Documentos de Académico

Documentos de Profesional

Documentos de Cultura

DB Chemicals

Cargado por

murghkhorDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

DB Chemicals

Cargado por

murghkhorCopyright:

Formatos disponibles

Company

Global Chemicals

8 April 2011

Global Chemicals Weekly

News, views and valuation

Periodical

Table of contents

Global Valuation ................................................ Page 02 Europe: News & valuation ................................ Page 03 US: News & valuation ...................................... Page 08 Asia/Japan: News & valuation .......................... Page 10 Event calendar .................................................. Page 13

Global Markets Research

Top picks

BASF (BASFn.DE),EUR63.11 Linde (LING.DE),EUR114.25 Arkema (AKE.PA),EUR66.16 Lanxess (LXSG.DE),EUR57.07 Syngenta (SYNN.VX),CHF303.00 Buy Buy Buy Buy Buy

Solvay (SOLB.BR, HOLD) Solvay is planning to acquire Rhodia for E6.6bn in cash. We think Rhodia is a good strategic fit for Solvay, increasing the group's exposure to emerging markets and more specialty, less cyclical businesses. We also welcome that Rhodia's CEO (good track record) is set to eventually become CEO of Solvay as we believe it also reduces the integration risk. Post this deal (expected to close end Aug 11), we believe Solvay should trade on 5.3x 12E EV/EBITDA (ex CERs) vs. peers on 5.1x. With no valuation advantage and the usual integration risk, we retain HOLD. Monsanto (MON.N, HOLD) Monsanto shares fell 6% following its Q2 release due to the lack of earnings upside in Q2 and likely '11 (guidance < consensus) despite record commodity prices. In addition, upside to '12 also looks limited as Monsanto reaffirmed that its primary focus next year will remain driving adoption of its next generation seeds. As a result seed pricing will be up "moderately" in '12 (10-15% est.) vs the 1520%-plus that could be justified given current commodity prices. With valuation already 24x '11E EPS, we believe upside in the shares, in the near-term, is limited. Mitsubishi Chem. Holdings (4188.T, BUY) The 2 Apr Nikkei reported on damage to Mitsubishi Chemical's Kashima complex. The article says the company incurred more damage than other general chemicals makers; we also have the same view. While it is difficult to assess the quake's earnings impact at present, we think OP could be depressed by 15-20bn premised on a three-month shutdown. This is based on the typical effect of regular maintenance and the impact of a fire at the plant's No. 2 ethylene facility in late 2007. The actual impact could be lower, as 1) fixed costs incurred during the shutdown could be booked as non-operating expenses or extraordinary losses, and 2) insurance will cover some of the impact (the plant has earthquake insurance). We intend to review our forecasts to reflect this as well as the decline in automobile production. While we expect the quake to have the negative impact outlined above, we also note that spreads on PTA and other products are running well ahead of our expectations. Figure 1: European stock performance (% change absolute)

Best Performer over the last week RHODIA SOLVAY Worst Performer over the last week AZ ELECTRONIC MATS.(DI) BAYER

Source: DataStream

Research Team

Tim Jones

Research Analyst (+44) 20 754-76763 tim.jones@db.com

Martin Dunwoodie, CFA

Research Analyst (+44) 20 754-72852 martin.dunwoodie@db.com

Virginie Boucher-Ferte

Research Analyst (+44) 20 754-57940 virginie.boucher-ferte@db.com

David Begleiter, CFA

Research Analyst (+1) 212 250-5473 david.begleiter@db.com

Takato Watabe, CMA

Research Analyst (+81) 3 5156-6686 takato.watabe@db.com

James Kan

Research Analyst (+886) 2 2192 2821 james.kan@db.com

1-week 51.7 9.4 1-week -1.0 -0.5

1-month 51.1 7.8 1-month -10.4 -2.5

YTD 26.7 14.6 YTD -11.9 -0.8

12-months 91.6 17.7 12-months NA 10.2

Figure 2: US stock performance (% change absolute)

Best Performer over the last week WESTLAKE CHEMICAL CELANESE 'A' Worst Performer over the last week MONSANTO POTASH CORP

Source: DataStream

1-week 5.2 4.7 1-week -5.9 -1.3

1-month 20.7 12.3 1-month -5.1 -1.8

YTD 36.0 12.8 YTD -2.4 9.7

12-months 113.0 41.0 12-months -0.2 48.5

Deutsche Bank AG/London All prices are those current at the end of the previous trading session unless otherwise indicated. Prices are sourced from local exchanges via Reuters, Bloomberg and other vendors. Data is sourced from Deutsche Bank and subject companies. Deutsche Bank does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MICA(P) 007/05/2010

8 April 2011

Chemicals Global Chemicals Weekly

Global sector valuation

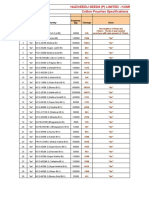

Figure 3: Global sector valuations

Rating EUROPE: MAJORS Arkema BASF Lanxess Rhodia Solvay EUROPE: INDUSTRIAL GAS Air Liquide Linde EUROPE: SPECIALTY AkzoNobel AZ Electronic Materials Clariant Croda DSM Givaudan Johnson Matthey Kemira Sika Symrise Umicore Victrex Wacker EUROPE: AGROCHEMICALS ICL K+S MA Industries Syngenta Yara EUROPE: PHARMA CHEMS Bayer US: MAJORS Celanese Dow PPG US: AGROCHEMICALS Agrium Mosaic Monsanto Potash Corp. US: INDUSTRIAL GAS Air Products Praxair Airgas US: SPECIALTY Albemarle Cytec ASIA/JAPAN: MAJORS Asahi Kasei Formosa Plastics Nan Ya Plastics Sumitomo Chemical ASIA/JAPAN: SPECIALTY JSR LG Chem Nitto Denko Shin-Etsu Chemical Buy Buy Buy Hold Hold Hold Buy Buy Buy Sell Buy Hold Hold Buy Hold Buy Buy Buy Hold Hold Hold Sell Hold Buy Hold Buy Buy Hold Hold Buy Hold Hold Hold Buy Buy Hold Buy Buy Buy Buy Buy Buy Buy Buy Buy Hold EUR EUR EUR EUR EUR EUR EUR EUR GBp CHF GBP EUR CHF GBP EUR CHF EUR EUR GBP EUR USD EUR USD USD NOK EUR $ $ $ $ $ $ $ $ $ $ $ $ JPY TWD TWD JPY JPY KRW JPY JPY 66.2 63.1 57.1 31.4 91.4 95.2 114.3 49.9 273.2 17.1 1723.0 43.7 924.0 1925.0 11.8 2241.0 21.1 36.1 1439.0 166.6 59.9 54.8 18.4 303.0 287.3 54.5 46.4 38.3 96.1 92.4 79.1 68.0 59.0 91.4 102.5 66.9 60.2 56.4 533 106 88.1 398 1,510 471000 4,180 4,065 75.0 70.0 69.0 20.0 85.0 98.0 135.0 58.0 340.0 14.0 1980.0 42.0 920.0 2250.0 12.0 2600.0 24.0 48.0 1250.0 135.0 55.0 45.0 15.5 380.0 340.0 65.0 50.0 40.0 95.0 80.0 87.0 75.0 62.0 110.0 102.0 64.0 65.0 65.0 630 79.6 68.7 500 2,000 490000 6,000 3,600 6.5 6.3 5.5 3.0 5.3 5.6 7.9 4.0 0.3 1.3 113.7 3.6 55.3 133.9 0.8 139.3 1.6 2.6 79.7 10.5 1.2 3.7 0.3 21.0 31.3 4.81 4.0 2.5 6.2 6.0 4.4 2.9 3.2 5.6 5.3 3.3 4.1 3.5 52.2 6.4 5.6 40.6 129.0 37066.3 408.1 242.6 7.2 6.9 6.2 3.1 8.6 6.3 9.1 4.6 0.4 1.3 126.6 4.0 64.1 149.8 0.8 166.6 1.8 2.9 87.4 12.6 1.3 4.1 0.4 23.7 27.2 5.42 4.6 3.1 6.7 6.3 6.0 3.4 3.5 6.3 6.0 3.8 4.6 4.0 56.5 7.2 6.3 53.9 141.3 40829.2 432.5 261.4 10.2 10.0 10.3 10.4 17.4 17.0 14.4 12.5 12.7 13.4 15.1 12.0 16.7 14.4 14.3 16.1 13.2 14.0 18.0 15.8 14.2 14.9 18.7 15.0 9.2 11.3 11.6 15.0 15.5 15.3 18.0 23.8 18.3 16.2 19.2 20.2 14.7 16.3 10.2 16.6 15.7 9.8 11.7 12.7 10.2 16.8 9.2 9.1 9.2 10.2 10.6 15.2 12.5 11.0 11.1 12.9 13.6 10.9 14.4 12.9 14.1 13.5 11.9 12.5 16.5 13.2 13.1 13.5 12.5 13.3 10.6 10.1 10.1 12.6 14.3 14.7 13.2 20.3 16.9 14.5 17.1 17.6 13.2 14.1 9.4 14.8 14.0 7.4 10.7 11.5 9.7 15.5 5.3 5.7 6.5 6.1 8.4 8.8 7.7 6.1 8.2 6.7 9.7 5.6 10.5 8.6 7.4 9.1 9.2 8.2 11.2 7.5 10.5 8.8 9.6 9.4 6.0 7.8 7.5 7.3 9.1 9.0 10.4 11.8 12.8 8.7 11.1 9.3 9.4 7.3 3.7 11.1 11.8 6.0 4.4 8.2 3.5 6.0 4.6 5.2 5.9 5.8 5.3 8.0 6.8 5.5 7.1 5.6 8.5 5.0 9.4 7.7 6.7 7.6 8.4 7.3 9.9 6.3 9.6 8.0 7.2 8.5 6.2 6.9 6.9 6.7 8.9 8.8 7.9 10.5 11.9 8.2 10.3 8.5 8.7 6.7 3.2 9.4 10.3 5.2 3.7 7.5 3.0 5.5 5,814 82,835 6,786 4,550 10,516 38,629 27,804 16,652 2,769 4,772 3,732 10,147 9,298 6,645 2,558 6,204 2,718 5,834 1,300 11,823 21,925 14,995 2,287 30,579 15,159 64,429 7,221 43,428 15,179 14,499 35,291 36,473 50,402 19,238 31,371 5,607 5,561 2,756 8,741 22,369 23,851 7,706 4,325 28,722 8,048 20,242 Cur. Price 07/04/2011 Target Price Est. Earnings FY11E FY12E P/E^ FY11E FY12E EV/EBITDA FY11E FY12E Mkt Cap (US$ m)

