Documentos de Académico

Documentos de Profesional

Documentos de Cultura

SP 500 Update 5 Jul 10

Cargado por

AndysTechnicalsDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

SP 500 Update 5 Jul 10

Cargado por

AndysTechnicalsCopyright:

Formatos disponibles

S&P 500 Daily - Head and Shoulders Patterns

Head

TARGET

Right

Shoulder

I was dubious of this inverted H&S at

the time because of the “small” nature Left

of the right shoulder. This was naïve Shoulder

thinking, as the best H&S patterns will

likely be the ones that are more difficult

to identify. This particular “set up” hit

the target perfectly.

A H&S topping pattern has been

triggered here. The target objective is

below 900. Some sort of retest of the

neckline should be expected, but the

market should not be able to settle

much above 1050 if this is to be a valid TARGET

pattern.

Right

Shoulder

Left

Shoulder

Head

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Daily - Head and Shoulders EVERYWHERE….

Head The head was

another H&S

itself.

Right

Shoulder

Left

Shoulder

Right

Shoulder

Left This chart should illustrate why

Shoulder it’s important to consider this

special pattern. It has shown up

enough times to make it a very

relevant phenomenon.

Head

Notice the way part of the

head was actually a H&S

pattern itself. This is not

uncommon.

Andy’s Technical Commentary__________________________________________________________________________________________________

Dow Jones Industrial Average ~ Monthly Log Scale

Head

Left

Shoulder Right

Shoulder

TARGET

As my friend and long time reader, Ben22 (aka: “McFearless”), has been

recently pointing out, there is a MUCH larger and ominous Head and Shoulder

in the works. This is the DJIA over the last few decades. If this were to play

out, it would target somewhere below 4,000. It’s probably worthwhile to note

that while 4,000 would be a horrible outcome, it’s not quite as bearish as some

of the predictions calling for a DJIA below 1,000. These sorts of larger scale

patterns MUST be charted on a log scale.

Andy’s Technical Commentary__________________________________________________________________________________________________

Dow Jones Industrial Average ~ Monthly Log Scale

<B>

- II -

<A> -I-

- IV -

- III -

-V-

<C>

Using the EWI (Prechter) proposed Wave count, it’s easy to see how we could see

sub-4000 on the DJIA. A classic 161.8% of -I- = -III- (log scale) would accomplish

this feat. Still, with that stated, it would seem to be a bit of a “reach” to suggest

targets as low as 1,000, even ASSUMING this bleak EWI wave model is the correct

one.

Andy’s Technical Commentary__________________________________________________________________________________________________

Dow Jones Industrial Average ~ Monthly Log Scale

<B>

(A)

- II -

(C)

- IV -

<A> (B)

-I-

“First Wave” extensions look

like “wedges” - III -

-V-

<C>

As bearish as his predictions are, even Robert Prechter (and EWI) would have to

admit that this wave count is equally possible. There is no way to dismiss a “first

wave” extension Cycle C-Wave. This would mean that the “dreaded” Primary-3 wave

(“P3”) might only be 61.8% or 78.6% of the Wave -I-. Again, this would be awful for

investors, but nowhere near as bleak as some predictions.

Note: The wave counts on this page and the previous page are NOT my

preferred counts. I have merely taken some time to address these very

popular models and explore some realistic outcomes. Waves often end

up playing out differently than can be imagined, EVEN when one has

the correct count!

Andy’s Technical Commentary__________________________________________________________________________________________________

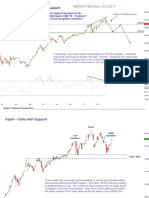

S&P 500 Sep e-Minis ~ (180 min.)

“y” REPRINTED from 6/27/2010

b

-2-

-1-

“x”

-2- c

-4-

b

-3-

-1- a

-4-

-5-

a

a

-3-

-5- b

c

“w”

c

“y”

(A)

This would also be a completely legitimate account of the price action. I favor the previous slide, though, because it

calls for more price action. If there’s a way for a wave to last longer, then it’s probably best to assume it will. What’s

interesting about this model is that it would SCREW everyone counting on the Head and Shoulders scenario. This

price action would break the neckline and trigger the proposed H&S top, only to disappoint all the new shorts as we

would likely be completing an Intermediate (A) Wave.

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (120 min.)

“y”

“Y” Wave Targets:

1000 for 78.6% of “w” = “y”

b 965 for 100% of “w” = “y”

931 for 61.8% of “w” measured from the “w” conclusion.

“x”

c

a b?

a?

b

c

“w”

c?

“y”

(A)

The move down from the proposed “x” wave has been difficult to decipher. Because of the way it developed in the

beginning, it remains a “reach” to label the move an “impulse” lower, so I’m stuck with this sort of wave model.

