Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Aurobindo Pharma: Performance Highlights

Cargado por

Angel BrokingDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Aurobindo Pharma: Performance Highlights

Cargado por

Angel BrokingCopyright:

Formatos disponibles

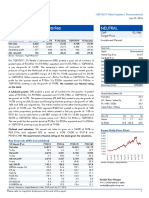

2QFY2012 Result Update | Pharmaceutical

November 16, 2011

Aurobindo Pharma

Performance Highlights

Y/E March (` cr) Net sales Other income Operating profit Interest Rep. net profit

Source: Company, Angel Research

BUY

CMP Target Price

2QFY2011 %chg (yoy) 1,043 80 184 19 198 3.1 (92.6) (37.8) 7.4

`92 `166

12 months

2QFY2012 1,075 6 115 21 (80)

1QFY2012 % chg (qoq) 922 3 172 13 135 16.6 92.6 (33.2) 60.2

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Pharmaceutical 2,685 1.1 275/91 220,520 1 16,776 5,030 ARBN.BO ARBP@IN

For 2QFY2012, Aurobindo Pharma (APL) posted lower-than-expected results on the top-line, operating and PAT fronts. Lower growth in the companys top line was on account of lower-than-expected growth in the formulation segment. However, we maintain our Buy view on the stock. Revenue growth disappoints: Net sales grew modestly by 3.1% yoy to `1,075cr, mainly on the back of pressure on the formulation segment. The US market and ARV segment reported lower-than-expected growth. The US market declined by 4.1% yoy, while the ARV segment grew only by 1.9% yoy. The API segment, on the other hand, grew by 8.5% yoy. Gross margin came in at 44.3%, impacted by higher raw-material costs. OPM declined to 10.7%, lower than our estimate of 16.7%, impacted by lower gross margin and increased employee and other expenses. Adjusted net profit came in at `42cr during the quarter. Outlook and valuation: Commencement of operations at the Hyderabad SEZ and incremental contribution from the Pfizer deal would boost APLs earnings with better growth visibility going forward. We estimate net sales to log a 12.7% CAGR to `5,243cr over FY201113E on the back of supply agreements and the US and ARV formulation contracts. Even after factoring in lower profitability going forward, the stock trades at attractive valuations. Hence, even after the downtrend, we maintain Buy on the stock with a revised price target of `166. Key financials (Consolidated)

Y/E March (` cr) Net sales % chg Net profit % chg Recurring profit % chg EPS (`) Recurring EPS (`) EBITDA margin (%) P/E (x) RoE (%) RoCE (%) P/BV (x) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 54.4 19.1 17.3 9.2

Abs. (%) Sensex Aurobindo

3m 0.3

1yr (15.6)

3yr 78.7

(37.2) (62.5) 260.2

FY2009 2,935 20.8 100 (58.0) 169 26.3 3.7 6.3 12.7 14.6 25.5 7.3 2.0 1.6 19.0

FY2010 3,370 14.8 563 463 304 79.4 20.2 10.9 18.3 8.4 29.6 12.1 1.4 1.4 11.6

FY2011E 4,126 22.4 563 (0.0) 332 9.2 19.3 11.4 17.1 8.1 24.6 11.7 1.1 1.2 10.7

FY2012E 4,519 9.5 462 (18.0) 343 3.5 15.9 11.8 14.8 7.8 17.1 9.4 0.9 1.0 8.6

FY2013E 5,243 16.0 480 3.9 401 16.8 16.5 13.8 14.6 6.7 15.1 10.2 0.8 0.8 7.1

Sarabjit Kour Nangra

+91 22 3935 7800 Ext: 6806 sarabjit@angelbroking.com

Please refer to important disclosures at the end of this report

Aurobindo Pharma | 2QFY2012 Result Update

Exhibit 1: 2QFY2012 performance (Consolidated)

Y/E March (` cr) Net sales Other income Total income Gross profit Gross margins Operating profit OPM (%) Interest Dep & amortisation PBT Provision for taxation Net profit Less : Exceptional items MI & share in associates PAT after Exceptional items EPS (`)

Source: Company, Angel Research

2QFY2012 1,075 6 1,081 476 44.3 115 10.7 21 46 54 (52) 105 186 (80) -

1QFY2012 922 3 925 464 50.3 172 18.6 13 40 122 29 93 (42) 135 1.8

% chg (qoq) 16.6 92.6 16.8 2.6 (33.2) 60.2 15.3 (55.9) 12.8 -

2QFY2011 1,043 80 1,123 488 46.8 184 17.7 19 41 205 83 122 (76) 198 6.8

% chg (yoy) 3.1% (92.6) (3.7) (2.5) (37.8) 7.4 13.5

1HFY2012 1,926 122 2,049 913 47.4 317 16.5 32 81 327 111

1HFY2011 1,652 98 1,750 1750 49.0 319 19.3 41 70 307 91 216 (54) 270 9.3

% chg (yoy) 16.6 24.5 17.0 (47.8) (0.6) (21.2) 15.0 6.6 22.7 (0.2) (7.7) (7)

