Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Aabe 804

Aabe 804

Cargado por

Yibeltal Assefa0 calificaciones0% encontró este documento útil (0 votos)

13 vistas7 páginasAABE

Título original

AABE 804 (2)

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoAABE

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

13 vistas7 páginasAabe 804

Aabe 804

Cargado por

Yibeltal AssefaAABE

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF o lea en línea desde Scribd

Está en la página 1de 7

ACCOUNTING AND AUDITING BOARD OF

ETHIOPIA

Directive to provide the Criteria for Identifying Reporting Entities

and Registration Directive No. AABE 804/2013

July 2021

Addis Ababa

INTRODUCTION

The Accounting and Auditing Board of Ethiopia is vested with multiple

powers and duties by Proclamation No. 847/2014 among which are to set

criteria to distinguish and register reporting entities as either public

interest entities or small and medium enterprises. Accordingly, the Board

considering the type or nature of business, size of resource or number of

employees set criteria that distinguish public interest entities and small

and medium enterprises. In addition, this Directive provides the time

when such reporting entities shall submit and register their audited

financial statements prepared in accordance with financial reporting

standards stipulated on the proclamation, as well as the accountability for

failing to submit such reports within the period prescribed.

Objective

The main objective ofthis Directive is, in accordance with the provisions

of the proclamation, to set criteria to classify reporting entities as public

interest entities and small and medium enterprises and to prescribe when

to submit their audited financial statements which is prepared according

to financial reporting standards to the Board, as well as the accountability

for failing to properly carry out such responsibilities.

Accordingly, this Directive is issued by the Accounting and Auditing

Board of Ethiopia in accordance with Article 53(2) of the Financial

Reporting Proclamation No.847/2014.

PART ONE

GENERAL

1. ShortTitle

a

This Directive may be cited as ' Directive to provide the Criteria for Identifying Reporting

Entitics and Registration Directive No. AABE 804/2013."

Definitions

Unless the context otherwise requires in this Directive:

"Board" means the Accounting and Auditing Board of Ethiopia established under

Council of Ministers Regulations No. 332/2014.

"Proclanation" means the Financial Reporting Proclamation No. 847/2014;

“Raulations" means the Establishment and Determination of the Procedure of the

Accounting and Auditing Board of Ethiopia Council of Ministers Regulations No.

332/2014,

“'Numberof Employees” means number ofemployees employed for specific period

or permanently by a reporting entity in each month ofthe financial year though not

working for the whole month the average number of employees is taken by

calculating the total number of employees in every month divided by the number of

months;

“Tota Asset" means the total asset indicated in the asset and liability statement of

the Reporting Entity

“Registration Certifate of ReportingEntities' means a registration certificate to

be issued to reporting entities by the Board which shows that they are Public Interest

Entities or Small and Medium Enterprises.

The definition under Article 2 of the Proclamation shall also apply to this Directive.

shall also include feminine.

3. SCOPE OF APPLICATION

This Directive shall apply on all Reporting Entities established under Ethiopian law or

operating in Ethiopia.

PART TWO

Criteriafor Classification of ReportingEntities and Reeistration

4, Reportineintities

Reporting entities which meet the criteria listed under the following articles shall be

considered as public interest entities or small and medium enterprises.

5. Criteriafor Classifyine Public InterestReportineEntities

1. Based on the nature of the Business they provide the following are classified as Public

Interest Reporting Entities:

5)

b)

°c)

d)

e)

5

ES)

hy)

i)

any company which places or intending to place the securities it issues in

regulated capital market;

banks, insurances, micro finance institutions capital goods finance companies

and other finance institutions;

a public enterprise fully or partially owned by the Government;

share Company;

an institution regulated by the relevant government organ which administers

pension or provident fund and other institution performs similar activities

union of cooperatives

regulated consumer associations;

organization of civil societies and charitable organization;

members of the Ethiopian Commodity Exchange.

2. Based on the size and number of employees a reporting entity which meets at least two

ofthe following criteria is classified as public interest reporting entities.

3iPage

b) its total asset is Birr 200,000 000 (two hundred million) or over;

©) its total liability is Birr 200,000,000 (two hundred million) or over;

@) its number of employees is 200 (two hundred) or over

3. For purposes of sub article 2 of this Article and article 6 of this directive, if the fiscal

year ofthe reporting entity is less than |2 (twelve) months the revenue generated during

the month(s) it has operated shall be converted into a year.

