Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Market Update 29 Aug 10

Cargado por

AndysTechnicalsDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Market Update 29 Aug 10

Cargado por

AndysTechnicalsCopyright:

Formatos disponibles

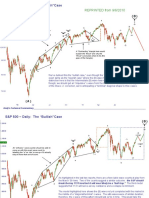

S&P 500 Sep e-Minis ~ (240 min.

)

(Z)

“y” This would be an “idealized” result of the wave count…It’s easy to see why it could be a “choppy” and

“unpredictable” type of ride to finish off an Intermediate (B) wave. This would be considered a “good

result” for bulls--it would be a decent, albeit grinding rally into Nov-Dec which would set up a crash to

begin 2011. It is because of this sort of “whipsaw” possibility that we have not done much with the

S&P500, except for maintaining a 20% (of maximum) short position.

b

(B)

“c”

“x” “a”

c c

b

a a

a

CRASH

b a

c b

“w” c

“b”

“y” REPRINTED from 8/22/2010

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (240 min.)

(Z)

“y” The idealized chart pattern presented last week remains ‘alive,’ with the market holding a very nice

area of support this week. There are probably bulls who are imagining the Head and Shoulders bottom

look to this pattern. In fact, if the market were to follow the “path of greatest pain for all,” it would look

a lot this forecast, with a failed neckline break to the upside. As it stands, it looks like we may have

completed wave-a of “b” this week. Some sort of b-wave rally for the next several days should not

b

surprise. At this point, the wave down from the “a” peak does not look like an impulsion lower, so the

subsequent b-wave rally MUST retrace at least 60% of the a-wave. Read: It could be a decent “hop”

this week.

(B)

“c”

“x” “a”

c c

b

a

a

a

CRASH

b

b a?

c c

“w” “b”

“y”

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

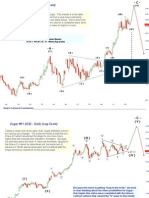

S&P 500 Sep e-Minis ~ (60 min.)

“a”

c

-5-

-3-

(b)

a (a)

-x-

-1-

-4-

(b)

1076

(c)

(a)

-w-

-2-

b

(c)

-y-

a?

This would be the wave count that finishes the move down for the a-wave. This is the same

preferred model we highlighted last weekend. Breaking above 1076 would confirm this wave

count. Breaking below last week’s lows would negate this wave count. Mr. Market will tell the

tale early this week.

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (60 min.): Uber-Bearish Model

“c”

c

-5-

-3-

-1-

-2-

-4- (2)

1076

(4)

-1-

(1)

-2-

(3)

-3-?!?

A case can still be made that we’re in the middle of an “impulsive” move lower, but a break above 1076

would KILL those bearish ideas. In fact, any further strength to begin the week ‘should’ negate this model

because a Wave (4) should not overlap with a wave (1), but I’m going with 1076 as the KILL level just in

case we completed a Wave -3- this week, and it’s simply not evident on the chart. The bottom line for

Wavers is this: The move down cannot be counted as a completed “impulse” of any kind. So, ‘if’ we

do get a stronger move higher this week, don’t believe any wave counts that try to ‘fit’ this into an

impulse lower.

b

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (240 min.)

(Z)

“y”

This is also a pretty decent explanation of the price action. While it is not my “preferred” count, it

does do a better of job of explaining the recent “terminal wedge” pattern that was witnessed. This

would be a very bearish outcome in the near term as we would be in the beginning stages of a

collapse that should last several weeks and drop the market 10-15% from current levels.

b

“b”

-d- c

-5-

-3-

a -b-

-1- -2-

a

-4-

-1-

-a- (1)

-2-

-c-

c

“a”

REPRINTED from 8/22/2010

-e-

b

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (240 min.)

(Z)

“y”

This remains my preferred count. It sugggests that we will continue to be in a prolonged period

of “congestion,” as we are smack in the middle of an Intermediate (B) wave. In fact, this would

be the “b” of the (B), which would imply the HIGHEST level of uncertainty and choppiness.

