Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Market Commentary 11mar12

Cargado por

AndysTechnicalsDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Market Commentary 11mar12

Cargado por

AndysTechnicalsCopyright:

Formatos disponibles

S&P 500 ~ Weekly Longer Term Count Updated

Confidence in the previous longer term counting of the y and x waves has wavered due to the price behavior of the market. I am now forced to make a slight adjustment to the previous longstanding count. Its becoming obvious that the last x wave did not conclude at the 1075 low--it had to have concluded later if thats even the correct count. The idea of contracting triangle x wave fits with the thrusting nature of this market since the year began. Confidence in this wave count is tepid.

y

b

(B) z

d

COPIED from 2/20/12

b a

w

d

e

e?

x

c a c e

x (C)

(A)

Andys Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily Longer Term Count

(B) z y

b

d b a e

x

e?

c a

e c

The thrust out of a triangle is typically limited to 75-125% of the widest leg, which in this case would be an extremely wide range of outcomes between 1375 and 1525 depending on where exactly the ewave (within x) concluded. I think this wave, though, will end up limited by its relationship to the y wave. It should be, 62-78% of y, which would suggest a move to 1400-1450.

(A)

Andys Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Current Rally with Weekly Support

As the Talking Heads sang Same as it ever was... The market continued its grind higher. One interesting thing to observe is that the S&P 500 is struggling a bit to get back to the upper end of the trend channel--this is usually a signal of a market thats losing its energy. Bulls/Longs should raise stops yet again because when this channel breaks, it should be fairly violent, a la the Gold market this week.

COPIED from 3/04/12

This would be support area on a breakdown.

Consider using 1352 and 1337 for first and second levels of support. 1337 would be a 23.6% retrace of the entire last move--a level that also aligns with prior short term support.

Andys Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily with Weekly Support

The break of the clear trendline did generate strong selling last week, but the market FAILED to get below the second level of support at 1337, the 23.6% retracement. Not only that, but the strong bounce back to close the week makes the latest move look like the beginning of a triangle pattern at the top--not really a bearish development. Basis this triangle concept, 1337 and 1378 should serve as the band of support/resistance in the week ahead. Breaks of those levels, particularly the 1337, should lead to increased volatility in the direction of the break.

Andys Technical Commentary__________________________________________________________________________________________________

Dollar Index (DXY) ~ Daily Continuation

c

81.78

COPIED from 3/04/12

-b(c) (a)

-a78.10

(b) d

It still looks like the wave down from 81.78 has further to develop -- it does not look like a completed wave form at the 78.10 low. So, were likely seeing an expanded flat -b- wave. It would not be a surprise to see the market rally to the mid 80s before taking a larger leg down. 80.53 would be the 61.8% retrace of the proposed -a- wave and 138.2% of (a) = (c), a nice target for an expanded flat correction.

Andys Technical Commentary__________________________________________________________________________________________________

Dollar Index (DXY) ~ Daily Continuation

c

81.78

-b(c)

(a)

-a78.10

(b) -cd

The DXY looks like it has further to move before the -b- wave finishes. This move may be what helps the S&P500 correct lower to start the week. Ultimately though, it does look like the dollar has one more decent little wave down (the -c- of d-wave), so maybe that will be the gyration which causes the S&P500 to breakout higher one more time.

b

I really like 80.53 as being good resistance that should cap the DXY in the near term.

Andys Technical Commentary__________________________________________________________________________________________________

PLEASE NOTE THAT THERE IS ADDITIONAL INTRA-WEEK AND INTRADAY DISCUSSION ON TECHNICAL ANALYSIS AND TRADING AT TRADERS-ANONYMOUS.BLOGSPOT.COM

Wave Symbology "I" or "A" I or A <I>or <A> -I- or -A(I) or (A) "1 or "a" 1 or a -1- or -a(1) or (a) [1] or [a] [.1] or [.a] = Grand Supercycle = Supercycle = Cycle = Primary = Intermediate = Minor = Minute = Minuette = Sub-minuette = Micro = Sub-Micro

