Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Brochure

Cargado por

Gopalaswamy BalasubramanianDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Brochure

Cargado por

Gopalaswamy BalasubramanianCopyright:

Formatos disponibles

Financial Modelling

Masterclass

18 - 22 September 2011, Dubai

Use Your Brain

Best practice modelling solutions for world-class analysts, investors, planners and finance professionals.

Learn the most effective ways to design, cross-check and structure your financial models. Build robust and flexible models so you can perform add-ins and make amendments while maintaining the integrity of your spreadsheets. Learn to create and compare scenarios base case, best case, worst case no more potential errors. Save literally hours of modelling manipulation time. Get the job done faster and painlessly.

www.terrapinnfinancial.com

www.terrapinnfinancial.com

Financial Modelling Masterclass

Develop effective financial models

About your presenter

Take your analytical skills to the next level... and design world-class models. This highly-practical, hands-on programme is specifically designed to strengthen your model structuring skills. Far too many business spreadsheet models are flawed due to a lack of thought about objectives, layout and design. By adopting a structured design strategy, you can develop better models, in less time and with greater accuracy.

Learn by doing - Real-world case studies demonstrating best practice This intensive course is packed with cutting edge spreadsheet design ideas and simulation exercises to bring your modelling skills to the next level. By the end of this course, you will be able to design sophisticated spreadsheets that you never imagined were possible. In just 5 days you will: Analyse financial data using a variety of database functions. Learn how to quickly, efficiently and effectively evaluate financial decisions when undertaking a project, making an investment, acquiring disposing of a business, etc. Discover how to prepare realistic and reliable financial forecasts. Learn how to determine a fair value of a company or other assets. Uncover how to determine the best price which to list a company. Design and build a model to analyse a lease proposal and decide between purchasing, leasing or borrowing. Remember just one good nugget of inspiration will repay the cost of this workshop 100 times over. Why not bring your team? Register 4 delegates and bring a 5th free see the registration form the back of this brochure for full details.

Ranjit Naik is a UK based award-winning Financial Modelling expert and with over 30 years practical experience in financial modelling across the world. Terrapinn's #1 rated trainer in 2009. His specialist areas include corporate finance, financial modelling and company valuation, credit analysis, corporate strategy and financial planning.

Module One: Advanced Spreadsheet Skills (Day1 & 2) Attend this Module to sharpen your Excel skills. Youll discover best-practice techniques for spreadsheet planning and design - plus how to record Macros to save yourself hours of modelling time. These first two days are an ideal preparation for the next 3 days of intensive Corporate Financial Modelling (Module II). Module Two: Corporate Financial Modelling (Days 3, 4 & 5) This second module allows you to APPLY your skills for building superior financial models. Here, you will work on exercises and case studies designed to take your own models to a whole new level.

DAY ONE

Spreadsheet Concepts Session 1 - Review of Excel Concepts Setting up workbooks and worksheets Setting up formulas, copying and pasting data and formulas Linking cells on different worksheets Formatting cells and entering comments Understanding and using controls Prepare a profit and balance sheet to examine and identify any errors. Learn to expand the functionality of spreadsheet and enhance its appearance and usability Session 2 - Exploring Functions in a Spreadsheet Program General format and use Selected financial & statistical functions Lookup and other functions Array functions You will be provided with a number of problems to solve using Excel functions, to enhance your understanding. Session 3 - Advanced Functions and Tools Using database functions and pivot tables Using database functions You will analyse a set of financial data using a variety of database functions. Session 4 - Other useful Excel tools & techniques Data validation and conditional formatting Protecting data and formulas in a spreadsheet Multi-file models Consolidation and summarisation Using graphs and charts You will complete a variety of exercises designed to confirm and consolidate your understanding of the tools and techniques.

