Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Risk and Return: Two Sides of The Investment Coin

Cargado por

rohitkingre0 calificaciones0% encontró este documento útil (0 votos)

261 vistas17 páginasThis document discusses risk and return as two central concepts in investment decisions. It defines return as the reward for undertaking an investment, which has both a current component like dividends and a capital component like price appreciation. Risk refers to the possibility that the actual outcome differs from expected and can come from business, interest rate, and market factors. The types of risk are unique/non-systematic risk and market/systematic risk. Historical returns are measured using formulas that consider cash payments and price changes. The cumulative wealth index tracks the compound growth of an investment over time.

Descripción original:

Título original

Risk and Return

Derechos de autor

© Attribution Non-Commercial (BY-NC)

Formatos disponibles

PPTX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoThis document discusses risk and return as two central concepts in investment decisions. It defines return as the reward for undertaking an investment, which has both a current component like dividends and a capital component like price appreciation. Risk refers to the possibility that the actual outcome differs from expected and can come from business, interest rate, and market factors. The types of risk are unique/non-systematic risk and market/systematic risk. Historical returns are measured using formulas that consider cash payments and price changes. The cumulative wealth index tracks the compound growth of an investment over time.

Copyright:

Attribution Non-Commercial (BY-NC)

Formatos disponibles

Descargue como PPTX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

261 vistas17 páginasRisk and Return: Two Sides of The Investment Coin

Cargado por

rohitkingreThis document discusses risk and return as two central concepts in investment decisions. It defines return as the reward for undertaking an investment, which has both a current component like dividends and a capital component like price appreciation. Risk refers to the possibility that the actual outcome differs from expected and can come from business, interest rate, and market factors. The types of risk are unique/non-systematic risk and market/systematic risk. Historical returns are measured using formulas that consider cash payments and price changes. The cumulative wealth index tracks the compound growth of an investment over time.

Copyright:

Attribution Non-Commercial (BY-NC)

Formatos disponibles

Descargue como PPTX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 17

Risk and Return

Two sides of the Investment Coin

Introduction

• For earning returns investors have to almost

invariably bear some risk.

• Risk and return go hand in had.

• Risk and return are central to investment

decisions.

Return

• Reward for undertaking investment.

• Historical returns are used as an important input in

estimating future returns.

• Two components of returns:

Current Return : Periodic cash flow(Income), such as

dividend or interest, generated by the investment.

Capital Return : Reflected in the price change called the

capital return.

Price appreciation or depreciation / Beginning price of the

asset

• Total Return = Current Return + Capital Return

Risk

• Refers to the possibility that the actual

outcome of an investment will differ from its

expected outcome.

• Sources of Risk :

• Business Risk

• Interest Rate Risk

• Market Risk

Risk

• Business Risk:

• Shareholders are exposed to poor business

performance

• Reason being factors like heightened competition,

emergence of new technologies, development of

substitute products, shifts in consumer

preferences, inadequate supply of essential

inputs, changes in governmental policies etc…

• Inept and incompetent management

Risk

• Interest Risk:

• As IR , market prices of existing fixed income

securities fall, and vice versa.

• Bcoz the buyer of a fixed income security would not

buy it at its par value or face value if its fixed interest

is lower than the prevailing interest rate on a similar

security.

• For example, a debenture that has a face value of Rs

100 and a fixed rate of 12% will sell at a discount if the

interest rate moves up from 12 to 14%.

Risk

• Interest Risk:

• Changes in interest rate have a direct bearing

on the prices of fixed income securities, they

affect equity prices too, indirectly.

• Changes in relative yields of debentures and

equity shares influence equity prices.

Risk

• Market Risk:

• Changing sentiments of the investors

• Sometimes investors become bullish and their

investment horizons lengthen

• On the other hand, when a wave of

pessimism, response to some unfavourable

political or economic sweeps the market,

investors turn bearish and myopic.

Risk

• Market Risk:

• Market tends to move in cycles caused by mass

psychology.

• As John Train explains: “ The ebb and flow of mass

emotion is quite regular: Panic is followed by relief,

and relief by optimism; then comes enthusiasm,

then euphoria and rapture, then the bubble bursts,

and public feeling slides off again into concern,

desperation and finally a new panic.”

