,091 10,699

Total de patrimonio y pasivos 280,333 275,772

Total de patrimonio 58,733 49,717

Patrimonio neto atribuible a los propietarios de la controladora 58,733 49,717

Capital Suscrito 4,310 4,392

Otras reservas 2,179 2,221

Resultados acumulados 50,323 42,198

Otros componentes del patrimonio 1,921.18 906.21

Pasivos Totales 221,600 226,055

Pasivos no corrientes 142,357 136,021

Créditos y préstamos no corrientes 5,143.30 127.66

Ingresos diferidos, gastos devengados y otros pasivos no circulantes diferidos 38,659 39,000

Otros pasivos no corrientes 98,555 96,894

Pasivos Corrientes 79,243 90,034

Créditos y préstamos corrientes 0.00 0.00

Comerciales y otras cuentas a pagar 72,115 81,177

Cuentas Comerciales por pagar 72,115 81,177

Pasivos corrientes por impuesto a la renta 7,128 8,857

La redistribución de esta información está estrictamente prohibida.

Derechos de Autor 2022 EMIS, todos los derechos reservados.

P constantes de 2020

2018 2017 2016 AV 2016

376,812 375,712 357,811 100.00%

373,289 371,260 351,842 98.33%

-157,069 -161,481 -156,445 -43.72%

216,220 209,779 195,397 54.61%

-174,888 -169,567 -159,283 -44.52%

-19,968 -20,238 -18,002 -5.03%

388 1,683 3,126 0.87%

3,523 4,451 5,968 1.67%

-3,135 -2,768 -2,843 -0.79%

21,752 21,657 21,237 5.94%

31,625 33,138 36,183 10.11%

-1,301.30 -531.85 -563.41 -0.16%

642.90 1,107.34 974.31 0.27%

-1,944 -1,639 -1,538 -0.43%

20,451 21,126 20,674 5.78%

-9,130 -8,152 -9,471 -2.65%

11,321 12,974 11,203 3.13%

11,321 12,974 11,203 3.13%

2018 2017 2016

108,484 98,899 83,368 100.00%

53,483 46,097 46,467 55.74%

53,153 45,900 46,160 55.37%

0.00 0.00 0.00 0.00%

0.00 0.00 0.00 0.00%

320.90 188.55 297.77 0.36%

320.90 188.55 297.77 0.36%

8.41 8.68 9.03 0.01%

55,002 52,802 36,901 44.26%

11,156 9,029 9,270 11.12%

16,497 18,504 11,559 13.86%

9,334 9,869 11,171 13.40%

7,163.45 8,634.18 387.93 0.47%

12,404.67 3,100.38 766.93 0.92%

12,404.67 3,100.38 766.93 0.92%

14,944 22,170 15,305 18.36%

108,484 98,899 83,368 100.00%

41,335 36,967 30,931 37.10%

41,335 36,967 30,931 37.10%

4,559 4,704 4,896 5.87%

2,305 2,379 2,476 2.97%

33,530 28,914 23,559 28.26%

940.64 970.56 0.00 0.00%

67,150 61,933 52,437 62.90%

9,575 11,038 12,697 15.23%

280.26 231.08 306.84 0.37%

2,776 2,508 2,293 2.75%

6,518 8,298 10,097 12.11%

57,575 50,895 39,740 47.67%

0.00 0.00 37.92 0.05%

47,645 35,738 33,443 40.12%

47,645 35,738 33,443 40.12%

9,930 15,157 6,259 7.51%

AH 2020-2019 AH 20219-2018

Var. Absoluta Var. Relativa Var. Absoluta Var. Relativa

-64,082 -15.17% 45,480 12.07%

-63,215 -15.11% 45,059 12.07%

34,699 -19.17% -23,908 15.22%

-28,516 -12.01% 21,151 9.78%

21,282 -11.30% -13,519 7.73%

3,496 -16.48% -1,249 6.26%

-483 150.21% -710 -182.73%

-867 -21.99% 421 11.94%

384 -9.01% -1,131 36.07%

-4,221 -15.39% 5,673 26.08%

-8,068 -11.26% 40,007 126.50%

1,237.69 -31.81% -2,589.57 199.00%

-170.69 -20.13% 205.02 31.89%

1,408 -29.72% -2,795 143.74%

-2,983 -12.68% 3,083 15.08%

2,550 -26.67% -432 4.73%

-433 -3.10% 2,651 23.42%

-433 -3.10% 2,651 23.42%

4,561 1.65% 167,288 154.20%

-3,280 -1.50% 165,390 309.24%

-2,664 -1.46% 129,627 243.87%

-201.73 -100.00% 201.73 ---

-201.73 -100.00% 201.73 ---

-611.88 -1.70% 35,569.73 11084.29%

-611.88 -1.70% 35,569.73 11084.29%

