Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Showket 333

Cargado por

arshadsofiDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Showket 333

Cargado por

arshadsofiCopyright:

Formatos disponibles

[Type text]

A PROJECT REPORT ON LOANS AND ADVANCES

of

State Bank Of India

Submitted to Himachal Pradesh University for fulfillment of the requirement for the award of

BACHELORS OF BUSINESS ADMINISTRATION SUBMITTED TO:

MR . Vishal Deep

SUBMITTED BY:

ACADEMIC SESSION

2011-2012

ACKNOWLEDGEMENT

[Type text]

I avail this opportunity to express my deep sense of gratitude to Mrs. Mini Mam the respected for providing me an opportunity to work as a Virtual Private Network (VPN). I also take this opportunity to thank to my guide Mr. Sushil Narayan for providing me proper direction to my project, for sparing their valuable time and rendering all possible guidance whenever approached. Thus, from which I have gained many insights. I am also thankful to my family and friends who gave me complete support to work on this project.

(AARIF

BHAT)

DECLARATION BY THE STUDENT

[Type text]

I hereby declare that this project tilted LOANS AND ADVANCES is based on the original work carried out by me under the supervision of Ms. Shikha Sharma is an original and bonafide work carried out in partial fulfillment of the requirement of the Award of the degree of Bachelors of Business Administration of Himachal Pradesh University. This is my original work and not submitted for any other diploma, fellowship, award or prizes. This is my sole effort.

Shikha Sharma

[Type text]

CERTIFICATE-I

Certified that research project entitled LOANS AND

ADVANCES is a bonafide research work conducted by me under the supervision and guidance of Lecturer Mr Arshad submitted to K.L.B.D.A.V in partial fulfillment for the degree of Bachelors of Business Administration. No part of the research project is submitted for any other degree.

Shikha Sharma

CERTIFICATE-II

[Type text]

This is to certify that the research project entitled loans and Advances submitted by Showkat Ahmad is a bonafide research work conducted under the supervision of Mr. Muzamil Ahmad. No part of the research project has been submitted for evaluation in partial fulfillment of the requirement for the degree of BBA before. The assistance and help received during the course of investigation has been duly acknowledged.

Vishal Deep

CONTENTS

[Type text]

S. No. I II III IV V VI VII VIII IX X XI XII XIII IX

Title of the Chapter INTRODUCTION TO THE COMPANY ACHIEVEMENTS RECOGNISATION & AWARDS INTRODUCTION TO THE PROJECT SCOPE OF THE STUDY THEORTICAL FRAMEWORK OBJECTIVES RESEARCH METHODOLOGY DATA ANALYSIS & INTERPRETATION FINDINGS LIMITATIONS SUGGESTIONS CONCLUSIONS BIBLIOGRAPHY QUESTIONNAIRE

Page No. 7 14 17 19 25 27 51 52 58 69 70 71 72 74 75

[Type text]

COMPANY PROFILE

[Type text]

INTRODUCTION TO THE PROJECT

LOANS AND ADVANCES

INTRODUCTION TO THE PROJECT

8

[Type text]

Loans and advances is the most important unit of any banking organization. Loan is a type of debt. Like all debt instruments, a loan entails the redistribution of financial assets over time. The borrower initially receives an amount of money from the lender, which they pay back, usually but not always in regular installments, to the lender. This service is generally provided at a cost, referred to as interest on the debt. A sum of borrowed money (principal) that is generally repaid with interest. Loan-to-Value Ratio the relationship between the amount of the mortgage loan and the appraised value of the property expressed as a percentage. Lock Lender's guarantee that the mortgage rate quoted will be good for a specific number of days from day of application. Money Margin, the amount a lender adds to the index on an adjustable rate mortgage to establish the adjusted interest rate. Advance is a term that describes a secured loan made to a member. Advances are offered at fixed or floating rates with specific maturities or with embedded options for early redemption. There are different types of loans offered by a bank :

LOANS AND ADVANCES

CONSUMER LOANS HOUSING LOANS

9

[Type text]

CAR LOANS EDUCATION LOAN PERSONAL CONSUMPTION LAON LOAN AGAINST MORTIGAGE LOAN AGAINST FIXED DEPOSITS/BOND/SHARES MORTIGAGE LOAN FOR TRADE

LOANS AND ADVANCES

BACK GROUND OF THE STUDY

No one can say for certain where the history of loans began it's likely that people have been practicing lending and borrowing for as long as there has been a concept of ownership. The history of loans can be documented at least several thousand years back forms of lending were evident in ancient Greek and Roman times, and monetary loans were even mentioned in the Christian bible.

10

[Type text]

The modern history of loans started much later than these ancient times, of course it is, however, important to realize that lending started much earlier than many people would imagine and has its origin in much older times.

Indentured loans

One of the early forms of lending that should be explored in the history of loans is the indentured loan (also known as indentured servitude.) Initially practiced in the middle ages and through the 19th century by landowners and the wealthy indentured servitude allowed poor individuals to borrow the money needed for major expenses such as travel and real estate work off their debt over the course of several years unfortunately, many a times they continue to add provisions to the debt long after it had been repaid.Indentured servants often had very few rights, and were seen by some wealthy individuals as a way to maintain slave labor long after slavery had been abolished in both Europe and the United States.