Types of Risk

• Modern Portfolio Theory looks at risk from a different

perspective.

• Total Risk = Unique Risk + Market Risk

• Unique Risk : stems from firm-specific factors like the

development of a new product, labour strike, new

competitor.

• UR can be removed by combining one particular stock

with other stocks.

• In a diversified portfolio, unique risks of different

stocks tend to cancel each other.

Types of Risk

• Market Risk: Risk attributable to economy-

wide factors like the growth rate of GDP, the

level of government spending, money supply,

interest rate structure and inflation rate.

• Systematic or Non-diversifiable risk

Measuring Historical Return

• Total return = (Cash payment received during the

period + Price change over the period )/ Price of the

investment at the beginning

• All items are measured in rupees.

• R = C + (PE – PB)

PB

• Where C = Cash payment received during the period

• PE = ending price of the investment

• PB = beginning price

• Following are details about an equity stock

• Price at the beginning of the year: Rs. 60.00

• Dividend paid at the end of the year: Rs. 2.40

• Price at the end of the year: Rs. 69

• R = 2.40 + (69 -60)

60

• Split into current return and capital return

• Total Return = (Cash payment / Beginning price ) Current

Return + (Ending price-beginning price)/Beginning price

Capital Return

• R = 2.40 + 69-60

60 60

• R = 4 % (current) + 15% (capital)

Return Relative

• When returns are negative and further returns

are required for calculating Geometric mean

or Cumulative wealth index, concept of

RETURN RELATIVE is used.

• Return relative = C + PE

PB

• Differently RR = 1 + Total return in decimals

Cumulative Wealth Index

• To measure cumulative effect of returns over time,

given some stated initial amount, which is typically

one rupee, CWI is used

• CWI captures the cumulative effect of total returns.

• CWIn = WI0 (1+R1) (1+R2)…..(1+Rn)

• CWIn is the cumulative wealth index at the end of n

years, WI0 is the beginning index value which is

typically one rupee and Ri is the total return for

year I (i=1, 2…n)

Cumulative Wealth Index

• Consider a stock which earns the following returns

over a five year period: R1 = 014, R2 = 0.12, R3 =

-0.08, R4 = 0.25 and R5 = 0.02

• CWI at the end of five year period, assuming a

beginning index value of one rupee is :

• CWI5 = 1 (1.14) (1.12) (0.92) (1.25) (1.02)

= 1.498

Thus 1 rs invested at the beginning of year 1 would

be worth Re. 1.498 at the end of year 5.

Cumulative Wealth Index

• Values for the CWI can be used to obtain total

return for a given period using the following

equation:

• Rn = CWIn - 1

CWIn-1

También podría gustarte

- High-Q Financial Basics. Skills & Knowlwdge for Today's manDe EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manAún no hay calificaciones

- Financial Accounting and Reporting Study Guide NotesDe EverandFinancial Accounting and Reporting Study Guide NotesCalificación: 1 de 5 estrellas1/5 (1)

- Risk and Return FundamentalsDocumento30 páginasRisk and Return FundamentalsVaidyanathan Ravichandran0% (1)

- Risk & ReturnDocumento26 páginasRisk & ReturnAmit RoyAún no hay calificaciones

- Financial Management: by K Lubza NiharDocumento21 páginasFinancial Management: by K Lubza NiharAashutosh MishraAún no hay calificaciones

- Financial Managament Session 1Documento42 páginasFinancial Managament Session 1amishi.22019Aún no hay calificaciones

- Chapter 1 - The Investment Setting - UEFDocumento56 páginasChapter 1 - The Investment Setting - UEFTín TrungAún no hay calificaciones

- BBMF3083 Portfolio Management: The Investment SettingDocumento54 páginasBBMF3083 Portfolio Management: The Investment SettingKhai Wen OnexoxAún no hay calificaciones

- CH - 1 Understanding InvestmentDocumento59 páginasCH - 1 Understanding InvestmentBerhanu ShankoAún no hay calificaciones