DAY TWO

Modelling Approaches and Project Appraisal Session 1 - Approaching the Building of a Model Nature of financial models and application areas Systematic approach to model-building Designing models and model structures Designing input, cell logic and output sheets Testing and documenting the model Given a statement of a business problem, you will design and build a model to solve the problem. Session 2 - Forecasting for Modelling Applications Analysing historic data to identify components Trends, Cyclical variations and Seasonal variations Random variations Modelling time series analysis and regression analysis Use modelling techniques to prepare forecasts. Session 3 - Forecasting Financial Statements Use of business experience and judgment Forecasting the income statement Balance sheet and cash flow statements Evaluating the reliability of forecasts# You will use your analysis of historic company data from the previous exercise to model the forecasting of financial statements. Session 4 - Cost of Capital Calculation of future and present values Discount factors and tables Continuous compounding Calculating the cost of debt Gordon growth models Capital asset pricing model Calculating the weighted average cost of capital (WACC) You will model the calculation of the weighted average cost of capital for a company with an interesting mix of types of debt and equity capital.

DAY T

Modelling Applications for C Session 1 - Project appraisa Determining relevant costs Determining fixed and varia Determining revenues Modelling cash flows and ca Project risk and sensitivity Setting up scenarios You will examine details of a m revenues and decision. You w viability of the project calculat

Session 2 - Optimisation Te Elements of optimisation te Using the Goal Seek facility Understanding and using lin Using the Solver facility in E Nature and importance of sh You will use linear programmi of resource competing projec

Session 3 - Review of Valua Asset-based valuation Market/Book Value calculati Using P/E ratios in valuation Using other multiples to cal Introduction to Free Cash Fl simple of methods to determ

online www.terrapinnfinancial.com | email nikola.clay@terrapinn.com | phone +44 (0)20 7608 7068 | fax +44 (0)20 7608 7050

Recent Terrapinn attendees

ABN AMRO Abu Dhabi Investment Authority Abraaj Capital Aman for Securities Ltd ANZ Arab Banking Corporation BNP Paribas Capital Mall Trust Management Citigroup Credit Libanais SAL Dubai International Capital Dubai International Financial Centre Deutsche Bank AG Fidelity Investment Global Investment House Gulf International Bank Gulf Investment Corporation Istithmur JP Morgan Kuwait Finance House Macquarie Bank Mashreq Bank Merill Lynch National Bank of Dubai National Commercial Bank Qatar Islamic Bank Samba Financial Group Saudi National Commercial Bank Shuaa Capital

Who's attending?

Analysts - Financial, Business, Investment Analysts Planners - Strategic, Business and Financial Planners Finance Directors, CFOs, Financial Controllers Corporate Valuation Specialists: M&A, Private Equity, Real Estate

www.terrapinnfinancial.com

Banks & Asset Managers

Telecoms & Media

RELATED EVENTS

3 day MBA in Company Valuation 12-14 September 2011 London 5 Day MBA in Applied Corporate Finance & Valuation 25-29 September 2011 Dubai

Consultants

Utilities

Organisations that will benefit

Mines Oil & Gas Companies

Pharmaceuticals & Healthcare

Transport Operators

Register now: Call Nikola Clay on +44 (0)20 7608 7068 or email nikola.clay@terrapinn.com

DAY FIVE

Monte Carlo Simulation, Macros, and User-defined Functions Session 1 - Monte Carlo Simulation Statistical measures and how to calculate them Probability distributions and the normal distribution Running a simulation and interpreting results You will use a macro to perform simulations and examine the results to analyse the viability of a project. Session 2 - Introduction to Spreadsheet Macros Using the macro recorder to create macros Editing and enhancing recorded macros Identifying and correcting errors in macros You will examine a number of prewritten macros that are not operating as intended. You will then use Excel function to identify the error(s) in each macro and correct the errors as appropriate. Session 3 - Extending the Power of Macros Data input and output macros Branching from one macro to another Using loops and other features Creating list boxes and attaching lists to macros You will examine specifications for a number of macros and create the macros starting with a blank sheet. You will then debug the macros and ensure that they are operating as required. Session 4 - Using VBA (Visual Basic for Applications) Creating a new module Using VBA to create user-defined functions Incorporating a help facility Variables and variable types Branching and looping You will examine specification for user-defined functions, write and debug the functions to ensure that they are operating as required.

