Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Automobile Industies India

Cargado por

Sharath RaoDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Automobile Industies India

Cargado por

Sharath RaoCopyright:

Formatos disponibles

Automobile industies and their dealers in India

The Indian Auto Industry & The Role of Dealers Dr V Sumantran The global auto industry has been the subject of much analysis in recent years. While global capacity creation proceeds at a good clip on one hand, continued capacity creation in the face of sluggish sales have led to depressed levels of capacity utilisation. At the same time, driven by escalating customer expectations, aggressive competition as well as huge advances in regulations governing environmental considerations and safety, the levels of investment needed for new products continue to grow rapidly. This resulting squeeze on margins had eroded the profitability of several auto majors. Nothing manifests this sentiment better than the steady erosion of market cap of the aggregate of major auto companies. However, in this picture of gloom, there is broad agreement that the bright spots for the industry globally remain the new markets of China, South East Asia and India. The last decade has seen the Indian industry gain in maturity and confidence. This industry is counted amongst the larger contributors to India's economic development, witnessed over the last decade. Today, the Indian auto industry is one of the largest industrial sectors with a turnover that contributes to roughly 5 per cent of India's GDP. More importantly, it contributes to employment of over 2 million people directly and indirectly to another 10 million. The industry is important for national policy in that it contributes 19 per cent of indirect taxes. Indian Market Scenario Until a decade ago, the auto sector in India had been a relatively protected industry limiting the entry of foreign companies with high tariffs against imports. Today, as part of a broader move to liberalise its economy, India has opened up the sector to Foreign Direct Investments, and since then has also progressively relaxed trade barriers. Today, almost all of the major global companies are present in India producing two-wheelers and passenger cars in almost all segments. Dr V Sumantran Dr V Sumantran was the Executive Director-Passenger Car Business Unit and Engineering Research Centre at Tata Motors Limited during November 2001 to August 2005. He also served as President of the Automotive Research Association of India and as Chairman of Concorde Motors Limited. In 2005, Dr Sumantran, a fellow of Indian National Academy of Engineering, was inducted to the Scientific Advisory Council to the Prime Minister (SAC - PM). He holds a PhD degree in, Aerospace Engineering as well as a Master's degree in Management of Technology. Prior to joining Tatas, Dr Sumantran began his career at General Motors in 1985 in the R&D Centre in the USA. In 2000, he became Director, Advanced Engineering, SAAB Automobile AB, Sweden, on deputation from General Motors. Actively associated with the Board of SAE International, he has also served as editor for Passenger Car Journal from 1995 until 2001. India produced over 7.6 million two-wheelers, 1.3 million passenger cars and utility vehicles in 2005-06. India is a global major in the two-wheeler industry and primarily produces motorcycles, scooters and mopeds of engine capacities below 200cc. It ranks second in the world in the production of two-wheelers and 13th in the production of passenger cars. Among the commercial vehicle makers, Tata figures at number six among the ten largest global manufacturers. The two-wheeler industry in India has grown at a compounded annual growth rate of more than 10 per cent during the last five years and has also witnessed a shift in the demand mix, with sales of motorcycles showing an increasing trend. Indian two-wheelers comply with some of the most stringent emission standards worldwide. For the passenger car market, this segment has been growing at a rapid pace - from over 650,000 vehicles sold during 2001 to over a million vehicles sold during 2004-05. Industry Growth Drivers The passenger car penetration in India is at 8.5 vehicles per thousand people absolute terms. It is among the lowest in the world. As per capita GDP of a society grows, mobility needs for its population rapidly increase.

The proportion of young people, who are economically active, is rising in the overall population. This has led to increasing urbanisation and the need for mobility which translates into a higher demand for two and four wheelers in India. Relatively good availability of money and a favourable interest rate regime has also been a strong contributor to sustained demand. The Indian auto industry is expected to get a boost from the road development programmes that the country has undertaken especially the Golden Quadrilateral programme and the NSEW corridors with feeder roads.

