Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Citibank Performance Evluation

Cargado por

Namita ChaudharyDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Citibank Performance Evluation

Cargado por

Namita ChaudharyCopyright:

Formatos disponibles

Citibank: performance evaluation

HRM ASSIGNMENT SWATI JAIN 2010238 SECTION-E

Q 1) Describe the performance management and appraisal system adopted by Citibank?

A performance evaluation is done to find out the loop holes and barriers that hinder the performance of an employee and a team leader. This evaluation is done with an aim to establish clear expectations an understanding about: Planning, organising and Leadership effective. How team leader is effective in delegating the task to his employee and how far is he successful in maintain and coordinate group work and is he able to make substantial profit or not. What are the barriers in achieving his desired goal? On what parameters does an employee stand to be at par with the organisations goal and how far he can contribute towards it?

Citibank was a niche player in the California market. Having 80 branches its strategy was to build a profitable franchise by providing relationship banking combined with a high level of service to its customers. And for that Citibank provided a huge and dense network of ATM machines, 24 hour banking and home banking. However, Citibank felt the need to create a new performance score card as the earlier performance measures were dominated by the financial measures but as the banks is growing day by day it needed to focus their attention towards measures of long term success. The new score card also laid importance to non financial measures as a key ingredient in strategy implementation. The new performance evaluation scorecard was done to study all the aspect of performance relating to:

1) Financial measures- to succeed financially, how we should appear to our shareholders. These measures were obtained from regular accounting system and focused primarily on total revenue and profit margin against target. 2) Strategy implementation- target customer segment relevant to branch strategy. 3) Customer satisfaction-to achieve our strategy, how should we appear to our customers. Given the current strategy of the bank, which focused on customer service as a key differentiator, it was considered that the customer satisfaction measure is critical to the long term success and a leading indicator of future financial performance. If customer satisfaction deteriorated, it was only a matter of time before it showed in the financials. 4) Control measures- through internal audits. Branches have to score at least par (defined as 4 on a scale of 1 to 5) to be eligible for any bonus. If the rating was below 4, the branchs business was considered at risk and did not meet the requirements for effective control. 5) People and standards- to achieve our strategy, how will we sustain our ability to change and improve? It is a non-quantifiable ratings determined subjectively by the branch managers boss. The people measure focused on the proactive efforts of the manager to develop and communicate with subordinates, to encourage area training programs, and to be a role model to more juniors. Standards included an assessment of a managers involvement in community groups, trade associations, and business ethics. Each component of the score card was scored independently into one of three rating categories: below par, par or above par. For those measures that could be measures quantitivelyfinancial, strategy implementation, customer satisfaction, and control- pre-defined ratings related to people and standards lacked an appropriate objective indicator; in these cases performance was determined subjectively by the branch managers superior. In addition, the managers boss gave a global rating for each of the six components of the scorecard and an overall rating for the branch manager.

Q2) what in your opinion are the strengths and weaknesses of performance scorecard of Citibank? Strengths and weakness of the new score card Strength

It had been made a structured evaluation which takes care of all the measures that the company thinks fit and necessary under a performance evaluation system. Now the non- financial measure has also been taken into account as an important factor contributing among the leading indicators of strategy implementation. An above par rating manager is separately recognised and is been looked by other manager as a benchmark. The score card has differentiate different measures including customer satisfaction which makes it easy to separately rank separate parameter which further makes it

better for the evaluator that where is the bone of contention in the system and what should be done for its improvement.

Weakness

The scorecard rating was very stringent as a person who doesnt score a at least par rating in all the components a manager could not get a above par rating as a whole. The incentive was also just 15% of the basic salary and no other incentives were given for at par to grow as well as a below par rating was not given any incentive or motivation to improve.

Though ratings were given separately, it did not indentified each factor separately to evaluate the performance There were very high targets set to achieve the above the targets.

Q3) Assume that you are Lisa Johnson, complete exhibit 1 to evaluate James McGarans performance.

