Documentos de Académico

Documentos de Profesional

Documentos de Cultura

The PMI Group, Inc.

Cargado por

Scott SchaeferDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

The PMI Group, Inc.

Cargado por

Scott SchaeferCopyright:

Formatos disponibles

The PMI Group, Inc.

The PMI Group, Inc.

About PMI Products & Services Investor Relations Media Center Careers Locations

● Press Releases

● Publications

● Photos and Bios

PMI Fall 2008 Risk Index Indicates Rising

Foreclosures and Unemployment Intensifying Risk of

Future Home Price Declines

Housing Affordability Continues to Improve

WALNUT CREEK, Calif., Oct. 1 /PRNewswire/ -- PMI Mortgage Insurance Co., the primary

U.S. subsidiary of The PMI Group, Inc. (NYSE: PMI), today released its Fall 2008 U.S.

Market Risk Index(SM), which shows increases in foreclosures and unemployment have

significantly heightened the risk of future home price declines. PMI's U.S. Market Risk

Index(SM) ranks the nation's 50 largest metropolitan statistical areas (MSAs) according

to the likelihood that home prices will be lower in two years.

Risk scores translate directly into an estimated percentage risk that home prices will be

lower in two years. The Fall 2008 Risk Index is based on second-quarter Office of Federal

Housing Enterprise Oversight (OFHEO) data. A complete copy of the Fall 2008 PMI

Economic and Real Estate TrendsSM (ERET) report and an appendix that provides data

for all 381 U.S. MSAs is available at: http://www.pmi-us.com/eret.

The risk of future price declines rose by more than 10 percent in 16 of the nation's top

50 MSAs, primarily in areas of the country that experienced major increases in house

prices during the housing boom. Only two MSAs -- Cambridge-Newton-Framingham, MA

and Boston-Quincy, MA -- saw their risk decrease by more than one percent. Among the

top 50 MSAs, 17 ranked in the highest risk category and 16 of those were in California,

Florida, Nevada, and Arizona.

"The risk of future home price declines increased in 94 percent of all 381 MSAs in the

country this quarter," said David Berson, PMI's Chief Economist and Strategist. "The

majority of these increases aren't statistically significant, in many cases risk increased by

LEXINGTON

research less than ten percent, but risk did increase by a significant amount -- as much as 30

http://phx.corporate-ir.net/phoenix.zhtml?c=63356&p=irol-newsArticle&ID=1204334&highlight= (1 of 5) [12/4/2008 12:48:36 PM]

The PMI Group, Inc. -

percent or more -- in some states and MSAs where foreclosures and unemployment

increased significantly."

The highest risk of future price declines remains in Fort Lauderdale-Pompano Beach-

Deerfield Beach, FL (99.5 percent), Riverside-San Bernardino-Ontario, CA (99.5

percent), Orlando-Kissimmee, FL (99.4 percent), Miami-Miami Beach-Kendall, FL (99.3

percent), Tampa-St. Petersberg-Clearwater, FL (99 percent). The areas with the lowest

risk of price declines -- less than one percent -- are in Fort Worth-Arlington, TX, Dallas-

Plano-Irving, TX, Houston-Sugar Land-Baytown, TX and Pittsburgh, PA.

Housing affordability also failed to improve this quarter, according to PMI's proprietary

Affordability Index(SM), which measures how affordable homes are today in a given MSA

relative to a baseline of 1995. An Affordability Index score exceeding 100 indicates that

homes have become more affordable while a score below 100 means they are less

affordable.

Across the nation, 40 percent of the nation's 381 MSAs showed increased affordability;

while 60 percent of all MSAs experienced declines in affordability. Affordability remains

challenged in 14 of the 17 MSAs with risk scores in the highest risk ranks. Home prices in

these areas will need to fall further in order to move back in line with incomes before

there will be meaningful reductions in risk scores.

In addition to the PMI U.S. Market Risk Index showing the risk of price declines, PMI's

Fall 2008 ERET examines major changes in the mortgage origination trends as well as

the impact foreclosures and unemployment are having on home prices in the second

quarter of 2008.