197.97 --- -8.41 -100.00%

7,841 13.78% 1,898 3.45%

1,787 19.97% -2,209 -19.80%

-3,249 -14.96% 5,220 31.64%

-2,182 -16.21% 4,124 44.18%

-1,067.17 -12.92% 1,095.46 15.29%

11,911.12 76.67% 3,131.80 25.25%

11,911.12 76.67% 3,131.80 25.25%

-2,608 -24.37% -4,245 -28.40%

4,561 1.65% 167,288 154.20%

9,016 18.13% 8,383 20.28%

9,016 18.13% 8,383 20.28%

-82 -1.86% -167 -3.66%

-41 -1.86% -84 -3.66%

8,124 19.25% 8,668 25.85%

1,014.97 112.00% -34.44 -3.66%

-4,455 -1.97% 158,905 236.64%

6,336 4.66% 126,447 1320.65%

5,015.64 3928.89% -152.60 -54.45%

-341 -0.87% 36,223 1304.67%

1,661 1.71% 90,376 1386.58%

-10,791 -11.99% 32,459 56.38%

0.00 --- 0.00 ---

-9,062 -11.16% 33,531 70.38%

-9,062 -11.16% 33,531 70.38%

-1,729 -19.52% -1,073 -10.80%

AH 2018-2017 AH 2017-2016

Var. Absoluta Var. Relativa Var. Absoluta Var. Relativa

1,101 0.29% 17,901 5.00%

2,029 0.55% 19,418 5.52%

4,412 -2.73% -5,036 3.22%

6,441 3.07% 14,382 7.36%

-5,321 3.14% -10,283 6.46%

271 -1.34% -2,236 12.42%

-1,295 -76.92% -1,442 -46.15%

-928 -20.85% -1,517 -25.42%

-367 13.24% 75 -2.63%

95 0.44% 420 1.98%

-1,513 -4.57% -3,045 -8.42%

-769.45 144.67% 31.56 -5.60%

-464.43 -41.94% 133.03 13.65%

-305 18.61% -101 6.60%

-674 -3.19% 452 2.19%

-979 12.01% 1,319 -13.93%

-1,653 -12.74% 1,771 15.81%

-1,653 -12.74% 1,771 15.81%

9,585 9.69% 15,531 18.63%

7,386 16.02% -370 -0.80%

7,254 15.80% -260 -0.56%

0.00 --- 0.00 ---

0.00 --- 0.00 ---

132.35 70.19% -109.21 -36.68%

132.35 70.19% -109.21 -36.68%

-0.27 -3.08% -0.35 -3.93%

2,199 4.17% 15,901 43.09%

2,127 23.56% -241 -2.60%

-2,006 -10.84% 6,945 60.08%

-536 -5.43% -1,301 -11.65%

-1,470.72 -17.03% 8,246.25 2125.70%

9,304.28 300.10% 2,333.45 304.26%

9,304.28 300.10% 2,333.45 304.26%

-7,226 -32.59% 6,864 44.85%

9,585 9.69% 15,531 18.63%

4,368 11.82% 6,036 19.51%

4,368 11.82% 6,036 19.51%

-145 -3.08% -192 -3.93%

-73 -3.08% -97 -3.93%

4,616 15.97% 5,355 22.73%

-29.91 -3.08% 970.56 ---

5,217 8.42% 9,496 18.11%

-1,463 -13.25% -1,659 -13.07%

49.18 21.28% -75.76 -24.69%

268 10.68% 216 9.41%

-1,780 -21.45% -1,799 -17.82%

6,680 13.12% 11,155 28.07%

0.00 --- -37.92 -100.00%

11,907 33.32% 2,295 6.86%

11,907 33.32% 2,295 6.86%

-5,227 -34.49% 8,898 142.16%

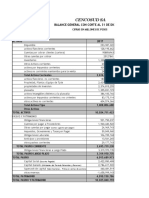

Indicadores de liquidez 2020 2019 2018 2017

Razón corriente 0.81698538 0.63198013 0.95530526 1.03747172

Prueba ácida 0.68152811 0.53260446 0.76153964 0.86007111

Indicadores de actividad 2020 2019 2018 2017

Rotación de CxC 31.7680714 31.378522 40.3702973 38.0681057

Rotación de inventario 33.3715067 47.1985278 33.7764725 41.6122837

Rotación de CxP 2.02841473 2.22942759 3.29664046 4.51843396

Rotación de activos totales 1.27780161 1.53130828 3.47342348 3.79892479

Periodo promedio de cobro 11.4895234 11.6321604 9.04130076 9.58807886

Periodo promedio de inventario 10.9374744 7.73329205 10.8063386 8.77144841

Periodo promedio de pago 179.943477 163.719154 110.718777 80.7802002

Indicadores de deuda 2020 2019 2018 2017

Endeudamiento total 79.049% 81.972% 61.898% 62.622%

Cobertura del interés ganado 6.96747257 5.78739262 11.1883076 13.2122812

Concentración del endeudamiento de corto plazo 35.759% 39.828% 85.741% 82.178%

Indicadores de rentabilidad 2020 2019 2018 2017

Margen operacional 6.478% 6.494% 5.773% 5.764%