(13.6)

215 (34) 250 8.6

Exhibit 2: Actual vs. Estimates

(` cr) Net sales Other operating income Operating profit Tax Adj. Net profit

Source: Company, Angel Research

Actual 1,075 6.0 115 (52) 42

Estimate 1,238 80 207 48 192

Variation (%) (13.1) (92.6) (44.5) (78.4)

Revenue up at 3.1% yoy, but disappoints Net sales grew modestly by 3.1% yoy to `1,075cr, mainly on the back of pressure on the formulation segment. The US market and ARV segment reported lowerthan-expected growth. The US market declined by 4.1% yoy, while the ARV segment grew only by 1.9% yoy. The API segment posted growth of 8.5% yoy to `490cr (`452cr), driven by SSP, which declined by 6.2% yoy. As of September 2011, the company reported 138 approved ANDAs and 29 tentative approvals, with cumulative filings to 222.

Exhibit 3: Sales break-up (Consolidated)

(` cr) Formulations US Europe and ROW ARV API SSP Cephs ARV & others

Source: Company, Angel Research

2QFY2012 592 283 134 174 490 150 170 170

1QFY2012 623 274 137 212 459 157 194 108

% chg (qoq) (5.0) 3.4 (2.0) (17.7) 6.8 (4.3) (12.2) 56.9

2QFY2011 615 296 149 171 452 160 206 85

% chg (yoy) (3.8) (4.1) (9.6) 1.9 8.5 (6.2) (17.4) 98.7

1HFY2012 1215 557 271 386 949 307 365 278

1HFY2011 1109 512 279 318 864 293 391 180

% chg 9.5 8.9 (2.9) 21.4 9.9 4.9 (6.8) 54.3

November 16, 2011

Aurobindo Pharma | 2QFY2012 Result Update

OPM dips by 700bp for the quarter: The companys gross margin came in at 44.3%, impacted by higher raw-material cost. OPM for the quarter declined to 10.7%, lower than our estimate of 16.7%, impacted by lower gross margin and increased employee and other expenses. Net profit lower than estimates: For the quarter, APL reported losses on account of notional exchange losses. However, even after adjusting for the same, APL reported net profit at `29.1cr, for the quarter, lower than our estimate of `192cr, mainly on the back of the lower-than-expected operating margin.

Management takeaways

1HFY2012 was impacted on the back of lower formulation sales, full impact of the USFDA alert on our Unit VI Cephalosporin manufacturing facility, subdued demand environment in Europe and disruption in operations due to regional unrest. Management expects the following quarters to be better and more profitable. Supply agreements with Pfizer and AstraZeneca will drive revenue growth in Europe and RoW markets. Europe business is expected to gain traction from 3QFY2012. Management has not given any clarity on timelines with the resolution of the USFDA issue w.r.t. Unit III and VI. As of September 2011, gross debt on books stood at around `3,045.9cr, with cash of `83.38cr.

November 16, 2011

Aurobindo Pharma | 2QFY2012 Result Update

Recommendation rationale

Supply agreements to drive growth: On the global filings front (ANDAs and dossiers), APL has increased its filing dramatically from 313 in FY2008 to 1,171 in FY2010, as it proposes to scale up from SSP and Cephs to NPNC products. Further, the companys transformation from being a pure API supplier to becoming a formidable formulations player has increased APLs cost efficiencies, as 90% of its formulation is now backward integrated. Thus, to leverage on its cost efficiency and strong product filings, APL entered into long-term supply agreements with Pfizer (March 2009) and AstraZeneca (September 2010), which provide significant revenue visibility going ahead. APL is also in discussion with other MNCs for more supply agreements. US and ARV formulation segments The key drivers for base business: APLs business, excluding the supply agreements, would primarily be driven by the US and ARV segments on the formulation front. APL has been an aggressive filer in the US market, with 209 ANDAs filed and 134 approvals received until FY2011. Amongst peers, APL is the third-largest ANDA filer. The company has aggressively filed ANDAs in the last three years and is now geared to reap benefits, even though most of the filings are for highly competitive products. APL expects to file 1520 ANDAs every year going forward. Going ahead, during the next three years in the US with US$70bn going off-patent, one of the highest in history, we believe APL is well placed to tap this opportunity. We expect the base business (ex-Pfizer) to post a 36.0% CAGR over FY201012 and contribute US$268mn by FY2012, with revenue per product increasing to US$2.6mn from US$2.3mn in FY2010, as the company moves towards the high revenue-generating NPNC and injectable (SSP and Cephs) products. APL is one of the largest generic suppliers under ARV contracts, with a 35% market share. The company enjoys high market share as it is fully integrated in all its products apart from having a larger product basket. Overall, we expect the ARV segment to post a 21.4% CAGR over FY2010-12E to `730cr, with PEPFAR allocation for generic ARVs expected to increase.

