Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Sampling of Cases Re Steven Baum - Chart

Cargado por

pano2012Descripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Sampling of Cases Re Steven Baum - Chart

Cargado por

pano2012Copyright:

Formatos disponibles

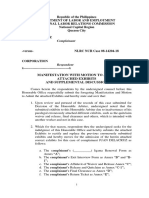

Page 1 of 6 SAMPLING OF CASES RE STEVEN BAUM Case Index County/Court 1-25-10 Deutsche Bank v McRae, 894 N.Y.S.

2d 720 Alleghany Supreme

Order/Disposition J. Walker: foreclosure denied because Baums client bank as Plaintiff had no standing, Baum never produces assignment of Note, only Mortgage assigned which is inconsistent with Real Property Law 258 [Form O] language that assignor ... hereby assigns a certain mortgage... together with the bond or obligation described in said mortgage, and the moneys due and to grow due thereon with interest ...;thus, assigning only the mortgage terms w/o the debt obligation of Note is unlawful. Court also found Baums ethics issues of conflict of interest/simultaneous representation of different parties. J. Schack: denied foreclosure for lack of standing, found Baums conflict in interest by his employee/attorney, Elpiniki M. Bechakas representing both plaintiff while suing MERS, yet requesting MERS get paid, while concealing Baum employs Bechakas. J. Schack: dismissed Baum foreclosure, holding Plaintiff U.S. BANK's attempt to foreclose upon a mortgage in which it has no legal or equitable interest is without foundation in law or fact. Found that Baum appears to violate 22 NYCRR 1200.0 (Rules of Professional Conduct, effective April 1, 2009) Rule 1.7, "Conflict of Interest: Current Clients." By representing MERS as the ineffective assignor of the mortgage but not the Note, and the Plaintiff Bank had no standing because of MERS. Found that a 6/16/09 assignment was signed by "Elpiniki Bechakas, Assistant Secretary and Vice President" of MERS who is also a lawyer working for Baum. J. Schack: denied Baums renewal motion and his foreclosure filing for lack of standing, noted Baums ethics violations of simultaneous representation of MERS as a nominee on the mortgage and Bank as an alleged assignee w/o proper paperwork, his false affidavits with false powers of attorney and no assignments filed, no corporate resolutions authorizing the alleged assignment. Court found Plaintiff's counsel, Steven J. Baum, P.C., appears to be operating in a parallel mortgage universe, unrelated to the real universe. Found Baums employee Ms. Gazzo signs on legal papers as a MERS officer, not an agent, and refers to her power as officer to MERS by corp resolution dated 7/19/07. Found Baum concealed the actual Pooling & Servicing Agreement where a PSA pools notes & sells in secondary market no matter if some Notes are bad, which Baum alleged that very PSA gives him the right to file the foreclosure. J. Schack: denied foreclosure because EMC lacked standing. MERS was on mortgage and no assignment to EMC existed (case disposed. Baum never refiled)

3-22-10 Lasalle Bank NA v Smith & MERS, 2010 NY Slip Op 50470U

35207/07

Kings Supreme

5-11-10 US Bank v. Emanuel

19271/09

Kings Supreme

5-24-10 HSBC Bank v. Yeasmin; 2010 NY Slip Op 50927U

34142/07

Kings Supreme

6-5-07 EMC Mtg v. Batista, 841 N.Y.S.2d 819

34145/06

Kings Supreme

Page 2 of 6

Case 9-24-07 In re Fagan

Index # 04 B 23460

11-19-07 Bank of NY v. Orosco

32052/07

2-7-08 In re McCourt, Daniel,Sagman, LAWSONCAMPBELL, DELANEY

05-38803 06-35505 07-35282 07-36217 07-36421

4-10-08 In re Schuessler

07-35608

2-26-09 LaSalle Bank v. Ahearn

505597

3-16-09 Wells Fargo, NA v. Dmitriev et al.