India's competitiveness has enabled it to make a steady foray in International markets with passenger car exports crossing the 100,000 mark in 2004. Multinationals use India as a manufacturing hub for small cars in addition to growing exports from indigenous makers such as Tata Motors and furthermore, India's twowheeler manufacturers have also stepped up their export plans and apart from export, have also announced CKD operations in many new markets outside India. As India forges free trade agreements (FTA) with Thailand, MERCOSUR and other trading blocs, the industry has the potential to emerge even stronger. However, against this optimism, the industry has felt the effects of cost pressure.

The global movement of oil prices has dealt a setback to the country's economic policy. While the threat of inflation seems to have been temporarily brought under control, sustained fuel price hikes and the consequent hike in operating costs for vehicle owners can cause a depression in demand. The past two years have also seen considerable pressure for the industry from input costs. Prices of steel, which is a primary input for the industry, have doubled over the last three years. The situation has forced players to resort to innovative ways to control costs whilst meeting rising customer expectations. Industry Performance During the period 2005-06, sale of passenger vehicles in India registered a growth of 7.7 per cent. Continuing the tempo of explosive growth, two-wheelers registered a robust growth of 13.6 per cent. Within the segment, scooters registered a decline of 1.6 per cent, and motorcycles - a growth of 17 per cent, reflecting a continued movement from scooters to motorcycles. At the same time, the moped segment continues to see a shift from urban markets to rural markets and has grown by a modest 3 per cent. The health of the commercial vehicle industry has also improved with the total industry reporting a growth of 10 per cent for this period. While the industry continues to see some structural trends with larger growth at the lower tonnage segments and the high tonnage segments, the Medium Commercial Vehicle (MCV) segment has been witnessing a decline. This is attributed to a migration to 'hub and spoke' patterns for freight movement and increasing competitiveness for road haulage even for longer distances compared to rail. A consequence has been a large increase in sales of vehicles with payload capacities of one-half to one tonne. At the opposite end of the product spectrum, a number of players including Tata, Volvo, DaimlerChrysler and MAN have announced plans for new modern generation Heavy Commercial Vehicles, anticipating increased growth of large tonnage, long-haul movement with the new highways. While the industry, particularly, the commercial vehicle segment, has been known to be cyclical, the secular trends for the industry are positive, bolstered by the overall growth of the Indian economy. The past couple of years of healthy demand have seen the industry players post positive financial results and by and large this is reflected in the stock market movement of the listed companies. With environmental concerns gaining momentum in Indian society, a long-term roadmap has been charted by the Mashelkar committee, to drive the country faster down the road to low emission vehicles. With this, from 1st April 2005, all eleven major cities require to comply with the more restrictive Bharat Stage III (BS III) emission standards. At the same time, the rest of the country advanced from BS I to BS II levels of norms. Future Trends Buoyed by recent performance, many manufacturers have rolled out plans for increasing capacity. Prominent among them, Maruti, Hyundai and Tata - the passenger car makers - have announced plans for substantial scaling up of vehicle and engine production. Among two-wheelers, companies such as Honda and Suzuki have embarked on their own production facilities for scooters and motorcycles, separate from the activities from their current or erstwhile partners. Daimler-Chrysler and MAN have announced plans for small volume assembly of Heavy Commercial Vehicles in the country. India is also emerging as a credible hub for R&D and vehicle development. Global majors (among OEMs) and several global Tier One suppliers have scaled up operations of their Indian technical centres and the quality and value of development in India is witnessing noticeable improvement. However, at this time, the most critical vehicle integration activities remain limited to the home centres of these overseas manufacturers. As infrastructure improves, both the government and industry will need to pay even greater attention to road safety. The safety record of India, as far as fatalities and serious injury is concerned is dismal. This will need to be addressed at all points: products, infrastructure and user behaviour.

