Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Calculo Renta 2021

Cargado por

Johanna Cárdenas Cruz0 calificaciones0% encontró este documento útil (0 votos)

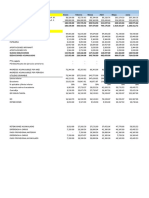

4 vistas15 páginasEl documento presenta información financiera de varios años de una persona. Muestra el patrimonio bruto, deudas y patrimonio líquido anualmente, así como avalúos y valores declarados de vehículos, apartamentos y una casa. En 2018 el patrimonio líquido se vuelve negativo debido a un aumento en las deudas. En años posteriores el patrimonio vuelve a ser positivo gracias a incrementos en el patrimonio bruto y reducciones en deudas.

Descripción original:

Cálculo renta

Derechos de autor

© © All Rights Reserved

Formatos disponibles

XLSX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoEl documento presenta información financiera de varios años de una persona. Muestra el patrimonio bruto, deudas y patrimonio líquido anualmente, así como avalúos y valores declarados de vehículos, apartamentos y una casa. En 2018 el patrimonio líquido se vuelve negativo debido a un aumento en las deudas. En años posteriores el patrimonio vuelve a ser positivo gracias a incrementos en el patrimonio bruto y reducciones en deudas.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como XLSX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

4 vistas15 páginasCalculo Renta 2021

Cargado por

Johanna Cárdenas CruzEl documento presenta información financiera de varios años de una persona. Muestra el patrimonio bruto, deudas y patrimonio líquido anualmente, así como avalúos y valores declarados de vehículos, apartamentos y una casa. En 2018 el patrimonio líquido se vuelve negativo debido a un aumento en las deudas. En años posteriores el patrimonio vuelve a ser positivo gracias a incrementos en el patrimonio bruto y reducciones en deudas.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como XLSX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 15

AÑO 2017 2018

PATRIMONIO BRUTO 66,262,000.00 PATRIMONIO BRUTO 211,107,000.00

DEUDAS 8,571,000.00 DEUDAS 213,690,000.00

PATRIMONIO LIQUIDO 57,691,000.00 PATRIMONIO LIQUIDO -2,583,000.00

3.50% 2,019,185.00 RENTA PRESUN 3.50% -90,405.00

2019 2020

PATRIMONIO B 224,244,000.00 PATRIMONIO B 235,157,000.00

DEUDAS 213,292,000.00 DEUDAS 73,729,000.00

PATRIMONIO L 10,952,000.00 PATRIMONIO L 161,428,000.00

0.50% 54,760.00 0.00% 0.00

2021

PATRIMONIO BRUTO 235,157,000.00

DEUDAS 73,729,000.00

PATRIMONIO LIQUIDO 161,428,000.00

0.00% 0.00

AVALUO AVALUO

VEHICULO 41,290,000.00

APTO JAZ 24,972,000.00 RICHARD 24,972,000.00 APTO 49,944,000.00

66,262,000.00

DEUDAS 6,071,000.00 VEHICULO 21,200,000.00 72.00 294,444.44

2,500,000.00 T.C.

8,571,000.00

reajuste fiscal

COSTO 4.07% AVALUO 50%

VEHICULO 51,200,000.00 51,200,000.00 2,083,840.00 53,283,840.00 33,150,000.00

APTO JAZ 34,200,000.00 17,100,000.00 695,970.00 17,795,970.00 32,823,000.00

CASA JAZ 250,000,000.00 125,000,000.00 5,087,500.00 130,087,500.00 90,785,000.00

335,400,000.00 193,300,000.00 7,867,310.00 201,167,310.00 156,758,000.00

7,867,310.00

201,167,310.00

VALOR A DECLARAR

VEHICULO 51,200,000.00 2,083,840.00 53,283,840.00

APTO JAZ 17,100,000.00 695,970.00 17,795,970.00

CASA JAZ 125,000,000.00 5,087,500.00 130,087,500.00

MEJORAS 9,939,690.00

193,300,000.00 7,867,310.00 211,107,000.00 211,107,000.00 0.00

DEUDAS 507,000.00 VEHICULO

3,183,000.00 T.C.

