Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Definitions of Planning

Cargado por

Muhammad IlyasDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Definitions of Planning

Cargado por

Muhammad IlyasCopyright:

Formatos disponibles

Definitions of Planning

In the Western discussion on the economics of socialism perhaps the British economist H. D. Dickinson in a book from 1938, has given the most careful definition. According to this definition planning is the making of major economic decisions what and how much is to be produced, and to whom it is to be allocated by the conscious decisions of a determinate authority, on the basis of a comprehensive survey of the economic system as a whole. This is a very demanding definition in the sense that planning should be concerned with many spheres: with what, how, how much, when, where and to whom. This is perhaps a necessary consequence of the emphasis on decisions in this definition. In C. Landauers book from 1944 on national economic planning we find the following description of planning:Planning means coordination through a conscious effort, instead of the automatic coordination which takes place in the market and that conscious effort is to he made by an organ of society. Therefore, planning is an activity of a collectivistic character and is regulation of the activities of individuals by the community. This is true whether or not the plan is enforced by compulsion. Even if the plan is carried out through councel voluntarily accepted the weight is shifted from individual decisions to the deliberations of communal bodies. it is interesting to observe that L.andauer distinguishes between a plan which is enforced by compulsion and a plan which is carried out through councel voluntarily accepted. This is similar to the distinction between imperative planning and indicative planning which has been common in more recent literature. Some definitions of planning given in Western countries naturally consider the market mechanism as the main method of allocation of resources, and planning as a supplementary activity. The American economist G. Sirkin ( 1968) arrives at [definition] as follows: Planning is the attempt, by centralizing the management of the allocation of resources sufficiently, to take into account social costs and social benefits which would be irrelevant to the calculations of the decentralized decisionmaker,

In Sirkins definition it is important to observe the word sufficiently. The starting point is a system of decentralized decisions and planning means centralizing management to a sufficient degree. The title of Sirkins book. The Visible Hand: The Fundamentals of Economic Planning, is in the same spirit as his definition. The counterpart of The Visible Hand is of course The Invisible Hand which is the famous metaphor used by Adam Smith to visualize the ability of the market mechanism to generate an optimal allocation of resources. Where The Invisible Hand fails, The Visible Hand must be used to guide the economic processes. In France, where there is a rather extensive literature on planning, several definitions are given in a similar vein. In discussing such definitions, G. Caire (1967) in fact distinguishes between approaches to planning which consider planning as a supplement to the market mechanism, and definitions which consider planning as something which should replace the market mechanism. In France activities and arrangements which are intended to improve the functioning of the market mechanism are often considered as the most essential elements of planning. For instance, the influential French economist F. Perroux (1965) emphasizes the absence of competitive conditions in the various markets as the main reason for economic planning. The reduction of uncertainty created by the market mechanisms is also often considered as a main aspect of planning as suggested by P. Masses book (1965) with the title Le plan ou lanti-hasard. The definitions given above are ranked from a definition which emphasizes centralized control over a wide range of activities to definitions which consider planning as a supplement to the market mechanism or as a means of improving the working of the market mechanism. It is possible to go even further, as is in a way done by the British economist and econometrician R. Stone (1964). He explains that a plan tells us how to set about achieving our policies given the operating characteristics of the system. It can be identified with administration or control. These words can in turn be identified either with coercion exemplified by the policeman, or with means o self-regulation exemplified by the Watts governor or the thermostat.

The definitions quoted above aim at rather broad and general characterizations of economic planning- Many other definitions emphasize more specific aspects. A Soviet definition from the period of discussions about economic reforms, by V. S. Nemchinov in a book published in 1962 runs as follows: Practical planning consists in harmonious coordination of the conscious control with the cybernetic principle of the automatic, autoregulatory and autoorganizing flow of the economic process.... This solution is possible only under certain decentralization of the planning decision making,,,,. The cybernetic principle involved will in practice take the form of some sort of market mechanism. This definition thus emphasizes the coordination of central decision-making with some use of market mechanisms ..V.S. Nemchinov was a leading person in the great progress which took place in Soviet economics front the late 1950s, partly by taking into use mathematical methods and modern computational techniques, and his views can be taken as representative of the period. In Czechoslovakia an interesting discussion about the purpose and methods of planning took place in the reform period in the 1960s. One aspect of this discussion, which appeared also in other socialist countries, was the confrontation between those who see planning in very deterministic terms, searching for the one objectively determined, correct plan, and those who emphasize the possibility of conscious choice, where preference elements which are not objectively determined must be brought to bear on the plan. In a contribution to this discussion L. Rychetnik and O. Kyn. who belonged to the second group, assigned two different functions to central management. The first was the coordination of economic activities. ... The basic task of central management should ... be to humanize the course of the: economy, to adapt it to social and extra-economic ends of society.. . , From this point of view they criticized the deterministic conception of planning as harmful. The quotation given here is of course not intended to give a complete definition of the concept of planning, but it emphasizes an aspect which is an important supplement to elements laid down in other definitions, and which helps to put economic planning in its proper place in a broader view of society.

