Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Jardenil V Salas

Cargado por

cmv mendozaDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Jardenil V Salas

Cargado por

cmv mendozaCopyright:

Formatos disponibles

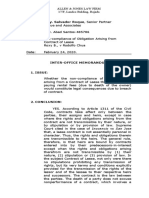

Giljardenil vs.

Solas July 24, 1942 [GRN 47878 July 24, 1942] GILJARDENIL, plaintiff and appellant vs. HEPTI SOLAS (alias HEPTI SOLAS, JEPTI SOLAS), defendant and appellee. 1.INTEREST; ARTICLE1755 OF THE CIVIL CODE; INTERPRETATION OR CONTRACTS.-Defendaut has agreed to pay interest only up to the date of maturity, or until March 31, 1984. As the contract in silent as to whether after that date, in the event of non-payment, the debtor would continue to pay interest no legal presumption as to such interest can be indulged, for this would be imposing upon the debtor an obligation that the parties have not chosen to agree upon Article 1755 of the Civil Code provides that "interest shall be due only when It has been expressly stipulated." 2. ID.; ID.; ID.-As the contract is clear and unmistakable and the terms employed therein have not been shown to belie or otherwise fail to express the true intention of the parties, and that the deed has not been assailed on the ground of mutual mistake which would require its reformation, same should be given its full force and effect. When a party sues on a written contract and no attempt is made to show any vim therein, he cannot be allowed to lay any claim more than what its clear stipulations accord. His omission, to which the law attach" a definite meaning as in the instant case. cannot by the courts be arbitrarily supplied by what their own notions of justice or equity may dictate. APPEAL from a judgment of the Court of First Instance of Iloilo. Dizon, J. The facts are stated in the opinion of the court. Eleuterio J. Gustilo for appellant. Jose C. Robles for appellee. MORAN, J.: This is an action for foreclosure of mortgage. The only question raised in this appeal is: la defendant-appellee bound to pay the stipulated interest only up to the date of maturity as fixed in the promissory note, or up to the date payment is effected? This question is, in our opinion, controlled by the express stipulation of the parties. Paragraph 4 of the mortgage deed recites: "Que en considerncin a dicha sums aun par pager de DOS MIL CUATROMENTOS PESOS ( P2,400.00), moneda filipina, que el Sr. Hepti Solas se comproinete a pager al Sr. Jardenil en o antes del dia treintaiuno (31) at marzo de mil novecientos treintaicuatro (1934), con los Interests de dicha suma al tipo de dos por ciento (12%) anual a partir desde esta fecha basis el dia de su vencimiento, as el treintaiuno (31) de marso de mil novecientos treintaicuatro, (1934), por la presente, el Sr. Hepti Solas cede y trampass, por via de primera hipoteca, a favor del Sr. Jardenil, sun herederos y causshabientes, la parcela de terra descrita en el parrafo primero (1.) do esta excritura." Defendant-appellee has, therefore, clearly agreed to pay interest only up to the date of maturity, or until March 31, 1934. As the contract is silent as to whether after that date, in the event of non-payment, the debtor would continue to pay interest we cannot, in law, indulge in any presumption as to such interest; otherwise, we would be imposing upon the debtor an obligation that the parties have not chosen to agree upon. Article 1755 of the Civil Code provides that "interest shall be due only when it has been expressly stipulated." (Italic supplied.) A writing must be interpreted according to the legal meaning of its language (action 286 Act No. 190, now section 58 Rule 123), and only when the wording of the written instrument appears to be contrary to the evident intention of the parties that such intention must prevail. (Article 1291, Civil rode.) There is nothing in the mortgage deed to show that the terms employed by the parties thereto are at war with their evident intent. On the contrary, the act of the mortgages of granting to the mortgagor, on the same date of the execution of the deed of mortgage, an extension of out year from the date of maturity within which to make payment, without making any mention of any interest which the mortgagor should pay during the additional period (see Exhibit B attached to the complaint), indicates that the true intention of the parties was that no interest should be paid during the period of grace. What reasons the parties may have therefor, we need not here seek to explore. Neither has either of the parties shown that, by mutual mistake, the deed of mortgage fails to express their true agreement, for if such mistake existed, plaintiff would have undoubtedly adduced evidence to establish it and asked that the deed be reformed accordingly, under the parcel-evidence rule. We hold, therefore, that as the contract in clear and unmistakable and the terms employed therein have not been shown to belie or otherwise fail to express the true intention of the parties, and that the deed has not been assailed on the ground of mutual mis. take which would require its reformation, same should be given its full force and effect. When a party sues on a written contract and no attempt is made to show any vice therein, he cannot be allowed to lay any claim more than what its clear stipulations accord. His omission, to which the law attaches a definite meaning as in the instant case, cannot by the courts be arbitrarily supplied by what their own notions of justice or equity may dictate. Plaintiff is, therefore, entitled only to the stipulated interest of 12 per cent on the loan of P2,400 from November 8, 1932 to March 31, 1934. And it being a fact that extrajudicial demands have been made which we may assume to have been so made on the expiration of the year of grace, he shall be entitled to legal interest upon the principal and the accrued interest from April 1, 1935, until full payment. Thus modified, judgment is affirmed, with Costs against appellant. Yulo, C. J., Ozaeta and Bocobo, JJ., concur. PARAS, J., dissenting: Under the facts stated in the decision of the majority, I come to the conclusion that interest at the rate of 12 per cent per annum should be paid up to the date of payment of the whole indebtedness in made. Payment of such interest is expressly stipulated. True, it is stated in the mortgage contract that interest was to be paid up to March 31, 1984, but this date was inserted merely because it was the date of maturity. The extension note is silent as regards interest, but its payment is clearly implied from the nature of the transaction which is only a renewal of the old obligation. In my opinion, the ruling of the majority is anomalous and at war with common practice and everyday business usage. Judgment modified.

