Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Luis Wolkowiez Acusado de Desvío de Fondos, Estafa y Lavado de Dinero

Cargado por

abc noticiasnews0 calificaciones0% encontró este documento útil (0 votos)

306 vistas45 páginasLuis Wolkowiez de nacionalidad venezolana ejecutó 61 plagios de identidad con fines de fraude financiero a banca privada Norteamericana y al Estado.

En 2014, fue detenido por desvío de fondos, estafa y lavado de dinero. Actualmente Wolkowiez lidera organización criminal conformada por "empresarios venezolanos que operan en Florida.

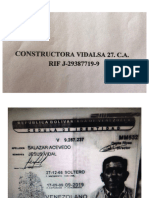

Título original

Luis Wolkowiez acusado de desvío de fondos, estafa y lavado de dinero

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoLuis Wolkowiez de nacionalidad venezolana ejecutó 61 plagios de identidad con fines de fraude financiero a banca privada Norteamericana y al Estado.

En 2014, fue detenido por desvío de fondos, estafa y lavado de dinero. Actualmente Wolkowiez lidera organización criminal conformada por "empresarios venezolanos que operan en Florida.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

306 vistas45 páginasLuis Wolkowiez Acusado de Desvío de Fondos, Estafa y Lavado de Dinero

Cargado por

abc noticiasnewsLuis Wolkowiez de nacionalidad venezolana ejecutó 61 plagios de identidad con fines de fraude financiero a banca privada Norteamericana y al Estado.

En 2014, fue detenido por desvío de fondos, estafa y lavado de dinero. Actualmente Wolkowiez lidera organización criminal conformada por "empresarios venezolanos que operan en Florida.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF o lea en línea desde Scribd

Está en la página 1de 45

IN THE CIRCUIT COURT OF THE ELEVENTH JUDICIAL CIRCUIT

TN AND FOR MIAMI-DADE COUNTY, FLORIDA

GENERAL JURISDICTION DIVISION

CASE NO.;

113-1208 3CA2 0

D ALL FACTORING DE VENEZUELA, C.A.,

&

y.

ATMOSPHERE FUND SPC LTD.; CP

CAPITAL SECURITIES, INVERSIONES

01590, C.A., AMICORP FUND SERVICES

N.V., PROFESIONALES DE BOLSA,

ARMANDO IACHINI, MARTIN LITWAK,

LUIS WOLKOWIEZ, JORGE REYES, and

RICARDO RIPEPI,

Defendants.

f

3

=

3

a

a

2

=

2

°

COMPLAINT

Plaintiff, All Factoring de Venezuela, C.A., hereby sues Defendants, Atmosphere Fund

SPC Ltd., CP Capital Securities, Inversiones 01590, C.A., Amicorp Fund Services N.V.,

Profesionales De Bolsa, Armando Iachini, Martin Litwak, Luis Wolkowiez, Jorge Reyes, and

Ricardo Ripepi and alleges as follows:

JURISDICTION, VENUE AND PARTIES

This is an action for damages in excess of $15,000, and thus falls within the

_

jurisdiction of this Court. Venue is proper in Miami-Dade County, Florida pursuant to Florida

Statutes § 47.011.

2, All Factoring de Venezuela, C.A., (“AE”) is a factoring company incorporated

under the laws of Venezuela and having its registered office at Av. Francisco de Miranda,

Edificio Parque Cristal, Piso 08, Oficina 8-8, Urb. Los Palos Grandes, Chacao, Venezuela 1060.

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

3. Atmosphere Fund SPC Ltd. (“Atmosphere Fund”) is a segregated portfolio

‘company incorporated under the laws of the British Virgin Islands and having its registered

office at Wattley Building, P.O. Box 3410, Road Town, British Virgin Islands. Atmosphere

Fund is subject to the personal jurisdiction of this Court pursuant to Florida Statutes

§ 48.193(1)(a) and § 48.193 (1)(b), respectively, because (a) it conducted and engaged in

business in the State of Florida through the entities and/or individuals listed below and (b) it

conspired with the entities and/or individuals listed below to commit tortious acts against AFV in

the State of Florida.

4. Armando Tachini (“lachini”), is an individual residing in Venezuela and who is

otherwise sui juris, Upon information and belief, Tachini is the ultimate beneficial owner and the

alter ego of Atmosphere Fund, Upon information and belief, lachini, personally and through

various agents, conspired with others to commit tortious acts against AFV in the State of Florida

and is subject to the personal jurisdiction of this Court pursuant to Florida Statutes

§ 48.193(1)(b).

5. Martin Litwak (“Litwak”), is an individual residing in Uruguay and who is

otherwise sui juris. Litwak is a Director of Atmosphere Fund and the alter ego of Atmosphere

Fund, Upon information and belief, Litwak, personally and through various agents, conspired

with others to commit tortious acts against AFV in the State of Florida and is subject to the

personal jurisdiction of this Court pursuant to Florida Statutes § 48.193(1)(b).

6. CP Capital Securities, Inc. (“CP Capital”), is a Florida financial services company

having its registered office and principal place of business at 1428 Brickell Avenue, Suite 600,

Miami, Florida 33131. CP Capital is the Broker and Custodian for Atmosphere Fund and

conducts business in the State of Florida. Further, upon information and belief, CP Capital

conspired with others to commit a tortious act against AFV in the State of Florida and is also

2

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

eae

subject to the personal jurisdiction of this Court pursuant to Florida Statutes § 48.193(1)(b).

7. Jorge Reyes (“Reyes”) is an individual residing in Miami-Dade County, Florida

and who is otherwise sui juris. Reyes is an employee of CP Capital and a principal agent for

Atmosphere Fund, As such, Reyes operates, conducts, engages in, and carries on a business or

business venture in the State of Florida and is thus subject to the personal jurisdiction of this

Court pursuant to Florida Statutes §§ 48.193(1) and (2). Further, upon information and belief,

Reyes conspired to and did directly commit tortious acts against AFV in the State of Florida and

is also subject to the personal jurisdiction of this Court pursuant to Florida Statutes

§ 48.193(1)(b).

8. __ Inversiones 01590, C.A. (“Inversiones”) is a company organized under the laws

of Venezuela and having its registered office at Urbanizacion Parque Humboldt, Calle Velutini

con Avenida Rio Manapire, Edificio Palmira, Planta Baja, apartamento P-B-2, Prados del Este,

Municipio Baruta, Estado Bolivariano de Miranda. The sole shareholder, ultimate beneficial

‘owner, and alter-ego of Inversiones is Luis Wolkowiez who resides in Miami, Florida. Upon

information and belief, Inversiones operates, conducts, engages in, and carries on a business or

business venture in the State of Florida and is thus subject to the personal jurisdiction of this

Court pursuant to Florida Statutes §§ 48.193(1) and (2). Further, upon information and belief,

Inversiones conspired to and did commit a tortious act against AFV in the State of Florida and is

thus subject to the personal jurisdiction of this Court pursuant to Florida Statutes § 48.193(1)(b).

9, Luis Wolkowiez (“Wolkowie7”) is an individual residing in Miami-Dade County

‘and who is otherwise sui juris. Wolkowiez is the sole shareholder and/or ultimate beneficial

owner of Inversiones. As such, Wolkowiez operates, conducts, engages in, and carties on

business or business venture in the State of Florida and is thus subject to the personal jurisdiction

of this Court pursuant to Florida Statutes § 48.193(1)(a). Further, Wolkowiez, personally and

3

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

through various agents, conspired to and did directly commit a tortious act against AFV in the

State of Florida and is thus subject to personal jurisdiction pursuant to Florida Statutes §

48.193(1)(b).

10. Amicorp Fund Services N.V. (“Amicorp”), is a financial services company

incorporated under the laws of Curacao and having its registered office and principal place of

business at Pareraweg 45, P.O. Box 4914, Curacao, Netherland Antilles. Amicorp is the

‘Administrator for Atmosphere Fund and is a world-wide organization that also conducts business

in the State of Florida through its affiliate Amicorp Services Ltd, located at 1001 Brickell Bay

Drive, Suite 2306, Miami, Florida 33131. Further, upon information and belief, Amicorp

conspired with others to commit tortious acts against AFV in the State of Florida and is thus

subject to the personal jurisdiction of this Court pursuant to Florida Statutes § 48.193(1)().

11. Profesionales de Bolsa (“Profesionales”), is a financial services company

incorporated under the laws of Colombia and having a registered office at Calle 938 No.12-18,

Edificio Profesionales de Bolsa $.A., Piso 2, 4, y 5, Bogota, Colombia. Upon information and

belief, Profesionales conspired with others to commit tortious acts against AFV in the State of

Florida and is thus subject to the personal jurisdiction of this Court pursuant to Florida Statutes

§ 48.193(1}(b).

