Documentos de Académico

Documentos de Profesional

Documentos de Cultura

14 June 2012

Cargado por

Bulls BearsTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

14 June 2012

Cargado por

Bulls BearsCopyright:

Formatos disponibles

YOHA SECURITIES LTD

CAPITAL PLACE

50, South Boag Road T.Nagar, Chennai-17 Phone: 24334379 / 24355634 Fax: 24325643

DAILY NEWS

HEADLINES

SENSEX 16880.5117.70

14 June 2012

DOW JONES 12496.3877.42 NASDAQ 2818.6124.46 S&P 1314.889.30 NIKEII 8587.8451.12 HANG SANG 19026.5253.77

NIFTY

5121.455.55

Spain rating slashed 3 notches by Moody's PE investors bet big on Indian FMCG companies May inflation seen at 7.4% vs 7.23%, MoM:polls Wipro sees healthcare, retail, utilities driving growth maker Suzuki Powertrain

Super Religare to get Rs 370-cr PE infusion

Nifty Futures

June 28 July 26 Aug 30

5121 5142 5171

Maruti to absorb diesel engine Rupee closes at new low of 55.67 vs $

Top Gainers 13th June 2012

HIND UNILEVER AMBUJA CEM SUN PHARMA LT ONGC

Top Losers 13th June 2012

MARUTI STER NTPC TATA MOTOR TATA POWER

Watch outs 14.06.2012

Positive Trigger

WIPRO

RANBAXY MARUTI SESA GOA

Negative Trigger

PNB SBIN

MOST ACTIVE SECURITIES

Downward Trends

SBI LT RELINFRA

TATA MOTORS

ICICI BANK

TATA MOTORS MARUTI JINDAL STEL

CIPLA DR.REDDY

13 June 2012

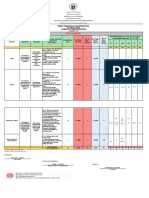

INDICES

SUPPORT 2 1 TODAY'S MARKET LEVEL RESISTANCE 1 2

16534 5013

16780 5090

SENSEX 16880.51 NSE 5121.45

16855 5130

16997 5160

Intra Day: Scrip

Hcl Tech

DLF

Levels 478-482

194-197

Strategy Recommended

Buy, SL 477 Sell sl 199

Target 487-493

189

Stop Loss 1-2 Days

1-2 Days

Jet Airways AGC network GT offshore

385-388 260-265 86-87

Buy SL 383,crosses month high Buy, crosses Year High breakout Buy

395-410 280 90-92

1-2 Days 2-3 Days 1-2 Days

Long Term: Genesys Target 300(***), Ranbaxy Target 600(*****), Tata Motors Target 270 (*****)

Grading (***** Very Good Buy- Immediate, **** Good Buy-Short Time, *** Buy-To hold , ** Buy-Wait, * Long term Buy-slow at every dip)

Wall St ends down amid Greek vote fears

Wall Street ended lower on Wednesday as fears ahead of the Greek elections over the weekend drove down a market that had been treading water through most of the day. Based on the latest available data, the Dow Jones industrial average was down 78.63 points, or 0.63%, at 12,495.17. The Standard & Poor's 500 Index was down 9.38 points, or 0.71%, at 1,314.80. The Nasdaq Composite Index was down 24.46 points, or 0.86%, at 2,818.61. US crude fell 0.1 percent at $82.54 a barrel but Brent crude futures inched up 0.1 percent at $97.20. Financial markets this week will dance to the tune of a slew of data coming from across the globe. Expect high volatility as April IIP number (Tuesday), inflation (Thursday) and advance tax (Friday) will keep market-men busy. All the three numbers will show the direction in which the first quarter corporate earnings are headed. They will also impact RBI's stance during its mid-quarter review of the monetary policy early next week. A 25 basis point rate cut has already been discounted by the stock market.

Board Meetings / Results Today 14 JUNE 2012 Symbol NOL Company Name Purpose 14 JUNE 15 JUNE 15 JUNE 15 JUNE

NATIONAL OXYGEN LIMITED JYOTI STRUCTURES LIMITED JYOTHY LABORATORIES LIMITED KOUTONS RETAIL INDIA LIMITED

JYOTISTRUC JYOTHYLAB KOUTONS

Indian stock market not attractive now-GOLDMAN SACHS

Indian stock market does not present attractive prospects for investors in the near term amid sluggish domestic and global economic growth outlook, according to Goldman Sachs. The global investment banking major Goldman Sachs in its report said that a sluggish domestic and global growth outlook would have a bearing on the Indian equities in the coming months. "We find that the Indian stock market does not present an attractive risk/reward entry point currently as macro headwinds are likely to persist in the near-term," it said. The report titled 'India: Fade short-lived rally, not too late to underweight Portfolio' focuses on the performance and future outlook for National Stock Exchange's 50-share benchmark Nifty index. Goldman Sachs said that continued weak domestic growth in the next 3-6 months as well as a poor global growth environment would weigh on Nifty, which has been seeing bearish trends in recent months. This index, according to Goldman Sachs, is the "most exposed market in Asia to a 'muddle-through' environment through liquidity and foreign corporate debt linkages". "Poor Nifty performance has been attributable in part to a gridlocked political landscape, plagued by project delays and lack of reforms.While we agree that the political headlines have created uncertainty in the market, the main impact to the market is through the investment channel in our view," the report said. Goldman Sachs noted that an important component of "our underweight view on India" stems from risk of significant capital flight. It said while the impact of RBI rate cuts is months away, a potentially poor monsoon season poses risks of sticky inflation which in turn might dampen policy flexibility in case growth continues to slide. Pointing out that India relies on foreign funding, Goldman Sachs said, "lowered growth expectations for India have impacted investment appetite already, and we are wary of policies that could further curb capital flows into the country or beget foreigner equity selling, which has not yet occurred in size." Concerns are on the rise that Indian economy is losing momentum, mainly after it touched a nine-year low of 6.5 per cent in 2011-12. Also, industrial production rose just 0.1 per cent in April as against 5.3 per cent in the year-ago period. Indian economy expanded 8.4 per cent for two straight years -- 2009-10 and 2010-11 -- even as many developed nations reeled under the impact of 2008 financial meltdown.