PMI Fall 2008 PMI U.S. Market Risk Index

Rank MSA Score

1 Fort Lauderdale-Pompano Beach-Deerfield Beach; FL A 99.5

1 Riverside-San Bernardino-Ontario; CA 99.5

1 Orlando-Kissimmee; FL 99.4

1 Miami-Miami Beach-Kendall; FL 99.3

1 Tampa-St. Petersburg-Clearwater; FL 99.0

1 Las Vegas-Paradise; NV 98.5

LEXINGTON 1 Los Angeles-Long Beach-Glendale; CA 98.5

research

1 Santa Ana-Anaheim-Irvine; CA 97.7

http://phx.corporate-ir.net/phoenix.zhtml?c=63356&p=irol-newsArticle&ID=1204334&highlight= (2 of 5) [12/4/2008 12:48:36 PM]

The PMI Group, Inc. -

1 Jacksonville; FL 97.5

1 Phoenix-Mesa-Scottsdale; AZ 96.3

1 Sacramento-Arden-Arcade-Roseville; CA 96.3

1 San Diego-Carlsbad-San Marcos; CA 95.9

1 Oakland-Fremont-Hayward; CA 94.4

1 San Jose-Sunnyvale-Santa Clara; CA 87.1

1 Providence-New Bedford-Fall River; RI-MA 72.4

1 San Francisco-San Mateo-Redwood City; CA 71.6

3 Edison-New Brunswick; NJ 35.1

3 Nassau-Suffolk; NY 29.4

3 Washington-Arlington-Alexandria; DC-VA-MD-WV 26.0

3 Virginia Beach-Norfolk-Newport News; VA-NC 25.4

4 Detroit-Livonia-Dearborn; MI 17.8

4 Minneapolis-St. Paul-Bloomington; MN-WI 14.8

4 Newark-Union; NJ-PA 14.4

4 Baltimore-Towson; MD 10.1

5 New York-White Plains-Wayne; NY-NJ 9.8

5 Boston-Quincy; MA 7.7

5 Warren-Troy-Farmington Hills; MI 7.3

5 Portland-Vancouver-Beaverton; OR-WA 6.4

5 Chicago-Naperville-Joliet; IL 6.3

5 Atlanta-Sandy Springs-Marietta; GA 3.5

5 Seattle-Bellevue-Everett; WA 2.3

5 Philadelphia; PA 2.1

5 Cambridge-Newton-Framingham; MA 1.6

5 Nashville-Davidson-Murfreesboro-Franklin; TN 1.6

5 Cleveland-Elyria-Mentor; OH 1.1

5 St. Louis, MO-IL <1

5 Milwaukee-Waukesha-West Allis; WI <1

5 Charlotte-Gastonia-Concord; NC-SC <1

5 Cincinnati-Middletown; OH-KY-IN <1

5 Denver-Aurora; CO <1

5 Columbus; OH <1

5 Austin-Round Rock; TX <1

LEXINGTON 5 Kansas City; MO-KS <1

research

5 Indianapolis-Carmel; IN <1

http://phx.corporate-ir.net/phoenix.zhtml?c=63356&p=irol-newsArticle&ID=1204334&highlight= (3 of 5) [12/4/2008 12:48:36 PM]

The PMI Group, Inc. -

5 Memphis, TN-MS-AR <1

5 San Antonio; TX <1

Pittsburgh; PA <1

5 Houston-Sugar Land-Baytown; TX <1

5 Dallas-Plano-Irving; TX <1

5 Fort Worth-Arlington; TX <1

About PMI's Economic & Real Estate Trends(SM) (ERET) and U.S. Market Risk Index(SM)

The PMI Economic and Real Estate Trends (ERET) containing the U.S. Market Risk Index

is published quarterly by PMI Mortgage Insurance Co., a subsidiary of The PMI Group,

Inc. (NYSE: PMI). The Risk Index is a proprietary statistical model that measures

geographic house price risk by predicting the probability that home prices in the nation's

381 largest metropolitan statistical areas (MSAs) and metropolitan statistical area

divisions (MSADs) (as measured by the House Price Index from the Office of Federal

Housing Enterprise Oversight (OFHEO)) will be lower in two years. The PMI U.S. Market

Risk Index is based on data including the OFHEO House Price Index, labor market

statistics from the Bureau of Labor Statistics, and the PMI Affordability Index, which uses

local per capita household income, home price appreciation, and a blended mortgage

rate to calculate the local share of mortgage payment to income relative to its baseline

year of 1995. The PMI U.S. Market Risk Index scale ranges from one to 100 and

translates to a percentage. For example, a score of 50 indicates a 50 percent chance that

home prices will be lower in two years.