12, Ricardo Ripepi (“Ripepi”), is an individual residing in Colombia and who is

otherwise sui juris. Upon information and belief, Ripepi (as an employee of Profesionales de

Bolsa) conspired with others to commit tortious acts against AFV in the State of Florida and is

thus subject to the personal jurisdiction of this Court pursuant to Florida Statutes § 48.193(1)(b).

GENERAL ALLEGATIO!

A. Ripepi Introduces AFV to Atmosphere Fund

13. On or about November 23, 2012, Ripepi, a broker at Profesionales de Bolsa,

4

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

contacted representatives AFV regarding a short term loan investment operation administered by

‘Amicorp in Curacao, By the time AFV responded to Ripepi regarding the investment transaction

the deal was already closed and AFV could not participate.

14, Approximately one week later, Ripepi contacted AFV representatives again

regarding another short term investment transaction. This time, Ripepi informed representatives

at AFV that another investment transaction was being proposed by Mr. Santiago Goiri (“Giri”),

a sales officer at Amicorp in Curacao and that the transaction involved entering into a short term

Joan agreement with Atmosphere Fund, whereby Atmosphere Fund would borrow a

predetermined sum of money from AFV on a short term basis. Ripepi also indicated to AFV that

Atmosphere Fund was administered by Ami

rp’s offices in Curacao and that the deal had been

presented to him by an employee who worked at Amicorp Curacao (i.e., Goiri)

15. Prior to speaking with representatives at AFV, Ripepi had exchanged numerous

communications with Goiri regarding the Atmosphere Fund and the logistics for making a deal.

During these communications, Goiri informed to Ripepi that Atmosphere Fund was represented

by Reyes, a broker working at CP Capital located in Miami, Florida. Goiri also provided Ripepi

with the contact information for Reyes so that he could negotiate directly with Reyes on the

terms of a potential financing transaction between All Factoring and Atmosphere Fund,

16. Prior to Ripepi’s conversation with Goiri regarding Atmosphere Fund, Ripepi had

never met, heard of, or spoken to Reyes. Similarly, Ripepi had no prior knowledge of

‘Atmosphere Fund. Following Ripepi’s conversation with Goiri, Ripepi asked the compliance

department at Profesionales de Bolsa to conduct a background check on both Reyes and

‘Atmosphere Fund. Ripepi also performed his own online background search as well. These

searches did not tum up any negative information or history on either Reyes or Atmosphere

Fund.

s

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

17. Onor around November 29, 2012, Ripepi contacted Reyes directly to gather more

details regarding the transaction, including how the financing deal would be structured and

documented. Reyes informed Ripepi over the phone that he represented Atmosphere Fund and

that Atmosphere Fund would be responsible for preparing the documents necessary to effectuate

the transaction with All Factoring.

18. Following this conversation, Reyes sent Ripepi an email at Profesionales de Bolsa

\with a zip file containing templates pertaining to the agreements that would be used as the basis

for documenting the deal between All Factoring and the Fund. This zip file included the

following templates in PDF format: a short term loan agreement, a promissory note, a leter of

instruction for repayment, a promissory note assignment, a settlement letter, and a letter of

repayment in case of default. All these documents contained the letterhead of Atmosphere Asset

‘Management (the investment manager for Atmosphere Fund) and were designed to be filled and

printed online,

19. In addition to these template agreements, Reyes also provided Ripepi with a legal

opinion prepared by Valmy Diaz (“Diaz”), a lawyer working at a reputable law firm in Caracas,

Venezuela called Torres, Plaz, y Araujo (“IPA”). The purpose of the legal opinion was to

provide comfort with respect to the legality and risks associated with an international transaction

such as the one being contemplated by AFV and Atmosphere Fund under Venezuelan law.

Notably, Reyes informed Ripepi that Diaz at TPA would be responsible for drafting the deal

documents based on the templates previously provided,

B. _AFV and Atmosphere Fund Exchange Documents through Reyes and Ripepi.

20. After Ripepi reviewed the materials received from Reyes, he then forwarded the

template agreements and TPA’s legal opinion to AFV for their own intemal review. Ripepi then

began communicating on a regular basis with Francisco Martinez (“Martinez”), a commercial

6

"ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

agent for AFV, in order to complete the financing transaction with Atmosphere Fund.

21. Over the course of numerous communications, Ripepi forwarded to Martinez by

email a “Know Your Customer” checklist form on Atmosphere Fund’s letterhead to gather and

confirm All Factoring’s corporate information. In return, AFV (through Martinez) requested and

was provided with documents regarding Atmosphere Fund, including, a certificate of

incorporation, the articles of incorporation, a private placement memorandum, and a copy of

Litwak’s passport. All of the materials provided to AFV with respect to Atmosphere Fund

except for Litwak's passport, were originally provided by Reyes to Ripepi. Litwak’s passport

‘was provided by Goiri to Ripepi who then forwarded it to AFV.

22. With this information in hand, Martinez proceeded to conduct due diligence on

Atmosphere Fund on behalf of AFV. In this regard, AFV was able to locate Atmosphere Fund's

website which indicated that the Fund’s directors are Litwak and LG Managers Ltd. The website

‘also confirms that Atmosphere Fund's Administrator is Amicorp, a worldwide financial services

company that offers fund administration services. AFV also checked the website for Litwak’s

law firm in Uruguay (Litwak & Partners) and found many references to his involvement with

investment funds such as Atmosphere Fund.

23. AFV also studied the legal opinion issued by TPA with respect to the structure

and documentation to be used for the deal between APV and the Fund. This document was

addressed to Claudio Cecchini, Eric Chang, and Jorge Reyes and was signed by Valmy Diaz and

Rodolfo Plaz of TPA. Rodolfo Plaz is the President of TPA

24. During Martinez’s conversations with Ripepi regarding the terms of the

transaction, Ripepi confirmed that Reyes was the representative of the Fund who was brokering

this transaction and that Santiago Goiri had access to the Fund’s accounts and could verify all

transactions entered into with the Fund. Ripepi also stated that all documents pertaining to the

7

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

transaction would be drawn up by Diaz at TPA. Ripepi also verbally indicated to AFV that this

deal would be completed in a span of 10 business days once the loan proceeds were transferred

and confirmed by the Fund. In other words, the money lent by AFV to Atmosphere would be

repaid within 10 days business days.

25, Atal times material hereto, AF, in assessing whether to enter into a short term

Joan transaction with Atmosphere Fund, reasonably relied upon information provided to its

representatives by Ripepi (through Reyes and Goiri as agents for Atmosphere Fund and

‘Amicorp, respectively). AFV"s reliance on this information was reasonable in light of the

following facts:

a. __ AFV's own independent research confirmed the fact that Litwak was the

Director of Atmosphere Fund and that Amicorp was the Administrator for

the Fund.

b. FV was provided with documentation, including, template agreements

on Atmosphere Fund letter head, corporate formation documents, and a

copy of Litwak’s passport

¢. _ AFV was asked to provide Atmosphere Fund with information regarding

its own company, such as a “Know Your. Customer” checklist and other

financial information, indicating that this transaction was being conducted

in the ordinary course of business.

c AFV and Atmosphere Fund Enter Into Loan Transaction for Bs 234.6 Million.

26. On or about December 4, 2012, AFV started making arrangements on its end to

enter into the aforementioned short term loan transaction with Atmosphere Fund in the amount

of BsF 151 million. As such, on December 5, 2012, Martinez contacted Valmy Diaz at TPA to

inform him that AFV needed the final loan documents before it could make a disbursement to

8

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A,

‘Atmosphere Fund. During this conversation, Diaz. confirmed to Martinez that he was working

on the loan documents on behalf of Atmosphere Fund and assured him the documents would be

transmitted to AFV in short order.

27. On or about December 6, 2012, Ripepi received a fax at Profesionales de Bolsa

from Reyes containing a final draft of the first short term loan agreement (the “First Short Term

Loan Agreement”) which was signed and executed by Litwak and reviewed by Diaz and Iachini.

The First Short Term Loan Agreement provided that AFV would agree to lend and Atmosphere

Fund would agree to borrow a total of BsF 151 million payable in Bolivars or in a different

currency, at the discretion of Borrower, within thirty (30) days of the date of the agreement. The

agreement also provided that AFV was to deposit the BsF 151 million in an account at Banco

Banesco (Acct. No, = held in the name of Inversiones 01590, C.A.