FII trading activity on NSE and BSE in Capital Market Segment(In Rs. Crores) Category FII DII Date 13-JUNE-2012 13-JUNE-2012 Buy Value 1868.63 918.99 Sell Value 1650.95 842.12 Net Value 217.68 76.87

5 DAYS NIFTY GRAPH

WARNING This publication has been prepared by YOHA SECURITIES LTD solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. While the information contained therein has been obtained from sources believed to be reliable, investors are advised to satisfy themselves before making any investments. Technical would work only if the past continues in the future and is based on the Daily Moving Averages. Contact us @ 044-24353151 Email us ebharati@yohasecurities.com or yohasec@yahoo.co.in

También podría gustarte

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Restaurant Report Card: February 9, 2023Documento4 páginasRestaurant Report Card: February 9, 2023KBTXAún no hay calificaciones

- DxDiag Copy MSIDocumento45 páginasDxDiag Copy MSITạ Anh TuấnAún no hay calificaciones

- The Piano Lesson Companion Book: Level 1Documento17 páginasThe Piano Lesson Companion Book: Level 1TsogtsaikhanEnerelAún no hay calificaciones

- Unit 1 - Lecture 3Documento16 páginasUnit 1 - Lecture 3Abhay kushwahaAún no hay calificaciones

- PDS (OTO360) Form PDFDocumento2 páginasPDS (OTO360) Form PDFcikgutiAún no hay calificaciones

- Public Access - The GauntletDocumento1 páginaPublic Access - The GauntletTesting0% (2)

- Lecture Notes 3A - Basic Concepts of Crystal Structure 2019Documento19 páginasLecture Notes 3A - Basic Concepts of Crystal Structure 2019Lena BacaniAún no hay calificaciones

- Using The Monopoly Board GameDocumento6 páginasUsing The Monopoly Board Gamefrieda20093835Aún no hay calificaciones

- PH of Soils: Standard Test Method ForDocumento3 páginasPH of Soils: Standard Test Method ForYizel CastañedaAún no hay calificaciones

- Chap9 PDFDocumento144 páginasChap9 PDFSwe Zin Zaw MyintAún no hay calificaciones

- LicencesDocumento5 páginasLicencesstopnaggingmeAún no hay calificaciones

- Sample Cross-Complaint For Indemnity For CaliforniaDocumento4 páginasSample Cross-Complaint For Indemnity For CaliforniaStan Burman75% (8)

- Suspend and Resume Calls: Exit PlugDocumento4 páginasSuspend and Resume Calls: Exit PlugrajuAún no hay calificaciones

- Corvina PRIMEDocumento28 páginasCorvina PRIMEMillerIndigoAún no hay calificaciones

- Endometab Exam 2018Documento8 páginasEndometab Exam 2018teabagmanAún no hay calificaciones

- Uneb U.C.E Mathematics Paper 1 2018Documento4 páginasUneb U.C.E Mathematics Paper 1 2018shafickimera281Aún no hay calificaciones

- Research On Export Trade in BangladeshDocumento7 páginasResearch On Export Trade in BangladeshFarjana AnwarAún no hay calificaciones

- LDSD GodseDocumento24 páginasLDSD GodseKiranmai SrinivasuluAún no hay calificaciones

- BRAND AWARENESS Proposal DocumentDocumento11 páginasBRAND AWARENESS Proposal DocumentBuchi MadukaAún no hay calificaciones

- Geotechnical Aspects of Open Stope Design at BHP Cannington: G C StreetonDocumento7 páginasGeotechnical Aspects of Open Stope Design at BHP Cannington: G C StreetonJuan PerezAún no hay calificaciones

- Lista de Precios Agosto 2022Documento9 páginasLista de Precios Agosto 2022RuvigleidysDeLosSantosAún no hay calificaciones

- Bag Technique and Benedict ToolDocumento2 páginasBag Technique and Benedict ToolAriel Delos Reyes100% (1)

- Five Kingdom ClassificationDocumento6 páginasFive Kingdom ClassificationRonnith NandyAún no hay calificaciones

- Chapter Three: Tools For Exploring The World: Physical, Perceptual, and Motor DevelopmentDocumento43 páginasChapter Three: Tools For Exploring The World: Physical, Perceptual, and Motor DevelopmentHsieh Yun JuAún no hay calificaciones

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Documento6 páginasRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoAún no hay calificaciones

- Ds-Module 5 Lecture NotesDocumento12 páginasDs-Module 5 Lecture NotesLeela Krishna MAún no hay calificaciones

- Mangas PDFDocumento14 páginasMangas PDFluisfer811Aún no hay calificaciones

- SEC CS Spice Money LTDDocumento2 páginasSEC CS Spice Money LTDJulian SofiaAún no hay calificaciones

- Timetable - Alton - London Timetable May 2019 PDFDocumento35 páginasTimetable - Alton - London Timetable May 2019 PDFNicholas TuanAún no hay calificaciones