Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Accounting Standard-28 Impairment of Assets: Presented By:-Dr. Raj K. Agarwal

Cargado por

Sanchita GuptaDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Accounting Standard-28 Impairment of Assets: Presented By:-Dr. Raj K. Agarwal

Cargado por

Sanchita GuptaCopyright:

Formatos disponibles

ACCOUNTING STANDARD-28 IMPAIRMENT OF ASSETS

PRESENTED By :Dr. Raj K. Agarwal

M. Com, FCA, FCS, AICWA, LLB, Ph. D

M/s. Rakesh Raj & Associates Chartered Accountants

AS-28 IMPAIRMENT OF ASSETS

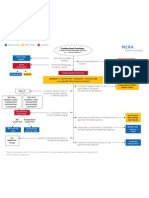

OVERALL VIEW - Applicability Objective Scope Concept Identification of asset to be impaired - indications Recoverable amount of an asset - Net selling price of value in use Recognition & measurement of an impairment loss Cash generating unit Reversal of impairment loss Disclosures Transitional provisions Certain issues

AS-28 IMPAIRMENT OF ASSETS

APPLICABILITY

Accounting periods : on or after 01.04.2004 - Companies which are listed or in the process of listing - Enterprises having turnover exceeding 50 crores All other enterprises Corporate or noncorporate

on or after 01.04.2005 :

AS-28 IMPAIRMENT OF ASSETS

OBJECTIVE.

- To ensure that the assets are carried at no more than recoverable amount - Recoverable amount not to exceed the amount to be recovered through use or sale of the asset - Impaired loss to be recognised in the financial statement - Impaired loss may be reversed in certain circumstances - To make certain disclosures for impaired assets.

AS-28 IMPAIRMENT OF ASSETS

SCOPE

* To be applied in accounting for impairment of all assets, other than :- Inventories as per (AS-2) - Assets arising from construction contracts as per (AS-7) - Financial assets including investments as per (AS-13) - Deferred tax assets as per (AS-22) * Applicable to assets valued at cost or at revalued amount

AS-28 IMPAIRMENT OF ASSETS

CONCEPT

Impairment loss - is the amount by which the carrying amount of an asset exceeds its recoverable amount Carrying amount- is the amount at which an asset is recognised in the balance sheet (W.D.V.) Recoverable - is the higher of an assets net selling amount price and its value in use

AS-28 IMPAIRMENT OF ASSETS CONCEPT Net selling price - Sale price - costs of disposal in an arms length transaction Value in use - Present value of estimated future cash flows expected from the use of an asset & from its disposal at the end of its useful life

AS-28 IMPAIRMENT OF ASSETS

Identifying an asset that may be impaired Whether at each balance sheet date, recoverable amount of each asset to be estimated ? NO To see whether there is any indication that an asset may be impaired

IF YES

recoverable amount to be estimated

AS-28 IMPAIRMENT OF ASSETS

Indications for estimating recoverable amount External sources - Decline in market value significantly

- Significant changes with an adverse effect on the enterprise due to technological, market, economic or legal environment

- Decrease in assets value in use due to adjustment in the discount rate as a result of increase in market interest rate or other market rates of ROI - Carrying amount of the net assets of the enterprise is more than its market capitalisation

AS-28 IMPAIRMENT OF ASSETS

INTERNAL SOURCES

- Obsolescence or physical damage of an asset - Significant changes with an adverse effect on the enterprise, regarding use of asset e.g. - plans to discontinue or restructuring the operation or disposal of asset at an earlier date. - Decline in the economic performance of asset

-

list is not exhaustive concept of materiality

AS-28 IMPAIRMENT OF ASSETS

Recoverable amount

Net selling price or Value in use

Whichever is higher

Whether both to be determined - No

If either of these amounts exceeds the assets carrying amount, the asset is not impaired and it is not necessary to estimate the other amount

AS-28 IMPAIRMENT OF ASSETS Net Selling Price

Selling Price - How to estimate ?

Binding sale agreement Market price Current bid price Price of the most recent transaction Based upon best information available

AS-28 IMPAIRMENT OF ASSETS

Value in use

- Estimating the future cash inflows and outflows arising from continuing use of the asset and from its ultimate disposal and Applying the appropriate discount rate to these future cash flows - While estimating future cash flows, the following factors to be considered - effect of price increase due to general inflation - for the asset in its current condition - adjustment of associated risk factors - not to include cash inflows or outflows from financing activities. - Pre-tax inflows or outflows to be considered.