Ripepi forwarded the First Short Term Loan Agreement to AFV for its review and signature

using his email account at Profesionales de Bolsa.

28. Acco!

g to two recent letters from Valmy Diaz to counsel for AFV, the First

Short Term Loan Agreement was originally provided to him by Mr. Reyes via email According

{0 Diaz, “Mr, Armando Tachini of Atmosphere Fund SPC” was also copied on the email. AFV is

also in possession of two emails dated December 6, 2012 from Reyes to Ripepi, Diaz, and

Iachini (copying Litwak) in which Reyes attaches final drafts of the Short Term Loan

‘Agreement, a promissory note, both of which were purportedly “reviewed by” Valmy Diaz

Thus, Ripepi, Reyes, Diaz, lachini, and Litwak all had firsthand knowledge of the contemplated

Joan transaction and the fact that AFV was being asked by Atmosphere Fund to deposit the entire

Joan balance into an account held in the name of Inversiones.

29. Omor about December 6, 2012, Ripepi received another fax at Profesionales de

Bolsa from Reyes containing an instruction letter signed by Litwak (the

9

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

Letter”). This letter directed AFV to deposit the BsF 151 million borrowed by Atmosphere Fund

in an account at Banco Banesco (Acct. No, EES) held in the name of

Inversiones 01590, CA. The letter also requested that AFV deposit an additional BsF 56.24

million in light of the fact that the parties had mutually agreed to increase the Total Loan

‘Amount. Ripepi forwarded the First Instruction Letter directly to AFV (through Martinez).

30. Upon receipt of the Fitst Instruction Letter, AFV forwarded to Ripepi an executed

copy of the First Short Term Loan Agreement. Ripepi then confirmed to AFV that the Total

Loan Amount would still be repaid by Atmosphere Fund in ten (10) days after the transfer of the

loan proceeds was verified and confirmed despite the fact that the Short Term Loan Agreements

provided for repayment within thirty (30) days. Based on this confirmation, AFV began

transferring funds to Inversiones’ bank account shortly thereafter.

31. On or around December 6, 2012, Martinez inquired with Ripepi as to whether the

Total Loan Amount could be increased by an additional BsF 27.36 million. Ripepi spoke to

Reyes regarding this request and obtained confirmation from him that the loan transaction could

be modified to include these additional funds. Shortly thereafter, Ripepi forwarded to Martinez a

second letter of instruction directing AFV to deposit the additional BsF 27.36 at Inversiones’

bank account (the “Second Instruction Letter”). ‘The Second Instruction Letter was also signed

by Litwak.

32. Based on the two subsequent increases to the Total Loan Amount agreed to by

'AFV and Atmosphere Fund, the aggregate amount borrowed by Atmosphere Fund was

BsF 234.6 million (the “Total Loan Amount”), These loans were documented in two separate

short term loan agreements: (a) the First Short Term Loan Agreement dated December 6, 2012

in the amount of BsF 151.0 million attached hereto as Exhibit A and (b) the Second Short Term

Loan Agreement dated December 7, 2012 between APV and Atmosphere Fund in the amount of

10

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

Bs 83.6 million attached hereto as Exhibit B (collectively, the “Short Term Loan Agreements”).

33. On or around December 6, 2012, Ripepi received two separate emails from Reyes

(copying Diaz, lachini, and Litwak) attaching copies of the Short Term Loan Agreements and

confirming the transaction between Atmosphere Fund and AFV for USD $15.5 million. As

previously stated, these emails also included Diaz and Iachini (as direct recipients) with copies

to Litwak. ‘These emails make clear the fact that Ripepi, Reyes, Diaz, lachini, and Litwak all had

direct knowledge that AFV was being asked by Atmosphere Fund to deposit the Total Loan

‘Amount into an account held in the name of Inversiones.

34. On or about December 10, 2012, Martinez, Ripepi, and Mr. Armando Hortua (an

officer at Profesionales de Bolsa) met in person at the offices of Profesionales de Bolsa in

Bogota to review all of the documents related to this deal and to confirm that everything was

executed as previously agreed. At this meeting, Ripepi confirmed that all of the funds except

two transfers totaling BsF 104,000 had been received. These two transfers were later confirmed

that same afternoon.

35. On or about December 10, 2012, AFV sent Ripepi via email an instruction letter

from AFV addressed to Atmosphere Fund with wire transfer information for the repayment of

Total Loan Amount owed to AFV pursuant to the Short Term Loan Agreements. Ripepi

forwarded this letter to Reyes via email.

36, On December 11, 2012, Ripepi sent Martinez by email a copy of the fully

executed Short Term Loan Agreements originally sent by Reyes and a copy of a letter from

‘Atmosphere Fund to JP Morgan Asset Management instructing JP Morgan to wire transfer USD.

$15.5 mil

sn to an account previously designated by All Factoring in repayment of the Total

Loan Amount, ‘This wire transfer instruction was originally sent by Reyes to Ripepi’s fax at

Profesionales de Bolsa and was signed by Litwak, Director of Atmosphere Fund.

u

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

eee

37. On December 12, 2012, Ripepi forwarded to Martinez by email a written

confirmation that USD $15.5 million had been transferred to AFV (the ‘Transfer

C. This written confirmation was also

Repayment Confirmation”) attached hereto as Exhi

originally sent by Reyes to Ripepi's fax at Profesionales de Bolsa

38, On December 13, 2012, Martinez informed Ripepi that the funds had not been

received, At this point, Ripepi instructed Martinez to speak to Reyes direetly and proceeded to

coordinate a meeting between Martinez and Reyes at the offices of CP Capital (Atmosphere

Fund’s Custodian and Broker) located at 1428 Brickell Avenue, Suite 600, Miami, Florida

33131.

D. Atmosphere Fund Informs AFV That It Cannot Perform Under the Short Term Loan

‘Agreements and AFV Cancels the Loan Transaction.

39, On the moming of December 14, 2012, Martinez met with Reyes in his office at

CP Capital to discuss the status of the funds Atmosphere Fund has presumably wire transferred

to AFV two days prior to the meeting. Reyes started the meeting by establishing his credentials

during which time he provided Martinez with his business card indicating that he worked for CP

Capital and that his position was Managing Director for Latin American Markets. Reyes also

wrote down his personal email and cell number on the business card provided to Martinez,

During the meeting, Reyes informed Martinez thet Atmosphere Funds had substantial funds

‘under management, that they were a serious organization, and that they had done these deals

‘many times before. At this meeting, Reyes held himself out to be an employee of CP Capital and

an agent for Atmosphere Fund. These representations further confirmed AFV's understanding of

the agency relationship between Reyes and Atmosphere Fund.

40. Reyes then showed Martinez a set of the original Short Term Loan Agreements

signed by Litwak and a repayment schedule that extended to January 30, 2013 Martinez

2

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

eee

informed Reyes that AFV was never given a copy of this repayment schedule and that the

repayment schedule was not consistent with Ripepi’s oral representation that repayment would

bbe made in ten (10) days of receipt of the Total Loan Amount. Significantly, Reyes statement

was also at odds with the thirty (30) day repayment deadline set forth in the Short Term Loan

Agreements and undermined the validity of the Wire Transfer Repayment Confirmation

provided to AFV by Reyes (through Ripepi).

41. Accordingly, Martinez informed Reyes that the Total Loan Amount borrowed by

‘Atmosphere Fund was already due. Reyes responded by saying that it was impossible to deliver

the funds prior to the dates set forth in the repayment schedule and suggested that the funds

‘would start being transferred to AFV during the last week of December 2012 at a rate of BsF 45

million per week, Martinez informed Reyes that he would have to consult with AFV on the

proposed timetable before he could to agree to terms that were materially different from the

previous agreements.

42, In the afternoon of December 14, 2012, Martinez. sent Reyes a letter indicating

that AFV did not agree with Atmosphere’s modified repayment terms and that AFV was

cancelling the transaction and requesting that all the funds be retumed immediately

(the “Cancellation Letter”). Reyes acknowledged cancellation of the transaction and sent

Martinez an email specifying how the Cancellation Letter should be worded. Importantly,

Reyes" email stated that the Cancellation Letter should specify the following two points: (a) that

'AFV’s funds were deposited in the account of Inversiones which is the “custodian account” for

[Atmosphere Fund and (b) that the transaction between AFV and Atmosphere Fund would be

terminated following the return of the loan proceeds to AFV. Ultimately, Reyes signed the

Cancellation Letter. As such, Reyes continued to act as Atmosphere’s agent with respect to the

cancellation of the transaction and acknowledged that AFV had deposited funds with

B

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

CC ———E—_=_

Inversiones’ bank account pursuant to the terms of the Short Term Loan Agreements. AFV and

its representatives reasonably relied upon these representations by Reyes.