210,000,000.00 CREDITO HIPOTECARIO

213,690,000.00

DIFERENCIA reajuste fiscal AVALUO 100%

18,050,000.00 33,150,000.00 33,150,000.00

-15,723,000.00 RICHARD 32,823,000.00 APTO 65,646,000.00 32,823,000.00

34,215,000.00 JAIME 90,785,000.00 CASA QUIRO 181,570,000.00 90,785,000.00

36,542,000.00 280,366,000.00 156,758,000.00

4,07% ajuste fiscal

reajuste fiscal

COSTO 4.07% AVALUO

VEHICULO 51,200,000.00 51,200,000.00 2,083,840.00 53,283,840.00 32,200,000.00

APTO JAZ 34,200,000.00 17,100,000.00 695,970.00 17,795,970.00 33,486,500.00

CASA JAZ 250,000,000.00 125,000,000.00 5,087,500.00 130,087,500.00 96,850,000.00

335,400,000.00 193,300,000.00 7,867,310.00 162,536,500.00

7,867,310.00

201,167,310.00

VALOR DECLARADO AÑO ANTERIOR AVALUO 2019 100% AVALUO 50%

VEHICULO 53,283,840.00 MÁS 32,200,000.00 32,200,000.00

APTO JAZ 17,795,970.00 MÁS 66,973,000.00 33,486,500.00

CASA JAZ 130,087,500.00 MÁS 193,700,000.00 96,850,000.00

201,167,310.00 292,873,000.00 162,536,500.00

VALOR A DECLARAR AÑO 2019 3.36%

reajuste fiscal

VEHICULO 53,283,840.00 1,790,337.02 55,074,177.02 55,074,000.00

APTO JAZ 33,486,500.00 1,125,146.40 34,611,646.40 34,612,000.00

CASA JAZ 130,087,500.00 4,370,940.00 134,458,440.00 134,458,000.00

7,286,423.42 224,144,263.42 224,144,000.00

CTA AHORROS 100,145.00 100,000.00

224,244,408.42 224,244,000.00

DEUDAS 0.00 VEHICULO

5,341,899.00 T.C.

207,949,511.00 CREDITO HIPOTECARIO

213,291,410.00

213,291,000.00

DIFERENCIA reajuste fiscal AVALUO

19,000,000.00 32,200,000.00 32,200,000.00

-16,386,500.00 RICHARD 33,486,500.00 APTO 66,973,000.00 33,486,500.00

28,150,000.00 JAIME 96,850,000.00 CASA QUIRO 193,700,000.00 96,850,000.00

30,763,500.00 292,873,000.00 162,536,500.00

4,07% ajuste fiscal

reajuste fiscal

COSTO 3.90% AVALUO

VEHICULO 51,200,000.00 51,200,000.00 1,996,800.00 53,196,800.00 29,624,000.00

APTO JAZ 34,200,000.00 17,100,000.00 666,900.00 17,766,900.00 34,925,000.00

CASA JAZ 250,000,000.00 125,000,000.00 4,875,000.00 129,875,000.00 110,120,500.00

335,400,000.00 193,300,000.00 7,538,700.00 200,838,700.00 174,669,500.00

7,538,700.00

200,838,700.00

VALOR DECLARADO AÑO ANTERIOR AVALUO 2020 1 AVALUO 50%

VEHICULO 55,074,177.02 MÁS 29,624,000.00 29,624,000.00 se toma el valor más alto

APTO JAZ 34,611,646.40 MÁS 69,850,000.00 34,925,000.00 se toma el valor más alto

CASA JAZ 134,458,440.00 MÁS 220,241,000.00 110,120,500.00 se toma el valor más alto

224,144,263.42 319,715,000.00 174,669,500.00

VALOR A DECLARAR AÑO 2020 3.90%

reajuste fiscal

VEHICULO 55,074,177.02 2,147,892.90 57,222,069.93 57,222,000.00

APTO JAZ 34,925,000.00 1,362,075.00 36,287,075.00 36,287,000.00

CASA JAZ 134,458,440.00 5,243,879.16 139,702,319.16 139,702,000.00

8,753,847.06 233,211,464.09 233,211,000.00 290,091,000

CTA AHORROS 1,946,488.76 1,946,000.00

235,157,952.85 235,157,000.00

DEUDAS 0.00 VEHICULO

4,409,773.00 T.C.