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any kind. This report is technical commentary only. The author is NOT representing himself as a CTA or CFA or Investment/Trading Advisor of any kind. This merely reflects the authors interpretation of technical analysis. The author may or may not trade in the markets discussed. The author may hold positions opposite of what may by inferred by this report. The information contained in this commentary is taken from sources the author believes to be reliable, but it is not guaranteed by the author as to the accuracy or completeness thereof and is sent to you for information purposes only. Commodity trading involves risk and is not for everyone. Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading: Trading commodity futures and options is not for everyone. IT IS A VOLATILE, COMPLEX AND RISKY BUSINESS. Before you invest any money in futures or options contracts, you should consider your financial experience, goals and financial resources, and know how much you can afford to lose above and beyond your initial payment to a broker. You should understand commodity futures and options contracts and your obligations in entering into those contracts. You should understand your exposure to risk and other aspects of trading by thoroughly reviewing the risk disclosure documents your broker is required to give you.

También podría gustarte

- Leaders Eat Last Key PointsDocumento8 páginasLeaders Eat Last Key Pointsfidoja100% (2)

- John Lear UFO Coverup RevelationsDocumento30 páginasJohn Lear UFO Coverup RevelationscorneliusgummerichAún no hay calificaciones

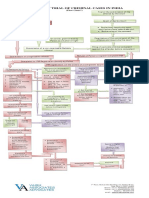

- Process of Trial of Criminal Cases in India (Flow Chart)Documento1 páginaProcess of Trial of Criminal Cases in India (Flow Chart)Arun Hiro100% (1)

- Trading The Regression ChannelDocumento14 páginasTrading The Regression Channelserebrum2000Aún no hay calificaciones

- Market Commentary 5aug12Documento7 páginasMarket Commentary 5aug12AndysTechnicalsAún no hay calificaciones

- Market Commentary 5aug12Documento7 páginasMarket Commentary 5aug12AndysTechnicalsAún no hay calificaciones

- The Secrets of Trading Chart Patterns Like The Pros11 Mar 24' Issue 044Documento123 páginasThe Secrets of Trading Chart Patterns Like The Pros11 Mar 24' Issue 044VERO NICA100% (1)

- Trading The Gartley 222Documento14 páginasTrading The Gartley 222Joao PereiraAún no hay calificaciones

- Bollinger Band Manual - Mark DeatonDocumento31 páginasBollinger Band Manual - Mark DeatonYagnesh Patel100% (2)

- Acd 2Documento15 páginasAcd 2KumaraRajaAún no hay calificaciones

- Bản Sao Của Trắc Nghiệm Đttc Tổng Hợp Thầy LinhDocumento19 páginasBản Sao Của Trắc Nghiệm Đttc Tổng Hợp Thầy LinhThảo LêAún no hay calificaciones

- Bakery Interview QuestionsDocumento15 páginasBakery Interview QuestionsKrishna Chaudhary100% (2)

- Pineapple Working PaperDocumento57 páginasPineapple Working PaperAnonymous EAineTiz100% (7)

- Dynamic Trader Daily Report: Practical Application of Price, Time and PatternDocumento6 páginasDynamic Trader Daily Report: Practical Application of Price, Time and PatternBudi MulyonoAún no hay calificaciones

- Ermita Malate Hotel Motel Operators V City Mayor DigestDocumento1 páginaErmita Malate Hotel Motel Operators V City Mayor Digestpnp bantay100% (2)

- Siy Cong Bien Vs HSBCDocumento2 páginasSiy Cong Bien Vs HSBCMJ Decolongon100% (1)

- The Great Resistance. Bitcoin Price Report 1st Issue. EmperorBTCDocumento25 páginasThe Great Resistance. Bitcoin Price Report 1st Issue. EmperorBTCHulu LuluAún no hay calificaciones

- Math9 - Q2 - Mod2 - WK 3 - JointAndCombinedVariations - Version2Documento37 páginasMath9 - Q2 - Mod2 - WK 3 - JointAndCombinedVariations - Version2Precious Arni100% (7)

- Charging Station Location and Sizing For Electric Vehicles Under CongestionDocumento20 páginasCharging Station Location and Sizing For Electric Vehicles Under CongestionJianli ShiAún no hay calificaciones