43. Subsequently thereafter, Reyes and Martinez met again at the offices of CP

Capital where Reyes received, signed, and acknowledged on behalf of Atmosphere Fund the

Cancellation Letter addressed to the Fund, Litwak, and Reyes formally requesting the return of

the funds to AFV. See Exhibit D. Reyes kept a copy of the letter and informed Martinez that he

would forward it to Litwak immediately. Reyes also represented to Martinez that AFV would

receive BsF 151 million by December 17, 2012 and that the remaining balance would be

returned by December 21, 2012. AFV and its representatives reasonably relied upon these false

representations.

44, After the meeting with Reyes, Martinez. informed Ripepi that the deal had been

cancelled and that AFV was asking for the immediate return of the money. Martinez. provided

Ripepi with a copy of the letter and asked him to inform Goiri at Amicorp of this development

E. Atmosphere Fund Fails to Return Loan Proceeds to AFV as Promised by its Agents.

45, On December 17, 2012, after numerous failed attempts, Martinez finally was able

to reach Reyes to confirm the transfer of the BsF 151 million previously agreed to by the parties

Reyes confirmed to Martinez that Atmosphere Fund was getting ready to transfer BsF 151

million back to AFV. Despite this representation, however, no transfer was completed and

Reyes ultimately informed Martinez that the transfer could not be made that day because the

person who could authorize the transfer was out of the office that day.

46, On the same day, Martinez conferred with Ripepi several times to express

concems over Atmosphere Fund’s failure to return any funds as promised. Ripepi informed

‘Martinez that he had spoken with Goiri at Amicorp who has had assured him that the deal was

legitimate and the funds would be returned, Similarly, Ripepi also spoke with Reyes who

4

[ASTIGARRA DAVIS MULLINS & GROSSMAN, PLA.

reassured him that the money would be repaid to AFV.

47, On December 18, 2012, Martinez again called Reyes to inquire about the status of

funds, This time, Reyes informed Martinez. that Atmosphere Fund was again attempting to make

the transfer to AFV but that the bank was requiring that the person in charge of the account be

physically present at the bank due to the large sum being transferred. Martinez called the bank

directly and was able to confirm that there was no such requirement. Subsequently thereafter,

Reyes asked Martinez to amend the Cancellation Letter so that the money could be returned to a

bank account in the same bank (Banco Baneseo). AFV complied with this request and sent

Reyes an amended Cancellation Letter requesting that the funds be retumed to an account in

Banco Banesco controlled by AFV.

48, In view of this failure, Martinez then traveled to Miami on December 18, 2012 to

meet with Mr. Miteh McInnis (“McInnis”) the CEO of CP Capital. Martinez showed Melnnis

the Cancellation Letter and relayed to him the fact that Reyes had promised to return a certain

amount of money by that day and that AFV had not yet received any funds. Melnnis called

Reyes at his cell phone and asked him to inform Martinez when the funds would be retuned to

AFV, During this call, Reyes represented to Martinez that all the funds owed to AFV would be

retuned by 1:00 pm. on Friday, December 21, 2012, Melnnis offered Martinez to keep track of

Reyes’ assurances and to help in any way he could. AFV detrimentally relied upon these

representations made by Melnnis, on behalf of CP Capital and as Reyes's supervisor.

49. Later that day, Reyes called Martinez.to inform him that some of the funds would

be transferred that afternoon and to get in touch with Mr. Luis Wolkowiez who managed the

account of Inversiones at Banco Banesco. Martinez. called Wolkowiez and was able to confirm

that two transfers would be made by Inversiones to APV that day: one transfer for BsF

22,606,000 and another for BSF 5,000,000. Following the transfers, Martinez called Wolkowiez

18

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A,

es

to confirm the receipt of the funds and suggested that they both meet the next day in his office in

Miami.

50. For this part, Ripepi also claims that he called Iachini on December 18, 2012 to

determine whether he was aware of what had transpired and what Atmosphere Fund was doing

to correct the situation. Ripepi was provided with Iachini’s contact information by Goiri at

‘Amicorp. During the call, lachini confirmed the existence of the transaction and assured Ripe

that he should remain calm because everything would work itself out. acl also stated that

Reyes was the one responsible for the deal, that he was aware of the fact that the deal had been

cancelled by AFV, and that the loan proceeds would be returned to AFV. Specifically, Tachini

acknowledged to Ripepi the existence of AFV’s Cancellation Letter formally requesting the

return of the funds and the cancellation of the transaction.

51. Onor around the same date, Ripepi claims to have received a message from Goiri

indicating that Reyes was getting upset with respect to his involvement and that Reyes wanted

both Goiri and Ripepi to discontinue their involvement in the deal so that he could work directly

with APV in securing the return of the funds. These communications and representations made

on behalf of Atmosphere Fund were ultimately transmitted to Martinez as AFV's representative

F.__ AEVIs Introduced to Luis Wolkowiez the Principal for Inversiones and SLB

‘Investments and Armando Iachini the Principal for Atmosphere Fund.

52, On December 19, 2012, at 9:30 am, Martinez met with Wolkowiez at his office

located at 8384 NW 68 Street, Miami, Florida 33166 from where he operates a company called

S.LB. Investments LLC (“SLB”) and manages Inversiones’ banking operations, Wolkowiez

represented to Martinez that he controlled the account of Inversiones at Banco Banesco, but that

Inversiones had no direct relationship with Atmosphere Fund. This was the first time AFV was

informed that there was allegedly no relationship between Atmosphere Fund and Inversiones.

16

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

eee

53. Martinez described to Wolkowiez the facts surrounding AFV’s deal with

‘Atmosphere Fund, specifically, AFV's deposit of BsF 234.6 to Inversiones and Atmosphere

Fund’s promise to repay AFV either in Bolivares or in US dollars within 10 days. Wolkowiez

stated that both Inversiones and SLB managed transactions involving US dollars and Venezuelan

Bolivares. Specifically, Wolkowiez stated that Inversiones’ bank account was designated as an

account used to receive and transfer Venezuelan Bolivares and that SLB’s bank account held

with a JPMorgan banking entity was designated as an account used to receive and transfer US

dollars.

54. Wolkowiez also stated that SLB’s account was currently receiving US dollars

from Venezuela on Wednesdays of certain weeks and, that these US dollars were then

transferred out on Friday the same week, With respect to Wolkowiez’s relationship with Reyes,

Wolkowiez further stated that the two had an agreement whereby Wolkowiez could supply up to

USD $4 million per week from SLB’s account at a U.S. Bank in transactions not to exceed USD

$1 million each, Mr. Wolkowiez’s also stated that he expected to receive an aggregate total of

USD $100 million from Venezuela over a 25-week period. Thus, if AFV had not cancelled its

deal with Atmosphere Fund (which was brokered through Reyes), it would have taken at least 4

weeks for AFV to receive back all of its funds in exchange for its BsF 234.6 loan (as opposed to

10 business days as originally promised).

55. Wolkowiez also stated that he personally knew Iachini and that lachini had asked

for his cooperation in retuming the funds to AFV.. In the presence of Martinez, Wolkowier. then

called lachini and put him on speaker so that all three men could discuss the situation, Tachini

stated that he was the owner of Atmosphere Fund and that Litwak was a Director of the Fund.

Tachini also stated that he was aware of the transaction between Atmosphere Fund and AFV, but

that he had not authorized Litwak to sign any of the Short Term Loan Agreements, therefore, in

”

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

his opinion no agreements had been validly signed by Atmosphere Fund. Martinez then

informed him that AFV had a set of executed documents which had been sent to him on behalf of

‘Atmosphere Fund. Iachini asked Martinez to provide him with a copy of the executed loan

agreement which Martinez did on the spot by sending them using Wolkowiez’s email. lachini

ended the conversation by assuring Martinez that all of AFV's monies would be promptly

retuned,

G. _ Wolkowiez Informs AFV of Reyes’s Conspiracy to Defraud AFV By Claiming a

Portion of AFV’s Funds.

56. After the conference call with Iachini, Wolkowiez informed Martinez that

Inversiones had only been recently notified by Reyes regarding ownership of the funds deposited

by AFV, Specifically, Wolkowiez stated that Reyes at first claimed that the BsF 234.6 million

belonged to him and that Reyes then revised his statement by indicating that BsF 177.0 million

betonged to AFV and that the rest belonged to him. Wolkowiez told Martinez that the difference

between BsF 234.6 million and BsF 177 million (ic., 57.6 million) has been paid to Inversiones

by Reyes as cancellation of a separate and unrelated outstanding debt.