Also J. Kornai (1970) criticizes the deterministic, or fatalistic philosophy of planning. If this philosophy were true, then planning would be practically equivalent with forecasting. We would have to discover objectively given trends, describe them and accept them as plans of our future activity. This way of looking at the planning problem is characterized by Kornai as a one-sided misinterpretation of Marxian historical materialism, the overrating of the deterministic side, and the underrating of the freedom in human action. In another paper (with L. Ujlaki. 1967) Kornai mentions that occasionally when working out their proposals and giving them a definite form, the planners would even make themselves believe that they succeeded in finding this only true and inevitable plan.Kornai then launches his own characterization of planning: The main purposes of planning are the collection and careful evaluation of information about the future. It is a framework for the exchange of information and the coordination of otherwise independent activities. planning is a device to understand the interdependencies and to reconcile the conflicting interests. From a broader point of view there is of course economic planning at many levels, and there are correspondingly more general definitions of planning to be found in the literature. For instance, the British economist L. Robbins also discussed the concept of planning. . According to his definition (from 1937), to plan is to act with purpose, to choose and choice is the essence of economic activity. Robbins, however, made it clear that as soon as there is more than one individual planning, the different plans may not harmonize. This meant that ... The result of our separate planning may be disorder and chaos. To avoid this, a coordinating apparatus, a social order, a social plan is necessary. An early and most remarkable general discussion of economic planning was given in a book by the Swedish economist I. Svennilson in 1938. . Svennilson saw planning as being concerned with coordination into one plan of actions under different future periods. Having thus introduced the time dimension, he raised the question about new information which accrues during plan execution, and the possibilities of revising the plans. The actually realized development will be a sequence

of pieces of successively initiated new plans, none of which are implemented in full. According to Svennilson this raises a planning problem of a higher order, namely the problem of designing a plan for how the lower-order plans should be revised in the light of information and experiences which are gained as time passes and which may contradict previously held expectations. We could leave it at that, but as a sort of summary we may perhaps put down an eclectic definition drawing on those quoted above: Macroeconomic planning is an institutionalized activity by or on behalf of a Central Authority for (a) the preparation of decisions and actions to be taken by the Central Authority, and (b) the coordination of decisions and actions by lower-order units of the economy as between themselves and vis--vis the Central Authority, for the purpose of governing the development of the whole economy and its constituent parts so as to achieve certain (more or less detailed and more or less explicitly specified) goals for the economy and harmonize the development of the economy with broader non-economic goals. It should be observed that this is a definition of macroeconomic planning as such: it is not an attempt at saying what is good planning. It would be to go beyond the purpose of a definition to include assertions which could be doubted or even falsified by reference to observed facts. Different economic systems will clearly differ with regard to the emphasis on (a) and (b), with socialist planned economies putting more weight on (a) and market-oriented economies with indicative planning emphasizing (b). But generally both elements will be present, cf. the definitions quoted above from C. Landauer. G. Sirkin. V.S. Nemchinov and J. Kornai. The insertion of the word institutionalized at the beginning of the definition refers to such considerations as were emphasized particularly by K. Bicanic so as to distinguish macroeconomic planning from various sorts of more incidental orientations about future economic development. The last element of the definition corresponds to considerations emphasized by L. Rychetnik and O. Kyn. 7.2. The Main Theorem of Welfare economics and the Needs

