Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Financial Assign 2

Cargado por

subba1995333333Descripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Financial Assign 2

Cargado por

subba1995333333Copyright:

Formatos disponibles

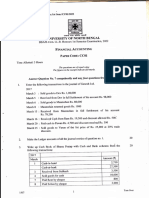

CHRISTCOLLEGE, JAGDALPUR ASSIGNMENT NO.

2 CASH BOOK,TRAIL BALANCE,OPENING ENTRIES,FINAL ACCOUNTS & RECTIFICATION Question 1 :From the following particulars, given below, prepare a Three-Column cash book. 2004 April 1 Cash in hand 1 Cash at bank 2 Paid into bank 5 Received from Mohan bros. 5 Discount allowed 7 Bought furniture for cash 10 Paid Ramlal $ co. by cheque Discount received 13 Received from Hamid Ali by cheque and paid into bank 15 Cash sales 15 Paid into bank 17 Bought a motor cycle and paid for same by cheque 19 Paid to J. Walker by cheque Discount received 22 Drew from bank for office use 25 Goods purchased for cash 27 Paid ram Lal $ co. by cheque 28 Received from hamid ali Discount allowed 30 Paid establishment charges by cheque Paid rent in cash -

5,675 1, 26,753 5,000 7,900 100 2,500 7,450 50 5,000 7,856 10,000 52,400 3,670 30 2,500 3,500 5,000 1,950 50 4,500 500

Question 2:Write the following transaction in the proper Cash book and balance it : 2004 Jan 1 Cash in hand 5,600 1 Cash at bank 48,000 2 Paid salary by Cheque 8,000 3 Paid to Ramesh cash 3,900 5 Goods sold for cash 7,500 7 Suresh paid cash Rs. 7,000 in full settlement of debt of 7,120 8 Cash purchases 8,000 9 Cash sales 20,000 12 Deposited into bank 10,000 15 Received a cheque of Rs. 7,840 from Mohan in discharge of a debt of Rs. 8,000. and it was sent to bank on the same day. 20 Issued a Cheque in favour of Shankar in full settlement of a debt of Rs. 10,000 9,800 22 Paid to Narendra cash Rs. 9,900 and discount received Rs. 100 24 Purchased machinery worth Rs. 60,000 payment being made by cheque. 28 Bank returned Mohans Cheque being dishonoured and charged Rs. 40 for expenses. 30 Withdrew cash from bank for private use 4,500 31 Bank charges as per pass book 150

Question 3:Make necessary journal entry in respect of the following balances in the book of Ravindra : 2004 April, 1 Assets cash in hand Rs. 700, cash at bank Rs. 10,800, stock Rs. 10,000, furniture Rs. 12,000, Debtors Rs. 18,000, bills receivable Rs. 3,000, Liabilities : Creditors Rs. 4,800, Bills payable Rs. 1,700. Question 4 :The under mentioned trial balance of messrs Rastogi Brothers has been wrongly drawn. You are to redraft the same correctly : Trial Balance Dr. (for the year ended on 31st march, 2004) Cr. Opening stock Sundry debtors Fixed assets Gross purchases Return inwards Carriage (on purchase) Import duty Wages and salary Bills payable Rent received Bank overdraft Cash in hand Rates and taxes 16,590 20,670 79,000 60,920 2,400 800 1,200 31,400 15,000 3,800 11,000 380 7,130 2,50,290 Capital Closing stock Sundry creditors Gross sales Return outwards Carriage (on sales) Export duty Bills payable Interest paid Commission received Discount allowed 1, 00,000 20,580 12,000 1, 02,600 1,230 1,850 800 8,000 1,100 870 760

