Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Tutorial Part 2

Cargado por

bennyv1990Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Tutorial Part 2

Cargado por

bennyv1990Copyright:

Formatos disponibles

Corporate Finance

Tutorial 2

Ben Varian 2014

Investment Criteria

Q2. Chapter 6-Q28 Comparing Investment Criteria You are a senior manager at Airbus

and have been authorized to spend up to 200,000 for projects. The three projects you

are considering have the following characteristics:.

Project A: Initial investment of 150,000. Cash flow of 50,000 at year 1 and 100,000

at year 2. This is a plant expansion project, where the required rate of return is 10 per

cent.

Project B: Initial investment of 200,000. Cash flow of 200,000 at year 1 and

111,000 at year 2. This is a new product development project, where the required rate

of return is 20 per cent.

Project C: Initial investment of 100,000. Cash flow of 100,000 at year 1 and

100,000 at year 2. This is a market expansion project, where the required rate of

return is 20 per cent.

Assume the corporate discount rate is 10 per cent. Please offer your

recommendations, backed by your analysis.

Ben Varian 2014

Figures

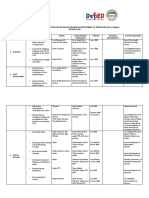

Year 0 Year 1 Year 2 Required

Rate of

Return

Investment A -150000 50000 100000

10%

Investment B -200000 200000

111000

20%

Investment C -100000 100000 100000

20%

Ben Varian 2014

Payback

Diagram:

Cash Inflow

Time

Cash Outflow

0

2

X

1

x

3

x x

Payback Occurs

at Time 2

Ben Varian 2014

Payback Continued

Investment A:

0

2

-1500000

1

50000 10000

0

Payback Occurs at

Year 2

Ben Varian 2014

Payback Continued

Investment B

0

2

-2000000

1

200000 111000

Payback Occurs at

Year 1

Ben Varian 2014

Payback Continued

Investment C

0

2

-1000000

1

100000 10000

0

Payback Occurs at

Year 1

Ben Varian 2014

Internal Rate of Return

Internal rate of return (IRR) is the interest rate at

which the net present value of all the cash flows

(both positive and negative) from a project or

investment equal zero. Internal rate of return is

used to evaluate the attractiveness of a project or

investment.

IRR is the discount rate when NPV = 0

0 = -(Initial Investment) + Cash Flows / (1 + IRR)

Ben Varian 2014

IRR Continued

Investment A:

i) 0 = -150000 + 50000/(1+IRR) +

(100000/(1+IRR)

2

)

ii) In this instance IRR is 0 because the projects

cash flows do not exceed its initial investment.

iii) As the rate of return does not exceed 10% -

Reject

Ben Varian 2014

IRR Continued

Investment B

i) 0 = -200000 + 200000/(1+IRR) +

(111000/(1+IRR)

2

)

