Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Lowe's Companies, Inc. First Quarter Report 2012

Cargado por

RiverheadLOCALDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Lowe's Companies, Inc. First Quarter Report 2012

Cargado por

RiverheadLOCALCopyright:

Formatos disponibles

Lowes Reports First Quarter Sales and Earnings Results

MOORESVILLE, N.C. (BUSINESS WIRE), May 21, 2012 - Lowes Companies, Inc. (NYSE: LOW), the worlds second largest home improvement retailer, today reported net earnings of $527 million for the quarter ended May 4, 2012, a 14.3 percent increase over the same period a year ago. Diluted earnings per share increased 26.5 percent to $0.43 from $0.34 in the first quarter of 2011. Sales for the quarter increased 7.9 percent to $13.2 billion from $12.2 billion in the first quarter of 2011. Lowes fiscal year ends on the Friday nearest the end of January; therefore, fiscal year 2011 included 53 weeks. The 2012 quarterly comparisons will be impacted by a shift in comparable weeks. The week shift aided the first quarter sales increase by $514 million or 4.2 percent, and contributed approximately $0.05 to the diluted earnings per share growth. Included in the above reported results is a charge related to a previously announced reduction in staff at U.S. headquarters. This charge reduced pre-tax earnings for the first quarter by $17 million and diluted earnings per share by $0.01. Comparable store sales for the quarter increased 2.6 percent, while comparable store sales for the U.S. business increased 2.7 percent. We delivered solid results for the quarter, consistent with our expectation at the beginning of the year, commented Robert A. Niblock, Lowes chairman, president and CEO. While we capitalized on better than anticipated weather during most of the quarter, demand for seasonal products slowed toward the end. We continue to maintain a cautious view of the housing and macro demand environment, and are focused on what we can control, Niblock added. We are building on our core strengths and strategically investing in ways that will better position Lowes for success. I would like to express my gratitude to our employees for their continued dedication and customer focus. As of May 4, 2012, Lowes operated 1,747 stores in the United States, Canada and Mexico representing 196.7 million square feet of retail selling space. A conference call to discuss first quarter 2012 operating results is scheduled for today (Monday, May 21) at 9:00 am ET. The conference call will be available through a webcast and can be accessed by visiting Lowes website at www.Lowes.com/investor and clicking on Lowes First Quarter 2012 Earnings Conference Call Webcast. A replay of the call will be archived on Lowes.com until August 19, 2012. Lowes Business Outlook Fiscal Year 2012 a 52-week Year (comparisons to fiscal year 2011 a 53-week year) Total sales are expected to increase 1 to 2 percent. On a 52 versus 52 week basis, total sales are expected to increase approximately 3 percent. The company expects comparable store sales to increase 1 to 3 percent (52 versus 52 week basis). The company expects to open approximately 10 stores in fiscal year 2012. Earnings before interest and taxes as a percentage of sales (operating margin) are expected to increase approximately 90 basis points. Depreciation expense is expected to be approximately $1.5 billion.

The effective income tax rate is expected to be approximately 37.9%. Diluted earnings per share of $1.73 to $1.83 are expected for the fiscal year ending February 1, 2013. Disclosure Regarding Forward-Looking Statements This news release includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 (the "Act"). Statements of the company's expectations for sales growth, comparable store sales, earnings and performance, shareholder value, capital expenditures, store openings, the housing market, the home improvement industry, demand for services, share repurchases, the Companys strategic initiatives and any statement of an assumption underlying any of the foregoing, constitute "forward-looking statements" under the Act. Although we believe that the expectations, opinions, projections, and comments reflected in these forward-looking statements are reasonable, we can give no assurance that such statements will prove to be correct. A wide variety of potential risks, uncertainties, and other factors could materially affect our ability to achieve the results either expressed or implied by our forward-looking statements including, but not limited to, changes in general economic conditions, such as continued high rates of unemployment, interest rate and currency fluctuations, higher fuel and other energy costs, slower growth in personal income, changes in consumer spending, changes in the rate of housing turnover, the availability and increasing regulation of consumer credit and of mortgage financing, inflation or deflation of commodity prices and other factors which can negatively affect our customers, as well as our ability to: (i) respond to adverse trends in the housing industry, such as the psychological effects of lower home prices, and in the level of repairs, remodeling, and additions to existing homes, as well as a general reduction in commercial building activity; (ii) secure, develop, and otherwise implement new technologies and processes designed to enhance our efficiency and competitiveness; (iii) attract, train, and retain highly-qualified associates; (iv) manage our business effectively as we adapt our traditional operating model to meet the changing expectations of our customers; (v) to maintain, improve, upgrade and protect our critical information systems; (vi) respond to fluctuations in the prices and availability of services, supplies, and products; (vii) respond to the growth and impact of competition; (viii) address changes in existing or new laws or regulations that affect consumer credit, employment/labor, trade, product safety, transportation/logistics, energy costs, health care, tax or environmental issues; and (ix) respond to unanticipated weather conditions that could adversely affect sales. In addition, we could experience additional impairment losses if the actual results of our operating stores are not consistent with the assumptions and judgments we have made in estimating future cash flows and determining asset fair values. For more information about these and other risks and uncertainties that we are exposed to, you should read the "Risk Factors" and "Critical Accounting Policies and Estimates" included in our Annual Report on Form 10-K to the United States Securities and Exchange Commission (the SEC) and the description of material changes therein or updated version thereof, if any, included in our Quarterly Reports on Form 10-Q. The forward-looking statements contained in this news release are based upon data available as of the date of this release or other specified date and speak only as of such date. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf about any of the matters covered in this release are qualified by these cautionary statements and the Risk Factors included in our Annual Report on Form 10-K to the SEC and the description of material changes, if any, therein included in our Quarterly Reports on Form 10-Q. We expressly disclaim any obligation to update or revise any forward-looking statement, whether as a result of new information, change in circumstances, future events, or otherwise. With fiscal year 2011 sales of $50.2 billion, Lowes Companies, Inc. is a FORTUNE 100 company that