- Dollar Index (DXY) Daily ContinuationDocumento6 páginasDollar Index (DXY) Daily ContinuationAndysTechnicalsAún no hay calificaciones

- Market Commentary 1JUL12Documento8 páginasMarket Commentary 1JUL12AndysTechnicalsAún no hay calificaciones

- Sp500 Update 5sep11Documento7 páginasSp500 Update 5sep11AndysTechnicalsAún no hay calificaciones

- Market Commentary 18mar12Documento8 páginasMarket Commentary 18mar12AndysTechnicalsAún no hay calificaciones

- Market Commentary 6NOVT11Documento4 páginasMarket Commentary 6NOVT11AndysTechnicalsAún no hay calificaciones

- Market Commentary 25SEP11Documento8 páginasMarket Commentary 25SEP11AndysTechnicalsAún no hay calificaciones

- Market Commentary 30OCT11Documento6 páginasMarket Commentary 30OCT11AndysTechnicalsAún no hay calificaciones

- Sp500 Update 11sep11Documento6 páginasSp500 Update 11sep11AndysTechnicalsAún no hay calificaciones

- Sp500 Update 23oct11Documento7 páginasSp500 Update 23oct11AndysTechnicalsAún no hay calificaciones

- Market Commentary 25mar12Documento8 páginasMarket Commentary 25mar12AndysTechnicalsAún no hay calificaciones

- Market Commentary 17JUN12Documento7 páginasMarket Commentary 17JUN12AndysTechnicalsAún no hay calificaciones

- Market Commentary 22JUL12Documento6 páginasMarket Commentary 22JUL12AndysTechnicalsAún no hay calificaciones

- Market Commentary 19DEC11Documento9 páginasMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 27NOV11Documento5 páginasMarket Commentary 27NOV11AndysTechnicalsAún no hay calificaciones

- Market Commentary 20NOV11Documento7 páginasMarket Commentary 20NOV11AndysTechnicalsAún no hay calificaciones

- Market Commentary 16jan12Documento7 páginasMarket Commentary 16jan12AndysTechnicalsAún no hay calificaciones

- Market Commentary 1apr12Documento8 páginasMarket Commentary 1apr12AndysTechnicalsAún no hay calificaciones

- Market Commentary 10JUN12Documento7 páginasMarket Commentary 10JUN12AndysTechnicalsAún no hay calificaciones

- Market Commentary 27feb11Documento12 páginasMarket Commentary 27feb11AndysTechnicalsAún no hay calificaciones

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocumento6 páginasS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 29apr12Documento6 páginasMarket Commentary 29apr12AndysTechnicalsAún no hay calificaciones

- Copper Commentary 2OCT11Documento8 páginasCopper Commentary 2OCT11AndysTechnicalsAún no hay calificaciones

- Copper Commentary 11dec11Documento6 páginasCopper Commentary 11dec11AndysTechnicalsAún no hay calificaciones

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocumento8 páginasREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsAún no hay calificaciones

- Market Update 21 Nov 10Documento10 páginasMarket Update 21 Nov 10AndysTechnicalsAún no hay calificaciones

- NISM QuestionsDocumento333 páginasNISM QuestionsAKshay100% (1)

- Supply and Demand Levels Forecasting Based On Returns VolatilityDocumento6 páginasSupply and Demand Levels Forecasting Based On Returns VolatilityJoao Vitor SchaedlerAún no hay calificaciones

- Stock Evaluation PDFDocumento11 páginasStock Evaluation PDFmaxmunirAún no hay calificaciones

- Assignment-1:Investment Management 2020Documento2 páginasAssignment-1:Investment Management 2020Rajkumar RakhraAún no hay calificaciones

- Morning View 24 Feb 10Documento4 páginasMorning View 24 Feb 10AndysTechnicalsAún no hay calificaciones

- Market Discussion 5 Dec 10Documento9 páginasMarket Discussion 5 Dec 10AndysTechnicalsAún no hay calificaciones

- CH 16Documento11 páginasCH 16Fahad Javaid50% (2)