Source: Datastream, Capital IQ & Deutsche Bank estimates. Syngenta Share price is in Swiss Francs but reporting is in US dollars, ICL and MA Industries report in US$ while the stock price are in ILS. *For Johnson Matthey 2011E is March ending 2012. For additional information on all stocks mentioned here please refer to our website at: http://gm.db.com

Page 2

Deutsche Bank AG/London

8 April 2011

Chemicals Global Chemicals Weekly

Europe: valuation & newsflow

Givaudan (GIVN.VX, HOLD): Q1 sales rose by 3.1% ex FX which we view as disappointing given Givaudans leading position. Q1 10 comps were admittedly tough but we believe this was mostly a return to a normal situation. This performance reflects the lumpiness of F&F sales and we anticipate some improvement from Q2. H1 should be weak however due to severe raw material & FX headwinds whilst pricing will only start rising in Q2 with a full annual benefit only expected in 2012 (we forecast a 5% EBITDA decline in 2011). At 14.6x 12E P/E we see better value elsewhere. HOLD. Our DCF based TP is based on a WACC of 8.0% (COE 8.7%, COD 3.7%) and a 2.5% TGR. Key risks: higher/lower sales growth (volume/pricing), higher/slower customer innovation, raw material cost decrease/increase. Victrex (VCTX.L, HOLD): 1) Volumes up 23% YoY. H1 sales volumes were approximately 1,434 tonnes, up 23% YoY, 1.5% below our forecast of 1456 tonnes. Following the update in February when tonnage of approximately 682 tonnes for Q1 11 was reported, this implies average tonnage of 752 tonnes for Q2 11 indicating an improvement of 10% both YoY and QoQ. The strength appears to have been stable through Q2, with all months from Jan to March being strong and April appearing to have started off strongly. The company is not seeing any slowdown (yet) from Japan (9% of sales) or auto customers. By region, Europe and Asia/Pacific were strong whilst US was lagging slightly but showed some recovery in March. By end-use industries, management indicated that the strength has been broad-based. 2) Invibio revenues up 10% YoY but materially below our forecast. Invibio revenues in H1 11 were 24.3m, up 10% YoY but 15% below our estimates, mainly because of adverse market conditions in US. The US represents 75% of the Invibio market and is currently experiencing pressures from changes in the regulatory environment and reimbursement system. The company, however, sees strong growth opportunities in new market areas and geographies 3) No outlook given; full half-year results on 24 May. Mgmt has not provided any guidance with this IMS, other than highlighting (already flagged) continuing challenging conditions for Invibio in the US. We expect more details with the full half year results on 24 May. Victrex's strong volume growth momentum is encouraging, but the with the stock already trading on 18.2x 2011E P/E and 11.2x 2011E EV/ EBITDA, we see it as fully valued. 4) Read-across supportive for engineering plastics/Q1 chemical results. This IMS highlights the continuing robust demand levels for Engineering Plastics across the sector and we believe these encouraging demand levels will help companies to use their pricing power and offset the raw material pressure. We expect to see similar trends in BASF (B, EUR 63.43) Plastics, DSM (H, EUR44.06) Performance Materials and Rhodia (H, EUR31.33) plastics business which have similar end markets to Victrex Polymer Solutions. As highlighted recently in our Q1 chemical preview book, we expect the sector to report a strong Q1 in general. Bayer AG (BAYGn.DE, BUY): Data from the MAGELLAN PhIII study Xarelto in prevention of venous thromboembolism (VTE) in hospitalized patients with acute medical illness has been presented at the 60th American College of Cardiology (ACC) Annual Scientific Session. Key points are as follows: (1) Xarelto met its primary efficacy endpoints, demonstrating non-inferiority to Lovenox in short-term use (c. 10 days) and superiority over Lovenox/placebo in long-term use (c. 35 days). (2) Xarelto was associated with increased clinically relevant bleeding (2.8% vs 1.2% at 10 days and 4.1% vs 1.7% at 35 days) in the study. (3) Although the numbers of bleeds were small, the overall low number of VTE events (2.7%-5.7%) meant there was a net clinical disbenefit for treatment of Xarelto versus Lovenox. <2% negative impact on 2016E EPS; little read-through to other settings. The VTE prevention in the medically ill setting contributed to c. 5% of our 2016E sales forecast for Xarelto (currently 4.8bn) and <2% of our 2016E EPS forecast. The observation of higher rate of bleeding with Xarelto versus Lovenox is somewhat of a surprise given that