69,318,962.00 CREDITO HIPOTECARIO

73,728,735.00

73,729,000.00

143,047,697.00 REPORTE DIAN 143,048,000.00

69,318,962.00 Valor correspondiente a la mitad d 92,109,000.00

Intereses de 7,213,806.50

7,214,000.00

Otras rentas exentas

10,232,100.00

DIFERENCIA reajuste fiscal AVALUO

21,576,000.00 29,624,000.00 29,624,000.00

-17,825,000.00 RICHARD 34,925,000.00 APTO 69,850,000.00 34,925,000.00

14,879,500.00 JAIME 110,120,500.00 CASA QUIRO 220,241,000.00 110,120,500.00

18,630,500.00 319,715,000.00 174,669,500.00

3,90% ajuste fiscal

ma el valor más alto

ma el valor más alto

ma el valor más alto

Avalúo total de los inmuebles, se divie en 2 por ser 2 propietarios

reajuste fiscal

COSTO 3.90% AVALUO

VEHICULO 51,200,000.00 51,200,000.00 1,996,800.00 53,196,800.00 29,624,000.00

APTO JAZ 34,200,000.00 17,100,000.00 666,900.00 17,766,900.00 34,925,000.00

CASA JAZ 250,000,000.00 125,000,000.00 4,875,000.00 129,875,000.00 110,120,500.00

335,400,000.00 193,300,000.00 7,538,700.00 200,838,700.00 174,669,500.00

7,538,700.00

200,838,700.00

VALOR DECLARADO AÑO ANTERIOR AVALUO 2020 100% AVALUO 50%

VEHICULO 55,074,177.02 MÁS 29,624,000.00 29,624,000.00 se toma el valor más alto

APTO JAZ 34,611,646.40 MÁS 69,850,000.00 34,925,000.00 se toma el valor más alto

CASA JAZ 134,458,440.00 MÁS 220,241,000.00 110,120,500.00 se toma el valor más alto

224,144,263.42 319,715,000.00 174,669,500.00

VALOR A DECLARAR AÑO 2020 3.90%

reajuste fiscal

VEHICULO 55,074,177.02 2,147,892.90 57,222,069.93 57,222,000.00

APTO JAZ 34,925,000.00 1,362,075.00 36,287,075.00 36,287,000.00

CASA JAZ 134,458,440.00 5,243,879.16 139,702,319.16 139,702,000.00

8,753,847.06 233,211,464.09 233,211,000.00 290,091,000

CTA AHORROS 1,946,488.76 1,946,000.00

235,157,952.85 235,157,000.00

DEUDAS 0.00 VEHICULO

4,409,773.00 T.C.

69,318,962.00 CREDITO HIPOTECARIO

73,728,735.00

73,729,000.00

143,047,697.00 REPORTE DIAN 143,048,000.00

69,318,962.00 Valor correspondiente a la mitad de la 92,109,000.00

Intereses de 7,213,806.50

7,214,000.00

Otras rentas exentas

10,232,100.00

DIFERENCIA reajuste fiscal AVALUO

21,576,000.00 29,624,000.00 29,624,000.00

-17,825,000.00 RICHARD 34,925,000.00 APTO 69,850,000.00 34,925,000.00

14,879,500.00 JAIME 110,120,500.00 CASA QUIRO 220,241,000.00 110,120,500.00

18,630,500.00 319,715,000.00 174,669,500.00

3,90% ajuste fiscal

ma el valor más alto

ma el valor más alto

ma el valor más alto

Avalúo total de los inmuebles, se divie en 2 por ser 2 propietarios

SALUD 3,410,700 12.5% 170,535.00 12 2,046,420 2,758,574

RIESGOS 3,410,700 4.350% 59,346.18 12 712,154

PENSIONES 3,410,700 16% 218,284.80 12 2,619,418 2,619,418

10,232,100.00 448,165.98 5,377,992 5,377,992

448,000

Total pagos l 40,928,400 25% 10,232,100.00 0%

Deducción

pagos realizados mensualmente

Salud 172,000.00 2,064,000.00 Valor año

Riesgos 60,000.00 720,000.00 Valor año

Pensión 218,000.00 2,616,000.00 Valor año

450,000.00 5,400,000.00 Valor año

2020 BASE

ESTAMPILLA PROCULTURA 38,160.00 7,632,000.00 Según certificado

ESTAMPILLA PROADULTO MAYOR 152,640.00 7,632,000.00 Según certificado

RETEICA 9,66 X MIL 65,320.00 6,761,952.00 Según certificado

256,120.00

2016 7.08%

2017 4.07%

2018 4.07%

2019 3.36%

2020 3.90%

También podría gustarte

- Leyes aduanales y de comercio exterior 2016: AcadémicaDe EverandLeyes aduanales y de comercio exterior 2016: AcadémicaCalificación: 5 de 5 estrellas5/5 (2)

- Excel Plan de NegociosDocumento11 páginasExcel Plan de NegociosMaría Consuelo Robledo VieraAún no hay calificaciones

- Beneficios que se contienen en las disposiciones fiscales. Análisis práctico 2017De EverandBeneficios que se contienen en las disposiciones fiscales. Análisis práctico 2017Aún no hay calificaciones