16038/08

County/Court Order/Disposition SDNY J. Hardin: found Baum's filings for his Bank as a creditor Bankruptcy secured by a Note and to lift Bankruptcy stay were the exact false filings condemned by the court. Found Baums filings callous in design or inadvertence. and sanctioned Baum. Kings J Schack: denied foreclosure because plaintiff had no Supreme standing, and no assignment of Mortgage and Note recorded even 3 months after a Keri Selman swore in her affidavit that MERS assigned when it never did. Court found that Selman may have engaged in subterfuge against separating the lien from the debt so MERS has no standing to bring foreclosure actions, citing Merritt v. Bartholick, 36 NY 44,45 (1867) SDNY J. Morris: Found in each case, Steven J. Baum, P.C. Bankruptcy appears to have attempted a delegation of its representation of Ctthe secured creditor to Pillar Processing, LLC, a Limited Poughkeepsie Liability Corporation that does not appear to be a law firm. ORDERED that in each of these cases, Baum, Pillar and their assigns or servicers were barred from collecting any fees and lambasted Baum for using Pillar like an attorney before the courts. Court concerned with Baums misuse of his company Pillar doing legal work when it is not a licensed attorney. SDNY J. Morris: found that a third party Vendor refers foreclosure Bankruptcy cases to a regional law firm. The Vendor receives payment Ctfor each referral. A Law firm supervisor, not an attorney, Poughkeepsie signs affidavits w/o verifying pertinent information. The Supervisor executes affidavits daily in batches to be notarized by someone else. The regional law firm sends an attorney to appear and utilizes a separate non-legal entity, Pillar, to contact the Court. The Court sanctioned the Mortgage servicer for abusing the bankruptcy petitioners with false filings by utilizing third party vendors and law firms with obvious volume and profit motives, an analyst that analyzed nothing, and a supervisor with no discretion other than to verify default information as it appears on a computer screen and sign the affidavit drafted by the outside law firm and notarized by the vendor. The Court found this misconduct constituted an abuse of process, identifying Pillar Processing, LLC as using legal assistants to act in lawyer capacities and Steven J. Baum connected with Pillar. The court found that there was never an assignment to the bank that engaged in this proceeding. It appears that the Steven J. Baum firm, emulating its client, has created its own servicer in order to distance itself from dealing directly with this Court and other attorneys and parties when it suits the Steven J. Baum firm to do so. The Court has questioned the legal and ethical propriety of this practice. Third Dept. Appellate Court affirmed lower courts dismissal of foreclosure complaint with prejudice because Bank had no standing and assignment was created after Baum filed the lawsuit, which Baums complaint alleged they would assign after the filing. Suffolk J. Baisley; Defendants executed Mortgage in favor of MERS Supreme and later Mortgage and Note assigned. Court denied Plaintiffs motion to default Defendants because Plaintiff never submitted an affidavit by a party with knowledge of facts and the amount due per CPLR 3125(f). Also violated CPLR 2309(c) as Jeffrey Stephan identified himself as a limited signing officer for GMAC but never proved he had

Page 3 of 6 authority to execute the affidavit for the Plaintiff Wells. Court found Stephan affidavit suspect as facts and dates he recited were contrary to the documents. J. Baisley: dismissed foreclosure as MERS assignment submitted by Baum as executed by Jeffrey Stephan was unlawful, and questionable when Stephan represented MERS and Bank simultaneously. Court found Baum firm attorney Elpinicki Bechakas was the corporate officer who signed a mortgage assignment on behalf of MERS while Baum represents the plaintiff. The judge raised the conflict of interest issue in the context of the New York Rules of Professional Conduct. J. Meddaugh: Dismissed Baum foreclosure because his client had no standing as Plaintiff when Mortgage assigned 12/12/08 from MERS as nominee to another bank, not HSBC; and no assignment of the Note. J. Meddaugh denied Baums motion to reargue the 5/6/09 dismissal, finding his affirmation filed was not made with personal knowledge of the facts about the Note and Baum never submitted proof that MERS assigned the note with the mortgage per the UCC-citing Matter of MERSCORP, Inc v. Romaine, 8 NY3d 90,100(2006) holding MERS violated the clear prohibition on separating a lien from the debt and has no standing to file foreclosures. J. Spinner: Lambasted Baums client bank for duplicity to a homeowner and its egregious misconduct in refusing to negotiate, held sanctions would not be enough so he cancelled the entire mortgage J. Demarest: denied foreclosure action because Plaintiff had no standing. MERS mortgage as nominee and complaint filed before assignment made from MERS to Plaintiff. Where an assignee of a note and mortgage commences a foreclosure action prior to the date of the execution of the assignment and a "written assignment claiming an earlier effective date" is not "accompanied by proof that the physical delivery of the note and mortgage was, in fact, previously effectuated," such assignee has no standing (Marchione, 887 N.Y.S.2d 615, 2009 NY Slip Op 7624, *3; see Lasalle Bank Natl. Assn. v Ahearn, 59 AD3d 911, 912, 875 N.Y.S.2d 595 [3d Dept 2009]). J. Meddaugh found that Baum engaged in frivolous conduct under 22 NYCRR 130-1.1(c) by commencing a lawsuit without merit, which included Baums false lis pendens and foreclosure complaint. J. Fairgrieve: In holdover proceeding, found Baums petition was false, Baum filed for a fictitious plaintiff bank that had no standing to bid on the property by using an unlawful assignment to bid. Court scheduled a sanctions hearing against Baum. J. Fairgrieve Held: At the hearing, the attorney for Baum repeatedly attempted to excuse the firms past conduct on the basis that it is sometimes acceptable to swear to false statements if the statements are immaterial. Court found conversely, every statement in the petition was material to a determination by this court in this case. The misrepresentation of the material statements here was outrageous. Citing multiple violations of Disciplinary Rules and finding Baum dishonest held Baum has been professionally irresponsible which has impeded the proper administration of justice.

