Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Akuntansi - Accounting Information System

Cargado por

Arif YuliantoDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Akuntansi - Accounting Information System

Cargado por

Arif YuliantoCopyright:

Formatos disponibles

The McGraw-Hill Companies, Inc.

, 2003

McGraw-Hill/Irwin

Slide

2-1

2

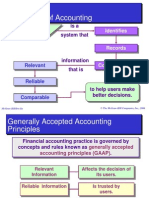

Accounting Information

System

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-2

Preparers

ASB

Auditors

Decision makers

GAAP

Financial Statements, Auditing and

Users

Financial

Statements

Audit

Report

FASB

GAAS

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-3

International Accounting Principles

Despite our growing global economy, countries

continue to maintain their unique set of

acceptable accounting practices.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-4

Fundamental Principles of

Accounting

Business Entity

Principle

Objectivity

Principle

Cost Principle

Going-Concern

Principle

Monetary Unit

Principle

A business is accounted for separately

from its owner or owners.

Financial statement information is

supported by independent, unbiased

evidence.

Financial statements are based on actual

costs incurred in business transactions.

A business continues operating instead of

being closed or sold.

Express transactions and events in

monetary units.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-5

Source

documents

Recording &

posting

Trial balance

Reporting

Transaction

or event

Analysis

The Accounting Process

Exh.

2.2

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-6

External Transactions

occur between the

organization and an

outside party.

Internal Transactions

occur within the

organization.

Transactions and Events

Exchanges of economic consideration between two

parties.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-7

Sales

Invoices

Bank

Statement

Purchase

Orders

Checks

Source Documents

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-8

Detailed record of

increases and

decreases in

specific assets,

liabilities, equities,

revenues, or

expenses.

Separate accounts are

maintained for each

item of importance.

The Account

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-9

Liabilities Equity Assets

= +

Common

Stock

Retained

Earnings

Revenues Expenses

Expanded Accounting Equation

+ + +

Exh.

2.4

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-10

Land

Equipment

Buildings

Cash

Prepaid

Expenses

Office

Supplies

Store

Supplies

Prepaid

Insurance

Notes

Receivable

Accounts

Receivable

ASSETS

Asset Accounts

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-11

Accrued

Liabilities

Unearned

Revenues

Notes

Payable

Accounts

Payable

LIABILITIES

LiabilityAccounts

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-12

Equities

Revenues

Common

Stock

Dividends

Expenses

Equity Accounts

Retained

Earnings

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-13

Analyze the transaction

and its source.

Identify the impact of the

transaction on account

balances.

Also identify the financial

statements that are

impacted by the

transaction.

Analyzing Transactions

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-14

Buck Johnson forms a

building consulting

business. It is set up as

a corporation called

Build-Up, Inc..

Analyze the following

transactions.

Transaction Analysis

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-15

The accounts involved are:

(1) Cash (asset)

(2) Owners Equity (equity)

Buck Johnson invests $50,000 in the

company in exchange for common stock.

Transaction Analysis

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable Equity

(1) 50,000 $ 50,000 $

50,000 $ - $ - $ - $ - $ 50,000 $

50,000 $ = 50,000 $

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-16

The accounts involved are:

(1) Cash (asset)

(2) Supplies (asset)

Transaction Analysis

Build-Up, Inc. purchased supplies

paying $4,800 cash.

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable Equity

(1) 50,000 $ 50,000 $

(2) (4,800) 4,800 $

45,200 $ 4,800 $ - $ - $ - $ 50,000 $

50,000 $ = 50,000 $

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-17

The accounts involved are:

(1) Cash (asset)

(2) Equipment (asset)

Transaction Analysis

Build-Up, Inc. purchased equipment

for $30,000 cash.

