Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Variance Analysis 5.11

Cargado por

George BulikiDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Variance Analysis 5.11

Cargado por

George BulikiCopyright:

Formatos disponibles

SOTE TWAWEZA 2012

PART D STANDARD COSTING AND VARIANCE ANALYSIS

Question

Various variances

A company produces and sells one product only, the Thing, the standard cost for one unit being as follows. $ Direct material A 10 kilograms at $20 per kg 200 Direct material B 5 litres at $6 per litre 30 Direct wages 5 hours at $6 per hour 30 Fixed production overhead 50 Total standard cost 310 The fixed overhead included in the standard cost is based on an expected monthly output of 900 units. Fixed production overhead is absorbed on the basis of direct labour hours. During April the actual results were as follows. Production Material A Material B Direct wages Fixed production overhead $47,000 Required (a) (b) (c) Calculate price and usage variances for each material. Calculate labour rate and efficiency variances. Calculate fixed production overhead expenditure and volume variances and then subdivide the volume variance. 800 units 7,800 kg used, costing $159,900 4,300 litres used, costing $23,650 4,200 hours worked for $24,150

Answer

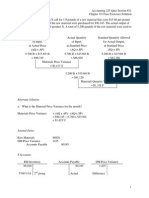

(a) Price variance A 7,800 kgs should have cost ( $20) but did cost Price variance Usage variance A 800 units should have used ( 10 kgs) but did use Usage variance in kgs standard cost per kilogram Usage variance in $ Price variance B 4,300 litres should have cost ( $6) but did cost Price variance $ 25,800 23,650 2,150 (F) 8,000 kgs 7,800 kgs 200 kgs (F) $20 $4,000 (F) $ 156,000 159,900 3,900 (A)

298

SOTE TWAWEZA 2012

11: VARIANCE ANALYSIS

Usage variance B 800 units should have used ( 5 l) but did use Usage variance in litres standard cost per litre Usage variance in $ (b) Labour rate variance 4,200 hours should have cost ( $6) but did cost Rate variance Labour efficiency variance 800 units should have taken ( 5 hrs) but did take Efficiency variance in hours standard rate per hour Efficiency variance in $ (c) Fixed overhead expenditure variance Budgeted expenditure ($50 900) Actual expenditure Expenditure variance Fixed overhead volume variance Budgeted production at standard rate (900 $50) Actual production at standard rate (800 $50) Volume variance Fixed overhead volume efficiency variance 800 units should have taken ( 5 hrs) but did take Volume efficiency variance in hours standard absorption rate per hour Volume efficiency variance Fixed overhead volume capacity variance Budgeted hours Actual hours Volume capacity variance in hours standard absorption rate per hour ($50 5) 4,500 hrs 4,200 hrs 300 hrs (A) $10 $3,000 (A) $ 4,000 hrs 4,200 hrs 200 hrs $10 $2,000 (A) $ 45,000 40,000 5,000 (A) $ 45,000 47,000 2,000 (A) 4,000 hrs 4,200 hrs 200 hrs (A) $6 $1,200 (A) $ 25,200 24,150 1,050 (F) $ 4,000 l 4,300 l 300 (A) $6 $1,800 (A)

Exam focus point

You have to be very happy with basic variance calculations so it is essential to do more practice if you struggled with this question.

299

También podría gustarte

- Tijuana Bronze MachiningDocumento19 páginasTijuana Bronze MachiningHari Haran43% (7)

- Solution Manual of Chapter 7 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerDocumento55 páginasSolution Manual of Chapter 7 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerMehedi Hasan Shatil100% (1)

- Mama's AssignmentDocumento34 páginasMama's AssignmentUche Aquilina OzegbeAún no hay calificaciones

- F2 MockDocumento23 páginasF2 MockH Hafiz Muhammad AbdullahAún no hay calificaciones

- Managerial Accounting by Garrison Appendix 12B34 MASDocumento29 páginasManagerial Accounting by Garrison Appendix 12B34 MASJoshua Hines0% (1)

