Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Syllabus 30151

Cargado por

rmd1990Descripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Syllabus 30151

Cargado por

rmd1990Copyright:

Formatos disponibles

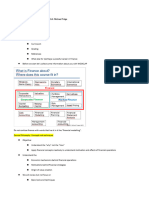

Principles of International Finance (30151)

Professor: Office: Office hours: Teaching assistant:

Linus Siming (linus.siming@unibocconi.it) Room 02-E2-04 in Via Rntgen building Wednesdays 09.00-11.00, email me in advance to book a slot Madina Karamysheva (madina.karamysheva@phd.unibocconi.it)

The aim of this course is to give a very broad picture about international finance management moving from the needs of the firm in terms of financing and corporate advisory services (demand-side approach) to the analysis of investment banking offerings (supply-side approach). The first part of the course covers crucial topics of corporate finance, such as the demand for equity and debt financing, and the market for corporate control (M&A). The second part focuses on the investment banks organizational structure and the products they offer such as M&A advisory services, issuance of equity, bonds and convertibles, and sales and trading. In addition, new, innovative Wall Street securities and advisory products will be reviewed. The whole structure of the course is applied, involves real-world examples and is oriented to develop capabilities to understand and use methodologies and practices used on global financial markets. Course Prerequisites: Knowledge of the basic topics covered in corporate finance and valuation courses, such as Bocconi courses 30017 and 30149 Required Books: Investment Banking, Hedge Funds and Private Equity: The New Paradigm, by David P. Stowell (2010, Academic Press, Elsevier Inc.) Principles of Corporate Finance, by Richard A. Brealey, Stewart C. Myers, Franklin Allen (McGraw-Hill Companies) Non-required Book (Just for fun): Monkey Business: Swinging Through the Wall Street Jungle, by John Rolfe and Peter Troob, (Business Plus) Grading: Final exam 1.5 hours Closed book Multiple choice questions and open questions

COURSE CONTENT SUMMARY BMA: indicates the relevant chapters in the 10th edition of Principles of Corporate Finance S: indicates the relevant chapters in Investment Banks, Hedge Funds and Private Equity: The New Paradigm Part One (Corporate Finance) 1. Demand for financing (BMA: 14, 15): Demand for equity Demand for debt 2. Mergers, corporate control and governance (BMA: 31, 33): Mergers Corporate control and governance Part Two (Investment Banking) 1. Financial markets and the interaction between firms and investment banks (S: I1, III-1): The business system of investment banking Case study discussion: Rise and fall of Bear Sterns 2. Regulation and supervision of investment banking activities: (S: I-2, III-2): Overview of regulation in US, UK, Japan and China Case study discussion: A Brave New World 3. Corporate lending activity (S: I-3): Medium and long term financing and planning of debt Different sell-side processes Techniques of syndication 4. Capital markets (S: I-8, II-13, III-3): Underwriting and selling bonds and equities in domestic and international markets IPO and follow-on equity offerings Convertibles and debt transactions Public versus private equity Euromarkets Case study discussion: Freeport-McMoRan, financing an acquisition 5. Corporate finance services (S: I-4, III-4): Advisory & arranging in M&A Cross-border M&A M&A in Japan and Emerging markets (Russia, Brazil, India, China) Case study discussion: ServiceCo Advisory & arranging in corporate restructuring deals Advisory services for corporate governance Case study discussion: Procter and Gambles acquisition of Gillette 6. Other investment banking activities (S: I-5, I-6): Sales,Trading Asset management Research Wall Street innovations

Lecture 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Date 13/2 16/2 20/2 23/2 27/2 1/3 5/3 8/3 12/3 15/3 19/3 22/3 23/4 26/4 3/5 7/5 10/5 14/5 17/5 21/5 24/5 28/5 31/5 4/6 11/6 9/7 10/9

