Documentos de Académico

Documentos de Profesional

Documentos de Cultura

33 9278

Cargado por

MarketsWikiDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

33 9278

Cargado por

MarketsWikiCopyright:

Formatos disponibles

UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION SECURITIES ACT OF 1933 Release No.

9278 / November 16, 2011 ADMINISTRATIVE PROCEEDING File No. 3-14628

In the Matter of MORGAN STANLEY INVESTMENT MANAGEMENT INC., Respondent. ORDER UNDER RULE 602(e) OF THE SECURITIES ACT OF 1933 GRANTING A WAIVER OF THE RULE 602(c)(3) DISQUALIFICATION PROVISION

I. Morgan Stanley Investment Management Inc. (MSIM or Respondent) has submitted a letter, dated October 20, 2011, requesting a waiver of the Rule 602(c)(3) disqualification from the exemption from registration under Regulation E arising from MSIMs settlement of an administrative proceeding commenced by the Commission. II. On November16, 2011, pursuant to Respondents Offer of Settlement, the Commission issued an Order Instituting Administrative and Cease-and-Desist Proceedings Pursuant to Sections 203(e) and 203(k) of the Investment Advisers Act of 1940, and Sections 9(b) and 9(f) of the Investment Company Act of 1940, Making Findings, and Imposing Remedial Sanctions and a Cease-and-Desist Order (Order) against MSIM. Under the Order, the Commission found that MSIM, the primary investment adviser to The Malaysia Fund, Inc. (Fund), represented to investors and the Funds board of directors (Board) that the Funds Malaysian sub-adviser was providing certain services that the sub-adviser in fact was not providing. MSIM also did not adopt and implement procedures governing its oversight of the Funds Malaysian sub-adviser and its provision of information regarding the sub-advisers services to the Board in connection with the investment advisory contract renewal process. Accordingly, the Commission found that MSIM willfully violated Sections 15(c) and 34(b) of the Investment Company Act, and Sections 206(2) and 206(4) of the Advisers Act and Rule 206(4)-7 thereunder. In the Order, the Commission

ordered MSIM to cease and desist from committing or causing any violations and any future violations of Sections 15(c) and 34(b) of the Investment Company Act, and Sections 206(2) and 206(4) of the Advisers Act and Rule 206(4)-7 thereunder, ordered MSIM censured, and ordered MSIM to pay a civil money penalty in the amount of $1,500,000 and to comply with undertakings. III. The Regulation E exemption is unavailable for the securities of small business investment company issuers or business development company issuers if any investment adviser or underwriter for the securities to be offered is subject to an order of the Commission entered pursuant to Section 203(e) of the Advisers Act. Rule 602(e) under the Securities Act of 1933 (Securities Act) provides, however, that the disqualification shall not apply . . . if the Commission determines, upon a showing of good cause, that it is not necessary under the circumstances that the exemption be denied. 17 C.F.R. 230.602(e). IV. Based upon the representations set forth in MSIMs request, the Commission has determined that pursuant to Rule 602(e) under the Securities Act a showing of good cause has been made that it is not necessary under the circumstances that the exemption be denied as a result of the Order. Accordingly, IT IS ORDERED, pursuant to Rule 602(e) under the Securities Act, that a waiver from the application of the disqualification provision of Rule 602(c)(3) under the Securities Act resulting from the entry of the Order is hereby granted.

By the Commission. Elizabeth M. Murphy Secretary

También podría gustarte

- 2016 20745aDocumento31 páginas2016 20745aMarketsWikiAún no hay calificaciones

- Minute Entry 335Documento1 páginaMinute Entry 335MarketsWikiAún no hay calificaciones

- Minute Entry 336Documento1 páginaMinute Entry 336MarketsWikiAún no hay calificaciones

- CFTC Fact SheetDocumento3 páginasCFTC Fact SheetMarketsWikiAún no hay calificaciones

- Fact Sheet - Final Rule Regarding The Cross-Border Application of The Margin RequirementsDocumento3 páginasFact Sheet - Final Rule Regarding The Cross-Border Application of The Margin RequirementsMarketsWikiAún no hay calificaciones

- CFTC Proposed Rule - Additional Interest Rate Swaps For Clearing RequirementDocumento32 páginasCFTC Proposed Rule - Additional Interest Rate Swaps For Clearing RequirementMarketsWikiAún no hay calificaciones