Banking loans

Luckily, legitimate banks were developing even as indentured servitude was rampant. Individuals known as moneylenders played an important part in the history of loans in fact, it's from the Italian moneylenders of the Middle Ages that we get both the English words bank" and bankrupt" that we use today. Italian moneylenders would set up benches in the local marketplace (with the word for bench being banca" from which, we eventually derived the word bank"). The moneylenders would charge interest on their loans at a rate that they set, and would sometimes be quite successful and become very wealthy.

11

[Type text]

As an interesting side note to the history of loans, if the moneylenders were not successful, though, they would break up their benches and pursue other venues. The Latin expression for breaking up a bench in this way was banca rupta", which eventually became the English word bankrupt" (which carries a much steeper connotation than simply a broken bench.).

Modern banking loans

Of course, the history of loans has progressed quite a bit since the days of the middle Ages moneylender. Interest rates are much more controlled, loan terms have a much higher degree of fairness to them, and the banks of our era aren't out to simply get as much money out of borrowers as they can. The modern banks, finance companies, and online lenders that provide loans to the public and private sectors provide a great service to the world economy, and are regulated by both local and governmental policy so as to make sure that nothing interferes with that service. However, if not for some of the oppression and misdealing that was present throughout the history of lending then the fairness and opportunity that exists in banking today might not be possible even the oppression that resulted from indentured servitude in the past helped to

12

[Type text]

establish modern banking by showing what factors needed to be eliminated so as best to benefit both lender and borrower.

LOANS AND ADVANCES

SCOPE OF THE STUDY

To be competitive and successful in modern corporate world, constant capital flow is essential. Whether to expand your business or to relocate your production unit to some other place for cost effectiveness, you require finance. Its not always possible to fund them through internal sources. A delay of a few days can cost you in millions. To make your enterprise successful and to run your business strategically, a secured business loan is an option worth trying for. Life can take an adverse turn at any moment. We cant be certain about our future responsibilities and obligations. In an hour of need, we look for various options to raise money. Many new ways have been evolved to raise money, but as a human being,

13

[Type text]

we tend to rely on the most favored options. A secured loan provides easier and olden way to acquire loan. One can easily plan his future investments and can easily fulfill his requirements and needs of life without risk Loans like housing loans, car loans, educational have made people to fulfill their needs at very ease.

LOANS AND ADVANCES

BENEFITS TO THE LENDER The lender of the loan gets the desired rate of interest on the amount he has owed to the borrower.

The lender can plan his investments and can earn solid amount of returns on the investment to be utilized in the future and can build a good reputation in the market. BENEFITS TO THE BORROWER

The advantage with loans is that you can design your

repayment period as well as monthly installments according to your financial capacity. A secured business loan comes at a lower interest rate when compared with other business loans. As these loans are taken against collateral, any default in repayment can put your commercial property at risk.

14

[Type text]

Interest rates offered on secured business loan is variable and easily affordable. Such opportunities are provided to entrepreneurs to encourage them and ultimately enhance the economy of the region. By promoting business or industries, local government can

LOANS AND ADVANCES

even eradicate unemployment and improve overall standard of living.

15

[Type text]

LOANS AND ADVANCES

THEORETICAL FRAMEWORK

LO A N S A N D A D V A N C E S

16

[Type text]

TYPES OF LOANS

CONSUMER LOANS HOUSING LOANS CAR LOANS EDUCATION LOAN PERSONAL CONSUMPTION LAON LOAN AGAINST MORTIGAGE LOAN AGAINST FIXED DEPOSITS/BOND/SHARES MORTIGAGE LOAN FOR TRADE

LOANS AND ADVANCES

17

[Type text]

CONSUMER LOANS

It is a loan that establishes consumer credit that is granted for personal use; usually unsecured and based on the borrower's integrity and ability to pay. For acquiring consumer loan one has to complete all the formalities. There are many types of consumer loans provided by the bank. Computer (P.C). Scooter/Motor cycle. Refrigerator/Washing machine/Air condition. Color T.V/VC

18

LOANS AND ADVANCES

[Type text]

iv ) R ef iii ri ) g C a) Scale of Finance er ol at or b) Maximum Finance or T (More than One / V article/Durable) Di / c) Eligibility sh V A C nt P e / d) Security vi n V ) n C W a R Rate of Interest e) at / (subject to change) er K G Fi er e lt os n e er cu n at m e or p R / S ur o W al ifi o as ie er m hi ntRepayment f) / H n F B e g Margin g) e & at ii) at W er LOANS AND ADVANCES ur T / M es V W ac ot : / as hi or T hi n C h) a n e yc A g (a le p e m ut pr / R ac Sc o ec hi m o ve or n at ot d d e ic er C er v) (S ) / i) o/ s e C Ai/ ns V C G ac m r o u ey u i o C m se u A ki o p er r m n ut D/ C cl o g di er ur I o e m ra ti (T a ol a at n o P. bl E er ic g n C es M . e. er ) :S