About PMI Mortgage Insurance Co.

PMI Mortgage Insurance Co. (PMI US), a subsidiary of The PMI Group, Inc. (NYSE: PMI),

provides residential mortgage insurance to mortgage lenders, capital market

participants, and investors throughout the United States. PMI US is incorporated in

Arizona, headquartered in Walnut Creek, CA, and licensed in all 50 states, the District of

Columbia, Puerto Rico, Guam, and the Virgin Islands. By mitigating default risk,

residential mortgage insurance expands home ownership opportunities and assists

financial institutions in reducing the capital they are required to hold against low down

payment mortgages. PMI US is rated A+ by Standard and Poor's, Aa2 by Moody's, and A

LEXINGTON + by Fitch. For more information: http://www.pmi-us.com.

research

http://phx.corporate-ir.net/phoenix.zhtml?c=63356&p=irol-newsArticle&ID=1204334&highlight= (4 of 5) [12/4/2008 12:48:36 PM]

The PMI Group, Inc. -

Cautionary Statement: Statements in this press release that are not historical facts or

that relate to future plans, events or performance are 'forward-looking' statements

within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-

looking statements include, but are not limited to, PMI's U.S. Market Risk Index,

Affordability Index, and any related discussion, and statements relating to future

economic and housing market conditions. Forward-looking statements are subject to a

number of risks and uncertainties including, but not limited to, the following factors:

changes in economic conditions, economic recession or slowdowns, adverse changes in

consumer confidence, declining housing values, higher unemployment, deteriorating

borrower credit, changes in interest rates, or a combination of these factors. Readers are

cautioned that any statements with respect to future economic and housing market

conditions are based upon current economic conditions and, therefore, are inherently

uncertain and highly subject to the changes in the factors enumerated above. Other risk

and uncertainties are discussed in the Company's filings with the Securities and

Exchange Commission, including our reports on Form 10-K for the year ended December

31, 2007 and Form 10-Q's for the quarters ended March 31, 2008 and June 30, 2008.

LEXINGTON

research SOURCE PMI Mortgage Insurance Co.

© 2008 The PMI Group, Inc. All rights reserved. | Terms of Use | PMI Privacy | Contact Us

LEXINGTON

press release

L EXINGTON

Luxury Builders LLC

http://phx.corporate-ir.net/phoenix.zhtml?c=63356&p=irol-newsArticle&ID=1204334&highlight= (5 of 5) [12/4/2008 12:48:36 PM]

También podría gustarte

- Fannie Mae Seniors Housing Loan Fact SheetDocumento1 páginaFannie Mae Seniors Housing Loan Fact SheetScott SchaeferAún no hay calificaciones

- US Census Report On Affluent CitiesDocumento49 páginasUS Census Report On Affluent CitiesScott Schaefer100% (10)

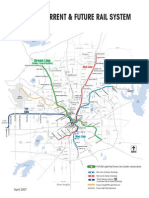

- Dallas Area Rapid Transit:Current and Future Rail MapDocumento1 páginaDallas Area Rapid Transit:Current and Future Rail MapScott Schaefer100% (1)

- Summary Resume Scott SchaeferDocumento2 páginasSummary Resume Scott SchaeferScott Schaefer100% (3)

- Capturing The Value of Transit: Strategies For Capturing Value From Transit Oriented DevelopmentDocumento38 páginasCapturing The Value of Transit: Strategies For Capturing Value From Transit Oriented DevelopmentScott Schaefer100% (1)

- Fannie Mae DUS Multifamily Financing Fact SheetDocumento1 páginaFannie Mae DUS Multifamily Financing Fact SheetScott SchaeferAún no hay calificaciones