Margen EBITDA 17.745% 16.962% 8.393% 8.820%

Margen neto 3.780% 3.309% 3.004% 3.453%

Rentabilidad del activo (ROA) 4.830% 5.066% 10.435% 13.118%

Rentabilidad del patrimonio (ROE) 23.052% 28.103% 27.388% 35.096%

Sistema Dupont 2020 2019 2018 2017

Beneficio neto 13539.34 13971.8962 11320.6188 12973.7749

Ventas 358210.42 422292.604 376812.299 375711.758

Activos 280333.36 275772.429 108484.411 98899.4987

Patrimonio 58733.22 49717.3463 41334.7921 36966.5615

Beneficio neto/Ventas 0.03779717 0.03308582 0.03004312 0.03453119

Ventas/Activos 1.27780161 1.53130828 3.47342348 3.79892479

ROA 4.830% 5.066% 10.435% 13.118%

Activos/Patrimonio 4.77299491 5.54680507 2.62453022 2.67537728

ROE 23.052% 28.103% 27.388% 35.096%

2016

0.92856077

0.69529059

2016

32.030761

38.5979771

4.67794774

4.29194251

11.3952959

9.45645414

78.0256686

2016

62.898%

13.8107976

75.787%

2016

5.935%

10.112%

3.131%

13.438%

36.218%

2016

11202.5943

357810.975

83368.0725

30931.04

0.03130869

4.29194251

13.438%

2.69528837

36.218%

También podría gustarte

- Taller Conjunto - Trabajo FinalDocumento6 páginasTaller Conjunto - Trabajo Finalleotom1428100% (1)

- Archivo Descargable Funciones AvanzadasDocumento43 páginasArchivo Descargable Funciones AvanzadasMartha Laura Reyes100% (1)

- Ses 12 y 13 Cinematica de Cuerpo Rigido J ReyesDocumento40 páginasSes 12 y 13 Cinematica de Cuerpo Rigido J Reyesangelosolorzano3927Aún no hay calificaciones

- Taller Valor e InterpolacionDocumento22 páginasTaller Valor e Interpolacionwilson lozano cardenas100% (1)

- Extracto Ligia MayoDocumento2 páginasExtracto Ligia MayoJulian Amariles TAún no hay calificaciones

- Ejercicio Urania S. A.Documento5 páginasEjercicio Urania S. A.KEVIN YULIAN CORONAAún no hay calificaciones

- Balance General y PyG Elsa Mara ContableDocumento3 páginasBalance General y PyG Elsa Mara ContableAngie Torrez100% (1)

- Actividad # 6 ContabilidadDocumento7 páginasActividad # 6 ContabilidadVillada AYAún no hay calificaciones

- 4.-Actividad Gestion Tecnologica - de Paseo Con SofiaDocumento5 páginas4.-Actividad Gestion Tecnologica - de Paseo Con Sofiaisabel niebles arenas100% (1)

- Ej. de Contabilidad 1ra PruebaDocumento5 páginasEj. de Contabilidad 1ra PruebaRobertCortesFuentealba100% (1)

- Semana 5 Gestion FinancieraDocumento4 páginasSemana 5 Gestion FinancieraMARELVIS ESTHER FORNARI IBAÑEZAún no hay calificaciones

- TALLER No. 2 Contabilidad II Terminación Del Ciclo ContableDocumento2 páginasTALLER No. 2 Contabilidad II Terminación Del Ciclo ContableAntonio José RosarioAún no hay calificaciones

- Trabajo Grupal Proceso ContableDocumento3 páginasTrabajo Grupal Proceso ContableMayely Nycole Dominguez Vera100% (1)

- Taller Esteban CortesDocumento56 páginasTaller Esteban CortesEsteban Cortes50% (4)

- Semana 9 (DP y DS El Caballero, S.a.)Documento8 páginasSemana 9 (DP y DS El Caballero, S.a.)MICHAEL ELIJAH MIRANDA CALDERONAún no hay calificaciones

- Quiz Sistemas ContablesDocumento13 páginasQuiz Sistemas Contablesmichel montoyaAún no hay calificaciones

- Ejercicio Clase Ppto. Financiero-1Documento3 páginasEjercicio Clase Ppto. Financiero-1balnca100% (1)

- 12 Funciones Exponenciales y LogaritmicasDocumento2 páginas12 Funciones Exponenciales y LogaritmicasSergio FloresAún no hay calificaciones

