Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Cuadro 032

Cargado por

dgmamanigomezDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Cuadro 032

Cargado por

dgmamanigomezCopyright:

Formatos disponibles

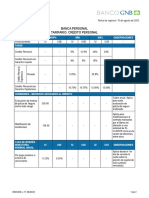

CUADRO 032 TASAS DE INTERÉS ACTIVAS PROMEDIO DE LAS CAJAS MUNICIPALES DE AHORRO Y CRÉDITO (% en términos efectivos anuales) /

AVERAGE LENDING INTEREST RATES OF MUNICIPAL CREDIT AND SAVINGS INSTITUTIONS BY TYPE OF CREDIT (% annual effective rates) 1/ 2/

MONEDA NACIONAL / DOMESTIC CURRENCY MONEDA EXTRANJERA / FOREIGN CURRENCY

CORPORATIVAS. GRANDES Y CORPORATIVAS. GRANDES Y

PEQUEÑA y MICROEMPRESA CONSUMO/ PEQUEÑA y MICROEMPRESA CONSUMO/

MEDIANAS EMPRESAS MEDIANAS EMPRESAS

SMALL BUSINESS CONSUMPTION SMALL BUSINESS CONSUMPTION

WHOLESALE BANKING WHOLESALE BANKING

PROMEDIO PROMEDIO

ESTRUCTURA ESTRUCTURA

Préstamos Préstamos Préstamos HIPOTECARIO/

CONSTANTE/

Préstamos Préstamos Préstamos HIPOTECARIO/

CONSTANTE/

Loans Loans Tarjeta de Loans MORTGAGE Loans Loans Tarjeta de Loans MORTGAGE

FIX-WEIGHED FIX-WEIGHED

Crédito / AVERAGE 3/ Crédito / AVERAGE 3/

Credit Credit

Hasta 360 d./ Más de 360 d./ Hasta 360 d./ Más de 360 d./ Card Hasta 360 d./ Más de 360 d./ Hasta 360 d./ Más de 360 d./ Hasta 360 d./ Más de 360 d./ Card Hasta 360 d./ Más de 360 d./

Up to 360 days More than 360 days Up to 360 days More than 360 days Up to 360 days More than 360 days Up to 360 days More than 360 days Up to 360 days More than 360 days Up to 360 days More than 360 days

2021 2021

Dic. 17.9 10.8 30.9 21.2 - 47.0 23.5 13.2 18.2 11.9 11.3 21.3 16.2 - 16.8 12.9 11.5 9.3 Dec.

2022 2022

Ene. 17.9 10.8 31.0 21.3 - 47.6 23.6 13.2 18.1 12.8 11.2 20.9 16.1 - 15.6 13.6 11.5 9.3 Jan.

Feb. 17.4 10.9 31.0 21.4 - 47.4 23.5 13.2 18.1 12.8 11.2 20.0 16.2 - 15.2 12.8 11.5 9.2 Feb.

Mar. 17.8 11.0 31.1 21.5 - 47.6 23.6 13.2 18.1 12.7 11.3 18.5 16.0 - 19.7 12.6 11.6 9.2 Mar.

Abr. 17.4 11.0 31.2 21.6 - 47.8 23.5 13.2 18.2 12.6 11.8 28.3 16.0 - 16.1 12.6 11.5 9.2 Apr.

May. 18.0 11.1 31.5 21.7 - 48.0 23.6 13.1 18.3 12.2 11.7 28.5 16.1 - 13.4 12.4 11.5 9.4 May

Jun. 17.1 11.2 31.8 21.8 - 47.6 23.5 13.1 18.3 13.2 11.7 21.5 16.0 - 14.7 13.0 11.4 9.4 Jun.

Jul. 16.6 11.1 30.2 20.8 - 46.6 22.2 13.0 17.6 13.2 10.8 29.5 16.0 - 12.3 11.7 11.3 9.1 Jul.

Ago. 16.0 11.5 32.0 22.1 - 47.5 23.5 13.1 18.4 13.4 11.6 22.9 16.4 - 11.6 13.6 11.3 9.4 Aug.