If I were Lisa, I would have given James McGaran an above par rating as he has been consistently performing well in the past years. Though his branch was the largest and the toughest branch in the division and he had a demanding clientele and challenging competition. It was difficult to manage such a diverse set of indicators, and the customer measure was sometimes hard to reconcile with demonstrated financial performance. His financials were outstanding- 20% above target. He has generated the highest revenue and made the greatest margin contribution to the business of any branch in the system. He has done exceptionally well across the scorecard and though he is seen as struggling in the area of customer satisfaction, he is consciously making efforts to overcome it. James was a reference point for a lot of other branch managers. Also let us not forget, the parameters which are beyond branchs control are also detrimental for customer satisfaction score. Scoring can be:

También podría gustarte

- AriseDocumento21 páginasArisearjunparekh100% (6)

- Citibank CaseDocumento2 páginasCitibank CaseMichi Kunugi-WangAún no hay calificaciones

- Citibank Performance EvaluationDocumento9 páginasCitibank Performance EvaluationRajat KaulAún no hay calificaciones

- Citibank Case AnalysisDocumento4 páginasCitibank Case Analysistmcclary8356100% (10)

- CitibankDocumento12 páginasCitibankshubhamAún no hay calificaciones

- Paying Quantities Key & Charest - CLE - Oil and Gas Disputes 2019Documento22 páginasPaying Quantities Key & Charest - CLE - Oil and Gas Disputes 2019Daniel CharestAún no hay calificaciones

- Citibank Performance EvaluationDocumento3 páginasCitibank Performance EvaluationPriyanka Sharma100% (2)

- Syndicate 1 - Microsoft Competing On TalentDocumento9 páginasSyndicate 1 - Microsoft Competing On TalentardianabyAún no hay calificaciones

- Performance Appraisal and Management (Pma)Documento9 páginasPerformance Appraisal and Management (Pma)Priyanka BiswasAún no hay calificaciones

- Citibank CaseDocumento11 páginasCitibank CaseAbhinaba Ghose100% (1)

- Treasurer'S Affidavit: Republic of The Philippines) City of Taguig) S.S. Metro Manila)Documento2 páginasTreasurer'S Affidavit: Republic of The Philippines) City of Taguig) S.S. Metro Manila)Maria Andres50% (2)

- Citybank CaseDocumento8 páginasCitybank CaseDeepika Dhir0% (1)

- SG CowenDocumento7 páginasSG CowenNafees Reza75% (4)

- Citibank Case Study Group1Documento11 páginasCitibank Case Study Group1Deepaksayu100% (1)

- Citibank HRMDocumento12 páginasCitibank HRMBala MeenakshiAún no hay calificaciones

- The Case For Low-Cost Index Fund Investing - Thierry PollaDocumento19 páginasThe Case For Low-Cost Index Fund Investing - Thierry PollaThierry Polla100% (1)

- Citibank Performance Evaluation Case StudyDocumento2 páginasCitibank Performance Evaluation Case Studybonotz375% (4)

- Citibank Performance Evaluation 2Documento11 páginasCitibank Performance Evaluation 2Randy Marzeind100% (2)

- FX4Cash CorporatesDocumento4 páginasFX4Cash CorporatesAmeerHamsa0% (1)

- Answers To CtbankDocumento18 páginasAnswers To Ctbankmanjoi7440% (5)

- HR - Case Analysis - 360 Deg Morgan Stanley - Group 6 - Section CDocumento6 páginasHR - Case Analysis - 360 Deg Morgan Stanley - Group 6 - Section CSuruchi Kashyap100% (1)

- Somany CeramicsDocumento16 páginasSomany CeramicsAMIT SHARMA100% (1)

- Rob Parson at Morgan StanleyDocumento10 páginasRob Parson at Morgan StanleyFirra Astria Noezar100% (2)

- Microsoft Competing On TalentDocumento1 páginaMicrosoft Competing On TalentM Reihan F RAún no hay calificaciones

- Group10 B CitibankDocumento12 páginasGroup10 B CitibankParvathy RajanAún no hay calificaciones

- Eyes of Janus-Tata Motors: Group-14Documento9 páginasEyes of Janus-Tata Motors: Group-14Govind GuptaAún no hay calificaciones

- CITIBANK Performance EvaluationDocumento11 páginasCITIBANK Performance EvaluationdoraemonAún no hay calificaciones

- Marshall & Gordon: Designing An Effective Compensation System (A) ACC 675 Case AnalysisDocumento11 páginasMarshall & Gordon: Designing An Effective Compensation System (A) ACC 675 Case AnalysisiyylAún no hay calificaciones

- Microsoft Corporation On Talent (A)Documento4 páginasMicrosoft Corporation On Talent (A)Arun DevAún no hay calificaciones

- Microsoft Competing On TalentDocumento6 páginasMicrosoft Competing On TalentSalman ShahzadAún no hay calificaciones