Dealer Role The environment, looking ahead, is expected to greatly increase the importance of contact with customers. Every manufacturer will need to strive even harder to ensure that customer experience with every aspect of contact with the product (through sales, after-sales service and product use and ownership) will exceed their expectations. Here the role of the dealer and the network is invaluable. The increased emphasis on brand and the importance of relationship with the customer will further change the way' we conduct our business. Increase in distribution reach will push up the sales of passenger cars, as it brings a large number of households into the target population. Typically, these households have the potential to purchase a car, but defer the decision due to the lack of sales and service infrastructure. With most urban centres covered by dealership networks, car manufacturers are looking for new dealerships in smaller towns to increase penetration and sales in semi-urban and rural areas. Current established dealers can help OEM's scale up their networks quickly by setting up satellite dealerships along with service facilities in the neighbouring semi urban/rural areas. The vehicle parc in India has reached that critical level wherein secondhand vehicle business is expected to emerge in a more organised form than it is today. Availability of a good & credible secondhand vehicle market will not only help current owners upgrade to their next vehicle but will also bring a large number of new low budget customers into the vehicle ownership cycle. The time is ripe for dealerships to set up multibrand secondhand vehicle trading and refurbishment facilities to expand the customer base in their respective locations. We are also witnessing a period of affordable cost for loans and easy availability of vehicle financing. This too causes us to view the future with some optimism. Conclusion The growing mobility needs of the people in India augur well for two and four wheeler industry. The cost advantage that India offers with respect to product development is fast establishing the country as an R&D hub. In addition, the credibility that India has gained as a cost effective manufacturing base for both small cars and two-wheelers is fuelling creation of capacities by all major manufacturers in the country. Likewise, economic growth and the Golden Quadrilateral project will also increase demand for road freight movement and this is bound to sustain the commercial vehicle industry's growth. The two-wheeler segments is expected to grow to 12 million units and passenger car segment to 2 million units by the end of this decade. However, this industry cannot be insulated from global trends where the state of industry provides pointers for caution. In conclusion, to survive and grow, the Indian Auto industry has to ensure product innovation and overall cost competitiveness. Finally, the customer will reign supreme and the success of OEMs and dealers in this department will spell the difference between success and failure.

The Indian automobile industry has received positive response in the current market scenario. The car sales in the domestic market have grown 32.28% touching 145,905 units in the month of January 2010 as against 110,300 units in the corresponding month last year. The competition is getting tougher for all the small and big players. To remain in the race, the biggies like Maruti, Hyundai and General Motors are coming up with their latest models and at the same time introducing several automobile service stations in India to draw the loyalty of the customers. If you want to know about the location of the car servicing centers in India of the renowned companies like Maruti, Hyundai and General Motors, you can follow the details given below.

Maruti Service Centers in India

It is the world of high competition for the car manufacturing companies in India. In this automobile race, Maruti Suzuki has been able to build a larger consumer base on account of its world-class car models and sales services. The company has also opened numerous automobile service stations in India across its various regions to provide complete customer satisfaction. Some of the Maruti's automobile service centers in India have been listed below in the table for you.

Hyundai Motor Service Centers in India

Hyundai Motor India Ltd stands on the second position in the list of biggest car manufactures in India in terms of sales record. The can manufacturing company has posted a growth of 46.1% in the market against previous year. To keep the momentum of its growth and to ensure highest customer satisfaction, the company has opened various automobile service centers in India.

Some of the main car service centers of Hyundai Motors in India have been listed below in the table for you.

General Motors Service Centers in India

With registering constant growth in the Indian car market, General Motors has become a household name here in the nation. According to reports, the sales figures of the company surged to 11,111 vehicles from 4,921 in the month of January 2010. This was a major leap. The company is eyeing such robust growth in near future also. To keep up with this pace and to satisfy the needs of its ever growing customer base, the car giant has opened a number of automobile service stations in India across its diverse regions.