Set. 16.0 11.6 32.1 22.3 - 47.6 23.6 13.1 18.5 15.0 11.7 23.2 16.5 - 11.6 13.6 11.4 9.5 Sep.

Oct. 16.4 12.1 32.5 22.6 - 48.2 24.6 13.1 19.0 14.2 11.6 23.8 16.7 - 13.1 12.7 11.3 9.7 Oct.

Nov. 16.5 12.0 32.0 22.6 - 47.9 23.6 13.1 18.7 14.1 11.7 23.7 17.3 - 12.3 13.1 11.3 9.7 Nov.

Dic. 17.3 12.3 32.0 22.8 - 48.0 23.6 13.1 18.8 14.9 11.8 24.6 17.3 - 12.1 13.0 11.3 9.7 Dec.

2023 2023

Ene. 17.0 12.4 32.2 23.0 - 48.4 23.8 13.1 18.9 16.0 11.7 21.1 16.9 - 14.7 12.9 11.2 9.6 Jan.

Feb. 18.0 12.6 32.3 23.2 - 48.8 23.8 13.1 19.0 16.0 11.7 21.6 16.9 - 15.3 12.9 11.2 9.6 Feb.

Mar. 18.5 12.7 32.4 23.4 - 49.0 24.0 13.1 19.1 9.6 11.8 18.6 16.9 - 14.5 12.8 11.2 9.5 Mar.

Abr. 19.2 12.9 32.8 23.5 - 49.4 23.5 13.2 19.0 9.1 11.2 19.0 16.7 - 14.6 12.9 11.3 9.4 Apr.

May. 18.5 13.2 32.8 23.7 - 49.7 24.0 13.2 19.3 13.4 11.8 20.8 16.4 - 15.5 13.0 11.3 9.5 May

También podría gustarte

- Trabajo de Recuperacion de CarteraDocumento8 páginasTrabajo de Recuperacion de CarteraLuis Miguel Santiago Chiclla100% (1)

- Triptico Modelo 2Documento2 páginasTriptico Modelo 2Mishell LuCero100% (2)

- Analista de Comercio Exterior (Prueba Comex)Documento16 páginasAnalista de Comercio Exterior (Prueba Comex)Ricardo AragonAún no hay calificaciones

- Recibo Noviembre 2018 PDFDocumento2 páginasRecibo Noviembre 2018 PDFJean Albañil0% (1)

- Cuadro 033Documento1 páginaCuadro 033dgmamanigomezAún no hay calificaciones

- Cuadro 031Documento1 páginaCuadro 031dgmamanigomezAún no hay calificaciones

- SOE.376 Solicitud Global de Crédito Al ConsumoDocumento3 páginasSOE.376 Solicitud Global de Crédito Al ConsumoGenesis LacruzAún no hay calificaciones

- Cuadro 034Documento2 páginasCuadro 034dgmamanigomezAún no hay calificaciones

- BanecuadorDocumento4 páginasBanecuadorAlexis MaldonadoAún no hay calificaciones

- Tarifario FassilDocumento1 páginaTarifario FassilRoberto ValverdeAún no hay calificaciones

- Banco AgrarioDocumento1 páginaBanco AgrarioUAFU6 MontelibanoAún no hay calificaciones

- Ejercicios ResueltosDocumento2 páginasEjercicios ResueltosReycer Quispe ArroyoAún no hay calificaciones

- Cuadro de Excepciones Junio2017Documento1 páginaCuadro de Excepciones Junio2017josecovinosAún no hay calificaciones

- Tasas 0720Documento5 páginasTasas 0720wendyyyAún no hay calificaciones

- For GTN 02-03-01 Solicitud de Credito Persona Natural EDIT 2023Documento3 páginasFor GTN 02-03-01 Solicitud de Credito Persona Natural EDIT 2023Jimmy TaipeAún no hay calificaciones

- Indicadores Morosidad y Créditos Directos Por Tipo de CréditoDocumento2 páginasIndicadores Morosidad y Créditos Directos Por Tipo de Créditoancon puesto de capitaniaAún no hay calificaciones