7-28-08 GMAC v. Remkus

32606/07

NY Supreme

2-2-09 U.S. Bank N.A. v. Guichardo, 22 Misc3d1116(A) 2009 WL 224693 (Supr. Ct. Kings Co. Feb 2, 2009). 5-6-09 HSBC v. Miller 4786-2008

Kings Supreme

Sullivan County

10-29-09 HSBC v. Miller

4786-2008

Sullivan County

11-19-09 Indymac Bank v. Yano Horoski

Suffolk

12-29-09 Citigroup v. Bowling

12817/07

Kings Supreme

7/20/10 HSBC v. Miller

4786-2008

7-22-10 Federal Home Loan Mtge Corp v. Raia, 2010 NY Slip Op 51287(U) [28 Misc 3d 1212(A)] 11/23/10 Federal Home Loan Mtge Corp v. Raia, 2010 NY Slip Op 52003(U) [

SP 002253/10

Nassau Dist Ct

SP 002253/10

Nassau Dist Ct

Page 4 of 6 Found this is not the first time Baum has been unethical. Sanctioned Baum for $19,532.50 J Tanenbaum: Regarding Baum, This Court has repeatedly directed plaintiffs counsel to submit proposed orders of reference and judgments of foreclosure in proper form and counsel has continuously failed to do so and The court deems plaintiffs counsels actions to be an intentional failure to comply with the directions of the Court and a dereliction of professional responsibility. Hon. Cohalen: enforcing Chief Judges 10/20/10 Order for an attorney affirmation of direct review of foreclosure filings, that he has personally reviewed the mortgage, note and any assignments and noted robo-signing is a problem, he stayed this and all below cases until Baum filed the proper affirmation. Same as above Same Same Same Same

11-3-10 Wells Fargo Bank N.A v Sanders

2791-2009

Suffolk Supreme

US Bank Natl Assoc, as Trustee of Asset backed securities v. Hiciano

25473/09

Suffolk

2010 Wells Fargo Bank v. Genneralli et. al. 11/4/10 Wells Fargo Bank v. Descovich 11-3-10 HSBC v Rodriguez 11-3-10 US Bank N.A. v Osorto et al. 11-3-10 Wells Fargo v. Flowers et. al 11-13-10 US Bank NA v Hernandez et al. 11-13-10 Aurora loan Services LLC v. Deamr et. al 11/4/10 Deutsche Bank v. Osman 11/4/10 HSBC v. Hill 11/4/10 HSBC v. Vinas 11/5/10 US Bank NA v. Ferraro 11/5/10 Wells Fargo Bank, NA v. Noble 11/8/10 US Bank Natl Assoc. v. Lee et al. 11/8/10 Chase Home Finance v. Fonseca 11/19/10 Select Portfolio Servicing, Inc. v. Amaya 11/19/10 US Bank Natl Assoc. v. Escobar 12/1/10 HSBC v. Rice 12/1/10 CitiMortgage v. Chopyk 12/1/10 Wells Fargo Bank N.A. v. Liranzo 12/1/10 M&T Trust v. Rodriguez 12/1/10 Bank of America v. Hararah 12/1/10 Wells Fargo Bank NA v. Ventimiglia 12/1/10 Wells Fargo Bank NA v. Carbone 12/1/10 Deutsched Bank Natl

31087/09 20469/09 3434-2009 8347-2009 13588-2009 24299-2009 24492-2008 25227/07 49172/09 11482/10 29554/08 42627/09 17314/09 43054/09 28534/08 41778/09 17638/10 18074/10 18224/09 18304/10 19395/10 19505/10 20180/10 20194/09

Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk

Page 5 of 6 Trust Co. v. Mondela (named per a Trust) 12/1/10 Bank of America (named per a Pooling & Servicing Agreement) v. Strong 12/1/10 Wells Fargo (on behalf of asset backed securities holders) v. Mahmud 12/1/10 Wells Fargo Bank v. Zepernick 12/1/10 Bank of NY,trustee (for assetbacked certificate holders) v. Schevis 12/1/10 Wells Fargo Bank, NA v. Jabbar 12/1/10 Wells Fargo Bank v. Kirkham 12/1/10 Wells Fargo Bank v. Bonilla 12/1/10 Wells Fargo Bank v. Shapiro 12/1/10 Bank of NY v. Hyppolite 12/1/10 Wells Fargo v. Fullan 12/1/10 HSBC, as trustee under Deutsche Loan Trust v. Medrano 12/1/10 New Century Mortgage Corp. v. Jackson 12/1/10 Aurora Loan Srvcs v. Balado 12/1/10 US Bank, NA as Trustee for Asset Backed Securities v. Manzanares 12/1/10 US Bank NA as Trustee for Asset Trust v. Lopez 12/1/10 Everhome Mtg. Co v. Trampe 12/1/10 Deutsche bank as trustees for Asset Backed Certs v. Gray 12/1/10 Indymac v. Fernandez 12/1/10 Wells Fargo Bank v. Beria 12/1/10 US Bank Natl Assocs as Trustee for Morgan Stanley Loan Trust v. Pananma et al. 12/1/10 Wells Fargo Bank, NA v. Condinzio 12/1/10 Wells Fargo Bank as Trustee for Asset Backed Securities v. Dixon 12/1/10 Chase Home Finance, LLC v. Jones 12/1/10 US Natl Trust v. Fitzgerald et. al.

20202/09

Suffolk

20367/10

Suffolk

20456/09 21267/08

Suffolk Suffolk

22003/10 22008/10 22637/10 22841/09 23361/08 25053/09 25246/10

Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk Suffolk

26872/07 28103/08 28197/08

Suffolk Suffolk Suffolk

28284/07

Suffolk

30637/09 31749/08

Suffolk Suffolk

32859/08 34199/09

Suffolk Suffolk

37714/09

Suffolk

38015/09 38335/09

Suffolk Suffolk

42343/09 46461/09

Suffolk Suffolk

Page 6 of 6 12/1/10 UBS Realty Estates Secs Inc v. Roero et al 12/1/10 Wells Fargo Home Mtg Inc v. Tavarez 11/15/10 Wells Fargo v. Eng, HTFC et. al 47357/09 48403/09 39792/07 Suffolk Suffolk Suffolk J. Baisley: Notes Baum represented competing plaintiffs in foreclosure, Wells and HTFC; HTFC president Aron Wider proved that Baums filed papers with a Jeffrey Stephan (who is a Baum attorney) never had authority to represent HTFC nor file an assignment of mortgage from HTFC to Wells. Court found no docs to substantiate Stephan assignment Court found Baum filed a petition of false statements (that) went directly to the heart of the matter of standing. Id. at *2;and the representations in the pleadings were intended to mislead the court regarding standing. The court called Baums actions reprehensible,, Specifically, Baum has recently faced numerous standing issues concerning assignment, for which its cases were dismissed. [See Deutsche Bank Nat. Trust Co.v. McRae, 27 Misc.3d 247, 894 N.Y.S.2d 720 (2010); Citigroup Global Markets Realty Corp. v. Randolph, 2009 N.Y. Slip Op.52567(U) (2009); HSBC Bank USA, Nat. Ass'n v. Miller, 26 Misc.3d 407, 889 N.Y.S.2d 430 (2009).] U.S. Trustee objects to Baum concealing from the court that his attorney Elpiniki M. Bechakas acts as attorney for Baum, signs assignments as an officer of MERS and also acts on behalf of the mortgagee reserved its right to bring further action for Baums misconduct, requested the Bankruptcy Court to sanction Baum to protect the integrity of the bankruptcy system and objected to Baum filing for BAC as creditor when no assignment of both the mortgage and Note Elpiniki M. Bechakas, signs assignments as Assistant Secretary and Vice President of MERS on behalf of the original mortgagee U.S. Trustee reserved its right to bring further action for Baums misconduct, requested the Bankruptcy Court to sanction Baum to protect the integrity of the bankruptcy system and objected to Baum filing for BAC as creditor when no assignment of both the mortgage and Note and Elpiniki M. Bechakas, signs assignments as Assistant Secretary and Vice President of MERS on behalf of the original mortgagee (see Case. No. 10-12856, on the issue of MERS Assignment). J. Schack: dismissed w/prejudice Baums foreclosure filing because he violated court orders and acted with impunity and did not comply with the 10/20/10 Admin Js directive for foreclosure attorneys swearing that to personally reviewing documents and records; confirming the factual accuracy of their court filings and the accuracy of the notarizations in their documents. The court emphasized that "[i]f the credibility of court orders and the integrity of our judicial system are to be maintained, a litigant cannot ignore court orders with impunity [Emphasis added]." (Kihl, 94 NY2d at 123). at 4.