- Time Value of Money: Practical Application of Compounding & DiscountingDocumento32 páginasTime Value of Money: Practical Application of Compounding & DiscountingSaurabh RajputAún no hay calificaciones

- Returns and VolatilityDocumento35 páginasReturns and VolatilitymonikatatteAún no hay calificaciones

- Portfolio Management: Lecturer: Th.S. Le Phuoc Thanh (NCS)Documento47 páginasPortfolio Management: Lecturer: Th.S. Le Phuoc Thanh (NCS)Eli ZabethAún no hay calificaciones

- Interest Rates and Risk PremiumDocumento36 páginasInterest Rates and Risk PremiumPrathiba PereraAún no hay calificaciones

- NISM Chap - 11Documento20 páginasNISM Chap - 11Shubhangi jadhavAún no hay calificaciones

- CH 2 Concept of Return and RiskDocumento48 páginasCH 2 Concept of Return and RiskRanjeet sawAún no hay calificaciones

- Investment Analysis & Portfolio ManagementDocumento27 páginasInvestment Analysis & Portfolio ManagementKhalid ZaffarAún no hay calificaciones

- Strategic Financial Planning Lec 2Documento62 páginasStrategic Financial Planning Lec 2MALIK WASEEM JANAún no hay calificaciones

- Chapter 2Documento35 páginasChapter 2ZachClementAún no hay calificaciones

- Applied Portfolio and Fund Management: Muhammad Khalid SohailDocumento32 páginasApplied Portfolio and Fund Management: Muhammad Khalid SohailMahvesh ZahraAún no hay calificaciones

- Unit 4 - IAPMDocumento17 páginasUnit 4 - IAPMPRAGASM PROGAún no hay calificaciones

- Value Investing Workshop Day 3 PE Valuation Discounted Cash Flow and Risk ManagementDocumento34 páginasValue Investing Workshop Day 3 PE Valuation Discounted Cash Flow and Risk ManagementWai SoonHanAún no hay calificaciones

- Time Value of Money FinalDocumento30 páginasTime Value of Money FinalVinodh_Shankar_6121Aún no hay calificaciones

- Chapter 7 - Appraising Investment RiskDocumento32 páginasChapter 7 - Appraising Investment RiskRika Yunita Chandra HarimurtiAún no hay calificaciones

- Cavendish University Uganda: Mba715 Finance For Managers SATURDAY at 2:30-5:30PMDocumento53 páginasCavendish University Uganda: Mba715 Finance For Managers SATURDAY at 2:30-5:30PMFaith AmbAún no hay calificaciones

- Session1 - Risk and ReturnNewDocumento16 páginasSession1 - Risk and ReturnNewUtsav ThakkarAún no hay calificaciones

- The Returns and Risks Form InvestingDocumento56 páginasThe Returns and Risks Form InvestingALEEM MANSOORAún no hay calificaciones

- Cycle 6 - Session 1-2Documento28 páginasCycle 6 - Session 1-2Anubhab GuhaAún no hay calificaciones

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocumento42 páginasInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownRaja GoharAún no hay calificaciones

- Risk and ReturnDocumento88 páginasRisk and ReturnRatul HasanAún no hay calificaciones

- TVM, Valuation, Risk and ReturnDocumento23 páginasTVM, Valuation, Risk and ReturnSreenivasan PadmanabanAún no hay calificaciones

- Reading 52: Portfolio Risk and Return: Part IDocumento48 páginasReading 52: Portfolio Risk and Return: Part IAlex PaulAún no hay calificaciones

- Chapter 6 - Risk and ReturnDocumento37 páginasChapter 6 - Risk and ReturnRoshan Ara Abdoolhamid100% (1)

- Lecture01 PPT-1 NewformatDocumento55 páginasLecture01 PPT-1 Newformatsarakhan0622Aún no hay calificaciones

- Asset Liability ManagementDocumento32 páginasAsset Liability ManagementAshish ShahAún no hay calificaciones

- CH IIIDocumento10 páginasCH IIIVeeravalli AparnaAún no hay calificaciones

- Investment ch-3Documento12 páginasInvestment ch-3Robsan AfdalAún no hay calificaciones