Deutsche Bank AG/London

Page 3

8 April 2011

Chemicals Global Chemicals Weekly

previous trials of the drug in VTE prevention following surgery (RECORD-1 through -4) have not demonstrated a meaningful increased risk versus Lovenox. This may reflect the more heterogeneous patient population and likely poor health status in MAGELLAN. We also note that further analyses of the MAGELLAN trial are being conducted and will be presented later this year. These could still demonstrate a net benefit in subgroups of patients. Although disappointing, we believe the outcome of MAGELLAN has little readthrough to Xarelto's potential in other indications. As a reminder trials in stroke prevention in atrial fibrilation (SPAF; which makes up c. 80% of our peak sales forecast) have compared the drug to warfarin and shown a similar or lower risk of bleeding with a meaningful net clinical benefit. We continue to expect an approval of Xarelto by the FDA in SPAF later this year and for Xarelto to become a class leader based on its once-daily dosing. Solvay (SOLB.BR, HOLD): Solvay is planning to acquire Rhodia for E6.6bn in cash. We think Rhodia is a good strategic fit for Solvay, increasing the group's exposure to emerging markets and more specialty, less cyclical businesses. We also welcome that Rhodia's CEO (good track record) is set to eventually become CEO of Solvay as it also reduces the integration risk. Post this deal (expected to close end Aug 11), we believe Solvay should trade on 5.3x 12E EV/EBITDA (ex CERs) vs. peers on 5.1x. With no valuation advantage and the usual integration risk, we maintain our HOLD. We base our TP on DCF (WACC: 8.4%; tgr: 1.75%). Key upside/downside risks are lower/higher GDP, higher/lower raw mat. cost (mostly oil & gas based), FX and less/more severe-than-expected price erosion. Other risks include lower/higher than expected synergies from Rhodia acquisition and any possible disruptions in integration. Other key risks include CERs/Carbon credit risks. Chemical Databook - Inflation is not all bad: High inflation across many input costs is now so visible that chemical companies are finding discussions with customers easier (although the exact quantum of inflation passed onto customers will still depend on market share). Q1 results should be strong with volume support for most and cost inflation pressures increasingly being dealt with. We focus on cyclicals with strong share (cope best with inflation) alongside undervalued niche growth. Our top picks are Linde, BASF, Arkema, Lanxess, Syngenta. We also like Akzo, Symrise and Croda. Following strong performance in 2009 and 2010 it is tempting to underweight the sector. However, the sectors valuation is not unattractive and with >60% sales coming from non chemical-cycle businesses, we see some interesting opportunities based on niche growth or specific cyclical themes (often supported by strong market shares and/or structural tightness). Our top picks are Linde, BASF, Arkema, Lanxess, Syngenta. We also favour AkzoNobel, Symrise and Croda (top UK pick). We value the sector using DCF/SOTP. Risks are FX, GDP, oil.

Page 4

Deutsche Bank AG/London

Deutsche Bank AG/London Page 5

8 April 2011

Figure 4: European Valuations

Company Bulk Arkema BASF Lanxess Rhodia Solvay Industrial Gases Air Liquide Linde Specialties AkzoNobel AZ Electronic Mat Clariant Croda DSM Givaudan Johnson Matthey Kemira Sika Symrise Umicore Victrex Wacker Agrochemicals ICL K+S MA Industries Syngenta Yara Hybrids Bayer Sector Average 64,121 Buy EUR 54.52 65.0 20,686 14,464 2,263 30,215 14,580 Hold USD Sell EUR Hold USD Buy USD Hold NOK 59.88 54.84 18.35 303.00 287.30 55.0 45.0 15.5 380.0 340.0 16,064 2,700 4,647 3,571 9,988 9,298 6,310 2,449 6,142 2,673 5,612 1,224 11,188 Buy Buy Sell Buy EUR GBp CHF 49.91 273.20 17.07 43.74 924.00 11.81 21.11 36.13 166.55 58.0 340.0 14.0 1980.0 42.0 920.0 2250.0 12.0 2600.0 24.0 48.0 1250.0 135.0 37,800 26,934 Hold EUR Buy EUR 95.15 114.25 98.0 135.0 5,593 79,548 6,232 2,978 9,550 Buy Buy Buy EUR EUR EUR 66.16 63.11 57.07 31.35 91.41 75.0 70.0 69.0 20.0 85.0 Mkt Cap US$ Rec. Cur Price 07/04/11 Target 11E 11.6 10.2 10.0 10.3 10.4 17.4 15.7 17.0 14.4 14.4 12.5 12.7 13.4 15.1 12.0 16.7 14.4 14.3 16.1 13.2 14.0 18.0 15.8 14.4 14.2 14.9 18.7 15.0 9.2 11.3 11.3 13.9 P/E 12E 9.7 9.2 9.1 9.2 10.2 10.6 13.8 15.2 12.5 12.9 11.0 11.1 12.9 13.6 10.9 14.4 12.9 14.1 13.5 11.9 12.5 16.5 13.2 12.6 13.1 13.5 12.5 13.3 10.6 10.1 10.1 12.2 13E 8.8 8.1 8.9 7.9 9.8 9.4 12.4 13.7 11.0 11.8 10.7 9.8 10.9 12.5 10.3 12.7 11.7 13.9 11.8 10.8 11.6 15.3 na 11.7 12.3 12.5 11.7 11.8 10.0 8.6 8.6 11.1 11E 6.4 5.3 5.7 6.5 6.1 8.4 8.2 8.8 7.7 8.3 6.1 8.2 6.7 9.7 5.6 10.5 8.6 7.4 9.1 9.2 8.2 11.2 7.5 8.9 10.5 8.8 9.6 9.4 6.0 7.8 7.8 8.0 EV/EBITDA 12E 5.3 4.6 5.2 5.9 5.8 5.3 7.4 8.0 6.8 7.3 5.5 7.1 5.6 8.5 5.0 9.4 7.7 6.7 7.6 8.4 7.3 9.9 6.3 7.9 9.6 8.0 7.2 8.5 6.2 6.9 6.9 7.1 13E 4.9 4.0 4.9 5.2 5.5 4.8 6.7 7.3 6.1 6.7 5.2 6.2 5.1 7.6 4.6 8.4 6.9 6.4 6.5 7.7 6.7 8.9 na 7.3 9.0 7.4 6.9 7.5 5.6 5.8 5.8 6.4 11E 1.0 0.7 1.0 0.8 1.0 1.4 2.0 2.2 1.8 1.9 0.8 2.7 0.8 2.3 0.8 2.3 1.9 0.9 1.2 1.9 2.0 5.2 1.9 2.0 3.5 2.0 1.2 2.2 1.1 1.6 1.6 1.7 EV/Sales 12E 0.8 0.6 0.9 0.7 0.9 0.9 1.9 2.0 1.7 1.7 0.7 2.4 0.7 2.1 0.7 2.1 1.7 0.8 1.1 1.8 1.8 4.7 1.7 1.9 3.3 1.9 1.2 2.1 1.0 1.5 1.5 1.6 13E 0.8 0.6 0.9 0.7 0.9 0.8 1.7 1.9 1.5 1.5 0.7 2.1 0.7 1.9 0.7 1.9 1.6 0.7 1.0 1.7 1.6 4.2 na 1.8 3.1 1.8 1.1 1.9 0.9 1.3 1.3 1.4 11E 5.3% 4.7% 10.3% 1.5% 6.6% 3.6% 4.1% 4.1% 4.1% 5.7% 5.2% 6.1% 4.0% 5.2% 12.7% 4.8% 5.0% 5.6% 5.1% 6.6% 7.2% 4.4% 2.5% 2.9% 6.2% 5.4% -9.4% 5.5% 7.0% 8.0% 8.0% 5.1% FCF Yield % 12E 7.1% 6.4% 9.3% 5.0% 8.0% 7.1% 4.9% 4.7% 5.0% 6.1% 6.5% 7.9% 4.9% 6.8% 8.9% 5.3% 6.7% 4.1% 6.3% 7.7% 4.4% 5.5% 4.0% 5.3% 7.0% 6.4% -0.3% 6.5% 7.1% 9.0% 9.0% 6.2% 13E 8.8% 9.8% 9.5% 7.6% 8.7% 8.1% 5.7% 5.6% 5.8% 7.3% 6.6% 8.9% 8.3% 7.4% 9.5% 6.4% 7.0% 6.1% na 9.1% 5.1% 5.7% na 6.2% 7.2% 6.9% 1.0% 8.0% 7.6% 10.1% 10.1% 7.3% Dividend Yield% 11E 2.2% 1.8% 3.5% 1.2% 1.9% 2.5% 2.4% 2.8% 2.1% 2.5% 2.8% 2.8% 1.2% 2.4% 3.0% 2.3% 2.7% 3.8% 2.5% 3.3% 2.5% 1.9% 1.6% 2.6% 4.9% 3.0% 0.0% 2.6% 2.3% 3.0% 3.0% 2.5% 12E 2.6% 2.3% 3.8% 1.3% 2.1% 3.4% 2.7% 3.1% 2.3% 2.8% 3.3% 3.2% 1.5% 2.7% 3.0% 2.4% 3.0% 4.2% 2.6% 4.2% 2.8% 2.0% 1.9% 2.8% 5.3% 3.3% 0.0% 3.0% 2.3% 3.2% 3.2% 2.8% 13E 2.9% 2.6% 4.2% 1.8% 2.2% 3.6% 3.0% 3.5% 2.5% 3.1% 4.0% 3.6% 1.8% 2.9% 3.0% 2.4% 3.3% 4.2% 2.7% 4.6% 3.0% 2.1% na 3.0% 5.7% 3.6% 0.0% 3.3% 2.4% 3.4% 3.4% 3.1%