Topic Course introduction. Corporate financing overview Security issuance overview Market for corporate control Market for corporate control, international perspective Overview of investment banking Case discussion: Investment banking in 2008: Rise and fall of the bear Regulation of the investment banking industry in US, UK, Japan and China Case discussion: Investment banking in 2008: A brave new world case Financings for corporate and government clients Financings for corporate and government clients continued Case discussion: Freeport-McMoRan case: financing an acquisition Advising in mergers and acquisitions Advising in mergers and acquisitions continued Case discussion: Case: Procter & Gambles acquisition of Gillette Sales and Trading Sales and Trading continued Case discussion: A tale of two hedge funds: Magnetar and Peloton Case discussion: Kmart, Sears, and ESL: how a hedge fund became one of the worlds largest retailers Asset management, wealth management, research Credit rating agencies, exchanges, clearing and settlement Investment banking in an international perspective Wall Street innovations Recent developments and current issues Review session Exam Exam Exam

Reading BMA: Ch.14 BMA: Ch.15 BMA: Ch. 31 BMA: Ch. 33 Stowell: Ch. 1 Stowell: Case 1 Stowell: Ch. 2 Stowell: Case 2 Stowell: Ch. 3 Stowell: Ch. 3 Stowell: Case 3 Stowell: Ch.4 Stowell: Ch.4 Stowell: Case 4 Stowell: Ch. 5 Stowell: Ch. 5 Stowell: Case 5 Stowell: Case 6 Stowell: Ch. 6 Stowell: Ch. 7 Stowell: Ch. 8 Stowell: Ch. 9 Stowell: Ch. 10 -

All classes are held in Aula Perego

También podría gustarte

- An Introduction to Investment Banks, Hedge Funds, and Private EquityDe EverandAn Introduction to Investment Banks, Hedge Funds, and Private EquityCalificación: 4.5 de 5 estrellas4.5/5 (2)

- The Crisis of Crowding: Quant Copycats, Ugly Models, and the New Crash NormalDe EverandThe Crisis of Crowding: Quant Copycats, Ugly Models, and the New Crash NormalAún no hay calificaciones

- The Capital Markets: Evolution of the Financial EcosystemDe EverandThe Capital Markets: Evolution of the Financial EcosystemAún no hay calificaciones

- A Pragmatist’s Guide to Leveraged Finance: Credit Analysis for Below-Investment-Grade Bonds and LoansDe EverandA Pragmatist’s Guide to Leveraged Finance: Credit Analysis for Below-Investment-Grade Bonds and LoansCalificación: 5 de 5 estrellas5/5 (1)

- Handbook of the Economics of Finance: Asset PricingDe EverandHandbook of the Economics of Finance: Asset PricingAún no hay calificaciones

- Capital Structure in The Modern WorldDocumento266 páginasCapital Structure in The Modern WorldsangAún no hay calificaciones

- Strategies of Banks and Other Financial Institutions: Theories and CasesDe EverandStrategies of Banks and Other Financial Institutions: Theories and CasesAún no hay calificaciones

- Wealth Global Navigating the International Financial MarketsDe EverandWealth Global Navigating the International Financial MarketsAún no hay calificaciones

- Structured Finance Course OutlineDocumento7 páginasStructured Finance Course OutlineHimanshu DovalAún no hay calificaciones

- Why Do European Firms Issue Convertible DebtDocumento36 páginasWhy Do European Firms Issue Convertible DebtChunrong WangAún no hay calificaciones

- Syndicated Lending 7th edition: Practice and DocumentationDe EverandSyndicated Lending 7th edition: Practice and DocumentationAún no hay calificaciones

- The Bank Credit Analysis Handbook: A Guide for Analysts, Bankers and InvestorsDe EverandThe Bank Credit Analysis Handbook: A Guide for Analysts, Bankers and InvestorsCalificación: 4 de 5 estrellas4/5 (1)

- Handbook of Empirical Corporate Finance: Empirical Corporate FinanceDe EverandHandbook of Empirical Corporate Finance: Empirical Corporate FinanceAún no hay calificaciones