También podría gustarte

- OBLICON STUDY GUIDE Page 329-330 I. Definitions Define or Give The Meaning of The FollowingDocumento20 páginasOBLICON STUDY GUIDE Page 329-330 I. Definitions Define or Give The Meaning of The FollowingJave Haira PatagatayAún no hay calificaciones

- House Rent Receipt - FormatDocumento2 páginasHouse Rent Receipt - Formatshruthi shruAún no hay calificaciones

- PNP Manual PDFDocumento114 páginasPNP Manual PDFIrish PD100% (9)

- 03 Evidence - Rule 130 Statute of FraudsDocumento16 páginas03 Evidence - Rule 130 Statute of FraudsMa Gloria Trinidad ArafolAún no hay calificaciones

- Simple Guide for Drafting of Civil Suits in IndiaDe EverandSimple Guide for Drafting of Civil Suits in IndiaCalificación: 4.5 de 5 estrellas4.5/5 (4)

- Atty. Salvador Roque, Senior PartnerDocumento4 páginasAtty. Salvador Roque, Senior PartnerEmmelie DemafilesAún no hay calificaciones

- Valid Sale Between PartiesDocumento135 páginasValid Sale Between PartiesMonaliza BanaAún no hay calificaciones

- OBLIGATIONS TITLEDocumento24 páginasOBLIGATIONS TITLEOfe Dumindin86% (7)

- LAW ON OBLIGATION AND CONTRACTS: WHO IS THE REAL PARTY-IN-INTERESTDocumento7 páginasLAW ON OBLIGATION AND CONTRACTS: WHO IS THE REAL PARTY-IN-INTERESTCristy C. Bangayan100% (1)

- Summary of Chapter 8 - Unenforceable ContractsDocumento4 páginasSummary of Chapter 8 - Unenforceable ContractsHannah dela MercedAún no hay calificaciones

- ObliconDocumento4 páginasObliconRam BeeAún no hay calificaciones

- G2 Case Digest G.R. Nos. L 48195 and 48196 FinalDocumento3 páginasG2 Case Digest G.R. Nos. L 48195 and 48196 Finaldanielzar delicanoAún no hay calificaciones

- Lima Technology Center CompaniesDocumento34 páginasLima Technology Center CompaniesSharonRosePatitico50% (2)

- Court Rules Interest Stipulated in Promissory Note Governs Rate After MaturityDocumento2 páginasCourt Rules Interest Stipulated in Promissory Note Governs Rate After MaturityDenise Jane DuenasAún no hay calificaciones

- SAP ISU InformationDocumento5 páginasSAP ISU InformationSuhas Misal100% (1)

- DOJ Circular No. 18, 18 June 2014Documento2 páginasDOJ Circular No. 18, 18 June 2014cmv mendozaAún no hay calificaciones