Chemicals Global Chemicals Weekly

Hold EUR Hold EUR

GBP 1723.00

Hold EUR Hold CHF Buy Buy Buy Buy Hold EUR EUR EUR

GBP 1925.00 CHF 2241.00

Hold GBP 1439.00 Hold EUR

Notes: 1) FCF defined as free cashflow before acquisitions, dividends and share buyback programmes but after restructuring payments. 2) FCF Yield is defined as FCF / Market Cap

Source: Deutsche Bank estimates, Syngenta Share price is in Swiss Francs but reporting is in US dollars, ICL and MA Industries report in US$ while the stock price are in ILS. *For Johnson Matthey 2011E is March ending 2012...

Page 6 Deutsche Bank AG/London

8 April 2011

Figure 5: European chemical sector financial performance

Company 11E Bulk Arkema (Euro) BASF (Euro) Lanxess (Euro) Rhodia (Euro) Solvay (Euro) Industrial Gases Air Liquide (Euro) Linde (Euro) Specialties AkzoNobel (Euro) AZ Electronic (US$) Clariant (CHF) Croda(GBP) DSM (Euro)

Givaudan (CHF)

Sales 12E 7,610 8,607 5,886 12457 13E 7,872 9,225 6,054 12840

Net debt 11E 508 1253 1,032 1780 5,414 5,124 583 337 1,409 183 -179 1,016 462 455 162 -70 516 -37 1,256 1,221 4,848 6,883

Net Debt BV/Share /EBITDA 11E 0.5 0.8 1.2 1.1 1.3 1.4 1.6 0.3 1.4 1.4 0.7 -0.1 1.1 0.8 1.3 0.3 -0.7 0.3 0.0 3.6 0.4 0.3 0.9 11E 38.57 27.56 25.98 -1.69 93.41 32.99 65.99 66.51 1.72 8.51 222.73 35.52 390.1 733.89 7.51 15.11 2.60 2.25 14.91 2.95 87.33 134.9 23.59 11E 11.9 8.7 12.6 9.0 11.3 10.5 15.9 17.2 14.1 14.2 10.4 19.8 9.5 20.3 9.4 14.2 16.7 15.2 18.3 42.5 20.7 29.6 18.4 8.2 19.1 15.0 15.7 15.7 15.8

EBIT Margin 12E 12.2 8.9 12.9 9.3 11.1 11.0 16.5 17.4 15.1 14.7 10.7 20.8 9.6 20.8 9.7 16.4 16.8 15.8 18.5 43.1 21.1 30.6 19.3 11.5 20.2 12.5 16.3 16.3 16.3 13E 12.1 9.3 12.8 9.5 10.7 11.1 16.8 17.7 15.6 14.9 10.5 21.5 9.8 20.8 9.7 17.1 17.3 16.5 18.5 43.2 21.8 31.5 19.7 11.2 21.1 12.7 17.6 17.6 16.7

EBITDA Margin 11E 16.9 13.4 17.6 12.7 16.6 16.3 24.6 25.5 23.2 19.2 13.4 33.0 12.6 24.1 14.6 21.6 22.3 20.5 24.3 47.0 24.8 33.3 23.0 13.0 23.8 18.4 20.5 20.5 21.4 12E 17.2 13.6 17.9 12.7 16.3 16.6 25.0 25.8 23.9 19.4 13.7 33.1 12.9 24.6 14.9 22.2 22.0 21.1 24.1 47.3 25.1 34.2 23.9 16.1 24.4 16.2 21.1 21.1 21.7 13E 17.0 14.1 17.7 12.8 16.0 16.8 25.3 26.0 24.3 19.5 13.5 33.1 13.0 24.6 14.9 22.8 22.4 21.8 23.7 47.2 25.7 34.9 24.4 15.7 25.2 16.4 22.1 22.1 22.1 11E 20.5 18.1 22.8 15.6 21.2 7.8 17.5 16.8 18.5 18.0 20.8 15.9 9.8 28.8 14.3 13.7 17.1 17.3 15.1 48.0 24.7 36.4 24.2 9.6 19.2 22.0 16.0 16.0 20.0

CFRoA 12E 20.4 19.4 22.1 16.1 20.5 10.9 18.2 17.4 19.5 18.8 21.7 17.9 10.9 30.1 14.9 14.6 18.1 18.2 15.4 48.4 25.4 38.0 25.2 12.1 20.3 19.6 17.5 17.5 20.7 13E 20.5 20.4 22.1 16.7 20.2 11.3 18.8 17.8 20.2 19.3 21.6 20.0 11.3 31.4 15.1 15.5 18.8 19.3 15.4 48.8 26.2 38.9 25.6 11.9 21.6 19.9 19.7 19.7 21.5 11E 17.7 15.7 19.1 17.1 22.2 7.3 16.8 15.2 19.0 17.7 14.9 14.2 13.2 33.2 14.1 15.5 20.6 15.9 15.8 55.1 30.1 44.0 28.4 8.9 25.4 24.4 13.7 13.7 19.8

RoCE 12E 18.9 17.0 20.0 17.9 21.6 11.3 17.6 15.7 20.1 18.8 16.0 17.0 12.1 35.5 14.9 16.6 22.4 16.9 16.7 56.6 31.0 46.0 28.7 12.7 28.0 20.2 15.5 15.5 21.1 13E 19.1 18.2 20.0 19.0 21.0 11.7 18.2 16.2 20.9 19.6 16.2 19.9 12.6 37.5 15.2 18.0 23.7 18.0 17.0 57.6 32.3 47.3 28.9 12.4 30.4 20.6 19.1 19.1 22.2 11E 12.3 15.9 23.0 16.5 -171.3 5.6 14.5 16.1 12.2 15.9 10.1 20.1 7.1 51.1 10.3 14.6 18.2 20.3 17.2 31.0 29.1 48.2 24.6 9.4 23.1 21.3 18.3 18.3 18.1

RoE 12E 39.7 15.5 22.2 16.3 487.6 8.5 14.9 16.4 12.9 16.0 10.9 21.6 7.7 45.2 10.5 15.2 18.2 20.3 17.1 30.2 27.5 45.3 23.7 12.3 23.4 16.2 19.3 19.3 25.8 13E 22.3 15.5 20.4 16.7 104.5 8.9 15.1 16.4 13.3 15.4 10.7 22.7 8.5 37.9 10.4 15.7 17.9 20.4 16.5 26.6 26.2 42.2 22.3 11.6 23.3 15.3 20.7 20.7 20.8

Chemicals Global Chemicals Weekly

6,925 8,072 5,729 8274

71,207 73,629 75,530 10,159

14,707 16,048 17,272 13,790 14,782 15,829 15,915 16,607 17,080 750 8,032 1,128 8,906 4,235 2,487 1,666 2,151 216 6,181 5,558 2,676 823 9,122 1,207 9,365 4,404 2,722 1,733 2,386 233 6,426 5,739 2,894 899 9,422 1,292 9,734 4,548 2,865 1,793 2,588 250 6,601 5,892 3,074

JMAT (GBp) Symrise (Euro) Umicore (Euro) Victrex (GBp) Agrochemicals ICL (US$) K+S (Euro) MA Industries (US$) Syngenta (US$) Yara (NOK) Hybrids Bayer (Euro) Sector Average Notes:

12,865 13,570 14,152 79,798 82,292 83,938 37,107 39,039 41,596

1) BV/Share adjusted for previously written-off goodwill. 2) EBITA and EBITDA margins shown on an underlying basis where possible 3) CFRoA is defined as EBITDA divided by Total Assets (adjusted for Goodwill write-offs) minus Cash 4) RoCE defined as EBITA divided by Total Shareholder Funds (adjusted for Goodwill write-offs), Net Debt and other long-term items 5) RoE defined as pre goodwill net income divided by Total Shareholder funds (adjusted for Goodwill write-offs)

Source: Deutsche Bank estimates, Syngenta Share price is in Swiss Francs but reporting is in US dollars, ICL and MA Industries report in US$ while the stock price are in ILS. Croda BV/Share is in Pence. *For Johnson Matthey 2011E is March ending 2012.