Outlook and valuation

Commencement of operations at the Hyderabad SEZ and incremental contribution from the Pfizer deal would boost APLs earnings with better growth visibility going forward. We estimate the companys net sales to log a 12.7% CAGR to `5,243cr over FY2011-13E on the back of supply agreements and the US and ARV formulation contracts. Even after factoring in a lower profitability going forward, the stock trades at attractive valuations. Hence, even after the downtrend, we maintain our Buy recommendation on the stock with a revised price target of `166.

November 16, 2011

Aurobindo Pharma | 2QFY2012 Result Update

Exhibit 4: Key assumptions

FY2012E API sales growth (%) Formulations sales growth (%) Operating margin (%) Capex (` cr)

Source: Company, Angel Research

FY2013E (2.3) 18.6 14.6 429

(0.4) 21.1 14.8 280

Exhibit 5: One-year forward PE

1,600 1,400 1,200 1,000

(`)

800 600 400 200 -

Source: Company, Angel Research

Exhibit 6: Recommendation summary

Company Alembic Pharmaceuticals Aurobindo Pharma# Aventis* Cadila Healthcare Cipla Dr. Reddy's Dishman Pharma Glaxo* Indoco Remedies Ipca labs Lupin Orchid Chemicals Ranbaxy* Sun Pharma Reco Buy Buy Sell Buy Buy Buy Buy Buy Buy Buy Buy Buy Buy CMP Tgt. price Upside (`) 42 92 2,345 723 310 1,614 43 399 250 456 153 473 490 (`) 77 166 1,937 965 369 1,920 68 555 358 593 270 577 569 % PE (x) 82.5 80.5 (17.4) 26.8 19.0 19.0 59.3 39.0 34.0 30.1 76.5 22.2 16.1 5.5 6.7 26.1 15.8 16.8 16.8 3.8 22.8 7.2 9.7 15.4 4.1 9.0 19.0 FY2013E EV/Sales (x) 0.7 0.8 3.3 2.4 3.1 2.9 0.9 5.2 0.9 1.5 2.5 1.5 1.7 5.3 EV/EBITDA (x) 4.9 5.8 21.6 12.8 14.4 11.6 5.0 14.5 5.9 6.9 12.8 6.9 7.3 15.0 FY11-13E 30.6 9.9 15.4 19.4 23.8 22.7 3.5 14.6 15.6 14.8 24.0 29.6 22.0 21.4 FY2013E RoE (%) 37.0 15.1 17.1 31.1 18.2 25.2 8.8 30.7 16.9 24.9 30.8 23.4 25.9 22.4 26.6 10.2 15.7 25.2 16.6 17.7 7.1 41.0 14.2 23.3 23.9 11.7 26.8 22.4 CAGR in EPS (%) RoCE (%)

Neutral 1,982

Source: Company, Angel Research; Note: * December year ending;#CAGR in EPS is based on recurring EPS

November 16, 2011

Apr-05 Jul-05 Oct-05 Jan-06 Apr-06 Jul-06 Oct-06 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11

5x 10x 15x 20x

Aurobindo Pharma | 2QFY2012 Result Update

Profit & loss statement (Consolidated)