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (60 min.)

“x”

-2- This is a “closer” view of the last several days of price action. There is certainly a

way to interpret this move down as an overall impulse (it would be a fifth extension),

but for now, I will stick with this more straightforward accounting. The sideways

congestion in the MIDDLE of the pattern must be reconciled in some way.

-1-

-4-

-a-

-3-

-c- b

-5- -e-

a

-d-

-b-

-2-

-4-

“Y” Wave Targets: -1-

1000 for 78.6% of “w” = “y”

965 for 100% of “w” = “y”

931 for 61.8% of “w” measured from the “w” conclusion. -3-

-5-

c

“y”??

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (60 min.)

“x”

This would be my best guess at fitting the move into an “impulse.” This particular

-2- count carries with it certain “implications.” The area around 1075 would be serious

resistance on any rebound because the fourth wave should NOT be exceeded during

2 a “fifth extension.”

-1- 1

4

a

3

c -4-

5 e

1070s

-3-

d

b

4

1

5

-5-

a

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (240 min.)

To quote Crash Davis’ advice to “Nuke” LaLoosh in Bull Durham: “Don’t think

meat.” Sometimes it’s best to just pull back and observe the market for what “it is.”

This is a downtrend that appears to have triggered a large scale head and shoulder

top. The trading bias has been bearish and must remain so. I’m nervous about a

sharp bounce back due to excessive short term negativity, which is why I remain only

20% of Max short position. Highlighted below are short and medium term resistance

levels for the Sep Mini futures. Breaks of these points should lead to “pivots” higher.

1130

1075

1044

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

También podría gustarte

- Rethink, Reinvent, Reposition: 12 Strategies to Make Over Your BusinessDe EverandRethink, Reinvent, Reposition: 12 Strategies to Make Over Your BusinessCalificación: 4.5 de 5 estrellas4.5/5 (2)

- Real Self Ideal Self ExerciseDocumento1 páginaReal Self Ideal Self ExerciseBruce100% (1)

- Ss3 EconomicsDocumento27 páginasSs3 EconomicsAdio Babatunde Abiodun CabaxAún no hay calificaciones

- 003 - Markepedia RoadmapDocumento5 páginas003 - Markepedia Roadmaperic5woon5kim5thak100% (3)

- Crec Masterlist Format v8Documento83 páginasCrec Masterlist Format v8Jojie HugoAún no hay calificaciones

- Market Commentary 10apr11Documento12 páginasMarket Commentary 10apr11AndysTechnicalsAún no hay calificaciones

- Sp500 Update 23oct11Documento7 páginasSp500 Update 23oct11AndysTechnicalsAún no hay calificaciones

- Market Commentary 10JUN12Documento7 páginasMarket Commentary 10JUN12AndysTechnicalsAún no hay calificaciones

- Head and Shoulders Pattern: Stock Chart Patterns AnalysisDocumento9 páginasHead and Shoulders Pattern: Stock Chart Patterns AnalysisMOHD TARMIZIAún no hay calificaciones

- Publication 1Documento9 páginasPublication 1Nur Ain HuntuaAún no hay calificaciones

- My BodyDocumento2 páginasMy BodyPaula DanielaAún no hay calificaciones

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocumento6 páginasS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 27NOV11Documento5 páginasMarket Commentary 27NOV11AndysTechnicalsAún no hay calificaciones

- Market Commentary 27feb11Documento12 páginasMarket Commentary 27feb11AndysTechnicalsAún no hay calificaciones

- Market Commentary 27mar11Documento10 páginasMarket Commentary 27mar11AndysTechnicalsAún no hay calificaciones

- EsibusinessplantemplateDocumento21 páginasEsibusinessplantemplateWorking PersonAún no hay calificaciones

- Match Pictures with Parts of the HeadDocumento4 páginasMatch Pictures with Parts of the HeadGermana copiiAún no hay calificaciones

- 04 Discovering Multiple Period Chart PatternsDocumento10 páginas04 Discovering Multiple Period Chart PatternsWinson A. B.Aún no hay calificaciones

- Market Commentary 1JUL12Documento8 páginasMarket Commentary 1JUL12AndysTechnicalsAún no hay calificaciones

- ACCTG CONCEPTS & PRINCIPLESDocumento11 páginasACCTG CONCEPTS & PRINCIPLESAndrea Nicole De LeonAún no hay calificaciones

- Belajar Trading INTERMEDIATEDocumento32 páginasBelajar Trading INTERMEDIATEDedy sAún no hay calificaciones