57. Martinez then showed Wolkowiez the Cancellation Letter requesting the return of

the funds which had been acknowledged, accepted, and signed by Reyes on behalf of

‘Atmosphere Fund as well as all the documents supporting the transaction for BsF 234.6 million.

Wolkowiez then proceeded to make two transfers to AFV in the amount of BsF 21,000,000 and

BsF 55,994,000; thus, returning a portion of the Total Loan Amount. Following, these two

transfers, the aggregate amount repaid to AFV by Wolkowiez totaled BsF 104,610,000.

Wolkowiez also informed Martinez that the next day he would transfer an additional Bs 30

million, however, this transfer was never completed and the rest of the funds have yet to be

received.

18

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

Se eee eee ee

58, After the meeting with Wolkowiez, Martinez. notified Reyes that AFV expected

full repayment ofthe Total Amount as promised by Reyes by December 21, 2012, Martinez also

proposed that the two meet at his office at CP Capital on December 20, 2012 at 10:00 am.

59, On December 20, 2012, at 9:30 a.m., Martinez met with McInnis at the offices of

CP Capital and notified him that AFV had some very serious concerns about the transaction

pecause Reyes was not fulfilling promises made on behalf of Atmosphere Fund and because his

statements were riddled with inconsistencies.

60, When Reyes finally arrived at the meeting, McInnis asked him (in the presence of

Martinez) why AFV's money had not been returned as previously discussed. In response, Reyes

unilaterally began asserting allegations that the Short Term Loan Agreements were fraudulent

and that a judicial investigation had to be opened, therefore, all remaining payments to AFV

were being stopped. Given Reyes’ inability to substantiate these unfounded allegations and

sensing that Reyes was merely attempting to buy Atmosphere Fund more time, Martinez

informed Reyes that the remaining balance owed by Atmosphere Fund had to be returned by

December 21, 2012 as originally promised by Reyes, otherwise Atmosphere Fund would be in

default.

H. Reyes’ Web of Lies Expands.

61. After the meeting at CP Capital ended, Wolkowiez spoke to Martinez and asked

him to participate in a meeting with Reyes and himself at the Miami offices of SLB and

Inversiones. During this meeting, Wolkowiez. informed Martinez that Reyes had asked him to

aspend all farther payments because there was a purported fraud occurring, It was suggested

thatthe parties meet with Amicorp, the Fund’s Administrator, to determine the proper course of

action. Martinez agreed to such meeting, on behalf of AFV, wl ich took place at 2:30 p.m. at the

offices of Amicorp located at 1001 Brickell Bay Drive, Suite 2306, Miami, Florida 33131. The

19

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

eee

meeting was attended by Martinez, Reyes, and Mr. Femando Cancino (“Cancino”) of Amicorp.

62. During this meeting, Cancino asked Reyes to explain the situation concerning the

Joan transaction between AFV and Atmosphere Fund. Cancino notified Reyes in the presence of

Martinez that the money should be refunded to AFV immediately and that any allegations of

fraud had to be taken up between Atmosphere Fund and Amicorp. In fact, Cancino went so far

as to mention that AFV had no appropriate role in that investigation.

63. Reyes then responded by stating that the money could not be retumed

immediately because the deal had gone through and now AFV had to wait until all the monies

came in, Noting the inconsistency between this statement and Reyes's previous fraud

allegations, Cancino indicated that it was not possible that the deal had gone through because

Reyes had just alleged that Atmosphere Fund did not have a set of validly executed documents

and because the Fund had agreed to return the funds to AFV (a process which had already

commenced as evidenced by the disbursements to AFV from Inversiones).

64. After this meeting, Cancino asked Martinez to meet him outside of the conference

room where he informed him (in his capacity as an agent for Amicorp, the Fund’s administrator)

that this problem had nothing to do with AFV and that in his opinion Atmosphere Fund should

return the funds immediately. AFV detrimentally relied upon these representations made by

Cancino, on behalf of Amicorp, the agent and administrator for Atmosphere Fund.

1. Reyes and Wotkowiez Continue to Conspire to Defraud Against AFV by Virtue of

Their Material Misrepresentations and Unfulfilled Promises.

65. After the meeting at Amicorp, Martinez drove to Wolkowiez’s office to determine

whether any further payments would be forthcoming from Inversiones. Wolkowiez informed

Martinez that he was aware of the outcome of the meeting with Cancino and that Reyes had to

make up a balance of approximately BsF 60 million before the rest of the funds could be

20

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

itt

retuned to AFV.

66. Wolkowiez then called Reyes in the presence of Martinez to ask him when he

would be able to return the rest of the funds. While on speaker phone, Reyes represented to

Martinez that AEV would receive BsF 76 million the next day (i.e., December 21, 2012) and an

additional BsF 20 million before December 31, 2012. Reyes also informed Martinez that the

balance would be paid before January 15, 2013 and that a settlement agreement between the

Fund, AFV, and some undisclosed investors was being drawn up and would have to be signed.

Reyes further indicated to Martinez that Atmosphere Fund’s lawyers would prepare this

settlement agreement and that it would be ready for AFV’s signature by December 25, 2012.

'AFV and its representatives reasonably relied upon these representations by Reyes on behalf of

Atmosphere Fund

67. Wolkowiez, for his part, also represented 10 Martinez that his lawyer would

prepare a settlement agreement to be signed between Inversiones and AFV and that this

agreement would include a personal guarantee from Reyes confirming that all funds would be

returned by January 15, 2013. Wolkowiez informed Martinez that the agreement being drafted

by his attomey would be ready for signing on Friday, December 21, 2013. Ultimately,

Wolkowiez represented to Martinez that Inversiones would cover all of the amounts agreed to by

Reyes on the dates previously established which is why he was having his own lawyer prepare a

separate settlement agreement. AFV and its representatives reasonably relied upon these

representations by Wolkowiez on behalf of Inversiones and SLB.

68. On December 21, 2012, the day AFV was promised to receive BsF 76 million,

Martinez communicated with Wolkowiez on numerous occasions regarding the status of the wire

transfer and the proposed settlement agreement. Initially, Wolkowiez. informed Martinez that

there was no reason to worry about the scheduled transfer and settlement agreement was in the

a

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

process of being drafted. However, after the last call between Martinez and Wolkowiez.at 3:00

pam, that day, Wolkowiez stopped answering his phone and did not respond to any messages by

text, Blackberry Messenger, or by email. Despite his previous representations to Martinez,

Wolkowiez never circulated a draft settlement to AFV for its review.

69. At approximately 5:25 pm. on December 21, 2012, Martinez called Reyes

regarding the status of the transfer to AFV. Reyes indicated to Martinez that he had made a

deposit of Bs 20 million to Inversiones’ bank account (despite the previous promise to transfer

Bs 76 million) and that the settlement agreement between AFV and the Fund would be ready for

review on December 25, 2013. Despite this representation by Reyes, AFV did not receive any

funds on December 21, 2012 as originally promised by Atmosphere Fund and was beginning to

realize that the unfulfilled promises made by its agents were becoming a trend.

70. On December 22, 2013, Martinez made several attempts to contact Wolkowiez to

no avail, Martinez also called Reyes to inquire about the settlement agreement and he said that it

would be ready on December 25, 2012. Reyes did not have an explanation for why the funds

‘were not transmitted to AFV as promised.

71. On December 26, 2012, Martinez met with Wolkowiez at his office in Miami and

was informed that Reyes had not made up the difference owed to Inversiones, therefore,

Inversiones could not return any additional monies to AFV. Later that afiernoon Martinez met

with Reyes who this assured him that all monies would be returned by January 15, 2013 at the

latest, Martinez also inquired about the status of the settlement document that was being drafted

by lawyers for Atmosphere Fund, however, Reyes was unable to provide any concrete answers.

72, On December 27, 2012, Martinez met with Reyes and Wolkowiez at the offices of

SLB and Inversiones to establish concrete timetable for the return of the money to AFV. After a

heated exchange, Reyes claimed that it was Wolkowiez who actually had the money and that it

2

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

was exclusively up to him to return it, After Reyes left the meeting, Wolkowiez promised

Martinez, that a payment of BsF 50 million would be made on or before December 31, 2012 and

the rest before January 15, 2013. Despite the numerous assurances by Reyes and Wolkowiez,

on behalf of Atmosphere Fund and Inversiones, respectively, AFV did not receive any funds on

or before December 31, 2012, Further, AFV did not have any additional communication from

Reyes or Wolkowiez until January 10, 2013.