General Motors Service Centers in Karnataka General Motors Service Centers in Maharashtra General Motors Service Centers in Kerala General Motors Service Centers in Delhi General Motors Service Centers in West Bengal Tata Motors Service Centers in India Tata Motors Service Centers in Mumbai Tata Motors Service Centers in Chennai Tata Motors Service Centers in Kolkata Ford India service stations in Agra Ford India service stations in Delhi Ford India service stations in Mumbai Ford India service stations in Kolkata Ford India service stations in Hyderabad Ford India service stations in Chandigarh

También podría gustarte

- How To Manifest Money Quickly and Easily (8 SuperFast Keys)Documento3 páginasHow To Manifest Money Quickly and Easily (8 SuperFast Keys)The Secret Revealed100% (1)

- Contract For Tutor Services For Website VersionDocumento5 páginasContract For Tutor Services For Website VersiongigiAún no hay calificaciones

- The East Pakistan Tragedy by Tom StaceyDocumento148 páginasThe East Pakistan Tragedy by Tom StaceyAli Khan0% (1)

- BL-OAM-2122-LEC-1922S Organization and ManagementDocumento169 páginasBL-OAM-2122-LEC-1922S Organization and ManagementPAul De Borja100% (1)

- Delaware County Pennsylvania Lawsuit Against County Election OfficialsDocumento91 páginasDelaware County Pennsylvania Lawsuit Against County Election OfficialsJim Hoft50% (2)

- Annika Mombauer - The Origins of The First World War (Controversies and Consensus)Documento267 páginasAnnika Mombauer - The Origins of The First World War (Controversies and Consensus)Gama100% (11)

- Car Market in India - KPMGDocumento36 páginasCar Market in India - KPMGAvinash VermaAún no hay calificaciones

- Automobile Industry ProfileDocumento9 páginasAutomobile Industry ProfileMohan Ravi90% (10)

- TIA-568.0-D FinalDocumento62 páginasTIA-568.0-D FinalJose Jimenez100% (2)

- Changes in The Marketing Strategies of Automobile Sector Due To RecessionDocumento102 páginasChanges in The Marketing Strategies of Automobile Sector Due To RecessionVivek SinghAún no hay calificaciones

- Automotive Industry in IndiaDocumento17 páginasAutomotive Industry in IndiaSiddharth GuptaAún no hay calificaciones

- 1.1: Overview of Automobile Industry in India: Chapter 1: Industrial ProfileDocumento93 páginas1.1: Overview of Automobile Industry in India: Chapter 1: Industrial Profiletamal mukherjeeAún no hay calificaciones

- HG-G8 Module 2 DepEdDocumento9 páginasHG-G8 Module 2 DepEdNoli Esmeña100% (3)

- A Project Report On TaTa MotorsDocumento73 páginasA Project Report On TaTa Motorsrannvijay singh chauhanAún no hay calificaciones

- Organic Vs Conventional FoodDocumento10 páginasOrganic Vs Conventional FoodRizwan HussainAún no hay calificaciones

- 03-The PPSTDocumento35 páginas03-The PPSTElisa Siatres MarcelinoAún no hay calificaciones

- A Comparative Study On Various Premium Segment BikesDocumento48 páginasA Comparative Study On Various Premium Segment BikeskashniavikasAún no hay calificaciones

- Industry AnalysisDocumento38 páginasIndustry AnalysisIbrahim RaghibAún no hay calificaciones

- Indian Two-Wheeler Industry Growth and Key PlayersDocumento64 páginasIndian Two-Wheeler Industry Growth and Key Playersgangaprasada50% (4)

- 34 Tvs Apache in ShimogaDocumento102 páginas34 Tvs Apache in Shimogaavinash_s1302Aún no hay calificaciones

- Challenges for Indian auto component industry in Indo-Thai FTADocumento12 páginasChallenges for Indian auto component industry in Indo-Thai FTAgurdishpal9275Aún no hay calificaciones

