Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Finance

Cargado por

samtengh75Descripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Finance

Cargado por

samtengh75Copyright:

Formatos disponibles

Liquidation of loan or loan amortization can be done by the annuity method.

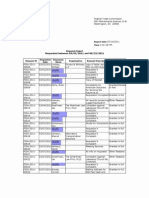

Equal installment needed to be made to payoff loan over a defined period of time. Reduced balance method is calculated and interest is calculated on the principal amount outstanding. example Xyz supermarket has decided to open a new store and the cost estimated for the initial investment was AED 2,00,00 and a bank is ready to finance the amount with 10 percentage of interest for a 5 years period. Calculate the fixed repayment amount and prepare a loan amortisation schedule. The firm has same amount as free reserve which can be invested in some other business which has earn 9 percentages opportunity cost for a period of 5 years. The finance manager asked to make a good decision on both opportunities. First the fixed repayment amount has to be calculated. PVA= PMT(PVIFA) AED 2,00,00= PMT 3.791 PMT =AED 2,00,000/3.791 = AED 52756.5 THE FIXED REPAYMENT IS = AED 52756 NOW THE LOAN AMORTISATION SCHEDULE CAN BE MADE. End of year 0 1 2 3 4 5 Repayment amount AED ------------52,756 52,756 52,756 52,756 52,756 Interest amount AED -------------20,000 16,724 13,121 9,157 4,978 Principal amount -AED ------------32,756 36,032 39,635 43,599 47,960 Outstanding balance AED 2,00,000 1,67,244 1,31,212 91,577 47,978 47,778 200

The difference of AED 200 occurred because of small variation in the repayment amount adjusted i.e. AED 52,756.5 is adjusted to AED 52,756 for easy calculation. Interest is calculated on reducing balance method by finding it based on outstanding balance. Principal amount is calculated by deducting interest amount from the repayment amount. MI

The firm has two investment opportunities. The firm has only investment amount to start any one of the project. The firm can either use its free reserve for the first project or avoid loan from the bank. The free reserve can be utilized for the second investment purpose it is viable. The future value of AED 2, 00,000 would be n FV= PV( 1+r) 5 FV= AED 2,00,000(1+.09) = AED 2,00,000 * 1.53 = AED 3,077,25 The firm will find its amount invested in the second project is grown up to AED 3,077,25 In the first incident for the amount of AED 2,00,000 the company pays only AED 2,63,980 which is inclusive of the interest amount paid to the bank. The finance manager can advice the company to use the loan facility for the first project and use its reserve amount to be invested in the second project. RISK AND RETURN Every financial decision contains an element of risk and return. The relation ship between these exists in the form of risk-return trade off. This means it is only possible to earn higher returns by accepting higher risk. In other words risk and return are positively correlated i.e. an increase in one is accompanied by an increase in other. The risk- and return trade off is central to investment decision making. One way to reduce risk is through diversification of business or in other words investment is done in collection of projects known as portfolio.

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (72)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Almaha Ceramics ProspectusDocumento148 páginasAlmaha Ceramics ProspectusAbdoKhaledAún no hay calificaciones

- Portfolio ManagementDocumento35 páginasPortfolio Managementhemant vermaAún no hay calificaciones

- The Power of Concentration: A Theoretical Appeal of Concentrated Portfolios - Subverting The "Law"Documento6 páginasThe Power of Concentration: A Theoretical Appeal of Concentrated Portfolios - Subverting The "Law"solid9283Aún no hay calificaciones

- Mutual Fund Litrature ReviewDocumento7 páginasMutual Fund Litrature ReviewRavi KumarAún no hay calificaciones

- Brand Value Measurement of DoveDocumento15 páginasBrand Value Measurement of DoveSujit100% (1)

- Responsive Document - CREW: FTC: Regarding Efforts by Wall Street Investors To Influence Agency Regulations: 7/20/2011 - Foia Log Cont.Documento21 páginasResponsive Document - CREW: FTC: Regarding Efforts by Wall Street Investors To Influence Agency Regulations: 7/20/2011 - Foia Log Cont.CREWAún no hay calificaciones

- Business Association I-1Documento93 páginasBusiness Association I-1Joseph VictorAún no hay calificaciones

- Sweet Coffee Shop: Business PlanDocumento12 páginasSweet Coffee Shop: Business PlanhenridennyAún no hay calificaciones

- Banco de Oro (Bdo) : Corporate ProfileDocumento1 páginaBanco de Oro (Bdo) : Corporate ProfileGwen CaldonaAún no hay calificaciones

- Jet Etihad PresentationDocumento22 páginasJet Etihad PresentationAjay Sancheti100% (1)

- Nike Vertical Integration StrategyDocumento8 páginasNike Vertical Integration StrategyvijayhegdeAún no hay calificaciones

- Internship Report BBADocumento102 páginasInternship Report BBAfarukAún no hay calificaciones

- Primary Cost and Secondary Cost PlanningDocumento4 páginasPrimary Cost and Secondary Cost PlanningsampathAún no hay calificaciones

- Lecture 6 Part II (Multivariate GARCH Only) 20130527002724Documento35 páginasLecture 6 Part II (Multivariate GARCH Only) 20130527002724georgiana 0912Aún no hay calificaciones

- Investment Books ListDocumento4 páginasInvestment Books ListSavisheshAún no hay calificaciones

- Valuing StocksDocumento39 páginasValuing StocksANITAAZHARNED0% (3)

- Growth Equity Case Study SlidesDocumento13 páginasGrowth Equity Case Study SlidesShrey JainAún no hay calificaciones

- Crypto Investing For BeginnersDocumento19 páginasCrypto Investing For Beginnerszoragi75% (4)

- 01 - Baltimore and Ohio RailroadDocumento12 páginas01 - Baltimore and Ohio RailroadLinh NguyenAún no hay calificaciones

- Kraljic Matrix v1.0Documento19 páginasKraljic Matrix v1.0Poornika AwasthiAún no hay calificaciones

- Corporate Finance Academic Year 2011-2012 TutorialsDocumento21 páginasCorporate Finance Academic Year 2011-2012 TutorialsSander Levert100% (1)

- Difference Between Product and BrandDocumento26 páginasDifference Between Product and Brandgastro8606342Aún no hay calificaciones

- A Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal KhanDocumento19 páginasA Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal KhanVandita KhudiaAún no hay calificaciones

- Book 1Documento57 páginasBook 1Alex Richard CarlosAún no hay calificaciones

- CH 13Documento9 páginasCH 13Haha KaAún no hay calificaciones

- Chapter 5 - Fund Flow Statement (FFS)Documento36 páginasChapter 5 - Fund Flow Statement (FFS)T- SeriesAún no hay calificaciones

- Monetary Policy - Objectives, Tools, and Types of Monetary PoliciesDocumento3 páginasMonetary Policy - Objectives, Tools, and Types of Monetary PoliciesVincentAún no hay calificaciones

- KFC Holdings (Malaysia) BHD: Information Circular To ShareholdersDocumento15 páginasKFC Holdings (Malaysia) BHD: Information Circular To ShareholderscutetybeeAún no hay calificaciones

- Lao VS lAODocumento2 páginasLao VS lAOJuris Renier MendozaAún no hay calificaciones

- Tbe C - Mock - Exam - 100Documento22 páginasTbe C - Mock - Exam - 100Sharania Udhaya Kumar100% (4)