J. Wolkowiez and lachini Induce AFV to Delay Legal Action Through Additional

Fraudulent Misrepresentations of Material Facts.

73. On January 10, 2013, Martinez met with Wolkowiez at the offices of SLB and

Inversiones to find out why the promised payment of BsF 50 million had not been made.

Wolkowiez informed Martinez that Reyes had not made any of the agreed upon transfers to the

account of Inversiones, therefore, Inversiones could not make any additional payments to AF,

Wolkowiez then expressed his doubts as to whether Reyes would fulfill his obligations to

Inversiones, but that ultimately, Inversiones would make good on the promised payments to

AFV. AEV reasonably relied upon this representation made by Wolkowiez on behalf of

Inversiones.

74, During this meeting, Wolkowiez called Iachini again and put him on the speaker

phone. Iachini informed Wolkowiez and Martinez that he would be back in Caracas the

weekend of January 12-13, 2013 and, that at that point, he would take care of everything. That

evening, Martinez informed Wolkowiez that AFV was considering sending a formal demand

letter prepared by AFV’s lawyers. Wolkowiez asked Martinez to wait until Monday, January 14,

2013 in order to give Tachini a chance to make things right on behalf of Atmosphere Fund. AFV

reasonably relied upon the representations made by Wolkowie7. and Iachini and was induced into

unnecessarily delaying legal action.

23

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

75, On January 14, 2013, Martinez met with Wolkowiez at the offices of SLB and

Inversiones to discuss the status of the situation. During this meeting, Wolkowiez informed

Martinez that Iachini had decided to distance himself from AFV’s transaction with Atmosphere

Fund and that neither he nor Atmosphere Fund would assume any responsibility for the funds

that had been deposited to Inversiones.

76. Nonetheless, Wolkowiez presented Martinez with a repayment plan that called for

the return of the monies owed by Atmosphere Fund to APV based on the following timeline:

(a) BsF 10 million on or before January 18, 2013, (b) BsF 50 million on or before January 31,

2013, and (¢) BsF 70 million on or before February 28, 2013. This proposed repayment schedule

did not comply with any of the terms of the Short Term Loan Agreements nor with any of the

rumerous promises made by Reyes and Wolkowiez which AFV had detrimentally relied upon in

the prior weeks.

77. On January 15, 2013, Martinez met again with Wolkowiez at the offices of SLB

‘and Inversiones who indicated that Reyes had yet to make up the difference and that AFV should

consider taking legal action against all the necessary parties, Wolkowiez also informed Martinez

that approximately four months ago Inversiones had lost approximately $2.9 million due to a

failed investment referred to him by Reyes. Based on Wolkowiez’s description of the situation,

it appears that the BsF 59.6 million owed to Inversiones by Reyes is directly related to the USD

$2.9 million loss suffered by Wolkowiez with respect to the deal Reyes referred to him and is the

reason why Wolkowiez has repeatedly conditioned returning the funds to AFV on his ability to

recover from Reyes.

K. — Allof the Defendants Continue to Purposefully Misrepresent, Conceal, and Suppress

‘Material Facts in Response to AFV’s Demand Letter.

78. On January 16, 2013, AFV directed its lawyers to send a formal demand letter to

4

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

all the entities and individuals involved in the transaction (e.g., Atmosphere Fund, Atmosphere

‘Asset Management, CP Capital, Amicorp, Inversiones, SLB, Reyes, McInnis, Wolkowiez,

Iachini, Litwak, Cancino, and Diaz) formally demanding the return of all the funds still owed to

AFV and giving the parties 30 days’ notice with respect to AFV’s rights pursuant to Florida's

Civil Theft Statute (the “Demand Letter”).

79. Not surprisingly, each of the Defendants refused to “accept any responsibility” for

their role with respect to the transaction and refused to offer any type of cooperation to AFV

despite (a) the existence of written contractual obligations between AFV and Atmosphere Fund

and (b) the existence of numerous claims against each of the parties by virtue of their agency and

fiduciary relationships with the parties, their fraudulent misrepresentations, their unfilled

promises of payment, and the outright theft of funds belonging to AFV.

80. Notably, Atmosphere Fund, Atmosphere Asset Management, and Martin Litwak

(through counsel) claimed that the documents referenced in AFV’s demand letter were forgeries

without explaining how it obtained the documents to begin with since AFV did not attach any

documents to its demand letter to begin with. Moreover, Litwak also claimed that while

“possible loan agreements were being negotiated with AFY, it was his understanding, based on

an email from Mr, Jorge Reyes on December 14, 2012, that the loan agreement negotiations had

fallen apart and that no transactions would take place.” Given this statement, Atmosphere Fund

conceded that Reyes and Litwak are its agents and that they were authorized to negotiate the loan

transaction at issue on behalf of Atmosphere Fund. Despite admitting that Reyes acted an agent

for Atmosphere Fund with respect to the AFV transaction, Atmosphere Fund and Litwak

continued their trend of making fraudulent representations by claiming that it “appears [your]

client has negotiated with individuals and entities not authorized to speak on behalf of

25

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

Atmosphere.”

81. Amicorp, the Fund’s administrator, also claimed that none of its employees “acted

as an agent for any of the parties in connection with the loan agreements at issue.” Interestingly,

itis Amicorp's employee, Santiago Goiri, who was the original proponent of this transaction and

who stated in unequivocal terms that Reyes is a client of Amicorp and that he manages these

types of transactions through Atmosphere Fund out of Miami, Florida

82. In ifs response, CP Capital (the Fund's Broker and the employer of Reyes who

facilitated this fraud), claimed that CP Capital does not have any custody of any assets of

‘Atmosphere Fund. However, CP Capital did not address it concerns regarding its negligent

supervision of Reyes as an agent of CP Capital and Atmosphere Fund,

83, Reyes, while not responding to AFV's Demand Letter in writing, instead retained

counsel dedicated to handling criminal matters. Through his counsel, Reyes’s initial position

‘was that the documents in AFV's possession pertaining to Reyes — the emails to Ripepi,

Litwak, Iachini, and Diaz and even the Cancellation Letter he signed — were also forgeries.

Despite taking such a strong initial position, three weeks later Reyes informed AFV through

counsel that the documents referenced above, in fact, are not forgeries.

84, _ Iachini, for his part has retained counsel and informed AFV through his counsel

that he “knows nothing regarding the alleged loans and had no participation with any of the

alleged transactions.” This is obviously not true, as Tachini has participated on at least three

conference calls with Martinez and Ripepi whereby he provided numerous assurances to

Martinez that the money owed to AFV would be repaid and that everything would get

straightened out.

85. Diaz, the attorney who purportedly was in charge of drafting the documents for

the transaction on behalf of Atmosphere Fund/Reyes, has also taken inconsistent positions and

26

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

££

nay also be liable to AFV as a result of his agency relationship with Reyes and Atmosphere

Fund, In his two responses to the Demand Letter, Diaz made the following admissions:

a. In December 2012, he was asked by Jorge Reyes to review a draft loan

agreement between AFV and Atmosphere Fund provided to him via email

by Reyes (of which Mr. Armando Iachini was copied).

b. Diaz reviewed the loan agreement and provided his opinion on them as @

qualified attomey in Venezuela and partner of the Venezuelan firm Torres,

Plaz, y Araujo.

c. _Torge Reyes and/or Atmosphere Fund was the client on file

4. Diaz confirmed that in all the documents he reviewed Atmosphere Fund

instructed AFV to deposit the money in Inversiones’ bank account at

Banco Banesco

e. Diaz was formerly employed by Amicorp.

L._ AFV Continues to Follow-Up To Determine the Status of the Loan Proceeds After

Payment Deadlines Are Not Met by Either Atmosphere Fund or Inversiones.

86. On January 18, 2013, Martinez called Wolkowiez to inquire about the BsF 10

million payment scheduled for that day as previously agreed to by Wolkowiez. During this

meeting, however, Wolkowiez informed Martinez that his lawyer had advised him not to make

any more payments to AFV, but that he would still like to meet to find a way to fix the situation.

Wolkowiez also represented to Martinez that removing SLB from the demand letter was a

condition for working out a deal,

87. Martinez. and Wolkowiez subsequently agreed to meet at SLB's office on January

22, 2013 at 11:00 am. However, on his way to the meeting, Martinez was informed by

Wolkowiez that he would not be able to make the meeting due another emergency meeting,

21

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

Despite making plans to meet later that afternoon, Martinez did not hear from Wolkowiez again

for several days.