AS-28 IMPAIRMENT OF ASSETS

- Discount rate - To be pre tax rate - That reflects time value of money and the risks specific to the asset as per current market assessments unless risk factors have been adjusted while estimating future cash flows

AS-28 IMPAIRMENT OF ASSETS

Value in use - Certain issues

- While estimating cash outflows, whether repayment of

installment of borrowings (against those assets) and interest cost thereof, to be taken into account. - While estimating cash outflows, whether following costs to be taken into account :- Corporate office costs - Interest cost of working capital - Depreciation of assets - Why pre-tax cash flows are required to be considered? - Why income tax expense, which is a cash outflow of variable nature, is not being considered?

AS-28 IMPAIRMENT OF ASSETS

Recognition & Measurement of an impairment loss * If the recoverable amount of an asset is less than its carrying amount, the carrying amount of the asset should be reduced to its recoverable amount * That reduction is an impairment loss * Impairment loss to be recognised as an expense in the profit and loss account * Adjustment against revaluation reserve if existing against the same asset * Depreciation for future periods to be adjusted as per revised carrying amount

AS-28 IMPAIRMENT OF ASSETS

Cash Generating Units

- At the first instance, to determine impairment loss, the recoverable amount to be estimated for the individual asset - If it is not possible to estimate the recoverable amount of the individual asset, to determine the recoverable amount of the cash generating unit to which the asset belongs. - A cash generating unit is the smallest identifiable group of assets that generates cash inflows from continuing use that are largely independent of the cash inflows from other assets or group of assets - Allocation of goodwill and corporate assets to cash generating unit

AS-28 IMPAIRMENT OF ASSETS

- Impairment loss for a cash generating unit to be allocated for individual assets in the following order - first to goodwill allocated to the cash generating unit, if any, and - then, to the other assets of the unit on pro-rate basis based on the carrying amount of each asset in the unit

AS-28 IMPAIRMENT OF ASSETS

Reversal of impairment loss - If there are indications, that an impairment loss no longer exists, the enterprise should estimate the recoverable amount of the asset - In case recoverable amount is higher than assets carrying amount, the impairment loss earlier recognised may be reversed - The increased carrying amount of an asset due to a reversal of an impairment loss should not exceed the carrying amount that would have been determined (net of depreciation) had no impairment loss been recognised for the asset in prior accounting periods.

AS-28 IMPAIRMENT OF ASSETS

Disclosures - For each class of asset, the financial statements should

disclose:- the amount of impairment loss and the reversal, if any recognised in profit and loss account - the amount of impairment loss and its reversal, if any, recognised against revaluation surplus For each segment as per AS-17, separate information to be given The events and circumstances that led to the recognition or reversal of the impairment loss The nature and basis of recoverable amount determined for recognising (reversing) impairment loss Other disclosures

AS-28 IMPAIRMENT OF ASSETS Transitional Provision In the first year of applicability of this standard, if there is any impairment loss in the beginning of the year, the same to be recognised and adjusted against opening balance of revenue reserves or revaluation reserve as the case may be.

AS-28 IMPAIRMENT OF ASSETS

CERTAIN ISSUES - Most of the calculations in the standard are based upon

estimates and projections. What is the reliability of the same. Whether auditors are bound to rely upon managements estimates and projections. Net selling price of a particular asset is less than its carrying amount but value in use of cash generating unit (of which this asset is a part) is higher. Whether asset is required to be impaired. In case a particular asset becomes idle which was earlier part of cash generating unit and now not in use, whether its value to be determine separately or still as part of cash generating unit. Impairment loss is a timing difference as per AS-22 and deferred tax asset may be created for the same subject to the principle of prudence.

THANK

YOU

También podría gustarte

- Accounting Standard-28 Impairment of AssetsDocumento23 páginasAccounting Standard-28 Impairment of Assetsvenugopal naiduAún no hay calificaciones

- As-28 Impairment of Assets: Overall ViewDocumento22 páginasAs-28 Impairment of Assets: Overall ViewsweetlilangelAún no hay calificaciones

- Understanding AS-28 on Impairment of AssetsDocumento22 páginasUnderstanding AS-28 on Impairment of AssetsPankajRateriaAún no hay calificaciones

- As 28Documento14 páginasAs 28Harsh PatelAún no hay calificaciones

- IAS 36 Impairment of Assets SummaryDocumento9 páginasIAS 36 Impairment of Assets SummaryAbdullah Al Amin MubinAún no hay calificaciones

- Theory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesDocumento5 páginasTheory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesAnna Antonio100% (1)