- Tasas 0619Documento5 páginasTasas 0619JessAún no hay calificaciones

- Solucionario - s14 y 15 - Caso Benavente Se Fue A Rusia - SolucionarioDocumento3 páginasSolucionario - s14 y 15 - Caso Benavente Se Fue A Rusia - SolucionarioLILIBET BRENDA UNCHUPAICO ALIAGAAún no hay calificaciones

- MapasDocumento8 páginasMapasajax_kbronAún no hay calificaciones

- Tarifario de TasasDocumento1 páginaTarifario de TasasleonardoAún no hay calificaciones

- Bases Plan Amigo HipotecasDocumento2 páginasBases Plan Amigo Hipotecasalejandrosp091Aún no hay calificaciones

- Cuenta de Cobro 7 MODIFICADODocumento1 páginaCuenta de Cobro 7 MODIFICADOJonathan JaimesAún no hay calificaciones

- Simulador Residencial FOVISSSTE Octubre 2023.XlsmDocumento7 páginasSimulador Residencial FOVISSSTE Octubre 2023.XlsmJulio PosadasAún no hay calificaciones

- Cuadro 035Documento18 páginasCuadro 035Fernanda JaraAún no hay calificaciones

- Banesco CredimujerDocumento1 páginaBanesco CredimujerNELMIR ZAMBRANOAún no hay calificaciones

- Actividad de Soportes ContablesDocumento5 páginasActividad de Soportes ContablesElizabeth Castañeda bornacellyAún no hay calificaciones

- 002 Rol de Pagos FebreroDocumento19 páginas002 Rol de Pagos FebreroErika PamelaAún no hay calificaciones

- Estados de Cuenta A Marzo 2023Documento4 páginasEstados de Cuenta A Marzo 2023Leny Luz Lopez LozanoAún no hay calificaciones

- Estados de Cuenta Abril 2023Documento4 páginasEstados de Cuenta Abril 2023Leny Luz Lopez LozanoAún no hay calificaciones

- E000208 TARIFARIO PP Agosto 2022Documento2 páginasE000208 TARIFARIO PP Agosto 2022Giancarlo Ardiles ArdilesAún no hay calificaciones

- Tasas 0819 PDFDocumento5 páginasTasas 0819 PDFgabyAún no hay calificaciones

- Formulario Conocimiento PJ 12-06-2018Documento5 páginasFormulario Conocimiento PJ 12-06-2018Javier PenagosAún no hay calificaciones

- Planilla Robinson Andres Castro 11Documento1 páginaPlanilla Robinson Andres Castro 11Juan Pablo RobayoAún no hay calificaciones

- Simulador Residencial FOVISSSTE - SCDocumento6 páginasSimulador Residencial FOVISSSTE - SCCaleb ReyesAún no hay calificaciones

- Brochure Comparativo MercantilDocumento4 páginasBrochure Comparativo MercantilRosaura Del Valle PerdomoAún no hay calificaciones

- Folleto Informativo de TDC BBVADocumento5 páginasFolleto Informativo de TDC BBVAeumiramcAún no hay calificaciones

- 4g-Lte Entidades Bancarias - Notificación Sms.Documento7 páginas4g-Lte Entidades Bancarias - Notificación Sms.qugonjinnAún no hay calificaciones

- Red SemanticaDocumento1 páginaRed Semantica1233667ehefAún no hay calificaciones

- Cuadro Sinoptico y Mapa Conceptual.Documento3 páginasCuadro Sinoptico y Mapa Conceptual.Edilverto B Huaman Cruz100% (3)

- Mapa SinopticoDocumento1 páginaMapa SinopticoMaycoll LcAún no hay calificaciones

- Entidades Supervisadas Por SIB GuatemalaDocumento1 páginaEntidades Supervisadas Por SIB GuatemalaRandy PeraltaAún no hay calificaciones

- DM 090000018195a65d 3418713900403 CobroDocumento1 páginaDM 090000018195a65d 3418713900403 CobroelizabethAún no hay calificaciones

- Formato de Pago de DerechosDocumento2 páginasFormato de Pago de DerechospedritoAún no hay calificaciones

- ACTIVIDAD de SoporteDocumento5 páginasACTIVIDAD de SoporteEris Ramos RomeroAún no hay calificaciones