6. Criteria to Classify Small and Medium Enteprises

Is

Page

I

2:

A Reporting Entity which meets at least two of the following criteria is Small and

Medium Enterprise;

a) its annual revenue is over Birr 20,000,000 (twenty million) and less than Birr

300,000,000 (three hundred million);

b) its total asset is over Birr 20,000 000 (twenty million) and less than Birr

200 000 000 (two hundred million);

©) its total liability is over Birr 20,000 000 (twenty million) and less than Birr

200,000,000 (two hundred million);

4) its number ofemployees is over 20 (twenty) and less than 200 (two hundred)

Notwithstanding the provisions of Article 5 of this directive any private limited

company regardless ofthe criteria listed under sub articles | ofthis article is small

and medium enterprise.

Micro Enterpises

A partnership or sole proprietorship which does not meet the criteria under Article $ and 6

of this Directive is a micro enterprise.

PART THREE

Obligations of Reporting Entities

8. Obligation of Reporting Entities

Any reporting entity shall submit to the Board its annual audited financial

statements prepared in accordance with the following upon payment of the service

fee:

a) Public Interest Entities m accordance with the international Financial

Reporting Standards;

b) Small and Medium Enterprises m accordance with the International

Financial Reporting Standards applicable for Small and Medium

Enterprises

©) organization of civil societies and charitable organization in accordance

with the International Public Sector Accounting Standards.

The audited financial statement of any Reporting Entity shall be prepared in

accordance with the fmancial reporting standards provided under this Article and

audit standards issued or adopted by the Board and shall first be submitted to the

Board; the report to be submitted to publie bodies authorized by other laws shall be

the original copy of the one submitted to the Board

‘The annual financial statement to be submitted to the Board by reporting entities

shall be audited by external auditor.

The reporting entities specified under this article shall submit their audited financial

statement within four months from the end of their fiscal year using the reporting

method prescribed by the Board,

A reporting entity which

iled to submit the report within the time specified under

sub article 4 ofthis Article shall be liable to pay a penalty of Birr 200 (two hundred)

for each day of delay: and the Director ofthe reporting entity shall pay a penalty of

Birr 100 (one hundred) for each day of delay. However, the penalty shall only

continue to apply for three months after which they will be criminally liable in

9.

If a reporting entity not registered with the Board, fails to register within three

months from the date of issuance of this Directive shall be liable to pay a penalty

of Birr 200 (two hundred) for each day of delay and the Director of the Reporting

Entity shall pay apenalty of Birr 100 one hundred) for each day of delay. However,

the penalty shall only continue to apply for three months after which they will be

criminally liable in accordance with Article 44 of the Proclamation.

If areporting entity established after the issuance of this Directive, fails to register

within three months from the date of commencement ofthe business shall be liable

to pay a penalty of Birr 200 (two hundred) for each day of delay and the Director

ofthe reporting entity shall pay a penalty of Birr 100 (one hundred) for each day of

delay, However, the penalty shall only continue to apply for three months after

which they will be criminally liable in accordance with Article 44 of the

Proclamation

if any reporting entity intends to prepare its annual financial statement by using

external professional shall conclude a legal contract with the accounting or audit

firm that registered by the Board. If it fails to do so the financial statement or the

audit report shall not be acceptable.

PART FOUR

Miscellaneous Provisions

Ingpplicable Laws

Any Directive or working procedure which is not consistent with this Directive shall not

be applicable on matters provided by this Directive

10. Effective Date

This Directive shall take effect upon being approved by Board of Directors of the

Accounting and Auditing Board of Ethiopia. ta

Done at Addis Ababa July 15, 2021.

Eyob Tekalign (PhD)

Chairpersomf the Boardof Directors of the Accounting and Auditing Boardof Ethiopia

También podría gustarte

- Evaluacion Final - Escenario 8 - PRIMER BLOQUE-TEORICO - VIRTUAL - FORMULACION Y EVALUACION DE PROYECTOS - (GRUPO B05) - 1Documento9 páginasEvaluacion Final - Escenario 8 - PRIMER BLOQUE-TEORICO - VIRTUAL - FORMULACION Y EVALUACION DE PROYECTOS - (GRUPO B05) - 1Leidy DayAún no hay calificaciones

- Informe GerencialDocumento33 páginasInforme GerencialGuía Contable100% (1)

- 400 Preguntas de Examen de PAS - Sin RespDocumento33 páginas400 Preguntas de Examen de PAS - Sin RespEdgar Lopez100% (1)