- Where Did Our Employees Go?: Complimentary Article ReprintDocumento15 páginasWhere Did Our Employees Go?: Complimentary Article ReprintcapriaruAún no hay calificaciones

- Easp-Critical Writing ApproachesDocumento49 páginasEasp-Critical Writing ApproachesKristine Angel EspinozaAún no hay calificaciones

- Smart Goal Setting Worksheet: With Guidance NotesDocumento5 páginasSmart Goal Setting Worksheet: With Guidance Notesapi-255355794Aún no hay calificaciones

- Using The Arms Index in Intraday Applications: by Richard W. Arms JRDocumento6 páginasUsing The Arms Index in Intraday Applications: by Richard W. Arms JRsatish s100% (1)

- Small Business AccountingDocumento5 páginasSmall Business AccountingSDaroosterAún no hay calificaciones

- Business Report Analysis Group 4Documento32 páginasBusiness Report Analysis Group 4Daniel ColungaAún no hay calificaciones

- Sp500 Update 5sep11Documento7 páginasSp500 Update 5sep11AndysTechnicalsAún no hay calificaciones

- Buffett On Valuation PDFDocumento7 páginasBuffett On Valuation PDFvinaymathew100% (1)

- Blue and Pink Professional Business Strategy PresentationDocumento20 páginasBlue and Pink Professional Business Strategy PresentationHanae MouhssineAún no hay calificaciones

- PDF OnlineDocumento4 páginasPDF Onlinehhelmi21Aún no hay calificaciones

- Support To Financial PlanDocumento6 páginasSupport To Financial PlanreshadAún no hay calificaciones

- Restaurant Business PlanDocumento53 páginasRestaurant Business Planmanishpandey1972100% (6)

- Resume Writing Powerpoint - FINALDocumento31 páginasResume Writing Powerpoint - FINAL022 Deep VanapariyaAún no hay calificaciones

- Evidencia Profit and LossDocumento8 páginasEvidencia Profit and LossGina GinaAún no hay calificaciones

- Earlier This Week On Bloomberg RadioDocumento1 páginaEarlier This Week On Bloomberg RadioTheng RogerAún no hay calificaciones

- Marketing ManagementDocumento7 páginasMarketing ManagementNaturallyAún no hay calificaciones

- Real Self Ideal Self ExerciseDocumento1 páginaReal Self Ideal Self ExerciseJaqueline Benj OftanaAún no hay calificaciones

- Diseño Sin TítuloDocumento17 páginasDiseño Sin TítuloMarcosAún no hay calificaciones

- Saying Now?: Is Publisher Yale Hirsch Bullish or Bearish?Documento1 páginaSaying Now?: Is Publisher Yale Hirsch Bullish or Bearish?Copy JunkieAún no hay calificaciones

- Market Commentary 21feb11Documento10 páginasMarket Commentary 21feb11AndysTechnicalsAún no hay calificaciones

- Belajar Trading INTERMEDIATEDocumento31 páginasBelajar Trading INTERMEDIATESoleh StyantoAún no hay calificaciones

- Belajar Trading INTERMEDIATEDocumento31 páginasBelajar Trading INTERMEDIATEWilliamAún no hay calificaciones

- Warren-Buffett/: INTRINSIC VALUE (1996, Berkshire Hathaway's Letter To Shareholders)Documento7 páginasWarren-Buffett/: INTRINSIC VALUE (1996, Berkshire Hathaway's Letter To Shareholders)Raunaq SinghAún no hay calificaciones

- How To Write A Business ReportDocumento2 páginasHow To Write A Business ReportRuthMariaDavidAún no hay calificaciones

- Dark Green Light Green White Corporate Geometric Company Internal Deck Business PresentationDocumento17 páginasDark Green Light Green White Corporate Geometric Company Internal Deck Business Presentationisrael arteagaAún no hay calificaciones

- Employee Attrition Project Report in BigbazarDocumento107 páginasEmployee Attrition Project Report in Bigbazarshantu_110% (2)

- Marketing Plan: Market Share Market Trend Market GrowthDocumento2 páginasMarketing Plan: Market Share Market Trend Market GrowthChara etangAún no hay calificaciones

- Keys To Identifying and Trading The Head and Shoulders PatternDocumento3 páginasKeys To Identifying and Trading The Head and Shoulders PatternAmbadnya-Amogh AnbhavaneAún no hay calificaciones

- Rana ProjectDocumento76 páginasRana ProjectKuldeep RathiAún no hay calificaciones

- Do It Yourself Business Plan: How To Write A Business PlanDe EverandDo It Yourself Business Plan: How To Write A Business PlanAún no hay calificaciones

