Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Retirement Under The Age Discrimination Regulations

Cargado por

shahzadshahDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Retirement Under The Age Discrimination Regulations

Cargado por

shahzadshahCopyright:

Formatos disponibles

Retirement under the Age Discrimination Regulations As we mentioned earlier this year, one of the most significant additions

to legislation that may affect your business is the Employment Equality (Age) Regulations. The final draft of the Regulations has been approved by Parliament and ACAS has now published a guide for employers entitled Age and the Workplace. The Regulations will outlaw age discrimination in recruitment, promotion and training. This e-mail focuses on retirement, which has become one of the most technical aspects of the Regulations. We will keep you informed of other aspects of the Regulations in future e-mail updates. The Regulations come into force on 1st October 2006. There are three significant changes to the law relating to retirement. The Regulations introduce a default retirement age of 65 (to be reviewed in 2011) and a retirement procedure. They also abolish the upper age limit for claims of unfair dismissal. 1 When can I retire my employees?

With a new default retirement age of 65, the Regulations require that employers must objectively justify earlier retirement ages. Retirement at the age of 65 may in certain circumstances also be unlawful. Before 65? It will still be possible to have a retirement age below 65. However, you will have to provide an objective justification as to why your business requires an earlier retirement age, otherwise the retirement will be an automatically unfair dismissal and age discriminatory. An objective justification is defined as a proportionate means of achieving a legitimate aim and needs to be proven. Neither the DTI Guidance on the Regulations nor the ACAS guide venture to provide any example of what would be an objective justification for a retirement age below 65. We looked for guidance from countries that have already introduced age discrimination legislation, it was not encouraging. For example, in an Australian case, it was decided that the retirement of a 60-year-old pilot was unlawful, despite the fact that it was in compliance with an international rule that prevents pilots above the age of 60 from holding a pilot licence. We think that in the UK justifying a pre-65 mandatory retirement age is likely to be

very difficult in all but the most exceptional of cases.

The most cautious course of action is not to set a retirement age below 65. Should you need to do so, we recommend that you speak to us about your retirement age.

At 65? Whilst the legislation introduces a default retirement age of 65, retirement at 65 will not always be fair. Prior to the Regulations, an employee needed to be younger than 65 or younger than the normal retirement age applicable in the company (NRA) to claim unfair dismissal. The NRA could be above 65. Under the Regulations, the default retirement is 65 or the NRA. What is a companys NRA? The age at which employees at a particular role or level in a company are normally retired. For example, although your contracts set the retirement age at 65, custom and practice in your company is that most of your managers work until the age of 68. This means that you will not be able to compel a manager to retire at 65, because your NRA will be considered to be 68. As you will appreciate, there may be more than one NRA in your business. The Regulations have not done away with the idea of having an NRA, and if you do compel an employee to retire before the NRA, even if it is after the default retirement age of 65, it could still be an unfair dismissal and age discriminatory. 2 What Retirement Procedure do I use?

Employers are now expected to plan their employees retirement by following a procedure. This procedure applies no matter the retirement age selected. It is modelled on the existing procedure for dealing with requests for flexible working, with one significant difference. Unlike the request for flexible working, a refusal to allow some one to work beyond the NRA does not have to be justified. The procedure requires that before retiring an employee, you must notify the employee in writing no more than 12 months and no less than 6 months before retirement is due of: his or her impending retirement; and

his or her right to request to continue working longer.

If you do not notify in the correct time, the employee could ask the employment tribunals to make an award of compensation of up to 8 weeks pay. A weeks pay is currently capped at 290. What happens if I dont notify in time? Although you may have missed the six month deadline, all is not lost. The failure to notify by the deadline is not fatal to the fairness of the dismissal, so long as you remember to notify at least two weeks before the date you have set for the retirement. However, if you have not notified at all and have missed the two week deadline, and go on to compel a retirement, the retirement will be considered as an automatically unfair dismissal. If you have missed all the deadlines, it would be advisable to delay the retirement and take advice on how to go through some form of notification process. What do I do if an employee asks to continue to work? If an employee exercises his or her right to request to continue to work longer, you must consider the request without unreasonable delay. To do so, you will be expected to organise a meeting to discuss the request, and, within 14 days of the meeting, set out your answer to the request in writing. If you refuse the request, you must confirm in writing the date on which the retirement will take effect and set out the appeal procedure. The appeal should be heard by a more senior manager who did not take part in the decision to refuse the request. You do not need to explain why you are rejecting the request, and our advice would be to give no explanation as if you give an explanation, the employee may wish to challenge it. If one of your employees is due to retire soon after 1st October 2006, you will not have the time to follow the notification procedure. There are transitional arrangements for retirements between 1st October 2006 and 30th April 2007. 3 Can my decision be challenged?

