Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Economic Focus 8-29-11

Cargado por

Jessica Kister-LombardoDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Economic Focus 8-29-11

Cargado por

Jessica Kister-LombardoCopyright:

Formatos disponibles

Economic Focus

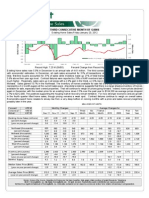

IMPACT OF REOS ON THE HOUSING MARKET

Here are some very interesting observations by Brad Hunter of Metrostudy Report: There is downward pressure on home prices - According to estimates it will take 3 years for the market to absorb excess existing home inventory, provided the economy gains some momentum. New homes are not subject to as much downward pressure Estimates are that new home prices fall about half the percentage as existing homes. The excess inventory (REO) consists of older homes, not new homes. Builder inventory is now low in most communities. REO will remain a serious problem: While the downward trend that had begun in 2006 is leveling off, but due to efforts to slow down the introduction of REO in the market. REO is now being brought to the market at a much faster pace. CoreLogic estimates that only about 0ne-fourth of the REO are on the MLS. That would place a shadow inventory of over 400,000 REO units. It is estimated that at the current clearance pace it will take 33 months to clear this REO inventory. Then we have to take into account the estimated 2.100,000 units in foreclosure as of the end of Q1. Conservative estimates of 1.6 million homes are 90-days delinquent and will be added to the inventory burden. Additionally, there are nearly 2 million more loans whose borrowers are upside down by 50%, or at least $150,000. Fannie

RELEASE DATE Mon 08/29 8:30 am et Mon 08/29 10:00 am et Tue 08/30 9:00 am et Tue 08/30 10:00 am et Tue 08/30 2:00 pm et Wed 08/31 7:00 am et Thu 09/01 Thu 09/01 8:30 am et Thu 09/01 10:00 am et Thu 09/01 10:00 am et Fri 09/02 8:30 am et

1

for the week of August 29, 2011 Volume 15, Issue 34

Key Economic Reports Released This Week

ECONOMIC INDICATORS RELEASED BY Bur. of Econ. Analysis Dept. of Commerce National Association of Realtors S&P Case-Shiller HPI Conference Board Federal Reserve Board Mortgage Bankers Association of America Automobile Manufacturers Bur. of Labor Statistics Department of Labor National Association of Purchasing Mgt. Bureau of the Census Dept. of Commerce Bur. of Labor Statistics Department of Labor CONSENSUS 1 SURVEY Income 0.3% Outlays 0.4% -0.3% -4.8% 53.5% N/A N/A Vehicles 12.0M 405k 50.0% 0.1% Wt. *** ** * ** **** * ** * ** ** INFLUENCE ON INTEREST RATES

Personal Income & Outlays for July 11 Pending Home Sales Index for June 11 Case-Shiller HPI for June 11 Y/Y Consumer Confidence for August 11 FOMC Minutes for 08/10 meeting MBA Mtg Apps Survey for week ending 08/26 Motor Vehicle Sales for August 11 Jobless Claims for week ending 08/27 ISM (NAPM) Mfg Index for August 11 Construction Spending for July 11 Employment Situation for August 11

If above consensus If below consensus If above consensus If below consensus

Undetermined

If above consensus If below consensus

Determines Policy Undetermined

Survey courtesy of Insight Economics, LLC

Payrolls 95k **** Unemp 9.1% * Low Importance ** Moderate Importance *** Important **** Ver y Important

If above consensus If below consensus If above consensus If below consensus If above consensus If below consensus If above consensus If below consensus If above consensus If below consensus

Mae, Freddie and FHA are selling about 130,000 Reo units per quarter. Then you can add to that the inventory held by FDIC-insured banks and thrifts and private-label securitized lenders. If all were sold at that same rate the number would about 250,000 per quarter, or 1 million units per year added to the market. Brad Hunter concludes, This all leads me to believe that we will get a second down-leg in Case-Shiller over the next year, but probably not a drastic one. Were 1/3 off the peak now. If we go down another 10%, then the total peak-to-trough decline will end up being 40%. Overall, I think weve got another three years before we work through the remaining excess housing supply (assuming no double-recession). As we draw down the supply, the amount of price pressure will ease.

