Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Monetary Policy Stance and Actions in August 2010

Cargado por

Geoffrey KidegaDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Monetary Policy Stance and Actions in August 2010

Cargado por

Geoffrey KidegaCopyright:

Formatos disponibles

Monetary Policy Stance and Actions in August 2010

In the domestic economy, low and stable inflation and overall macroeconomic stability remained the key objectives of monetary policy in August 2010. The Bank o Uganda continued to manage liquidity awith a view of supporting aggregate demand while at the same time mindful of the price stability objective. The steralization of structural (long term) liquidity was effected through sales of government securities and repurchase agreements (REPO) were used to fune tune short-term liquidity conditions. (for the full report read the Monthly Economic and Financial Indicators for August 2010, published on this website)

MONETARY POLICY IN UGANDA Section 162(c) of the Constitution of the Republic of Uganda (1995) provides that: "The Bank of Uganda shall encourage and promote economic development and the effective utilization of the resources of Uganda through effective and efficient operations of the banking and credit system". The Bank of Uganda Act, CAP 51 (Laws of Uganda, 2005) states in Section 5(i) the function of the Bank "shall be to formulate and implement monetary policy directed to economic objectives of achieving and maintaining economic stability The objective of Monetary Policy is ensure low and stable inflation and competitive exchange rates. This is implemented through the Monetary and Credit Policy Committee (MCPC) which is chaired by the Governor and meets on weekly basis.

Composition of MCPC

MCPC is chaired by the Governor. Other members are: Deputy Governor, Executive DirectorOperations, Executive Director-Research, Executive Director - Supervision, Executive Director General Duties, Economic Advisor to Governor, Director Financial Markets, Director Communications, Director Statistics, and Director - Research, who is the Secretary.

Roles and Responsibilities of MCPC

To formulate and direct the conduct of monetary policy in order to deliver price stability and support Governments objectives for sustainable economic growth To direct the conduct of financial markets operations

To ensure that liquidity conditions in the money markets are consistent with the broad objectives of price stability> To review developments in the foreign exchange market and formulate policies to promote stability in the market To seek harmonization and coordination of Government fiscal policies with monetary policies to support macroeconomic stability To address any other issue that has implications for the stability of the macro economy, including appraising policy recommendations from Functions, Government Departments and other forums.

Implementation

The Financial markets Operations Subcommittee (FMOSC) meets daily to implement monetary policy actions in accordance with the policies, guidelines and decisions made by the Monetary and Credit Policy Committee (MCPC). FMOSC is chaired by the Deputy Governor, with the Executive Director - Operations as the alternate chair and Director Financial Markets as Secretary. Other members are: Executive Director - Research, Executive Director - Supervision, Director Commercial Banking, Director Research, Director Communications, and Director Financial Stability.

También podría gustarte

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Distribution Channel of United BiscuitsDocumento5 páginasDistribution Channel of United BiscuitsPawan SharmaAún no hay calificaciones

- 2080 The Business of Agricultural Business Services PDFDocumento192 páginas2080 The Business of Agricultural Business Services PDFMohamed SururrAún no hay calificaciones

- Lecture 6 and 7 Project Finance Model 1Documento61 páginasLecture 6 and 7 Project Finance Model 1w_fibAún no hay calificaciones

- Glosario de SAP en InglésDocumento129 páginasGlosario de SAP en InglésTester_10Aún no hay calificaciones

- MERCHANDISINGDocumento74 páginasMERCHANDISINGKisha Nicole R. EnanoriaAún no hay calificaciones

- History of Behavioral Economics PDFDocumento17 páginasHistory of Behavioral Economics PDFAntonio Garcês100% (1)

- Tourist Attraction and The Uniqueness of Resources On Tourist Destination in West Java, IndonesiaDocumento17 páginasTourist Attraction and The Uniqueness of Resources On Tourist Destination in West Java, IndonesiaAina ZainuddinAún no hay calificaciones

- A Study On Market Anomalies in Indian Stock Market IDocumento10 páginasA Study On Market Anomalies in Indian Stock Market ISrinu BonuAún no hay calificaciones

- Finweek English Edition - March 7 2019Documento48 páginasFinweek English Edition - March 7 2019fun timeAún no hay calificaciones

- Online Shopping Hesitation: Chang-Hoan Cho, PH.D., Jaewon Kang, PH.D., and Hongsik John Cheon, PH.DDocumento14 páginasOnline Shopping Hesitation: Chang-Hoan Cho, PH.D., Jaewon Kang, PH.D., and Hongsik John Cheon, PH.DAmber ZahraAún no hay calificaciones

- Call Front Spread - Call Ratio Vertical Spread - The Options PlaybookDocumento3 páginasCall Front Spread - Call Ratio Vertical Spread - The Options PlaybookdanAún no hay calificaciones

- Gapminder WebsiteDocumento2 páginasGapminder WebsitejenieAún no hay calificaciones

- Csec Pob January 2015 p2Documento15 páginasCsec Pob January 2015 p2Ikera ClarkeAún no hay calificaciones

- Bullet Proof InvestingDocumento25 páginasBullet Proof InvestingNiru0% (1)

- Marketing Plan of Indigo AirlinesDocumento14 páginasMarketing Plan of Indigo AirlinesShrey Chaurasia100% (4)

- Punjab Spatial Planning StrategyDocumento12 páginasPunjab Spatial Planning Strategybaloch47Aún no hay calificaciones

- E TaxDocumento1 páginaE TaxTemesgenAún no hay calificaciones

- Computer Science AICTEDocumento2 páginasComputer Science AICTEchirag suresh chiruAún no hay calificaciones

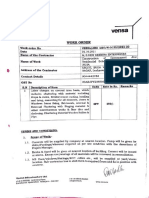

- Vensa WorkorderDocumento9 páginasVensa WorkorderAshutosh Kumar DwivediAún no hay calificaciones

- Questionnaire - CG and Stock Returns 1Documento2 páginasQuestionnaire - CG and Stock Returns 1Mostafa AbidAún no hay calificaciones

- Econ 305 Dr. Claudia Strow Sample Final Exam QuestionsDocumento5 páginasEcon 305 Dr. Claudia Strow Sample Final Exam Questionscognac19840% (1)

- Brta Payment For Learner HeavyDocumento3 páginasBrta Payment For Learner HeavymotiarbspAún no hay calificaciones

- Class 12 Economic - Indian Economic Development NCERT Solution eDocumento115 páginasClass 12 Economic - Indian Economic Development NCERT Solution eRounak BasuAún no hay calificaciones

- Fedex Label - PL2303002 S&S MartechDocumento6 páginasFedex Label - PL2303002 S&S MartechAnh HuynhAún no hay calificaciones

- BPSMDocumento1 páginaBPSMrickyakiAún no hay calificaciones

- NCP 31Documento14 páginasNCP 31Arunashish MazumdarAún no hay calificaciones

- Clean Edge Razor-Case PPT-SHAREDDocumento10 páginasClean Edge Razor-Case PPT-SHAREDPoorvi SinghalAún no hay calificaciones

- Benihana of Tokyo Case AnalysisDocumento2 páginasBenihana of Tokyo Case AnalysisJayr Padillo33% (3)

- Term Paper Edit Swizel and VernonDocumento10 páginasTerm Paper Edit Swizel and VernonswizelAún no hay calificaciones

- ICUMSA 45 Specifications and Proceduers - 230124 - 134605Documento3 páginasICUMSA 45 Specifications and Proceduers - 230124 - 134605Alexandre de Melo0% (1)