Before 1st October 2006, employees older than the state retirement age or a companys NRA cannot bring a claim for unfair dismissal. From 1st October, they will be able to do so. During the consultation on the draft Regulations, the Government found itself faced with some strong and conflicting views on retirement. There was opposition to the idea of any compulsory retirement age and support for the idea that any termination of employment at any age could be unfair. This group were successful in persuading the Government to abolish the upper age limit for unfair dismissal, but they were not the winners in the lobbying exercise. The groups supporting a compulsory retirement age were the clear winners since not only did they get a state retirement age of 65, not 70 (granted this will be reviewed in 5 years) but more importantly, they made a significant change to the draft version of the Regulations. Originally, the draft Regulations stated that employers were required to consider a request to continue to work in good faith. This was amended after consultation to say that the request should be considered within a reasonable period. As a consequence, the retirement provisions have become merely procedural. Employers are not compelled to explain a decision to reject a request. This means that if the reason for the termination of employment is retirement at 65 or the NRA and the procedure has been followed, the tribunals are going to have very little opportunity to decide that a retirement was unfair. There will be a strong presumption that the termination was for genuine retirement if an employer complies with the procedure. An employee will be able to claim unfair dismissal but his burden of proof if the procedure is followed will be very heavy. The consultation documents gave two examples of when a planned retirement could be considered unfair. Where you retire an employee while you are in the midst of a redundancy exercise that could potentially affect that employee, and where you retire an employee during a performance or conduct process. We are expecting to see tribunal claims over the next few years that help establish just how far the tribunals

will be able to look beyond the decision to retire an employee. We will keep you posted. For more specific information or to discuss your requirements please call either Amanda Galashan or Julie Calleux at EmployEase on 0207 831 5052, or email us at info@employease.co.uk. We hope you find this update useful. Should you wish to unsubscribe from this free update, please email us at the above address and your name will be removed. This email does not constitute legal advice on any particular situation you may have. EmployEase 2007

También podría gustarte

- Retirement Letter SampleDocumento2 páginasRetirement Letter SampleTAún no hay calificaciones

- Countdown To October 2011Documento2 páginasCountdown To October 2011Constructing EqualityAún no hay calificaciones

- Article - So You Have To Downsize - 2008 - MEGDocumento4 páginasArticle - So You Have To Downsize - 2008 - MEGsimmi2768Aún no hay calificaciones

- Constructive DismissalDocumento2 páginasConstructive DismissalEstela BenegildoAún no hay calificaciones

- 5 When Your Job EndsDocumento2 páginas5 When Your Job EndsEnggel Bernabe100% (1)

- Forward With Fairness Regime - Summary of The Fair Work Act: Unfair DismissalDocumento9 páginasForward With Fairness Regime - Summary of The Fair Work Act: Unfair Dismissalapi-15662010Aún no hay calificaciones

- Law Assignment 2.Documento8 páginasLaw Assignment 2.Shivani JatakiyaAún no hay calificaciones

- Have You Lost Your JobDocumento28 páginasHave You Lost Your Jobeverlord123Aún no hay calificaciones

- Jobseeker's Allowance: Help While You Look For WorkDocumento24 páginasJobseeker's Allowance: Help While You Look For Worklearningcurveasia3076Aún no hay calificaciones

- Guide To HR Policies and Legal 101 For HR Managers in M'siaDocumento14 páginasGuide To HR Policies and Legal 101 For HR Managers in M'siaHarsimran Kaur Virk100% (1)

- Statement of Terms and ConditionsDocumento3 páginasStatement of Terms and Conditionspyrelight0Aún no hay calificaciones

- Textbook of Urgent Care Management: Chapter 15, Human Resources Overview: Key Labor and Employment IssuesDe EverandTextbook of Urgent Care Management: Chapter 15, Human Resources Overview: Key Labor and Employment IssuesAún no hay calificaciones