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable Equity

(1) 50,000 $ 50,000 $

(2) (4,800) 4,800 $

(3) (30,000) 30,000 $

15,200 $ 4,800 $ 30,000 $ - $ - $ 50,000 $

50,000 $ = 50,000 $

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-18

The accounts involved are:

(1) Supplies (asset)

(2) Accounts Payable (liability)

Transaction Analysis

Build-Up, Inc. purchased additional

supplies of $9,400 on account.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-19

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable Equity

(1) 50,000 $ 50,000 $

(2) (4,800) 4,800 $

(3) (30,000) 30,000 $

(4) 9,400 9,400 $

15,200 $ 14,200 $ 30,000 $ 9,400 $ - $ 50,000 $

59,400 $ = 59,400 $

Transaction Analysis

Build-Up, Inc. purchased additional

supplies of $9,400 on account.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-20

Transaction Analysis

The balances so far appear below. Note that the

Balance Sheet Equation is still in balance.

Now lets look at transactions

involving revenues and expenses.

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable Equity

Bal 15,200 $ 14,200 30,000 9,400 50,000 $

15,200 $ 14,200 $ 30,000 $ 9,400 $ - $ 50,000 $

59,400 $ = 59,400 $

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-21

The accounts involved are:

(1) Cash (asset)

(2) Revenues (equity)

Transaction Analysis

Rendered consulting services

receiving $9,800 cash.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-22

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable Equity

Bal 15,200 $ 14,200 30,000 9,400 50,000 $

(5) 9,800 9,800

25,000 $ 14,200 $ 30,000 $ 9,400 $ - $ 59,800 $

69,200 $ = 69,200 $

Transaction Analysis

Rendered consulting services

receiving $9,800 cash.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-23

The accounts involved are:

(1) Cash (asset)

(2) Rent Expense (equity)

Transaction Analysis

Paid $2,800 rent to the landlord of the

building where the business is located.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-24

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable Equity

Bal 15,200 $ 14,200 30,000 9,400 50,000 $

(5) 9,800 9,800

(6) (2,800) (2,800)

22,200 $ 14,200 $ 30,000 $ 9,400 $ - $ 57,000 $

66,400 $ = 66,400 $

Transaction Analysis

Paid $2,800 rent to the landlord of the

building where the business is located.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-25

The accounts involved are:

(1) Cash (asset)

(2) Salary Expense (equity)

Transaction Analysis

Paid Salaries of $2,300.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-26

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable Equity

Bal 15,200 $ 14,200 30,000 9,400 50,000 $

(5) 9,800 9,800

(6) (2,800) (2,800)

(7) (2,300) (2,300)

19,900 $ 14,200 $ 30,000 $ 9,400 $ - $ 54,700 $

64,100 $ = 64,100 $

Transaction Analysis

Paid Salaries of $2,300.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-27

Account Name

(Left Side)

Debit

(Right Side)

Credit

Used as a simple tool for

illustrating the balance in a

given account.

Chart of Accounts & the T-Account

Typically, a

company

keeps a

listing of all

the accounts

is uses. This

list is called

the Chart of

Accounts.

Exh.

2.8

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-28

Cash T-Account for FastForward

Cash

Issuance of stock 30,000 Purchase of supplies 2,500

Consulting services revenues earned 4,200 Purchase of equipment 26,000

Collection of accounts receivable 1,900 Payment of rent 1,000

Payment of salary 700

Payment of note payable 900

Payment of dividend 600

Total increases 36,100 Total decreases 31,700

Less decreases (31,700)

Balance 4,400

Balance of an Account

An account balance is the difference between the

increases and decreases in an account.

Exh.

2.9

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-29

Liabilities Equity Assets

= +

Debit Credit Debit Credit Debit Credit

ASSETS

+ -

LIABILITIES

- +

EQUITIES

- +

Double-Entry Accounting

Exh.

2.10

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-30

Revenues Expenses

Retained

Earnings

Dividends

_

+

_

Debit Credit

Ret. Earnings

- +

Debit Credit

Dividends

+ -

Debit Credit

Expenses

+ -

Debit Credit

Revenues

- +

Double-Entry Accounting - Detail of

Effects on Equity

Exh.

2.11

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-31

Step 1: Examine

source documents.

Remember these two steps?

Now lets look at some

additional steps.

Steps in Processing Transactions

Equipment

(3) 30,000

Liabilities Equity Assets

= +

Step 2: Analyze

transactions.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-32

ACCOUNT NAME: ACCOUNT No.