Y/E March (` cr) Gross sales Less: Excise duty Net sales Other operating income Total operating income % chg Total Expenditure Net Raw Materials Other Mfg costs Personnel Other EBITDA % chg (% of Net Sales) Depreciation& Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Share in profit of Associates Recurring PBT % chg Extraordinary Expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Less: Minority interest (MI) PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Adj EPS (`) % chg FY2008 FY2009 FY2010 FY2011 FY2012E FY2013E 2,547 117 2,430 11 2,441 14.3 2,089 1,412 267 193 217 341 13.2 14.0 100 241 19.3 9.9 69 110 37.6 292 41.8 292 53.6 18.4 238 239 239 19.1 9.8 8.9 8.9 17.8 3,025 90 2,935 142 3,077 26.1 2,561 1,680 301 244 336 374 9.6 12.7 128 246 2.3 8.4 93 27 8.4 323 10.5 201.0 122 21.4 17.6 100 100 301 26.3 3.4 3.7 11.2 26.3 3,446 76 3,370 206 3,575 16.2 2,752 1,777 338 327 310 617 65.1 18.3 149 468 90.0 13.9 73 44 6.9 645 100.0 (109.5) 754 191.4 25.4 563 563 454 50.7 16.7 20.2 16.3 45.4 4,225 100 4,126 256 4,381 22.5 3,422 2,189 411 429 804 704 14.0 17.1 172 532 13.8 12.9 62 25 3.4 751 16.4 (37.2) 788 225.1 28.6 563 563 526 15.9 13.7 19.3 18.1 10.9 4,588 69 4,519 150 4,669 6.6 3,849 2,368 475 602 404 670 (4.8) 14.8 206 465 (12.7) 10.3 54 43 7.1 603 (19.6) 603 141.5 23.5 462 462 462 (12.2) 10.2 15.9 15.9 (12.2) 5,322 80 5,243 100 5,343 14.4 4,477 2,770 550 696 460 766 14.3 14.6 232 534 14.8 10.2 57 52 8.3 629 4.3 629 149.4 23.7 480 480 480 3.9 9.2 16.5 16.5 3.9

November 16, 2011

Aurobindo Pharma | 2QFY2012 Result Update

Balance sheet (Consolidated)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Share Application Money Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Mis. Exp. not written off Total Assets 1,601 418 1,184 278 53 60 2,059 283 316 1,460 526 1,534 3,109 1,869 575 1,294 536 105 0.3 2,289 128 394 1,767 570 1,719 3,654 2,312 697 1,615 570 96 0.3 2,506 73 375 2,058 708 1,798 4,079 2,774 882 1,892 502 48 39 3,392 188 505 2,699 886 2,506 4,987 3,280 1,087 2,192 352 48 0.28 3,472 106 642 2,724 1,138 2,334 4,926 3,709 1,320 2,389 352 48 0.28 4,020 165 721 3,134 1,320 2,700 5,490 27 1,097 1,124 3 1,908 73 3,109 27 1,214 1,241 3 2,333 77 3,654 28 1,801 1,829 4 2,155 91 4,079 29 2,416 2,445 9 2,414 118 4,987 29 2,921 2,950 9 1,834 133 4,926 29 3,368 3,397 9 1,934 150 5,490 FY2008 FY2009 FY2010 FY2011E FY2012E FY2013E

November 16, 2011

Aurobindo Pharma | 2QFY2012 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

Profit before tax Depreciation (Inc)/Dec in WC Less: Other income Direct taxes paid Cash Flow from Operations (Inc.)/Dec. in Fixed Assets (Inc.)/Dec. in Investments Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances

FY2008 FY2009 FY2010 FY2011E FY2012E FY2013E

292 100 (91) (49) (46) 305 (244) 113 (49) (181) 2 (141) (16) (268) (423) (300) 582 283 73 128 (334) (180) (30) 16 (479) 48 (180) (611) 287 (39) 193 440 (155) 283 128 752 149 (261) 44 (153) 443 (400) (9) 44 (365) 5 (1) (29) (109) (132) (54) 128 73 751 172 (593) 25 (180) 124 (470) (38) 25 (483) 1 297 (37) 261 (97) 73 188 603 206 90 43 (127) 730 (280) 38 43 (199) (580) (32) (613) (82) 188 106 629 232 (308) 52 (132) 370 (429) 52 (377) 100 (34) 66 59 106 165

November 16, 2011

Aurobindo Pharma | 2QFY2012 Result Update

Key ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Interest) 1.4 4.8 3.5 1.8 5.9 2.6 1.1 3.4 6.4 0.9 3.2 8.5 0.5 2.0 11.1 0.4 1.6 13.6 1.6 108 97 78 174 1.8 99 92 70 169 1.7 101 94 74 169 1.7 107 92 67 168 1.5 112 99 70 177 1.5 103 94 70 162 7.8 10.3 23.7 7.3 9 25.5 12.1 15 29.6 11.7 14 24.6 12.0 14 20.7 13.8 16 19.0 9.9 81.6 0.9 7.5 2.8 1.6 14.7 8.4 82.4 1.0 6.7 3.6 1.6 11.7 13.9 74.6 0.9 9.8 2.4 1.5 20.6 12.9 71.4 1.0 9.2 2.0 1.0 16.6 13.3 77.0 1.0 9.9 2.0 0.7 15.7 13.9 76.9 1.1 11.3 2.3 0.5 15.5 8.9 8.9 12.6 0.7 41.8 3.7 11.2 8.5 0.9 46.2 20.2 16.3 25.6 1.0 65.7 19.3 18.1 25.2 1.1 84.0 19.5 19.5 26.6 1.2 104.8 21.8 21.8 29.8 1.3 125.1 10.4 7.3 2.2 0.7 1.7 12.0 1.3 8.2 10.9 2.0 1.0 1.6 12.5 1.3 5.6 3.6 1.4 1.1 1.4 7.5 1.1 5.1 3.6 1.1 1.2 1.2 7.0 1.0 5.8 4.0 0.9 1.0 1.0 6.6 0.9 5.6 3.8 0.8 1.1 0.8 5.8 0.8 FY2008 FY2009 FY2010 FY2011E FY2012E FY2013E