11-23-10 Federal Home Loan Mtg. Corp. v. Raia, 29Misc.3d 1226(A),2010 WL 4750043, 2010 NY Slip Op. 52003(U) (Dist. Ct. Nassau Co. Nov. 23, 2010).

Nassau

1-6-11 In re Bevins

Case#1012856 (REL)

New York SD Bankruptcy

1/6/11 In re Szumowski

Case#1012431 (REL)

New York SD Bankruptcy

1-7-11 Citibank, N.A. v Murillo

16214/08

Kings Supreme

También podría gustarte

- Swindled: If Government is ‘for the people’, Why is the King Wearing No Clothes?De EverandSwindled: If Government is ‘for the people’, Why is the King Wearing No Clothes?Calificación: 5 de 5 estrellas5/5 (2)

- A Compendium of Mortgage CasesDocumento54 páginasA Compendium of Mortgage CasesCarrieonicAún no hay calificaciones

- Foreclosure Defense: Know The Law, The Rules of Evidence, The Rules, The Fact and Don't Give Up.Documento2 páginasForeclosure Defense: Know The Law, The Rules of Evidence, The Rules, The Fact and Don't Give Up.Allen Kaul100% (1)

- Ibanez DecisionDocumento414 páginasIbanez Decisionmike_engle100% (1)

- 6 Case File Montana Paatalo v. J.P. Morgan Chase Motion To Re-Open Discovery Re Inspection of 118 Page Wamu PAADocumento5 páginas6 Case File Montana Paatalo v. J.P. Morgan Chase Motion To Re-Open Discovery Re Inspection of 118 Page Wamu PAADeontos100% (1)

- 8 The Silver Lining in Paatalo v. JPMorgan Chase Bank NA Et AlDocumento3 páginas8 The Silver Lining in Paatalo v. JPMorgan Chase Bank NA Et AlDeontosAún no hay calificaciones

- APPEAL WIN FOR HOMEOWNER - Reversal and Remand Nevada Supreme Court - FOUST V WELLS FARGO, MERS Et Al. July 2011Documento7 páginasAPPEAL WIN FOR HOMEOWNER - Reversal and Remand Nevada Supreme Court - FOUST V WELLS FARGO, MERS Et Al. July 201183jjmack100% (2)

- Tax Consequences For REMIC and REMIC Investors-For Loan ModsDocumento13 páginasTax Consequences For REMIC and REMIC Investors-For Loan Mods83jjmackAún no hay calificaciones

- Cruz V Jpmorgan No Standing Paa and Fdic Assignment Does Not Prove Ownership PDFDocumento7 páginasCruz V Jpmorgan No Standing Paa and Fdic Assignment Does Not Prove Ownership PDFdrattyAún no hay calificaciones

- Washington Mutual (WMI) - Objection of The TPS Consortium To Confirmation PlanDocumento100 páginasWashington Mutual (WMI) - Objection of The TPS Consortium To Confirmation PlanmeischerAún no hay calificaciones

- LYNN E. SZYMONIAK - Trust Assignment Fraud Letter To SEC - 2Documento6 páginasLYNN E. SZYMONIAK - Trust Assignment Fraud Letter To SEC - 2fox23434Aún no hay calificaciones

- WaMu Settlement Date ExtensionDocumento1 páginaWaMu Settlement Date ExtensionForeclosure FraudAún no hay calificaciones

- GCR Nims Amicus BriefDocumento148 páginasGCR Nims Amicus BriefRussinator100% (1)

- Foreclosing On Nothing, Dale WhitmanDocumento51 páginasForeclosing On Nothing, Dale WhitmanMarie McDonnellAún no hay calificaciones

- Fivecoat Foreclosures & FraudDocumento429 páginasFivecoat Foreclosures & FraudAlbertelli_Law100% (1)

- Foreclosure Manual For Judges - Wa AppleseedDocumento240 páginasForeclosure Manual For Judges - Wa AppleseedJanet Reiner100% (1)

- Chase-Wamu Answer To Amended Complaint by Deutsche Bank-Ma 2011 - Fdic Also DefendantDocumento25 páginasChase-Wamu Answer To Amended Complaint by Deutsche Bank-Ma 2011 - Fdic Also Defendant83jjmack100% (1)

- 153 Memorandum of LawDocumento30 páginas153 Memorandum of Lawlarry-612445Aún no hay calificaciones