2,50,290

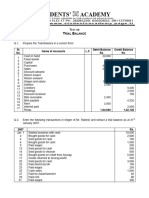

Question :- 5 From the following balances are extracted for the year ending 31st March, 2004 from the book of Vivek Saraf : Debit Credit Rs. Rs. Capital 10,000 Cash in hand 1,500 Bank overdraft 2,000 Purchases and sales 12,000 15,000 Returns 1,000 2,000 Establishment charges 2,500 Taxes and insurance 500 Bad debt and bad debt provisions 500 ` 1,000 Sundry debtors and creditors 5,000 2,000 Commission 500 Investment 4,000 st Stock 1 April, 2003 3,000 Drawings 1,400 Furnitures 600 Bills receivable and payable 3,000 2,500 25,000 35,000 You are required to prepare Trading and Profit & Loss and Balance sheet On 31st march, 2004, taking into account following information : 1 Salaries Rs. 100, taxes Rs. 200 are outstanding but Rs. 50 for insurance is prepaid 2 Commission Rs. has been received in advance for work to be done next year. 3 Interest accrued on investment Rs. 210, Interest to be paid on overdraft Rs. 300. 4 Bad debt provisions is to be maintained Rs. 1,000 5 Depreciation on furniture at 10%. 6 Stock on 31st March, 2004 is valued at Rs. 4,500.

Question 6 :The following is the trial balance of Mr. Moiz as on 31st march, 2004 : Name of accounts Moizs capital A/c Opening stock Sales Purchases Sundry creditors Salaries and wages Office furniture Octroi expenses Municipal taxes Discount received Rent Mr. Mirzas loan Insurance Sundry debtors General expenses

Debit Rs. 15,000 10,000 60,000 6,000 3,000 400 400 1,250 600 7,000 9,350 1,13,000 -

Credit Rs.

80,000 7,650 350 25,000 1,13,000

The following adjustments are to be made : 1 Closing stock was valued at Rs. 9,000. 2 Sales include sales invoices of Rs. 2,000 for which goods are not dispatched and such goods are already included in the closing stock of Rs. 9,000. 3 Goods worth Rs. 1,000 were taken away by Mr. Moiz for his personal use. 4 Octroi expenses included expenses paid Rs. 200 on purchases. 5 Salaries and wages included Rs. 1,000 paid as wages to workmen to make the office furniture. 6 Furniture to be depreciated @ 10% 7 Municipal taxes are paid for the 12 months commencing from 1st October, 2003 8 Loan is taken from Mr. Mirza on 1st august, 2003. Interest rate for the same was 12% p.a. 9 Provision for bad and doubtful, debts be created 5% and provision for discount 2% on sundry debtors. Prepare : i. Trading and Profit & Loss Account for the year ended 31st march, 2004. ii. Balance sheet as on 31st march, 2004. Question 7:State with reason whether the following are Capital 'or' Revenue items: i. Nazrana paid for lease of land; ii. Compensation paid to retrenched employee for loss of employment; iii. Compensation paid for breach of contract for the supply of goods; iv. Received financial aid from State Government; v. Loss of cash sent to bank stolen on the way; vi. Legal expenses incurred in an Income-tax appeal; vii. Discount allowed on issue of shares and debentures; viii. Losses on fixed assets by obsolescence; ix. Embezzlement by Accountant; x. Preliminary expenses of company;