8 April 2011

Chemicals Global Chemicals Weekly

Figure 6: Absolute stock price performance (%) as on 07th April, 2011

1 WK Rhodia Solvay Lanxess Victrex Wacker Chemie ICL BASF Johnson Matthey Umicore Arkema Clariant AkzoNobel K+S Linde Croda International Yara International Symrise Syngenta Air Liquide DSM Koninklijke Givaudan MA Industries Bayer AZ Electronic Mats.(Di)

Source: Datastream

2 WK 55.5 11.8 10.6 7.6 5.8 2.4 8.4 4.3 3.3 6.2 5.2 5.8 3.3 4.6 4.7 5.2 3.0 2.3 2.3 1.5 0.6 5.2 1.7 2.8

3 WK 58.4 17.6 17.4 10.0 12.2 8.5 14.8 7.1 7.0 19.7 17.7 9.3 9.3 8.5 6.5 8.7 7.4 5.4 7.7 7.0 3.4 4.6 4.2 1.2

4 WK 55.0 10.7 7.2 9.6 25.7 6.9 7.9 5.2 3.0 16.7 14.7 4.1 4.5 2.3 8.4 7.2 5.9 1.0 2.1 3.1 -1.0 2.7 -0.7 -2.1

5 WK 51.8 7.2 3.7 6.5 22.9 1.4 3.4 1.2 -3.8 12.3 11.3 2.3 -3.3 1.6 7.3 -0.9 12.3 -1.9 1.3 0.5 -1.5 1.3 -4.7 -10.4

6 WK 54.4 10.3 9.6 14.5 26.9 4.0 7.3 6.2 -0.1 29.8 11.4 1.8 1.4 6.1 11.1 0.4 12.0 0.3 3.6 3.8 1.3 1.4 -0.6 -6.3

7 WK 40.4 8.6 -0.2 7.7 20.0 -6.4 3.9 -1.7 -6.2 21.6 13.8 -0.5 -4.4 3.1 16.2 -5.9 5.1 -3.0 1.1 0.0 -1.9 -1.1 -3.4 -11.0

8 WK 42.3 16.7 1.9 6.3 19.9 -3.1 8.1 -3.0 -4.8 23.9 0.1 1.2 -4.7 4.3 17.5 -11.1 4.9 -5.1 1.3 -0.7 1.5 -0.4 -1.8 -13.9

51.7 9.4 8.2 6.6 5.0 4.5 3.5 3.5 3.2 3.2 3.0 2.9 2.9 2.7 2.7 2.5 1.8 1.5 1.5 0.9 0.1 -0.3 -0.5 -1.0

Deutsche Bank AG/London

Page 7

8 April 2011

Chemicals Global Chemicals Weekly

US: valuation & newsflow

Figure 7: US chemicals sector valuation

Price Rating MAJOR CHEMICALS Celanese Dow Solutia Eastman PPG Kronos Westlake AGROCHEMICALS Agrium Mosaic Monsanto Potash Corp INDUSTRIAL GAS Air Products Praxair Airgas SPECIALTY CHEMICALS Ashland Albemarle Cytec Ecolab Lubrizol Sigma Aldrich Spartech Valspar Buy Hold Buy Buy Hold Buy Hold Buy Hold Hold Hold Buy Buy Hold Hold Buy Buy Hold Hold Buy Hold $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 46.4 38.3 25.3 100.3 96.1 58.2 59.1 92.4 79.1 68.0 59.0 91.4 102.5 66.9 59.6 60.2 56.4 51.5 134.1 64.8 7.3 40.2 50.0 40.0 30.0 110.0 95.0 60.0 45.0 80.0 87.0 75.0 62.0 110.0 102.0 64.0 55.0 65.0 65.0 52.0 140.0 10.0 36.0 4.00 2.55 2.20 8.10 6.20 4.65 3.75 6.05 4.40 2.85 3.23 5.65 5.35 3.31 6.49 4.10 3.45 2.50 11.50 3.54 0.40 2.55 4.60 3.05 2.50 9.00 6.70 5.55 4.00 6.28 6.00 3.35 3.48 6.30 6.00 3.80 8.20 4.55 4.00 2.80 12.50 3.89 0.80 2.80 11.6 15.0 11.5 12.4 15.5 12.5 15.7 15.3 18.0 23.8 18.3 16.2 19.2 20.2 9.2 14.7 16.3 20.6 11.7 18.3 18.0 15.7 10.1 12.6 10.1 11.1 14.3 10.5 14.8 14.7 13.2 20.3 16.9 14.5 17.1 17.6 7.3 13.2 14.1 18.4 10.7 16.7 9.1 14.4 7.5 7.3 7.3 6.6 9.1 7.3 7.4 9.0 10.4 11.8 12.8 8.7 11.1 9.3 4.8 9.4 7.3 10.1 6.7 10.8 5.8 9.4 6.9 6.7 6.7 6.2 8.9 6.3 7.0 8.8 7.9 10.5 11.9 8.2 10.3 8.5 4.1 8.7 6.7 9.3 6.4 10.0 4.4 9.1 7,221 43,428 3,018 7,124 15,179 3,373 3,920 14,499 35,291 36,473 50,402 19,238 31,371 5,607 4,650 5,561 2,756 11,941 8,374 7,898 222 3,870 Cur. 07/04/2011 Target price Est. Earnings FY11E FY12E P/E^ FY11E FY12E EV/EBITDA FY11E FY12E Mkt Cap (US$ m)

Source: Datastream & Deutsche Bank estimates, Capital IQ estimates where stocks are not rated. ^=P/E are calculated on pre-goodwill EPS please see https://gm.db.com/Equities for further details and disclosures.

Monsanto (MON.N, HOLD): Monsanto shares fell 6% following its Q2 release due to the lack of earnings upside in Q2 and likely '11 (guidance < consensus) despite record commodity prices. In addition, upside to '12 also looks limited as Monsanto reaffirmed that its primary focus next year will remain driving adoption of its next generation seeds. As a result seed pricing will be up "moderately" in '12 (10-15% est.) vs the 15- 20%-plus that could be justified given current commodity prices. With valuation already 24x '11E EPS, we believe upside in the shares, in the near-term, is limited. Our $75 TP = $4 for Ag Productivity (DCF, rfr 4%; beta 1; erp 4.5%; Ke 8.5%; Tg - 2%) + $71 for Seeds & Genomics, (23.2x 12E Seeds EPS of $3.05). Risks include delayed regulatory approvals and higher/lower grain prices. Westlake Chemical (WLK.N, HOLD): The announcement of ethylene capacity expansions by Westlake Chemical, following a similar announcement on March 28 by Chevron- Phillips Chemical, are designed to increase the company's ethylene integration and to take advantage of abundant low cost ethane resulting from growing production of natural gas liquids (NGLs) from shale gas sources in North America. As we outlined in our 3/25/11 note, "CMAI Day 2: New US Ethylene Capacity and Ethane", we expect several ethylene capacity additions in North America, reflecting the industry's increased confidence in the sustainability of a US natural gas based cost advantage. According to CMAI, US ethylene cash costs from ethane of $630/m.t. in March were advantaged by $584/m.t. (27c/lb) over Southeast Asia (naphtha) and $476/m.t. (22c/lb) vs Western Europe (naphtha). Westlake announced plans to expand the capacity of its two Lake Charles, LA light feedstock ethylene crackers (combined capacity of 2.5B lbs/yr), upgrade its ethylene facilities at Calvert City, KY, and evaluate expansion options for the Calvert City site. The first Lake Charles expansion is expected to be in the range of 230-240MM lbs/yr of production capacity, representing 0.4% of US ethylene capacity and 0.3% of North American ethylene