- Absorption and Marginal Costing - Additional Question With AnswersDocumento14 páginasAbsorption and Marginal Costing - Additional Question With Answersunique gadtaulaAún no hay calificaciones

- Cash BudgetDocumento2 páginasCash BudgetSenthil Kumar0% (1)

- Impairment of Assets - SolutionsDocumento7 páginasImpairment of Assets - SolutionsGeorge Buliki100% (5)

- PracticeMCQECO401 PDFDocumento42 páginasPracticeMCQECO401 PDFSyed ShoaibAún no hay calificaciones

- Process CostingDocumento83 páginasProcess CostingMohammad MoosaAún no hay calificaciones

- Unit 4 - Limiting Factor Lecture NotesDocumento5 páginasUnit 4 - Limiting Factor Lecture NotesBarby Angel93% (14)

- Chap 005Documento214 páginasChap 005deepak_baid100% (4)

- Chap 015Documento40 páginasChap 015palak32100% (2)

- Tanzania Land PolicyDocumento10 páginasTanzania Land PolicyGeorge BulikiAún no hay calificaciones

- Hilton MAcc Ch14 SolutionDocumento5 páginasHilton MAcc Ch14 SolutionDini Rayhana Prasetyaningtyas33% (3)

- Absorption & Marginal CostingDocumento17 páginasAbsorption & Marginal CostingAhmed Ali KhanAún no hay calificaciones

- 17-2 Lipman Bottle CompanyDocumento6 páginas17-2 Lipman Bottle CompanyYJ26126100% (1)

- ACCA F5 - Part A - Specialist Cost and Management Accounting TechniquesDocumento5 páginasACCA F5 - Part A - Specialist Cost and Management Accounting TechniquesMuneera Al Hassan100% (2)

- 4 5931788210203003021Documento139 páginas4 5931788210203003021Issa Boy100% (1)

- Chapter 10-Advanced VariancesDocumento36 páginasChapter 10-Advanced VariancesKevin Kausiyo100% (5)

- Ias 2 Questions and AnswersDocumento3 páginasIas 2 Questions and AnswersShameel Irshad75% (8)

- Limitations of Conceptual Framework PDFDocumento20 páginasLimitations of Conceptual Framework PDFGeorge Buliki100% (25)

- QS11 - Class Exercises SolutionDocumento8 páginasQS11 - Class Exercises Solutionlyk0tex100% (2)

- Group 3 - Master Budget-Earrings UnlimitedDocumento8 páginasGroup 3 - Master Budget-Earrings UnlimitedLorena Mae LasquiteAún no hay calificaciones

- Hilton Chapter 14 Adobe Connect LiveDocumento18 páginasHilton Chapter 14 Adobe Connect LiveGirlie Regilme BalingbingAún no hay calificaciones

- Assignment CH 4Documento17 páginasAssignment CH 4Svetlana100% (2)

- Standard Costing & Variance Analysis - Sample Problems With SolutionsDocumento8 páginasStandard Costing & Variance Analysis - Sample Problems With SolutionsMarjorie NepomucenoAún no hay calificaciones

- Solution Manual For Cost Management Accounting and Control 6th Edition by HansenDocumento6 páginasSolution Manual For Cost Management Accounting and Control 6th Edition by Hansenphilips monitorsAún no hay calificaciones

- Fashion ShoeDocumento5 páginasFashion ShoeManal ElkhoshkhanyAún no hay calificaciones

- Impairment of Assets NotesDocumento23 páginasImpairment of Assets NotesGeorge Buliki100% (1)

- Final Project LUSH Group 2Documento32 páginasFinal Project LUSH Group 2Pat Neenan60% (5)

- Case 29 SolutionDocumento7 páginasCase 29 Solutiongators333100% (6)

- Solution Manual of Chapter 7 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerDocumento55 páginasSolution Manual of Chapter 7 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerCoco ZaideAún no hay calificaciones

- ACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDDocumento17 páginasACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDEjaz KhanAún no hay calificaciones

- Accounting for Managers: Calculating Break-Even PointsDocumento123 páginasAccounting for Managers: Calculating Break-Even PointsAmanuel GirmaAún no hay calificaciones

- Chapter 17 Standard Costing Setting Standards and Analyzing VariancesDocumento23 páginasChapter 17 Standard Costing Setting Standards and Analyzing VariancesHashir AliAún no hay calificaciones

- Garrison 13th Edition Chapter 9Documento18 páginasGarrison 13th Edition Chapter 9Ali HaiderAún no hay calificaciones

- Activity Based CostingDocumento2 páginasActivity Based CostingVivek KheparAún no hay calificaciones

- Chapter 21Documento4 páginasChapter 21Rahila RafiqAún no hay calificaciones

- Chapter 11 PDFDocumento66 páginasChapter 11 PDFSyed Atiq TurabiAún no hay calificaciones

- Cost Variance AnalysisDocumento30 páginasCost Variance AnalysisJc QuismundoAún no hay calificaciones

- Managerial Accounting: Osama KhaderDocumento37 páginasManagerial Accounting: Osama Khaderroaa ghanimAún no hay calificaciones

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDocumento31 páginasPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamAún no hay calificaciones

- MCS MatH QSTN NewDocumento7 páginasMCS MatH QSTN NewSrijita SahaAún no hay calificaciones

- Chapter 4 Questions SolutionsDocumento2 páginasChapter 4 Questions Solutionscamd1290100% (2)

- Chap7 PDFDocumento61 páginasChap7 PDFAshraf Alawneh100% (1)

- Chapter Six Consolidation of Financial Statements Under Purchase AccountingDocumento15 páginasChapter Six Consolidation of Financial Statements Under Purchase AccountingMelody Lisa100% (1)

- Chapter 5Documento43 páginasChapter 5Sajid AliAún no hay calificaciones

- Transfer Pricing ExerciseDocumento2 páginasTransfer Pricing Exercisechetan_patil_9100% (2)

- 35 Resource 11Documento16 páginas35 Resource 11Anonymous bf1cFDuepPAún no hay calificaciones

- Cost Accounting by Usry Chapter 6 Exercise 1Documento4 páginasCost Accounting by Usry Chapter 6 Exercise 1Saadia Saeed100% (2)

- ACC00152 Business Finance Topic 6 Tutorial AnswersDocumento2 páginasACC00152 Business Finance Topic 6 Tutorial AnswersPaul TianAún no hay calificaciones

- T1 - Tutorial MaDocumento10 páginasT1 - Tutorial Matylee970% (1)

- Exercises For Decision Making (Part I)Documento13 páginasExercises For Decision Making (Part I)Rawan Yasser100% (1)

- Chapter 12 SolutionsDocumento29 páginasChapter 12 SolutionsAnik Kumar MallickAún no hay calificaciones

- Optimize Tablet Production Using Linear ProgrammingDocumento31 páginasOptimize Tablet Production Using Linear ProgrammingYi WeiAún no hay calificaciones

- Chap 5Documento43 páginasChap 5Akm Engida67% (3)

- Problem 8 25Documento2 páginasProblem 8 25anon_590039258100% (1)

- Lipman Bottle CompanyDocumento20 páginasLipman Bottle CompanySaswata BanerjeeAún no hay calificaciones

- Budgets For Control, Part 2Documento29 páginasBudgets For Control, Part 2vukicevic.ivan5Aún no hay calificaciones

- Budgeting QuizDocumento3 páginasBudgeting QuizMay Grethel Joy PeranteAún no hay calificaciones

- Variance Analysis With The Reasons of VariancesDocumento19 páginasVariance Analysis With The Reasons of Variancesmohamed Suhuraab100% (1)

- Lecture 15Documento20 páginasLecture 15Riaz Baloch NotezaiAún no hay calificaciones