Date Description PR Debit Credit Balance

Step 4: Record the

journal information in a

ledger.

GENERAL JOURNAL Page 123

Date Description

Post.

Ref. Debit Credit

Step 3: Record

transactions in a

journal.

Step 5: Prepare a

trial balance.

Steps in Processing Transactions

Step 1: Examine

source documents.

Equipment

(3) 30,000

Liabilities Equity Assets

= +

Step 2: Analyze

transactions.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-33

GENERAL JOURNAL Page 1

Date Description PR Debit Credit

2001

Dec. 1 Cash 30,000

Common Stock 30,000

Issuance of stock

Dec. 2 Supplies 2,500

Cash 2,500

Purchased store supplies

for cash

Transaction

Date

Titles of Affected

Accounts

Dollar amount of

debits and credits

Transaction

explanation

General Journal for FastForward

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-34

CASH ACCOUNT No. 101

Date Description PR Debit Credit Balance

2001

Dec. 1 Issuance of stock G1 30,000 30,000

Dec. 2 Purchased supplies G1 2,500 27,500

Dec. 3 Purchased equipment G1 26,000 1,500

Dec. 10 Collection from customer G1 1,900 3,400

T-accounts are useful illustrations, but balance

column ledger accounts are used in practice.

Balance Column Ledger

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-35

CASH ACCOUNT No. 101

Date Description PR Debit Credit Balance

2001

Dec. 1 Issuance of stock G1 30,000 30,000

Dec. 2 Purchased supplies G1 2,500 27,500

Dec. 3 Purchased equipment G1 26,000 1,500

Dec. 10 Collection from customer G1 1,900 3,400

Balance Column Ledger

Note the the t-account tool is derived from the

debit and credit columns of the ledger.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-36

The last line in the balance column shows the

current balance in the account.

Exh.

2.16

CASH ACCOUNT No. 101

Date Description PR Debit Credit Balance

2001

Dec. 1 Issuance of stock G1 30,000 30,000

Dec. 2 Purchased supplies G1 2,500 27,500

Dec. 3 Purchased equipment G1 26,000 1,500

Dec. 10 Collection from customer G1 1,900 3,400

Balance Column Ledger

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-37

GENERAL JOURNAL Page 1

Date Description PR Debit Credit

2001

Dec. 1 Cash 30,000

Common Stock 30,000

Issuance of stock

Dec. 2 Supplies 2,500

Cash 2,500

Purchased store supplies

for cash

CASH ACCOUNT No. 101

Date Description PR Debit Credit Balance

2001

Dec. 3 Purchased equipment G1 20,000.00 ########

Dec. 10 Collection from customer G1 2,200.00 ########

1

Identify the account.

Posting Journal Entries - Example

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-38

GENERAL JOURNAL Page 1

Date Description PR Debit Credit

2001

Dec. 1 Cash 30,000

Common Stock 30,000

Issuance of stock

Dec. 2 Supplies 2,500

Cash 2,500

Purchased store supplies

for cash

CASH ACCOUNT No. 101

Date Description PR Debit Credit Balance

2001

Dec. 1

Dec. 3 Purchased equipment G1 20,000.00 ########

Dec. 10 Collection from customer G1 2,200.00 ########

2

Enter the date.

Posting Journal Entries - Example

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-39

GENERAL JOURNAL Page 1

Date Description PR Debit Credit

2001

Dec. 1 Cash 30,000

Common Stock 30,000

Issuance of stock

Dec. 2 Supplies 2,500

Cash 2,500

Purchased store supplies

for cash

CASH ACCOUNT No. 101

Date Description PR Debit Credit Balance

2001

Dec. 1 Issuance of stock 30,000

Dec. 3 Purchased equipment G1 20,000 (20,000)

Dec. 10 Collection from customer G1 2,200 (17,800)

3

Enter the amount.