ii) 1

st

Guess: 30% Rate

iii) -200000 + 200000/1.3 + 111000/1.3

2

iv) -200000 + 153846.15 + 65680.47= 19526.62

v) Positive NPV means raise discount rate

Ben Varian 2014

IRR Continued

Investment B Continued

i) 2

nd

Guess: 50% Rate

ii) -200000 + 200000/1.5 + 111000/1.5

2

iii) -200000 + 133333.33 + 49333.33 = -17333.34

iv) Negative NPV means lower discount

Ben Varian 2014

IRR Continued

Investment B Continued

i) 3rd Guess: 40% Rate

ii) -200000 + 200000/1.4 + 111000/1.4

2

iii) -200000 + 142857.14 + 56632.65 = -510.21

iv) -510 0 Therefore IRR = 40%

v) IRR is also over 20% so proceed

Ben Varian 2014

IRR Continued

Investment C

i) 1

st

Guess: 50% Rate

ii) -100000 + 100000/1.5 + 100000/1.5

2

iii) -100000 + 66666.67 + 44444.44 = 11111.11

iv) IRR is positive so raise discount rate

Ben Varian 2014

IRR Continued

Investment C

i) 2

nd

Guess: 60% Rate

ii) -100000 + 100000/1.6 + 100000/1.6

2

iii) -100000 + 62500 + 39062.50 = 1562.50

iv) IRR is positive so raise discount rate

Ben Varian 2014

Investment C

i) 3

rd

Guess: 62% Rate

ii) -100000 + 100000/1.62 + 100000/1.62

2

iii) -100000 + 61728.40 + 38103.95 = -167.65

iv) -167.65 0 Therefore IRR = 62%

v) IRR Greater than 20% so can proceed

Ben Varian 2014

Incremental IRR

Formula =

Discount Rate that gives NPV of 0

Difference in Initial Investment (Larger Project

Smaller) D

i

Plus Difference in Subsequent Cashflows D

c

Divided by 1 + Incremental IRR

0 = -D

i

+ D

c

/1+IRR

Ben Varian 2014

Incremental IRR Continued

Date 0 Date 1 Date 2

Project B -200000 200000 111000

Project A -150000 50000 100000

Difference -50000 150000 11000

Project B to Project A

Ben Varian 2014

Incremental IRR Continued

Project B to Project A

i) 0 = -50000 + 150000/(1+IIRR) + 11000/(1+IIRR)

2

ii) Guess = 200% IIRR

iii) -50000 + 150000/(1+2) + 11000/ (1+2)

2

iv) -50000 + 50000 + 1222.22 = 1222.22

v) Positive NPV = Increase Discount Rate

Ben Varian 2014

Incremental IRR Continued

Project B to Project A

i) Guess = 210% IIRR

ii) -50000 + 150000/(1+2.1) + 11000/ (1+2.1)

2

iii) -50000 + 48387.10+ 1144.64= -468.26

iv) Negative NPV = Decrease Discount Rate

Ben Varian 2014

Incremental IRR

Project B to Project A

i) Guess = 207% IIRR

ii) -50000 + 150000/(1+2.07) + 11000/ (1+2.07)

2

iii) -50000 + 48859.93 + 1167.12 = 27.05

iv) 27.05 0 Therefore IIRR B A = 207%

Ben Varian 2014

Incremental IRR Continued

Year 0 Year 1 Year 2

Project B -200000 200000 111000

Project C -100000 100000 100000

Difference -100000 100000 11000

Ben Varian 2014

Incremental IRR Continued

Project B to Project C

i) Guess = 10% IIRR

ii) -100000 + 100000/(1+0.1) + 11000/(1+0.1)

2

iii) -100000 + 90909.09 + 9090.90 = -0.01

iv) IIRR B C = 10%

Ben Varian 2014

Incremental IRR Continued

Year 0 Year 1 Year 2

Project A -150000 50000 100000

Project C -100000 100000 100000

Difference -50000 -50000 0

Ben Varian 2014

Incremental IRR Continued

Project A to Project C

i) Guess = 0% IIRR

ii) -50000+ -50000/(1+0) + 0/(1+0)

2

iii) -50000 + -50000 + 0 = 0

iv) IIRR A C = 0%

Ben Varian 2014

Profitability Index

Profitability Index = Present Value of Cash Flows

Subsequent to Initial Investment / Initial

Investment

i) Present Value = Cashflow/Discount

ii) Project A: (50000/1.1) + (100000/1.1

2)

=

iii) 45454.55 + 82644.63 = 128099.18

iv) 128099.18/150000 = 0.85 PI

Ben Varian 2014

Profitability Index Continued

i) Project B: (200000/1.1) + (111000/1.1

2)

=

ii) 181818.18 + 91735.54 = 273553.72

iii) 273553.72/200000 = 1.37 PI

Ben Varian 2014

Profitability Index Continued

i) Project C: (100000/1.1) + (100000/1.1

2)