- Item To Classify Standard Actual Type of VarianceDocumento7 páginasItem To Classify Standard Actual Type of Variancedavid johnsonAún no hay calificaciones

- Questions - Chapter 9Documento5 páginasQuestions - Chapter 9sajedulAún no hay calificaciones

- Practice Questions On Direct and Indirect Cost VariancesDocumento8 páginasPractice Questions On Direct and Indirect Cost VariancesAishwarya RaoAún no hay calificaciones

- Cost Accounting 6Documento5 páginasCost Accounting 6Frenz VerdidaAún no hay calificaciones

- Using Technology To Enhance Internal Audit IA ProcessDocumento28 páginasUsing Technology To Enhance Internal Audit IA ProcessGeorge BulikiAún no hay calificaciones

- Variance 5.13Documento3 páginasVariance 5.13George BulikiAún no hay calificaciones

- Budgeting 2.25Documento3 páginasBudgeting 2.25George BulikiAún no hay calificaciones

- CV SampleDocumento2 páginasCV SampleGeorge BulikiAún no hay calificaciones

- Products Materials: Solution To QN 5.10Documento4 páginasProducts Materials: Solution To QN 5.10George BulikiAún no hay calificaciones

- Liquidation Qn3Documento6 páginasLiquidation Qn3George BulikiAún no hay calificaciones

- CV Writing TipsDocumento1 páginaCV Writing TipsGeorge BulikiAún no hay calificaciones

- Solution To QN 6 (PG 135) : Calculation of Overhead Absorption RatesDocumento10 páginasSolution To QN 6 (PG 135) : Calculation of Overhead Absorption RatesGeorge BulikiAún no hay calificaciones

- Variance Analysis 5.16Documento3 páginasVariance Analysis 5.16George BulikiAún no hay calificaciones

- Variance Analysis 5.15Documento7 páginasVariance Analysis 5.15George BulikiAún no hay calificaciones

- Advanced Variance 5.9Documento2 páginasAdvanced Variance 5.9George Buliki100% (1)

- Advanced Variance 5.7Documento4 páginasAdvanced Variance 5.7George BulikiAún no hay calificaciones

- Advanced Variance 5.8Documento4 páginasAdvanced Variance 5.8George BulikiAún no hay calificaciones

- Pricing 7.13Documento1 páginaPricing 7.13George BulikiAún no hay calificaciones

- Performance 6.10Documento2 páginasPerformance 6.10George BulikiAún no hay calificaciones

- Transfer Pricing 8.12 BDocumento2 páginasTransfer Pricing 8.12 BGeorge BulikiAún no hay calificaciones

- Performance 6.10Documento3 páginasPerformance 6.10George BulikiAún no hay calificaciones

- Soln To 8.9Documento1 páginaSoln To 8.9George BulikiAún no hay calificaciones

- Transfer Pricing 8.7 BDocumento2 páginasTransfer Pricing 8.7 BGeorge BulikiAún no hay calificaciones

- Solution To QN 7.10Documento2 páginasSolution To QN 7.10George BulikiAún no hay calificaciones

- Perfomance6 15Documento2 páginasPerfomance6 15George BulikiAún no hay calificaciones

- Solution To QN 7.10Documento1 páginaSolution To QN 7.10George BulikiAún no hay calificaciones

- Solution To QN 7.10Documento2 páginasSolution To QN 7.10George BulikiAún no hay calificaciones

- Harden Company Case StudyDocumento2 páginasHarden Company Case StudyGeorge Buliki100% (1)

- NBAA SyllabusDocumento100 páginasNBAA SyllabusHamis ShekibulaAún no hay calificaciones

- Chapter 01Documento15 páginasChapter 01Saad AnisAún no hay calificaciones

- Past Year Question QMT181Documento13 páginasPast Year Question QMT181muhammad nurAún no hay calificaciones

- Ap 2020exam Sample Questions MicroeconomicsDocumento4 páginasAp 2020exam Sample Questions MicroeconomicsKayAún no hay calificaciones