- SBR - Chapter 4Documento6 páginasSBR - Chapter 4Jason KumarAún no hay calificaciones

- PAS36 Impairment AssessmentDocumento3 páginasPAS36 Impairment AssessmentPauline Joy GenalagonAún no hay calificaciones

- Material of As 28Documento48 páginasMaterial of As 28emmanuel JohnyAún no hay calificaciones

- Accounting Standard - 28 Impairment of Assets: Generally Follows IAS-36 (Differs From SFAS - 144 of US GAAP)Documento45 páginasAccounting Standard - 28 Impairment of Assets: Generally Follows IAS-36 (Differs From SFAS - 144 of US GAAP)Ranga NayakuluAún no hay calificaciones

- AS 6, 10 and 28 on Accounting for Depreciation, Fixed Assets and ImpairmentDocumento40 páginasAS 6, 10 and 28 on Accounting for Depreciation, Fixed Assets and ImpairmentArunkumarAún no hay calificaciones

- Accounting Standard-28 Impairment of AssetsDocumento8 páginasAccounting Standard-28 Impairment of AssetsManoranjan SarangiAún no hay calificaciones

- Theory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesDocumento5 páginasTheory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesPia DagmanAún no hay calificaciones

- Summary of Pas 36Documento5 páginasSummary of Pas 36Elijah MontefalcoAún no hay calificaciones

- Module 4 - ImpairmentDocumento5 páginasModule 4 - ImpairmentLuiAún no hay calificaciones

- IAS 36 Impairment of Non-Current Assets and GoodwillDocumento23 páginasIAS 36 Impairment of Non-Current Assets and GoodwillWinston 葉永隆 DiepAún no hay calificaciones

- IAS16 Defines Property, Plant and Equipment As "Tangible Items ThatDocumento35 páginasIAS16 Defines Property, Plant and Equipment As "Tangible Items ThatMo HachimAún no hay calificaciones

- Impairment of Assets TheoryDocumento6 páginasImpairment of Assets TheoryMendoza KlariseAún no hay calificaciones

- Value in Use WRT IAS 36Documento12 páginasValue in Use WRT IAS 36Noman_TufailAún no hay calificaciones

- Ias 16 - PpeDocumento4 páginasIas 16 - Ppecar itselfAún no hay calificaciones

- IAS 36 - ImpairmentDocumento4 páginasIAS 36 - ImpairmentAiman TuhaAún no hay calificaciones

- IAS 36 - ImpairmentDocumento4 páginasIAS 36 - ImpairmentAiman TuhaAún no hay calificaciones

- Examen Contabilidad IntermediaDocumento3 páginasExamen Contabilidad IntermediaMariaAún no hay calificaciones

- Disclosure Requirements of AsDocumento75 páginasDisclosure Requirements of AsVelayudham ThiyagarajanAún no hay calificaciones

- Impairment of AssetsDocumento3 páginasImpairment of Assetsber tingAún no hay calificaciones

- Lecture Notes On Revaluation and ImpairmentDocumento6 páginasLecture Notes On Revaluation and Impairmentjudel ArielAún no hay calificaciones

- Lecture Notes On Revaluation and Impairment PDFDocumento6 páginasLecture Notes On Revaluation and Impairment PDFjudel ArielAún no hay calificaciones

- Impairment Accounting IAS 36 0810Documento12 páginasImpairment Accounting IAS 36 0810Eynar MahmudovAún no hay calificaciones

- FR 01 Impairment of Assets - IAS36 - Part 1 NotesDocumento2 páginasFR 01 Impairment of Assets - IAS36 - Part 1 NotesUser Upload and downloadAún no hay calificaciones

- Acctg3 5 RevaluationDocumento2 páginasAcctg3 5 Revaluationflammy07Aún no hay calificaciones

- LESSON3Documento19 páginasLESSON3Ira Charisse BurlaosAún no hay calificaciones

- Financial Accounting and ReportingDocumento31 páginasFinancial Accounting and ReportingBer SchoolAún no hay calificaciones

- Acc470 Ias 36Documento33 páginasAcc470 Ias 36Naji EssaAún no hay calificaciones

- Exam NotesDocumento7 páginasExam NotesAmit VadiAún no hay calificaciones

- Ias 16Documento26 páginasIas 16Niharika MishraAún no hay calificaciones

- Umst MBA (B7) Finance IAS 36: Asset ImpairmentDocumento27 páginasUmst MBA (B7) Finance IAS 36: Asset ImpairmentHadina SafiAún no hay calificaciones

- IAS 36 Impairment of AssetsDocumento12 páginasIAS 36 Impairment of AssetsthinhAún no hay calificaciones