- Actividad 4. Declaración Anual Del ISR de Personas Físicas. Daniel VillegasDocumento8 páginasActividad 4. Declaración Anual Del ISR de Personas Físicas. Daniel VillegasPoder Gitano Dinastia SalvadorAún no hay calificaciones

- Flujo de Caja - Caso Practico RsuDocumento6 páginasFlujo de Caja - Caso Practico RsuVíctor Lando Calderón LópezAún no hay calificaciones

- Flujo de Caja Proyectado Turisbriel 10 AñosDocumento7 páginasFlujo de Caja Proyectado Turisbriel 10 AñosYelitza DigioiaAún no hay calificaciones

- Canedo Adela 2PDocumento14 páginasCanedo Adela 2PMuriel veronica Burgos floresAún no hay calificaciones

- Practica Contabilidad ElectronicaDocumento19 páginasPractica Contabilidad ElectronicaConta Consu SolorzAún no hay calificaciones

- Presupuesto PROFORMADocumento6 páginasPresupuesto PROFORMASt SAún no hay calificaciones

- Calculo ISR PMDocumento33 páginasCalculo ISR PMSalvador Avalos CerasAún no hay calificaciones

- Tercer Taller de Tributaria IIIDocumento10 páginasTercer Taller de Tributaria IIIVanessa AtencioAún no hay calificaciones

- Actividad 5Documento10 páginasActividad 5jeimy ossa satizabalAún no hay calificaciones

- Presupuesto TallerDocumento4 páginasPresupuesto TallerPERALTA GOMEZ WENDY JOHANNAAún no hay calificaciones

- Excel ExposicionDocumento13 páginasExcel ExposicionAllisonAún no hay calificaciones

- 12 Practica Anual PFDocumento19 páginas12 Practica Anual PFMiguel Angel Javier NiñoAún no hay calificaciones

- Presupuesto de Efectivo - TareaDocumento2 páginasPresupuesto de Efectivo - TareaAngel MontecinosAún no hay calificaciones

- Proyeccion Ventas y Gastos para 3 InversionesDocumento5 páginasProyeccion Ventas y Gastos para 3 InversionespaolaAún no hay calificaciones

- Flujo GIMNASIODocumento7 páginasFlujo GIMNASIOXimena Andrea Salas SalasAún no hay calificaciones

- Rentas de Primera Categoria Alquiler MejoraDocumento8 páginasRentas de Primera Categoria Alquiler MejoraDenise Flores MesccoAún no hay calificaciones

- Decreto Adicion Superavit Salud Vig 2022Documento7 páginasDecreto Adicion Superavit Salud Vig 2022alejandra diaz diazAún no hay calificaciones

- MantenimientoDocumento2 páginasMantenimientoSantiago Bedoya MontoyaAún no hay calificaciones

- Ejercicios Criterios FinancierosDocumento11 páginasEjercicios Criterios Financierosdamaris l crespin RAún no hay calificaciones

- Cuadro Resumen Cierre de Caja Abril 2021 FlacaDocumento21 páginasCuadro Resumen Cierre de Caja Abril 2021 FlacaJose ParraAún no hay calificaciones

- Caso Mitsuba.Documento4 páginasCaso Mitsuba.Alvaro RivamontanAún no hay calificaciones

- Si Se Puede x2Documento12 páginasSi Se Puede x2JOSE JEFFERSON HERNANDEZ CUEVAAún no hay calificaciones

- Practica 3 de Costos Por ProcesoDocumento11 páginasPractica 3 de Costos Por ProcesoLimbert Germán Mamani AlcónAún no hay calificaciones

- Rif ResicoDocumento3 páginasRif ResicoDahil A. GarciaAún no hay calificaciones

- Flujo de Caja Gerardo PazDocumento3 páginasFlujo de Caja Gerardo PazafrissosAún no hay calificaciones

- Flujo de Caja Caso GravetalDocumento7 páginasFlujo de Caja Caso GravetalSolares Padilla Roger DavidAún no hay calificaciones

- Material Complementario MEDICDRONEDocumento5 páginasMaterial Complementario MEDICDRONEmarisett cristina piñan kaiserAún no hay calificaciones

- Estados Financieros EC01293 SALON M NAIL SDocumento3 páginasEstados Financieros EC01293 SALON M NAIL SJavier CruzAún no hay calificaciones

- Lfherace - EJERCICIOS DE MATEMÁTICAS FINANCIERASDocumento18 páginasLfherace - EJERCICIOS DE MATEMÁTICAS FINANCIERASAnderson IzaquitaAún no hay calificaciones