THREE

DAY FOUR

VAR, Leases, Financial Options and Real Options Session 1 - Value at Risk (VAR) Measures of risk Statistical measures and how to calculate them Mean, variance, and standard deviation Calculating mean and variance of multi-asset portfolios Using Excel functions to calculate VAR VAR of multi-asset portfolios You will use modelling techniques to calculate the VAR for a multi-asset portfolio. Session 2 - Financial Analysis of Leasing Nature of leases and lease payments Modelling the lease versus buy decision Modelling the lessors perspective Special problems of leveraged leases You will design and build a model to analyse a lease proposal and to decide between purchasing, leasing or borrowing to acquire an asset. Session 3 - Financial Options and Options Pricing Using options in risk management Pricing using the binomial model Using the Black-Scholes model to price options Session 4 - Real Options Analysis The nature of real options and how they relate to financial options Typical examples, e.g. option to expand, options to abandon, option to defer or wait, etc. Valuing real options Modelling the option to expand Valuing an abandonment option You will use modelling techniques to value the option to defer a decision on whether to accept or reject a proposed business opportunity.

Corporate al

able

alculating

major to determine which will then build a evaluate the ting the companys cost

echniques Modelling echniques y near Excel programming problems hadow ing Excel to solve a problem cts with different

ation

ions n lculate low You will practice building mine the value company.

Financial Modelling Masterclass

Register now

Package Before 03 Jun 2011 Before 22 Jul 2011 Before 09 Sep 2011 After 09 Sep 2011 Quantity Sub-total

l 18 - 22 September 2011, Dubai

Registration fee

3,865 Save 860

4,295 Save 430

4,510 Save 215

4,725

Financial Modelling

Masterclass

18 - 22 September 2011, Dubai

Platinum Package Send 4 delegates and the 5th comes FREE

*Registrations without credit/debit card payments are subject to a 100 booking fee. How do you want to pay? Credit / Debit card Cheque / Bank transfer Select

Total

l l

0 100

How to book your course Online

Attendee details

www.terrapinnfinancial.com You can use our online calculator to tailor your ticket and buy multiple tickets. The calculator automatically selects the most favourable discount for you. If you book and pay online you also save a further 100.

1 2 3 4 5

Name .................................................................................................. Job title ........................................................................................................... Tel ....................................................................................................... Email ................................................................................................................ Name .................................................................................................. Job title ........................................................................................................... Tel ....................................................................................................... Email ................................................................................................................ Name .................................................................................................. Job title ........................................................................................................... Tel ....................................................................................................... Email ................................................................................................................ Name .................................................................................................. Job title ........................................................................................................... Tel ....................................................................................................... Email ................................................................................................................

Offline

Complete this form and fax to +44 (0)20 7608 7050 or call +44 (0)20 7608 7068 and well take your booking over the phone.

Take the platinum package

Get your team together and save up to 4,725 Send 4 attendees and get one FREE

FREE FREE Name .................................................................................................. Job title ........................................................................................................... FREE Tel ....................................................................................................... Email ................................................................................................................

Privacy policy

Terrapinn may contact you about products and services offered by Terrapinn and its group companies, which Terrapinn believes may be of interest to you, or about relevant products and services offered by reputable third parties. Please tick the appropriate box if you do not wish to receive such information from: l the Terrapinn group; l or reputable third parties.

Company details

Organisation name ..........................................................................................Industry........................................................................................................... Address ................................................................................................................................................................................................................................... Postcode ..........................................................................................................Country ........................................................................................................... Tel ....................................................................................................................Fax ..................................................................................................................