S. E fo Rs.3000/= to Rs.40, 000 per Article r Rs.75000/= subject to 12 times net monthly Salary. pr of es si Employees of Govt., Semi-Govt., Civic Bodies, Self employed on (with assured income) having minimum net monthly Salary als /Income of Rs.1800. D U 12 Primary Hypothecation of Article Financed. oc p % Collateral Third party Guarantee of one person. tor to p. O 13 s Rs a/ ve % En .2 r p. O gi 50 Rs a ve ne 00 .2 r er /= 50 Rs s/ 00 .2 C /= 50 ha 00 rte /= re d 60 months A 25 % (min.) of cost of article. cc ou nt an ts / Ar ch ite cts / M La in .N w et ye S r R al et M ax s. R ar R c. .s. 1 3 4 y s. 12 Fi 5, 0, 3 5 7 3, 5, 1 / 19 .5 n 5 0 In 8 5 0 % a 0 co 0 p. nc 0/ 0/ m a e = = e

[Type text]

HOUSING LOANS

It is a loan that establishes consumer credit that is granted for building house; usually unsecured and based on the borrower's integrity and ability to pay. For acquiring housing loan one has to complete all the formalities.

20

[Type text]

LOANS AND ADVANCES

Salient Features:

a) Quantum of loan

21

[Type text]

i) For Construction / Purchase

The maximum amount of loan to be sanctioned under the scheme would be 40 times the net monthly income/salary of the applicant and there would be no ceiling viz a viz. The amount of loan. The maximum loan granted for carrying out repairs, additions, extensions, improvement, completion, renovation of existing house is Rs. 4 Lakhs (Subject to 20 times net monthly salary/income). Also as an incentive for small borrowers, the loans up to Rs. 1.5 Lakhs granted for repairs/renovations of existing houses would now be secured by third party guarantee of 2 persons IC policies, Government securities, IVPs, NSCs, KVPs or such other security as is deemed appropriate by the sanctioning authority.However, negative lien would be stipulated over the existing house property for which the facility is granted and also have an ir-revocable power of attorney executed by the borrower authorizing the bank to sell the house in case of default. i) Employees of Govt., Semi-Govt. Dept., Civic Bodies, PSU's with min. 5 years service.

ii) For Renovation / Addition

LOANS AND ADVANCES

b) Eligibility

LOANS AND ADVANCES

c) Security

LOANS AND ADVANCES

ii) Reputed Businessmen with min. 5 years Standing. iii) Professionals & Self employed like Doctors, Engineers, CAs, Advocates, with min. 5 years standing. Primary: Mortgage of the house Property to

22

[Type text]

LOANS AND ADVANCES

EDUCATIONAL LOAN

23

[Type text]

An advance of funds to a student for the purpose of financing a college or vocational education. For acquiring consumer loan one has to complete all the formalities. There are two types of educational loans provided by the bank.

1. For those who study in India

2. For those who study in Foreign

LOANS AND ADVANCES

Salient Features: a) Scale of Finance i) Rs.7.50 Lakhs for studies in India. ii) Rs.15.00 Lakhs for studies abroad. b) Courses Allowed i) Graduate / P.G Courses in: for Medicine, Surgery, Engineering, Hotel Management, Design, Architecture, Biochemistry, Agriculture, Veterinary etc. ii) P.G Courses in: Business Management, Chartered or Cost Accounting, Company Secretary ship. c) Eligibility i) Should be an Indian National ii) Should have secured admission to professional/technical courses through entrance test/selection process. iii) Should have secured admission to foreign universities/institutions iv) Should have passed the qualifying examination for admission to the courses. v) Employed person intending to improve their educational qualification and/or receive training in modern technology in India or abroad can also be assisted under this scheme provided training offers prospects of better placement.

24

[Type text]

d) Security e) Margin

i) Personal guarantee of borrower/s. ii) Collateral security equal to amount of loan. i) For loans upto Rs. 4 Lakhs- nil ii) For loans above Rs. 4 Lakh Studies in India - 5%

LOANS AND ADVANCES

Studies abroad - 15% Upto Rs.25, 000 9% p.a Rs.25, 000 to 10% p.a f) Interest Rs.5.00 Lakhs (subject to change) Above Rs.5.00 11% p.a Lakhs g) Repayment Course period plus one year or six months after getting job, whichever is earlier Loan to be repaid in 5 - 7 years after commencement of repayment

25

[Type text]

LOANS AND ADVANCES

CAR LOANS

Automobile loan: a personal loan to purchase an automobile.

26

[Type text]

LOANS AND ADVANCES

Salient Features

a) Sc b) al El e igi of bil Fi ity c) na Se nc d) cu e R. rit O. y In te e) re R f) st ep M g) (s ay ar Q ub m gi ua je en n nt ct t u to m ch of an Fi ge na ) nc e