- Financial Markets and Trading: An Introduction to Market Microstructure and Trading StrategiesDe EverandFinancial Markets and Trading: An Introduction to Market Microstructure and Trading StrategiesCalificación: 3.5 de 5 estrellas3.5/5 (1)

- Volatality Measure Page No 10Documento35 páginasVolatality Measure Page No 10Imran YousafAún no hay calificaciones

- The Globalization of Chinese Companies: Strategies for Conquering International MarketsDe EverandThe Globalization of Chinese Companies: Strategies for Conquering International MarketsAún no hay calificaciones

- Understanding the Economic Basics and Modern Capitalism: Market Mechanisms and Administered AlternativesDe EverandUnderstanding the Economic Basics and Modern Capitalism: Market Mechanisms and Administered AlternativesAún no hay calificaciones

- Mutual Fund Industry Handbook: A Comprehensive Guide for Investment ProfessionalsDe EverandMutual Fund Industry Handbook: A Comprehensive Guide for Investment ProfessionalsAún no hay calificaciones

- EBOOK Etextbook PDF For Global Banking 3Rd Edition by Roy C Smith Download Full Chapter PDF Docx KindleDocumento61 páginasEBOOK Etextbook PDF For Global Banking 3Rd Edition by Roy C Smith Download Full Chapter PDF Docx Kindlecarol.miles887100% (38)

- Investment Banking Course Handout - IBS - 2011 - For ClassDocumento4 páginasInvestment Banking Course Handout - IBS - 2011 - For ClassvibhosinAún no hay calificaciones

- Opening Credit: A practitioner's guide to credit investmentDe EverandOpening Credit: A practitioner's guide to credit investmentAún no hay calificaciones

- Bancel & Mittoo (2004a)Documento36 páginasBancel & Mittoo (2004a)Leonardo CunhaAún no hay calificaciones

- Global BankingDocumento448 páginasGlobal BankingAnirudh Bhatjiwale100% (1)

- Investment Banking Preparation Week 1Documento12 páginasInvestment Banking Preparation Week 1Andrusha MakalewskiAún no hay calificaciones

- LSE-PKU Summer School 2018: LPS-FN209 - Corporate Finance in A Global World: Challenges and OpportunitiesDocumento5 páginasLSE-PKU Summer School 2018: LPS-FN209 - Corporate Finance in A Global World: Challenges and OpportunitiesAshish pariharAún no hay calificaciones

- Capital Structure and Corporate Financing Decisions: Theory, Evidence, and PracticeDe EverandCapital Structure and Corporate Financing Decisions: Theory, Evidence, and PracticeCalificación: 5 de 5 estrellas5/5 (1)

- Money and Banking SyllabusDocumento6 páginasMoney and Banking Syllabusscevola09Aún no hay calificaciones

- Learning From the Global Financial Crisis: Creatively, Reliably, and SustainablyDe EverandLearning From the Global Financial Crisis: Creatively, Reliably, and SustainablyAún no hay calificaciones

- 3790 - Download - M.A. Economics Syllb FinalDocumento5 páginas3790 - Download - M.A. Economics Syllb FinalAyushi PatelAún no hay calificaciones

- Crisis of Character: Building Corporate Reputation in the Age of SkepticismDe EverandCrisis of Character: Building Corporate Reputation in the Age of SkepticismAún no hay calificaciones

- The Securitization Markets Handbook: Structures and Dynamics of Mortgage- and Asset-backed SecuritiesDe EverandThe Securitization Markets Handbook: Structures and Dynamics of Mortgage- and Asset-backed SecuritiesAún no hay calificaciones

- The Wall Street Panic and The Korean EconomyDocumento11 páginasThe Wall Street Panic and The Korean EconomyKorea Economic Institute of America (KEI)Aún no hay calificaciones

- China's Emerging Financial Markets: Challenges and Global ImpactDe EverandChina's Emerging Financial Markets: Challenges and Global ImpactAún no hay calificaciones