- Fundsa Flow Hero MotocorpDocumento73 páginasFundsa Flow Hero MotocorpANOOPALINOORJAHANAún no hay calificaciones

- Definition of 'Ratio Analysis'Documento12 páginasDefinition of 'Ratio Analysis'VikasDoshiAún no hay calificaciones

- PDF Rsi The Complete Guide John HaydenDocumento195 páginasPDF Rsi The Complete Guide John Haydenmax johar100% (3)

- Parts of the Body WorksheetsDocumento1 páginaParts of the Body Worksheetsspy eraAún no hay calificaciones

- Buffett On ValuationDocumento7 páginasBuffett On ValuationAyush AggarwalAún no hay calificaciones

- 3 Hous AnalysisDocumento5 páginas3 Hous AnalysisEduardo Lopez-vegue DiezAún no hay calificaciones

- Working Capital Mangament FM AssignmntDocumento11 páginasWorking Capital Mangament FM AssignmntHimanshu PaliwalAún no hay calificaciones

- Principles of Accountancy 1913Documento200 páginasPrinciples of Accountancy 1913q3rAún no hay calificaciones

- Marketing Director Persona TemplateDocumento2 páginasMarketing Director Persona TemplateElham KakuzaiAún no hay calificaciones

- 20XX Sales Report SummaryDocumento10 páginas20XX Sales Report Summarylala bataAún no hay calificaciones

- Dummy PDF: TestingDocumento1 páginaDummy PDF: TestingAnton fisaAún no hay calificaciones

- Market Commentary 5aug12Documento7 páginasMarket Commentary 5aug12AndysTechnicalsAún no hay calificaciones

- Market Commentary 22JUL12Documento6 páginasMarket Commentary 22JUL12AndysTechnicalsAún no hay calificaciones

- Market Commentary 29apr12Documento6 páginasMarket Commentary 29apr12AndysTechnicalsAún no hay calificaciones

- Market Commentary 25mar12Documento8 páginasMarket Commentary 25mar12AndysTechnicalsAún no hay calificaciones

- Market Commentary 11mar12Documento7 páginasMarket Commentary 11mar12AndysTechnicalsAún no hay calificaciones

- Market Commentary 20may12Documento7 páginasMarket Commentary 20may12AndysTechnicalsAún no hay calificaciones

- Market Commentary 1JUL12Documento8 páginasMarket Commentary 1JUL12AndysTechnicalsAún no hay calificaciones

- Market Commentary 17JUN12Documento7 páginasMarket Commentary 17JUN12AndysTechnicalsAún no hay calificaciones

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocumento6 páginasS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 1apr12Documento8 páginasMarket Commentary 1apr12AndysTechnicalsAún no hay calificaciones

- S&P500 Report 22apr12Documento12 páginasS&P500 Report 22apr12AndysTechnicalsAún no hay calificaciones

- Dollar Index (DXY) Daily ContinuationDocumento6 páginasDollar Index (DXY) Daily ContinuationAndysTechnicalsAún no hay calificaciones

- Market Commentary 18mar12Documento8 páginasMarket Commentary 18mar12AndysTechnicalsAún no hay calificaciones

- S&P 500 Commentary 12feb12Documento6 páginasS&P 500 Commentary 12feb12AndysTechnicalsAún no hay calificaciones

- S& P 500 Commentary 20feb12Documento9 páginasS& P 500 Commentary 20feb12AndysTechnicalsAún no hay calificaciones

- Market Commentary 29jan12Documento6 páginasMarket Commentary 29jan12AndysTechnicalsAún no hay calificaciones

- Market Commentary 26feb12Documento6 páginasMarket Commentary 26feb12AndysTechnicalsAún no hay calificaciones

- Market Commentary 22jan12Documento8 páginasMarket Commentary 22jan12AndysTechnicalsAún no hay calificaciones

- Market Commentary 16jan12Documento7 páginasMarket Commentary 16jan12AndysTechnicalsAún no hay calificaciones

- Copper Commentary 11dec11Documento6 páginasCopper Commentary 11dec11AndysTechnicalsAún no hay calificaciones

- Market Commentary 8jan12Documento8 páginasMarket Commentary 8jan12AndysTechnicalsAún no hay calificaciones

- Market Commentary 6NOVT11Documento4 páginasMarket Commentary 6NOVT11AndysTechnicalsAún no hay calificaciones

- Market Commentary 2jan12Documento7 páginasMarket Commentary 2jan12AndysTechnicalsAún no hay calificaciones

- Market Commentary 27NOV11Documento5 páginasMarket Commentary 27NOV11AndysTechnicalsAún no hay calificaciones