- Edan2017 2A SUNCHUBAMBADocumento2 páginasEdan2017 2A SUNCHUBAMBADrpGilmerRamirezAún no hay calificaciones

- 1 PF Financiamiento de Proyectos Inmobiliarios de ViviendaDocumento40 páginas1 PF Financiamiento de Proyectos Inmobiliarios de ViviendaOswer C.Aún no hay calificaciones

- Silupu Cordova Saulo Samir PaoloDocumento1 páginaSilupu Cordova Saulo Samir PaoloPaolo ScordovaAún no hay calificaciones

- Mapa Mental 2Documento1 páginaMapa Mental 2Dario Roncancio100% (1)

- ANEXO 2.5.1. 8.2.5 Documentacion y Registro Conductores v1Documento14 páginasANEXO 2.5.1. 8.2.5 Documentacion y Registro Conductores v1Juan Carlos LópezAún no hay calificaciones

- Circular SB SG 00013 2020Documento1 páginaCircular SB SG 00013 2020Rodrigo Rafael Vallejos AcuñaAún no hay calificaciones

- Tarifario de TasasDocumento1 páginaTarifario de TasasPablo C. VillegasAún no hay calificaciones

- Planilla NovDocumento11 páginasPlanilla Novhelen barraganAún no hay calificaciones

- Requisitos Afiliación Al IessDocumento4 páginasRequisitos Afiliación Al IessEnkarservsa Encargos VentservariosAún no hay calificaciones

- C.cobro 4Documento2 páginasC.cobro 4wilfort sartoryAún no hay calificaciones

- Tarifario Bco 1Documento1 páginaTarifario Bco 1Judy QuispeAún no hay calificaciones

- Administracion y MaterialesDocumento1 páginaAdministracion y Materialesshander Oliveira RamosAún no hay calificaciones

- Pago AbrilDocumento1 páginaPago AbrilMauro Fuentes AguilarAún no hay calificaciones

- Cuadre de DeudaDocumento1 páginaCuadre de DeudaLuis DietrichAún no hay calificaciones

- AbrilDocumento2 páginasAbrilLino RenderosAún no hay calificaciones

- Cuadro 039Documento1 páginaCuadro 039dgmamanigomezAún no hay calificaciones

- Cuadro 041Documento1 páginaCuadro 041dgmamanigomezAún no hay calificaciones

- Cuadro 037Documento1 páginaCuadro 037dgmamanigomezAún no hay calificaciones

- Cuadro 038Documento1 páginaCuadro 038dgmamanigomezAún no hay calificaciones

- Cuadro 036Documento1 páginaCuadro 036dgmamanigomezAún no hay calificaciones

- Cuadro 011Documento9 páginasCuadro 011dgmamanigomezAún no hay calificaciones

- Cuadro 004Documento1 páginaCuadro 004dgmamanigomezAún no hay calificaciones

- Cuadro 014Documento1 páginaCuadro 014dgmamanigomezAún no hay calificaciones

- Cuadro 015Documento1 páginaCuadro 015dgmamanigomezAún no hay calificaciones

- Cuadro 005Documento1 páginaCuadro 005dgmamanigomezAún no hay calificaciones

- Peru Panorama Economico Departamental N 12 Diciembre 2023Documento28 páginasPeru Panorama Economico Departamental N 12 Diciembre 2023dgmamanigomezAún no hay calificaciones

- Cuadro 012Documento1 páginaCuadro 012dgmamanigomezAún no hay calificaciones

- EeP Fund 22 AnalisisMultivariante RegLinealMultipleDocumento7 páginasEeP Fund 22 AnalisisMultivariante RegLinealMultipledgmamanigomezAún no hay calificaciones

- Anc3a1lisis MultivariadoDocumento16 páginasAnc3a1lisis MultivariadodgmamanigomezAún no hay calificaciones

- Cuenta BanorteDocumento2 páginasCuenta BanorteElixxabeht NuñezAún no hay calificaciones

- Qué Es BancoDocumento7 páginasQué Es BancoEsvin AlexanderAún no hay calificaciones

- Contabilidad Instituciones Financieras: Lic. Roberto Antonio RodriguezDocumento5 páginasContabilidad Instituciones Financieras: Lic. Roberto Antonio RodriguezVelkis MadridAún no hay calificaciones