- Market Commentary 21feb11Documento10 páginasMarket Commentary 21feb11AndysTechnicalsAún no hay calificaciones

- Case 8Documento3 páginasCase 8Neil GumbanAún no hay calificaciones

- CaseDocumento4 páginasCaseRaghuveer ChandraAún no hay calificaciones

- The Secrets of Trading Chart Patterns Like The Pros 26 FEB 24'Documento90 páginasThe Secrets of Trading Chart Patterns Like The Pros 26 FEB 24'VERO NICAAún no hay calificaciones

- Market Discussion 12 Dec 10Documento9 páginasMarket Discussion 12 Dec 10AndysTechnicalsAún no hay calificaciones

- 2012 - 1st ExamDocumento3 páginas2012 - 1st ExamcataAún no hay calificaciones

- Case Study of Equitty Analysis - MbaDocumento2 páginasCase Study of Equitty Analysis - MbaAli HyderAún no hay calificaciones

- Weekly Technical Report: Retail ResearchDocumento4 páginasWeekly Technical Report: Retail ResearchGauriGanAún no hay calificaciones

- Data Preparation For Strategy ReturnsDocumento6 páginasData Preparation For Strategy ReturnsNumXL ProAún no hay calificaciones

- ReportDocumento6 páginasReportarun_algoAún no hay calificaciones

- Financial Institutions Management 4Th Edition Saunders Test Bank Full Chapter PDFDocumento57 páginasFinancial Institutions Management 4Th Edition Saunders Test Bank Full Chapter PDFclubhandbranwq8100% (11)

- Financial Institutions Management 4th Edition Saunders Test BankDocumento36 páginasFinancial Institutions Management 4th Edition Saunders Test Banktrancuongvaxx8r100% (34)

- Exam 2 KeyDocumento8 páginasExam 2 KeyTaylor SteeleAún no hay calificaciones

- Classroom: How To Identify Support & Resistance On Technical ChartsDocumento11 páginasClassroom: How To Identify Support & Resistance On Technical ChartsusmanAún no hay calificaciones

- Merrill Finch IncDocumento7 páginasMerrill Finch IncAnaRoqueniAún no hay calificaciones

- Risk and Rates of ReturnDocumento22 páginasRisk and Rates of ReturnJollybelleann MarcosAún no hay calificaciones

- Morning View 25jan2010Documento5 páginasMorning View 25jan2010AndysTechnicalsAún no hay calificaciones

- Exam2 Sample 2021Documento10 páginasExam2 Sample 2021maha rehmanAún no hay calificaciones

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsDe EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsAún no hay calificaciones

- Market Commentary 29apr12Documento6 páginasMarket Commentary 29apr12AndysTechnicalsAún no hay calificaciones

- Market Commentary 22JUL12Documento6 páginasMarket Commentary 22JUL12AndysTechnicalsAún no hay calificaciones

- Market Commentary 17JUN12Documento7 páginasMarket Commentary 17JUN12AndysTechnicalsAún no hay calificaciones

- Market Commentary 25mar12Documento8 páginasMarket Commentary 25mar12AndysTechnicalsAún no hay calificaciones

- Market Commentary 1apr12Documento8 páginasMarket Commentary 1apr12AndysTechnicalsAún no hay calificaciones

- Market Commentary 10JUN12Documento7 páginasMarket Commentary 10JUN12AndysTechnicalsAún no hay calificaciones

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocumento6 páginasS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 30OCT11Documento6 páginasMarket Commentary 30OCT11AndysTechnicalsAún no hay calificaciones

- Market Commentary 27NOV11Documento5 páginasMarket Commentary 27NOV11AndysTechnicalsAún no hay calificaciones

- Market Commentary 16jan12Documento7 páginasMarket Commentary 16jan12AndysTechnicalsAún no hay calificaciones

- Market Commentary 20NOV11Documento7 páginasMarket Commentary 20NOV11AndysTechnicalsAún no hay calificaciones

- Copper Commentary 11dec11Documento6 páginasCopper Commentary 11dec11AndysTechnicalsAún no hay calificaciones

- Market Commentary 19DEC11Documento9 páginasMarket Commentary 19DEC11AndysTechnicals100% (1)