“a”

“x” c

c -5-

(b)

-3-

a a (a) -x-

a -1-

a -4-

b

(c)

-w-

-2- (a) or -y-

b

b

c

“w”

REPRINTED from 8/22/2010 c

“y”

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (240 min.): Support/Resistance Levels

It appears 1130 was the “big hurdle” we thought it might be. It’s amazing how even the simplest forms of

technical analysis (i.e. classic support and resistance points) can yield nice ‘tradeable’ moments. Slide

#4 highlights an alternate, very bearish, count. If that model is correct, the S&P futures should NOT trade

above 1085 , the 62% retrace of the most recent decline. Thus, 1085 is the first level of resistance for the

week. First level of support would be 1051 and then 1036. As well as being “classic” support, 1051 is

also the 62% retrace of the entire advance, so I’m expecting a bounce from that level on the “first go.”

1130

1105

1085

1051

1036

REPRINTED from 8/22/2010

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (240 min.): Support/Resistance Levels

Key support and resistance levels from last weekend were “money” last week, with 1085 providing early

week resistance and 1036 causing two different ricochet moves which began at 1037. The 1076 level is

the 62% retrace of the wave down from 1098 to 1037 and also wave resistance on the line on close chart

(slide 4). Short term ‘bottom pickers’ might want to use 1054 as near term support with action below

1037 being ‘ominous’ for anyone with length. If the ‘preferred’ wave count from slide #2 is correct, the

market should rally to 1105 area where there will be resistance.

1105

1076

1054

1037

Andy’s Technical Commentary__________________________________________________________________________________________________

Dollar Index (30 min) (5)

[5]?

REPRINTED from 8/22/2010

[3]?

[b]

(3)

[5] [d]

[3] [4]?

[1]

[.5]

[.3]

[2]

[.4]

[a]

[4]

[.1] [e]

[c]

(1) (4)

[5] [1]

[x] [.2]

[3] [2]

I don’t normally like to look at waves on this small of time scale because there tends

[y]

to be “noise” with the overnight sessions. This is a very interesting wave

(2)* development with a few different ways to consider it. This counting adheres to the

[4]

most number of “rules” of wave theory. One of the interesting implications of this

[1]

[w] model is that the wave (1) and (3) were of nearly equivalent height, which means we

should expect the Wave (5) to be the extended wave. The target of that move would

be 84.60-84.80

[2]

* Wave (2) was a “double combination”

y

Andy’s Technical Commentary__________________________________________________________________________________________________

Dollar Index (45 min)

[1]

[.b]

[.3]

[b]

(3)

[5]

[d]

[.4] [.a]

[3] [.1]

[.c]

[.2] [2]

[4] [a]

[e]

[c]

(1) [1] (4)

[2]

This is the ‘preferred’ wave count from last week. We have not yet seen the ‘fifth

(2)* extension’ Wave (5). This model requires that the DXY explode higher this

week. A break below 82.60, the 61.8% retrace of the last wave higher, would negate

this count and leave us with the next page….

y * Wave (2) was a “double combination”

Andy’s Technical Commentary__________________________________________________________________________________________________

Dollar Index (45 min)

-1- or -a-

(5)

[.5]

[.b]

[3]

[b]

(3)

[5]

[d]

[4] [.a]

[3] [1]

[.c]

[2]

[4] [a]

[e]

[c]

(1) [1] (4)

[2]

A break below 82.60 would leave me with this model. It would mean that we

completed a wave higher at 83.56 and should be prepared for several days of

sideways/lower congestion that could take the DXY down to 81.40.

(2)

Andy’s Technical Commentary__________________________________________________________________________________________________

10 Yr Note ~ Continuous Daily Futures

One of the reasons I don’t do a lot of analysis on the treasury notes/bonds is that I don’t 3?

have a good ‘feed’ for interest rates, which is the best way to model such instruments.

Charting futures on notes/bonds have a lot of “issues,” but there are a few interesting things

about this current development. The most noteworthy item is the Daily RSI divergence

triggered on the new high last week, followed by the engulfing candlestick. This looks near

term bearish--10 yr note holders should be braced for lower prices over the next few weeks. 1?