- LOS 24 and Financial Ratio AnalysisDocumento46 páginasLOS 24 and Financial Ratio AnalysisBenny Mysa Casipong100% (2)

- AS - Key Accounting Policies and StandardsDocumento15 páginasAS - Key Accounting Policies and StandardsSrinivasprasadAún no hay calificaciones

- Operating Segment: Intermediate Accounting 3Documento51 páginasOperating Segment: Intermediate Accounting 3Trisha Mae AlburoAún no hay calificaciones

- Accounting Standard 28Documento27 páginasAccounting Standard 28Asif ShaikhAún no hay calificaciones

- Ias 1 Presentation of Financial Statements-2Documento7 páginasIas 1 Presentation of Financial Statements-2Pia ChanAún no hay calificaciones

- Topic 1Documento49 páginasTopic 1TafadzwaAún no hay calificaciones

- State Street:-: Information Classification: Limited AccessDocumento8 páginasState Street:-: Information Classification: Limited AccessOmkar DeshmukhAún no hay calificaciones

- SBR NoteDocumento27 páginasSBR Notejeewen thienAún no hay calificaciones

- Curriculum 3-Final NoteDocumento19 páginasCurriculum 3-Final NoteThế VinhAún no hay calificaciones

- Tab 25 - CICBV. Practice Bulletin No. 2 International Glossary of Business Valuation TermsDocumento8 páginasTab 25 - CICBV. Practice Bulletin No. 2 International Glossary of Business Valuation TermslarmcfAún no hay calificaciones

- Noncurrent Asset NotesDocumento4 páginasNoncurrent Asset NotesHyeju SonAún no hay calificaciones

- 1) Income Statement: Nature, Forms and Uses of Income StatementDocumento6 páginas1) Income Statement: Nature, Forms and Uses of Income StatementPaulineBiroselAún no hay calificaciones

- ImpairmentDocumento45 páginasImpairmentnati100% (1)

- Revenue Gross Net Operating Cogs, Free Equity Cash inDocumento4 páginasRevenue Gross Net Operating Cogs, Free Equity Cash inOlsjon BaxhijaAún no hay calificaciones

- ACCT1501 NotesDocumento31 páginasACCT1501 Notesmothermonk100% (1)

- Pas 16 - Property Plant and EquipmentDocumento4 páginasPas 16 - Property Plant and EquipmentJessie ForpublicuseAún no hay calificaciones

- Fixed Assets, DepreciationDocumento30 páginasFixed Assets, Depreciationnahar570Aún no hay calificaciones

- 3accountingstandards 120704142603 Phpapp02Documento37 páginas3accountingstandards 120704142603 Phpapp02MehtaMilanAún no hay calificaciones

- Joseph Willy Yose - Task 11Documento8 páginasJoseph Willy Yose - Task 11JOSEPH WILLY YOSEAún no hay calificaciones

- Chapter 2 (Accounting Income Ans Assets - The Accrual Concept)Documento32 páginasChapter 2 (Accounting Income Ans Assets - The Accrual Concept)Tonoy Roy67% (3)

- CPA Review Notes 2019 - Audit (AUD)De EverandCPA Review Notes 2019 - Audit (AUD)Calificación: 3.5 de 5 estrellas3.5/5 (10)

- CPA Review Notes: Audit 2022De EverandCPA Review Notes: Audit 2022Calificación: 4.5 de 5 estrellas4.5/5 (7)

- Fair Value. ACCA. Paper P2. Students notes.: ACCA studiesDe EverandFair Value. ACCA. Paper P2. Students notes.: ACCA studiesAún no hay calificaciones

- B2B Engagement MarketingDocumento6 páginasB2B Engagement MarketingSanchita GuptaAún no hay calificaciones

- Fuel Price DeregualationDocumento13 páginasFuel Price DeregualationSanchita GuptaAún no hay calificaciones

- Problems on Scheduling Job SequencingDocumento2 páginasProblems on Scheduling Job SequencingSanchita GuptaAún no hay calificaciones

- MDHDocumento3 páginasMDHSanchita GuptaAún no hay calificaciones

- 16 FMCG 1Documento9 páginas16 FMCG 1Sanchita GuptaAún no hay calificaciones

- 16 FMCG 1Documento9 páginas16 FMCG 1Sanchita GuptaAún no hay calificaciones

- Short Answer QuestionsDocumento5 páginasShort Answer QuestionsMuthu KrishnaAún no hay calificaciones