- Implied ContractsDocumento5 páginasImplied ContractskarlAún no hay calificaciones

- 161 Bayla V Silang Traffic Co. Inc. (De Leon)Documento2 páginas161 Bayla V Silang Traffic Co. Inc. (De Leon)Jovelan EscañoAún no hay calificaciones

- 1 - Conwi vs. CTA DigestDocumento2 páginas1 - Conwi vs. CTA Digestcmv mendozaAún no hay calificaciones

- Masco Corporation Living Case StudyDocumento33 páginasMasco Corporation Living Case StudyPaula Andrea GarciaAún no hay calificaciones

- Umali vs. EstanislaoDocumento8 páginasUmali vs. Estanislaocmv mendozaAún no hay calificaciones

- BIR Revenue Memorandum Order 10-2014Documento17 páginasBIR Revenue Memorandum Order 10-2014PortCalls100% (4)

- UNENFORCEABLE CONTRACTS Article 1403Documento25 páginasUNENFORCEABLE CONTRACTS Article 1403jane100% (1)

- Huibonhoa v. Court of AppealsDocumento27 páginasHuibonhoa v. Court of AppealsIAN ANGELO BUTASLACAún no hay calificaciones

- PEOPLE'S INDUSTRIAL AND COMMERCIAL CORPORATION VS COURT OF APPEALSDocumento2 páginasPEOPLE'S INDUSTRIAL AND COMMERCIAL CORPORATION VS COURT OF APPEALSFai MeileAún no hay calificaciones

- Taganito vs. Commissioner (1995)Documento2 páginasTaganito vs. Commissioner (1995)cmv mendozaAún no hay calificaciones

- PH Credit Vs CADocumento3 páginasPH Credit Vs CAOrlando DatangelAún no hay calificaciones

- Oblicon DoctrinesDocumento14 páginasOblicon DoctrinesAnonymous 3zhce7gpAún no hay calificaciones

- Jardenil V SolasDocumento2 páginasJardenil V SolasFielle IgnacioAún no hay calificaciones

- Dela Vega V BallilosDocumento2 páginasDela Vega V BallilosFrederick Xavier LimAún no hay calificaciones

- Jardenil Vs SolasDocumento3 páginasJardenil Vs Solasdominicci2026Aún no hay calificaciones

- G.R. No. L-47878Documento3 páginasG.R. No. L-47878Katherine EvangelistaAún no hay calificaciones

- Plaintiff-Appellant Vs Vs Defendant-Appellee Eleuterio J. Gustilo, Jose C. RoblesDocumento3 páginasPlaintiff-Appellant Vs Vs Defendant-Appellee Eleuterio J. Gustilo, Jose C. RoblesJia Chu ChuaAún no hay calificaciones

- Chapter 4: Sequestration or Judicial DepositDocumento1 páginaChapter 4: Sequestration or Judicial DepositrengieAún no hay calificaciones

- (CredTrans) 13 - Jardenil V SolasDocumento1 página(CredTrans) 13 - Jardenil V SolasALEC NICOLE PARAFINAAún no hay calificaciones

- Study Guide LawDocumento2 páginasStudy Guide LawAngela DimituiAún no hay calificaciones

- Civil law principles on constructive fulfillment and presumption of deathDocumento12 páginasCivil law principles on constructive fulfillment and presumption of deathmarge carreonAún no hay calificaciones

- A Transaction Is Deemed To Be An Equitable MortgageDocumento3 páginasA Transaction Is Deemed To Be An Equitable MortgageShan KhingAún no hay calificaciones

- Largojohnchristian Gen ProDocumento3 páginasLargojohnchristian Gen ProJohn Christian LargoAún no hay calificaciones

- Assigned PDFDocumento5 páginasAssigned PDFPoem JoseAún no hay calificaciones

- Assigned PDFDocumento5 páginasAssigned PDFPoem JoseAún no hay calificaciones

- No. 55 Case Title: Boysaw vs. Interphil Promotions, 148 SCRA 365, G.R. No. L-22590, March 20, 1987 Ticker: FactsDocumento6 páginasNo. 55 Case Title: Boysaw vs. Interphil Promotions, 148 SCRA 365, G.R. No. L-22590, March 20, 1987 Ticker: FactsRoyce Ann PedemonteAún no hay calificaciones