Jessica Lombardo Loan Officer Hi-Tech Mortgage 2184 McCulloch Boulevard, # A Lake Havasu City, AZ 86403 jessica@hi-techmortgage.com Office: 866.768.5626 Cell: 916.548.8533 Fax: 916.372.2518

También podría gustarte

- Economic Focus 9-19-11Documento1 páginaEconomic Focus 9-19-11Jessica Kister-LombardoAún no hay calificaciones

- Weekly Economic Commentary 3-26-12Documento11 páginasWeekly Economic Commentary 3-26-12monarchadvisorygroupAún no hay calificaciones

- Weekly Economic Commentary 3-26-12Documento6 páginasWeekly Economic Commentary 3-26-12monarchadvisorygroupAún no hay calificaciones

- Economic Focus April 16 2012Documento1 páginaEconomic Focus April 16 2012Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus August 1, 2011Documento1 páginaEconomic Focus August 1, 2011Jessica Kister-LombardoAún no hay calificaciones

- Axios Capital's Review/Preview: The Period in ReviewDocumento6 páginasAxios Capital's Review/Preview: The Period in ReviewLeo IsaakAún no hay calificaciones

- Are We There Yet?Documento8 páginasAre We There Yet?richardck30Aún no hay calificaciones

- 2010 0113 EconomicDataDocumento11 páginas2010 0113 EconomicDataArikKanasAún no hay calificaciones

- Foxhall Capital Management, Inc.: The Foxhall Global OutlookDocumento5 páginasFoxhall Capital Management, Inc.: The Foxhall Global OutlookRoger LingleAún no hay calificaciones

- May 252010 PostsDocumento14 páginasMay 252010 PostsAlbert L. PeiaAún no hay calificaciones

- June 142010 PostsDocumento28 páginasJune 142010 PostsAlbert L. PeiaAún no hay calificaciones

- Econ Focus 6-20-11Documento1 páginaEcon Focus 6-20-11Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus 9-26-11Documento1 páginaEconomic Focus 9-26-11Jessica Kister-LombardoAún no hay calificaciones

- The Pensford Letter - 12.12.11Documento3 páginasThe Pensford Letter - 12.12.11Pensford FinancialAún no hay calificaciones

- March 2010 Charleston Market ReportDocumento26 páginasMarch 2010 Charleston Market ReportbrundbakenAún no hay calificaciones

- The End of Buy and Hold ... and Hope Brian ReznyDocumento16 páginasThe End of Buy and Hold ... and Hope Brian ReznyAlbert L. PeiaAún no hay calificaciones

- Weekly Economic Commentary 11-3-11Documento7 páginasWeekly Economic Commentary 11-3-11monarchadvisorygroupAún no hay calificaciones

- The Pensford Letter - 1.9.12Documento7 páginasThe Pensford Letter - 1.9.12Pensford FinancialAún no hay calificaciones

- Q3 2007 Charleston Market ReportDocumento7 páginasQ3 2007 Charleston Market ReportbrundbakenAún no hay calificaciones

- Reporting, Reinvigorating, RebuildingDocumento3 páginasReporting, Reinvigorating, Rebuildingapi-26437180Aún no hay calificaciones

- Financial Forecast: Debbie BremnerDocumento4 páginasFinancial Forecast: Debbie Bremnerapi-26176222Aún no hay calificaciones

- Economic Focus 7-18-11Documento1 páginaEconomic Focus 7-18-11Jessica Kister-LombardoAún no hay calificaciones

- May 2010 Charleston Market ReportDocumento38 páginasMay 2010 Charleston Market ReportbrundbakenAún no hay calificaciones

- ReviewPreview07 30 10scribdDocumento6 páginasReviewPreview07 30 10scribdLeo IsaakAún no hay calificaciones

- A Random Walk Around The FrontlinesDocumento7 páginasA Random Walk Around The Frontlinesrichardck61Aún no hay calificaciones

- Home Construction Sinks, Building Permits DownDocumento30 páginasHome Construction Sinks, Building Permits DownAlbert L. PeiaAún no hay calificaciones

- Weekly Market Commentary 10-24-11Documento5 páginasWeekly Market Commentary 10-24-11monarchadvisorygroupAún no hay calificaciones

- Quarterly Highlights Q3Documento12 páginasQuarterly Highlights Q3tfong3477Aún no hay calificaciones