- Land Bank appeals valuation of just compensation for expropriated propertyDocumento9 páginasLand Bank appeals valuation of just compensation for expropriated propertyHarleneAún no hay calificaciones

- Convexity and ImmunizationDocumento8 páginasConvexity and Immunizationarjun guptaAún no hay calificaciones

- Chapter 5, Long Term Financing, RevisedDocumento9 páginasChapter 5, Long Term Financing, RevisedAndualem ZenebeAún no hay calificaciones

- G.R. No. 92585 May 8, 1992 Davide, JR.,: Caltex Philippines, Inc. vs. Commission On AuditDocumento1 páginaG.R. No. 92585 May 8, 1992 Davide, JR.,: Caltex Philippines, Inc. vs. Commission On AuditDonna DumaliangAún no hay calificaciones

- Agency Theory On WorldcomDocumento10 páginasAgency Theory On WorldcomAtlantis Ong100% (1)

- Learning Resource 9 Lesson 3Documento7 páginasLearning Resource 9 Lesson 3Vianca Marella SamonteAún no hay calificaciones

- Annual Report 2021-22 (English)Documento186 páginasAnnual Report 2021-22 (English)DaveAún no hay calificaciones

- Divya Jaiswal 1904 A71318219001 B.A. (H) Economics, Sem-4 2019-2022 Book ReviewDocumento4 páginasDivya Jaiswal 1904 A71318219001 B.A. (H) Economics, Sem-4 2019-2022 Book ReviewfrootiAún no hay calificaciones

- Homework Stata Exercises Due FridayDocumento6 páginasHomework Stata Exercises Due FridaySophia GoldsonAún no hay calificaciones

- FIN625Documento27 páginasFIN625Mahmmood AlamAún no hay calificaciones

- G Sec ActDocumento9 páginasG Sec Actuhyr ujdgbAún no hay calificaciones

- Mathematics of InvestmentDocumento5 páginasMathematics of InvestmentLaysa FloreceAún no hay calificaciones

- Chapter 4 Problem SetDocumento3 páginasChapter 4 Problem SetNasir Ali RizviAún no hay calificaciones

- Market Risk FlowchartDocumento1 páginaMarket Risk FlowchartlardogiousAún no hay calificaciones

- Agricultural & Applied Economics AssociationDocumento10 páginasAgricultural & Applied Economics AssociationfenderaddAún no hay calificaciones

- Multiple Choice Questions 1 According To The Crowding Out EffeDocumento2 páginasMultiple Choice Questions 1 According To The Crowding Out Effetrilocksp SinghAún no hay calificaciones

- The Trusts Act, 1882Documento44 páginasThe Trusts Act, 1882Rizwan Niaz RaiyanAún no hay calificaciones

- Mathematics of Investment 1Documento49 páginasMathematics of Investment 1John Luis Masangkay BantolinoAún no hay calificaciones

- Initiatives To Improve Business Ethics: and Reduce CorruptionDocumento14 páginasInitiatives To Improve Business Ethics: and Reduce CorruptiontheheckwithitAún no hay calificaciones

- Oag v. MC Solar ComplaintDocumento56 páginasOag v. MC Solar ComplaintABC Action NewsAún no hay calificaciones

- SWOT and PEST Analysis of Southwest AirlinesDocumento6 páginasSWOT and PEST Analysis of Southwest AirlinesAmmara LatifAún no hay calificaciones

- Public Goods and Private Communities - Fred E. FodlvaryDocumento291 páginasPublic Goods and Private Communities - Fred E. FodlvaryAcracia AncapAún no hay calificaciones

- A Loan Management System For SaccosDocumento17 páginasA Loan Management System For SaccosGILBERT KIRUIAún no hay calificaciones

- CH 7 Answer KeyDocumento88 páginasCH 7 Answer KeyT m100% (1)

- Applied Economics: Module No. 1: Week 1: First QuarterDocumento7 páginasApplied Economics: Module No. 1: Week 1: First QuarterhiAún no hay calificaciones

- Enhanced Business Loan PropositionDocumento6 páginasEnhanced Business Loan PropositionAwadhesh Kumar KureelAún no hay calificaciones

- Digital Currency: The Transition To A Cashless SocietyDocumento44 páginasDigital Currency: The Transition To A Cashless SocietyKenneth WeissAún no hay calificaciones

- Islamic Approaches To MoneyDocumento12 páginasIslamic Approaches To Moneyعلي اسحاقيAún no hay calificaciones

- Point of IndifferenceDocumento3 páginasPoint of IndifferenceSandhyaAún no hay calificaciones