November 16, 2011

Aurobindo Pharma | 2QFY2012 Result Update

Research Team Tel: 022 3935 7800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Aurobindo Pharma No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

November 16, 2011

10

También podría gustarte

- Aurobindo PharmaDocumento11 páginasAurobindo PharmaAngel BrokingAún no hay calificaciones

- Aurobindo Pharma Result UpdatedDocumento10 páginasAurobindo Pharma Result UpdatedAngel BrokingAún no hay calificaciones

- Aurobindo Pharma: Performance HighlightsDocumento11 páginasAurobindo Pharma: Performance HighlightsAngel BrokingAún no hay calificaciones

- Aurobindo-1QFY2013RU 10th AugDocumento11 páginasAurobindo-1QFY2013RU 10th AugAngel BrokingAún no hay calificaciones

- Aurobindo 4Q FY 2013Documento10 páginasAurobindo 4Q FY 2013Angel BrokingAún no hay calificaciones

- Aurobindo, 12th February 2013Documento11 páginasAurobindo, 12th February 2013Angel BrokingAún no hay calificaciones

- Aurobindo, 1Q FY 2014Documento11 páginasAurobindo, 1Q FY 2014Angel BrokingAún no hay calificaciones

- Alembic Pharma: Performance HighlightsDocumento11 páginasAlembic Pharma: Performance Highlightsvicky168Aún no hay calificaciones

- Alembic Pharma Result UpdatedDocumento9 páginasAlembic Pharma Result UpdatedAngel BrokingAún no hay calificaciones

- Alembic Pharma: Performance HighlightsDocumento11 páginasAlembic Pharma: Performance HighlightsAngel BrokingAún no hay calificaciones

- Indoco Remedies: Performance HighlightsDocumento11 páginasIndoco Remedies: Performance HighlightsAngel BrokingAún no hay calificaciones

- Indoco Remedies Result UpdatedDocumento11 páginasIndoco Remedies Result UpdatedAngel BrokingAún no hay calificaciones

- Alembic Pharma, 1Q FY 2014Documento10 páginasAlembic Pharma, 1Q FY 2014Angel BrokingAún no hay calificaciones

- Sun Pharma: Performance HighlightsDocumento11 páginasSun Pharma: Performance HighlightsAngel BrokingAún no hay calificaciones

- Indoco Remedies 4Q FY 2013Documento11 páginasIndoco Remedies 4Q FY 2013Angel BrokingAún no hay calificaciones

- Sun Pharma 1QFY2013Documento11 páginasSun Pharma 1QFY2013Angel BrokingAún no hay calificaciones

- Cadila Healthcare Result UpdatedDocumento12 páginasCadila Healthcare Result UpdatedAngel BrokingAún no hay calificaciones

- Indoco Remedies, 30th January 2013Documento11 páginasIndoco Remedies, 30th January 2013Angel BrokingAún no hay calificaciones

- Cadila Healthcare Result UpdatedDocumento12 páginasCadila Healthcare Result UpdatedAngel BrokingAún no hay calificaciones

- Dr. Reddy's Laboratories Result UpdatedDocumento11 páginasDr. Reddy's Laboratories Result UpdatedAngel BrokingAún no hay calificaciones

- Dr. Reddy's Laboratories: Performance HighlightsDocumento11 páginasDr. Reddy's Laboratories: Performance HighlightsAngel BrokingAún no hay calificaciones

- Cipla: Performance HighlightsDocumento11 páginasCipla: Performance HighlightsAngel BrokingAún no hay calificaciones

- Ranbaxy, 2Q CY 2013Documento11 páginasRanbaxy, 2Q CY 2013Angel BrokingAún no hay calificaciones

- Ranbaxy, 1st March, 2013Documento11 páginasRanbaxy, 1st March, 2013Angel BrokingAún no hay calificaciones