for Central Economic Planning

The main theorem of formal welfare economics says, roughly, that the equilibrium state of an economy under perfect competition is a Pareto optimal state. The theorem is of course valid only under certain assumptions which are stated carefully in the standard literature on welfare economics. This theorem has been a corner-stone of economic theory right from Adam Smith to recent advanced formulations of general equilibrium theory. It has also played an important part in political and ideological discussions about economic systems, forming the main rationale behind views which favour the decentralized competitive system. it remains an undisputable fact that the theorem, in its most careful formulation in modern literature, is correct, and has much to say about markets and prices as a means of organizing an economy so as to achieve some sort of optimality by decentralized decisions. the line of thought to be pursued in the following will show how far one should go in the direction of central planning according to the definition given by G Sirkin, or other definitions which consider planning as something which should improve and supplement the market mechanism, but not replace it. The strategy of argument to be pursued is similar to that suggested by J. Tinbergen in the following words: The main problems of economic policy may indeed be formulated as consisting of finding out the limitations of this general theorem and deriving the necessary modifications to a policy of fundamental freedom of action. The general theorem referred to by Tinbergen is what we have called the main theorem of welfare economics, and which, according to him. has exerted an enormous influence on economic policy. Similar lines of thought are often adduced in connection with economic planning in France. (1) Income distribution. The theorem says that perfect competition will lead to an optimal state in the sense of Pareto. In general there will be a large set of Pareto-optimal states, and a choice from among these states can only be made by... introducing a social welfare function which depends upon individual preference functions. If there is no interference from any central authority, the Pareto optimal state arrived at by perfect competition will only by pure coincidence be the same as the state which maximizes the social welfare function. On the other hand, welfare theory assert that any Pareto-optimal state can be arrived at by perfect competition provided that there is a suitable redistribution of incomes. Thus, even if all conditions for the validity of the theorem should be fulfilled, the theorem does not preclude the desirability of income redistribution. Accordingly, if there is a central authority with a social welfare function depending on individual preference functions (i.e., obeying the principle of consumers sovereignty), then it will, in general,

be necessary to carry out some income redistribution in order to maximize the social welfare function. (2) Public goods. Standard formulations of the theorem assume all goods to be private goods in the sense that .. the quantity consumed by one person or enterprise [is] not ... available for consumption by others. For public goods this is not so. In this case an additional consumer can benefit from the good without this reducing the benefit which others enjoy from the same good. For public goods no ordinary market mechanism can give rise to decentralized decisions which together produce an optimal state of the economy. As is well known the standard theorem can be extended so as to show the optimality of a Lindahl equilibrium, in which public consumption is financed by taxes and the tax burden is shared by consumers (income earners) in such a way that the tax shares play a role somewhat similar to the role of prices in markets for private goods. the Lindahl theory does not do away with the need for an activity by a central authority in the field of provision of public goods. (3) Externalities or indirect effects in production and consumption. In standard general equilibrium theory the private goods and the production and consumption processes involved are assumed to be such that all useful as well as all harmful effects of the use of the commodities, of the operation of the production activities, and of the consumption activities are gained or suffered by the decision-maker (producer or consumer) in command of the use of the commodities and activities. If these assumptions are not fulfilled, the system of perfect competition will not generate an optimal state of the economy. As is well known the assumptions mentioned are in many cases not realistic. i.e., there are externalities or indirect effects which are sufficiently important to justify some sort of intervention by central authorities. Possible remedies are excise taxes or subsidies and in some cases more direct intervention by regulations and prohibitions. Comments on points 13. The points mentioned under 1, 2, and 3 above provide reasons for interference with the economy by a central authority even if all agents of the economy (firms and persons) behave in perfect agreement with the competitive system, and even if the economy is always in equilibrium. They, therefore, refer to activities by the State which have always and by everybody been considered as natural fields of activity for the State (4) Forms of production functions which impair the workability of competition. It is well known from production and market theory that increasing returns to scale in production functions over relevant rangesmay impair the workability of competition. There are two different aspects involved. In the first place, if market clearing with price equal to marginal cost should correspond to an amount of output at