Posting Journal Entries - Example

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-40

GENERAL JOURNAL Page 1

Date Description PR Debit Credit

2001

Dec. 1 Cash 30,000

Common Stock 30,000

Issuance of stock

Dec. 2 Supplies 2,500

Cash 2,500

Purchased store supplies

for cash

CASH ACCOUNT No. 101

Date Description PR Debit Credit Balance

2001

Dec. 1 Issuance of stock G1 30,000

Dec. 3 Purchased equipment G1 20,000 (20,000)

Dec. 10 Collection from customer G1 2,200 (17,800)

4

Enter the journal reference.

Posting Journal Entries - Example

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-41

CASH ACCOUNT No. 101

Date Description PR Debit Credit Balance

2001

Dec. 1 Issuance of stock G1 30,000 30,000

Dec. 3 Purchased equipment G1 20,000 (20,000)

Dec. 10 Collection from customer G1 2,200 (17,800)

5

Compute the balance.

GENERAL JOURNAL Page 1

Date Description PR Debit Credit

2001

Dec. 1 Cash 30,000

Common Stock 30,000

Issuance of stock

Dec. 2 Supplies 2,500

Cash 2,500

Purchased store supplies

for cash

Posting Journal Entries - Example

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-42

GENERAL JOURNAL Page 1

Date Description PR Debit Credit

2001

Dec. 1 Cash 101 30,000

Common Stock 30,000

Issuance of stock

Dec. 2 Supplies 2,500

Cash 2,500

Purchased store supplies

for cash

CASH ACCOUNT No. 101

Date Description PR Debit Credit Balance

2001

Dec. 1 Issuance of stock G1 30,000 30,000

Dec. 3 Purchased equipment G1 20,000 (20,000)

Dec. 10 Collection from customer G1 2,200 (17,800)

Enter the ledger reference.

6

Posting Journal Entries - Example

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-43

Debits Credits

Cash 3,950 $

Accounts receivable -

Supplies 9,720

Prepaid Insurance 2,400

Equipment 26,000

Accounts payable 6,200 $

Unearned consulting revenue 3,000

Common Stock 30,000

Dividends 600

Consulting revenue 5,800

Rental revenue 300

Salaries expense 1,400

Rent expense 1,000

Utilities expense 230

Total 45,300 $ 45,300 $

FastForward

Trial Balance

December 31, 2001

A Trial

Balance is a

listing of all

accounts

and their

balances at

a point in

time.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-44

Revenues:

Consulting revenue 5,800 $

Rental revenue 300

Total revenues 6,100 $

Expenses:

Rent expense 1,000

Salaries expense 1,400

Utilities expense 230

Total expenses 2,630

Net income 3,470 $

FastForward

Income Statement

For Month Ended December 31, 2001

Income Statement

Inflows of assets in

exchange for

products and

services provided

to customers.

Outflows or the

using up of assets

that result from

providing

products and

services to

customers.

Exh.

2.19

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-45

Retained Earnings, 12/1/01 - $

Add: Net Income 3,470

Total 3,470 $

Less: Dividends (600)

Retained Earnings, 12/31/01 2,870 $

FastForward

Statement of Retained Earnings

For Month Ended December 31, 2001

Statement of Retained Earnings

Beginning of period Retained Earnings is adjusted for

dividends paid and net income (or loss) as reported on

the Income Statement.

Exh.

2.19

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-46

Cash 3,950 $ Accounts payable 6,200 $

Supplies 9,720 Unearned Revenue 3,000

Prepaid Ins. 2,400 Total liabilities 9,200 $

Equipment 26,000

Common Stock 30,000 $

Retained Earnings 2,870

Total assets 42,070 $

Total liabilities and

owners' equity

42,070 $

Assets

Equity

Liabilities

FastForward

Balance Sheet

December 31, 2001

Exh.

2.19

Balance Sheet

Assets are economic resources owned by a

business. They are expected to provide

future benefits to the business.

Liabilities are

obligations of the

business. They

are claims

against the

assets of the

business.

Equity is the

owners claim on

the assets of the

business. It is the

residual interest in

the assets after

deducting

liabilities.

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-47

Describes

the

sources

and uses

of cash

for a

reporting

period.

