Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011

Cargado por

Amar Mourya MouryaTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011

Cargado por

Amar Mourya MouryaCopyright:

Formatos disponibles

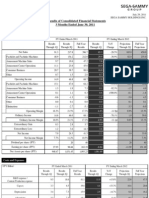

UNAUDITED STANDALONE FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED DECEMBER 31, 2011

(Rs. In Lacs except per share data) Particulars Dec-11 (Unaudited) Net Revenue Total Expenditure a) (Increase) / Decrease in Stock in Trade & WIP b) Consumption of Raw materials c) Staff Cost d) Depreciation & Impairment e) Other Expenditure Operating Profit before Other Income, Interest and Tax Other Income Profit before Interest and Tax Interest Cost Net Profit before Tax Provision for : Current Tax Minimum Alternate Tax Deferred Tax Net Profit after Tax Paid-up Equity Capital (Face value Rs.2 per share) Reserves excluding revaluation reserves Earning Per Share (Rs.)- Basic (not annualised) Earning Per Share (Rs.)- Diluted (not annualised) Aggregate of Public Share Holding Number Of Shares Percentage of Shareholding Promotors and promoter group Shareholding Pledged/Encumbered Number of Shares Percentage of Shares (as a % of the total shareholding of promoter and promoter group) Percentage of Shares (as a % of the total share capital of the company) Non-encumbered Number of Shares Percentage of Shares (as a % of the total shareholding of promoter and promoter group) Percentage of Shares (as a % of the total share capital of the company) 66,353 63,092 (4,896) 51,046 2,554 1,962 12,426 3,261 333 3,594 2,318 1,276 191 (787) 925 947 7,864 0.24 0.24 178,161,972 45.3% Quarter ended Sep-11 (Unaudited) 70,728 67,248 (3,024) 53,616 2,515 1,560 12,581 3,480 315 3,795 2,075 1,720 388 66 1,266 7,861 0.32 0.32 178,040,956 45.3% Dec-10 (Unaudited) 57,911 54,987 5,946 35,879 2,154 1,384 9,624 2,924 716 3,640 1,285 2,355 451 237 (43) 1,710 7,127 0.48 0.45 177,712,314 49.9% Nine Months ended Dec-11 (Unaudited) 191,814 183,517 (11,611) 146,699 7,200 4,985 36,244 8,297 2,028 10,325 6,578 3,747 787 (787) 1,011 2,736 7,864 0.70 0.70 178,161,972 45.3% Dec-10 (Unaudited) 158,032 140,392 (5,651) 110,361 6,196 4,026 25,460 17,640 1,590 19,230 2,919 16,311 2,902 (210) 596 13,023 7,127 3.66 3.41 177,712,314 49.9% Year ended Mar-11 (Audited) 226,255 205,292 (3,093) 158,533 8,256 5,601 35,995 20,963 1,597 22,560 4,741 17,819 3,203 (22) 585 14,053 7,128 93,452 3.95 3.72 177,853,274 49.9% (Rs. In Lacs) Segment Reporting Dec-11 (Unaudited) Segment Revenue Power Transmission Business 47,570 Telecom Products & Solutions 18,783 Total 66,353 Profit before Interest,Depreciation and Tax Power Transmission Business 2,572 Telecom Products & Solutions 2,984 Total 5,556 Profit before Interest and Tax Power Transmission Business 2,030 Telecom Products & Solutions 1,564 Total 3,594 Interest Cost 2,318 Profit before Tax 1,276 Capital Employed (Segment Assets- Segment Liabilities) Power Transmission Business 63,818 Telecom Products & Solutions 102,914 Unallocable 27,180 Total 193,912 Quarter ended Sep-11 (Unaudited) 51,471 19,257 70,728 2,357 2,998 5,355 1,825 1,970 3,795 2,075 1,720 78,107 95,844 12,437 186,388 Dec-10 (Unaudited) 42,186 15,725 57,911 1,221 3,803 5,024 823 2,817 3,640 1,285 2,355 79,860 95,159 2,390 177,409 Nine Months ended Dec-11 (Unaudited) 138,464 53,350 191,814 5,755 9,555 15,310 4,207 6,118 10,325 6,578 3,747 63,818 102,914 27,180 193,912 Dec-10 (Unaudited) 109,181 48,851 158,032 9,928 13,328 23,256 8,762 10,468 19,230 2,919 16,311 79,860 95,159 2,390 177,409 Year ended Mar-11 (Audited) 160,591 65,664 226,255 11,368 16,793 28,161 9,768 12,792 22,560 4,741 17,819 63,439 92,152 9,977 165,568