- SG CowenDocumento21 páginasSG CowenShashank KapoorAún no hay calificaciones

- F9 Apex CorporationDocumento5 páginasF9 Apex CorporationSHIBA100% (4)

- Autobus Vs BautistaDocumento1 páginaAutobus Vs BautistaJoel G. AyonAún no hay calificaciones

- Maruti Industrial RelationsDocumento22 páginasMaruti Industrial RelationsTakshi BatraAún no hay calificaciones

- BPOLAND1Documento11 páginasBPOLAND1HEM BANSAL100% (1)

- GE's Two Decade TransformationDocumento14 páginasGE's Two Decade TransformationGanesh Muralidharan100% (2)

- Design and Implementation of Real Processing in Accounting Information SystemDocumento66 páginasDesign and Implementation of Real Processing in Accounting Information Systemenbassey100% (2)

- PD 198 Local Water DistrictDocumento16 páginasPD 198 Local Water DistrictPaul Pleños TolomiaAún no hay calificaciones

- SG COwen AnalysisDocumento18 páginasSG COwen AnalysisTauseefAhmadAún no hay calificaciones

- Answers To CtbankDocumento18 páginasAnswers To CtbankshubhamAún no hay calificaciones

- Wrapitup 140411065037 Phpapp01Documento22 páginasWrapitup 140411065037 Phpapp01Amit KumarAún no hay calificaciones

- Rob Parson at Morgan Stanley Case AnalysisDocumento3 páginasRob Parson at Morgan Stanley Case Analysisjones aldo jones100% (1)

- AP Moller Case Analysis SummaryDocumento3 páginasAP Moller Case Analysis SummarySyaiful Alam100% (2)

- Case Summary: AT&T, Retraining and The Workforce of TomorrowDocumento1 páginaCase Summary: AT&T, Retraining and The Workforce of TomorrowRishabhJainAún no hay calificaciones

- Citibank Performance EvaluationDocumento9 páginasCitibank Performance EvaluationArpita NagAún no hay calificaciones

- CitibankDocumento2 páginasCitibankNiks Srivastava100% (1)

- CitibankDocumento12 páginasCitibanksyuhayudaAún no hay calificaciones

- Birth of Delloite UniversityDocumento2 páginasBirth of Delloite UniversityUphar Mandal100% (1)

- Appex Corporation Case Report (Group No 8)Documento6 páginasAppex Corporation Case Report (Group No 8)VaishnaviRaviAún no hay calificaciones

- Group 1Documento7 páginasGroup 1Siva KalyanAún no hay calificaciones

- Case Analysis Sonoco Products CompanyDocumento18 páginasCase Analysis Sonoco Products Companyashianam0% (1)

- Arrow Electric Case SolutionDocumento6 páginasArrow Electric Case SolutionSaurav Gupta100% (1)

- Case Study 1Documento5 páginasCase Study 1Trang Pham50% (2)

- (Syndicate 8) Pio - Vitality Health EnterpriceDocumento8 páginas(Syndicate 8) Pio - Vitality Health EnterpriceZafar Nur HakimAún no hay calificaciones

- OB2 - AppexDocumento27 páginasOB2 - AppexajayballiaAún no hay calificaciones

- R&R CaseDocumento14 páginasR&R CaseSyed Mahmudul MuddassirAún no hay calificaciones

- A.P. Møller - Maersk GroupDocumento10 páginasA.P. Møller - Maersk Groupsujeet palAún no hay calificaciones

- Eileen FisherDocumento1 páginaEileen FisherNimrah ZubairyAún no hay calificaciones

- Case Study 1Documento3 páginasCase Study 1Kate Thurgood0% (1)

- Case Analysis: HP Consumer Products Business Organization: Distributing Printers Via The InternetDocumento6 páginasCase Analysis: HP Consumer Products Business Organization: Distributing Printers Via The Internetsunil sakriAún no hay calificaciones

- Deloitte and KPMG: War For TalentDocumento4 páginasDeloitte and KPMG: War For TalentVinod Mathews100% (4)

- HUL Shakti FinalDocumento31 páginasHUL Shakti FinalAshish Arya0% (1)

- AP Moller-Maersk Group04Documento7 páginasAP Moller-Maersk Group04Kirti PrabhuAún no hay calificaciones