Cash flows from operating activities:

Cash received from clients 9,100 $

Cash paid for supplies (3,520)

Cash paid for insurance (2,400)

Cash paid for rent & utilities (1,230)

Cash paid to employee (1,400)

Net cash provided by operating acitivities 550 $

Cash flows from investing activities:

Purchase of equipment (26,000) $

Net cash used by investing activities (26,000)

Cash flows from financing activities:

Investment by owner 30,000 $

Withdrawal by owner (600)

Net cash provided by financing activities 29,400

Net increase in cash 3,950 $

Cash balance, December 1, 2001 -

Cash balance, December 31, 2001 3,950 $

FastForward

Statement of Cash Flows

For Month Ended December 31, 2001

Exh.

2.19

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-48

GENERAL JOURNAL Page 123

Date Description

Post.

Ref. Debit Credit

Generally, dollar signs ($)

are not used in the journals or

ledgers.

Rounding

Round numbers in financial

statements to the nearest

dollar.

ACCOUNT NAME: ACCOUNT No.

Date Description PR Debit Credit Balance

Formatting Conventions

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-49

Describes the relationship between net income

for the period and average equity.

Helps an owner judge the compnays profitability

compared to other business or personal

opportunities.

Return on Equity =

Net Income

Average Equity

Using the Information - Return on

Equity

The McGraw-Hill Companies, Inc., 2003

McGraw-Hill/Irwin

Slide

2-50

End of Chapter 2

Now, was that debits

to the left or credits

to the left?

I sure wish I had paid

more attention in

class!

También podría gustarte

- Chapter 13Documento59 páginasChapter 13Asad AbbasAún no hay calificaciones

- Accounting Principles: Second Canadian EditionDocumento39 páginasAccounting Principles: Second Canadian EditionRehan IqbalAún no hay calificaciones

- Chapter 02Documento68 páginasChapter 02loveshare100% (1)

- Financial Accounting Chapter 13Documento59 páginasFinancial Accounting Chapter 13Waqas MazharAún no hay calificaciones

- Investing and Financing Decisions and The Balance SheetDocumento42 páginasInvesting and Financing Decisions and The Balance SheetNahla Ali HassanAún no hay calificaciones

- 3-The Accounting Information SystemDocumento98 páginas3-The Accounting Information Systemtibip12345100% (1)

- 1 Introduction To Accounting and BusinessDocumento46 páginas1 Introduction To Accounting and BusinessAradi WisnuAún no hay calificaciones

- Chapter 02Documento38 páginasChapter 02Mrbroken92Aún no hay calificaciones

- Financial Accounting Workbook Version 2Documento90 páginasFinancial Accounting Workbook Version 2Honey Crisostomo EborlasAún no hay calificaciones

- Chap002 AccountingMBADocumento49 páginasChap002 AccountingMBAaliceaharp_621918018Aún no hay calificaciones

- Statement of Cash Flows: Mcgraw-Hill/IrwinDocumento59 páginasStatement of Cash Flows: Mcgraw-Hill/IrwinMuhammad Shafay MalikAún no hay calificaciones

- Financial Accounting PDFDocumento43 páginasFinancial Accounting PDFJaya SudhakarAún no hay calificaciones

- Lecture 5Documento12 páginasLecture 5Mohamed Salah El DinAún no hay calificaciones

- Chapter 2 QuestionsDocumento23 páginasChapter 2 QuestionsSaleh AlzahraniAún no hay calificaciones

- FA2e Chapter02 Solutions StudentsDocumento45 páginasFA2e Chapter02 Solutions StudentsKira YamatoAún no hay calificaciones

- Accounting Assignment Sample SolutionsDocumento20 páginasAccounting Assignment Sample SolutionsHebrew JohnsonAún no hay calificaciones

- The Accounting Information System: Financial Accounting, Seventh EditionDocumento75 páginasThe Accounting Information System: Financial Accounting, Seventh EditionRishabh Jain100% (1)

- Basic Financial Statements: Stofa, MBM 16 Batch, BIBMDocumento43 páginasBasic Financial Statements: Stofa, MBM 16 Batch, BIBMMorshed Chowdhury ZishanAún no hay calificaciones