which the production function shows increasing returns to scale, then production would incur losses and would not be kept up in the long run by a private producer, even if this would be desirable from the point of view of overall optimality. In the second place, increasing returns to scale would lead to the concentration of production in one firm, or a small number of firms, a fact which may lead to monopolistic or collusive behaviour. (5) From a technical point of view the problem of location of economic activities .... It was shown in an early paper by T.C. Koopmans and M.J. Beckmann that an optimal assignment of activities to a number of possible locations, with implications for production and transportation costs, may not be sustainable by a competitive price mechanism. ... This theoretical fact has its counterpart in the empirical fact that central authorities in most countries interfere in many different ways with the free play of market forces concerning the use of land and the location of dwellings and enterprises (6) Monopolistic and collusive behaviour. In general equilibrium theory it is usually assumed that producers behave as price-takers. This rule of conduct does not arise automatically if producers are left to themselves in the markets. Since they can earn more by monopolistic or collusive behaviour, there are incentives in the free enterprise economy which work towards the undermining of the competitive system If the tendencies to monopolize or collude are not held in check by difficulties of organizing the producers in various branches for the purpose of restricting competition, then the establishing and perpetuation of a market system approximating the perfectly competitive system requires government intervention. the main theorem of economic welfare theory does not give sufficient reason to believe that an optimal result will come about by itself in a market; on the contrary, it may require economic policy and interventions from a central authority to implement the optimal state as described in the theorem, ... Comments on points 16. ... points 13 refer to difficulties, and corresponding needs for central interventions, which occur even when all agents behave competitively, whereas points 46 refer to difficulties concerning the very workability of competition. ... all points 16, are points which have been recognized more or less clearly in economic thinking and practice for a very long time, although their importance may have been increasing through time. .. (7) Unemployment. A position held by J.M. Keynes and some of his followers is that an economy with free markets can settle and remain in an equilibrium with involuntary unemployment. Recent interpretations and extensions of Keynesian ideas emphasize the concept of effective demand and find here a special sort of poor functioning of the market system rather than simply a level of demand which is too

low effective demand in markets for commodities will not transmit signals in the way it is assumed in general equilibrium theory and standard types of dynamization of this kind of theory. Accordingly, producers will also not transmit signals back to the labour market that more labour is needed, and the economy is caught in a low employment trap. (8) The foreign trade balance. ... it has been observed that the market mechanism is often not able to secure a satisfactory balance in the foreign trade ... The traditional theory in the field would suggest that changes in the gold price, comparative price levels, exchange rates, interest rates, and perhaps other sorts of prices ... would provide automatic mechanisms for securing satisfactory developments of the balance of trade and corresponding capital movements between countries. Many sorts of interventions by central authorities have been used to tackle these problems. Among them are centrally determined manipulations of exchange rates, direct regulation of imports and exports, use of custom duties or other forms of taxation which may influence foreign trade, (9) Investment and growth. Welfare theory has been applied to problems of investment and growth, particularly through the theory of optimal saving or optimal growth. Satisfactory results concerning the correspondence between competitive market behaviour and optimality are, however, harder to establish in this field than for problems referring to allocation problems at a given point of time or problems conditioned by a given path of total investment. . These are not decisions which households, acting separately, are equipped to make. There is no satisfactory competitive solution to the problems of the horizon and terminal capital equipment or of investment generally. Households must act collectively if they are to act at all. And, in the absence of unanimity, the decisions they make must be imposed on those who disagree with them. Politics or paternalism is involved. ... A.C. Pigou, did not extend the theorems about the optimality of competitive behaviour so as to cover the savings decisions. He held the view that private self-interest is likely to favour consumption unduly as against investment, and that there are doors wide open here through which the State may claim, as good neighbour, to step in. (10) Development of the absolute price level. This point refers particularly to the problem of inflation. There is not doubt from actual experience that this is a serious problem. It is, however, somewhat hard to interpret the problems of inflation in relation to the standard theory of general equilibrium, . This problem is therefore largely something outside the realm of general equilibrium theory and its welfare-theoretic interpretation. Comments on points 710. The problems mentioned under points 710