- Practico Niif 15Documento9 páginasPractico Niif 15SAMUEL DE JESUS ULLU MUÑOZAún no hay calificaciones

- 3.1 Unidad ContableDocumento1 página3.1 Unidad ContableManuel Lopez Obrador100% (1)

- A3 - Mod8 - Unid6 - Rentabilidad, Autofinanciación y CrecimientoDocumento13 páginasA3 - Mod8 - Unid6 - Rentabilidad, Autofinanciación y CrecimientoJose Javier Ovalles CarvajalAún no hay calificaciones

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)De EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Aún no hay calificaciones

- Demanda de Obligacion de Dar Suma de DineroDocumento11 páginasDemanda de Obligacion de Dar Suma de DineroJorgeCutipaAún no hay calificaciones

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeDe Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeCalificación: 1 de 5 estrellas1/5 (1)

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018De EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Aún no hay calificaciones

- Wiley IFRS: Practical Implementation Guide and WorkbookDe EverandWiley IFRS: Practical Implementation Guide and WorkbookAún no hay calificaciones

- Executive's Guide to COSO Internal Controls: Understanding and Implementing the New FrameworkDe EverandExecutive's Guide to COSO Internal Controls: Understanding and Implementing the New FrameworkAún no hay calificaciones

- International Financial Statement AnalysisDe EverandInternational Financial Statement AnalysisCalificación: 1 de 5 estrellas1/5 (1)

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportDe EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportAún no hay calificaciones

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19De EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19Aún no hay calificaciones

- Innovative Infrastructure Financing through Value Capture in IndonesiaDe EverandInnovative Infrastructure Financing through Value Capture in IndonesiaCalificación: 5 de 5 estrellas5/5 (1)

- Financial Reporting under IFRS: A Topic Based ApproachDe EverandFinancial Reporting under IFRS: A Topic Based ApproachAún no hay calificaciones

- Accounting for Goodwill and Other Intangible AssetsDe EverandAccounting for Goodwill and Other Intangible AssetsCalificación: 4 de 5 estrellas4/5 (1)

- ISO 22301: 2019 - An introduction to a business continuity management system (BCMS)De EverandISO 22301: 2019 - An introduction to a business continuity management system (BCMS)Calificación: 4 de 5 estrellas4/5 (1)

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsDe EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsAún no hay calificaciones

- Financial Digitalization and Its Implications for ASEAN+3 Regional Financial StabilityDe EverandFinancial Digitalization and Its Implications for ASEAN+3 Regional Financial StabilityAún no hay calificaciones

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16De EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Aún no hay calificaciones

- Introduction to Negotiable Instruments: As per Indian LawsDe EverandIntroduction to Negotiable Instruments: As per Indian LawsCalificación: 5 de 5 estrellas5/5 (1)

- Handbook on Anti-Money Laundering and Combating the Financing of Terrorism for Nonbank Financial InstitutionsDe EverandHandbook on Anti-Money Laundering and Combating the Financing of Terrorism for Nonbank Financial InstitutionsCalificación: 5 de 5 estrellas5/5 (2)

- Corporate Governance: A practical guide for accountantsDe EverandCorporate Governance: A practical guide for accountantsCalificación: 5 de 5 estrellas5/5 (1)

- What You Must Know About Incorporate a Company in IndiaDe EverandWhat You Must Know About Incorporate a Company in IndiaAún no hay calificaciones

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisDe EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisAún no hay calificaciones

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsDe EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsAún no hay calificaciones

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanDe EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanAún no hay calificaciones

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteDe EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteAún no hay calificaciones

- Impact assessment KUSCCO: Co-operative policy & legislationDe EverandImpact assessment KUSCCO: Co-operative policy & legislationAún no hay calificaciones

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismDe EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismAún no hay calificaciones

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)De EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)Aún no hay calificaciones

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020De EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Aún no hay calificaciones

- KNCCI Vihiga: enabling county revenue raising legislationDe EverandKNCCI Vihiga: enabling county revenue raising legislationAún no hay calificaciones

- KNCCI Vihiga: enabling county revenue raising legislationDe EverandKNCCI Vihiga: enabling county revenue raising legislationAún no hay calificaciones

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19De EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Aún no hay calificaciones

- Regulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshDe EverandRegulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshAún no hay calificaciones