2?

Notice how the market lapsed into prolonged sideways congestion right in the middle of the

wave up. This is bizarre looking behavior that would cause me some ‘restless’ nights if I

were SHORT notes. The near term action suggests a bearish bias, but it’s WAY too early to

call a major top in the Ten Year.

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

También podría gustarte

- Mam - WitsDocumento28 páginasMam - WitsSushant Kanade0% (2)

- Market MasteryDocumento79 páginasMarket MasteryFrancis Ejike100% (3)

- Econ3007 ForexriskDocumento32 páginasEcon3007 ForexriskSta KerAún no hay calificaciones

- Financial Markets and Institutions 12th EditionDocumento61 páginasFinancial Markets and Institutions 12th Editionjerry.wolff99197% (39)

- Market Update 25 July 10Documento13 páginasMarket Update 25 July 10AndysTechnicalsAún no hay calificaciones

- Market Update 11 July 10Documento13 páginasMarket Update 11 July 10AndysTechnicalsAún no hay calificaciones

- SP500 Update 22 Aug 10Documento7 páginasSP500 Update 22 Aug 10AndysTechnicalsAún no hay calificaciones

- Market Update 28 Nov 10Documento8 páginasMarket Update 28 Nov 10AndysTechnicalsAún no hay calificaciones

- S&P 500 Update 19 Mar 10Documento8 páginasS&P 500 Update 19 Mar 10AndysTechnicalsAún no hay calificaciones

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Documento10 páginasS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsAún no hay calificaciones

- REPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseDocumento7 páginasREPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseAndysTechnicalsAún no hay calificaciones

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocumento8 páginasUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseDocumento8 páginasREPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseAndysTechnicalsAún no hay calificaciones

- S&P 500 Daily: The "Double Top Count"Documento7 páginasS&P 500 Daily: The "Double Top Count"AndysTechnicalsAún no hay calificaciones

- SpikedStar A4 ByverticeesDocumento5 páginasSpikedStar A4 ByverticeesFlorencia GiangarraAún no hay calificaciones

- SpikedStar Letter ByVerticeesDocumento5 páginasSpikedStar Letter ByVerticeesFlorencia GiangarraAún no hay calificaciones

- SP500 Update 2 Jan 11Documento9 páginasSP500 Update 2 Jan 11AndysTechnicalsAún no hay calificaciones

- Market Commentary 1may11Documento12 páginasMarket Commentary 1may11AndysTechnicalsAún no hay calificaciones

- Tutorial 3 - Solutions PDFDocumento1 páginaTutorial 3 - Solutions PDFDarian ChettyAún no hay calificaciones

- Market Update 18 July 10Documento10 páginasMarket Update 18 July 10AndysTechnicalsAún no hay calificaciones

- P3 RevisionDocumento93 páginasP3 Revisionapple liew ler xinAún no hay calificaciones

- Market Commentary 13mar11Documento8 páginasMarket Commentary 13mar11AndysTechnicalsAún no hay calificaciones

- Kiesha Locklear Portfolio 2020Documento17 páginasKiesha Locklear Portfolio 2020Kiesha LocklearAún no hay calificaciones

- Bar Bending Diagram: Provincial Engineers OfficeDocumento1 páginaBar Bending Diagram: Provincial Engineers OfficeCarl Lou BaclayonAún no hay calificaciones

- SiC StackingDocumento1 páginaSiC StackingmirckyAún no hay calificaciones

- Pages From Watson Molecular Biology of The Gene 7th Edition c2014 Txtbk-2Documento1 páginaPages From Watson Molecular Biology of The Gene 7th Edition c2014 Txtbk-2Kunal SethAún no hay calificaciones

- HO - Handout w7Documento3 páginasHO - Handout w7Billy JimenezAún no hay calificaciones

- 7 Meiosis en UvaDocumento1 página7 Meiosis en UvaAngieAún no hay calificaciones

- S&P 500 Update 9 Nov 09Documento6 páginasS&P 500 Update 9 Nov 09AndysTechnicalsAún no hay calificaciones