Question 8 :State with the reasons whether the following items are Capital or Revenue: i. Amount received on forfeiture of shares. ii. Advertisement expenses to launch a new product. iii. Amount received on sale of goodwill. iv. Money received on sale of waste paper. v. Aid received from State Government. vi. Extra-ordinary loss caused due to earthquake. vii. Profit received from the sale of investment. viii. Death of two bullocks in motor accident. Question 9 :- . From the following prepare Trading Account, Profit & Loss Account and Balance Sheet as on 31st March, 2004: Rs. Rs. Stock 40,000 Cash 14,000 Purchase 70,000 Furniture 50,000 Drawings 20,000 Capital 70,000 Trade Expenses 6,000 Creditors 10,000 Debtors 60,000 Bills ayable 90,000 Goodwill 10,000 Sales 1,00,000 A fire occurred on 10th March, 2004 and goods worth Rs.8,000 were destroyed. There was insurance on it for Rs. 10,000 but the insurance company accepted claim for Rs. 6,000 only. Factory manger is to be given commission at 10% on net profits after charging his own commission and commission of the General Manager who is given 25% commission on net profit which remains after paying has own commission and commission of the Factory manager. Purchases for personal use amounting to Rs. 2,000 have been recorded in the purchase book. Closing stock stood at Rs. 40,000. Question 10 :Pass necessary entries for the following errors: (i) Credit sales to Subhash R. 800 has been recorded in purchase book. (ii) Goods returned to Sushil Rs. 60 has been recorded in Returns inward book. (iii) A crossed cheque for Rs. 200 received from Kishan was not recorded. (iv) Goods purchased from Nandan & Co. Rs. 3,200 has been recorded in sales book. (v) Material Purchased for making loose tools Rs. 80 and wages paid Rs. 150, were recorded in debit side of purchase boo and wages account respectively. (vi) Goods returned by motilal Rs. 80 has been recorded in Returns outward book. (vii) Payments made to Kishore Rs. 150 and Ashok Rs. 220 but Kishore has been debited by Rs. 250 and Ashok Rs. 150. (viii) Amount of sale Rs. 400Recorded in the book only Rs. 40. Question 11 :The Trial Balance of a trader revealed a difference of Rs. 84.60 which was debited to suspence A/c. Thereafter the following facts were disclosed: (i) The total of sales book was undercast by Rs. 40. (ii) Paid to Rakesh Rs. 100 but posted Rs. 10 in his account. (iii) Purchase worth Rs. 40 was not posted in purchase A/c. (iv) Goods worth Rs. 20.60 was returned to Premnath, entered into purchasereturns book but not entered in his personal A/c. (v) Depreciation on machinery of Rs. 20 was debited to profit and loss A/c but no entry was made in Machinery accounts. (vi) Discount of Rs. 3 allowed to Mahesh was debited to Ramesh. (vii) The proprieter withdraw Rs. 150 for personal expenses but this amount was debited to traveling expenses.

Question 12 :A traders trial balance disclosed a difference of Rs. 1,488 which was placed to the credit side of suspense Account. So that the work of preparing final accounts may not be delayed. Afterwards following errors were discovered. Pass rectification entries, also prepare Profit & Loss Adjustment Account and Suspense Account: (i) Returns Outward Book was undercast by Rs. 475. (ii) Rs. 1175 Being the total of discount column on the credit side of the cash book was not posted in General Ledger. (iii) Rs. 4,500 being the cost of purchase of office furniture was entered in the Purchase Account. (iv) A credit sale f Rs. 82759 was wrongly posted as Rs. 82597 to the customers account in the sales Ledger. (v) Closing stock was overcastted by Rs. 7500.

Question 13 :There was a difference of Rs. 260 in the Trial Balance. It was transferred to the debit side of Suspense Account. Afterwards following errors were discovered. Rectify there errors and prepare Suspense Account: (i) An amount of Rs. 275 was posted as Rs. 375 to the debit side of Commission Acoount. (ii) Purchase from Mohan Lal on credit for Rs. 200 was posted to his account as Rs. 250. (iii) Rs. 75 were paid for wages but no record was made for it. (iv) An amount of Rs. 200recieved from Dinesh was posted to the debit side of his account. (v) A credit amount of Rs. 50 was debited to Personal Account (Drawing A/c) as Rs. 150. (vi) Rs. 200 were entered as Rs. 20 only in Bills Receivable Books. (vii) Rs. 75 paid for wages were posted twice to the Wages Account. (viii) Rameshs account was credited with Rs. 840 two times instead of once. (ix) A Sale of Rs. 172 was recrded n Sales Account as Rs. 217. (x) Depreciation of Rs. 100 was Charged on a Machinery, but it was not recorded in depreciation account.

THEORY QUESTIONS

1. What is a trial balance? Why is it prepared? Explain the errors which are not disclosed by trail balance. 2. What is a cash book? State its various types? Describe its merits. 3. What is the need for the preparation of Bank Reconciliation Statement periodically? Explain. 4. What do you understand by rectification of Errors? What are the advantages of such rectification? 5. What are the various types of errors in accounts/ Explain? 6. What do Balance Sheet, Manufacturing Account, Trading Account and Profit & Loss Account mean? Why are they prepared? 7. Explain the uses of Balance Sheet information. What information is conveyed by the Balance Sheet to the outsiders?