215,027,855 100.0% 54.7%

215,027,855 100.0% 54.7%

178,614,355 100.0% 50.1%

215,027,855 100.0% 54.7%

178,614,355 100.0% 50.1%

178,528,855 100.0% 50.1%

NOTES 1. In terms of clause 41 of the listing agreement, details of number of investor complaints for the quarter ended December 31, 2011 : Beginning - 0 , Received - 73 , Disposed off - 73 , Pending - 0. 2. During the year 2005-06, the CESTAT had upheld a demand of Rs.18,800 Lacs (including penalties and excluding interest) thereon in the pending Excise matter. The auditors have expressed their qualification on this matter. The Company is contesting this case and the matter is pending the decision of the Hon'ble Supreme Court. 3. In accordance with the nature of the business, the company had changed its method of valuation of inventories of aluminium conductors used in power transmission business from "Weighted Average" to "Specific Identification method" from March 31, 2011. Had "Weighted Average Method" been used during the period ended December 31, 2011, the inventory would have been lower by Rs.89 Lacs and the resultant net profit after tax would have been higher by Rs.69 Lacs. 4. In the current quarter, the Company has recognised a total amount of Rs.381 Lacs for quarters ended June 30, 2011 and September 30, 2011 towards recovery of expenses and interest on loans provided to certain wholly owned subsidiaries of the Company. Said amount has been netted off against the expenditure incurred under various heads. 5. Sterlite Infra- Tech Limited ( SITL), a wholly owned subsidiary, has been merged with the Company effective April 1, 2011 vide order of the Bombay High Court dated October 21, 2011. The impact of merger has been given in the results with effect from April 1, 2011 ; and accordingly, the results of the Company for the quarter and nine months ended December 31, 2011 are lower by Rs.663 lacs. To this extent results for the quarter and nine months ended December 31, 2011 are not comparable with the results for the prior periods presented 6. The above results have been reviewed by the Audit Committee. The Board of Directors at its meeting held on January 25, 2012 approved the above reesults. 7. Previous period figures have been regrouped / rearranged wherever considered necessary.

For Sterlite Technologies Limited Place : Pune Date: January 25, 2012 Sd/Anand Agarwal Chief Executive Officer

Registered office: Sterlite Technologies Limited, Survey No. 68/1, Rakholi, Madhuban Dam Road, Silvassa - 396230, Union Territory of Dadra & Nagar Haveli, INDIA. www.sterlitetechnologies.com

También podría gustarte

- How to Get Nigeria Passport in 40 StepsDocumento42 páginasHow to Get Nigeria Passport in 40 Stepsgynn100% (1)

- Caterpillar Cat 330L EXCAVATOR (Prefix 8FK) Service Repair Manual (8FK00001 and Up)Documento27 páginasCaterpillar Cat 330L EXCAVATOR (Prefix 8FK) Service Repair Manual (8FK00001 and Up)kfm8seuuduAún no hay calificaciones

- Financial Market and Portfolio Management Assignment 2Documento6 páginasFinancial Market and Portfolio Management Assignment 2leeroy mekiAún no hay calificaciones

- Line Sets in Oracle Order ManagementDocumento9 páginasLine Sets in Oracle Order ManagementS S PatelAún no hay calificaciones

- A&F Method OfInspectionDocumento26 páginasA&F Method OfInspectionzoomerfins22100% (1)

- Tool Catalog Ei18e-11020Documento370 páginasTool Catalog Ei18e-11020Marcelo Diesel85% (13)

- Life Insurance Exam Questions and Answers PDFDocumento13 páginasLife Insurance Exam Questions and Answers PDFDairo GaniyatAún no hay calificaciones

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosDe EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosAún no hay calificaciones