- Morning View 12feb2010Documento8 páginasMorning View 12feb2010AndysTechnicalsAún no hay calificaciones

- Complete Score (Tablature)Documento2 páginasComplete Score (Tablature)simantonstefanAún no hay calificaciones

- Lineas Notables Cap 3Documento5 páginasLineas Notables Cap 3Erick AgurtoAún no hay calificaciones

- Sugar Report Nov 06 2009Documento6 páginasSugar Report Nov 06 2009AndysTechnicalsAún no hay calificaciones

- 13 11th Maths Unit 8 Creative Questions English MediumDocumento4 páginas13 11th Maths Unit 8 Creative Questions English Mediumveeraragavan subramaniamAún no hay calificaciones

- Spice - Tokyo KarankoronDocumento6 páginasSpice - Tokyo Karankoroneliel MuñozAún no hay calificaciones

- Maths Lecture 3Documento3 páginasMaths Lecture 3Vb June 5Aún no hay calificaciones

- AP Grama Ward Sachivalayam Model Papers 3 Telugu Medium Category 1Documento12 páginasAP Grama Ward Sachivalayam Model Papers 3 Telugu Medium Category 1premkumarAún no hay calificaciones

- S&P 500 Update 23 Jan 10Documento7 páginasS&P 500 Update 23 Jan 10AndysTechnicalsAún no hay calificaciones

- IMSLP553061-PMLP146961-Hume - Duke John of Polland His Galiard, No.39 - Music NotationDocumento1 páginaIMSLP553061-PMLP146961-Hume - Duke John of Polland His Galiard, No.39 - Music Notationmichel kowalevskyAún no hay calificaciones

- U P: Competitive Exam GroupDocumento10 páginasU P: Competitive Exam GroupAppy PrinceAún no hay calificaciones

- Type-A Type-B Type-C Type-H Type-S: Dimensions (MM) Radius Total Length Notes A B C D e (MM) (M) Cutting Length (MM)Documento2 páginasType-A Type-B Type-C Type-H Type-S: Dimensions (MM) Radius Total Length Notes A B C D e (MM) (M) Cutting Length (MM)ybm987Aún no hay calificaciones

- iv. Perform the circuit analysis using PSPICE to validate your results a) R = 10Ω b) b) b) b) b) b) b) b) b) b) b) b) R = 20ΩDocumento3 páginasiv. Perform the circuit analysis using PSPICE to validate your results a) R = 10Ω b) b) b) b) b) b) b) b) b) b) b) b) R = 20ΩDevin RajAún no hay calificaciones

- CUADRILATEROSDocumento2 páginasCUADRILATEROSNazareth Narvasta AntonioAún no hay calificaciones

- Cuadrilateros IiDocumento2 páginasCuadrilateros IiNazareth Narvasta AntonioAún no hay calificaciones

- 64f5c9e85393ec001820ddc4 - ## - Science TestDocumento3 páginas64f5c9e85393ec001820ddc4 - ## - Science Testrajnishk126Aún no hay calificaciones

- 4-Storey Residential BLG - Page2Documento1 página4-Storey Residential BLG - Page2Mark Roger Huberit IIAún no hay calificaciones

- Footing Reinforcement: D19 - 200 (60 BESI) ADocumento1 páginaFooting Reinforcement: D19 - 200 (60 BESI) AAHMAD VALHEINAún no hay calificaciones

- PlanesDocumento2 páginasPlaneskillerk5555Aún no hay calificaciones

- Trigonometry - Sine Rule and Cosine RuleDocumento4 páginasTrigonometry - Sine Rule and Cosine Rulefaomah9Aún no hay calificaciones

- Physics 20 - Lesson 1.3 - UNIT VECTORS AND PRODUCT OF VECTORS (Part 2)Documento5 páginasPhysics 20 - Lesson 1.3 - UNIT VECTORS AND PRODUCT OF VECTORS (Part 2)julietAún no hay calificaciones

- Algebraic IdentitiesDocumento1 páginaAlgebraic IdentitiesDigital TutorAún no hay calificaciones