- Commercial Dispute Resolution in China: An Annual Review and Preview 2021De EverandCommercial Dispute Resolution in China: An Annual Review and Preview 2021Aún no hay calificaciones

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesDe EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesAún no hay calificaciones

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18De EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18Aún no hay calificaciones

- Case Studies in Not-for-Profit Accounting and AuditingDe EverandCase Studies in Not-for-Profit Accounting and AuditingAún no hay calificaciones

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaDe EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaAún no hay calificaciones

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismDe EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismAún no hay calificaciones

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDe EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionAún no hay calificaciones

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteDe EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteAún no hay calificaciones

- Ejercicio de Aplicación Caso 1 PDFDocumento2 páginasEjercicio de Aplicación Caso 1 PDFSandryta Chuchuca MogrovejoAún no hay calificaciones

- CONASEV Mercado de ValoresDocumento60 páginasCONASEV Mercado de ValoresJesus Alberto Bacilio Escobedo83% (6)

- Casos 4ta - 2023Documento2 páginasCasos 4ta - 2023CARLOS JOSE CIPRIAN DE LOS RIOSAún no hay calificaciones

- Factura ProformaDocumento2 páginasFactura ProformaDIEGO LEONARDO BURITICA SUAREZAún no hay calificaciones

- Carta DXP S.1029Documento2 páginasCarta DXP S.1029Yampier Trillo SulcaAún no hay calificaciones

- Normativa Contable Aplicable en Venezuela-Resumen TécnicoDocumento16 páginasNormativa Contable Aplicable en Venezuela-Resumen TécnicoAndry GarciaAún no hay calificaciones

- Ciencias Económicas y Empresariales: Facultad deDocumento4 páginasCiencias Económicas y Empresariales: Facultad deNOEL BENJAMIN HERNANDEZ GARCIAAún no hay calificaciones

- Examen de Finanzas 2Documento8 páginasExamen de Finanzas 2JHONATAN HUAMAN PERALTAAún no hay calificaciones

- Presentación Restaurante TemáticoDocumento53 páginasPresentación Restaurante TemáticocascanteAún no hay calificaciones

- Manejo de Glosa Segun Cricular 035Documento8 páginasManejo de Glosa Segun Cricular 035David HoustonAún no hay calificaciones

- EJERCICIOS COMBINADOS ER Y BG 11 y 14 DESARROLLADOS EN CLASESDocumento21 páginasEJERCICIOS COMBINADOS ER Y BG 11 y 14 DESARROLLADOS EN CLASESDENIA PEREZ100% (1)

- Curso Certificación SEP en Análisis de Precios Unitarios EjeciciosDocumento16 páginasCurso Certificación SEP en Análisis de Precios Unitarios EjeciciosJairo ReyesAún no hay calificaciones

- DineroDocumento11 páginasDineroWilber OrozcoAún no hay calificaciones

- Casos PrácticosDocumento7 páginasCasos PrácticosLUIS ALBERTO HENAOAún no hay calificaciones

- VistosDocumento6 páginasVistosErnesto Ascoy CajanAún no hay calificaciones

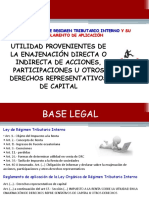

- 3 Utlidad Venta de Rep Captal 7feb2018Documento43 páginas3 Utlidad Venta de Rep Captal 7feb2018Lisseth HerreraAún no hay calificaciones

- Solucion - Guia 2 AnalisisDocumento6 páginasSolucion - Guia 2 AnalisisJorge David Pertuz MangaAún no hay calificaciones

- Ejercicios de Interes Simple 1Documento5 páginasEjercicios de Interes Simple 1marlene.garcialomeliAún no hay calificaciones

- Tablas de Amortizacion 2.BDocumento19 páginasTablas de Amortizacion 2.BPatricia MorenoAún no hay calificaciones

- Razones BachocoDocumento2 páginasRazones BachocoJovanna Guadalupe Vieyra FloresAún no hay calificaciones

- Requisitos Fotocopia Legalizada Tit BachDocumento4 páginasRequisitos Fotocopia Legalizada Tit BachAnonymous IIEeTjkdvAún no hay calificaciones

- 2-Entorno y Estructura Del CRMDocumento20 páginas2-Entorno y Estructura Del CRMGerman Velasquez Vargas50% (2)

- Tercera Entrega Gerencia EstrategicaDocumento16 páginasTercera Entrega Gerencia EstrategicaEsperanza Rojas FernandezAún no hay calificaciones