Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Longevidad de La Empresa Familiar

Longevidad de La Empresa Familiar

Cargado por

Jorge FantinTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Longevidad de La Empresa Familiar

Longevidad de La Empresa Familiar

Cargado por

Jorge FantinCopyright:

Formatos disponibles

Se suele afirmar que las transiciones generacionales en las empresas familiares son particularmente traumticas, resultando esto en una

alta tasa de fracasos. Nmeros ms, nmeros menos, se calcula que apenas un tercio de las empresas que logran atravesar con xito la gestin de una generacin, sobreviven a la siguiente. Sin embargo, pese a lo que casi todo el mundo cree, este comportamiento no es exclusivo de ese tipo de empresas. Segn John Hagel III, quien es co-presidente de un centro de investigacin en estrategia de Deloitte LLP en Silicon Valley, en la dcada del 30 la vida promedio de una gran empresa era de 75 aos, en tanto que en en la primera dcada del siglo 21 esa duracin promedio ha bajado a apenas 15 aos. En una observacin independiente, , y en 1997 Arie de Geus escriba en su libro The Living Company que la vida promedio de una empresa integrante del ndice S&P500 estaba entre los 40 y los 50 aos. Reforzando esta idea, Craig Aronoff, en un artculo publicado en Agosto de 2001 titulado Understanding family-business survival statistics comentaba que la tasa de sobrevida de una empresa familiar no es peor que la de cualquiera de las exclusivas empresas que componen el ndice Dow Jones. En definitiva, la cada vez ms corta duracin de la vida de las empresas no tiene correlacin alguna con el atributo de ser del tipo familiar o no. Por el contrario, y si bien an no dispongo de datos irrefutables al respecto, me permito arriesgar la hiptesis de que tal vez las empresas familiares tengan ms chances de sobrevivir que aquellas que no lo son. Explorando la fuente de la vida eterna Segn el conocido estudio realizado por Jim Collins y Jerry Porras y plasmado en su libro Built to Last, aquellas compaas capaces de preservar sus valores fundamentales sin por ello dejar de estimular un progreso permanente, son las que en el largo plazo terminan siendo exitosas y duraderas. El ya mencionado trabajo de De Geus afirma algo parecido, cuando dice que las empresas longevas comparten cuatro atributos: 1) Tienen un fuerte sentido de identidad, 2) Son tolerantes con el riesgo y alientan la experimentacin, 3) Son conservadoras financieramente y 4) Son especialmente sensibles a todo cambio que pudiera estar insinundose en el entorno. progreso, establecer y mantener una claro sentido de identidad, combinando esto con una justa cuota de audacia y bsqueda visin de futuro, a identidad, junto con una visin del futuro audaz y

What distinguishes family businesses, of course, is family. Adding family values, loyalty, pride, cohesiveness, meaning and all the other strengths of family to business ownership and management seems to provide sustenance not available to other enterprises. Given an economy that chews up and spits out whole industries; technology evolving at unprecedented rates; Wall Street probing every niche to unlock financial value; global competition; instantaneous communication; the alternative opportunities open to well-educated offspring; competition that drains margins as distribution channels are re-engineered; and the social and cultural pressures that make successful family life increasingly challenging, I believe that a 30% generational survival rate among family businesses is incredible testimony to the positive power of family when applied to business. I believe that these oft-cited statistics offer yet another reason to celebrate family businesses.

I found an opportunity for comparison by accident. In 1996, the Dow Jones Industrial Average (DJIA) celebrated its 100th anniversary. Its 30 companies represent the largest, best capitalized paragons of U.S. industry. And yet, only one company originally included remains on the list today. I did some quick arithmetic. A hundred years at 25 years per generation represents four generations. About a third of family businesses survive in each generation. With 30 companies on the DJIA, and a one-third survival rate defined as continuing on the DJIA for four generations, we would predict that one would still be around. The survival rates of the companies comprising the DJIA and of family businesses in general turns out to be the same! The single company from the original list that survived is General Electric. GE is generally considered to be one of the best managed and capitalized companies in the world. CEO Jack Welsh is considered among the best in the business, and GE is famous for providing other major companies' CEOs. According to statistics, your family business has the same chance of survival as General Electric. Does that suggest that a four-generation, 3-5% survival rate is "meager"? Rather than bemoaning family business survival rates, we should judge them as somewhere between normal and extraordinary. Indeed, I'm wondering what strengths family businesses have that allow them the same survival rate as companies like GE. What do family businesses have that most of the DJIA component companies lack? What distinguishes family businesses, of course, is family. Adding family values, loyalty, pride, cohesiveness, meaning and all the other strengths of family to business ownership and management seems to provide sustenance not available to other enterprises.