- Here We Grow Again - Texas A&m Demography ReportDocumento2 páginasHere We Grow Again - Texas A&m Demography ReportScott SchaeferAún no hay calificaciones

- Green Built North Texas Homeowner Education GuideDocumento6 páginasGreen Built North Texas Homeowner Education GuideScott Schaefer100% (1)

- DFW Metropolitan Area DemographicsDocumento7 páginasDFW Metropolitan Area DemographicsScott SchaeferAún no hay calificaciones

- Long Range Prospects For Texas Real Estate MarketsDocumento40 páginasLong Range Prospects For Texas Real Estate MarketsScott SchaeferAún no hay calificaciones

- 7 Packing Up - Texans On The Move - Texas A&m Housing StudyDocumento5 páginas7 Packing Up - Texans On The Move - Texas A&m Housing StudyScott SchaeferAún no hay calificaciones

- A Vision and Strategy For Creating A Transit Village: Downtown PlanoDocumento23 páginasA Vision and Strategy For Creating A Transit Village: Downtown PlanoScott SchaeferAún no hay calificaciones

- Interrelationship of Transportation Costs and HousingDocumento5 páginasInterrelationship of Transportation Costs and HousingScott SchaeferAún no hay calificaciones

- Green Building in North America - Oportunities & ChallengesDocumento80 páginasGreen Building in North America - Oportunities & ChallengesScott SchaeferAún no hay calificaciones

- City of Plano Urban Centers StudyDocumento34 páginasCity of Plano Urban Centers StudyScott SchaeferAún no hay calificaciones

- Demographic Report - North Texas 2030 Demographic Forecast - and BeforeDocumento26 páginasDemographic Report - North Texas 2030 Demographic Forecast - and BeforeScott Schaefer100% (1)

- Green Buildings and Bottom Line 2006 White PaperDocumento64 páginasGreen Buildings and Bottom Line 2006 White PaperScott Schaefer100% (2)

- Green Buildings Research White Paper 2007Documento60 páginasGreen Buildings Research White Paper 2007Scott Schaefer100% (1)

- Best Practices For Hot Humid ClimatesDocumento137 páginasBest Practices For Hot Humid ClimatesScott SchaeferAún no hay calificaciones

- Transportation State of The Region: Dallas Fort WorthDocumento16 páginasTransportation State of The Region: Dallas Fort WorthScott SchaeferAún no hay calificaciones

- The Affordability Index: A New Tool For Measuring The True Affordability of A Housing ChoiceDocumento24 páginasThe Affordability Index: A New Tool For Measuring The True Affordability of A Housing ChoiceScott SchaeferAún no hay calificaciones

- Charter of The New UrbanismDocumento2 páginasCharter of The New UrbanismScott SchaeferAún no hay calificaciones

- DART 2030 Transit System PlanDocumento89 páginasDART 2030 Transit System PlanScott SchaeferAún no hay calificaciones

- Building A Thriving Urban Economy - ToD in DallasDocumento21 páginasBuilding A Thriving Urban Economy - ToD in DallasScott SchaeferAún no hay calificaciones

- The BrochureDocumento11 páginasThe BrochureScott SchaeferAún no hay calificaciones

- Security Versus Status - The Two Worlds of Gated CommunitiesDocumento6 páginasSecurity Versus Status - The Two Worlds of Gated CommunitiesScott Schaefer100% (1)

- Demand Estimate Update For Housing Near TransitDocumento1 páginaDemand Estimate Update For Housing Near TransitScott SchaeferAún no hay calificaciones

- The Potential: Expanding Housing Near TransitDocumento20 páginasThe Potential: Expanding Housing Near TransitScott SchaeferAún no hay calificaciones

- Pedestrian Behavior in Gated CommunitiesDocumento10 páginasPedestrian Behavior in Gated CommunitiesScott Schaefer100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2102)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Moody's - Government of ArgentinaDocumento28 páginasMoody's - Government of ArgentinaCronista.com100% (1)

- Corporate Finance - BondsDocumento54 páginasCorporate Finance - BondsAnna LinAún no hay calificaciones