- Copper Commentary 2OCT11Documento8 páginasCopper Commentary 2OCT11AndysTechnicalsAún no hay calificaciones

- Sp500 Update 23oct11Documento7 páginasSp500 Update 23oct11AndysTechnicalsAún no hay calificaciones

- Market Commentary 25SEP11Documento8 páginasMarket Commentary 25SEP11AndysTechnicalsAún no hay calificaciones

- Sp500 Update 11sep11Documento6 páginasSp500 Update 11sep11AndysTechnicalsAún no hay calificaciones

- Natural Wonders of The World: I:GrammarDocumento8 páginasNatural Wonders of The World: I:GrammarNhị NguyễnAún no hay calificaciones

- Creative WritingDocumento13 páginasCreative WritingBeberly Kim AmaroAún no hay calificaciones

- Making A Spiritual ConfessionDocumento2 páginasMaking A Spiritual ConfessionJoselito FernandezAún no hay calificaciones

- Memorandum For APDSA Indonesia 2Documento3 páginasMemorandum For APDSA Indonesia 2Renanda Rifki Ikhsandarujati RyanAún no hay calificaciones

- World Turtle DayDocumento19 páginasWorld Turtle DaymamongelhiAún no hay calificaciones

- Climate Change Forests and Forest Management An O-Wageningen University and Research 481068Documento145 páginasClimate Change Forests and Forest Management An O-Wageningen University and Research 481068gulnuromar034Aún no hay calificaciones

- Article 124-133Documento14 páginasArticle 124-133andresjosejrAún no hay calificaciones

- Flex Li3 21 VAADocumento1 páginaFlex Li3 21 VAAAyman Al-YafeaiAún no hay calificaciones

- SDS Jojoba Wax Beads 2860Documento7 páginasSDS Jojoba Wax Beads 2860swerAún no hay calificaciones

- Articles of IncorporationDocumento2 páginasArticles of IncorporationLegal Forms100% (1)

- 19.2 - China Limits European ContactsDocumento17 páginas19.2 - China Limits European ContactsEftichia KatopodiAún no hay calificaciones

- Simple Future TenseDocumento14 páginasSimple Future TenseYupiyupsAún no hay calificaciones

- Estudio - Women Who Suffered Emotionally From Abortion - A Qualitative Synthesis of Their ExperiencesDocumento6 páginasEstudio - Women Who Suffered Emotionally From Abortion - A Qualitative Synthesis of Their ExperiencesSharmely CárdenasAún no hay calificaciones

- Q. 15 Insurance Regulatory and Development AuthorityDocumento2 páginasQ. 15 Insurance Regulatory and Development AuthorityMAHENDRA SHIVAJI DHENAKAún no hay calificaciones

- Downloaded From Manuals Search EngineDocumento29 páginasDownloaded From Manuals Search EnginehaivermelosantanderAún no hay calificaciones

- Whether To Use Their GPS To Find Their Way To The New Cool Teen HangoutDocumento3 páginasWhether To Use Their GPS To Find Their Way To The New Cool Teen HangoutCarpovici Victor100% (1)

- Soal CautionDocumento10 páginasSoal Cautionadhyatnika geusan ulun50% (2)

- $RV3E842Documento78 páginas$RV3E842Dorian VoineaAún no hay calificaciones

- Fujiwheel CatalogDocumento16 páginasFujiwheel CatalogKhaeri El BarbasyAún no hay calificaciones

- To Hemiette (Hette) Sitter-Zoetlief-Tromp Oegstgeest, Holland Bernhard (Ben) T Agnes Zoe/lief-Tromp Tournesol-, Breteuil Sur Lton, FranceDocumento45 páginasTo Hemiette (Hette) Sitter-Zoetlief-Tromp Oegstgeest, Holland Bernhard (Ben) T Agnes Zoe/lief-Tromp Tournesol-, Breteuil Sur Lton, FrancerathkiraniAún no hay calificaciones

- Shanu Return Ticket To Sobani HostelDocumento1 páginaShanu Return Ticket To Sobani HostelTamseel ShahajahanAún no hay calificaciones