- Entrepreneurial Finance For PGPM (Revised)Documento6 páginasEntrepreneurial Finance For PGPM (Revised)Puneet GargAún no hay calificaciones

- Boombustology: Spotting Financial Bubbles Before They BurstDe EverandBoombustology: Spotting Financial Bubbles Before They BurstCalificación: 3.5 de 5 estrellas3.5/5 (3)

- Papers on Accounting, Business, Economics, Politics, and Psychology: College Papers Plus 2019-2019De EverandPapers on Accounting, Business, Economics, Politics, and Psychology: College Papers Plus 2019-2019Aún no hay calificaciones

- Research QuestionDocumento7 páginasResearch QuestionchrisAún no hay calificaciones

- EC202 CourseOutlineDocumento4 páginasEC202 CourseOutlineEthan XuAún no hay calificaciones

- Advanced Corporate FinanceDocumento134 páginasAdvanced Corporate Financecaro.colcerasaAún no hay calificaciones

- Moreblessing AssignmentDocumento12 páginasMoreblessing AssignmentDonald ChivangeAún no hay calificaciones

- (Roy C. Smith, Ingo Walter) Global Banking (Econom (B-Ok - CC)Documento449 páginas(Roy C. Smith, Ingo Walter) Global Banking (Econom (B-Ok - CC)kamaAún no hay calificaciones

- Solution Manual For Case Studies in Finance Managing For Corporate Value Creation Bruner Eades Schill 7th EditionDocumento36 páginasSolution Manual For Case Studies in Finance Managing For Corporate Value Creation Bruner Eades Schill 7th Editionparoketsuccess190mio100% (42)

- Invest in Europe Now!: Why Europe's Markets Will Outperform the US in the Coming YearsDe EverandInvest in Europe Now!: Why Europe's Markets Will Outperform the US in the Coming YearsAún no hay calificaciones

- Private Equity in China: Challenges and OpportunitiesDe EverandPrivate Equity in China: Challenges and OpportunitiesAún no hay calificaciones

- Godlewski Are Bank Loans Still Special Especially During A CrisisDocumento33 páginasGodlewski Are Bank Loans Still Special Especially During A CrisisPhương Anh TrầnAún no hay calificaciones

- Capital Structure and Financing Decision - Evidence From The Four Asian Tigers and JapanDocumento14 páginasCapital Structure and Financing Decision - Evidence From The Four Asian Tigers and Japansitti yunisyahAún no hay calificaciones

- Capital StructureDocumento12 páginasCapital StructureMr_ABAún no hay calificaciones

- Financial Engineering: The Evolution of a ProfessionDe EverandFinancial Engineering: The Evolution of a ProfessionAún no hay calificaciones

- Eun Resnick Casemap1Documento32 páginasEun Resnick Casemap1Naseem Baloch0% (2)

- SSRN Id4441327Documento17 páginasSSRN Id4441327Velavan ShanmugasundaramAún no hay calificaciones

- Solution Manual For Case Studies in Finance Managing For Corporate Value Creation Bruner Eades Schill 7th EditionDocumento8 páginasSolution Manual For Case Studies in Finance Managing For Corporate Value Creation Bruner Eades Schill 7th EditionJames Page100% (32)

- Jinko Solar Equity ReportDocumento12 páginasJinko Solar Equity ReportShayne RebelloAún no hay calificaciones

- IFRS For SME 2015 Disclosure ChecklistDocumento25 páginasIFRS For SME 2015 Disclosure ChecklistUmar Naseer100% (1)

- ICARE Preweek MASDocumento16 páginasICARE Preweek MASjohn paulAún no hay calificaciones

- Overview of Accounting: EGR 403 Capital Allocation TheoryDocumento18 páginasOverview of Accounting: EGR 403 Capital Allocation TheoryBartholomew SzoldAún no hay calificaciones

- India Post Conference Notes Day 1 Feb 12 EDELDocumento104 páginasIndia Post Conference Notes Day 1 Feb 12 EDELjayantsharma04Aún no hay calificaciones