***************

También podría gustarte

- Cash Flow StatementDocumento3 páginasCash Flow StatementanupsuchakAún no hay calificaciones

- Journal EntryDocumento3 páginasJournal Entryiptrcrml100% (2)

- Auditing Concept Problems Cash and Cash EquivalentDocumento7 páginasAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenAún no hay calificaciones

- FAA Ist AssignemntDocumento9 páginasFAA Ist AssignemntRameshAún no hay calificaciones

- 2 Chapters Inter 1ST YearDocumento6 páginas2 Chapters Inter 1ST YearM JEEVARATHNAM NAIDUAún no hay calificaciones

- Maf 5101 Financial AccountingDocumento2 páginasMaf 5101 Financial AccountingertaudAún no hay calificaciones

- CA Intermediate Accounting Chapter 3 QuestionsDocumento15 páginasCA Intermediate Accounting Chapter 3 QuestionsKabiir RathodAún no hay calificaciones

- 5 Cash Book 08-2022 Regular 2023Documento8 páginas5 Cash Book 08-2022 Regular 2023jahnaviAún no hay calificaciones

- Accounting from Incomplete Records: Trading and Profit Loss StatementDocumento21 páginasAccounting from Incomplete Records: Trading and Profit Loss StatementbinuAún no hay calificaciones

- Journals, Ledgers, Trial Balance RecordsDocumento9 páginasJournals, Ledgers, Trial Balance RecordsSoumendra RoyAún no hay calificaciones

- CA Intermediate Accounting Test Paper Accounts from Incomplete RecordsDocumento3 páginasCA Intermediate Accounting Test Paper Accounts from Incomplete RecordsAryan GuptaAún no hay calificaciones

- Financial Accounting Unit 1Documento7 páginasFinancial Accounting Unit 1MOAAZ AHMEDAún no hay calificaciones

- Accountancy Practice Paper - 1Documento2 páginasAccountancy Practice Paper - 1Rinshi GuptaAún no hay calificaciones

- Financial Accounting First Midterm Test Ii BcaDocumento2 páginasFinancial Accounting First Midterm Test Ii BcasuryaAún no hay calificaciones

- Q-6. Enter The Following Transactions in The Cash Book With Cash and BankDocumento4 páginasQ-6. Enter The Following Transactions in The Cash Book With Cash and Bankkrish mehtaAún no hay calificaciones

- Q-6. Enter The Following Transactions in The Cash Book With Cash and BankDocumento4 páginasQ-6. Enter The Following Transactions in The Cash Book With Cash and Bankkrish mehtaAún no hay calificaciones

- Assignment Bballb BDocumento4 páginasAssignment Bballb BTavnish SinghAún no hay calificaciones

- I. Answer Any TWO of The Following Questions. 2 X 5 10Documento3 páginasI. Answer Any TWO of The Following Questions. 2 X 5 10M JEEVARATHNAM NAIDUAún no hay calificaciones

- Audit QuizDocumento5 páginasAudit QuizCatherine Dela VegaAún no hay calificaciones

- Nudjpia Far and Afar Solutions - CashDocumento5 páginasNudjpia Far and Afar Solutions - CashKyla Artuz Dela CruzAún no hay calificaciones

- Bba 1 Sem Business Accounting 21102401 Oct 2021Documento4 páginasBba 1 Sem Business Accounting 21102401 Oct 2021lizabnamazliaAún no hay calificaciones

- Bba Bcom Ll.b-I-Fincncial Accounting CC01Documento2 páginasBba Bcom Ll.b-I-Fincncial Accounting CC01vijay.s12usAún no hay calificaciones

- Subsidiary Books - DPP 03 - (Aarambh 2024)Documento3 páginasSubsidiary Books - DPP 03 - (Aarambh 2024)Shubh KhandelwalAún no hay calificaciones

- DSR Mock Test - 1 - Ca FoundationDocumento5 páginasDSR Mock Test - 1 - Ca Foundationmaskguy001Aún no hay calificaciones

- Bank Reconciliation - SolutionsDocumento6 páginasBank Reconciliation - SolutionsNIAZ HUSSAINAún no hay calificaciones

- Reg. No.:: APRIL 2023Documento7 páginasReg. No.:: APRIL 2023rishab.jain2903Aún no hay calificaciones

- Basu and Dutta Journal EntriesDocumento7 páginasBasu and Dutta Journal EntriesAranya HaldarAún no hay calificaciones

- 5.Cash-Bank Book (Three Column)Documento6 páginas5.Cash-Bank Book (Three Column)jangirvihan2Aún no hay calificaciones