- Cost Analysis Format-Exhaust DyeingDocumento1 páginaCost Analysis Format-Exhaust DyeingRezaul Karim TutulAún no hay calificaciones

- GUJARAT APOLLO INDUSTRIES LIMITED FINANCIAL RESULTSDocumento2 páginasGUJARAT APOLLO INDUSTRIES LIMITED FINANCIAL RESULTSTushar PatelAún no hay calificaciones

- BATA INDIA 1Q FY2011 Earnings ReportDocumento1 páginaBATA INDIA 1Q FY2011 Earnings ReportSagar KadamAún no hay calificaciones

- HCL Technologies LTD 170112Documento3 páginasHCL Technologies LTD 170112Raji_r30Aún no hay calificaciones

- Consolidated AFR 31mar2011Documento1 páginaConsolidated AFR 31mar20115vipulsAún no hay calificaciones

- Avt Naturals (Qtly 2011 09 30) PDFDocumento1 páginaAvt Naturals (Qtly 2011 09 30) PDFKarl_23Aún no hay calificaciones

- Summit Power Q3 Financial StatementsDocumento4 páginasSummit Power Q3 Financial StatementsShafiul MuznabinAún no hay calificaciones

- Avt Naturals (Qtly 2012 12 31)Documento1 páginaAvt Naturals (Qtly 2012 12 31)Karl_23Aún no hay calificaciones

- Avt Naturals (Qtly 2011 06 30) PDFDocumento1 páginaAvt Naturals (Qtly 2011 06 30) PDFKarl_23Aún no hay calificaciones

- Consolidated Balance Sheet: As at 31st December, 2011Documento21 páginasConsolidated Balance Sheet: As at 31st December, 2011salehin1969Aún no hay calificaciones

- Mothersum Standalone Results Q3 FY2012Documento4 páginasMothersum Standalone Results Q3 FY2012kpatil.kp3750Aún no hay calificaciones

- Avt Naturals (Qtly 2011 12 31) PDFDocumento1 páginaAvt Naturals (Qtly 2011 12 31) PDFKarl_23Aún no hay calificaciones

- Karnataka Bank Results Sep12Documento6 páginasKarnataka Bank Results Sep12Naveen SkAún no hay calificaciones

- ICI Pakistan Balance Sheet TitleDocumento9 páginasICI Pakistan Balance Sheet TitleSehrish HumayunAún no hay calificaciones

- EV CalcDocumento11 páginasEV CalcDeepak KapoorAún no hay calificaciones

- Q3 Results 201112Documento3 páginasQ3 Results 201112Bishwajeet Pratap SinghAún no hay calificaciones

- TCS Ifrs Q3 13 Usd PDFDocumento23 páginasTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiAún no hay calificaciones

- 2009-10 Annual ResultsDocumento1 página2009-10 Annual ResultsAshish KadianAún no hay calificaciones

- New Listing For PublicationDocumento2 páginasNew Listing For PublicationAathira VenadAún no hay calificaciones

- BHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Documento3 páginasBHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Shubham TrivediAún no hay calificaciones

- Aplab Limited: Unaudited Standalone Financial Results For The Quarter & Nine Months Ended 31St December 2012Documento1 páginaAplab Limited: Unaudited Standalone Financial Results For The Quarter & Nine Months Ended 31St December 2012Tanmoy AcharyaAún no hay calificaciones

- HKSE Announcement of 2011 ResultsDocumento29 páginasHKSE Announcement of 2011 ResultsHenry KwongAún no hay calificaciones

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Segment Reporting (Rs. in Crore)Documento8 páginasSegment Reporting (Rs. in Crore)Tushar PanhaleAún no hay calificaciones

- FY2011 ResultsDocumento1 páginaFY2011 ResultsSantosh VaishyaAún no hay calificaciones

- GTL Q1 2011 ResultsDocumento4 páginasGTL Q1 2011 ResultsAnantmmAún no hay calificaciones

- Dabur Balance SheetDocumento30 páginasDabur Balance SheetKrishan TiwariAún no hay calificaciones

- Balance Sheet and Financial StatementsDocumento7 páginasBalance Sheet and Financial StatementssaqibaliraoAún no hay calificaciones