Company details

Organisation name ..........................................................................................Industry........................................................................................................... Address ................................................................................................................................................................................................................................... Postcode ..........................................................................................................Country ........................................................................................................... Tel ....................................................................................................................Fax .................................................................................................................. EU VAT registration number (mandatory for all EU member states) .....................................................................................................................................

Terms and conditions

1. Should you be unable to attend, you are not able to transfer your registration to a later course. Instead a substitute delegate is welcome at no extra charge 2. Terrapinn Financial Training does not provide refunds for cancellations. Invoiced sums are payable within 14 days of the invoice date. Notwithstanding this, payment must be received prior to the course taking place. 3. Terrapinn Financial Training will make available course documentation to a delegate who is unable to attend and who has paid 4. Terrapinn Financial Training reserves the right to alter the programme without notice including the substitution, alteration or cancellation of speakers and / or topics and / or the alteration of the dates of the event 5. Terrapinn Financial Training is not responsible for any loss or damage as a result of a substitution, alternation, postponement or cancellation of an event under any circumstances

Payment details

Payment is due in 14 days. By signing and returning this form you are accepting our terms and conditions. If you reserve your ticket but pay by invoice or bank transfer payment must be received in 14 days

l Bank transfer

Card number

l Switch

l Visa

l American express

l Mastercard

Expiry date ........../........../................

llll -llll -llll -llll

Card holders name ..........................................................................................Card holders signature .................................................................................... Invoice contact name ............................................................................................................................................................................................................... Tel ....................................................................................................................Email................................................................................................................ Bank Transfers: Please quote invoice number on your telegraphic transfer instruction Barclays Bank Plc, Account name: The MBA Training Company, Sort Code: 20-78-98, Swift Code: BARC GB 22, IBAN: GB28 BARC 2078 9840 9723 47, Bank Account No: 40972347

You may also be interested in

3 day MBA in Applied Corporate Finance 3 day MBA in Finance 3 day MBA in Basel III 3 day MBA in Forecasting 3 day MBA in Company Valuation 3 day MBA in Project Finance Modelling 3 day MBA in Company Valuation Modelling 3 day MBA in Transfer Pricing 3 day MBA in Due Diligence 3 day MBA in Treasury Management 3 day MBA in Enterprise Risk Management Go to www.terrapinnfinancial.com to view our full course calendar for 2011

Course Schedule

Registration ................................. 8.30 am Course Begins ............................. 9.00 am Morning Break ........................... 10.30 am Lunch ......................................... 12.00 pm Afternoon Break .......................... 3.30 pm Close............................................ 5.30 pm

Part of the Terrapinn group

380420

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- GSL Hi-Temp Operation Manual-0217-Gl - Tube FurnaceDocumento36 páginasGSL Hi-Temp Operation Manual-0217-Gl - Tube FurnacehcaAún no hay calificaciones

- Best Lesson PlanDocumento4 páginasBest Lesson Planapi-398545121Aún no hay calificaciones

- DualityDocumento28 páginasDualitygaascrAún no hay calificaciones

- This XML File Does Not Appear To Have Any Style Information Associated With It. The Document Tree Is Shown BelowDocumento7 páginasThis XML File Does Not Appear To Have Any Style Information Associated With It. The Document Tree Is Shown BelowSpit FireAún no hay calificaciones

- Scan APIDocumento183 páginasScan APIChitradeep Dutta RoyAún no hay calificaciones

- Arduino Based Heart Rate Monitor ProjectDocumento7 páginasArduino Based Heart Rate Monitor ProjectMaged Alqubati100% (1)

- SAS Vs FC Vs ISCSI PDFDocumento15 páginasSAS Vs FC Vs ISCSI PDFLeonAún no hay calificaciones

- CustomPC 2023-2 PDFDocumento100 páginasCustomPC 2023-2 PDFTavimmmmmAún no hay calificaciones