Pe ri Le 3 od ss ye th ar an s 3 an ye d ar ab s ov e

N et Rs A .7 Rs n 5, .1, Rs n 00 20 .1, Rs ua 0 ,0 75 .2, Rs lto 01 ,0 50 .3, A In to 01 ,0 50 bo A co Rs R to 01 ,0 ve bo (O m .1, s.1 R to 01 Rs ve th/ eR 20 ,5 s.2 to . Rs er Pr ,0 75 , s.3 Rs La . co of 00 ,0 50 , . kh 6. nd it 00 ,0 50 5. st 50 iti 00 ,0 o La on 00 La Rs kh s kh . st ap s 6. o pl 50 Rs y) La . kh 10 s27 La kh s

i) E m pl oy ee s of G ov t. i)S / Pr e im Ra mi ar ng G y in ov H g t., yp fr Ci ot o vi he m c ca Rs B tio .1. od n 00 ies of La , V c PS eh to U' 5 icl Rs s ye 25 eI .5. / ar % Fi 00 nd s na La ivi in nc kh du eq ed s al ua de /P l ii) pe ro m C nd pri on oll in et thl at g or y er up sh in al on ip sta Th th C ll ird e on m pa N ce en rty et rn ts. G A/ s ua nn Fi ra ua rm nt l/ s ee In Li of co mi on m te e/ d pe Sa C rs lar o on y m

R at 9. 11 e 50 .0 of % 0 In p. % te a. p. re wi a. st th wi m th on m thl on y thl re y sts re sts

M ax Rs im .1. Rs u 00 .2. Rs m La 00 .3. Rs Fi c La 00 .4. Rs na kh La 00 .5. Rs nc s kh La 00 . Rs e s kh La 7. . s kh 00 10 s La .0 kh 0 s La kh s

[Type text]

LOAN AGAINST MORTIGAGE

This scheme is for individuals/business enterprises/professionals and self employed as an ideal source of funds for expenditures of any nature. ELIGIBILITY CRITERIA: The scheme would provide finance to Individuals/Business Enterprises having minimum net annual income of Rs.1.20 Lakhs per annum against mortgage of unencumbered immovable property situated in Metros/Urban/Semi-Urban Areas. Salaried Individuals LOANS AND ADVANCES must have put in a minimum confirmed service of 3 years. Business Enterprises, professionals and self-employed must have a minimum standing of 3 years in the respective line of activity.

28

[Type text]

LOANS AND ADVANCES

PURPOSE: For meeting their business and/or any personal need/expenditure. INCOME CRITERIA: Minimum net income should be Rs.1.20 Lakhs. AMOUNT OF LOAN: 20 times net monthly income or Rs.10 Lakhs whichever is lower.

LOANS AND ADVANCES

MINIMUM LOAN AMOUNT: MAXIMUM LOAN AMOUNT:

Rs.2.00 lakhs Rs.10.00 lakhs.

29

[Type text]

In case of Individual borrowers, the income of the spouse can be taken in to consideration for determining the loan amount. In such cases, the facility would be allowed in the joint name. MARGIN: nil. TYPE OF LOAN: Term loan. UPFRONT FEE/PROCESSING CHARGES: 0.25% of the loan sanctioned would be recovered as processing charges. SECURITY: Registered/Equitable mortgage of unencumbered residential house/flat, commercial or industrial property with a clear marketable title situated in the Metros/Urban/Semi-Urban areas/Center only and which stands in the name and possession LOANS AND borrower (individual/business enterprise). The forced sale of the ADVANCES value/market value of the property shall have to be at least equal LOANS AND ADVANCES to 1.5 times of the loan amount. Besides the property should be vacant.

LOANS AND ADVANCES LOANS AND ADVANCES

RATE OF INTEREST: 2.5% above the Banks Prime Lending Rate (PLR) (presently 12% per annum). Effective rate of interest would be 14.5% p.a. and would be charged with quarterly rests. REPAYMENT: The loan granted under the scheme together with interest thereon would be repayable within a maximum period of 60

30

[Type text]

months through Equated Monthly Installments (EMI`s) commencing one month after disbursement of the loan. The repayment shall have to be fixed on realistic basis so that the gross deductions including the EMI for the loan granted under this scheme does not exceed 50% of the borrower gross income. In case of individual borrowers the income of spouse shall be taken into account for determining the repaying capacity of the borrower. INSURANCE: The property against which the loan is granted will have to be comprehensively insured against all risks for its full value during the continuance of the loan facility from the Bank. The cost of the insurance to be borne by the borrower and the Policy will be drawn in the joint names of the Bank and the borrower

LOANS AND ADVANCES

with usual Bank clause therein.

LOANS AGAINST SHARES/BONDS

TYPE OF FACILITY

i) Over Draft ii)Term Loan SECURITY Pledge of Shares/Bonds/debentures in demat format only PURPOSE OF LOAN: Loan can be availed for any purpose. AMOUNT OF LOAN:

31

[Type text]

Minimum Rs.0.50 Lakhs Maximum Rs.20.00 Lakhs. The advance to single scrip shall be restricted to Rs.2.00 Lakhs only. MARGIN: i) 50% on the 52 weeks of average price ii) 25% margin in case of bonds/Govt.Securities In case of bonds, the rating should be not less than 'AAA' by CRISIL or equivalent rating by any other recognized rating agency. PROCESSING CHARGES: 0.25% of the loan amount.