También podría gustarte

- La Doble TributaciónDocumento17 páginasLa Doble TributaciónCabo CmAún no hay calificaciones

- Presupuesto PublicitarioDocumento19 páginasPresupuesto PublicitarioGabiitha Davila SanchezAún no hay calificaciones

- (D) 2019. Guía de Anfibios, Reptiles y Aves de La Provincia de El Oro. Segunda EdiciónDocumento430 páginas(D) 2019. Guía de Anfibios, Reptiles y Aves de La Provincia de El Oro. Segunda EdiciónJuan Carlos SánchezAún no hay calificaciones

- Semana 1 TrigonometriaDocumento7 páginasSemana 1 TrigonometriaroberthtaipevAún no hay calificaciones

- Contrato de Franquicia ModeloDocumento3 páginasContrato de Franquicia Modelodoris50% (2)

- LATAM - PPT Seminario PBN PDFDocumento14 páginasLATAM - PPT Seminario PBN PDFLuis HerediaAún no hay calificaciones

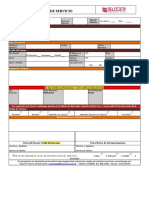

- Formato de Servicio-CASV3 EN BLanco TotalmenteDocumento1 páginaFormato de Servicio-CASV3 EN BLanco TotalmenteCibercell DabeibaAún no hay calificaciones

- Universidad Agraria Del EcuadorDocumento16 páginasUniversidad Agraria Del EcuadorSteven Sanchez PeñaAún no hay calificaciones

- Actuación Ante Electrocutado 01Documento14 páginasActuación Ante Electrocutado 01Rodrigo Andres Contreras FuentesAún no hay calificaciones

- Diseños Experimentales Grupo 5Documento4 páginasDiseños Experimentales Grupo 5Miguel PradoAún no hay calificaciones

- Receta Tabule o Tabulé - Receta Ensaladas PDFDocumento4 páginasReceta Tabule o Tabulé - Receta Ensaladas PDFrodcavicchioniAún no hay calificaciones

- Heavy MetalDocumento15 páginasHeavy MetalIsrael Alberto Cortez VásquezAún no hay calificaciones

- Proyecto de Tesis Enrique VasquezDocumento14 páginasProyecto de Tesis Enrique VasquezOrlando Tapia BenitesAún no hay calificaciones

- Produccion de UreaDocumento21 páginasProduccion de UreaNeyraOlguinAún no hay calificaciones

- Workbook Certificacion ADSDocumento23 páginasWorkbook Certificacion ADSJoseph Antonio Apaza GómezAún no hay calificaciones

- Tipos y Metodos de Mezcla Asfaltica y EnsayosDocumento17 páginasTipos y Metodos de Mezcla Asfaltica y EnsayosGuillermo Solis PedrazaAún no hay calificaciones

- Diseño Con Estructura Factorial de Factorial de TratamientosDocumento16 páginasDiseño Con Estructura Factorial de Factorial de TratamientosDianaAún no hay calificaciones

- Patologia Endometrial Benigna y Pre MalignaDocumento15 páginasPatologia Endometrial Benigna y Pre MalignaCatalina Guerrero BarrientosAún no hay calificaciones

- Programa Plantares SepDocumento11 páginasPrograma Plantares SepCENTRO PERICIAL INTERDISCIPLINARIO DE CORDOBAAún no hay calificaciones

- BurtzeñaDocumento19 páginasBurtzeñaluisaAún no hay calificaciones

- Taller #1Documento7 páginasTaller #1Salome Ortiz JaramilloAún no hay calificaciones

- Género y Recursos Naturales. Visión de Dos Comunidades de Yanacachi. La PazDocumento4 páginasGénero y Recursos Naturales. Visión de Dos Comunidades de Yanacachi. La PazPedro PachaguayaAún no hay calificaciones

- 11 Fuerzas y Aceleraciones CRDocumento10 páginas11 Fuerzas y Aceleraciones CRCarlos QuispeAún no hay calificaciones

- Señales de Seguridad e Higiene IndustrialDocumento2 páginasSeñales de Seguridad e Higiene IndustrialFranck Edison Jara RojasAún no hay calificaciones

- Epigenetismo o PreformacionismoDocumento5 páginasEpigenetismo o PreformacionismoLuis GobbiAún no hay calificaciones

- Formato Guardias Enfermeras Periodo 2023Documento1 páginaFormato Guardias Enfermeras Periodo 2023JielAún no hay calificaciones

- Procedimiento para Bloqueo de Equipos Energizados PDFDocumento11 páginasProcedimiento para Bloqueo de Equipos Energizados PDFMel PasacheAún no hay calificaciones

- 5.2 - Interpol-Lagrange y Con DatosIgualEspacioDocumento28 páginas5.2 - Interpol-Lagrange y Con DatosIgualEspacioJoseph GonzalezAún no hay calificaciones

- TRABAJO CRIS FERNANDEZ - Equipos e Instrumentos de Laboratorio de Hilanderia para El Control de CalidadDocumento30 páginasTRABAJO CRIS FERNANDEZ - Equipos e Instrumentos de Laboratorio de Hilanderia para El Control de CalidadAbigail FerAún no hay calificaciones

- Combinar Correspondencia 2007 PDFDocumento12 páginasCombinar Correspondencia 2007 PDFBoavitaBoyacáAún no hay calificaciones