- Weekly Economic Commentar 10-17-11Documento4 páginasWeekly Economic Commentar 10-17-11monarchadvisorygroupAún no hay calificaciones

- Economy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddeDocumento1553 páginasEconomy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddesvvpassAún no hay calificaciones

- Ricardo's Law: The Unintended Consequence of The Federal Government's Budget Only You Will SeeDocumento8 páginasRicardo's Law: The Unintended Consequence of The Federal Government's Budget Only You Will Seehunghl9726Aún no hay calificaciones

- The Pensford Letter - 11.11.13 PDFDocumento4 páginasThe Pensford Letter - 11.11.13 PDFPensford FinancialAún no hay calificaciones

- The Wright Report:: Sacramento's Residential Investment AnalysisDocumento26 páginasThe Wright Report:: Sacramento's Residential Investment AnalysisWright Real EstateAún no hay calificaciones

- Koo Read+ +dec+14+2010+ +Roller+Coaster+Ride+for+Bond+MarketDocumento10 páginasKoo Read+ +dec+14+2010+ +Roller+Coaster+Ride+for+Bond+Marketavicohen85Aún no hay calificaciones

- Morningstar - RobertDocumento7 páginasMorningstar - Robertcfasr_programsAún no hay calificaciones

- 06 - 10 Wither Green ShootsDocumento4 páginas06 - 10 Wither Green Shootsrichardck30Aún no hay calificaciones

- March 292010 PostsDocumento12 páginasMarch 292010 PostsAlbert L. PeiaAún no hay calificaciones

- The Pensford Letter - 8.13.12Documento5 páginasThe Pensford Letter - 8.13.12Pensford FinancialAún no hay calificaciones

- Santelli: $4 Gas, $150 Oil Coming This Summer..Documento9 páginasSantelli: $4 Gas, $150 Oil Coming This Summer..Albert L. PeiaAún no hay calificaciones

- Wright Report Q2 2010Documento33 páginasWright Report Q2 2010Wright Real EstateAún no hay calificaciones

- What Is GDP?: Kimberly AmadeoDocumento44 páginasWhat Is GDP?: Kimberly AmadeobhupenderkamraAún no hay calificaciones

- Economic Focus Feb. 20, 2012Documento1 páginaEconomic Focus Feb. 20, 2012Jessica Kister-LombardoAún no hay calificaciones

- Feb 2009 CMR1Documento26 páginasFeb 2009 CMR1brundbakenAún no hay calificaciones

- March 112010 PostsDocumento10 páginasMarch 112010 PostsAlbert L. PeiaAún no hay calificaciones

- Economic Focus Sept. 12, 2011Documento1 páginaEconomic Focus Sept. 12, 2011Jessica Kister-LombardoAún no hay calificaciones

- Lane Asset Management Commentary For November 2016Documento14 páginasLane Asset Management Commentary For November 2016Edward C LaneAún no hay calificaciones

- Weekly Economic Commentary 10-10-11Documento8 páginasWeekly Economic Commentary 10-10-11monarchadvisorygroupAún no hay calificaciones

- Summary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterDe EverandSummary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterAún no hay calificaciones

- Terranova Calendar Oct 2012Documento7 páginasTerranova Calendar Oct 2012B_U_C_KAún no hay calificaciones

- Executive 1Documento6 páginasExecutive 1KhardenAún no hay calificaciones

- Short Sales The Current Housing MarketDocumento25 páginasShort Sales The Current Housing Marketbrian3332Aún no hay calificaciones

- Economic Focus 7-11-11pdfDocumento1 páginaEconomic Focus 7-11-11pdfJessica Kister-LombardoAún no hay calificaciones

- Wien Byron - August 2010 Market CommentaryDocumento3 páginasWien Byron - August 2010 Market CommentaryZerohedgeAún no hay calificaciones

- Stock Rally Says Economic Boom, Fed Shows ConcernsDocumento3 páginasStock Rally Says Economic Boom, Fed Shows ConcernsValuEngine.comAún no hay calificaciones

- Zillow Q3 Real Estate ReportDocumento4 páginasZillow Q3 Real Estate ReportLani RosalesAún no hay calificaciones