- Test On Trial BalanceDocumento1 páginaTest On Trial Balanceamitabhkumar1979Aún no hay calificaciones

- Assignment 2023 For BPOI-102 (002) (DBPOFA Prog)Documento2 páginasAssignment 2023 For BPOI-102 (002) (DBPOFA Prog)Pawar ComputerAún no hay calificaciones

- Ex 2-20 Identificando Errores en El Balance de Comprobación Mascot Co. July 31, 2016Documento9 páginasEx 2-20 Identificando Errores en El Balance de Comprobación Mascot Co. July 31, 2016Christian Del Moral BraceroAún no hay calificaciones

- CASH BOOK TITLEDocumento3 páginasCASH BOOK TITLEJaijeet SinghAún no hay calificaciones

- Zimbabwe School Examinations Council: Accounts 7112/1Documento4 páginasZimbabwe School Examinations Council: Accounts 7112/1Munashe BinhaAún no hay calificaciones

- MBA-Final AccountsDocumento4 páginasMBA-Final AccountskanikaAún no hay calificaciones

- Endngrsi - Akuntsi - Jurnal (2) NewDocumento10 páginasEndngrsi - Akuntsi - Jurnal (2) NewMirzanun Nurul WakhidahAún no hay calificaciones

- Mr. Dunkin Bakery SCF for 2022Documento2 páginasMr. Dunkin Bakery SCF for 2022CHERIE MAY ANGEL QUITORIANOAún no hay calificaciones

- Problems 123Documento52 páginasProblems 123Dharani RiteshAún no hay calificaciones

- Current Liabilities and Warranties p2Documento4 páginasCurrent Liabilities and Warranties p2James AngklaAún no hay calificaciones

- Audit-ProblemsDocumento2 páginasAudit-ProblemsTicia TungpalanAún no hay calificaciones

- BAAB1014 Assignment EliteDocumento5 páginasBAAB1014 Assignment Elitejinosini ramadasAún no hay calificaciones

- Source Documents and Books of Original Entry QDocumento6 páginasSource Documents and Books of Original Entry QMoses IngudiaAún no hay calificaciones

- Assume Utlities Ni Org, Jadi Yg Bertambah Ni Bukan Duit You Tapi TNB DPT DuitDocumento5 páginasAssume Utlities Ni Org, Jadi Yg Bertambah Ni Bukan Duit You Tapi TNB DPT DuitJasmineAún no hay calificaciones

- Problems On Journal, Ledger and Accounting EquationDocumento11 páginasProblems On Journal, Ledger and Accounting EquationGopiAún no hay calificaciones

- Audit of Cash and Cash Equivalents QuizDocumento16 páginasAudit of Cash and Cash Equivalents QuizBienvenido JmAún no hay calificaciones

- Xi Annual NewDocumento5 páginasXi Annual NewPragadeshwar KarthikeyanAún no hay calificaciones

- Revision Questions for Accounting PrinciplesDocumento8 páginasRevision Questions for Accounting PrinciplesFranswa MateteAún no hay calificaciones

- Accounting CatDocumento3 páginasAccounting Catalanorules001Aún no hay calificaciones

- Sep 2012Documento8 páginasSep 2012Kelsey FalzonAún no hay calificaciones

- Accounting Cycle WorksheetDocumento11 páginasAccounting Cycle Worksheettarikuabdisa0Aún no hay calificaciones

- MTC 821-CatDocumento10 páginasMTC 821-Catbmuli6788Aún no hay calificaciones

- Statement of Cash FlowsDocumento2 páginasStatement of Cash FlowsMercurio, Katrina EuniceAún no hay calificaciones

- Acc ProjectDocumento4 páginasAcc Projectamirulfahmi433Aún no hay calificaciones

- Unit-Iii Bank Reconciliation Statement Debit (+) Credit (-) Credit (-) Debit (+)Documento6 páginasUnit-Iii Bank Reconciliation Statement Debit (+) Credit (-) Credit (-) Debit (+)aiswarya sAún no hay calificaciones

- Comp 2 Activity 5 SUPER FINAL1Documento11 páginasComp 2 Activity 5 SUPER FINAL1Jhon Lester MagarsoAún no hay calificaciones

