Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Editted

Cargado por

Rajab KhanDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Editted

Cargado por

Rajab KhanCopyright:

Formatos disponibles

INTRODUCTION A variety of methods are possible for negotiated tariff reductions. Some are more common than others.

Some are based on formulas. Even after a method or combination of methods has been agreed, the final outcome for each product can depend on bargaining between countries over the tariff rates for those specific products. There were high tariff rates on manufacturing and agricultural imported goods in developing countries. The average level of applied tariff in these countries was more than three times higher in comparison with developed countries. Moreover, there is a negative relationship between the degree of development and the level of tariff protection. For instance, a lowincome country applied higher level of tariffs on imports compared to a high- income country. In contrast, developed countries such as the USA, the EU and Japan apply tariff-rate quotas (TRQs) to protect their domestic agricultural producers. Surabhi Mittal, a researcher has studied the impact of trade reform for rice, wheat, cotton and sugarcane. He used different estimates from different sources based on the assumption and base years in 2007. The effect of removing subsidies, cut tariff and full liberalization on the price change and production change for rice and wheat is tiny in India. Despite of small change of production, 0.19 per cent for rice and 2.38 per cent for wheat, under tariff and full liberalization rice production will increase by 16 million tons. Despite high tariffs on agricultural products, there were negative protection rates on agricultural goods in most developing countries between the 1960s and 1980s. A substantial fall in average agricultural and manufacturing tariff has been observed in developing countries during 1990 to 2000. The average agricultural and manufacturing tariffs in developing countries dropped from 30 and 26 per cent, respectively, in 1990 and to 18 about 11 per cent in 2000 This backgrounder explains some of the main methods that are based on formulas, and compares them. Although it contains some algebra, it is kept as simple as possible, with the aim of providing nothing more than a taste of the various methods. METHODS Single rate: Tariffs are cut to a single rate for all products. Theoretically, this is the simplest outcome. In practice it is mainly used in regional free trade agreements where the final tariff rate is zero, or a low tariff, for trade within the group. Flat-rate percentage reductions: the same percentage reduction for all products, no matter whether the starting tariff is high or low. For example, all tariffs cut by 25% in equal steps over five years. Uruguay Round approach: The 1986-94 Uruguay Round negotiations in agriculture produced an agreement for developed countries to cut tariffs on agricultural products by an average of 36% over six years (6% per year) with a minimum of 15% on each product for the period. Harmonizing reductions. These are designed principally to make steeper cuts on higher tariffs, bringing the final tariffs closer together (to harmonize the rates): Different percentages for different tariff bands. For example, no cuts for tariffs between 0 and 10%, 25% cuts for tariffs between 11% and 50%, 50% cuts for tariffs above that, etc. A variation could include scrapping all tariffs below 5% which are sometimes seen as a nuisance with little benefit. These could be simple or average reductions within each band.

URUGUAY ROUND Under the Uruguay Round, members of WTO agreed in 1994 that developed countries would reduce tariff rates on agricultural products by an average of 36 per cent and on manufacturing goods by an average of 15 per cent over 6 years. Developing countries would cut the tariffs on agricultural products by an average rate of 24 per cent and on manufacturing by an average rate of 27 per cent over 10 years. Trade negotiation in the Dillon, Kennedy and Tokyo rounds caused substantial trade reform in industrial products in the early half of last century, while the members of WTO signed the Uruguay Round Agreement on Agriculture (URAA) to reduce agricultural support and protection in 1994. THE URUGUAY ROUND APPROACH Negotiate a specified average percentage reduction in tariffs over a specified number of years with the flexibility of a smaller minimum reduction for individual products Example: using 36% average cuts over six years (6% per year) This was the approach eventually adopted in the 198694 Uruguay Round agriculture negotiations. The approach has two features: the flat-rate percentage reductions lead to gentler cuts on high tariffs and a broader range of final tariffs than a harmonizing method such as the Swiss formula the combination of average and minimum reduction figures allows countries the flexibility to vary their actual tariff reductions on individual products (technically described as tariff lines) even if the average cut is 36%, some cuts will be more, some will be less, and it is possible that no single tariff is actually reduced by that amount THE SWISS FORMULA

the gap between high and low tariffs is called harmonizing the tariffs. The Swiss formula is a special kind of harmonizing method. It uses a single mathematical formula to produce: a narrow range of final tariff rates from a wide set of initial tariffs a maximum final rate, no matter how high the original tariff was. Usually the required cuts are then divided into equal annual steps. The forumula was proposed by Switzerland in the 197379 Tokyo Round negotiations. But Switzerland opposes using this method in the current agriculture negotiations; it prefers the Uruguay Round approach, while Uruguay prefers the Swiss formula! A key feature is a number, which is negotiated and plugged into the formula. It is known as a coefficient (A in the formula below). This also determines the maximum final tariff rate. THE FORMULA Z = AX / (A+X) where X = initial tariff rate A = coefficient and maximum final tariff rate Z= resulting lower tariff rate (end of period)