Page 8 Deutsche Bank AG/London

8 April 2011

Chemicals Global Chemicals Weekly

capacity. With the company expecting to complete the first expansion in late '12 and the second by year-end '14, the Lake Charles site will be able to crack a higher proportion of ethane in order to produce ethylene for its ethylene derivative units and the merchant market. At Calvert City, Westlake plans to convert its ethylene cracker (450MM lbs/yr) from propane to lower cost ethane feedstock and will consider additional expansion options. With engineering and design studies under way, we expect the company to announce an additional ethylene cracker at the site. Chemicals/Commodity - Solvay Bid for Rhodia Removes a Possible Buyer of US Assets: Belgium-based Solvay announced an agreement to acquire France-based Rhodia for E6.6B (US$9.4B). According to our European chemicals team, the acquisition equates to a 2010 EBITDA multiple of 7.3x (and 8.5x ex carbon credits) and EV/Sales of 1.3x. Rhodia is a leading producer of specialty chemicals (silica, rare earths, and surfactants), acetate tow (for cigarettes) and engineering plastics based on Polyamide 6.6. Since Solvay announced the sale of its Pharmaceutical business in September 2009 for E4.5B ($6.4B), the company was widely thought of as a possible acquirer of US specialty chemical assets. Among the assets/companies most often mentioned were Cytec, FMC, Solutia and Rockwood (see our Industry Alert April 4th 2011). With this announcement, we believe Solvay is no longer a buyer of US assets. While Solvay has likely been removed as a possible buyer of US assets, we note this is the second large transaction in specialty chemicals in 3 weeks (Lubrizol/Berkshire Hathaway), highlighting, in our view, the stillattractive valuations that exist for a number of high-quality specialty chemical companies. With stronger balance sheets, easier financing, and an improved macro picture, we expect acquisition activity to continue in chemicals in 2011. We believe potential consolidation candidates include Cytec, Rockwood, Solutia, and Valspar (as discussed in detail in our 2011 Outlook piece on Jan 10th).

Deutsche Bank AG/London

Page 9

8 April 2011

Chemicals Global Chemicals Weekly

Asia: valuation & newsflow

Figure 8: Asia and Japan chemicals sector valuation

Price Rating MAJOR CHEMICALS Asahi Kasei Formosa Chems & Fibre Formosa Petrochemical Formosa Plastics Mitsubishi Chem Holdings Mitsui Chemicals Nan Ya Plastics Sumitomo Chemical Tosoh SPECIALTY CHEMICALS Hitachi Chemical JSR LG Chem Nitto Denko Shin-Etsu Chemical Sumitomo Bakelite Tokyo Ohka Kogyo Buy Buy Buy Buy Hold Hold Hold JPY JPY KRW JPY JPY JPY JPY 1,545 1,510 471000 4,180 4,065 469 1,552 2,100 2,000 490000 6,000 3,600 550 1,800 141.65 128.97 37066 408.09 242.58 34.45 88.88 156.06 141.26 40829 432.46 261.42 37.35 102.21 10.9 11.7 12.71 10.2 16.8 13.6 17.5 9.9 10.7 11.54 9.7 15.5 12.6 15.2 3.4 4.4 8.24 3.5 6.0 4.0 2.0 3.0 3.7 7.54 3.0 5.5 3.6 1.5 3,773.3 4,325.1 28722 8,048.1 20,241.5 1,325.2 819.1 Buy Buy Hold Buy Buy Buy Buy Buy Hold JPY TWD TWD TWD JPY JPY TWD JPY JPY 533 119 98 106 513 281 88 398 277 630 84 72 80 800 360 69 500 260 52.20 7.22 4.10 6.38 66.92 24.45 5.61 40.58 21.72 56.50 7.50 4.15 7.17 69.82 28.94 6.29 53.90 29.24 10.2 16.5 23.9 16.6 7.7 11.5 15.7 9.8 12.8 9.4 15.9 23.6 14.8 7.3 9.7 14.0 7.4 9.5 3.7 11.9 13.3 11.1 4.4 5.7 11.8 6.0 5.8 3.2 11.3 12.5 9.4 3.9 5.0 10.3 5.2 5.2 8,740.7 23346.9 32186.2 22369.5 8,271.5 3,302.7 23851.0 7,706.4 1,944.1 Cur. 07/04/11 Target price Est. Earnings FY11E FY12E FY11E P/E^ FY12E EV/EBITDA FY11E FY12E Mkt Cap (US$ m)

Source: Datastream & Deutsche Bank estimates, ^=P/E are calculated on pre-goodwill EPS (except those marked with *).

Mitsubishi Chem. Holdings (4188.T, BUY): The 2 Apr Nikkei reported on damage to Mitsubishi Chemical's Kashima complex. The article says the company incurred more damage than other general chemicals makers; we also have the same view. A company press release dated 23 March says all production facilities have been shut down and that damage to berths and nearby roads makes deliveries and shipments impossible by either water or road. It also says there was severe damage to utility infrastructure in addition to the berths themselves. The release indicated that it will take at least two months for the plant to restart (regular maintenance had been scheduled for the No. 1 facility from midMay and the No.2 facility from end-June, with each to take 1.5 months). The company meanwhile has told us that, while detailed inspections will be needed, production facilities received no major damage. Mitsubishi Chemical's Kashima complex has ethylene capacity of 828,000t/year for use at both facilities combined (premised on regular maintenance being performed during the year), or just over 11% of the domestic capacity total. The complex also contains numerous subsidiaries and derivative makers that source raw material from Mitsubishi Chemical. Major products include PE, PP, VCM and EG. Threemonth shutdown could depress OP by 15-20bn While it is difficult to assess the quake's earnings impact at present, we think OP could be depressed by 15-20bn premised on a three-month shutdown. This is based on the typical effect of regular maintenance and the impact of a fire at the plant's No. 2 ethylene facility in late 2007. The actual impact could be lower, as 1) fixed costs incurred during the shutdown could be booked as non-operating expenses or extraordinary losses, and 2) insurance will cover some of the impact (the plant has earthquake insurance). We intend to review our forecasts to reflect this as well as the decline in automobile production. While we expect the quake to have the negative impact outlined above, we also note that spreads on PTA and other products are running well ahead of our expectations.

Page 10

Deutsche Bank AG/London

8 April 2011

Chemicals Global Chemicals Weekly

DIC Corporation (4631.T, BUY): The Tohoku earthquake has crippled printing ink material production. As reported in the Nikkei on 2 April, Maruzen Petrochemical revealed on 1 April that its alcohol ketone facilities in Chiba Prefecture sustained severe damage in the earthquake and would not be up and running again for at least one year. It is thus suspending shipments of methyl ethyl ketone (MEK) and diisobutylene (DIB). DIB is the basic material for para octyl phenol (POP), used to produce newspaper ink. These inks are made from rosin-modified phenol resin by combining POP and pine resin, which is then mixed with pigments. We believe DIC acquires some of the DIB needed for production of POP for external sale from Maruzen, but it appears to have found an alternative imported product. Most of the POP needed for its ink production is procured externally. The company did not rely significantly on Maruzen for MEK, a gravure ink material. DIC has halted production at its Kashima plant (ink pigments, PPS resin, some base inks) due to the disaster, but said in its 1 April release that it would gradually resume operations from mid April. The release indicated that it aims to restore production at all plants by the end of May. We plan to review our earnings forecast to account for the impact of the plant stoppage and cutbacks in auto production. Damage from the quake will naturally have a negative impact on earnings, but we retain our forecast of sustained steady profit growth in FY3/12 thanks to robust sales of TFT LC materials.