- Subsidy On Agriculture and Energy Sector in BangladeshDocumento25 páginasSubsidy On Agriculture and Energy Sector in BangladeshShumit T Whis100% (4)

- FDI Guide to Foreign Direct InvestmentDocumento9 páginasFDI Guide to Foreign Direct InvestmentVinitmhatre143Aún no hay calificaciones

- Manajemen Investasi Pertemuan 5Documento44 páginasManajemen Investasi Pertemuan 5fitria mulyawati pAún no hay calificaciones

- IIT Madras MBA Programme Curriculum (July 2018Documento93 páginasIIT Madras MBA Programme Curriculum (July 2018karanAún no hay calificaciones

- Nudge Theory in Transport Economics-Anik MaityDocumento17 páginasNudge Theory in Transport Economics-Anik MaityAnik MaityAún no hay calificaciones

- Role of Government in Empowering Women of Tamilnadu: Mrs. P. NaliniDocumento11 páginasRole of Government in Empowering Women of Tamilnadu: Mrs. P. NaliniAro JayaAún no hay calificaciones

- Marketing Analysis in The Case of S .George Brewery FactoryDocumento58 páginasMarketing Analysis in The Case of S .George Brewery Factoryfalcon04Aún no hay calificaciones

- Strategic Management of Southeast Bank LimitedDocumento32 páginasStrategic Management of Southeast Bank LimitediqbalAún no hay calificaciones

- Marketing vs Sales: Why Combining The Two Is A Strategic MistakeDocumento12 páginasMarketing vs Sales: Why Combining The Two Is A Strategic Mistake'Tareque SiddiqueAún no hay calificaciones

- Introduction To Economic Test CHPT 9,10 &14.docx NEWDocumento8 páginasIntroduction To Economic Test CHPT 9,10 &14.docx NEWAmir ContrerasAún no hay calificaciones

- Advanced To AdvantageousDocumento112 páginasAdvanced To AdvantageousJim KinneyAún no hay calificaciones

- Manish FinalDocumento44 páginasManish FinalMohit GahlawatAún no hay calificaciones

- Case Study China AirlinesDocumento5 páginasCase Study China AirlinesMohd FariqAún no hay calificaciones

- A Deep Dive On Vector Autoregression in R by Justin Eloriaga Towards Data ScienceDocumento18 páginasA Deep Dive On Vector Autoregression in R by Justin Eloriaga Towards Data Scienceante mitarAún no hay calificaciones

- Principles of Accounting, Volume 2: Managerial Accounting: Senior Contributing AuthorsDocumento4 páginasPrinciples of Accounting, Volume 2: Managerial Accounting: Senior Contributing AuthorsMichelleOgatisAún no hay calificaciones

- USTmacro2022b ps2Documento2 páginasUSTmacro2022b ps2Jasmine LeeAún no hay calificaciones

- Ethics 203 - Chapter 3Documento2 páginasEthics 203 - Chapter 3Rae WorksAún no hay calificaciones

- EquityDocumento92 páginasEquitySen RinaAún no hay calificaciones

- 3 Aggregate Demand and SupplyDocumento34 páginas3 Aggregate Demand and SupplySaiPraneethAún no hay calificaciones

- 2.0.1 Seatwork - Cost Behavior - Belle and Shinly - AnswersDocumento3 páginas2.0.1 Seatwork - Cost Behavior - Belle and Shinly - AnswersRoselyn LumbaoAún no hay calificaciones

- Case Study Plant RelocationDocumento5 páginasCase Study Plant Relocationviren gupta100% (1)

- Sarkar-Singer Hypothesis AssessmentDocumento8 páginasSarkar-Singer Hypothesis AssessmentArjun Garg100% (1)

- Analysis Period and Service PeriodDocumento10 páginasAnalysis Period and Service PeriodsalmanAún no hay calificaciones

- Ordinal Utility TheoryDocumento14 páginasOrdinal Utility Theorykajal goyalAún no hay calificaciones