- m3 JP Morgan Chase Stated in A Fed m3 CT It Is Not Successor in Interest To Wamu Loans and Lawerence Nardi Confirms 10-30-2017Documento4 páginasm3 JP Morgan Chase Stated in A Fed m3 CT It Is Not Successor in Interest To Wamu Loans and Lawerence Nardi Confirms 10-30-2017api-321082827Aún no hay calificaciones

- N.Y.S. Attorney General / Steven J. Baum, Assurance of DiscontinuanceDocumento16 páginasN.Y.S. Attorney General / Steven J. Baum, Assurance of DiscontinuanceMitch Paulsen0% (1)

- James Scheider, Jr. v. Deutsche Bank National Trust, 4th Cir. (2014)Documento13 páginasJames Scheider, Jr. v. Deutsche Bank National Trust, 4th Cir. (2014)Scribd Government DocsAún no hay calificaciones

- States AGs and Mortgage Lenders in Talks Over A Fund To Compensate Victims of Foreclosure Fiasco PaperworkDocumento4 páginasStates AGs and Mortgage Lenders in Talks Over A Fund To Compensate Victims of Foreclosure Fiasco Paperwork83jjmackAún no hay calificaciones

- JPMC and Wamu MTD MPSJDocumento39 páginasJPMC and Wamu MTD MPSJMike MaunuAún no hay calificaciones

- Foreclosure Cross ClaimDocumento14 páginasForeclosure Cross ClaimDwayne ZookAún no hay calificaciones

- Marie McDonnell Affidavit REDocumento8 páginasMarie McDonnell Affidavit REJohn ReedAún no hay calificaciones

- USDC WPB CFPB V OCWEN 17mar21 Motion To ReopenDocumento12 páginasUSDC WPB CFPB V OCWEN 17mar21 Motion To ReopenJaniceWolkGrenadierAún no hay calificaciones

- Washington Mutual Bank FA Status 1996-2007Documento13 páginasWashington Mutual Bank FA Status 1996-2007Brenda ReedAún no hay calificaciones

- Glaski V BOA Published Version-California Court of Appeals Decision - Cert For Pub August 8 2013Documento30 páginasGlaski V BOA Published Version-California Court of Appeals Decision - Cert For Pub August 8 201383jjmackAún no hay calificaciones

- Wendy Traxler Assignment Vice President MERS Mississippi NotarizedDocumento2 páginasWendy Traxler Assignment Vice President MERS Mississippi Notarizedtraderash1020Aún no hay calificaciones

- Paul L. Muckle, Plaintiff vs. The United States of America Et Al.Documento106 páginasPaul L. Muckle, Plaintiff vs. The United States of America Et Al.Foreclosure Fraud100% (1)

- Bayview Loan Servicing, LLC V Bozymowski WDocumento8 páginasBayview Loan Servicing, LLC V Bozymowski WDinSFLAAún no hay calificaciones

- Foreclosure Bench Book2013Documento98 páginasForeclosure Bench Book2013wiquida3213Aún no hay calificaciones

- A159998 OpinionDocumento12 páginasA159998 OpinionDinSFLAAún no hay calificaciones

- Suddenly Appearing EndorsementsDocumento12 páginasSuddenly Appearing EndorsementsAC Field100% (10)

- Florida 4th DCA Reverses ForeclosuresDocumento9 páginasFlorida 4th DCA Reverses ForeclosuresHelpin HandAún no hay calificaciones

- Why IndyMac and OneWest Avoid Loan ModsDocumento9 páginasWhy IndyMac and OneWest Avoid Loan Modstraderash1020Aún no hay calificaciones

- Nationwide Title Clearing Cease and Desist ExhibitsDocumento33 páginasNationwide Title Clearing Cease and Desist ExhibitsForeclosure Fraud100% (1)

- SHAM ASSIGNMENTS - McDonnell Amicus Supp Brief As Filed 1-30-2012 in Eaton V FNMADocumento69 páginasSHAM ASSIGNMENTS - McDonnell Amicus Supp Brief As Filed 1-30-2012 in Eaton V FNMA83jjmack100% (2)

- Memorandum of Points and Authorities in Support of Its Motion For Partial Summary Judgment Dismissing All Claims Against JPMCDocumento48 páginasMemorandum of Points and Authorities in Support of Its Motion For Partial Summary Judgment Dismissing All Claims Against JPMCmeischerAún no hay calificaciones

- Title and Foreclosure LitigationDocumento4 páginasTitle and Foreclosure LitigationJohn Reed100% (2)

- MERS V Cabrera Order of Dismissal Judge Jon Gordon Miami Dade Co FLDocumento17 páginasMERS V Cabrera Order of Dismissal Judge Jon Gordon Miami Dade Co FLWilliam A. Roper Jr.Aún no hay calificaciones