Deutsche Bank AG/London

Page 11

8 April 2011

Chemicals Global Chemicals Weekly

Global valuation and risks

In most cases we value the companies based on a DCF valuation to capture the long-term free-cash-flow prospects. The WACC will vary depending on the stocks volatility, the cost of debt and capital structure. Equity risk premiums and risk-free rates tend to be the same across the sector. Long-term growth rates do vary depending on each companys long-term growth prospects. For companies offering a broad portfolio, we tend to complement our DCF analysis with a SoTP, using peer group EV/EBITDA and PE multiples and a conglomerate discount wherever relevant. Key downside/upside risks for the sector are higher/lower raw material (mostly oil based) costs which cant/can be passed through to customers through higher prices (due to increasing/decreasing competition or weak/strong demand/GDP), FX (generally weaker/higher US$) and weaker/higher GDP.

Page 12

Deutsche Bank AG/London

8 April 2011

Chemicals Global Chemicals Weekly

Reporting dates & events

Figure 9: Reporting dates & events

April 2011 11 Henkel AGM 18 12 19 Syngenta AGM 13 20 Albemarle Q1 11 14 21 AkzoNobel Q1 11 APD Q2 11 DuPont Q1 11 Sherwin Williams Q1 11 28 Bayer Q1 11 DSM AGM Croda Q1 11 & AGM Potash Corp. Q1 11 Lubrizol Q1 11 Dow Q1 11 5 Arkema Q1 11 Rhodia Q1 11 Ecolab AGM 15 Syngenta Q1 11 sales 22 Cytec Q1 11

25

26 Umicore Q1 11 Update Umicore AGM Air Liquide Q1 sales Praxair AGM

27 DSM Q1 11 AkzoNobel AGM Rockwood Q1 11

29 Bayer AGM Yara Q1 11

May 2011 2

3 Kemira Q1 11 Albemarle- Investor Day

9 Solvay Q1 11

10 Agrium AGM Solvay AGM Yara AGM 17

16

23

24 Arkema AGM

4 Agrium Q1 11 Linde Q1 11 Henkel Q1 11 Air Liquide AGM AZ Materials- AGM, IMS Wacker Q1 11 11 K+S Q1 11, AGM Lanxess Q1 11 Symrise Q1 11 Solvay Q1 11 conf call 18 Lanxess AGM Rhodia AGM Symrise AGM MA Industries Q1 11 Wacker AGM 25

6 BASF Q1 11 & AGM Tikkurila Q1 11 Clariant Q1 11

12 Linde AGM Potash Corp. AGM Yule Catto AGM, IMS 19

13

20

26

27

30 June 2011

31 Wacker CMD 1 2 JMAT FY 10/11 9 16 23 3

6 13 20

7 14 21 Syngenta Capital Markets Day

8 15 22

10 17 24

27

28

29 Monsanto Q3 11

30

Source: Company data, Reuters. NOTE: Dates are subject to change.

Deutsche Bank AG/London

Page 13

8 April 2011

Chemicals Global Chemicals Weekly

Appendix 1

Important Disclosures Additional information available upon request

For disclosures pertaining to recommendations or estimates made on a security mentioned in this report, please see the most recently published company report or visit our global disclosure look-up page on our website at http://gm.db.com/ger/disclosure/DisclosureDirectory.eqsr.

Analyst Certification

The views expressed in this report accurately reflect the personal views of the undersigned lead analyst about the subject issuers and the securities of those issuers. In addition, the undersigned lead analyst has not and will not receive any compensation for providing a specific recommendation or view in this report. Tim Jones

Equity rating key Buy: Based on a current 12- month view of total shareholder return (TSR = percentage change in share price from current price to projected target price plus projected dividend yield ) , we recommend that investors buy the stock. Sell: Based on a current 12-month view of total shareholder return, we recommend that investors sell the stock Hold: We take a neutral view on the stock 12-months out and, based on this time horizon, do not recommend either a Buy or Sell. Notes: 1. Newly issued research recommendations and target prices always supersede previously published research. 2. Ratings definitions prior to 27 January, 2007 were: Buy: Expected total return (including dividends) of 10% or more over a 12-month period Hold: Expected total return (including dividends) between -10% and 10% over a 12-month period Sell: Expected total return (including dividends) of 10% or worse over a 12-month period

Equity rating dispersion and banking relationships

1600 1400 1200 1000 800 600 400 200 0

50 %

46 %

27 %

25 %

4%19 %

Sell

Buy

Com panies Covered

Hold

Cos. w BankingRelationship /

Global Universe

Page 14

Deutsche Bank AG/London

8 April 2011

Chemicals Global Chemicals Weekly

Regulatory Disclosures 1. Important Additional Conflict Disclosures

Aside from within this report, important conflict disclosures can also be found at https://gm.db.com/equities under the "Disclosures Lookup" and "Legal" tabs. Investors are strongly encouraged to review this information before investing.

2. Short-Term Trade Ideas

Deutsche Bank equity research analysts sometimes have shorter-term trade ideas (known as SOLAR ideas) that are consistent or inconsistent with Deutsche Bank's existing longer term ratings. These trade ideas can be found at the SOLAR link at http://gm.db.com.

3. Country-Specific Disclosures

Australia: This research, and any access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act. Brazil: The views expressed above accurately reflect personal views of the authors about the subject company(ies) and its(their) securities, including in relation to Deutsche Bank. The compensation of the equity research analyst(s) is indirectly affected by revenues deriving from the business and financial transactions of Deutsche Bank. EU countries: Disclosures relating to our obligations under MiFiD can be found at http://globalmarkets.db.com/riskdisclosures. Japan: Disclosures under the Financial Instruments and Exchange Law: Company name - Deutsche Securities Inc. Registration number - Registered as a financial instruments dealer by the Head of the Kanto Local Finance Bureau (Kinsho) No. 117. Member of associations: JSDA, The Financial Futures Association of Japan. Commissions and risks involved in stock transactions - for stock transactions, we charge stock commissions and consumption tax by multiplying the transaction amount by the commission rate agreed with each customer. Stock transactions can lead to losses as a result of share price fluctuations and other factors. Transactions in foreign stocks can lead to additional losses stemming from foreign exchange fluctuations. "Moody's", "Standard & Poor's", and "Fitch" mentioned in this report are not registered as rating agency in Japan unless specifically indicated as Japan entities of such rating agencies. New Zealand: This research is not intended for, and should not be given to, "members of the public" within the meaning of the New Zealand Securities Market Act 1988. Russia: This information, interpretation and opinions submitted herein are not in the context of, and do not constitute, any appraisal or evaluation activity requiring a license in the Russian Federation.

Deutsche Bank AG/London

Page 15

Deutsche Bank AG/London International locations

Deutsche Bank Securities Inc. 60 Wall Street New York, NY 10005 United States of America Tel: (1) 212 250 2500 Deutsche Bank AG London 1 Great Winchester Street London EC2N 2EQ United Kingdom Tel: (44) 20 7545 8000 Deutsche Bank AG Groe Gallusstrae 10-14 60272 Frankfurt am Main Germany Tel: (49) 69 910 00 Deutsche Bank AG Deutsche Bank Place Level 16 Corner of Hunter & Phillip Streets Sydney, NSW 2000 Australia Tel: (61) 2 8258 1234

Deutsche Bank AG Filiale Hongkong International Commerce Centre, 1 Austin Road West,Kowloon, Hong Kong Tel: (852) 2203 8888

Deutsche Securities Inc. 2-11-1 Nagatacho Sanno Park Tower Chiyoda-ku, Tokyo 100-6171 Japan Tel: (81) 3 5156 6770