- Cash Book PracticeDocumento3 páginasCash Book PracticeMai SalehAún no hay calificaciones

- Vijayam Junior College Commerce Exam QuestionsDocumento2 páginasVijayam Junior College Commerce Exam QuestionsM JEEVARATHNAM NAIDUAún no hay calificaciones

- Chapter 1 Extra ExercisesDocumento9 páginasChapter 1 Extra ExercisesTerenceLeoAún no hay calificaciones

- MS 21d11Documento5 páginasMS 21d11subba1995333333Aún no hay calificaciones

- Chapter 4 Joint Venture2Documento4 páginasChapter 4 Joint Venture2subba1995333333Aún no hay calificaciones

- Corporate Accounting QUESTIONSDocumento4 páginasCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Organisationalbehaviour PPT 101113224150 Phpapp01Documento67 páginasOrganisationalbehaviour PPT 101113224150 Phpapp01sarihadduAún no hay calificaciones

- 80D Deduction in Respect of Medical Insurance PremiaDocumento3 páginas80D Deduction in Respect of Medical Insurance PremiaIshita AggarwalAún no hay calificaciones

- Lemon Rice: Serves 3 Preperation Time 25 Minutes IngredientsDocumento1 páginaLemon Rice: Serves 3 Preperation Time 25 Minutes Ingredientssubba1995333333Aún no hay calificaciones

- 2final AccountsDocumento1 página2final Accountssubba1995333333Aún no hay calificaciones

- MS 21D9Documento5 páginasMS 21D9subba1995333333Aún no hay calificaciones

- Organizational Learning and Employee PromotionDocumento4 páginasOrganizational Learning and Employee Promotionsubba1995333333Aún no hay calificaciones

- Research Papers SitesDocumento1 páginaResearch Papers Sitessubba1995333333Aún no hay calificaciones

- Investment AccountsDocumento1 páginaInvestment Accountssubba1995333333Aún no hay calificaciones

- 80D Deduction in Respect of Medical Insurance PremiaDocumento3 páginas80D Deduction in Respect of Medical Insurance PremiaIshita AggarwalAún no hay calificaciones

- Investment Projet ContentDocumento2 páginasInvestment Projet Contentsubba1995333333Aún no hay calificaciones

- Bba Income Tax QuestionsDocumento2 páginasBba Income Tax Questionssubba1995333333Aún no hay calificaciones

- JointventureDocumento2 páginasJointventuremmuneebsdaAún no hay calificaciones

- Chapter 4 Joint Venture2Documento4 páginasChapter 4 Joint Venture2subba1995333333Aún no hay calificaciones

- Dissolution Question22Documento2 páginasDissolution Question22subba1995333333Aún no hay calificaciones

- Chapter 4 Joint Venture2Documento4 páginasChapter 4 Joint Venture2subba1995333333Aún no hay calificaciones

- Bills of ExchangeDocumento2 páginasBills of Exchangesubba199533333350% (2)

- Important Question B.com IiDocumento1 páginaImportant Question B.com Iisubba1995333333Aún no hay calificaciones

- Dissolution Question22Documento2 páginasDissolution Question22subba1995333333Aún no hay calificaciones

- 33Documento1 página33subba1995333333Aún no hay calificaciones

- Dissolution Question22Documento2 páginasDissolution Question22subba1995333333Aún no hay calificaciones

- Management Accounting 12Documento4 páginasManagement Accounting 12subba1995333333Aún no hay calificaciones

- THREE COLUMN CASH BOOKDocumento5 páginasTHREE COLUMN CASH BOOKsubba1995333333Aún no hay calificaciones

- Management Accounting 12Documento4 páginasManagement Accounting 12subba1995333333Aún no hay calificaciones

- THREE COLUMN CASH BOOKDocumento5 páginasTHREE COLUMN CASH BOOKsubba1995333333Aún no hay calificaciones

- Solution 4Documento5 páginasSolution 4subba1995333333Aún no hay calificaciones

- MS - 25Documento3 páginasMS - 25Ilaya RaniAún no hay calificaciones

- Cost AccountingDocumento16 páginasCost Accountingsubba1995333333Aún no hay calificaciones