- Contract stipulation pour Autrui rules and casesDocumento13 páginasContract stipulation pour Autrui rules and casesAweGooseTreeAún no hay calificaciones

- Memorandum For The PlaintiffDocumento12 páginasMemorandum For The Plaintiffjohn warren gabineteAún no hay calificaciones

- Rodriguez vs. Martinez, 5 Phil. 67, No. 1913 September 29, 1905 (Alvarez)Documento2 páginasRodriguez vs. Martinez, 5 Phil. 67, No. 1913 September 29, 1905 (Alvarez)Koolen AlvarezAún no hay calificaciones

- ESSENTIAL ELEMENTS OF CONTRACTSDocumento14 páginasESSENTIAL ELEMENTS OF CONTRACTSErika ApitaAún no hay calificaciones

- Court, 148 SCRA 347 (1987) .) : Classifi Cation of Contracts According To Its Name or DesignationDocumento3 páginasCourt, 148 SCRA 347 (1987) .) : Classifi Cation of Contracts According To Its Name or DesignationMARIA SOFIA SALVADORAún no hay calificaciones

- Court Rulings on Contract RescissionDocumento5 páginasCourt Rulings on Contract Rescissionjulandmic9Aún no hay calificaciones

- 25 Litton Vs Hill Ceron Et AlDocumento5 páginas25 Litton Vs Hill Ceron Et Alcertiorari19Aún no hay calificaciones

- A Obligations and Contracts PresentationDocumento34 páginasA Obligations and Contracts PresentationRica de GuzmanAún no hay calificaciones

- Right To Transfer of ShareholdingsDocumento4 páginasRight To Transfer of ShareholdingscjadapAún no hay calificaciones

- Obligations and Contracts CasesDocumento54 páginasObligations and Contracts CasesFernan CalvezAún no hay calificaciones

- Contract To Sell Is Not RescissibleDocumento10 páginasContract To Sell Is Not RescissibleSan Mig LightAún no hay calificaciones

- Cases Atp Nov 25Documento59 páginasCases Atp Nov 25Nerry Neil TeologoAún no hay calificaciones

- DKC Holdings Corp. v. Court of AppealsDocumento10 páginasDKC Holdings Corp. v. Court of AppealsPeter Joshua OrtegaAún no hay calificaciones

- Gen Prov ContDocumento9 páginasGen Prov Contooagentx44Aún no hay calificaciones

- Obligations and ContractsDocumento31 páginasObligations and ContractsRamir FamorcanAún no hay calificaciones

- Four Types of Defective ContractsDocumento6 páginasFour Types of Defective Contractssandra seguienteAún no hay calificaciones

- Civil Law...Documento4 páginasCivil Law...roneydaAún no hay calificaciones

- Case DigestDocumento6 páginasCase DigestCyrra Balignasay100% (1)

- Uy Tam Vs LeonardDocumento8 páginasUy Tam Vs LeonardTine TineAún no hay calificaciones

- R Atray MBA-III-Sem MB0035Documento7 páginasR Atray MBA-III-Sem MB0035Afsana ParveenAún no hay calificaciones

- G.R. No. L-7859 February 12, 1913 VICTORIA SEOANE, Administratrix of The Intestate Estate of Eduardo Fargas, PlaintiffDocumento4 páginasG.R. No. L-7859 February 12, 1913 VICTORIA SEOANE, Administratrix of The Intestate Estate of Eduardo Fargas, PlaintiffOmie Jehan Hadji-AzisAún no hay calificaciones

- Mutuum: An accepted promise to loan is consensual but a contract of loan is a real contractDocumento14 páginasMutuum: An accepted promise to loan is consensual but a contract of loan is a real contractGerard Anthony Teves RosalesAún no hay calificaciones

- Nag Hintay Ka Ba? Wala IssaprankDocumento22 páginasNag Hintay Ka Ba? Wala IssaprankChichi MotoAún no hay calificaciones

- Litton vs. Hill, 67 Phil. 509Documento9 páginasLitton vs. Hill, 67 Phil. 509Lorjyll Shyne Luberanes TomarongAún no hay calificaciones

- Fort Bonifacio Development Corporation vs. Yllas Lending CorporationDocumento20 páginasFort Bonifacio Development Corporation vs. Yllas Lending CorporationAmerigo VespucciAún no hay calificaciones