- BJE Q1 ResultsDocumento4 páginasBJE Q1 ResultsTushar DasAún no hay calificaciones

- Consolidated Accounts June-2011Documento17 páginasConsolidated Accounts June-2011Syed Aoun MuhammadAún no hay calificaciones

- Pak Elektron Limited: Condensed Interim FinancialDocumento16 páginasPak Elektron Limited: Condensed Interim FinancialImran ArshadAún no hay calificaciones

- PDF Processed With Cutepdf Evaluation EditionDocumento2 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAún no hay calificaciones

- Britannia Industries Q2 FY2012 Financial ResultsDocumento2 páginasBritannia Industries Q2 FY2012 Financial Resultspvenkatesh19779434Aún no hay calificaciones

- Audited Results 31.3.2012 TVSMDocumento2 páginasAudited Results 31.3.2012 TVSMKrishna KrishnaAún no hay calificaciones

- KFA - Published Unaudited Results - Sep 30, 2011Documento3 páginasKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasAún no hay calificaciones

- Sebi MillionsDocumento2 páginasSebi MillionsNitish GargAún no hay calificaciones

- BallCorporation 10Q 20130506Documento57 páginasBallCorporation 10Q 20130506doug119Aún no hay calificaciones

- 1st QTR 30 Sep 11Documento18 páginas1st QTR 30 Sep 11m__saleemAún no hay calificaciones

- Annual ReportDocumento1 páginaAnnual ReportAnup KallimathAún no hay calificaciones

- Sebi Million Q3 1213 PDFDocumento2 páginasSebi Million Q3 1213 PDFGino SunnyAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento5 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- MMH SGXnet 03 12 FinalDocumento16 páginasMMH SGXnet 03 12 FinalJosephine ChewAún no hay calificaciones

- Ever Gotesco: Quarterly ReportDocumento35 páginasEver Gotesco: Quarterly ReportBusinessWorld100% (1)

- 1Q FY2011 Performance ReportDocumento24 páginas1Q FY2011 Performance ReportMohnish KatreAún no hay calificaciones

- IFCI Q3 FY10 financial resultsDocumento3 páginasIFCI Q3 FY10 financial resultsnitin2khAún no hay calificaciones

- 3B36C062-4ACD-428C-A2C5-A960A40E32B7Documento173 páginas3B36C062-4ACD-428C-A2C5-A960A40E32B7belalangkupukupukupuAún no hay calificaciones

- TTR RRL: LimitedDocumento5 páginasTTR RRL: LimitedShyam SunderAún no hay calificaciones

- Noida Toll Bridge Company Limited: Expenditure CycleDocumento38 páginasNoida Toll Bridge Company Limited: Expenditure CycleArpit ManglaAún no hay calificaciones

- 1st Quarter Report 2011Documento4 páginas1st Quarter Report 2011Smart IftyAún no hay calificaciones

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento6 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Tcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Documento18 páginasTcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Cipar ClauAún no hay calificaciones

- Pak Elektron Limited: Condensed Interim FinancialDocumento15 páginasPak Elektron Limited: Condensed Interim FinancialImran RjnAún no hay calificaciones

- Consolidated Financial StatementsDocumento78 páginasConsolidated Financial StatementsAbid HussainAún no hay calificaciones

- Aftab Automobiles Limited: 27,2009, We Are Pleased To Forward Herewith The Un-Audited Statement of ComprehensiveDocumento4 páginasAftab Automobiles Limited: 27,2009, We Are Pleased To Forward Herewith The Un-Audited Statement of ComprehensiveNur Md Al HossainAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Balance Sheet As at 31 March, 2011: ST STDocumento14 páginasBalance Sheet As at 31 March, 2011: ST STLambourghiniAún no hay calificaciones

- MSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012Documento4 páginasMSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012kpatil.kp3750Aún no hay calificaciones

- Hosoku e FinalDocumento6 páginasHosoku e FinalSaberSama620Aún no hay calificaciones

- BGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEDocumento5 páginasBGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEmittleAún no hay calificaciones

- ITC Consolidated FinancialsDocumento49 páginasITC Consolidated FinancialsVishal JaiswalAún no hay calificaciones