- Could That Happen To MeDocumento2 páginasCould That Happen To MeNeeoila Cl.Aún no hay calificaciones

- Jobseeker's Allowance: Help While You Look For WorkDocumento24 páginasJobseeker's Allowance: Help While You Look For Workbillah786Aún no hay calificaciones

- Assignment 5 - Wrongful DismissalDocumento3 páginasAssignment 5 - Wrongful DismissalAraceli Gloria-Francisco100% (1)

- Dismissal Procedures: Claims For Unfair DismissalDocumento6 páginasDismissal Procedures: Claims For Unfair Dismissalsaurav0000Aún no hay calificaciones

- Mem Work Systems 2 Pre 844Documento35 páginasMem Work Systems 2 Pre 844Georgina SuleAún no hay calificaciones

- Debate 4Documento4 páginasDebate 4Gem KrisnaAún no hay calificaciones

- Retirement Planning ChecklistDocumento17 páginasRetirement Planning ChecklistDavid Caruso100% (3)

- Assignment 2 - Termination of EmploymentDocumento5 páginasAssignment 2 - Termination of EmploymentAraceli Gloria-FranciscoAún no hay calificaciones

- Offer Letter TemplateDocumento6 páginasOffer Letter Templateyashika swamiAún no hay calificaciones

- Sample LawDocumento22 páginasSample LawrewathyAún no hay calificaciones

- Labor Law DukaDocumento7 páginasLabor Law DukaJolas E. BrutasAún no hay calificaciones

- General Principles of The Labor CodeDocumento29 páginasGeneral Principles of The Labor Coderamil manlunasAún no hay calificaciones

- Unfair Dismissal RevisedDocumento16 páginasUnfair Dismissal RevisedSani AhamedAún no hay calificaciones

- Learn How To Claim The Unpaid Salary From Your CompanyDocumento1 páginaLearn How To Claim The Unpaid Salary From Your CompanyNitesh PatraAún no hay calificaciones

- 362413-Radoi 2Documento11 páginas362413-Radoi 2Adrian RadoiAún no hay calificaciones

- Unit 12 - Managing Within The LawDocumento30 páginasUnit 12 - Managing Within The LawChaw Yati KyawAún no hay calificaciones

- Attendance & Leave PolicyDocumento5 páginasAttendance & Leave Policyमहाराष्ट्र माझाAún no hay calificaciones

- Pathways - CPP ChangesDocumento2 páginasPathways - CPP Changesarsenic210Aún no hay calificaciones

- TERMINATION OF EMPLOYMENT (Real)Documento14 páginasTERMINATION OF EMPLOYMENT (Real)FahadAún no hay calificaciones

- Directors - Briefing - Employment Law The BasicsDocumento4 páginasDirectors - Briefing - Employment Law The Basicsh_20Aún no hay calificaciones

- For The People, Sept/Oct 2010Documento4 páginasFor The People, Sept/Oct 2010perfectpeoplesolsAún no hay calificaciones

- Contract of Employment - Valentin Ganchev - 220729 - 150023Documento9 páginasContract of Employment - Valentin Ganchev - 220729 - 150023Valentin GanchevAún no hay calificaciones

- Suspension: Art. 18 (1) LP & Art.45 (1) FCSPDocumento15 páginasSuspension: Art. 18 (1) LP & Art.45 (1) FCSPJøñë ÊphrèmAún no hay calificaciones

- Employment Contract ProbationaryDocumento2 páginasEmployment Contract Probationarygina100% (1)

- MIL Labor Law Essentials by Pyke LaygoDocumento24 páginasMIL Labor Law Essentials by Pyke LaygoMycor Castillo OpsimaAún no hay calificaciones

- Termination of Employment 2013Documento7 páginasTermination of Employment 2013Terry LollbackAún no hay calificaciones

- How To Employ Your Own Boss THE ULTIMATE GUIDE How To Move From Being An Employee to EmployerDe EverandHow To Employ Your Own Boss THE ULTIMATE GUIDE How To Move From Being An Employee to EmployerAún no hay calificaciones

- Appointment Letter Krazy IT Corrected Paper For FARJANA ISLAMDocumento10 páginasAppointment Letter Krazy IT Corrected Paper For FARJANA ISLAMFahim hassanAún no hay calificaciones

- Dissertation On Zero Hour ContractsDocumento7 páginasDissertation On Zero Hour ContractsHelpWithCollegePapersCanada100% (1)