- Case Study Report - 22MBAB35Documento50 páginasCase Study Report - 22MBAB35varshini vishakanAún no hay calificaciones

- Prince Tyagi Industry StudyDocumento38 páginasPrince Tyagi Industry StudyGaurav DikshitAún no hay calificaciones

- Industry Overview - Automobile Sector in India 2012-13Documento18 páginasIndustry Overview - Automobile Sector in India 2012-13Kinshuk AcharyaAún no hay calificaciones

- FEDERAL MOGUL GOETZE INDIA LIMITED - ReportDocumento56 páginasFEDERAL MOGUL GOETZE INDIA LIMITED - Reportchaitra rAún no hay calificaciones

- Bentley SDMDocumento34 páginasBentley SDMramramjirockyAún no hay calificaciones

- "Marketing Strategies of Two Wheeler Dealers" Automobile SectorDocumento65 páginas"Marketing Strategies of Two Wheeler Dealers" Automobile Sectorpawan dhingraAún no hay calificaciones

- A Study On Costomer Perception Towards Selected Marketing Mix of Shivnath Hyundai Raipur C.GDocumento59 páginasA Study On Costomer Perception Towards Selected Marketing Mix of Shivnath Hyundai Raipur C.Gjassi7nishadAún no hay calificaciones

- Automobile Industry in WorldDocumento20 páginasAutomobile Industry in WorldHari Haran100% (1)

- A Study On Employee Welfare at Bimal Auto AgencyDocumento73 páginasA Study On Employee Welfare at Bimal Auto AgencypraveenAún no hay calificaciones

- India's Growing Automobile IndustryDocumento79 páginasIndia's Growing Automobile Industry2014rajpoint0% (1)

- Marketing Case StudyDocumento10 páginasMarketing Case StudyShakshi TradersAún no hay calificaciones

- Bharat BenzDocumento31 páginasBharat BenzMUHAMMED ASLAMAún no hay calificaciones

- Project Final YearDocumento79 páginasProject Final YearTamil film zoneAún no hay calificaciones

- Industry ProfileDocumento30 páginasIndustry ProfilePrabhakar RaoAún no hay calificaciones

- A Study of Tata Motors Vehicle Services in Gorakhpur 27-11-2012Documento122 páginasA Study of Tata Motors Vehicle Services in Gorakhpur 27-11-2012Shakti Singh RawatAún no hay calificaciones

- Two Wheeler Automobile Marketing StrategyDocumento42 páginasTwo Wheeler Automobile Marketing StrategyRaj KumarAún no hay calificaciones

- India's Growing Automotive Industry: An OverviewDocumento5 páginasIndia's Growing Automotive Industry: An OverviewPretty RitzAún no hay calificaciones

- Tata Motors Summer Training Report PDFDocumento98 páginasTata Motors Summer Training Report PDFMohd SalmanAún no hay calificaciones

- Research Paper On Automobile Industry in IndiaDocumento4 páginasResearch Paper On Automobile Industry in Indiac9spy2qz100% (1)

- Auto MobileDocumento44 páginasAuto MobileSanjay PatelAún no hay calificaciones

- RESEARCH PROJECT Auvesh Buisness EnviroDocumento19 páginasRESEARCH PROJECT Auvesh Buisness EnviroDevesh ShuklaAún no hay calificaciones

- 08 Ashok LeylandDocumento18 páginas08 Ashok Leylandkohinoor_roy5447Aún no hay calificaciones

- FDI Inflows To Automobile IndustryDocumento7 páginasFDI Inflows To Automobile Industryomkarvp2002Aún no hay calificaciones

- Auto in IndiaDocumento13 páginasAuto in Indiaarunjoseph143Aún no hay calificaciones

- Porter's Five Forces Analysis - Indian Automobile Industry 2Documento60 páginasPorter's Five Forces Analysis - Indian Automobile Industry 2Ashish Mendiratta50% (2)