- Formato Curriculo UnefaDocumento2 páginasFormato Curriculo UnefaRichard PerdomoAún no hay calificaciones

- Trabajo Práctico #1 Numeros EnterosDocumento10 páginasTrabajo Práctico #1 Numeros EnterosCecilia ÁlvarezAún no hay calificaciones

- Tarea 2 Conta GeneralDocumento6 páginasTarea 2 Conta GeneralSandra Soraya GarciaAún no hay calificaciones

- TP 16Documento2 páginasTP 16Nico MoyaAún no hay calificaciones

- Edpyme SolidaridadDocumento26 páginasEdpyme SolidaridadAnderson ImenjerAún no hay calificaciones

- Proyecto de La BeneficaDocumento36 páginasProyecto de La BeneficaManuel DominguezAún no hay calificaciones

- EVALUACIONDocumento10 páginasEVALUACIONSantiago QuirogaAún no hay calificaciones

- Cuadro AnàlisisDocumento2 páginasCuadro AnàlisisBender Doblador RodriguezAún no hay calificaciones

- Acta de Entrega de Cargo de La Administracion JuliacaDocumento3 páginasActa de Entrega de Cargo de La Administracion JuliacaDiana Zirena AjajahuiAún no hay calificaciones

- Ejercicios Descuento Comercial 14-15Documento2 páginasEjercicios Descuento Comercial 14-15rararafafafa0% (1)

- Recibo Maestria Autor DesconocidoDocumento1 páginaRecibo Maestria Autor DesconocidoABEL HUMBERTO ESPINOSA GALLEGOAún no hay calificaciones

- Cuadro Sinoptico Semana 5Documento3 páginasCuadro Sinoptico Semana 5DEYSI FERNANDA ROBAYO GONZALEZAún no hay calificaciones

- De Los Santos Caballero Fanny. Unidad 1. Actividad 1. Entregable. Ley 183-02Documento3 páginasDe Los Santos Caballero Fanny. Unidad 1. Actividad 1. Entregable. Ley 183-02Fanny de los SantosAún no hay calificaciones

- Resumen La PorotaDocumento4 páginasResumen La PorotaJose Miguel Ferrada SaraviaAún no hay calificaciones

- Cambioos en La Ecuacion Contable JUANDocumento4 páginasCambioos en La Ecuacion Contable JUANXavi EscobarAún no hay calificaciones

- Demanda IncidentaDocumento9 páginasDemanda IncidentaAdolfo MendiolaAún no hay calificaciones

- Influencia de La Inclusión Financiera en La Informalidad Laboral en El PerúDocumento4 páginasInfluencia de La Inclusión Financiera en La Informalidad Laboral en El PerúNaylaAún no hay calificaciones

- Analisis de Costos Jumbo EhDocumento3 páginasAnalisis de Costos Jumbo EhJuan Macedo GuerreroAún no hay calificaciones

- Práctica de Reforzamiento de Matemática FinancieraDocumento8 páginasPráctica de Reforzamiento de Matemática FinancieraSantos Martinez SelmoAún no hay calificaciones

- Bernanke, B. - La Regla de Taylor. Un Punto de Referencia para La Política MonetariaDocumento10 páginasBernanke, B. - La Regla de Taylor. Un Punto de Referencia para La Política MonetariaJorge Esteban Mendoza OrtizAún no hay calificaciones

- Ejemplo Inscripcion de EmpresaDocumento58 páginasEjemplo Inscripcion de EmpresaCASTELLANOS REYES DIEGO MARCELINOAún no hay calificaciones

- Los Descuentos en Las VentasDocumento2 páginasLos Descuentos en Las VentasJuliethBecerraAún no hay calificaciones

- Ejemplo Letra de CambioDocumento2 páginasEjemplo Letra de CambioMelissa MendezAún no hay calificaciones

- 8F180 Solicitud de Retiro FCLDocumento1 página8F180 Solicitud de Retiro FCLJulian Cordero ArroyoAún no hay calificaciones

- Extrato 20210428Documento6 páginasExtrato 20210428Gustavo AlfhaFazAún no hay calificaciones