serves approximately 15 million customers a week at more than 1,745 home improvement stores in the United States, Canada and Mexico. Founded in 1946 and based in Mooresville, N.C., Lowes is the second-largest home improvement retailer in the world. For more information, visit Lowes.com.

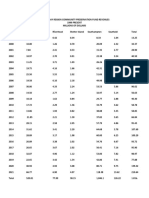

Lowe's Companies, Inc. Consolidated Statements of Current and Retained Earnings (Unaudited) In Millions, Except Per Share and Percentage Data Three Months Ended May 4, 2012 April 29, 2011 Amount Percent Amount Percent $ 13,153 100.00 $ 12,185 100.00 8,589 4,564 65.30 34.70 7,866 4,319 64.56 35.44

Current Earnings Net sales Cost of sales Gross margin Expenses: Selling, general and administrative Depreciation Interest - net Total expenses Pre-tax earnings Income tax provision Net earnings Weighted average common shares outstanding - basic Basic earnings per common share (1) Weighted average common shares outstanding - diluted Diluted earnings per common share (1)

3,241 370 103 3,714 850 323 $ 527

24.65 2.81 0.78 28.24 6.46 2.45 4.01

3,120 371 88 3,579 740 279 $ 461

25.60 3.05 0.72 29.37 6.07 2.28 3.79

1,206 $ 0.43 1,208 $ 0.43

1,324 $ 0.35 1,328 $ 0.34

Cash dividends per share Retained Earnings

$ 0.14

$ 0.11

También podría gustarte

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Riverhead Town Proposed Battery Energy Storage CodeDocumento10 páginasRiverhead Town Proposed Battery Energy Storage CodeRiverheadLOCALAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Riverhead Budget Presentation March 22, 2022Documento14 páginasRiverhead Budget Presentation March 22, 2022RiverheadLOCALAún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- RXR/GGV Qualified & Eligible Documents (Final 09.26.22)Documento23 páginasRXR/GGV Qualified & Eligible Documents (Final 09.26.22)RiverheadLOCALAún no hay calificaciones

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- 2022 - 03 - 16 - EPCAL Resolution & Letter AgreementDocumento9 páginas2022 - 03 - 16 - EPCAL Resolution & Letter AgreementRiverheadLOCALAún no hay calificaciones

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Draft Scope Riverhead Logistics CenterDocumento20 páginasDraft Scope Riverhead Logistics CenterRiverheadLOCALAún no hay calificaciones

- Peconic Bay Region Community Preservation Fund Revenues 1999-2021Documento1 páginaPeconic Bay Region Community Preservation Fund Revenues 1999-2021RiverheadLOCALAún no hay calificaciones

- AKRF Public Outreach Report AttachmentsDocumento126 páginasAKRF Public Outreach Report AttachmentsRiverheadLOCALAún no hay calificaciones

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Kenneth RothwellDocumento5 páginasKenneth RothwellRiverheadLOCALAún no hay calificaciones

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Yvette AguiarDocumento10 páginasYvette AguiarRiverheadLOCALAún no hay calificaciones

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- N.Y. Downtown Revitalization Initiative Round Five GuidebookDocumento38 páginasN.Y. Downtown Revitalization Initiative Round Five GuidebookRiverheadLOCALAún no hay calificaciones