- Objective of A FirmDocumento35 páginasObjective of A FirmShibin PaulAún no hay calificaciones

- The Investment Setting: Questions To Be AnsweredDocumento58 páginasThe Investment Setting: Questions To Be AnsweredAimen AyubAún no hay calificaciones

- Chapter 1 (Continued) : Muhammad Khalid SohailDocumento29 páginasChapter 1 (Continued) : Muhammad Khalid SohailMahvesh ZahraAún no hay calificaciones

- 1.7 Investment Income and RiskDocumento48 páginas1.7 Investment Income and RiskestAún no hay calificaciones

- Chapter 1 Fair FinancersDocumento71 páginasChapter 1 Fair FinancersArfan AhmedAún no hay calificaciones

- Share ValuationDocumento52 páginasShare ValuationMinato UzumakiAún no hay calificaciones

- The Role of The Financial Manager: (Topic 1)Documento19 páginasThe Role of The Financial Manager: (Topic 1)Tarique AnwerAún no hay calificaciones

- The Investment Settings Chapter 1Documento36 páginasThe Investment Settings Chapter 1tjsamiAún no hay calificaciones

- 1 - The Investment SettingDocumento48 páginas1 - The Investment SettingYash Raj SinghAún no hay calificaciones

- Chapter 1: The Investment SettingDocumento54 páginasChapter 1: The Investment Settingcharlie tunaAún no hay calificaciones

- Investment-Ch 3Documento18 páginasInvestment-Ch 3bereket nigussieAún no hay calificaciones

- Investment Analysis and Portfolio Managemnet by Frank K. Relly & Keith C. Brown01 Iapm9e PPT - ch01Documento34 páginasInvestment Analysis and Portfolio Managemnet by Frank K. Relly & Keith C. Brown01 Iapm9e PPT - ch01LenAún no hay calificaciones

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocumento48 páginasInvestment Analysis and Portfolio Management: Lecture Presentation SoftwareShrajati TandonAún no hay calificaciones

- Risk - Return-II-07102023-125519pmDocumento17 páginasRisk - Return-II-07102023-125519pmsaadullah98.sk.skAún no hay calificaciones

- Valuation of SecuritiesDocumento43 páginasValuation of SecuritiesVaidyanathan RavichandranAún no hay calificaciones

- Chapter 4: The Valuation of Long-Term Securities: - Study ObjectivesDocumento5 páginasChapter 4: The Valuation of Long-Term Securities: - Study ObjectivesUsman FazalAún no hay calificaciones

- Topic 6 WACCDocumento43 páginasTopic 6 WACCsimfukwepascal812Aún no hay calificaciones

- FM - OverviewDocumento14 páginasFM - OverviewDuaa IbrahimAún no hay calificaciones

- Chapter 3: Valuing Bonds: C F PPV I IDocumento4 páginasChapter 3: Valuing Bonds: C F PPV I ImylittlespammyAún no hay calificaciones

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocumento48 páginasInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownMahzareen MalickAún no hay calificaciones

- Valuation Concepts & ModelsDocumento18 páginasValuation Concepts & Modelssmwanginet7Aún no hay calificaciones

- Investment Analysis - Chapter 3Documento34 páginasInvestment Analysis - Chapter 3Linh MaiAún no hay calificaciones

- Investment SettingDocumento34 páginasInvestment SettingRafia NaveedAún no hay calificaciones

- Economic AnalysisDocumento33 páginasEconomic AnalysisDeadly NightshadeAún no hay calificaciones

- Technology Based Project: Special Track 1)Documento14 páginasTechnology Based Project: Special Track 1)Kim ChiquilloAún no hay calificaciones

- Distinguish The Relationship/difference Between Entrepreneurial and MarketingDocumento3 páginasDistinguish The Relationship/difference Between Entrepreneurial and MarketingAcua RioAún no hay calificaciones

- 28 Rules For Successful TradingDocumento3 páginas28 Rules For Successful TradingEvangelioErnestAún no hay calificaciones