indicate the most obvious targets of macroeconomic policy and planning in its strictest macro sense. The recognition of the fact that a market mechanism left to itself does not (or at least not always) provide good solutions to the problems mentioned under these points and the idea that conscious use of policy instruments in the hands of a central authority may help at least some way towards overcoming these problems, have evolved on the background of actual experiences, policy debates, and theoretical research and controversies (11) The problem of establishing correct prices. ... The main theorem of welfare economics is concerned with states of equilibrium. Given certain assumptions about the forms of production possibility sets or production functions and utility functions it has been proved that equilibrium solutions of the competitive system exist. Such existence theorems are, however, mathematical assertions. They do not immediately answer the question as to whether or not a free market mechanism is in itself able to establish the equilibrium prices. ... The theorem considers producers as price-takers. This means that there is, in the market game considered, no actual agent who is in command of the fixation of prices. A theory which should answer the question of whether the markets are able to find and establish correct equilibrium prices must somehow let some agents change prices. ... there are many possibilities of unsatisfactory developments, for instance through slow convergence towards correct equilibrium prices or through oscillatory movements. ... there are many openings for central authorities to help the markets. (12) Future prices. ... there are many interrelationships between what happens in different periods of time. Many types of production equipment are durable and yield services in different periods of time, technical choices made in one period have consequences for other periods, storing of commodities means transferring commodities from one period of time to another, and so on. At a first glance the standard theory of welfare economics might appear not to be able to take into account such intertemporal aspects, since the theory is static. However, this is not quite correct. The standard formulation is able to cover many intertemporal aspects by a suitable definition of the variables involved. The trick is to let the same type of commodity be considered as different commodities when they refer to different periods of time By this extended interpretation of the general equilibrium system the statement about the optimality properties of the allocation reached by the competitive system still holds good. However, the task of finding the correct prices is now much more demanding. The theorem assumes that all decision-makers know all prices and adapt optimally to them, but now some of these prices refer to future periods of time. Even if an instantaneous market should he able to establish its current equilibrium price in an efficient way, this is not necessarily so for prices which refer to future periods. For some commodities there are markets for trade in

commodities to be delivered in future periods, and one may have a mechanism which works so as to determine future prices in a similar way as contemporary markets determine current prices. However, this is not so for the majority of commodities. There is therefore an opening for meaningful activities by a central authority. The idea is that a central authority could establish information which might make it possible to make better forecasts of future prices than the individual decisionmakers themselves could make. (13) Risk and uncertainty. ... it will on the whole be considered advantageous if risks and uncertainties in connection with economic processes can be avoided or reduced: In French planning literature the reduction of risk and uncertainty has been considered as one of the main purposes of planning, and it is often argued that the State will have to undertake projects which are considered by private business to be too risky, It is of course not obvious that dealing with risk and uncertainty in an optimal way would require central activities and interferences with decentralized market mechanisms. (14) Other aspects of production and dissemination of information. The standard theory of the competitive system and economic welfare theory usually assume that information is perfect and available free of charge. In practice both production and dissemination of information require inputs and are themselves economic activities. .. There will in practice be a large range of such activities which will, in one way or other, be guided or influenced by central authorities. (15) Non-economic values. ... economic systems and mechanisms may have positive or negative values beyond and in addition to their efficiency in terms of usual economic criteria. ... Possible problems relating to these aspects can hardly be solved by individual actions. There may therefore be a need for collective actions which must somehow be implemented through central authorities (Compare the definitions of economic planning by L. Rychetnik and 0. Kyn quoted in Section 1.4. They pointed out as a task for central management to humanize the course of the economy, to adapt it to social and extra-economic ends of society ... there are many tasks to be solved by central authorities even if the basic theorems on the competitive market system and its optimality properties are accepted and made the backbone of the organization of the economic proce

También podría gustarte

- Beta Management SolutionDocumento5 páginasBeta Management SolutionMuhammad IlyasAún no hay calificaciones

- Question No. 01 1 (A) .Total Sale Volume VarianceDocumento8 páginasQuestion No. 01 1 (A) .Total Sale Volume VarianceMuhammad IlyasAún no hay calificaciones

- Q2Documento6 páginasQ2Muhammad Ilyas100% (1)

- What Is A Research?Documento1 páginaWhat Is A Research?Muhammad IlyasAún no hay calificaciones

- Local Council Board BackgroungDocumento1 páginaLocal Council Board BackgroungMuhammad IlyasAún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Img - Oriental Magic by Idries Shah ImageDocumento119 páginasImg - Oriental Magic by Idries Shah ImageCarolos Strangeness Eaves100% (2)