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Riverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022Documento30 páginasRiverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022RiverheadLOCALAún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Catherine KentDocumento7 páginasCatherine KentRiverheadLOCALAún no hay calificaciones

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Riverhead Town Marijuana SurveyDocumento44 páginasRiverhead Town Marijuana SurveyRiverheadLOCALAún no hay calificaciones

- Riverhead Town Police Report, August 2021Documento6 páginasRiverhead Town Police Report, August 2021RiverheadLOCALAún no hay calificaciones

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- Juan Micieli-MartinezDocumento3 páginasJuan Micieli-MartinezRiverheadLOCALAún no hay calificaciones

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Robert E. KernDocumento3 páginasRobert E. KernRiverheadLOCALAún no hay calificaciones

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- Evelyn Hobson-Womack Campaign Finance DisclosureDocumento3 páginasEvelyn Hobson-Womack Campaign Finance DisclosureRiverheadLOCALAún no hay calificaciones

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- League of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsDocumento2 páginasLeague of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsRiverheadLOCAL67% (3)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- 2021 General Election - Suffolk County Sample Ballot BookletDocumento154 páginas2021 General Election - Suffolk County Sample Ballot BookletRiverheadLOCALAún no hay calificaciones

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Riverhead Town Police Monthly Report July 2021Documento6 páginasRiverhead Town Police Monthly Report July 2021RiverheadLOCALAún no hay calificaciones

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Aguiar-Kent Campaign Finance Report 32-Day Pre GeneralDocumento2 páginasAguiar-Kent Campaign Finance Report 32-Day Pre GeneralRiverheadLOCALAún no hay calificaciones

- Old Steeple Church Time CapsuleDocumento4 páginasOld Steeple Church Time CapsuleRiverheadLOCALAún no hay calificaciones

- "The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PEDocumento10 páginas"The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PERiverheadLOCALAún no hay calificaciones

- Town of Southampton Police Reform PlanDocumento308 páginasTown of Southampton Police Reform PlanRiverheadLOCALAún no hay calificaciones

- Turtles of New York StateDocumento2 páginasTurtles of New York StateRiverheadLOCALAún no hay calificaciones

- Town of Riverhead Draft Solid Waste Management PlanDocumento73 páginasTown of Riverhead Draft Solid Waste Management PlanRiverheadLOCALAún no hay calificaciones

- Riverhead Town State of Emergency Order Issued May 12, 2021Documento3 páginasRiverhead Town State of Emergency Order Issued May 12, 2021RiverheadLOCAL100% (1)

- Town of Riverhead Railroad Street TOD RedevelopmentDocumento54 páginasTown of Riverhead Railroad Street TOD RedevelopmentRiverheadLOCALAún no hay calificaciones

- Riverhead Police Reform Plan - FinalDocumento96 páginasRiverhead Police Reform Plan - FinalRiverheadLOCALAún no hay calificaciones

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- 2021-2022 Proposed Budget SummaryDocumento2 páginas2021-2022 Proposed Budget SummaryRiverheadLOCALAún no hay calificaciones

- Ethiopian TVET-System: Learning Guide # 1Documento19 páginasEthiopian TVET-System: Learning Guide # 1Carraa BaqqalaaAún no hay calificaciones

- Assistant Manager - CSR (Mumbai)Documento2 páginasAssistant Manager - CSR (Mumbai)Kumar GauravAún no hay calificaciones

- Integrated Auditing of ERP Systems (PDFDrive)Documento289 páginasIntegrated Auditing of ERP Systems (PDFDrive)Chaima LejriAún no hay calificaciones

- Literature ReviewDocumento3 páginasLiterature ReviewRohan SharmaAún no hay calificaciones

- Tan, Tiong, Tick vs. American Hypothecary Co., G.R. No. L-43682 March 31, 1938Documento2 páginasTan, Tiong, Tick vs. American Hypothecary Co., G.R. No. L-43682 March 31, 1938Barrymore Llegado Antonis IIAún no hay calificaciones

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Is Enhanced Audit Quality Associated With Greater Real Earnings Management?Documento22 páginasIs Enhanced Audit Quality Associated With Greater Real Earnings Management?Darvin AnanthanAún no hay calificaciones

- @magzrock Dalal Street Invest Jour - June - 2017Documento69 páginas@magzrock Dalal Street Invest Jour - June - 2017Srinivasulu MachavaramAún no hay calificaciones

- Mobilink FinalDocumento28 páginasMobilink FinalMuhammad Imran Burhanullah0% (1)

- Warehouse Layout OptimizationDocumento4 páginasWarehouse Layout OptimizationJose Antonio UrdialesAún no hay calificaciones

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- SAP ComponentsDocumento7 páginasSAP ComponentsFahad QuadriAún no hay calificaciones