Global Disclaimer

The information and opinions in this report were prepared by Deutsche Bank AG or one of its affiliates (collectively "Deutsche Bank"). The information herein is believed to be reliable and has been obtained from public sources believed to be reliable. Deutsche Bank makes no representation as to the accuracy or completeness of such information. Deutsche Bank may engage in securities transactions, on a proprietary basis or otherwise, in a manner inconsistent with the view taken in this research report. In addition, others within Deutsche Bank, including strategists and sales staff, may take a view that is inconsistent with that taken in this research report. Opinions, estimates and projections in this report constitute the current judgement of the author as of the date of this report. They do not necessarily reflect the opinions of Deutsche Bank and are subject to change without notice. Deutsche Bank has no obligation to update, modify or amend this report or to otherwise notify a recipient thereof in the event that any opinion, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Prices and availability of financial instruments are subject to change without notice. This report is provided for informational purposes only. It is not an offer or a solicitation of an offer to buy or sell any financial instruments or to participate in any particular trading strategy. Target prices are inherently imprecise and a product of the analyst judgement. As a result of Deutsche Banks recent acquisition of BHF-Bank AG, a security may be covered by more than one analyst within the Deutsche Bank group. Each of these analysts may use differing methodologies to value the security; as a result, the recommendations may differ and the price targets and estimates of each may vary widely. Deutsche Bank has instituted a new policy whereby analysts may choose not to set or maintain a target price of certain issuers under coverage with a Hold rating. In particular, this will typically occur for "Hold" rated stocks having a market cap smaller than most other companies in its sector or region. We believe that such policy will allow us to make best use of our resources. Please visit our website at http://gm.db.com to determine the target price of any stock. The financial instruments discussed in this report may not be suitable for all investors and investors must make their own informed investment decisions. Stock transactions can lead to losses as a result of price fluctuations and other factors. If a financial instrument is denominated in a currency other than an investor's currency, a change in exchange rates may adversely affect the investment. Past performance is not necessarily indicative of future results. Deutsche Bank may with respect to securities covered by this report, sell to or buy from customers on a principal basis, and consider this report in deciding to trade on a proprietary basis. Unless governing law provides otherwise, all transactions should be executed through the Deutsche Bank entity in the investor's home jurisdiction. In the U.S. this report is approved and/or distributed by Deutsche Bank Securities Inc., a member of the NYSE, the NASD, NFA and SIPC. In Germany this report is approved and/or communicated by Deutsche Bank AG Frankfurt authorized by the BaFin. In the United Kingdom this report is approved and/or communicated by Deutsche Bank AG London, a member of the London Stock Exchange and regulated by the Financial Services Authority for the conduct of investment business in the UK and authorized by the BaFin. This report is distributed in Hong Kong by Deutsche Bank AG, Hong Kong Branch, in Korea by Deutsche Securities Korea Co. This report is distributed in Singapore by Deutsche Bank AG, Singapore Branch, and recipients in Singapore of this report are to contact Deutsche Bank AG, Singapore Branch in respect of any matters arising from, or in connection with, this report. Where this report is issued or promulgated in Singapore to a person who is not an accredited investor, expert investor or institutional investor (as defined in the applicable Singapore laws and regulations), Deutsche Bank AG, Singapore Branch accepts legal responsibility to such person for the contents of this report. In Japan this report is approved and/or distributed by Deutsche Securities Inc. The information contained in this report does not constitute the provision of investment advice. In Australia, retail clients should obtain a copy of a Product Disclosure Statement (PDS) relating to any financial product referred to in this report and consider the PDS before making any decision about whether to acquire the product. Deutsche Bank AG Johannesburg is incorporated in the Federal Republic of Germany (Branch Register Number in South Africa: 1998/003298/10). Additional information relative to securities, other financial products or issuers discussed in this report is available upon request. This report may not be reproduced, distributed or published by any person for any purpose without Deutsche Bank's prior written consent. Please cite source when quoting. Copyright 2011 Deutsche Bank AG

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Construction Agreement SimpleDocumento3 páginasConstruction Agreement Simpleben_23100% (4)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Google Chrome OSDocumento47 páginasGoogle Chrome OSnitin07sharmaAún no hay calificaciones

- Complete Cocker Spaniel Guide 009 PDFDocumento119 páginasComplete Cocker Spaniel Guide 009 PDFElmo RAún no hay calificaciones

- 5 Point Scale PowerpointDocumento40 páginas5 Point Scale PowerpointMíchílín Ní Threasaigh100% (1)

- EEN 203 Slide Notes Year 2018: PART I - Numbers and CodesDocumento78 páginasEEN 203 Slide Notes Year 2018: PART I - Numbers and CodesSHIVAM CHOPRAAún no hay calificaciones

- Deep MethodDocumento13 páginasDeep Methoddarkelfist7Aún no hay calificaciones

- Air Microbiology 2018 - IswDocumento26 páginasAir Microbiology 2018 - IswOktalia Suci AnggraeniAún no hay calificaciones

- Journal of The Folk Song Society No.8Documento82 páginasJournal of The Folk Song Society No.8jackmcfrenzieAún no hay calificaciones

- Grade 10 Science - 2Documento5 páginasGrade 10 Science - 2Nenia Claire Mondarte CruzAún no hay calificaciones

- Corrugated Board Bonding Defect VisualizDocumento33 páginasCorrugated Board Bonding Defect VisualizVijaykumarAún no hay calificaciones

- Total ChangeDocumento9 páginasTotal ChangeaurennosAún no hay calificaciones

- Detailed Award Sheet Government College University, FaisalabadDocumento1 páginaDetailed Award Sheet Government College University, FaisalabadAnayat KhetranAún no hay calificaciones

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDocumento4 páginasSorsogon State College: Republic of The Philippines Bulan Campus Bulan, Sorsogonerickson hernanAún no hay calificaciones

- HelloDocumento31 páginasHelloShayne Dela DañosAún no hay calificaciones

- HitchjikersGuide v1Documento126 páginasHitchjikersGuide v1ArushiAún no hay calificaciones

- Cooking Oils and Smoke Points - What To Know and How To Choose The Right Cooking Oil - 2020 - MasterClassDocumento7 páginasCooking Oils and Smoke Points - What To Know and How To Choose The Right Cooking Oil - 2020 - MasterClasschumbefredAún no hay calificaciones

- STS INVENTOR - Assignment 3. If I Were An Inventor For StsDocumento2 páginasSTS INVENTOR - Assignment 3. If I Were An Inventor For StsAsuna Yuuki100% (3)

- Lyndhurst OPRA Request FormDocumento4 páginasLyndhurst OPRA Request FormThe Citizens CampaignAún no hay calificaciones

- Indiabix PDFDocumento273 páginasIndiabix PDFMehedi Hasan ShuvoAún no hay calificaciones

- Where Is The Love?-The Black Eyed Peas: NBA National KKK Ku Klux KlanDocumento3 páginasWhere Is The Love?-The Black Eyed Peas: NBA National KKK Ku Klux KlanLayane ÉricaAún no hay calificaciones

- Project Report Devki Nandan Sharma AmulDocumento79 páginasProject Report Devki Nandan Sharma AmulAvaneesh KaushikAún no hay calificaciones

- Mythologia: PrologueDocumento14 páginasMythologia: ProloguecentrifugalstoriesAún no hay calificaciones

- Title: Daily Visit Report: SDL Mini - Project Academic Year 2020-21 Group ID:GB6Documento2 páginasTitle: Daily Visit Report: SDL Mini - Project Academic Year 2020-21 Group ID:GB6Arjuna JppAún no hay calificaciones

- Company Profile RadioDocumento8 páginasCompany Profile RadioselviAún no hay calificaciones

- Pengaruh Abu Batu Sebagai Subtitusi Agregat Halus DanDocumento10 páginasPengaruh Abu Batu Sebagai Subtitusi Agregat Halus Danangela merici rianawatiAún no hay calificaciones

- Curriculum Vitae For Modern MutumwaDocumento4 páginasCurriculum Vitae For Modern MutumwaKudakwashe QuQu MaxineAún no hay calificaciones

- Soal Pas Myob Kelas Xii GanjilDocumento4 páginasSoal Pas Myob Kelas Xii GanjilLank BpAún no hay calificaciones

- Cotton Pouches SpecificationsDocumento2 páginasCotton Pouches SpecificationspunnareddytAún no hay calificaciones

- 2nd Quarter Exam All Source g12Documento314 páginas2nd Quarter Exam All Source g12Bobo Ka100% (1)