- Dishman Pharmaceuticals: Performance HighlightsDocumento10 páginasDishman Pharmaceuticals: Performance HighlightsAngel BrokingAún no hay calificaciones

- Indoco Remedies: Performance HighlightsDocumento11 páginasIndoco Remedies: Performance HighlightsAngel BrokingAún no hay calificaciones

- Sun Pharma: Performance HighlightsDocumento12 páginasSun Pharma: Performance HighlightsAngel BrokingAún no hay calificaciones

- Cipla: Performance HighlightsDocumento11 páginasCipla: Performance HighlightsAngel BrokingAún no hay calificaciones

- Sun Pharma 4Q FY 2013Documento11 páginasSun Pharma 4Q FY 2013Angel BrokingAún no hay calificaciones

- United Phosphorus: Performance HighlightsDocumento12 páginasUnited Phosphorus: Performance HighlightsAngel BrokingAún no hay calificaciones

- Ipca Labs: Performance HighlightsDocumento11 páginasIpca Labs: Performance HighlightsAngel BrokingAún no hay calificaciones

- Dr. Reddy's Laboratories Result UpdatedDocumento11 páginasDr. Reddy's Laboratories Result UpdatedAngel BrokingAún no hay calificaciones

- Alembic 291010 04Documento11 páginasAlembic 291010 04varsaxenaAún no hay calificaciones

- Ipca Labs Result UpdatedDocumento12 páginasIpca Labs Result UpdatedAngel BrokingAún no hay calificaciones

- Cadila Healthcare: Performance HighlightsDocumento12 páginasCadila Healthcare: Performance HighlightsAngel BrokingAún no hay calificaciones

- Dishman Pharmaceuticals: Performance HighlightsDocumento10 páginasDishman Pharmaceuticals: Performance HighlightsAngel BrokingAún no hay calificaciones

- Alembic Pharma LTD (APL) Stock Update: Retail ResearchDocumento5 páginasAlembic Pharma LTD (APL) Stock Update: Retail ResearchShashi KapoorAún no hay calificaciones

- DRL, 22nd February, 2013Documento11 páginasDRL, 22nd February, 2013Angel BrokingAún no hay calificaciones

- Cadila, 1Q FY 2014Documento12 páginasCadila, 1Q FY 2014Angel BrokingAún no hay calificaciones

- Ranbaxy: Performance HighlightsDocumento11 páginasRanbaxy: Performance HighlightsAngel BrokingAún no hay calificaciones

- Dishman 4Q FY 2013Documento10 páginasDishman 4Q FY 2013Angel BrokingAún no hay calificaciones

- United Phosphorus Result UpdatedDocumento11 páginasUnited Phosphorus Result UpdatedAngel BrokingAún no hay calificaciones

- Rallis India: Performance HighlightsDocumento10 páginasRallis India: Performance HighlightsAngel BrokingAún no hay calificaciones

- Dr. Reddy's Laboratories: Performance HighlightsDocumento10 páginasDr. Reddy's Laboratories: Performance HighlightsAngel BrokingAún no hay calificaciones

- Orchid Chemicals: Performance HighlightsDocumento11 páginasOrchid Chemicals: Performance HighlightsAngel BrokingAún no hay calificaciones

- HDFC Securities Pharma UpdateDocumento3 páginasHDFC Securities Pharma UpdateVijayAún no hay calificaciones

- GSK, 20th February, 2013Documento11 páginasGSK, 20th February, 2013Angel BrokingAún no hay calificaciones

- Orchid Chemicals Result UpdatedDocumento11 páginasOrchid Chemicals Result UpdatedAngel BrokingAún no hay calificaciones

- Cipla 4Q FY 2013Documento11 páginasCipla 4Q FY 2013Angel BrokingAún no hay calificaciones

- Market Outlook 9th August 2011Documento6 páginasMarket Outlook 9th August 2011Angel BrokingAún no hay calificaciones

- Cadila Healthcare, 12th February 2013Documento12 páginasCadila Healthcare, 12th February 2013Angel BrokingAún no hay calificaciones

- Orchid Chemicals Result UpdatedDocumento11 páginasOrchid Chemicals Result UpdatedAngel BrokingAún no hay calificaciones

- Ipca Labs Result UpdatedDocumento10 páginasIpca Labs Result UpdatedAngel BrokingAún no hay calificaciones

- Cipla: Performance HighlightsDocumento11 páginasCipla: Performance HighlightsAngel BrokingAún no hay calificaciones

- Alembic Pharma: Performance HighlightsDocumento10 páginasAlembic Pharma: Performance HighlightsTirthajit SinhaAún no hay calificaciones