También podría gustarte

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Aiaca - GIs of India - Socio Economic and Development IssuesDocumento12 páginasAiaca - GIs of India - Socio Economic and Development IssuesLuis GermanoAún no hay calificaciones

- International Trading (Import &export) : GlossaryDocumento4 páginasInternational Trading (Import &export) : GlossaryPavelAún no hay calificaciones

- Taiwan's Cross-Strait Economic Policy ThesisDocumento280 páginasTaiwan's Cross-Strait Economic Policy ThesispasslackAún no hay calificaciones

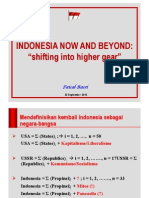

- Faisal Basri - Indonesia Now and Beyond PDFDocumento20 páginasFaisal Basri - Indonesia Now and Beyond PDFAmalia AyuningtyasAún no hay calificaciones

- MITI Report 2010 PDFDocumento152 páginasMITI Report 2010 PDFAdilawi MuhammadAún no hay calificaciones

- Assignment of International Trade LawDocumento15 páginasAssignment of International Trade LawTanya Tandon0% (1)

- History of ASEAN's Formation and GrowthDocumento30 páginasHistory of ASEAN's Formation and GrowthSyakir Perlis100% (1)

- Notice: Order Renewing Temporary Denial Order: Aviation Services International B.V. Et Al.Documento3 páginasNotice: Order Renewing Temporary Denial Order: Aviation Services International B.V. Et Al.Justia.comAún no hay calificaciones

- SWOT Analysis of ITC Limited With USP and Other StuffDocumento4 páginasSWOT Analysis of ITC Limited With USP and Other Stuffqwertyzaz1989Aún no hay calificaciones

- MT 798 The ApproachDocumento7 páginasMT 798 The ApproachadnanbwAún no hay calificaciones

- 1899 Grand Trunk Railway System TimetableDocumento36 páginas1899 Grand Trunk Railway System TimetableAnonymous X9qOpCYfiBAún no hay calificaciones

- Current Trends in International BusinessDocumento4 páginasCurrent Trends in International BusinessAamir TankiwalaAún no hay calificaciones

- Iseas Working Paper Sanchita Basu DasDocumento24 páginasIseas Working Paper Sanchita Basu DasAhmad AmiruddinAún no hay calificaciones

- Emergence of The Entrepreneurial ClassDocumento5 páginasEmergence of The Entrepreneurial Classrohan dobhalAún no hay calificaciones

- 2nd Sem Globalization and Purcom Midterm ExamDocumento4 páginas2nd Sem Globalization and Purcom Midterm ExamChristine Jade100% (2)

- Procedure For Patent ApplicationDocumento13 páginasProcedure For Patent ApplicationNing ClaudioAún no hay calificaciones

- Speech by Uganda President Yoweri Kaguta Museveni at The Forum For China - Africa CooperationDocumento7 páginasSpeech by Uganda President Yoweri Kaguta Museveni at The Forum For China - Africa CooperationThe Independent MagazineAún no hay calificaciones

- 1st Stage of ImperialismDocumento38 páginas1st Stage of ImperialismTeresaMarasiganAún no hay calificaciones

- International Trade TheoryDocumento4 páginasInternational Trade TheoryRokeesharmaAún no hay calificaciones

- Bilhete - Luanda - Lisboa - 26 DezembroDocumento1 páginaBilhete - Luanda - Lisboa - 26 DezembrowaldeinAún no hay calificaciones

- Document Types For GTS RelevanceDocumento15 páginasDocument Types For GTS RelevancepramodhramaiahAún no hay calificaciones

- South Asian Association For Regional CooperationDocumento26 páginasSouth Asian Association For Regional CooperationVipul SavlaAún no hay calificaciones

- Politics and LawDocumento25 páginasPolitics and LawitaliasixAún no hay calificaciones

- Globalization's Economic ImpactDocumento3 páginasGlobalization's Economic ImpactPrincess Marie Juan100% (1)

- Transformers Industry PowerhouseDocumento17 páginasTransformers Industry PowerhousevinodmoryaAún no hay calificaciones

- SG01 PG03 Nucor Case PresentationDocumento51 páginasSG01 PG03 Nucor Case PresentationSharon GohAún no hay calificaciones

- PPA - Standard Request For QuotationDocumento12 páginasPPA - Standard Request For QuotationIlyas HarisAún no hay calificaciones

- Loc Post Neocupat m25Documento15 páginasLoc Post Neocupat m25Amarinei AlexAún no hay calificaciones

- India's Hotel Industry Booming Growth Despite ChallengesDocumento12 páginasIndia's Hotel Industry Booming Growth Despite ChallengesJitendra GuptaAún no hay calificaciones

- Customs DutyDocumento17 páginasCustoms DutyBabasab Patil (Karrisatte)Aún no hay calificaciones