88. On January 23, 2013, Martinez received a message from Ripepi indicating that

Santiago Goiri wanted to speak with AFV regarding this transaction. On January 24, 2013,

Martinez and Goiri spoke directly on the telephone, Notably, Goiri informed Martinez that he

had knowledge of previous deals originating from Atmosphere Fund which were brokered by

Reyes. Goiri also stated that he was willing to vouch for the authenticity of the transaction and

that he had personal knowledge of an email from Litwak confirming the transaction. Goiri was

asked by Martinez to tumover any documents AFV needed to support its claims against

‘Atmosphere Fund, however, Goiri claimed that his confidentiality agreement with Amicorp

prohibited him for being able to do so.

89. On February 4, 2013, Martinez met with Valmy Diaz in Caracas, Venezuela to

discuss his participation in the review of the Short Term Loan Agreements. Diaz told Martinez.

that he had reviewed several sets of documents related to the Short Term Loan Agreements

between All Factoring and Atmosphere Fund on behalf of law firm Torres, Plaz, y Araujo. Diaz

also acknowledged his phone conversation with Martinez on December 5, 2012 regarding the

need to have the documents ready prior to transferring the money to Inversiones. Diaz. also

confirmed that he received the documents to review from Reyes and that lachini and Litwak

were both copied on all of the emails from Reyes.

90. On February 11, 2013, Martinez. met with Ricardo Ripepi in Bogota to request all

the documents related to the Atmosphere Fund transaction that had been brokered by him and

Profesionales de Bolsa on behalf of AFV. Ripepi said that all phone calls, emails, and faxes

were in the possession of Profesionales de Bolsa and that he was going to formally request them

and make them available to AFV.

28

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

91. On February 23, 2013, Martinez met with Santiago Goiri in Curacao to discuss

the details of his personal knowledge regarding the transaction between AFV and Atmosphere

Fund. The meeting, which lasted three hours, focused on the personal connection between the

various parties involved in this transaction and the events which transpired behind the scenes,

including, the following:

a.

‘The structure of the transaction that served as the model for the loan

agreement between AFV and Atmosphere Fund was devised by a former

‘Amicorp employee named Eric Chang (“Chang”), along with Valmy Diaz

and Jorge Reyes,

The initial Aumosphere Fund deal templates (discussed above) were

originally provided by Jorge Reyes to Santiago Goiri who then provided

them to Ricardo Ripepi.

Reyes sent a completed “Know Your Customer” checklist form for both

Inversiones and AFV to Amicorp so that Amicorp could prepare certain

documents and open a file for Inversiones and AFV.

On or around December 5, 2012, Santiago Goiri had communications with

Valmy Diaz regarding the preparation of the loan documents between

‘Atmosphere Fund and AFV.

On or around December 10, 2012, Santiago Goiri spoke to Reyes who

confirmed receipt of a large majority of the funds transferred by AFV to

Inversiones.

On December 11, 2012, Santiago Goiri received an email from Reyes

copying Iachini, Litwak, and Diaz to confirm that the final documents had

been prepared and reviewed by Diaz, executed by Litwak, and that all

funds had been received by Inversiones.

Goiri confirmed that Atmosphere Fund only has two bank accounts, one at

Amicorp B&T and the other one at First Caribbean International Bank.

Further, Goiri had no knowledge of the letter of instruction to Atmosphere

from AFV or the swift confirmation notice purporting to evidence the

transfer of funds back to AFV.

On or around December 14, 2012, Santiago Goiri received a copy of the

Cancellation Letter from Ripepi requesting the retum of the funds and

forwarded it to his superiors at Amicorp indicating that there had been

many irregularities with the documentation on the part of the Fund.

29

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

i On or around December 15, 2012, Santiago Goiri participated in a

telephone conference with Chang and Reyes to discuss the now defunct

deal. Reyes informed the parties that he would take care of everything (as

he promised Martinez)

oS On or around December 18, Santiago Goiri took part in a telephone

conference with Reyes, Iachini, Litwak, and Claudio Cecchini, the head of

Fund Services at Amicorp, During this conference call, Iachini stated that

although AFV’s money had gone through, Atmosphere Fund was not

‘going to honor the short term loan agreements because AFV did not have

the original executed documents.

k. In the days following this call, Reyes continued to reassure Amicorp that

everything would be okay regarding the transaction because he had sold

the deal to a bank in Venezuela (apparently BFC or BNC Bank).

L On or around December 19, 2012, Fernando Cancino wrote to Rob Ellis,

Claudio Cecchini, and Santiago Goiri informing them of the meeting that

had taken place at Amicorp’s office in Miami with Reyes and Martinez.

m, Ono around December 28, 2012, Goiri sent a detailed email to Claudio

Cecchini, Zulma Pinto, Femando Caneino, and Rob Ellis about all of the

events that had transpired in this deal. In this email, Goiri stated that he

believed there was a fraud underway and that Amicorp should take action.

Claudio Cecchini responded by saying that the short term loan agreement

was of no concer to Amicorp.

92. On February 25, 2013, Martinez received a call from Wolkowiez informing him

that Reyes had not paid him any money and therefore he could not return any of the funds to

ABV. He also mentioned the possibility of having @ meeting (as suggested by AFV’s attorneys),

however, this meeting never took place after receiving notice from Wolkowiez’s attorney that a

meeting would not be “fruitful.”

93. On March 5, 2013, Martinez met with Wolkowiez at the offices of

‘SLB/Inversiones to discuss a potential agreement involving the repayment of the Total Loan

Balance (approximately BsF 130 million). During this meeting the parties also called Iachini so

that he could participate in the discussions. Ultimately, lachini maintained his position that he

was not involved in this transaction (despite his previous assurances) and that Reyes did not have

authority to act on behalf of Atmosphere Fund, therefore, this issue was not his problem. Shortly

30

/ARRA DAVIS MULLINS & GROSSMAN, P.A.

thereafter, the conversation with Iachini ended and Wolkowiez informed Martinez that he would

get back to him after consulting with his attorney.

94. On March 13, 2013, Martinez contacted Wolkowiez to discuss a potential

meeting. During this meeting, Wolkowiez informed Martinez that Reyes was still in Venezuela

with Iachini who was helping him find the money needed to repay AFV. Wolkowiez also

informed Martinez, that Reyes and Iachini had recently deposited BsF 2 million with Inversiones

and had promised Wolkowiez another BsF 20 million by the next day, March 14. Martinez. also

asked Wolkowiez what his thoughts were on discussing a potential settlement agreement

discussed last week. Wolkowiez responded to Martinez by informing him that Reyes’s lawyer

had sent him an email advising him not to negotiate a settlement unless it included all the other

parties because otherwise they would proceed against him. Martinez informed Wolkowiez that

he could not agree to such terms and that AFV was prepared to file its lawsuit against all the

parties. Wolkowiez was very upset by this news and threatened AFV and anybody involved in

the deal with retaliation in Venezuela,

COUNT I - BREACH OF CONTRACT

(Against Atmosphere Fund, Litwak, and Iachini)

95. AEV re-alleges paragraphs 1 through 94 as if fully set forth herein.

96. The Short Term Loan Agreements are valid and enforceable contracts between

ABV and Atmosphere Fund.

97. Atmosphere Fund has materially breached the First Short Term Loan Agreement

in the amount of Bs 151 million by (a) failing to repay the outstanding balance due as set forth in

section 4.1.1 of the First Short Term Loan Agreement and (b) giving information and making

representations to AFV that are inaccurate as set forth in section of 4.1.2 of the First Short Term

Loan Agreement.

31

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

98. Atmosphere Fund has materially breached the Second Short Term Loan

Agreement in the amount of Bs 83.6 million by (a) failing to repay the outstanding balance due

‘as set forth in section 4.1.1 of the Second Short Term Loan Agreement and (b) giving

information and making representations to AFV that are inaccurate as set forth in section of 4.1.2

of the First Short Term Loan Agreement.

99, AFV has been damaged as a result of Atmosphere Fund’s breach of the Short

Term Loan Agreements.

100, As detailed above, Litwak and Jachini used Atmosphere Fund for improper

purposes and in bad faith to effectuate multiple acts of malfeasance against AFV.

101, Iachini (the ultimate beneficial sole shareholder of the fund) and Litwak (the

director of the fund), used their power, influence, and control over Atmosphere Fund to such an

extent that its corporate existence was in fact non-existent.