- Annual Report Aneka Tambang Antam 2015Documento670 páginasAnnual Report Aneka Tambang Antam 2015Yustiar GunawanAún no hay calificaciones

- Seangio Vs ReyesDocumento2 páginasSeangio Vs Reyespja_14Aún no hay calificaciones

- Food NutritionDocumento21 páginasFood NutritionLaine AcainAún no hay calificaciones

- Assignment 2 Malaysian StudiesDocumento4 páginasAssignment 2 Malaysian StudiesPenny PunAún no hay calificaciones

- Astm D1895 17Documento4 páginasAstm D1895 17Sonia Goncalves100% (1)

- 978-1119504306 Financial Accounting - 4thDocumento4 páginas978-1119504306 Financial Accounting - 4thtaupaypayAún no hay calificaciones

- PLSQL Day 1Documento12 páginasPLSQL Day 1rambabuAún no hay calificaciones

- Group 2 Lesson 2 DramaDocumento38 páginasGroup 2 Lesson 2 DramaMar ClarkAún no hay calificaciones

- TOURISM AND HOSPITALITY ORGANIZATIONS Di Pa TapooosDocumento97 páginasTOURISM AND HOSPITALITY ORGANIZATIONS Di Pa TapooosDianne EvangelistaAún no hay calificaciones

- Chemistry InvestigatoryDocumento16 páginasChemistry InvestigatoryVedant LadheAún no hay calificaciones

- Duterte Vs SandiganbayanDocumento17 páginasDuterte Vs SandiganbayanAnonymous KvztB3Aún no hay calificaciones

- Ra 7877Documento16 páginasRa 7877Anonymous FExJPnCAún no hay calificaciones

- Advanced Financial Accounting and Reporting Accounting For PartnershipDocumento6 páginasAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceAún no hay calificaciones

- Kozier Erbs Fundamentals of Nursing 8E Berman TBDocumento4 páginasKozier Erbs Fundamentals of Nursing 8E Berman TBdanie_pojAún no hay calificaciones

- CebuanoDocumento1 páginaCebuanoanon_58478535150% (2)

- 5f Time of Legends Joan of Arc RulebookDocumento36 páginas5f Time of Legends Joan of Arc Rulebookpierre borget100% (1)

- The Leaders of The NationDocumento3 páginasThe Leaders of The NationMark Dave RodriguezAún no hay calificaciones

- Human Development IndexDocumento17 páginasHuman Development IndexriyaAún no hay calificaciones

- Living Greyhawk - Greyhawk Grumbler #1 Coldeven 598 n1Documento2 páginasLiving Greyhawk - Greyhawk Grumbler #1 Coldeven 598 n1Magus da RodaAún no hay calificaciones

- Financial Performance Report General Tyres and Rubber Company-FinalDocumento29 páginasFinancial Performance Report General Tyres and Rubber Company-FinalKabeer QureshiAún no hay calificaciones

- Packing List Night at Starlodge Adventure SuitesDocumento2 páginasPacking List Night at Starlodge Adventure SuitesArturo PerezAún no hay calificaciones

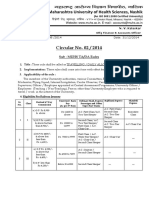

- Circular No 02 2014 TA DA 010115 PDFDocumento10 páginasCircular No 02 2014 TA DA 010115 PDFsachin sonawane100% (1)

- SRL CompressorsDocumento20 páginasSRL Compressorssthe03Aún no hay calificaciones

- FAMILYDocumento3 páginasFAMILYJenecel ZanoriaAún no hay calificaciones

- Branding Assignment KurkureDocumento14 páginasBranding Assignment KurkureAkriti Jaiswal0% (1)

- Feng Shui GeneralDocumento36 páginasFeng Shui GeneralPia SalvadorAún no hay calificaciones

- Imc Case - Group 3Documento5 páginasImc Case - Group 3Shubham Jakhmola100% (3)

- Java Magazine JanuaryFebruary 2013Documento93 páginasJava Magazine JanuaryFebruary 2013rubensaAún no hay calificaciones

- 19-Microendoscopic Lumbar DiscectomyDocumento8 páginas19-Microendoscopic Lumbar DiscectomyNewton IssacAún no hay calificaciones