- William Roberts Vs America's Wholesale Lender Appellant's OpeningDocumento23 páginasWilliam Roberts Vs America's Wholesale Lender Appellant's Openingforeclosurelegalrigh100% (1)

- Doble V Deutsche BankDocumento14 páginasDoble V Deutsche BankRobert SalzanoAún no hay calificaciones

- Motion - Substantiated Allegations of Foreclosure Fraud That Implicates The Florida Attorney General's Office and The Florida Default Law GroupDocumento38 páginasMotion - Substantiated Allegations of Foreclosure Fraud That Implicates The Florida Attorney General's Office and The Florida Default Law GroupForeclosure Fraud100% (1)

- U.S. Bank National Association As Trustee v. Toni Ascenzia Et AlDocumento3 páginasU.S. Bank National Association As Trustee v. Toni Ascenzia Et AlForeclosure Fraud100% (3)

- Zarro Inference 1 Report of The Special Master Concerning Jpmorgan Chase Bank and Chase Home Finance - Aug 15, 2011Documento30 páginasZarro Inference 1 Report of The Special Master Concerning Jpmorgan Chase Bank and Chase Home Finance - Aug 15, 2011DeontosAún no hay calificaciones

- Complaint RICO Case Against JP Morgan-Chase - LINDA ZIMMERMAN V JPMORGAN CHASE BANK NA Foreclosure Fraud - Fighting Foreclosure Fraud by Sharing The KnowledgeDocumento16 páginasComplaint RICO Case Against JP Morgan-Chase - LINDA ZIMMERMAN V JPMORGAN CHASE BANK NA Foreclosure Fraud - Fighting Foreclosure Fraud by Sharing The Knowledgefreddiefletcher24830% (1)

- Westlaw - Deutsche v. Suttles - PSA Plaintiff Response Aff Def.Documento3 páginasWestlaw - Deutsche v. Suttles - PSA Plaintiff Response Aff Def.PWOODSLAWAún no hay calificaciones

- After The Storm FinalDocumento106 páginasAfter The Storm FinalNye Lavalle100% (2)

- HSBC Bank's Standing to Bring Foreclosure Case QuestionedDocumento11 páginasHSBC Bank's Standing to Bring Foreclosure Case QuestionedSampall100% (1)

- Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetDe EverandQuantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetAún no hay calificaciones

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1151De EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1151Aún no hay calificaciones

- Foreclosure Fraud 101Documento7 páginasForeclosure Fraud 101Charlton Butler100% (1)

- BAUM Assignment of Mortgage But Not The Note BankruptcyDecisionsOverviewDocumento9 páginasBAUM Assignment of Mortgage But Not The Note BankruptcyDecisionsOverviewwingandaprayerAún no hay calificaciones

- United States Bankruptcy Court HSBC Adv CLDocumento6 páginasUnited States Bankruptcy Court HSBC Adv CLroberts101Aún no hay calificaciones

- Foreclosure Motion To Dismiss - Lack of StandingDocumento10 páginasForeclosure Motion To Dismiss - Lack of StandingDwayne Zook100% (3)

- Section CDocumento16 páginasSection CForeclosure Fraud100% (3)

- Gregory Johnson V HSBC Bank - Big Win For Homeonwer - CA FEDERAL COURT-HOW TO USE SECURITIZATION IN YOUR COURT CASEDocumento11 páginasGregory Johnson V HSBC Bank - Big Win For Homeonwer - CA FEDERAL COURT-HOW TO USE SECURITIZATION IN YOUR COURT CASE83jjmack100% (3)

- Chisholm V GeorgiaDocumento59 páginasChisholm V Georgiapano2012100% (1)

- Affidavit of Elaina Saperstein regarding rights and lawful processDocumento2 páginasAffidavit of Elaina Saperstein regarding rights and lawful processpano2012100% (1)

- Tennessee Vs Mers Mortgage Electronic Registration Systems April 20 2010 RECORDING FRAUD FRAUD SHAMDocumento15 páginasTennessee Vs Mers Mortgage Electronic Registration Systems April 20 2010 RECORDING FRAUD FRAUD SHAMpano2012Aún no hay calificaciones

- Judge Schack - U.S. Bank, N.A. V EmmanuelDocumento7 páginasJudge Schack - U.S. Bank, N.A. V EmmanuelForeclosure FraudAún no hay calificaciones

- Campbell v. Steven J. Baum, MERSCORP Inc. NY CLASS ACTIONDocumento17 páginasCampbell v. Steven J. Baum, MERSCORP Inc. NY CLASS ACTIONDinSFLA0% (1)