REPAYMENT: The Term Loan together with interest thereon shall be repayable in 36 Equated Monthly Installments commencing one month after disbursement of loan. The overdraft facility shall be for one year renewable after review. DISBURSEMENT: The disbursement shall be by Credit to the saving/CD account of the borrower. GENERAL TERMS AND CONDITIONS:

1) The party should have dematted account preferably with J&K Bank. 2) The loan should be granted against the security of not less than two scripts preferably of different business houses. 3) The Shares should be fully paid. 4) Individuals cannot pledge scrips of companies of which they themselves are directors/promoters.

32

[Type text]

5) The Shares of J&K Bank are not eligible for finance under this scheme in terms of Sec.20 (1) of BR Act, 1949. 6) The facility should be granted against the Shares of companies as are given in the Annexure I only. 7) The Shares to be pledged should not be under lock-in-period. 8) The facility of loan against shares shall be available at branches as are detailed in Annexure- II. 9) The branches shall pay 0.50% p.a. as service charges to the Depository .

LOANS AND ADVANCES

ROLE OF DEPOSITORY SERVICES CONNAUGHT PLACE, NEW DELHI. The Depository Services, Connaught Place New Delhi, will provide Risk Management Services to the Branches for loan facility against demat Shares/Securities under LAS Scheme. The Risk Management Services will include: 1) Processing of Application for LAS received directly from clients and those forwarded by branches. 2) Verification of Demat Account Status of the Applicant. 3) Scrutiny of Shares/Securities proposed to be pledged on the basis of Banks approved list of Shares/Securities. 4) Creation of charge on the securities. 5) Valuation of securities and assessment of Drawing Power on the basis of 52 weeks average price or current market value of securities, which ever is lower.

33

[Type text]

6) Regular monitoring value of securities and advising the concerned branch of the D.P. to regulate drawings.

LOANS AND ADVANCES

7) Branches will invariably be furnished valuation report on weekly basis or as and when demanded by the branch or the day indices (Nifty/Sensex) fall by 3% or more.8) In case branches directly receive request regarding the reshuffling of portfolio from the clients, the branches will send the request to Depository Services Connaught Place New Delhi for necessary actions. The sanctioning authorities/operative levels are advised to give wide publicity to the scheme and ensure that credit requests there under are disposed judiciously and expeditiously. Branches are also advised to keep close liaison with Depository Services.

34

[Type text]

LOANS AND ADVANCES

MORTIGAGE AGAINST LOAN TRADE

Purpose: To provide hassle free working capital finance to the borrowers. Nature of facility:The loan facility should be granted as cash credit and overdraft. Eligibility: Retail and Wholesale Traders and Other Business Enterprises, with a satisfactory track record of 3 years. (Cash profits during the last 3 years and net profit in the immediate preceding year). Amount of Loan:

Minimum Loan: Rs.2.00 Lakhs Maximum Loan: Rs.50.00 Lakhs

Basis of Assessment: 15% of the Projected Annual Sales Turnover. OR 50% of the forced realizable value of the property (whichever is lower).Sales Turnover shall be supported with Sales Tax Return acknowledgements or Turnover through account, which should be at least 60% of the sales turnover reflected in the Balance Sheet. If it is below

35

LOANS AND ADVANCES

[Type text]

60% the Sales Turnover shall be adjusted in proportion to the account turnover by multiplying it with conversion factor 1.66. To elucidate Turnover in the account is Rs25 Lakhs the sales turnover will be assumed at Rs.25 Lakhs 1.66= Rs.41.50 Lakhs. Projected annual turnover should not exceed 125% of the turnover achieved in the immediate preceding year. Security Primary: Hypothecation of stocks and book-debts. Collateral: Mortgage of Unencumbered residential house/flat, commercial or industrial property with a clear marketable title in the name and possession of the borrower/Proprietor/ Partner/s/Director/s either selfoccupied or vacant. Valuation: Forced Value of the property should be based on latest Valuation Report of the Bank's approved Value and concerned Branch Manager should satisfy himself about the valuation so made. Rate of interest: PLR +1% i.e. 12.00% with monthly rests

LOANS AND ADVANCES

Disbursement: The loan amount to be released for business purpose only Validity: sanctioned limits shall be valid for a period of 3years .

36

[Type text]

OBJECTIVE OF RESEARCH

To know the procedure for the payment of loan by J&K bank

To know about the interest rates of the J&K bank. To know customers loyalty towards J&K bank.

*.

37

[Type text]

RESEARCH METHODOLOGY

38

[Type text]

LOANS AND ADVANCES

MEANING OF THE RESEARCH

Research may mean the first small step in an endeavor to understand better the change occurring and at times forced upon we as individuals or as society. Research as a process involves defining problems, hypothesis, formulation and organization and evaluating data, deriving deductions, interferences and conclusion after careful testing. In this research study of LOANS AND ADVANCES simple random sampling was used .Both primary and secondary data was collected. The survey was confined only to the costumers of SBI bank. The size of sample was twenty two (22) .Both open ended and close ended questions were asked to the respondents. Among these respondents 6 were govt. employees, 9 were businessmen, 5 were students and others were 2.

LOANS AND ADVANCES

39

[Type text]

METHODS OF DATA COLLECTION

Data is of primarily of two kinds. 1. Primary data 2. Secondary data. Secondary data may be defined as data that has been collected earlier for some purpose other than the purpose of the present study. Any data that is available prior to the commencement of the research project is secondary data and it is called historic data

USES OF SECONDARY DATA

It acts as a reference for the present study. The secondary data can be a useful benchmark, which the findings of the study can be tested. At times it may be the only source of data.