- Thomas Green Power Office Politics and A Career in CrisisDocumento2 páginasThomas Green Power Office Politics and A Career in CrisisswapnilAún no hay calificaciones

- Ob and HRM Assignment 4 Name: Rabeea Umair ID: 19U00518 Section: BDocumento2 páginasOb and HRM Assignment 4 Name: Rabeea Umair ID: 19U00518 Section: BRabeea UmairAún no hay calificaciones

- Assignment 4Documento1 páginaAssignment 4AhmedAún no hay calificaciones

- Citi Bank CaseDocumento3 páginasCiti Bank Casedua khanAún no hay calificaciones

- Electrical Equipment IndustryDocumento3 páginasElectrical Equipment IndustryNamita ChaudharyAún no hay calificaciones

- Hyper InflationDocumento12 páginasHyper InflationNamita ChaudharyAún no hay calificaciones

- The GoalDocumento2 páginasThe GoalNamita ChaudharyAún no hay calificaciones

- The GoalDocumento2 páginasThe GoalNamita ChaudharyAún no hay calificaciones

- IDC IBM Honda Case Study May2017Documento6 páginasIDC IBM Honda Case Study May2017Wanya Kumar (Ms.)Aún no hay calificaciones

- Institute of Management Technology: Centre For Distance LearningDocumento1 páginaInstitute of Management Technology: Centre For Distance Learningmahendernayal007Aún no hay calificaciones

- Introduction To Operation ManagementDocumento78 páginasIntroduction To Operation ManagementNico Pascual IIIAún no hay calificaciones

- Okayyss Lang - SadDocumento28 páginasOkayyss Lang - SadEngelbert Lutao PalisAún no hay calificaciones

- Issue 7: October 1998Documento68 páginasIssue 7: October 1998Iin Mochamad SolihinAún no hay calificaciones

- Sales - Cases 2Documento106 páginasSales - Cases 2Anthea Louise RosinoAún no hay calificaciones

- Entry Modes AnalysisDocumento24 páginasEntry Modes AnalysisShona JainAún no hay calificaciones

- QuestionnaireDocumento5 páginasQuestionnaireDivya BajajAún no hay calificaciones

- HSC Economics Essay QuestionsDocumento5 páginasHSC Economics Essay QuestionsYatharth100% (1)

- DELMIA V5 Automation Platform - Merging Digital Manufacturing With AutomationDocumento20 páginasDELMIA V5 Automation Platform - Merging Digital Manufacturing With Automationomar_3dxAún no hay calificaciones

- Leadership Development at Hindustan Unilever Limited FinalDocumento10 páginasLeadership Development at Hindustan Unilever Limited FinaldurdenAún no hay calificaciones

- Meaning of MarketingDocumento7 páginasMeaning of MarketingkritikanemaAún no hay calificaciones

- Amount of Investment Bonus Method: Than Investment Greater Than InvestmentDocumento14 páginasAmount of Investment Bonus Method: Than Investment Greater Than InvestmentElla Mae Clavano NuicaAún no hay calificaciones

- CR 2015Documento13 páginasCR 2015Agr AcabdiaAún no hay calificaciones

- Ibs Bukit Pasir, BP 1 31/03/22Documento5 páginasIbs Bukit Pasir, BP 1 31/03/22Design ZeroAún no hay calificaciones

- Form Restoran Sederhana Masakan PadangDocumento30 páginasForm Restoran Sederhana Masakan PadangLuthfi's Mzakki'sAún no hay calificaciones

- Wordpress - The StoryDocumento3 páginasWordpress - The Storydinucami62Aún no hay calificaciones

- Products Services FCPO EnglishDocumento16 páginasProducts Services FCPO EnglishKhairul AdhaAún no hay calificaciones

- The Chits Funds ActDocumento40 páginasThe Chits Funds Actdesikudi9000Aún no hay calificaciones

- ISO 17025 PresentationDocumento48 páginasISO 17025 PresentationSanthosh Srinivasan100% (1)

- Shivani Singhal: Email: PH: 9718369255Documento4 páginasShivani Singhal: Email: PH: 9718369255ravigompaAún no hay calificaciones

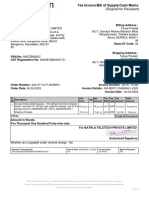

- InvoiceDocumento1 páginaInvoicetanya.prasadAún no hay calificaciones

- Midsemester Practice QuestionsDocumento6 páginasMidsemester Practice Questionsoshane126Aún no hay calificaciones