- Lupin: Performance HighlightsDocumento11 páginasLupin: Performance HighlightsAngel BrokingAún no hay calificaciones

- Lupin Result UpdatedDocumento11 páginasLupin Result UpdatedAngel BrokingAún no hay calificaciones

- DR Reddys Laboratories Limited 4 QuarterUpdateDocumento11 páginasDR Reddys Laboratories Limited 4 QuarterUpdateparry0843Aún no hay calificaciones

- Asian Paints Result UpdatedDocumento10 páginasAsian Paints Result UpdatedAngel BrokingAún no hay calificaciones

- Instruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryDe EverandInstruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryAún no hay calificaciones

- Oilseeds and Edible Oil UpdateDocumento9 páginasOilseeds and Edible Oil UpdateAngel BrokingAún no hay calificaciones

- Daily Metals and Energy Report September 16 2013Documento6 páginasDaily Metals and Energy Report September 16 2013Angel BrokingAún no hay calificaciones

- Special Technical Report On NCDEX Oct SoyabeanDocumento2 páginasSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingAún no hay calificaciones

- WPIInflation August2013Documento5 páginasWPIInflation August2013Angel BrokingAún no hay calificaciones

- Technical & Derivative Analysis Weekly-14092013Documento6 páginasTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 páginasRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingAún no hay calificaciones

- International Commodities Evening Update September 16 2013Documento3 páginasInternational Commodities Evening Update September 16 2013Angel BrokingAún no hay calificaciones

- Daily Agri Tech Report September 14 2013Documento2 páginasDaily Agri Tech Report September 14 2013Angel BrokingAún no hay calificaciones

- Daily Agri Tech Report September 16 2013Documento2 páginasDaily Agri Tech Report September 16 2013Angel BrokingAún no hay calificaciones

- Metal and Energy Tech Report November 12Documento2 páginasMetal and Energy Tech Report November 12Angel BrokingAún no hay calificaciones

- Commodities Weekly Outlook 16-09-13 To 20-09-13Documento6 páginasCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingAún no hay calificaciones

- Market Outlook 13-09-2013Documento12 páginasMarket Outlook 13-09-2013Angel BrokingAún no hay calificaciones

- Commodities Weekly Tracker 16th Sept 2013Documento23 páginasCommodities Weekly Tracker 16th Sept 2013Angel BrokingAún no hay calificaciones

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 páginasDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingAún no hay calificaciones

- Derivatives Report 16 Sept 2013Documento3 páginasDerivatives Report 16 Sept 2013Angel BrokingAún no hay calificaciones

- Currency Daily Report September 16 2013Documento4 páginasCurrency Daily Report September 16 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report September 16 2013Documento9 páginasDaily Agri Report September 16 2013Angel BrokingAún no hay calificaciones

- Sugar Update Sepetmber 2013Documento7 páginasSugar Update Sepetmber 2013Angel BrokingAún no hay calificaciones

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAún no hay calificaciones

- IIP CPIDataReleaseDocumento5 páginasIIP CPIDataReleaseAngel BrokingAún no hay calificaciones

- Derivatives Report 8th JanDocumento3 páginasDerivatives Report 8th JanAngel BrokingAún no hay calificaciones

- Technical Report 13.09.2013Documento4 páginasTechnical Report 13.09.2013Angel BrokingAún no hay calificaciones

- TechMahindra CompanyUpdateDocumento4 páginasTechMahindra CompanyUpdateAngel BrokingAún no hay calificaciones

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 páginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingAún no hay calificaciones

- Metal and Energy Tech Report Sept 13Documento2 páginasMetal and Energy Tech Report Sept 13Angel BrokingAún no hay calificaciones

- MetalSectorUpdate September2013Documento10 páginasMetalSectorUpdate September2013Angel BrokingAún no hay calificaciones

- Daily Agri Tech Report September 06 2013Documento2 páginasDaily Agri Tech Report September 06 2013Angel BrokingAún no hay calificaciones

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 páginasTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingAún no hay calificaciones

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 páginasJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingAún no hay calificaciones

- MarketStrategy September2013Documento4 páginasMarketStrategy September2013Angel BrokingAún no hay calificaciones

- Localization On ECG: Myocardial Ischemia / Injury / InfarctionDocumento56 páginasLocalization On ECG: Myocardial Ischemia / Injury / InfarctionduratulfahliaAún no hay calificaciones

- Final SEC Judgment As To Defendant Michael Brauser 3.6.20Documento14 páginasFinal SEC Judgment As To Defendant Michael Brauser 3.6.20Teri BuhlAún no hay calificaciones