SOURCES OF SECONDARY DATA

Published Sources Unpublished sources

LOANS AND ADVANCES

Data collection methods can be classified as follows

40

[Type text]

Observation Interviewing Experimentation Simulation Projective techniques

In this project two methods of collection were used. They are-------------1. Interviewing. 2. Published source of data in the form of books of accounts.

INTERVEIWING

It is the most commonly used method of data collection. It is two ways purposive communication between the interviewer and the respondent aimed at obtaining and recording information pertinent to the subject matter of the study.

HOUSING LOANS

41

[Type text]

Repayment

i) For Construction of New House 20 years Including 9 months moratorium in equal monthly installments. (Applicable to new loans and disbursements only) ii) For addition / Renovation 5 years Including 2 months moratorium in equal monthly Installments.

EDUCATIONAL LOAN

Repayment Course period plus one year or six months after getting job, whichever is earlier Loan to be repaid in 5 - 7 years after commencement of repayment

5 years in equal monthly installments.

CAR LOANS

Repayment

LOAN AGAINST MORTIGAGE

REPAYMENT: The loan granted under the scheme together with interest thereon would be repayable within a maximum period of 60 months through Equated Monthly Installments (EMI`s) commencing one month after disbursement of the loan. The repayment shall have to be fixed on realistic basis so that the gross deductions including the EMI for the loan granted under this scheme does not exceed 50% of the borrower gross income. In case of individual borrowers the income of spouse shall be

42

[Type text]

taken into account for determining the repaying capacity of the borrower.

LOANS AGAINST SHARS/BONDS

REPAYMENT: The Term Loan together with interest thereon shall be repayable in 36 Equated Monthly Installments commencing one month after disbursement of loan. The overdraft facility shall be for one year renewable after review.

MORTIGAGE AGAINST LOAN TRADE

Sanctioned limit shall be valid for a period of 3 years subject to review/renewal at the end of the year.

43

[Type text]

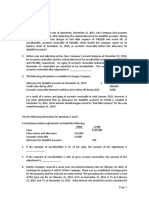

DATA ANALYSIS, INTREPRETITION

44

[Type text]

LOANS AND ADVANCES

1. How long you have been banking with the SBI bank?

10 percent of respondents are dealing with bank from last 1year. 15 percent of respondents are dealing with bank from last 5years. 60 percent of respondents are dealing with bank from 10years. 15 percent are not dealing at all.

45

[Type text]

LOANS AND ADVANCES

2. Are you aware of the different loan schemes provided by the bank?

From The above graph we can say that: 80% of the respondents agreed that they are aware of the different loan schemes provided by the bank. While only 20% are not aware of the loan schemes provided by the bank.

46

[Type text]

LOANS AND ADVANCES

3. If you are aware of the loan scheme offered by the bank and desire to avail the facility of the scheme but have not availed so far, what is the reason? a.Indifference of the branch people b. complicated formailities c. Slow pace of processing

From The above graph it is clear that: 65% of the respondents said that the reasons for not availing the different loan schemes are the complicated formalities .20% of the respondents said that the reasons for not availing the different loan schemes are the slow processing of applications. 15% of the respondents gave the other reasons for not availing the different loan schemes.

LOANS AND ADVANCES

47

[Type text]

4. How do you rate the attitude of bank officials towards youself while making transactions?

From The above graph it is clear that: 59% of the customers think that the attitude of the bank officials while making transactions is excellent. 21% of the customers think that the attitude of the bank officials while making transactions is good.

15% of the customers think that the attitude of the bank officials

while making transactions is satisfactory

LOANS AND ADVANCES

02% of the customers think that the attitude of the bank while making transactions is poor. 03% of the customers think that the attitude of the bank officials while making transactions is very poor.

48

LOANS AND ADVANCES

[Type text]

5. What interest rates do you suggest for the maximum loan amount (15 Lakhs)?

From The above graph it is clear that: 60% of the respondents think that interest rates should be 6 to 7% 25% of the respondents think that interest rates should be between 8 to 10%

LOANS AND ADVANCES

6. The bank provides different loans schemes, which one you avail among these? a. b. c. d. Home loans. Education loans. Cars loans. Business loans. No. of customers 6 5 3

49

Scheme Home Loans Education Loans Car Loans

[Type text]

Business Loans

From The above graph it is clear that: 23% of respondents avail education loan 36% of respondents avail bus. Loan 27 % of respondents avail home loans & only 14% of responds avail car loans.

7. Why do you want to avail this scheme? a. b. c. d. Need to build my house. Need for higher studies. Need to buy a car. Need to start/invest in the business. No. of Customers 6 5 3 8

Schemes Need to build to house Need for higher studies Need to buy a car Need to start/invest in the business

From The above graph it is clear that: 27% of the respondents avail the scheme to build house. 23% of the respondents avail the scheme for higher studies. 14% of the respondents avail the scheme to buy a car. 36% of the respondents avail the scheme to invest/start business.