- ECON 201 Submitted By: Remar James A. Dollete Submitted To: Sir AmorosoDocumento4 páginasECON 201 Submitted By: Remar James A. Dollete Submitted To: Sir AmorosoRemar James DolleteAún no hay calificaciones

- Lecture 8.2 (Capm and Apt)Documento30 páginasLecture 8.2 (Capm and Apt)Devyansh GuptaAún no hay calificaciones

- Quiz 1 Online PracticeDocumento34 páginasQuiz 1 Online Practicerussell_mahmoodAún no hay calificaciones

- Lesson 5 - EARNINGS AND MARKET APPROACHDocumento2 páginasLesson 5 - EARNINGS AND MARKET APPROACHJessica PaludipanAún no hay calificaciones

- SEB Report: New FX Scorecard Sees Swedish Currency StrengtheningDocumento44 páginasSEB Report: New FX Scorecard Sees Swedish Currency StrengtheningSEB GroupAún no hay calificaciones

- Course Description BSBADocumento18 páginasCourse Description BSBAveehneeAún no hay calificaciones

- 1.0 Chapter IntroductionDocumento16 páginas1.0 Chapter IntroductionnoorsidiAún no hay calificaciones

- Medfield Pharma CaseDocumento7 páginasMedfield Pharma CaseRahul KumarAún no hay calificaciones

- Case Study-Precision WorldwideDocumento7 páginasCase Study-Precision WorldwideJustin Doh100% (3)

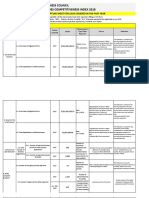

- National Competitiveness Council Cities and Municipalities Competitiveness Index 2018Documento21 páginasNational Competitiveness Council Cities and Municipalities Competitiveness Index 2018Chen C AbreaAún no hay calificaciones

- Revised Diploma Teaching Timetable May - Aug 2023Documento5 páginasRevised Diploma Teaching Timetable May - Aug 2023Stella MerlinAún no hay calificaciones

- Zara Apparel Case StudyDocumento3 páginasZara Apparel Case StudyAbdul Rehman100% (4)

- Actuarial EconomicsDocumento52 páginasActuarial EconomicsRavi Shankar VermaAún no hay calificaciones

- Lecture 10 Relevant Costing PDFDocumento49 páginasLecture 10 Relevant Costing PDFShweta Sridhar57% (7)

- Rising Unemployment in India - A Statewise Analysis FromDocumento8 páginasRising Unemployment in India - A Statewise Analysis FrommaheshuohAún no hay calificaciones

- Lecture Notes XII Principles of TaxationDocumento6 páginasLecture Notes XII Principles of TaxationNgamije Jackson67% (3)

- Unit1 Forms EnterprisesDocumento16 páginasUnit1 Forms EnterprisesAnkitha VardhiniAún no hay calificaciones

- Multiple Choice Quiz Chapter 3 4Documento9 páginasMultiple Choice Quiz Chapter 3 4Linh Tran PhuongAún no hay calificaciones

- Indian Monetary Policies Since IndependenceDocumento10 páginasIndian Monetary Policies Since IndependenceShail KrAún no hay calificaciones

- Microeconomics U5Documento59 páginasMicroeconomics U5LilyAún no hay calificaciones

- ColumbiaDocumento4 páginasColumbiaswami4ujAún no hay calificaciones

- Measuring Project Performance Inspired by Stock Index: SciencedirectDocumento8 páginasMeasuring Project Performance Inspired by Stock Index: SciencedirectUvesh ShaikhAún no hay calificaciones

- Hull RMFI4 e CH 07Documento18 páginasHull RMFI4 e CH 07jlosamAún no hay calificaciones

- IrrDocumento5 páginasIrrMohmet SaitAún no hay calificaciones

- Tourism Market SegmentationDocumento9 páginasTourism Market Segmentationchaitu100% (1)

- Factors Affecting Balance of PaymentsDocumento3 páginasFactors Affecting Balance of Paymentsashu khetan100% (5)

- Models of Conflict, Negotiation and Third Party Intervention: Review and SynthesisDocumento44 páginasModels of Conflict, Negotiation and Third Party Intervention: Review and SynthesisFiza kamranAún no hay calificaciones