- Dissertation On Automobile Industry in IndiaDocumento6 páginasDissertation On Automobile Industry in IndiaCustomPaperWritingSingapore100% (1)

- Tata Motors Summer Training ReportDocumento98 páginasTata Motors Summer Training ReportAnsh SoniAún no hay calificaciones

- Birla Institute of Technology and Science Pilani: Automobile Sector in IndiaDocumento16 páginasBirla Institute of Technology and Science Pilani: Automobile Sector in Indiaਸਚਿਨ ਸੋਨੀAún no hay calificaciones

- Automobile Industry Analysis in PakistanDocumento27 páginasAutomobile Industry Analysis in PakistanSeemab Sheikh QurashiAún no hay calificaciones

- Industry: Key Points Supply DemandDocumento4 páginasIndustry: Key Points Supply DemandHarsh AgarwalAún no hay calificaciones

- JBMDocumento53 páginasJBMVaibhav Ahlawat100% (1)

- Promotional Tools in Selling Hero Honda BikesDocumento65 páginasPromotional Tools in Selling Hero Honda BikesMohit kolli0% (1)

- Indian Automobile Industry OverviewDocumento16 páginasIndian Automobile Industry OverviewKanoj AcharyAún no hay calificaciones

- Indus Motor Co. Pvt. Ltd.Documento70 páginasIndus Motor Co. Pvt. Ltd.Shiv Kamble100% (6)

- Pre Owned Cars and BikesDocumento83 páginasPre Owned Cars and Bikesdarshan1793Aún no hay calificaciones

- Automobile Industry in India GrowthDocumento7 páginasAutomobile Industry in India GrowthMohammad HasanAún no hay calificaciones

- Final ProjectDocumento64 páginasFinal ProjectAneesh Chorode0% (2)

- Tvs ReportDocumento62 páginasTvs ReportvipinkathpalAún no hay calificaciones

- Industry Profile: Automobile Industry at Global LevelDocumento21 páginasIndustry Profile: Automobile Industry at Global LevelTanzim VankaniAún no hay calificaciones

- AUTOMOBILE INDUSTRY GROWTHDocumento16 páginasAUTOMOBILE INDUSTRY GROWTHHarish ShashidharAún no hay calificaciones

- RESEARCH METHODOLOGY FOR AUTO INDUSTRYDocumento63 páginasRESEARCH METHODOLOGY FOR AUTO INDUSTRYNILANJAN SENGUPTAAún no hay calificaciones

- Car AssignmentDocumento80 páginasCar AssignmentVineet SharmaAún no hay calificaciones

- India's Automobile Industry Growth and StatisticsDocumento5 páginasIndia's Automobile Industry Growth and StatisticsSonia MaheshwariAún no hay calificaciones

- Analysis of Automobile IndustryDocumento9 páginasAnalysis of Automobile IndustryNikhil Kakkar100% (1)

- Designated Drivers: How China Plans to Dominate the Global Auto IndustryDe EverandDesignated Drivers: How China Plans to Dominate the Global Auto IndustryAún no hay calificaciones

- From the Cradle to the Craze: China's Indigenous Automobile IndustryDe EverandFrom the Cradle to the Craze: China's Indigenous Automobile IndustryAún no hay calificaciones

- Final 2Documento64 páginasFinal 2Sharath RaoAún no hay calificaciones

- Software QualityDocumento92 páginasSoftware QualitySharath RaoAún no hay calificaciones

- Impact of WTO Women in AgricultureDocumento204 páginasImpact of WTO Women in AgricultureAnkush JajuAún no hay calificaciones

- Sem 1Documento10 páginasSem 1karthik88888Aún no hay calificaciones

- Biz Improv Characteristics of Improv Professionals Vs Executives v2Documento10 páginasBiz Improv Characteristics of Improv Professionals Vs Executives v2Sharath RaoAún no hay calificaciones