- Cuadro Resumen Cierre de Caja Junio 2021 FlacaDocumento15 páginasCuadro Resumen Cierre de Caja Junio 2021 FlacaJose ParraAún no hay calificaciones

- Fecha Practico # 1: Presupuesto de EfectivoDocumento8 páginasFecha Practico # 1: Presupuesto de EfectivoYamile GarcíaAún no hay calificaciones

- Conta Guber PedDocumento12 páginasConta Guber Pedernesto olivaAún no hay calificaciones

- Desarrollo de Ejercicios de Indice Costo BeneficioDocumento6 páginasDesarrollo de Ejercicios de Indice Costo BeneficioAnggie CoraimaAún no hay calificaciones

- Libro 1Documento14 páginasLibro 1Velarmino MontalvoAún no hay calificaciones

- AsdfhjklDocumento37 páginasAsdfhjklLiz SugeyAún no hay calificaciones

- PRIMER PARCIAL 2021 Ysmel RosarioDocumento16 páginasPRIMER PARCIAL 2021 Ysmel RosarioYsmel Marie Rosario AstacioAún no hay calificaciones

- Copia de NeiderDocumento8 páginasCopia de NeiderWilliam TorresAún no hay calificaciones

- Declaracion Anual de Personas Fisicas Integrante de 3 CoordinadosDocumento8 páginasDeclaracion Anual de Personas Fisicas Integrante de 3 Coordinadoskarla iveth osorio diazAún no hay calificaciones

- PRÁCTICADocumento17 páginasPRÁCTICAIbrahim ColkeAún no hay calificaciones

- Almacen Logistico Acme v.2Documento17 páginasAlmacen Logistico Acme v.2David SánchezAún no hay calificaciones

- Presupuesto TallerDocumento4 páginasPresupuesto TallerPERALTA GOMEZ WENDY JOHANNAAún no hay calificaciones

- Flujo de Caja Caso Mitsuba, Con Analisis de EscenariosDocumento19 páginasFlujo de Caja Caso Mitsuba, Con Analisis de EscenariosSolares Padilla Roger DavidAún no hay calificaciones

- Proyecto Del 3 UamDocumento19 páginasProyecto Del 3 UamIggor ValdezAún no hay calificaciones

- Ejercicio 2 Amortizacion, Depreciación, Estado de Resultado y Flujo de FondosDocumento9 páginasEjercicio 2 Amortizacion, Depreciación, Estado de Resultado y Flujo de FondosNicolás Felipe LópezAún no hay calificaciones

- CUADRO RESUMEN CIERRE DE CAJA 22a28MARZO 2021Documento17 páginasCUADRO RESUMEN CIERRE DE CAJA 22a28MARZO 2021Jose ParraAún no hay calificaciones

- Tarea #3Documento2 páginasTarea #3Elvin RamosAún no hay calificaciones

- MantenimientoDocumento2 páginasMantenimientoSantiago Bedoya MontoyaAún no hay calificaciones

- Trabajo Iva Audit FinanDocumento6 páginasTrabajo Iva Audit FinanEdison Aunca Usuga0% (1)

- Casos de Amortizacion Carlos 1Documento9 páginasCasos de Amortizacion Carlos 1leopoldo de leon aceves franchezAún no hay calificaciones

- 25 Proyeccion de Venta y Compra de Productos A 5 AñosDocumento5 páginas25 Proyeccion de Venta y Compra de Productos A 5 AñosDaniel SanchezAún no hay calificaciones

- Copia de Muestra Impuestos Diciembre 2023 - Punto de Servicios S.ADocumento6 páginasCopia de Muestra Impuestos Diciembre 2023 - Punto de Servicios S.AAlvaro Gulloso VelaidesAún no hay calificaciones

- Ejercicio Estados Financieros ProformaDocumento5 páginasEjercicio Estados Financieros ProformaElena GalavizAún no hay calificaciones

- Solución Taller IVA Con ProrrateoDocumento3 páginasSolución Taller IVA Con ProrrateoCarolina ValenciaAún no hay calificaciones

- Ejercicio Tarea BereDocumento10 páginasEjercicio Tarea Berealma jimenezAún no hay calificaciones

- Cap III Caso No 3 Azucarera Virgen de La Paz LemaDocumento2 páginasCap III Caso No 3 Azucarera Virgen de La Paz LemaWalter HenríquezAún no hay calificaciones

- Waffles - Flujo de CajaDocumento5 páginasWaffles - Flujo de CajaChristopher Ayala BohorquezAún no hay calificaciones

- Caso Jabon UnoDocumento8 páginasCaso Jabon UnoYoselin GutierrezAún no hay calificaciones