50

[Type text]

8. What is the procedure to repay the loan? a. b. c. d. Monthly. Quarterly. Yearly. After 5years. Procedure Monthly Quarterly Yearly After 5years Duration 3 5 8 6

From The above graph it is clear that: 14% of the respondents say the procedure monthly. 23% of the respondents say the procedure is quarterly. 376% of the respondents say the procedure is yearly. 27% of the respondents say the procedure is after 5 years.

9. Are you satisfied with bank dealings? a. Yes. b. No.

51

[Type text]

From The above graph it is clear that: 77% of the respondents are satisfied with bank dealings. And 13% of the respondents are not satisfied.

10. Would you like to borrow money again from the bank? a. Yes. b. No.

From The above graph it is clear that: 77% of the respondents would like to borrow again. And 13% of the respondents will not borrow again.

52

[Type text]

LOANS AND ADVANCES

FINDINGS

The J&K bank is one of the leading and fast growing banks. The bank has its branches in all parts of Jammu & Kashmir and other states of the country. The bank with its better customer service and almost all the facilities which must be present in the present technological world is widely accepted by the people. 1. The J&K bank has wide range of acceptance. 2. The J&K bank provides better customer service. 3. The bank has good fame among customers. 4. The bank is loyal to its customers and provides every possible help to them. 5. The bank provides loans on easy terms which are easily full filled by the customers. 6. The bank provides every possible assistance to unemployed youth. 7. Insufficient employees increases the processing time in the banks. 8. High interest rates make obstacles in borrowing from bank. 9. Less promotion of the bank products. 10. The attitude of bank officials is good towards customers. 11. Mostly the customers go for business loans.

53

[Type text]

LOANS AND ADVANCES

LIMITATIONS

My research was limited because of the fact that the major source of data was from the annual reports of the company, which were subject to accounting policies and practices followed by the company. The major limitations are Due to strict confidentiality policy of the company the accounts department provided only screened information. Accuracy of the data provided cannot be guaranteed which does not statements obtain secondary data

54

[Type text]

LOANS AND ADVANCES

SUGGESTIONS

There are lots of benefits by acquiring any type of loan and one can easily fulfill his needs and basic requirements of life. There are also tax related benefits that is tax liability can be reduced a lot by showing more debt than equity in capital structure. Banks also get the interest on the loans so accordingly they can also earn profits and plan the future investments. A lot of documentation and formalities are to be completed for raising the loan, which requires a lot of time so the procedure of raising the loan should be simplified to some extent.

Banks can adopt few qualitative techniques to educate the borrower

about its lending policies

LOANS AND ADVANCES

55

[Type text]

CONCLUSION

As we observe the trends in Indian financial sector is changing rapidly through innovation, dependability of loans and advances has also increased and much awareness of this concept has been found. Loans and advances have become the important source of raising the finance among the individual, corporate as well as for the higher organizations. A secured business loan is a loan given for commercial Purposes. It keeps business properties as collateral. It can be taken for a variety of purposes like Diversification, research and development or to buy Plants and machineries. The advantage with loans is that you can design your repayment period as well as monthly installments according to your financial capacity. A loan comes

LOANS AND ADVANCES

a lower interest rate when compared with other business loans. As these loans are taken against collateral, any

56

[Type text]

default in repayment can put your commercial property at risk. To be competitive and successful in modern corporate world, constant capital flow is essential. Whether to expand your business or to relocate your production unit to some other place for cost effectiveness, you require finance. Its not always possible to fund them through internal sources. A delay of a few days can cost you in millions. To make your enterprise successful and to run your business strategically, a secured business loan is an option worth trying for.

57

[Type text]

BIBLOGRAPHY

1: WWW.J&KBANK.COM 2:WWW.SBIBANK.CO.IN 3:WWW.SBIBANK LOANS.COM 4:WWW.LOANSCHEMS OF SBI BANK.COM 5:WWW.ECNOMICTIMES.COM 6: DIRECT SEARCH

58

[Type text]

LOANS AND ADVANCES

Questionnaire for customer

M/S. ______________________________________________________ Address: ___________________________________________________ Phone: ____________________________________________________ Dear customer It has always been our earnest endeavor to serve you better. The following questionnaire is aimed at knowing your satisfaction level. You are requested to respond fairly to the questions and guide us in developing strategies for serving you better. 1. How long you have been banking with the SBI bank? a. 1 year b. 1-5 years c. 5-10 years d. Not at all 1. Are you aware of the different loan schemes provided by the bank? a. Yes b. No

59

[Type text]

LOANS AND ADVANCES

3. What interest rates do you suggest for the maximum loan amount (15 Lakhs)? a. 6-7% b. 8-10% c. Agree with existing 4. How do you rate the attitude of bank officials towards you while making transactions? a. Excellent b. Good c. Satisfactory

a. Poor.

1. If you are aware of the loan scheme offered by the bank and desire to avail the facility of the scheme but have not availed so far, what is the reason? a.Indifference of the branch people b. complicated formailities c. Slow pace of processin

60

[Type text]

LOANS AND ADVANCES

2. The bank provides different loans schemes, which one you avail

among these? a. b. c. d. Home loans. Education loans. Cars loans. Business loans.