- Position Limits For Derivatives - Certain Exemptions and GuidanceDocumento58 páginasPosition Limits For Derivatives - Certain Exemptions and GuidanceMarketsWikiAún no hay calificaciones

- CFTC - Margin Requirements For Uncleared Swaps For Swap Dealers and Major Swap Participants-Cross-Border Application of The Margin RequirementsDocumento38 páginasCFTC - Margin Requirements For Uncleared Swaps For Swap Dealers and Major Swap Participants-Cross-Border Application of The Margin RequirementsMarketsWiki100% (1)

- 34 77724Documento1090 páginas34 77724MarketsWikiAún no hay calificaciones

- Federal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsDocumento6 páginasFederal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsMarketsWikiAún no hay calificaciones

- CFTC Final RuleDocumento52 páginasCFTC Final RuleMarketsWikiAún no hay calificaciones

- SEC Proposed Rule Incentive Based Compensation PDFDocumento488 páginasSEC Proposed Rule Incentive Based Compensation PDFMark JaffeAún no hay calificaciones

- SEC Final RuleDocumento268 páginasSEC Final RuleMarketsWikiAún no hay calificaciones

- Regulation SBSR-Reporting and Dissemination of Security-Based Swap InformationDocumento412 páginasRegulation SBSR-Reporting and Dissemination of Security-Based Swap InformationMarketsWikiAún no hay calificaciones

- Federal Register 050216Documento22 páginasFederal Register 050216MarketsWikiAún no hay calificaciones

- 34 77617 PDFDocumento783 páginas34 77617 PDFMarketsWikiAún no hay calificaciones

- 2015 30533a PDFDocumento126 páginas2015 30533a PDFMarketsWikiAún no hay calificaciones

- 2015 32143a PDFDocumento53 páginas2015 32143a PDFMarketsWikiAún no hay calificaciones

- Eemac022516 EemacreportDocumento14 páginasEemac022516 EemacreportMarketsWikiAún no hay calificaciones

- Federal Register 121615 BDocumento92 páginasFederal Register 121615 BMarketsWikiAún no hay calificaciones

- 34 77104Documento140 páginas34 77104MarketsWikiAún no hay calificaciones

- Via Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400Documento7 páginasVia Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400MarketsWikiAún no hay calificaciones

- Federal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesDocumento13 páginasFederal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesMarketsWikiAún no hay calificaciones

- 2016 03178 PDFDocumento41 páginas2016 03178 PDFMarketsWikiAún no hay calificaciones

- White Paper Commissioner GiancarloDocumento89 páginasWhite Paper Commissioner GiancarlotabbforumAún no hay calificaciones

- Specifications Swap Data 122215Documento70 páginasSpecifications Swap Data 122215MarketsWikiAún no hay calificaciones

- 34 76620 PDFDocumento202 páginas34 76620 PDFMarketsWikiAún no hay calificaciones

- Douglas C I FuDocumento4 páginasDouglas C I FuMarketsWikiAún no hay calificaciones

- Commodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015Documento26 páginasCommodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015MarketsWikiAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Villanueva vs. Court of AppealsDocumento1 páginaVillanueva vs. Court of AppealsPNP MayoyaoAún no hay calificaciones

- Introduction To Forensic Science Lecture 5 Forensic PathologyDocumento89 páginasIntroduction To Forensic Science Lecture 5 Forensic PathologyBoţu Alexandru100% (4)

- Sanders vs. Veridiano Case DigestsDocumento4 páginasSanders vs. Veridiano Case DigestsBrian Balio50% (2)

- Oblicon QuestionsDocumento1 páginaOblicon QuestionsCaseylyn RonquilloAún no hay calificaciones

- Contract MootDocumento14 páginasContract MootCLAT SIMPLIFIEDAún no hay calificaciones

- Origin of Sati Practice?: SanskritDocumento3 páginasOrigin of Sati Practice?: SanskritNaman MishraAún no hay calificaciones

- G.R. No. L-66865 Que VS IacDocumento8 páginasG.R. No. L-66865 Que VS IacArvin JayloAún no hay calificaciones