=

ii) 90909.09 + 82644.63 = 173553.72

iii) 173553.72 / 100000 = 1.74 PI

Ben Varian 2014

Profitability Index Continued

Cashflows

PV @ 10%

PI

C

0

C

1

C

2

Project A -150000 50000 100000 128.099.19 0.85

Project B -200000 200000 111000 273553.72 1.37

Project C -100000 100000 100000 173553.72 1.74

Ben Varian 2014

NPV

Ben Varian 2014

NPV Continued

Project A: -150000 + 50000/1.1 + 100000/1.1

2

-150000 + 45454.55 + 82644.63 = -21900.82

Project B: -200000 + 200000/1.1 + 111000/1.1

2

-200000 + 181818.18 + 91735.54 = 73553.72

Project C: -100000 + 100000/1.1 + 100000/1.1

2

-100000 + 90909.09 + 82644.63 = -73553.72

Ben Varian 2014

NPV Corrections

Wrong rate used for Projects B & C:

Project B: -200000 + 200000/1.2 + 111000/1.2

2

-200000 + 166666.67 + 77083.33 = 43750

Project C: -100000 + 100000/1.2 + 100000/1.2

2

-100000 + 83333.33 + 69444.44 = 52777.77

Ben Varian 2014

Overall

A B C Implication

s

Payback 2 Years 1 Year 1 Year (Project A is

out either

B or C)

IRR 0% 40% 62% C

Incremental

IRR

(To C) 0% To C 10%

To A 207%

N/A B

PI 0.85 1.37 1.74 C

NPV -

21900.83

43750 52777.77 C

Ben Varian 2014

Overall Continued

Project C performs best across the spread of

Investment Rules therefore I would select Project

C.

Ben Varian 2014

También podría gustarte

- LACF - Revision ClassDocumento13 páginasLACF - Revision Classbennyv1990Aún no hay calificaciones

- Company Law Revision Part 2Documento16 páginasCompany Law Revision Part 2bennyv1990Aún no hay calificaciones

- Civil Lit MCQs 2 & 3 FeedbackDocumento17 páginasCivil Lit MCQs 2 & 3 Feedbackbennyv1990Aún no hay calificaciones

- Who Is Responsible For thASDe UK Consumer Debt MountainDocumento2 páginasWho Is Responsible For thASDe UK Consumer Debt Mountainbennyv1990Aún no hay calificaciones

- How Does The Passage Portray The Relationship Between Ferdinand and MirandaDocumento3 páginasHow Does The Passage Portray The Relationship Between Ferdinand and Mirandabennyv1990100% (3)

- How Does AchebeDocumento2 páginasHow Does Achebebennyv1990Aún no hay calificaciones

- Is Divorce Law Without Fault?Documento11 páginasIs Divorce Law Without Fault?bennyv1990Aún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Induction Motor Steady-State Model (Squirrel Cage) : MEP 1422 Electric DrivesDocumento21 páginasInduction Motor Steady-State Model (Squirrel Cage) : MEP 1422 Electric DrivesSpoiala DragosAún no hay calificaciones

- Lakh Only) Being The Amount Covered Under The Aforesaid Dishonoured Cheque, and So AlsoDocumento2 páginasLakh Only) Being The Amount Covered Under The Aforesaid Dishonoured Cheque, and So AlsoShivam MishraAún no hay calificaciones

- Maharashtra State Board 9th STD History and Political Science Textbook EngDocumento106 páginasMaharashtra State Board 9th STD History and Political Science Textbook EngSomesh Kamad100% (2)

- Thermodynamic c106Documento120 páginasThermodynamic c106Драгослав БјелицаAún no hay calificaciones

- Rs2-Seamanship (Inc Anchoring, Mooring, Berthing, Pilot Ladder)Documento19 páginasRs2-Seamanship (Inc Anchoring, Mooring, Berthing, Pilot Ladder)Mdpn. Salvador67% (3)

- Channel & Lomolino 2000 Ranges and ExtinctionDocumento3 páginasChannel & Lomolino 2000 Ranges and ExtinctionKellyta RodriguezAún no hay calificaciones