- Company/Finance/Balance Sheet Consolidated/37832/Eros Intl - Media Cmbdetail 2Documento21 páginasCompany/Finance/Balance Sheet Consolidated/37832/Eros Intl - Media Cmbdetail 2Amar Mourya MouryaAún no hay calificaciones

- DepartmentalDocumento5 páginasDepartmentalAmar Mourya MouryaAún no hay calificaciones

- 2008F CareersOnWallStDocumento67 páginas2008F CareersOnWallStAmar Mourya MouryaAún no hay calificaciones

- DCF Valuation Guide to Determine Company ValueDocumento3 páginasDCF Valuation Guide to Determine Company ValueDurga ShankarAún no hay calificaciones

- Case Study ON: The Spark Batteries LTDDocumento8 páginasCase Study ON: The Spark Batteries LTDRitam chaturvediAún no hay calificaciones

- Py Py y Py Y: The Second-Order Taylor Approximation GivesDocumento4 páginasPy Py y Py Y: The Second-Order Taylor Approximation GivesBeka GurgenidzeAún no hay calificaciones

- JESTEC TemplateDocumento11 páginasJESTEC TemplateMuhammad FakhruddinAún no hay calificaciones

- Brexit Essay - Jasraj SinghDocumento6 páginasBrexit Essay - Jasraj SinghJasraj SinghAún no hay calificaciones

- Air Purification Solution - TiPE Nano Photocatalyst PDFDocumento2 páginasAir Purification Solution - TiPE Nano Photocatalyst PDFPedro Ortega GómezAún no hay calificaciones

- Office of The Controller of Examinations Anna University:: Chennai - 600 025Documento4 páginasOffice of The Controller of Examinations Anna University:: Chennai - 600 025M.KARTHIKEYANAún no hay calificaciones

- What is a Server ClusterDocumento2 páginasWhat is a Server Clusterfikru tesefayeAún no hay calificaciones

- Group 2 - Assignment 2 - A Case Study of Telecom SectorDocumento13 páginasGroup 2 - Assignment 2 - A Case Study of Telecom Sectorfajarina ambarasariAún no hay calificaciones

- Apple Led Cinema Display 24inchDocumento84 páginasApple Led Cinema Display 24inchSantos MichelAún no hay calificaciones

- Landmark Philippine and international cases on human rights, elections, and other legal issuesDocumento4 páginasLandmark Philippine and international cases on human rights, elections, and other legal issuesSachieCasimiroAún no hay calificaciones

- Pumping Station Modification PDFDocumento15 páginasPumping Station Modification PDFcarlosnavalmaster100% (1)

- Human Computer InteractionDocumento12 páginasHuman Computer Interactionabhi37Aún no hay calificaciones

- Error 500 Unknown Column 'A.note' in 'Field List' - Joomla! Forum - Community, Help and SupportDocumento1 páginaError 500 Unknown Column 'A.note' in 'Field List' - Joomla! Forum - Community, Help and Supportsmart.engineerAún no hay calificaciones

- Rural Perception of SUV CarsDocumento29 páginasRural Perception of SUV CarsritusinAún no hay calificaciones

- DB51 BTP 160 8PDocumento1 páginaDB51 BTP 160 8Pnagaraj.ss@quest-global.comAún no hay calificaciones

- English Speech Save Our Earth Save Our RainforestDocumento3 páginasEnglish Speech Save Our Earth Save Our RainforestYeremia Billy100% (1)

- BurhanresumeDocumento1 páginaBurhanresumeAbdul Rangwala0% (1)

- Inner RingDocumento16 páginasInner RingService - Anda Hydraulics Asia Pte LtdAún no hay calificaciones

- E. Market Size PotentialDocumento4 páginasE. Market Size Potentialmesadaeterjohn.studentAún no hay calificaciones

- Essential earthquake preparedness stepsDocumento6 páginasEssential earthquake preparedness stepsRalphNacisAún no hay calificaciones

- Proforma PromotionDocumento1 páginaProforma PromotionRavinderSinghAún no hay calificaciones

- TT1 2lecture SpinningDocumento29 páginasTT1 2lecture SpinninghaiAún no hay calificaciones