- Chapter 2 - The Accounting CycleDocumento36 páginasChapter 2 - The Accounting CycleAlan Lui50% (2)

- Accounting IDocumento18 páginasAccounting IMohammed mostafaAún no hay calificaciones

- Fundamentals of Accounting 2 Draft PDFDocumento123 páginasFundamentals of Accounting 2 Draft PDFCzaeshel Edades100% (5)

- Basic Financial Statements: Mcgraw-Hill/IrwinDocumento39 páginasBasic Financial Statements: Mcgraw-Hill/IrwinenriAún no hay calificaciones

- Accounting Principles: Second Canadian EditionDocumento39 páginasAccounting Principles: Second Canadian Editionfredrick_5467Aún no hay calificaciones

- ch01 ProblemsDocumento7 páginasch01 Problemsapi-274120622Aún no hay calificaciones

- Chapter 2 - The Accounting Cycle: During The Period: Click On LinksDocumento24 páginasChapter 2 - The Accounting Cycle: During The Period: Click On LinksABDULLAH ALSHEHRIAún no hay calificaciones

- Financial Statements and Accounting Transactions: Solutions Manual For Chapter 2 9Documento70 páginasFinancial Statements and Accounting Transactions: Solutions Manual For Chapter 2 9Tấn Lộc LouisAún no hay calificaciones

- Investing and Financing Decisions and The Accounting SystemDocumento33 páginasInvesting and Financing Decisions and The Accounting SystemrorysuxdixAún no hay calificaciones

- Importance of AccountingDocumento52 páginasImportance of AccountingLalithaAún no hay calificaciones

- Accounting Bank ReconciliationDocumento90 páginasAccounting Bank Reconciliationan2204Aún no hay calificaciones

- BIS SheetDocumento24 páginasBIS Sheetmagdy kamelAún no hay calificaciones

- Lec. 3 - Transactions Recording - PRMG 030Documento9 páginasLec. 3 - Transactions Recording - PRMG 030Ahmad SharaawyAún no hay calificaciones

- Accounting and The Business EnvironmentDocumento46 páginasAccounting and The Business EnvironmentSatya JeetAún no hay calificaciones

- Basic Financial StatementsDocumento45 páginasBasic Financial StatementsparhAún no hay calificaciones

- Financial Statements and Accounting Concepts/PrinciplesDocumento30 páginasFinancial Statements and Accounting Concepts/PrinciplesdanterozaAún no hay calificaciones

- Brooks Financial Mgmt14 PPT Ch02Documento37 páginasBrooks Financial Mgmt14 PPT Ch02Asylkhan NursultanAún no hay calificaciones

- ExerciseDocumento5 páginasExerciseICS TEAMAún no hay calificaciones

- CH 2 Accounting 2Documento45 páginasCH 2 Accounting 2EmadAún no hay calificaciones

- Chap 002Documento17 páginasChap 002soso900Aún no hay calificaciones

- Sample Computation of Capital Gains Tax On Sale of Real PropertyDocumento9 páginasSample Computation of Capital Gains Tax On Sale of Real PropertyNardsdel RiveraAún no hay calificaciones

- College Accounting A Contemporary Approach 3rd Edition Haddock Solutions ManualDocumento36 páginasCollege Accounting A Contemporary Approach 3rd Edition Haddock Solutions Manualsynomocyeducable6pyb8k100% (24)

- Accounting Equation Service Business 6Documento21 páginasAccounting Equation Service Business 6udayraj_vAún no hay calificaciones

- College Accounting A Contemporary Approach 3rd Edition Haddock Price Farina ISBN Solution ManualDocumento22 páginasCollege Accounting A Contemporary Approach 3rd Edition Haddock Price Farina ISBN Solution Manualdonald100% (24)

- L2 - Accounting Equation & Transaction Analysis - Edited With AnsswerDocumento39 páginasL2 - Accounting Equation & Transaction Analysis - Edited With AnsswerEslam SamyAún no hay calificaciones

- Advanced Accounting Week 1-2Documento5 páginasAdvanced Accounting Week 1-2rahmaAún no hay calificaciones