102. Upon information and belief, lachini and Litwak disregarded Atmosphere Fund's

corporate formalities. Inchini and Litwak also used Atmosphere Fund as a mere instrumentality

to further their improper conduct.

103, lachini and Litwak’s improper use of Atmosphere Fund has damaged AFV and,

as such, the fund's corporate form should be disregarded so as to hold Iachini and Litwak liable

for any and all losses caused by Atmosphere Fund,

WHEREFORE, AFV demands judgment against Defendants Atmosphere Fund, lachini,

and Litwak for money damages, prejudgment and post judgment interest, costs, and such other

and further relief as this Court deems just and proper.

COUNT Il - MONEY HAD AND RECEIVED

(Against Atmosphere Fund, Inversiones, Wolkowiez and Reyes)

104, AFV re-alleges paragraphs 1 through 94 as if fully set forth herein.

32

[ASTIOARRA DAVIS MULLINS & GROSSMAN, P.A.

eee

105, ARV transferred BsF 234.6 million to a bank account in name of Inversiones

which is directly owned and controlled by Wolkowiez pursuant to the Short Term Loan

‘Agreements entered into with Atmosphere Fund.

106, The Inversiones bank account which received AFV’s funds pursuant to the Short

‘Term Loan Agreements was represented to AFV as being the “custodian account” for

‘Atmosphere Fund and therefore any money received by Inversiones directly benefited

Atmosphere Fund.

107. Atmosphere Fund, Reyes, and their agents represented and orally agreed to repay

AFV within 10 days of the receipt of the loan proceeds and no Jater than 30 days pursuant to the

Short Term Loan Agreements.

108, _Inversiones and Wolkowiez also represented to AFV and its agents on numerous

occasions that the funds AFV transferred to Inversiones would be returned by certain deadlines

which have since passed.

109. Atmosphere Fund, Inversiones, Wolkowiez, and Reyes had knowledge of and

voluntarily accepted the transfer of funds from AFV to Inversiones/Atmosphere Fund and failed

to provide AFV with any consideration for these payments.

110. Atmosphere Fund, Inversiones, Wolkowiez, and Reyes received the benefit of the

funds transferred by AFV to Inversiones and have only returned BsF 104.6 million of this

amount

111. Inversiones, Wolkowiez, and Reyes applied approximately BsF $7.6 million of

nes/Wolkowiez which is

AFV’s funds to settle an outstanding debt owed by Reyes to Inver

completely unrelated to the obligations of Atmosphere Fund under the Short Term Loan

Agreements.

3

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

112. _ In faimess and in equity, the remaining BsF 130 million owed to AFV should be

returned by Atmosphere Fund, Inversiones, Wolkowiez and Reyes. AFV is entitled to the return

of all funds improperly retained by Atmosphere Fund, Inversiones, Wolkowiez and Reyes.

WHEREFORE, AFV demands judgment against Atmosphere Fund, Inversiones,

Wolkowiez, and Reyes for money damages, prejudgment and post judgment interest, costs, and

such other and further relief as this Court deems just and proper.

COUNT Il CONVERSION

(Against Atmosphere Fund, Inversiones, Wolkowiez, and Reyes)

113, AFV re-alleges paragraphs | through 94 as if fully set forth herein.

114. ARV transferred BsF 234.6 million to a bank account in name of Inversiones

which is directly owned and controlled by Wolkowiez pursuant to the Short Term Loan

Agreements.

115. The Inversiones bank account which received AFV's funds pursuant to the Short

Term Loan Agreements was represented to AFV as being the “custodian account” for

‘Atmosphere Fund and therefore any money received by Inversiones directly benefited

Atmosphere Fund,

116. Atmosphere Fund, Reyes, and their agents represented and orally agreed to pay

AFV within 10 days of the receipt of the loan proceeds and no later than 30 days pursuant to the

Short Term Loan Agreements.

117. Inversiones and Wolkowiez also represented to AFV and its agents on numerous

occasions that the funds AFV transferred to Inversiones would be returned by certain deadlines

which have since passed. To date, only BsF 104.6 million has been retumed to AFV.

118. The fraudulent misrepresentations and breached oral agreements made by

Atmosphere Fund, Inversiones, Wolkowiez, and Reyes are the product of a scheme to defraud

34

ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

AFV with the criminal intent of misappropriating the funds AFV transferred to Inversiones

pursuant to the Short ‘Term Loan Agreement.

119, Atmosphere Fund, Inversiones, Wolkowiez, and Reyes converted,

misappropriated, or otherwise purported to exercise unlawful dominion and control over

proceeds belonging to AFV which were transferred to Inversiones/Atmosphere Fund in

connection with the Short Term Loan Agreements,

120. Inversiones, Wolkowiez, and Reyes applied approximately BsF 57.6 million of

AFV’s funds to settle an outstanding debt owed by Reyes to Inversiones/Wolkowiez which is

completely unrelated to the obligations of Atmosphere Fund under the Short Term Loan

Agreements.

121. Atmosphere Fund, Inversiones, Wolkowiez, and Reyes have acknowledged the

transfer and receipt of the loan proceeds at issue but have not complied with Atmosphere Fund’s

obligations pursuant to the Short Term Loan Agreements, or, in the alternative have claimed that

the Short Term Loan Agreements are not valid.

122, AFV has made demands to Defendants Atmosphere Fund, Inversiones,

Wolkowiez, and Reyes for the return of all loan proceeds that have been misappropriated and

converted in bad faith by Atmosphere Fund, Inversiones, Wolkowiez, and Reyes and renews

those demands again herein,

123. Atmosphere Fund, Inversiones, Wolkowiez, and Reyes have failed to comply

with these demands and have failed to return the balance of the loan proceeds to AFV.

124, ARV has suffered damages as a direct and proximate result of the conversion of

Joan proceeds by Defendants Atmosphere Fund, Inversiones, Wolkowiez, and Reyes.

WHEREFORE, AFV demands judgment against Defendants Atmosphere Fund,

Inversiones, Wolkowiez and Reyes for money damages, the retum of all the converted loan

35

[ASTIGARRA DAVIS MULLINS & GROSSMAN, P.A.

proceeds belonging to AFV, prejudgment and post judgment interest, costs, and, such other and

further relief as the Court deems just and proper.

COUNT IV ~ CIVIL THEFT

(Against Atmosphere Fund, Inversiones, Wolkowier, and Reyes)

125. AFV re-alleges paragraphs 1 through 94 as if fully set forth herein,

126. AFV transferred BsF 234.6 million to a bank account in name of Inversiones

Which is directly owned and controlled by Wolkowiez pursuant to the Short Term Loan

Agreements.

127. The Inversiones bank account which received AFV’s funds pursuant to the Short

Term Loan Agreements was represented to AFV as being the “custodian account” for

‘Atmosphere Fund and therefore any money received by Inversiones directly benefited

Atmosphere Fund.

128. Atmosphere Fund, Reyes, and their agents represented and orally agreed to pay

AFV within 10 days of the receipt of the loan proceeds and no later than 30 days pursuant to the

Short Term Loan Agreements.

129, Inversiones and Wolkowiez also represented to AFV and its agents on numerous

occasions that the funds AFV transferred to Inversiones would be returned by certain deadlines

which have since passed.

130, These deadlines passed and AFV has yet to be fully repaid despite numerous

promises and assurances from Wolkowiez (on behalf of Inversiones) and from Iachini and Reyes

(on behalf of Atmosphere Fund). To date, only BsF 104.6 million has been returned to AFV

following numerous demands,

131, Inversiones, Wolkowiez, and Reyes applied approximately BsF $7.6 million of

AFV’s funds to seitle an outstanding debt owed by Reyes to Inversiones/Wolkowiez which is

36

ASTIGARRA DAViS MULLINS & GROSSMAN, PLA.

completely unrelated to the obligations of Atmosphere Fund under the Short Term Loan

Agreements.

132. Atmosphere Fund, Inversiones, Wolkowiez, and Reyes had knowledge of and

voluntarily accepted the transfer of funds from AFV to Inversiones/Atmosphere Fund and failed

to provide AFV with any consideration for these payments.

133, Atmosphere Fund, Inversiones, Wolkowiez, and Reyes converted BsF 130 million

belonging to AFV with the criminal intent to permanently deprive AFV of its funds for their own

use,

134. AFV made a written demand to the parties for the amounts owed and advised

them of AFV rights to seek treble damages pursuant to Florida’s Civil Theft Statute, § 772.11.

‘None of the parties subject to this cause of action complied with AFV’s demand.

WHEREFORE, AFV demands judgment against Atmosphere Fund, Inversiones,