- ISO-3046-4-2009 (Gobernador de Velocidad)Documento8 páginasISO-3046-4-2009 (Gobernador de Velocidad)David GastelumAún no hay calificaciones

- 2432 - Test Solutions - Tsol - 2432 - 21702Documento5 páginas2432 - Test Solutions - Tsol - 2432 - 21702Anmol PanchalAún no hay calificaciones

- Pontevedra 1 Ok Action PlanDocumento5 páginasPontevedra 1 Ok Action PlanGemma Carnecer Mongcal50% (2)

- Profibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/SpDocumento3 páginasProfibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/Spmelad yousefAún no hay calificaciones

- Chunking Chunking Chunking: Stator Service IssuesDocumento1 páginaChunking Chunking Chunking: Stator Service IssuesGina Vanessa Quintero CruzAún no hay calificaciones

- Sickle Cell DiseaseDocumento10 páginasSickle Cell DiseaseBrooke2014Aún no hay calificaciones

- Barista Skills Foundation Curriculum enDocumento4 páginasBarista Skills Foundation Curriculum enCezara CarteșAún no hay calificaciones

- Abbas Ali Mandviwala 200640147: Ba1530: Information Systems and Organization StudiesDocumento11 páginasAbbas Ali Mandviwala 200640147: Ba1530: Information Systems and Organization Studiesshayan sohailAún no hay calificaciones

- Astm D2000 PDFDocumento38 páginasAstm D2000 PDFMariano Emir Garcia OdriozolaAún no hay calificaciones

- Bathinda - Wikipedia, The Free EncyclopediaDocumento4 páginasBathinda - Wikipedia, The Free EncyclopediaBhuwan GargAún no hay calificaciones

- What Is A Fired Heater in A RefineryDocumento53 páginasWhat Is A Fired Heater in A RefineryCelestine OzokechiAún no hay calificaciones

- Laudon - Mis16 - PPT - ch11 - KL - CE (Updated Content For 2021) - Managing Knowledge and Artificial IntelligenceDocumento45 páginasLaudon - Mis16 - PPT - ch11 - KL - CE (Updated Content For 2021) - Managing Knowledge and Artificial IntelligenceSandaru RathnayakeAún no hay calificaciones

- Angelo (Patrick) Complaint PDFDocumento2 páginasAngelo (Patrick) Complaint PDFPatLohmannAún no hay calificaciones

- VC AndrewsDocumento3 páginasVC AndrewsLesa O'Leary100% (1)

- UBMM1011 Unit Plan 201501Documento12 páginasUBMM1011 Unit Plan 201501摩羯座Aún no hay calificaciones

- Example of Flight PMDG MD 11 PDFDocumento2 páginasExample of Flight PMDG MD 11 PDFVivekAún no hay calificaciones

- Lotus Exige Technical InformationDocumento2 páginasLotus Exige Technical InformationDave LeyAún no hay calificaciones

- Needle BasicsDocumento31 páginasNeedle BasicsARYAN RATHOREAún no hay calificaciones

- Lifting PermanentmagnetDocumento6 páginasLifting PermanentmagnetShekh Muhsen Uddin Ahmed100% (1)

- 16 Personalities ResultsDocumento9 páginas16 Personalities Resultsapi-605848036Aún no hay calificaciones

- P66 M10 CAT B Forms and Docs 04 10Documento68 páginasP66 M10 CAT B Forms and Docs 04 10VinayAún no hay calificaciones

- Switching Lab-05b Configuring InterVLAN RoutingDocumento2 páginasSwitching Lab-05b Configuring InterVLAN RoutingHernan E. SalvatoriAún no hay calificaciones

- Nyamango Site Meeting 9 ReportDocumento18 páginasNyamango Site Meeting 9 ReportMbayo David GodfreyAún no hay calificaciones

- 1 Prof Chauvins Instructions For Bingham CH 4Documento35 páginas1 Prof Chauvins Instructions For Bingham CH 4Danielle Baldwin100% (2)