- Financial and Managerial Accounting 11th Edition Warren Solutions ManualDocumento10 páginasFinancial and Managerial Accounting 11th Edition Warren Solutions Manualcharlesdrakejth100% (14)

- ACCT2020 Introduction To Accounting For Non-Business Majors Chapter 2Documento15 páginasACCT2020 Introduction To Accounting For Non-Business Majors Chapter 2H20-spoutAún no hay calificaciones

- Chapter 1 (Introduction To Accounting and Business)Documento94 páginasChapter 1 (Introduction To Accounting and Business)Kiky_Arizky_6781Aún no hay calificaciones

- Workshop Solutions T1 2014Documento78 páginasWorkshop Solutions T1 2014sarah1379Aún no hay calificaciones

- Topic 2 (Acc)Documento48 páginasTopic 2 (Acc)Nur Adnin KhairaniAún no hay calificaciones

- Excercise Sheet Lectures 1 and 2 Spring 2022Documento16 páginasExcercise Sheet Lectures 1 and 2 Spring 2022Mohamed ZaitoonAún no hay calificaciones

- Finaccl1 120205210417 Phpapp0254Documento105 páginasFinaccl1 120205210417 Phpapp0254mukesh697Aún no hay calificaciones

- MGT45 Fall 2013 HWDocumento27 páginasMGT45 Fall 2013 HWTrevor Allen HolleronAún no hay calificaciones

- CH 02 Review and Discussion Problems SolutionsDocumento16 páginasCH 02 Review and Discussion Problems SolutionsArman Beirami100% (2)

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersDe EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersAún no hay calificaciones

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDe EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAún no hay calificaciones

- Summary of Richard A. Lambert's Financial Literacy for ManagersDe EverandSummary of Richard A. Lambert's Financial Literacy for ManagersAún no hay calificaciones

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDe EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsAún no hay calificaciones

- Internal Control of Fixed Assets: A Controller and Auditor's GuideDe EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideCalificación: 4 de 5 estrellas4/5 (1)

- UntitledDocumento29 páginasUntitledArif YuliantoAún no hay calificaciones

- Visual FoxProDocumento116 páginasVisual FoxProArif YuliantoAún no hay calificaciones

- UntitledDocumento1 páginaUntitledArif YuliantoAún no hay calificaciones

- Description Commodity Type Part NumberDocumento2 páginasDescription Commodity Type Part NumberArif YuliantoAún no hay calificaciones

- ROG Crosshair VIII Series Memory QVL 20200211Documento8 páginasROG Crosshair VIII Series Memory QVL 20200211Arif YuliantoAún no hay calificaciones

- Komputasi Data LengkapDocumento42 páginasKomputasi Data LengkapArif YuliantoAún no hay calificaciones

- Prn256m8v69ag8gkf 15eDocumento12 páginasPrn256m8v69ag8gkf 15eArif YuliantoAún no hay calificaciones

- Img 2306Documento1 páginaImg 2306Arif YuliantoAún no hay calificaciones

- Nrouesrj: Name: GradeDocumento1 páginaNrouesrj: Name: GradeArif YuliantoAún no hay calificaciones

- Work WWW PDF s7 P Perpajakan-edisi-revisi-2011-MardiasmoDocumento3 páginasWork WWW PDF s7 P Perpajakan-edisi-revisi-2011-MardiasmoArif Yulianto25% (4)

- FS NewDocumento6 páginasFS NewNicah AcojonAún no hay calificaciones

- Vci 10KDocumento40 páginasVci 10KpalenhoyaAún no hay calificaciones

- Chapter 1 & 2 Review - Intermediate Accounting 7th EditionDocumento7 páginasChapter 1 & 2 Review - Intermediate Accounting 7th Editionginoa724Aún no hay calificaciones

- CHAPTER 4 Adjusting The AccountsDocumento5 páginasCHAPTER 4 Adjusting The Accountsmojii caarrAún no hay calificaciones