- Business Statistics, Canadian Edition Chapter 1 Test BankDocumento29 páginasBusiness Statistics, Canadian Edition Chapter 1 Test Bankdenisehuang9460% (5)

- 2012 Pse Annual R PTDocumento60 páginas2012 Pse Annual R PTJep TangAún no hay calificaciones

- Barkau v. California Resources Corp. - Trust Indenture Act Complaint PDFDocumento27 páginasBarkau v. California Resources Corp. - Trust Indenture Act Complaint PDFMark JaffeAún no hay calificaciones

- Leon Levy Garment BibliographyDocumento107 páginasLeon Levy Garment BibliographyGotham Center for New York City HistoryAún no hay calificaciones

- Factors Affecting International Investment in IndiaDocumento12 páginasFactors Affecting International Investment in IndiaSUALI RAVEENDRA NAIKAún no hay calificaciones

- Lessons From 200 LBO DefaultsDocumento10 páginasLessons From 200 LBO DefaultsforbesadminAún no hay calificaciones

- Thyssenkrupp Industries PDFDocumento7 páginasThyssenkrupp Industries PDFBinoy MtAún no hay calificaciones

- Ramani Cars Private Limited 2023Documento6 páginasRamani Cars Private Limited 2023Karthikeyan RK SwamyAún no hay calificaciones

- Moody's Financial Metrics KeyDocumento48 páginasMoody's Financial Metrics KeyJoao SilvaAún no hay calificaciones

- Zetwerk Manufacturing Businesses PVT LTDDocumento8 páginasZetwerk Manufacturing Businesses PVT LTDrahulappikatlaAún no hay calificaciones

- LCv2 DynamicPredictionOfLGD PDFDocumento44 páginasLCv2 DynamicPredictionOfLGD PDFshweta mishraAún no hay calificaciones

- Mechemco - R-30102017 PDFDocumento7 páginasMechemco - R-30102017 PDFflytorahulAún no hay calificaciones

- Credit Rating Prediction: Using Self-Organizing MapsDocumento173 páginasCredit Rating Prediction: Using Self-Organizing MapsIrina AlexandraAún no hay calificaciones

- Lawsuit Case 4Documento11 páginasLawsuit Case 4Jowjie TVAún no hay calificaciones

- Moodys State Bond Rating AnalysisDocumento9 páginasMoodys State Bond Rating Analysisapi-324076716Aún no hay calificaciones

- LMA Website User GuideDocumento16 páginasLMA Website User GuidejamedogAún no hay calificaciones

- Credit Rating Lecture 1Documento44 páginasCredit Rating Lecture 1Ahmed AliAún no hay calificaciones

- Credit Rating in India - A Case For AccountabilityDocumento66 páginasCredit Rating in India - A Case For AccountabilityArun Mishra100% (3)

- Ratings Arbitrage and Structured ProductsDocumento7 páginasRatings Arbitrage and Structured ProductsppateAún no hay calificaciones

- Developing A Scoring Credit Model Based On The Methodology of International Credit Rating AgenciesDocumento13 páginasDeveloping A Scoring Credit Model Based On The Methodology of International Credit Rating AgenciesHeber A.Aún no hay calificaciones

- Uday Kotak Letter PDFDocumento3 páginasUday Kotak Letter PDFGurjeevAún no hay calificaciones

- Chapter 10 - Bond Prices and YieldsDocumento42 páginasChapter 10 - Bond Prices and YieldsA_Students100% (3)

- Stove Kraft LimitedDocumento7 páginasStove Kraft LimitedSiddharth Rai SuranaAún no hay calificaciones

- Credit Rating NotesDocumento6 páginasCredit Rating NotesTouseef AhmadAún no hay calificaciones

- Performing Credit Quarterly 3q2023Documento17 páginasPerforming Credit Quarterly 3q2023zackzyp98Aún no hay calificaciones

- Financial Markets - Module 4Documento7 páginasFinancial Markets - Module 4garbenAún no hay calificaciones

- 10 10 Ftse Kick Out PlanDocumento37 páginas10 10 Ftse Kick Out PlanLiving GrangerAún no hay calificaciones

- Case AnalysisDocumento10 páginasCase AnalysisAmenu AdagneAún no hay calificaciones