- The Indian Contract Act, 1872: By: Vandana PGDM (T) 11TM13Documento28 páginasThe Indian Contract Act, 1872: By: Vandana PGDM (T) 11TM13Jeff Paul JosephAún no hay calificaciones

- Layug Vs IACDocumento6 páginasLayug Vs IACPaolo Antonio EscalonaAún no hay calificaciones

- Floriano vs Delgado Promissory Note CaseDocumento4 páginasFloriano vs Delgado Promissory Note Casenurseibiang100% (1)

- Wage Computation TableDocumento1 páginaWage Computation Tablecmv mendozaAún no hay calificaciones

- 8 - Commissioner vs. CA (1996)Documento30 páginas8 - Commissioner vs. CA (1996)cmv mendozaAún no hay calificaciones

- Abra Valley College vs. AquinoDocumento7 páginasAbra Valley College vs. Aquinocmv mendozaAún no hay calificaciones

- DOJ Department Circular No. 21 (July 15, 1992)Documento2 páginasDOJ Department Circular No. 21 (July 15, 1992)cmv mendozaAún no hay calificaciones

- Wells Fargo vs. CollectorDocumento5 páginasWells Fargo vs. Collectorcmv mendozaAún no hay calificaciones

- Roxas vs. RaffertyDocumento6 páginasRoxas vs. Raffertycmv mendozaAún no hay calificaciones

- 5 - Commissioner vs. CA (1998)Documento16 páginas5 - Commissioner vs. CA (1998)cmv mendozaAún no hay calificaciones

- Tanada vs. AngaraDocumento44 páginasTanada vs. Angaracmv mendozaAún no hay calificaciones

- Villanueva vs. City of IloiloDocumento15 páginasVillanueva vs. City of Iloilocmv mendozaAún no hay calificaciones

- Tan vs. Del RosarioDocumento8 páginasTan vs. Del Rosariocmv mendozaAún no hay calificaciones

- Osmena vs. OrbosDocumento9 páginasOsmena vs. Orboscmv mendozaAún no hay calificaciones

- Court of Tax Appeals: Republic of The PhilippinesDocumento28 páginasCourt of Tax Appeals: Republic of The Philippinescmv mendozaAún no hay calificaciones

- PLDT vs. City of DavaoDocumento10 páginasPLDT vs. City of Davaocmv mendozaAún no hay calificaciones

- Tax 1 - TereDocumento57 páginasTax 1 - Terecmv mendoza100% (1)

- Philippine Acetylene vs. CommissionerDocumento7 páginasPhilippine Acetylene vs. Commissionercmv mendozaAún no hay calificaciones

- Pepsi Cola vs. ButuanDocumento4 páginasPepsi Cola vs. Butuancmv mendozaAún no hay calificaciones

- Republic Bank V EbradaDocumento9 páginasRepublic Bank V Ebradacmv mendozaAún no hay calificaciones

- Pecson vs. CADocumento4 páginasPecson vs. CAcmv mendozaAún no hay calificaciones

- Misamis Oriental Assn vs. Dept of FinanceDocumento6 páginasMisamis Oriental Assn vs. Dept of Financecmv mendozaAún no hay calificaciones

- Republic Bank V EbradaDocumento9 páginasRepublic Bank V Ebradacmv mendozaAún no hay calificaciones

- Tax NotesDocumento10 páginasTax Notescmv mendozaAún no hay calificaciones

- Ra 9480Documento6 páginasRa 9480cmv mendozaAún no hay calificaciones

- BIR Form No. 0618 Download: (Zipped Excel) PDFDocumento6 páginasBIR Form No. 0618 Download: (Zipped Excel) PDFcmv mendozaAún no hay calificaciones

- Primer On The Tax Amnesty Act of 2007Documento8 páginasPrimer On The Tax Amnesty Act of 2007cmv mendozaAún no hay calificaciones

- DELL Inc Case StudyDocumento4 páginasDELL Inc Case StudyBerikbolatova KundyzAún no hay calificaciones

- Mtcs-Boq-190-1125 - Viproom - Artmind VarDocumento5 páginasMtcs-Boq-190-1125 - Viproom - Artmind Varsyed WajihAún no hay calificaciones