- Sugar Nov 28 2009Documento9 páginasSugar Nov 28 2009AndysTechnicalsAún no hay calificaciones

- Laiya - Electrical (Updated)Documento6 páginasLaiya - Electrical (Updated)paduitangel.2727Aún no hay calificaciones

- E1 MergedDocumento7 páginasE1 Mergedpaduitangel.2727Aún no hay calificaciones

- Digital Assignment For Week 5Documento6 páginasDigital Assignment For Week 5Aeronautical EngineerAún no hay calificaciones

- (Suite) : Silvius Leopold WeissDocumento17 páginas(Suite) : Silvius Leopold Weisspierlu58Aún no hay calificaciones

- Given and Its Reflection Image Find The Line of Reflection. ABC ABCDocumento1 páginaGiven and Its Reflection Image Find The Line of Reflection. ABC ABCHossam MahmoudAún no hay calificaciones

- CaedDocumento7 páginasCaedswarupa.23iseAún no hay calificaciones

- Morning View 27jan2010Documento6 páginasMorning View 27jan2010AndysTechnicals100% (1)

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Documento7 páginasS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsAún no hay calificaciones

- Duke John of Polland His Galiard: Tenor ViolDocumento1 páginaDuke John of Polland His Galiard: Tenor ViolLeandro MarquesAún no hay calificaciones

- Market Commentary 1JUL12Documento8 páginasMarket Commentary 1JUL12AndysTechnicalsAún no hay calificaciones

- Market Commentary 22JUL12Documento6 páginasMarket Commentary 22JUL12AndysTechnicalsAún no hay calificaciones

- Market Commentary 5aug12Documento7 páginasMarket Commentary 5aug12AndysTechnicalsAún no hay calificaciones

- Market Commentary 29apr12Documento6 páginasMarket Commentary 29apr12AndysTechnicalsAún no hay calificaciones

- Market Commentary 1apr12Documento8 páginasMarket Commentary 1apr12AndysTechnicalsAún no hay calificaciones

- Market Commentary 10JUN12Documento7 páginasMarket Commentary 10JUN12AndysTechnicalsAún no hay calificaciones

- Market Commentary 17JUN12Documento7 páginasMarket Commentary 17JUN12AndysTechnicalsAún no hay calificaciones

- Dollar Index (DXY) Daily ContinuationDocumento6 páginasDollar Index (DXY) Daily ContinuationAndysTechnicalsAún no hay calificaciones

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocumento6 páginasS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 11mar12Documento7 páginasMarket Commentary 11mar12AndysTechnicalsAún no hay calificaciones

- Market Commentary 16jan12Documento7 páginasMarket Commentary 16jan12AndysTechnicalsAún no hay calificaciones

- Market Commentary 18mar12Documento8 páginasMarket Commentary 18mar12AndysTechnicalsAún no hay calificaciones

- Market Commentary 25mar12Documento8 páginasMarket Commentary 25mar12AndysTechnicalsAún no hay calificaciones

- Market Commentary 19DEC11Documento9 páginasMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 6NOVT11Documento4 páginasMarket Commentary 6NOVT11AndysTechnicalsAún no hay calificaciones

- Market Commentary 20NOV11Documento7 páginasMarket Commentary 20NOV11AndysTechnicalsAún no hay calificaciones

- Market Commentary 27NOV11Documento5 páginasMarket Commentary 27NOV11AndysTechnicalsAún no hay calificaciones

- Copper Commentary 11dec11Documento6 páginasCopper Commentary 11dec11AndysTechnicalsAún no hay calificaciones

- Market Commentary 25SEP11Documento8 páginasMarket Commentary 25SEP11AndysTechnicalsAún no hay calificaciones

- Sp500 Update 23oct11Documento7 páginasSp500 Update 23oct11AndysTechnicalsAún no hay calificaciones

- Sp500 Update 11sep11Documento6 páginasSp500 Update 11sep11AndysTechnicalsAún no hay calificaciones

- Market Commentary 30OCT11Documento6 páginasMarket Commentary 30OCT11AndysTechnicalsAún no hay calificaciones