- Copper Commentary 2OCT11Documento8 páginasCopper Commentary 2OCT11AndysTechnicalsAún no hay calificaciones

- Market Commentary 19DEC11Documento9 páginasMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 20NOV11Documento7 páginasMarket Commentary 20NOV11AndysTechnicalsAún no hay calificaciones

- Market Commentary 30OCT11Documento6 páginasMarket Commentary 30OCT11AndysTechnicalsAún no hay calificaciones

- Printmedia 100813115605 Phpapp02Documento24 páginasPrintmedia 100813115605 Phpapp02Sudesh BanareAún no hay calificaciones

- Organizing Your Website's Layout in Scapple and ScrivenerDocumento10 páginasOrganizing Your Website's Layout in Scapple and ScrivenertallerzamyraAún no hay calificaciones

- Excel calendarDocumento28 páginasExcel calendarThanh LêAún no hay calificaciones

- Axe Deodorant Marketing-2Documento10 páginasAxe Deodorant Marketing-2moshin qureshiAún no hay calificaciones

- Store Keeper Cover LetterDocumento7 páginasStore Keeper Cover Letterfsv74mkj100% (1)

- Essay 2Documento18 páginasEssay 2Yee ting laiAún no hay calificaciones

- Bustax Compilation ExamsDocumento194 páginasBustax Compilation ExamsRialeeAún no hay calificaciones

- 9 - BSBPEF501 Appendix D - Work Goals, Plans and Activities Template Assessment 2cDocumento2 páginas9 - BSBPEF501 Appendix D - Work Goals, Plans and Activities Template Assessment 2cP APARNAAún no hay calificaciones

- Indian Creatives' Salary Survey Reveals Creative Fields' Pay RangesDocumento28 páginasIndian Creatives' Salary Survey Reveals Creative Fields' Pay RangesPrathmesh MahajaniAún no hay calificaciones

- 2020-2021 MFC CollectionDocumento51 páginas2020-2021 MFC CollectionTa Thanh PhongAún no hay calificaciones

- Blue BankDocumento3 páginasBlue BankDream SquareAún no hay calificaciones

- Chapter 7Documento10 páginasChapter 7Eki OmallaoAún no hay calificaciones

- Ukay-Ukay: The Philippine Culture As Sustainable FashionDocumento11 páginasUkay-Ukay: The Philippine Culture As Sustainable FashionElAún no hay calificaciones

- Valuation Report: Al Andalus Mall and Hotel, Jeddah, Kingdom of Saudi ArabiaDocumento96 páginasValuation Report: Al Andalus Mall and Hotel, Jeddah, Kingdom of Saudi Arabiaalim shaikhAún no hay calificaciones

- Customer Process ProcedureDocumento8 páginasCustomer Process Proceduremanno200Aún no hay calificaciones

- TCL Case StudyDocumento8 páginasTCL Case StudyParag_Ghatpand_8912Aún no hay calificaciones

- Strategic Management A1Documento5 páginasStrategic Management A1203370245Aún no hay calificaciones

- C. Castro Company-Cdc 2018Documento42 páginasC. Castro Company-Cdc 2018Gennelyn Lairise Rivera100% (1)

- Dictionary of Banking A Concise Encyclopaedia of Banking Law and PracticeDocumento590 páginasDictionary of Banking A Concise Encyclopaedia of Banking Law and Practiceishmaeliam100% (2)

- 4 PumpsDocumento219 páginas4 PumpsVũ QuangAún no hay calificaciones

- Trends in Global Trade - v1Documento13 páginasTrends in Global Trade - v1castro dasAún no hay calificaciones

- PT Trakindo Utama Quotation for PT Basuki Rahmanta PutraDocumento2 páginasPT Trakindo Utama Quotation for PT Basuki Rahmanta PutraDeden PramikaAún no hay calificaciones

- Bescom ProjectDocumento62 páginasBescom ProjectRakeshAún no hay calificaciones

- Canara - Epassbook - 2023-10-10 202024.654466Documento49 páginasCanara - Epassbook - 2023-10-10 202024.654466Kamal Hossain MondalAún no hay calificaciones

- Basel 3 PDFDocumento6 páginasBasel 3 PDFNischal PatelAún no hay calificaciones

- OfferLetter SignedDocumento19 páginasOfferLetter SignedNalin bhattAún no hay calificaciones

- Cryptocurrency System Using Body Activity Data 5 of 6Documento1 páginaCryptocurrency System Using Body Activity Data 5 of 6Nemo NemoAún no hay calificaciones

- DataHack Summit 2023 AgendaDocumento1 páginaDataHack Summit 2023 AgendaRishi rao KulakarniAún no hay calificaciones