- Hawkinge Employment ContractDocumento7 páginasHawkinge Employment ContractMadalina Maria MAún no hay calificaciones

- Statement of Terms and Conditions of EmploymentDocumento9 páginasStatement of Terms and Conditions of EmploymentfafelofidAún no hay calificaciones

- Phillippines Labor CodeDocumento3 páginasPhillippines Labor CodeTurboyNavarroAún no hay calificaciones

- The CYA Guide to Payroll and HRThe CYA Guide to Payroll and HRDe EverandThe CYA Guide to Payroll and HRThe CYA Guide to Payroll and HRAún no hay calificaciones

- Job Offer Lette2 (1) 2021Documento4 páginasJob Offer Lette2 (1) 2021James GassettAún no hay calificaciones

- Canadian - Agreement - Cep Experts - Construction)Documento7 páginasCanadian - Agreement - Cep Experts - Construction)Marcus AntoniusAún no hay calificaciones

- Constructive Dismissal Means That Even Though Your Employer Did Not Say You Were FiredDocumento8 páginasConstructive Dismissal Means That Even Though Your Employer Did Not Say You Were FiredParalegal JGGCAún no hay calificaciones

- Simple Appointment Letter FormatDocumento4 páginasSimple Appointment Letter FormatpritamjaanAún no hay calificaciones

- Century LinkDocumento6 páginasCentury LinkZiaul HaqAún no hay calificaciones

- 29 December 2021 Shubham Kumar Behind Hotel Corbet Madhuban Nag Ar Kashipur Dear ShubhamDocumento6 páginas29 December 2021 Shubham Kumar Behind Hotel Corbet Madhuban Nag Ar Kashipur Dear ShubhamShubham ChauhanAún no hay calificaciones

- A Simple Fair Dismissal System For Small BusinessDocumento10 páginasA Simple Fair Dismissal System For Small BusinessHumayun KhanAún no hay calificaciones

- Privatization Refers To The Rise of NeoDocumento5 páginasPrivatization Refers To The Rise of Neoadnan parvezAún no hay calificaciones

- Separation/Termination of Employment Policy SampleDocumento4 páginasSeparation/Termination of Employment Policy SampleferAún no hay calificaciones

- The Book of Answers for Federal Employees and Retirees - New 4th EditionDe EverandThe Book of Answers for Federal Employees and Retirees - New 4th EditionAún no hay calificaciones

- Mem Work Systems 844Documento137 páginasMem Work Systems 844Georgina SuleAún no hay calificaciones

- GWEI - Samantha A. Rivera PDFDocumento2 páginasGWEI - Samantha A. Rivera PDFLms LmsAún no hay calificaciones

- Offer Letter-AbhishekDocumento17 páginasOffer Letter-AbhishekVikas ChaudharyAún no hay calificaciones

- Frequently Asked Questions and Answers About Vermont'S "Earned Sick Time Law,"Documento6 páginasFrequently Asked Questions and Answers About Vermont'S "Earned Sick Time Law,"Will PearsallAún no hay calificaciones

- Final Pay COE Demand LetterDocumento2 páginasFinal Pay COE Demand LetterMartin SandersonAún no hay calificaciones

- Spare Parts Documentation: TD10004553 EN 00Documento69 páginasSpare Parts Documentation: TD10004553 EN 00Emon Sharma100% (1)

- Auditing Integrated Management System (ISO 9001:2015, ISO 14001:2015 & BS OHSAS 18001:2007)Documento50 páginasAuditing Integrated Management System (ISO 9001:2015, ISO 14001:2015 & BS OHSAS 18001:2007)WaliAún no hay calificaciones

- Chenrezi Sadhana A4Documento42 páginasChenrezi Sadhana A4kamma100% (7)

- Aryaman Gupta: EducationDocumento1 páginaAryaman Gupta: EducationxoteviAún no hay calificaciones

- RAW TM & HM Users Manual V 11Documento8 páginasRAW TM & HM Users Manual V 11arcangelus22Aún no hay calificaciones

- Formulating Affective Learning Targets: Category Examples and KeywordsDocumento2 páginasFormulating Affective Learning Targets: Category Examples and KeywordsJean LabradorAún no hay calificaciones