- Taller 2 Transacciones Con El EfectivoDocumento5 páginasTaller 2 Transacciones Con El EfectivoAlejo PrietoAún no hay calificaciones

- Examen Segundo Parcial Estados FinancierosDocumento4 páginasExamen Segundo Parcial Estados FinancierosBladimir Enmanuel Quezada SurielAún no hay calificaciones

- Guia 10 LogicoDocumento6 páginasGuia 10 LogicoKeiko JimenezAún no hay calificaciones

- Funciones ProblemasDocumento40 páginasFunciones ProblemasAmIn20122Aún no hay calificaciones

- EJERCICIO 1 Funcion Cubica ImprimirDocumento3 páginasEJERCICIO 1 Funcion Cubica Imprimirsebastian herreraAún no hay calificaciones

- Tarea 2 - ContabilidadDocumento24 páginasTarea 2 - ContabilidadCamila BarreraAún no hay calificaciones

- E S F POSTOBON (Autoguardado)Documento9 páginasE S F POSTOBON (Autoguardado)Diana Katherine MARTINEZ PAEZAún no hay calificaciones

- Estados Fiancieros Jumbo Taller 02Documento80 páginasEstados Fiancieros Jumbo Taller 02angelica maria avendaño hernandez100% (1)

- Sociedad ColectivaDocumento10 páginasSociedad ColectivadalvarezingAún no hay calificaciones

- Balance SonyDocumento2 páginasBalance SonyNatalia CarrilloAún no hay calificaciones

- Tarea Excedente Al ConsumidorDocumento4 páginasTarea Excedente Al ConsumidorElizabeth Milagros Figueroa Chavez0% (1)

- CO y TexDocumento6 páginasCO y TexEstefania Valencia GutierrezAún no hay calificaciones

- Taller Entregrable de Ecuaciones VLR e InterpolacionDocumento11 páginasTaller Entregrable de Ecuaciones VLR e InterpolacionMarieth DiazAún no hay calificaciones

- CASO PRACTICO SEM 02 EEFF Su Color-EberDocumento9 páginasCASO PRACTICO SEM 02 EEFF Su Color-EberEbert Mendoza YacilaAún no hay calificaciones

- P.E. Un Producto.Documento14 páginasP.E. Un Producto.Andrés NarváezAún no hay calificaciones

- Guía 2 - Casos MCUDocumento2 páginasGuía 2 - Casos MCUBastian Vargas ZúñigaAún no hay calificaciones

- Uni3 - Act5 Taller Partida DobleDocumento12 páginasUni3 - Act5 Taller Partida DobleCAYEYO3Aún no hay calificaciones

- Argos Proyeccion de CifrasDocumento25 páginasArgos Proyeccion de CifrasCarlos Ramirez LesmesAún no hay calificaciones

- EC2000 User Guide (ES)Documento4 páginasEC2000 User Guide (ES)JAIRSAN1Aún no hay calificaciones

- Balance MileniumDocumento5 páginasBalance MileniumElimelex Fernandez NarvaisAún no hay calificaciones

- Teoria de ErriresDocumento8 páginasTeoria de ErriresAndrés Pérez AtehortúaAún no hay calificaciones

- Base de Datos BimboDocumento33 páginasBase de Datos BimboAdrian PeranAún no hay calificaciones

- Funciones 1Documento10 páginasFunciones 1Gabriel AlfonsoAún no hay calificaciones

- Taller 1. Interes Simple y Compuesto FinalDocumento11 páginasTaller 1. Interes Simple y Compuesto Finalbiblioteca municipalAún no hay calificaciones

- Razones FinancierasDocumento4 páginasRazones FinancierasLauraa Estefanny'Aún no hay calificaciones

- Exploración, Práctica de Nómina 11-08-2020Documento7 páginasExploración, Práctica de Nómina 11-08-2020Dayana Rojas100% (1)

- TALLER ContabilidadDocumento6 páginasTALLER Contabilidadyuli duranAún no hay calificaciones

- Practica 01 - E.E.F.FDocumento5 páginasPractica 01 - E.E.F.FFrank Edwin Requelme ColoradoAún no hay calificaciones

- Grupo 11Documento43 páginasGrupo 11LU gianAún no hay calificaciones

- La Paila Modulo 7Documento3 páginasLa Paila Modulo 7David GarciaAún no hay calificaciones

- Ejercicio de IVA y Retención en La FuenteDocumento4 páginasEjercicio de IVA y Retención en La FuenteAndrea Díaz100% (1)

- Informe Financiero Quala PDFDocumento42 páginasInforme Financiero Quala PDFJesús E. Gaitán GómezAún no hay calificaciones

- Ejercicio #1 Balance General Empresa Frotinsa 2015Documento8 páginasEjercicio #1 Balance General Empresa Frotinsa 2015hvmanuAún no hay calificaciones