- Index: © Christopher Pitt 2018 C. Pitt, The Definitive Guide To AdonisjsDocumento5 páginasIndex: © Christopher Pitt 2018 C. Pitt, The Definitive Guide To AdonisjsZidi BoyAún no hay calificaciones

- CBSE 10th ResultsDocumento1 páginaCBSE 10th ResultsAkshit SinghAún no hay calificaciones

- New Presentation-Group AuditingDocumento23 páginasNew Presentation-Group Auditingrajes wariAún no hay calificaciones

- Flight Data Recorder Rule ChangeDocumento7 páginasFlight Data Recorder Rule ChangeIgnacio ZupaAún no hay calificaciones

- Chapter 13 Current Liabilities Test Bank Versi 2Documento72 páginasChapter 13 Current Liabilities Test Bank Versi 2Slamet Tri PrastyoAún no hay calificaciones

- JMC MSDS Puraspec 1173 (GB)Documento10 páginasJMC MSDS Puraspec 1173 (GB)Benny Samsul B.Aún no hay calificaciones

- Essays of Warren Buffett - Lessons For Corporate America by Lawrence Cunningham - The Rabbit HoleDocumento3 páginasEssays of Warren Buffett - Lessons For Corporate America by Lawrence Cunningham - The Rabbit Holebrijsing0% (1)

- QAU TTS Form Annual AssessmentDocumento6 páginasQAU TTS Form Annual AssessmentsohaibtarikAún no hay calificaciones

- 2010 Information ExchangeDocumento15 páginas2010 Information ExchangeAnastasia RotareanuAún no hay calificaciones

- TechBridge TCP ServiceNow Business Case - Group 6Documento9 páginasTechBridge TCP ServiceNow Business Case - Group 6Takiyah Shealy100% (1)

- FluteDocumento13 páginasFlutefisher3910% (1)

- 3) Uses and Gratification: 1) The Hypodermic Needle ModelDocumento5 páginas3) Uses and Gratification: 1) The Hypodermic Needle ModelMarikaMcCambridgeAún no hay calificaciones

- Rapp 2011 TEREOS GBDocumento58 páginasRapp 2011 TEREOS GBNeda PazaninAún no hay calificaciones

- ARIIX - Clean - Eating - Easy - Ecipes - For - A - Healthy - Life - Narx PDFDocumento48 páginasARIIX - Clean - Eating - Easy - Ecipes - For - A - Healthy - Life - Narx PDFAnte BaškovićAún no hay calificaciones

- Learning English Through The Educational Games of Wordwall Website For Elementary Students by Group 1 (R4E)Documento6 páginasLearning English Through The Educational Games of Wordwall Website For Elementary Students by Group 1 (R4E)NurulAún no hay calificaciones

- Blackbook 2Documento94 páginasBlackbook 2yogesh kumbharAún no hay calificaciones

- Standard BMW PDFDocumento19 páginasStandard BMW PDFIna IoanaAún no hay calificaciones

- Solutions DPP 2Documento3 páginasSolutions DPP 2Tech. VideciousAún no hay calificaciones

- Physiol Toric Calculator: With Abulafia-Koch Regression FormulaDocumento1 páginaPhysiol Toric Calculator: With Abulafia-Koch Regression FormuladeliAún no hay calificaciones

- Study and Interpretation of The ScoreDocumento10 páginasStudy and Interpretation of The ScoreDwightPile-GrayAún no hay calificaciones

- CHN Nutri LabDocumento4 páginasCHN Nutri LabMushy_ayaAún no hay calificaciones

- Lab Science of Materis ReportDocumento22 páginasLab Science of Materis ReportKarl ToddAún no hay calificaciones

- 4039-Texto Del Artículo-12948-3-10-20211123Documento14 páginas4039-Texto Del Artículo-12948-3-10-20211123Ricardo ApazaAún no hay calificaciones

- Aharonov-Bohm Effect WebDocumento5 páginasAharonov-Bohm Effect Webatactoulis1308Aún no hay calificaciones

- An Enhanced Radio Network Planning Methodology For GSM-R CommunicationsDocumento4 páginasAn Enhanced Radio Network Planning Methodology For GSM-R CommunicationsNuno CotaAún no hay calificaciones

- Equilibrium of A Rigid BodyDocumento30 páginasEquilibrium of A Rigid BodyChristine Torrepenida RasimoAún no hay calificaciones

- Agrinome For Breeding - Glossary List For Mutual Understandings v0.3 - 040319Documento7 páginasAgrinome For Breeding - Glossary List For Mutual Understandings v0.3 - 040319mustakim mohamadAún no hay calificaciones

- 1Documento2 páginas1TrầnLanAún no hay calificaciones