- BSBA Financial Management CurriculumDocumento3 páginasBSBA Financial Management Curriculumrandyblanza2014Aún no hay calificaciones

- Current Org StructureDocumento2 páginasCurrent Org StructureJuandelaCruzVIIIAún no hay calificaciones

- Report PT Bukit Uluwatu Villa 30 September 2019Documento146 páginasReport PT Bukit Uluwatu Villa 30 September 2019Hanif RaihanAún no hay calificaciones

- Why Average Cost Curve IsDocumento2 páginasWhy Average Cost Curve IsHasinaImamAún no hay calificaciones

- IPCC Group-I Paper 1: Accounting, Chapter 8 CA - SK Chhabra: © The Institute of Chartered Accountants of IndiaDocumento57 páginasIPCC Group-I Paper 1: Accounting, Chapter 8 CA - SK Chhabra: © The Institute of Chartered Accountants of IndiaRocky RkAún no hay calificaciones

- BX2011 Topic01 Tutorial Solutions 2020Documento15 páginasBX2011 Topic01 Tutorial Solutions 2020Shi Pyeit Sone Kyaw0% (1)

- Stock Control and InventoryDocumento8 páginasStock Control and Inventoryadede2009Aún no hay calificaciones

- Class 1 Notes 06062022Documento4 páginasClass 1 Notes 06062022Munyangoga BonaventureAún no hay calificaciones

- Software - Test Bank - FinalDocumento42 páginasSoftware - Test Bank - FinalAhmad OsamaAún no hay calificaciones

- Chapter 1 - Introduction To Management AccountingDocumento32 páginasChapter 1 - Introduction To Management Accountingyến lêAún no hay calificaciones

- Assignment PPE PArt 2Documento7 páginasAssignment PPE PArt 2JP MirafuentesAún no hay calificaciones

- Pepcid AC - Group1 - AnalysisDocumento2 páginasPepcid AC - Group1 - AnalysisRini RafiAún no hay calificaciones

- Set ADocumento11 páginasSet ALizi100% (1)

- Chris Sloan ResumeDocumento2 páginasChris Sloan ResumeChris SloanAún no hay calificaciones

- Notice Pay - Amneal-Pharmaceuticals-Pvt.-Ltd.-GST-AAR-GujratDocumento7 páginasNotice Pay - Amneal-Pharmaceuticals-Pvt.-Ltd.-GST-AAR-Gujratashim1Aún no hay calificaciones

- Impact X Workbook ToolDocumento15 páginasImpact X Workbook ToolAkash DasAún no hay calificaciones

- Hola-Kola ComputationsDocumento7 páginasHola-Kola ComputationsKristine Nitzkie SalazarAún no hay calificaciones

- SLA Part 2 Entities - Event Class - Event Types PDFDocumento6 páginasSLA Part 2 Entities - Event Class - Event Types PDFsoireeAún no hay calificaciones

- Accounts Agreed ValuesDocumento35 páginasAccounts Agreed ValuesJay Raphael TrioAún no hay calificaciones

- Fedex Supply Chain Global SuccessDocumento2 páginasFedex Supply Chain Global SuccessEldho RoyAún no hay calificaciones

- Jack Reacher Reading Order: The Complete Lee Child’s Reading List Of Jack Reacher SeriesDe EverandJack Reacher Reading Order: The Complete Lee Child’s Reading List Of Jack Reacher SeriesCalificación: 4.5 de 5 estrellas4.5/5 (7)

- 71 Ways to Practice English Writing: Tips for ESL/EFL LearnersDe Everand71 Ways to Practice English Writing: Tips for ESL/EFL LearnersCalificación: 5 de 5 estrellas5/5 (3)

- Political Science for Kids - Democracy, Communism & Socialism | Politics for Kids | 6th Grade Social StudiesDe EverandPolitical Science for Kids - Democracy, Communism & Socialism | Politics for Kids | 6th Grade Social StudiesCalificación: 5 de 5 estrellas5/5 (1)

- Great Short Books: A Year of Reading—BrieflyDe EverandGreat Short Books: A Year of Reading—BrieflyCalificación: 4 de 5 estrellas4/5 (10)

- Christian Apologetics: An Anthology of Primary SourcesDe EverandChristian Apologetics: An Anthology of Primary SourcesCalificación: 4 de 5 estrellas4/5 (2)

- English Vocabulary Masterclass for TOEFL, TOEIC, IELTS and CELPIP: Master 1000+ Essential Words, Phrases, Idioms & MoreDe EverandEnglish Vocabulary Masterclass for TOEFL, TOEIC, IELTS and CELPIP: Master 1000+ Essential Words, Phrases, Idioms & MoreCalificación: 3 de 5 estrellas3/5 (1)