1. Why do you want to avail this scheme? a. Need to build my house.

b. Need for higher studies. c. Need to buy a car. d. Need to start/invest in the business. 1. What is the procedure to repay the loan? a. b. c. d. Monthly. Quarterly. Yearly. After 5years

1. Are you satisfied with bank dealings?

a. Yes. b. No

1. Would you like to borrow money again from the bank?

a. Yes. b. No.

61

[Type text]

62

También podría gustarte

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Financial Management: Valuation of Bonds and Shares QuizDocumento12 páginasFinancial Management: Valuation of Bonds and Shares QuizSeri DiyanaAún no hay calificaciones

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Advance Accounting Chapter 10Documento53 páginasAdvance Accounting Chapter 10febrythiodorAún no hay calificaciones

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- BA 114.1 - Module2 - Receivables - Exercise 1 PDFDocumento4 páginasBA 114.1 - Module2 - Receivables - Exercise 1 PDFKurt Orfanel0% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Glacier Funding V CDO PitchbookDocumento79 páginasGlacier Funding V CDO Pitchbookthe_akinitiAún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Mastering Money Matters - A Financial Management WorkshopDocumento7 páginasMastering Money Matters - A Financial Management WorkshopCATHAún no hay calificaciones

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- Mishkin Fmi07 Ppt03Documento43 páginasMishkin Fmi07 Ppt03Wahbeeah MohtiAún no hay calificaciones

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Notice For Credit Card Holders On RBI's COVID-19 Relief: Page 1 of 4Documento4 páginasNotice For Credit Card Holders On RBI's COVID-19 Relief: Page 1 of 4cr4satyajitAún no hay calificaciones

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Kerpa Singh V Bariam SinghDocumento2 páginasKerpa Singh V Bariam SinghBotaz Chin100% (2)

- Star River Electronics LTDDocumento5 páginasStar River Electronics LTDAdam Amru100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- M Finance 2nd Edition Millon Test Bank Full Chapter PDFDocumento56 páginasM Finance 2nd Edition Millon Test Bank Full Chapter PDFLouisBeltrankrbi100% (11)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Robert Rasmussen, Robert B. Glenn Charged With INDIRECT CRIMINAL CONTEMPTDocumento159 páginasRobert Rasmussen, Robert B. Glenn Charged With INDIRECT CRIMINAL CONTEMPTChristopher Stoller EDAún no hay calificaciones

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Lusardi 2020 - Building Up Fnancial Literacy and Fnancial ResilienceDocumento7 páginasLusardi 2020 - Building Up Fnancial Literacy and Fnancial ResilienceNadia Cenat CenutAún no hay calificaciones

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Chapter 18Documento9 páginasChapter 18Kori NofiantiAún no hay calificaciones

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- Project Report On Capital Structure of RanbaxyDocumento95 páginasProject Report On Capital Structure of RanbaxyAltamash Shaikh0% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Section 3: Condonation or Remission of The DebtDocumento19 páginasSection 3: Condonation or Remission of The DebtRomar TaroyAún no hay calificaciones

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Press Release - Bumi Armada Refinances Corporate Debt 240419Documento2 páginasPress Release - Bumi Armada Refinances Corporate Debt 240419Philip RourneAún no hay calificaciones

- Simple and Compound InterestDocumento2 páginasSimple and Compound InterestRaymond EdgeAún no hay calificaciones

- What Is WACC Fallacy?Documento1 páginaWhat Is WACC Fallacy?mountain girlAún no hay calificaciones

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Emu LinesDocumento22 páginasEmu LinesRahul MehraAún no hay calificaciones

- Wworking Capital Management Project by Ramanpreet Khangura 1Documento67 páginasWworking Capital Management Project by Ramanpreet Khangura 1Ramandeep KaurAún no hay calificaciones

- 02 - PFM - Chapter 1 - Introduction To Personal Financial ManagementDocumento9 páginas02 - PFM - Chapter 1 - Introduction To Personal Financial ManagementLee K.Aún no hay calificaciones

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- FM Unit 2Documento2 páginasFM Unit 2Prabudh BansalAún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Euromoney Loan DocumentationDocumento8 páginasEuromoney Loan DocumentationIvan SuchkovAún no hay calificaciones

- Sample Import TemplateDocumento5 páginasSample Import TemplateAMMAR REHMANIAún no hay calificaciones

- Deposition of Claire SwazeyDocumento119 páginasDeposition of Claire SwazeySTOP RCO NOWAún no hay calificaciones

- Nonperforming LoansDocumento84 páginasNonperforming Loanssandra vujicAún no hay calificaciones

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- Project Report Final Samkit ExportsDocumento17 páginasProject Report Final Samkit ExportsSURANA1973Aún no hay calificaciones

- Ratings Till 20aug2010Documento123 páginasRatings Till 20aug2010piyushvishnoiAún no hay calificaciones

- Profile - of - MMM-converted - For MergeDocumento7 páginasProfile - of - MMM-converted - For Mergemadhukar sahayAún no hay calificaciones

- Vietnam National University, Hanoi: International SchoolDocumento24 páginasVietnam National University, Hanoi: International SchoolLương Vân TrangAún no hay calificaciones

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)