- Keeping Current Matters in Today's Market": Positioning Agents As Experts in The MarketplaceDocumento32 páginasKeeping Current Matters in Today's Market": Positioning Agents As Experts in The MarketplacerealmiamibeachAún no hay calificaciones

- Does New Data Really Suggest A Housing Market BottomDocumento4 páginasDoes New Data Really Suggest A Housing Market BottommatthyllandAún no hay calificaciones

- Pay Attention To What The Market Is SayingDocumento11 páginasPay Attention To What The Market Is SayingEmmy ChenAún no hay calificaciones

- The Myth of Capitalism: Monopolies and the Death of CompetitionDe EverandThe Myth of Capitalism: Monopolies and the Death of CompetitionCalificación: 4 de 5 estrellas4/5 (11)

- Economic Focus Feb. 20, 2012Documento1 páginaEconomic Focus Feb. 20, 2012Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus 1-23-12Documento1 páginaEconomic Focus 1-23-12Jessica Kister-LombardoAún no hay calificaciones

- January Housing StartsDocumento1 páginaJanuary Housing StartsJessica Kister-LombardoAún no hay calificaciones

- Economic Focus January 30, 2012Documento1 páginaEconomic Focus January 30, 2012Jessica Kister-LombardoAún no hay calificaciones

- January Existing Home SalesDocumento1 páginaJanuary Existing Home SalesJessica Kister-LombardoAún no hay calificaciones

- Housing Starts December 2011Documento1 páginaHousing Starts December 2011Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus 12-5-11Documento1 páginaEconomic Focus 12-5-11Jessica Kister-LombardoAún no hay calificaciones

- Construction Spending December 2011Documento1 páginaConstruction Spending December 2011Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus 12-12-11Documento1 páginaEconomic Focus 12-12-11Jessica Kister-LombardoAún no hay calificaciones

- Construction Spending Oct. 2011Documento1 páginaConstruction Spending Oct. 2011Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus 1-16-12Documento1 páginaEconomic Focus 1-16-12Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus 12-19-11Documento1 páginaEconomic Focus 12-19-11Jessica Kister-LombardoAún no hay calificaciones

- Existing Home SalesDocumento1 páginaExisting Home SalesJessica Kister-LombardoAún no hay calificaciones

- New Home Sales November December) 2011Documento1 páginaNew Home Sales November December) 2011Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus 10-17-11Documento1 páginaEconomic Focus 10-17-11Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus October 24, 2011Documento1 páginaEconomic Focus October 24, 2011Jessica Kister-LombardoAún no hay calificaciones

- Housing StartsDocumento1 páginaHousing StartsJessica Kister-LombardoAún no hay calificaciones

- Economic Focus 11-14-11Documento1 páginaEconomic Focus 11-14-11Jessica Kister-LombardoAún no hay calificaciones

- Housing Starts Oct 2011Documento1 páginaHousing Starts Oct 2011Jessica Kister-LombardoAún no hay calificaciones

- Existing Home Sales October 2011Documento1 páginaExisting Home Sales October 2011Jessica Kister-LombardoAún no hay calificaciones

- November Construction SpendingDocumento1 páginaNovember Construction SpendingJessica Kister-LombardoAún no hay calificaciones

- Economic Focus 9-5-11Documento1 páginaEconomic Focus 9-5-11Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus 9-26-11Documento1 páginaEconomic Focus 9-26-11Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus 10-10-11Documento1 páginaEconomic Focus 10-10-11Jessica Kister-LombardoAún no hay calificaciones

- Housing Starts September 2011Documento1 páginaHousing Starts September 2011Jessica Kister-LombardoAún no hay calificaciones

- Existing Home Sales August 2011Documento1 páginaExisting Home Sales August 2011Jessica Kister-LombardoAún no hay calificaciones

- Economic Focus Sept. 12, 2011Documento1 páginaEconomic Focus Sept. 12, 2011Jessica Kister-LombardoAún no hay calificaciones

- Newhome 8-23-11Documento1 páginaNewhome 8-23-11Jessica Kister-LombardoAún no hay calificaciones

- Dissertation Report: Rajesh M RDocumento59 páginasDissertation Report: Rajesh M RSachin Kumar SakriAún no hay calificaciones

- E-Banking Services of RbiDocumento14 páginasE-Banking Services of RbiSrinivasan SrinivasanAún no hay calificaciones