- What Is Immediate Assignment in GSMDocumento9 páginasWhat Is Immediate Assignment in GSMLindux50% (2)

- Areopagitica - John MiltonDocumento1 páginaAreopagitica - John MiltonwehanAún no hay calificaciones

- Stock Control Management SyestemDocumento12 páginasStock Control Management SyestemJohn YohansAún no hay calificaciones

- Frugal Innovation in Developed Markets - Adaption o - 2020 - Journal of InnovatiDocumento9 páginasFrugal Innovation in Developed Markets - Adaption o - 2020 - Journal of InnovatiGisselle RomeroAún no hay calificaciones

- Handouts For Module 1 Introduction To EthicsDocumento36 páginasHandouts For Module 1 Introduction To EthicsZerimar Dela CruzAún no hay calificaciones

- Tumor Suppressor Gene & Proto-OncogeneDocumento61 páginasTumor Suppressor Gene & Proto-OncogeneKartthik ShanmugamAún no hay calificaciones

- Lampiran 18-Lesson Plan 02Documento5 páginasLampiran 18-Lesson Plan 02San Louphlii ThaAún no hay calificaciones

- 04 TP FinancialDocumento4 páginas04 TP Financialbless erika lendroAún no hay calificaciones

- Transform Your Appraisal Management Process: Time-Saving. User-Friendly. Process ImprovementDocumento10 páginasTransform Your Appraisal Management Process: Time-Saving. User-Friendly. Process ImprovementColby EvansAún no hay calificaciones

- Written Test 4-Book 3Documento2 páginasWritten Test 4-Book 3Vinícius MoreiraAún no hay calificaciones

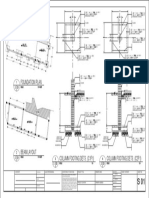

- Foundation Plan: Scale 1:100 MTSDocumento1 páginaFoundation Plan: Scale 1:100 MTSJayson Ayon MendozaAún no hay calificaciones

- 4 Economics Books You Must Read To Understand How The World Works - by Michelle Middleton - Ascent PublicationDocumento10 páginas4 Economics Books You Must Read To Understand How The World Works - by Michelle Middleton - Ascent Publicationjayeshshah75Aún no hay calificaciones

- The Basics of Effective Interpersonal Communication: by Sushila BahlDocumento48 páginasThe Basics of Effective Interpersonal Communication: by Sushila BahlDevesh KhannaAún no hay calificaciones

- Mercury and The WoodmanDocumento1 páginaMercury and The WoodmanLum Mei YeuanAún no hay calificaciones

- CV BTP AhokDocumento2 páginasCV BTP AhokDiah Purwati N.Aún no hay calificaciones

- TS-1326 (21581) MS For Dismantling Temporary Steel Platform at Grid P-7 To P-8 & P-AC To PTI-ADocumento21 páginasTS-1326 (21581) MS For Dismantling Temporary Steel Platform at Grid P-7 To P-8 & P-AC To PTI-AJiabing ZouAún no hay calificaciones

- (Downloadsachmienphi.com) Bài Tập Thực Hành Tiếng Anh 7 - Trần Đình Nguyễn LữDocumento111 páginas(Downloadsachmienphi.com) Bài Tập Thực Hành Tiếng Anh 7 - Trần Đình Nguyễn LữNguyên NguyễnAún no hay calificaciones

- Pegasus W200Documento56 páginasPegasus W200Aleixandre GomezAún no hay calificaciones

- 2003catalog PDFDocumento25 páginas2003catalog PDFPH "Pete" PetersAún no hay calificaciones

- IOCL JEA Recruitment 2021: Notification For 500+ Post, Apply Online From 21 SeptemberDocumento10 páginasIOCL JEA Recruitment 2021: Notification For 500+ Post, Apply Online From 21 SeptemberRajesh K KumarAún no hay calificaciones

- Introduction To Personal FinanceDocumento15 páginasIntroduction To Personal FinanceMa'am Katrina Marie MirandaAún no hay calificaciones

- Dbms QuoteDocumento2 páginasDbms QuoteAnonymous UZFenDTNMAún no hay calificaciones

- Dior Product Development PresentationDocumento59 páginasDior Product Development PresentationSade WycheAún no hay calificaciones

- Tazkira Mujaddid AlfesaniDocumento53 páginasTazkira Mujaddid AlfesanisayedAún no hay calificaciones