- Transnational Crimes and Malaysia's Domestic LawsDocumento5 páginasTransnational Crimes and Malaysia's Domestic LawsGlorious El DomineAún no hay calificaciones

- Marks Allocation Sheet.: ST James' SchoolDocumento7 páginasMarks Allocation Sheet.: ST James' SchoolNa No0% (1)

- Admit Card of B.Ed.Documento1 páginaAdmit Card of B.Ed.Taslim AnsariAún no hay calificaciones

- Sinayawan Central School: Objectives Means of Verifications Description of Mov Presented AnnotationsDocumento2 páginasSinayawan Central School: Objectives Means of Verifications Description of Mov Presented AnnotationsBenes Hernandez DopitilloAún no hay calificaciones

- The Rise of Nationalism in EuropeDocumento5 páginasThe Rise of Nationalism in EuropeRounak BasuAún no hay calificaciones

- Sociolinguistics 1Documento23 páginasSociolinguistics 1Afrio Pasaribu 106Aún no hay calificaciones

- Australian Study Examines Touch Screen Tablet Impact on Emergent LiteracyDocumento14 páginasAustralian Study Examines Touch Screen Tablet Impact on Emergent Literacyvampirek91Aún no hay calificaciones

- Sign Language Varieties in Lima Peru PDFDocumento44 páginasSign Language Varieties in Lima Peru PDFYedirel Stephany Catalán CórdovaAún no hay calificaciones

- Tripadvisor Case Study: Social Media and Tourism DestinationsDocumento26 páginasTripadvisor Case Study: Social Media and Tourism DestinationsKysha JohnsonAún no hay calificaciones

- Example of Tell Me About YourselfDocumento4 páginasExample of Tell Me About YourselfYulia Nurfajar AiniAún no hay calificaciones

- OPQ: Reimagined Frequently Asked QuestionsDocumento5 páginasOPQ: Reimagined Frequently Asked Questionsיניב מועלםAún no hay calificaciones

- Functional Academic Lesson PlanDocumento11 páginasFunctional Academic Lesson Planapi-588112627Aún no hay calificaciones

- Determinants That Influence The Performance of Women Entrepreneurs in Micro and Small Enterprises in EthiopiaDocumento20 páginasDeterminants That Influence The Performance of Women Entrepreneurs in Micro and Small Enterprises in EthiopiaNicolas GuglielmiAún no hay calificaciones

- Merits of entry strategies and their role in integrative global strategyDocumento3 páginasMerits of entry strategies and their role in integrative global strategyVikram KumarAún no hay calificaciones

- Rubric – Oral PresentationDocumento1 páginaRubric – Oral PresentationDaniela LopezAún no hay calificaciones

- BPS ConnectedInverter BasedResourcePerformanceGuideline NERCReliabilityGuidelineDocumento98 páginasBPS ConnectedInverter BasedResourcePerformanceGuideline NERCReliabilityGuideline3Aún no hay calificaciones

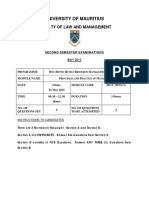

- University of Mauritius: Faculty of Law and ManagementDocumento4 páginasUniversity of Mauritius: Faculty of Law and ManagementFadil RushAún no hay calificaciones

- Sustainable Business Model For Salim Ali Bird SanctuaryDocumento7 páginasSustainable Business Model For Salim Ali Bird SanctuaryMaan MehtaAún no hay calificaciones

- PLDT V ArceoDocumento3 páginasPLDT V ArceoS.Aún no hay calificaciones

- International Standard: Electric Vehicle Wireless Power Transfer (WPT) Systems - Part 1: General RequirementsDocumento11 páginasInternational Standard: Electric Vehicle Wireless Power Transfer (WPT) Systems - Part 1: General RequirementsАндрейAún no hay calificaciones