- Fam Cia 1Documento8 páginasFam Cia 1MOHAMMED SHAHIDAún no hay calificaciones

- Deed of Agreement: ThailandDocumento16 páginasDeed of Agreement: Thailandruby calde100% (4)

- Organogram - State Bank of Pakistan: Deputy Governor Deputy Governor Deputy GovernorDocumento1 páginaOrganogram - State Bank of Pakistan: Deputy Governor Deputy Governor Deputy GovernorM Bilal KAún no hay calificaciones

- Business Finance Prelim To Finals ReviewerDocumento127 páginasBusiness Finance Prelim To Finals ReviewerMartin BaratetaAún no hay calificaciones

- Afu 07202 Individual AssignmentsDocumento2 páginasAfu 07202 Individual AssignmentsDEO MSOKA0% (1)

- Account Opening FormDocumento19 páginasAccount Opening Formrgsr2008Aún no hay calificaciones

- Basic Examples and Calculations in Life InsuranceDocumento42 páginasBasic Examples and Calculations in Life Insurancebranmondi8676Aún no hay calificaciones

- Sample Project AbstractDocumento2 páginasSample Project AbstractJyotiprakash sahuAún no hay calificaciones

- Facultative ReinsuranceDocumento3 páginasFacultative ReinsuranceAlisha ThapaliyaAún no hay calificaciones

- Full Download Fundamentals of Corporate Finance Canadian 6th Edition Brealey Test BankDocumento35 páginasFull Download Fundamentals of Corporate Finance Canadian 6th Edition Brealey Test Banktantalicbos.qmdcdj100% (22)

- MCQs Chapter 9 Financial CrisesDocumento12 páginasMCQs Chapter 9 Financial Crisesphamhongphat2014Aún no hay calificaciones

- Jagabaya Security Services - Jurnal Khusus - Hanifah Hilyah SyahDocumento4 páginasJagabaya Security Services - Jurnal Khusus - Hanifah Hilyah Syahreza hariansyahAún no hay calificaciones

- Data 5Documento6 páginasData 5abhinash biswal0% (1)

- Revenue and Receipt CycleDocumento10 páginasRevenue and Receipt CycleJericho100% (1)

- Question #1 of 25Documento15 páginasQuestion #1 of 25ALL ROUNDAún no hay calificaciones

- Acps 4 Complete SolutionsDocumento2 páginasAcps 4 Complete SolutionsLuna ShiAún no hay calificaciones

- Amy Vigil: 3062 Woodland RD Los Alamos, NM 87544Documento2 páginasAmy Vigil: 3062 Woodland RD Los Alamos, NM 87544jon100% (13)

- Unit 1 - Ffa Study Material-DrjDocumento19 páginasUnit 1 - Ffa Study Material-DrjTushar Singh SanuAún no hay calificaciones

- Chapter - 04 Financial Statement For Non Profit Making OrganizationDocumento71 páginasChapter - 04 Financial Statement For Non Profit Making OrganizationAuthor Jyoti Prakash rathAún no hay calificaciones

- Engineering Economics: InterestDocumento3 páginasEngineering Economics: InterestJm TangoAún no hay calificaciones

- Sid - Sbi S P Bse Sensex Index FundDocumento136 páginasSid - Sbi S P Bse Sensex Index FundKrish MudaliarAún no hay calificaciones

- IBPS Clerk Interview QuestionsDocumento4 páginasIBPS Clerk Interview QuestionsSai KaneAún no hay calificaciones

- Financial Management Principles and Applications 7th Edition Titman Test BankDocumento16 páginasFinancial Management Principles and Applications 7th Edition Titman Test Banktrancuongvaxx8r100% (34)

- UntitledDocumento13 páginasUntitledapi-167354334Aún no hay calificaciones

- Financial Ratio Analysis of HealthsouthDocumento11 páginasFinancial Ratio Analysis of Healthsouthfarha tabassumAún no hay calificaciones

- Filesure Task 2Documento4 páginasFilesure Task 2shrutiAún no hay calificaciones

- Chapter 5 Problems IA3Documento6 páginasChapter 5 Problems IA3monsta x noona-yaAún no hay calificaciones

- 8 - Operating and Financial LeverageDocumento15 páginas8 - Operating and Financial LeverageClariz VelasquezAún no hay calificaciones