- Facility Design GuidelinesDocumento440 páginasFacility Design GuidelinesWalid Abou HassanAún no hay calificaciones

- ME302-Syllabus - ME-302 Mechanical Systems IIDocumento2 páginasME302-Syllabus - ME-302 Mechanical Systems IIد.محمد كسابAún no hay calificaciones

- 2015 03 21a Mba Self-StudyDocumento8 páginas2015 03 21a Mba Self-Studyapi-265932575Aún no hay calificaciones

- Application Form: Full Name ID Card Number Date of Birth Sex Address Phone Number EmailDocumento3 páginasApplication Form: Full Name ID Card Number Date of Birth Sex Address Phone Number EmailesadisaAún no hay calificaciones

- Introduction To Vlsi Circuits and Systems John P UyemuraDocumento1 páginaIntroduction To Vlsi Circuits and Systems John P UyemuramgowtaamAún no hay calificaciones

- Grade 9 Math Unit 2 Review AssignmentDocumento6 páginasGrade 9 Math Unit 2 Review AssignmentQurat-Ul-Ain JaferiAún no hay calificaciones

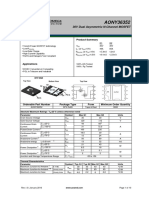

- AONY36352: 30V Dual Asymmetric N-Channel MOSFETDocumento10 páginasAONY36352: 30V Dual Asymmetric N-Channel MOSFETrobertjavi1983Aún no hay calificaciones

- Unit01-Getting Started With .NET Framework 4.0Documento40 páginasUnit01-Getting Started With .NET Framework 4.0mgsumaAún no hay calificaciones

- Skype For Business Server 2015 - Kickoff PresentationDocumento15 páginasSkype For Business Server 2015 - Kickoff PresentationItw UttAún no hay calificaciones

- CCpilot XM and CrossCore XM - Programmers GuideDocumento17 páginasCCpilot XM and CrossCore XM - Programmers GuideAndres Emilio Veloso RamirezAún no hay calificaciones

- Surpac ReportingDocumento4 páginasSurpac ReportingDelfidelfi SatuAún no hay calificaciones

- Assam CEE 2015 Information BrochureDocumento5 páginasAssam CEE 2015 Information BrochureMota ChashmaAún no hay calificaciones

- #14674 Difficulty: Moderate #35626 Difficulty: ModerateDocumento4 páginas#14674 Difficulty: Moderate #35626 Difficulty: ModerateLaszló KindAún no hay calificaciones

- CAPE 3320 & 5330M Advanced/ Reaction Engineering: Executive SummaryDocumento19 páginasCAPE 3320 & 5330M Advanced/ Reaction Engineering: Executive SummaryMeireza Ajeng PratiwiAún no hay calificaciones

- Schneider Electric Price List Feb 2020 V2Documento478 páginasSchneider Electric Price List Feb 2020 V2Amr SohilAún no hay calificaciones

- Department of Education: Project All Numerates Grade 6 Table of SpecificationsDocumento3 páginasDepartment of Education: Project All Numerates Grade 6 Table of Specificationsian bondocAún no hay calificaciones

- The Concept of "At Work"Documento17 páginasThe Concept of "At Work"Gerel Ann Lapatar TranquilleroAún no hay calificaciones

- Mini Pak HoneywellDocumento78 páginasMini Pak Honeywellliviu_dovaAún no hay calificaciones

- Camera Trap ManualDocumento94 páginasCamera Trap ManualAndreas VetraAún no hay calificaciones

- Blueprint - SOP - Target PagesDocumento3 páginasBlueprint - SOP - Target PagesKen CarrollAún no hay calificaciones

- FsDocumento8 páginasFskrishnacfp232Aún no hay calificaciones

- VFD Manual PDFDocumento60 páginasVFD Manual PDFray1coAún no hay calificaciones