- Khurana - Life and AutonomyDocumento35 páginasKhurana - Life and AutonomyAndrius DovydėnasAún no hay calificaciones

- Unit 2 Looking at OthersDocumento25 páginasUnit 2 Looking at OthersTipa JacoAún no hay calificaciones

- Drama tiktbt notesDocumento3 páginasDrama tiktbt notestedjackson608Aún no hay calificaciones

- Case Studies Class 11 Chapter 2Documento18 páginasCase Studies Class 11 Chapter 2Abhishek Jain100% (11)

- Classification of Consumer GoodsDocumento5 páginasClassification of Consumer GoodsSana KhanAún no hay calificaciones

- Sapexercisegbi FiDocumento18 páginasSapexercisegbi FiWaqar Haider AshrafAún no hay calificaciones

- 518pm31.zahoor Ahmad ShahDocumento8 páginas518pm31.zahoor Ahmad ShahPrajwal KottawarAún no hay calificaciones

- How To Write An ArticleDocumento9 páginasHow To Write An ArticleNati PesciaAún no hay calificaciones

- Sūrah al-Qiyamah (75) - The ResurrectionDocumento19 páginasSūrah al-Qiyamah (75) - The ResurrectionEl JuremAún no hay calificaciones

- LEOSA (2law Enforcement Officers Safety Act Frequently Asked QuestionsDocumento6 páginasLEOSA (2law Enforcement Officers Safety Act Frequently Asked QuestionsElaine VechorikAún no hay calificaciones

- Urban and Regional Planning Origins and Pioneering ThinkersDocumento5 páginasUrban and Regional Planning Origins and Pioneering ThinkersALFRED BERNARDINOAún no hay calificaciones

- Sexual Education in Malaysia. Acceptance or Rejection?Documento15 páginasSexual Education in Malaysia. Acceptance or Rejection?James AdrianAún no hay calificaciones

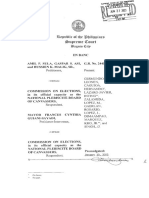

- Manifestation With Motion To AdmitDocumento4 páginasManifestation With Motion To AdmitAron Panturilla100% (2)

- Ilé-Ifè: : The Place Where The Day DawnsDocumento41 páginasIlé-Ifè: : The Place Where The Day DawnsAlexAún no hay calificaciones

- A BrewpubDocumento3 páginasA Brewpubjhanzab50% (4)

- MCVPN OvDocumento25 páginasMCVPN Ovuzaheer123Aún no hay calificaciones

- The Fair Debt Collection Practices ActDocumento7 páginasThe Fair Debt Collection Practices ActJohnson DamitaAún no hay calificaciones

- 40 Rabbana DuasDocumento3 páginas40 Rabbana DuasSean FreemanAún no hay calificaciones

- ResearchGate publication on key differences between salvage and towage contractsDocumento5 páginasResearchGate publication on key differences between salvage and towage contractsImran ur RehmanAún no hay calificaciones

- IARCS Learning MapDocumento174 páginasIARCS Learning MapAnh Tuan PhanAún no hay calificaciones

- Full Link Download Solution ManualDocumento36 páginasFull Link Download Solution Manualrobert.doyle368100% (12)

- GR 244587 2023Documento22 páginasGR 244587 2023marvinnino888Aún no hay calificaciones

- Digital Citizen and NetiquetteDocumento10 páginasDigital Citizen and NetiquetteKurt Lorenz CasasAún no hay calificaciones

- Camelot RulebookDocumento20 páginasCamelot RulebookAlex Vikingoviejo SchmidtAún no hay calificaciones

- Cracking Sales Management Code Client Case Study 72 82 PDFDocumento3 páginasCracking Sales Management Code Client Case Study 72 82 PDFSangamesh UmasankarAún no hay calificaciones

- NewsRecord15 01 28Documento12 páginasNewsRecord15 01 28Kristina HicksAún no hay calificaciones

- Marine Elevator Made in GermanyDocumento3 páginasMarine Elevator Made in Germanyizhar_332918515Aún no hay calificaciones

- 063 Coquia V Fieldmen's InsuranceDocumento2 páginas063 Coquia V Fieldmen's Insurancekeith105Aún no hay calificaciones

- JordanugaddanDocumento2 páginasJordanugaddanJordan UgaddanAún no hay calificaciones

- Assessment of Diabetes Mellitus Prevalence and Associated Complications Among Patients at Jinja Regional Referral HospitalDocumento10 páginasAssessment of Diabetes Mellitus Prevalence and Associated Complications Among Patients at Jinja Regional Referral HospitalKIU PUBLICATION AND EXTENSIONAún no hay calificaciones