- Corporate Jan17Documento24 páginasCorporate Jan17naytik jainAún no hay calificaciones

- Introduction To Cost Management Systems: Cost Accounting: Foundations and Evolutions, 9eDocumento34 páginasIntroduction To Cost Management Systems: Cost Accounting: Foundations and Evolutions, 9eGRACE ANN BERGONIOAún no hay calificaciones

- Employment-Related Letters: Well-Displayed, Easy-To-ReadDocumento4 páginasEmployment-Related Letters: Well-Displayed, Easy-To-ReadAira Mae Hernandez CabaAún no hay calificaciones

- Entrepreneurship Skills for Growth-Orientated SMEsDocumento23 páginasEntrepreneurship Skills for Growth-Orientated SMEsSurya PrasannaAún no hay calificaciones

- IRDAI Annual Report 2019-20 - EnglishDocumento242 páginasIRDAI Annual Report 2019-20 - EnglishKishore mohan ManapuramAún no hay calificaciones

- Effective Contract Management SeminarDocumento8 páginasEffective Contract Management SeminarYAHAMPATH ARACHCHIGE PASAN MADURA YahampathAún no hay calificaciones

- BABOR Phytoactive Combination in The Official BABOR Online Shop BABOR SkincareDocumento1 páginaBABOR Phytoactive Combination in The Official BABOR Online Shop BABOR SkincareDexterite Makeup ArtistAún no hay calificaciones

- Investing and Financing Decisions and The Accounting SystemDocumento44 páginasInvesting and Financing Decisions and The Accounting SystemSina RahimiAún no hay calificaciones

- Token TownDocumento18 páginasToken TownRohan KulshreshthaAún no hay calificaciones

- Ifrs 9 PresentationDocumento26 páginasIfrs 9 PresentationJean Damascene HakizimanaAún no hay calificaciones

- The Effects of Background Music On Consumer Responses in A High End SupermarketDocumento15 páginasThe Effects of Background Music On Consumer Responses in A High End SupermarketAYFERAún no hay calificaciones

- Online Summer ReportDocumento13 páginasOnline Summer ReportDevender DhakaAún no hay calificaciones

- Singapore AirlinesDocumento16 páginasSingapore Airlinessamadfarooq132000Aún no hay calificaciones

- DeepSecurity 9.6SP1 CertProf Slides FINAL 28jan2016Documento481 páginasDeepSecurity 9.6SP1 CertProf Slides FINAL 28jan2016EndeeeAún no hay calificaciones

- Manish Sudha ProjectDocumento80 páginasManish Sudha ProjectRaaGhav SharmaAún no hay calificaciones

- Work Permit Data SheetDocumento1 páginaWork Permit Data Sheetapi-472103056Aún no hay calificaciones

- VTU MBA Sem 1 Syllabus and Scheme of TeachingDocumento102 páginasVTU MBA Sem 1 Syllabus and Scheme of TeachingShashi KumarAún no hay calificaciones

- Communication SkillsDocumento26 páginasCommunication Skillsgrantemily615Aún no hay calificaciones

- Attach 5023947 1 PDFDocumento2 páginasAttach 5023947 1 PDFLawal HamedAún no hay calificaciones

- Solidbank Corporation/ Metropolitan Bank and Trust Company, Petitioner, vs. SPOUSES PETER and SUSAN TAN, RespondentsDocumento9 páginasSolidbank Corporation/ Metropolitan Bank and Trust Company, Petitioner, vs. SPOUSES PETER and SUSAN TAN, RespondentsJoielyn Dy DimaanoAún no hay calificaciones

- Practice Incentives Practice Closure or Withdrawal: When To Use This Form Filling in This FormDocumento3 páginasPractice Incentives Practice Closure or Withdrawal: When To Use This Form Filling in This Formshaka biasaAún no hay calificaciones

- Donald Gunn's: 12 Types of AdvertisingDocumento13 páginasDonald Gunn's: 12 Types of Advertisingapi-549018895Aún no hay calificaciones

- Bull Final Q223Documento99 páginasBull Final Q223Elijah CherubAún no hay calificaciones

- Service Quality, Customer Satisfaction and Loyalty in An Internet Service ProvidersDocumento13 páginasService Quality, Customer Satisfaction and Loyalty in An Internet Service ProvidersJhunry TañolaAún no hay calificaciones