- Theory and Practice of Model Risk Management: Riccardo RebonatoDocumento25 páginasTheory and Practice of Model Risk Management: Riccardo RebonatobionicturtleAún no hay calificaciones

- Part 15 - International Financial MarketsDocumento43 páginasPart 15 - International Financial MarketsPRks ChaulagainAún no hay calificaciones

- Chapter 14 Marketing Planning Implementation and ControlDocumento35 páginasChapter 14 Marketing Planning Implementation and ControlJENOVIC KAYEMBE MUSELEAún no hay calificaciones

- Mastery in Business MathDocumento2 páginasMastery in Business MathglaizacoseAún no hay calificaciones

- Lecture 1 Introduction Financial Management PDFDocumento29 páginasLecture 1 Introduction Financial Management PDFKamauWafulaWanyamaAún no hay calificaciones

- B1B121009 Linda Solusi Bab 8Documento7 páginasB1B121009 Linda Solusi Bab 8Aslinda MutmainahAún no hay calificaciones

- Market Maker TrapsDocumento109 páginasMarket Maker TrapsFarid Taufiq93% (14)

- "Systematic Investment Plan: Sbi Mutual FundDocumento60 páginas"Systematic Investment Plan: Sbi Mutual FundStudent ProjectsAún no hay calificaciones

- Chapter 6Documento14 páginasChapter 6euwilla100% (1)

- Theories ExerciseDocumento1 páginaTheories ExerciseZeneah MangaliagAún no hay calificaciones

- Eckhardt TradingDocumento30 páginasEckhardt Tradingfredtag4393Aún no hay calificaciones

- Practice Questions Capital StucutreDocumento26 páginasPractice Questions Capital StucutreMuhammad Abdul Wajid RaiAún no hay calificaciones

- 11/14/2019 Overview of Oil TradingDocumento62 páginas11/14/2019 Overview of Oil TradingAbhay MalikAún no hay calificaciones

- Lesson Plan - Demo TeachingDocumento4 páginasLesson Plan - Demo TeachingAngelo DefensorAún no hay calificaciones

- Actuarial Mathematics II - COURSE SYLLABUSDocumento2 páginasActuarial Mathematics II - COURSE SYLLABUSMarichu CuevasAún no hay calificaciones

- Saitta A Range Breakout TradingDocumento5 páginasSaitta A Range Breakout TradingArp PitAún no hay calificaciones

- Microstructure PDFDocumento7 páginasMicrostructure PDFflavioAún no hay calificaciones

- QUIZ 2-Mid.-Problems On Statement of Cash FlowsDocumento2 páginasQUIZ 2-Mid.-Problems On Statement of Cash FlowsMonica GeronaAún no hay calificaciones

- Introduction To OTC Options On Mortgage Backed SecuritiesDocumento16 páginasIntroduction To OTC Options On Mortgage Backed Securitiesyzyz123Aún no hay calificaciones

- (#2) Recognize A Potential MarketDocumento25 páginas(#2) Recognize A Potential MarketBianca Jane GaayonAún no hay calificaciones

- ACCT5001 2022 S2 - Module 1 - Student Lecture SlidesDocumento34 páginasACCT5001 2022 S2 - Module 1 - Student Lecture Slideswuzhen102110Aún no hay calificaciones

- Accounting Textbook Solutions - 18Documento18 páginasAccounting Textbook Solutions - 18acc-expertAún no hay calificaciones

- Options Exposed PlayBookDocumento118 páginasOptions Exposed PlayBookMartin Jp100% (4)

- Lambda ExercisesDocumento5 páginasLambda ExercisesSamAún no hay calificaciones

- ORI (Old Republic International Corporation) Statement of Changes in Beneficial Ownership of Securities (4) 2022-05-31Documento2 páginasORI (Old Republic International Corporation) Statement of Changes in Beneficial Ownership of Securities (4) 2022-05-31Ki IphoneAún no hay calificaciones