- Sp500 Update 5sep11Documento7 páginasSp500 Update 5sep11AndysTechnicalsAún no hay calificaciones

- Copper Commentary 2OCT11Documento8 páginasCopper Commentary 2OCT11AndysTechnicalsAún no hay calificaciones

- Paper14 SolutionDocumento21 páginasPaper14 SolutionJabir AghadiAún no hay calificaciones

- MBA 3rd Semester Curriculum in Session 2020-21Documento18 páginasMBA 3rd Semester Curriculum in Session 2020-21Uma KhamhariAún no hay calificaciones

- Binary Strategy From Forex MasterDocumento13 páginasBinary Strategy From Forex MasterfuadiAún no hay calificaciones

- CFA630Documento15 páginasCFA630Cfa Pankaj KandpalAún no hay calificaciones

- Other Derivatives: 8.1a AccumulatorsDocumento23 páginasOther Derivatives: 8.1a AccumulatorsAnDy YiMAún no hay calificaciones

- Iron OreDocumento36 páginasIron OreknowledgeINDIANAún no hay calificaciones

- Chapter 09Documento55 páginasChapter 09fatenyousmeraAún no hay calificaciones

- Hedging With Foreign Currency Futures at Transcend IncDocumento5 páginasHedging With Foreign Currency Futures at Transcend IncYuyun Purwita SariAún no hay calificaciones

- Getting Started in Online Investing PDFDocumento130 páginasGetting Started in Online Investing PDFBrian BarriosAún no hay calificaciones

- Forex Trading Using Intermarket Analysis-Louis MendelsohnDocumento20 páginasForex Trading Using Intermarket Analysis-Louis Mendelsohndrkwng0% (1)

- Amit SinghDocumento111 páginasAmit Singhashish_narula30Aún no hay calificaciones

- Questionnaire Stock MarketDocumento18 páginasQuestionnaire Stock Marketprateek gangwaniAún no hay calificaciones

- Project Finance (Smart Task 1)Documento14 páginasProject Finance (Smart Task 1)Aseem VashistAún no hay calificaciones

- There Are Three Ways A Malaysian MNC Can Manipulate Its Global Presence To Increase ItsDocumento3 páginasThere Are Three Ways A Malaysian MNC Can Manipulate Its Global Presence To Increase ItsStudy ThingyAún no hay calificaciones

- Watch ListDocumento5 páginasWatch Listkapil vaishnavAún no hay calificaciones

- Angel Broking LTD Project 03Documento82 páginasAngel Broking LTD Project 03Akshay SinghAún no hay calificaciones

- PMGT WhitepaperDocumento56 páginasPMGT WhitepapermbidAún no hay calificaciones

- Bba Project SharekhanDocumento51 páginasBba Project Sharekhanharsh malpaniAún no hay calificaciones

- Security Market and Stock Exchange: March 2023Documento6 páginasSecurity Market and Stock Exchange: March 2023Aman BaigAún no hay calificaciones

- FRM 2010 Part 1 Practice ExamDocumento59 páginasFRM 2010 Part 1 Practice ExamVitor Salgado100% (1)

- Build Sofr CurveDocumento27 páginasBuild Sofr CurveGeorge LiuAún no hay calificaciones

- TUTORIAL QUESTIONS CHAPTER 23 MGMT 3048Documento3 páginasTUTORIAL QUESTIONS CHAPTER 23 MGMT 3048NeceiaAún no hay calificaciones

- frm指定教材 risk management & derivativesDocumento1192 páginasfrm指定教材 risk management & derivativeszeno490Aún no hay calificaciones

- Stuart KaswellDocumento12 páginasStuart KaswellMarketsWikiAún no hay calificaciones

- KIM - Kotak Multicap FundDocumento34 páginasKIM - Kotak Multicap FunddrstudyteamAún no hay calificaciones

- Personal Financial Literacy Modlue 4 Regular NotesDocumento7 páginasPersonal Financial Literacy Modlue 4 Regular NotesSania SharpeAún no hay calificaciones