- Petition - Report & RecommendationDocumento5 páginasPetition - Report & RecommendationAmanda RojasAún no hay calificaciones

- Evidence & Practice Consolidated Lecture NotesDocumento25 páginasEvidence & Practice Consolidated Lecture NotesSteward Kabaso100% (6)

- Maintain A Safe A Navigational WatchDocumento7 páginasMaintain A Safe A Navigational Watchmuhammad mubaroqAún no hay calificaciones

- The Zone Gazette: The Danger Within. Artifact Spotlight: FireballDocumento1 páginaThe Zone Gazette: The Danger Within. Artifact Spotlight: FireballDavid CarterAún no hay calificaciones

- Aladdin Pitch FinishDocumento10 páginasAladdin Pitch Finishapi-268965515Aún no hay calificaciones

- Dept List - Engineering and Architecture Program-MIST Admission 2023-FINALDocumento25 páginasDept List - Engineering and Architecture Program-MIST Admission 2023-FINALSakib Md. AsifAún no hay calificaciones

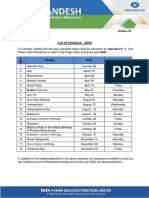

- Holiday List - 2020Documento3 páginasHoliday List - 2020nitin369Aún no hay calificaciones

- Ninety SeventiesDocumento6 páginasNinety Seventiesmuhammad talhaAún no hay calificaciones

- ABS-CBN v. Comelec, G.R. No. 133486, Jan. 28, 2000Documento7 páginasABS-CBN v. Comelec, G.R. No. 133486, Jan. 28, 2000Lourd CellAún no hay calificaciones

- (Promulgated June 21, 1988) : Code of Professional ResponsibilityDocumento2 páginas(Promulgated June 21, 1988) : Code of Professional ResponsibilityNadine Reyna CantosAún no hay calificaciones

- Suspects Apprehended After Vaal River Murder - OFMDocumento1 páginaSuspects Apprehended After Vaal River Murder - OFMAmoriHeydenrychAún no hay calificaciones

- The Boss Meets Mother: A Dinner Gone WrongDocumento6 páginasThe Boss Meets Mother: A Dinner Gone WrongAmrin FathimaAún no hay calificaciones

- Before The Honorable High Court of Uttar Pradesh Arising Out of Writ Petition No. - /2020Documento16 páginasBefore The Honorable High Court of Uttar Pradesh Arising Out of Writ Petition No. - /2020Shriya YewaleAún no hay calificaciones

- DGST Benguet V KeppelDocumento1 páginaDGST Benguet V KeppelJan-Lawrence Olaco100% (2)

- Case-Digest-Government-v-El Monte de PiedadDocumento1 páginaCase-Digest-Government-v-El Monte de PiedadJohn Alex OcayAún no hay calificaciones

- Basic Commerce Clause FrameworkDocumento1 páginaBasic Commerce Clause FrameworkBrat WurstAún no hay calificaciones

- Katy Perry Dark Horse Letras - Buscar Con GoogleDocumento1 páginaKaty Perry Dark Horse Letras - Buscar Con GoogleMaria MellaAún no hay calificaciones

- 13 M2W12 Theme Detection + Cause-EffectDocumento57 páginas13 M2W12 Theme Detection + Cause-EffectArun SomanAún no hay calificaciones

- The Geography of The Provincial Administration of The Byzantine Empire (Ca. 600-1200) (Efi Ragia)Documento32 páginasThe Geography of The Provincial Administration of The Byzantine Empire (Ca. 600-1200) (Efi Ragia)Agis Tournas100% (1)

- 07-22-2016 ECF 612 USA V RYAN PAYNE - OBJECTION To 291, 589 Report and Recommendation by Ryan W. PayneDocumento14 páginas07-22-2016 ECF 612 USA V RYAN PAYNE - OBJECTION To 291, 589 Report and Recommendation by Ryan W. PayneJack RyanAún no hay calificaciones

- Criminal Law ReviewerDocumento11 páginasCriminal Law ReviewerMoairah LaritaAún no hay calificaciones

- North 24 Parganas court document on property disputeDocumento5 páginasNorth 24 Parganas court document on property disputeBiltu Dey89% (9)

- Vs 3 GuideDocumento3 páginasVs 3 Guideapi-260052009Aún no hay calificaciones