- MFRD ExamDocumento13 páginasMFRD ExamBenj MadambaAún no hay calificaciones

- Financial Analysis Sample 5Documento10 páginasFinancial Analysis Sample 5throwawayyyAún no hay calificaciones

- Print Preview - Full Application: Project DescriptionDocumento26 páginasPrint Preview - Full Application: Project DescriptionRyan SloanAún no hay calificaciones

- Concept Note ROCSIL Leather Products Manufacturing ProjectDocumento3 páginasConcept Note ROCSIL Leather Products Manufacturing ProjectTumwine Kahweza ProsperAún no hay calificaciones

- B. P7,200,000 A. P300,000 B. P4,800,000Documento4 páginasB. P7,200,000 A. P300,000 B. P4,800,000Marco UyAún no hay calificaciones

- Accounting 2301 Final Exam Review ExamplesDocumento38 páginasAccounting 2301 Final Exam Review ExamplesVusal GahramanovAún no hay calificaciones

- Accrual Budgeting and Fiscal Policy: Marc RobinsonDocumento29 páginasAccrual Budgeting and Fiscal Policy: Marc RobinsonAngelo HuligangaAún no hay calificaciones

- Shs Abm Gr12 Fabm2 q1 m2 Statement-Of-comprehensive-IncomeDocumento14 páginasShs Abm Gr12 Fabm2 q1 m2 Statement-Of-comprehensive-IncomeKye RauleAún no hay calificaciones

- This Study Resource Was: Problem 5-3ADocumento6 páginasThis Study Resource Was: Problem 5-3AAlche MistAún no hay calificaciones

- PLS Taxation QA FinalDocumento24 páginasPLS Taxation QA FinalTAU MU OFFICIALAún no hay calificaciones

- Moderator: Mr. L.J. Muthivhi (CA), SADocumento11 páginasModerator: Mr. L.J. Muthivhi (CA), SANhlanhla MsizaAún no hay calificaciones

- 2 IFRS 17 The Actuarial ViewDocumento33 páginas2 IFRS 17 The Actuarial ViewmarhadiAún no hay calificaciones

- Adjusting Entries Theories Practice QuizDocumento16 páginasAdjusting Entries Theories Practice QuizChris MartinezAún no hay calificaciones

- Merchandising 2Documento2 páginasMerchandising 2Desirre TransonaAún no hay calificaciones

- Illustrations Partnership OperationsDocumento23 páginasIllustrations Partnership OperationsMary Joy AlbandiaAún no hay calificaciones

- FAQ For PIC and Cash GrantDocumento4 páginasFAQ For PIC and Cash GrantSathis KumarAún no hay calificaciones

- 1.020 ATP 2023-24 GR 10 Maths Lit FinalDocumento4 páginas1.020 ATP 2023-24 GR 10 Maths Lit Finalwisemanjele329Aún no hay calificaciones

- Class Exercises - Trial BalanceDocumento2 páginasClass Exercises - Trial BalanceDEEPAAún no hay calificaciones

- Porter Five Forces WordDocumento11 páginasPorter Five Forces WordvinodvahoraAún no hay calificaciones

- Problem 6 16 2Documento2 páginasProblem 6 16 2KC Hershey Lor100% (1)

- Regular Allowable Itemized DeductionsDocumento10 páginasRegular Allowable Itemized DeductionsArmi MilanesAún no hay calificaciones

- Level I - Simple Business PlanDocumento8 páginasLevel I - Simple Business PlanJerome BenipayoAún no hay calificaciones

- 2017 ATD Performance Measurement GuideDocumento13 páginas2017 ATD Performance Measurement GuideEdrialAún no hay calificaciones

- Innovation & Entrepreneurship (UTA012)Documento19 páginasInnovation & Entrepreneurship (UTA012)Kritagya SainAún no hay calificaciones

- Amity Business School: Cost & Management Accounting For Decision Making-ACCT611Documento76 páginasAmity Business School: Cost & Management Accounting For Decision Making-ACCT611Manjula ShastriAún no hay calificaciones

- 0.PTS - ReceivablesDocumento40 páginas0.PTS - ReceivablesDhanesh DhamanaskarAún no hay calificaciones