Documentos de Académico

Documentos de Profesional

Documentos de Cultura

BATA INDIA 1Q FY2011 Earnings Report

Cargado por

Sagar KadamDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

BATA INDIA 1Q FY2011 Earnings Report

Cargado por

Sagar KadamCopyright:

Formatos disponibles

BATA INDIA LIMITED

REGD. OFFICE: 6A, S.N. BANERJEE ROAD, KOLKATA 700013

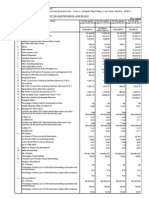

UNAUDITED FINANCIAL RESULTS FOR THE Ist QUARTER ENDED 31ST MARCH, 2011

(Rs. in Lacs except EPS figure)

Sl No

Particulars

Turnover less: Excise duty Net Sales/Income from Operations c Other Operating Income Expenditure a (Increase)/Decrease in stock in trade and work in progress b Consumption of Raw Materials c Purchase of Traded Goods d Employees cost e Rent f Depreciation g Amortisation of VRS h Other Expenditure Total Profit from Operations before Other Income, Interest and Tax (1-2) Other Income Profit before Interest and Tax (3+4) Interest Profit after Interest but before Tax (5-6) Tax Expense - Current Tax - Deferred Tax (Credit)/ Charge Net Profit for the Period Paid up Equity Share Capital (Rs 10/- per share) Reserves excluding Revaluation Reserves EPS (Basic & Diluted) Rs. Public Shareholding: - Number of Shares (Lacs) - Percentage of Shareholding Promoters and Promoter Group Shareholding: a Pledged/ Encumbered - Number of Shares (Lacs) - Percentage of Shares (as a % of the total shareholding of promoter and promoter group) - Percentage of Shares (as a % of the total share capital of the company) b Non-encumbered - Number of Shares (Lacs) - Percentage of Shares (as a % of the total shareholding of promoter and promoter group) - Percentage of Shares (as a % of the total share capital of the company) a b

Quarter 1 ended 31st March

2011 2010 26360.3 444.9 25915.4 241.6 (2595.6) 5498.3 9071.9 4213.4 2707.3 639.2 153.1 4422.8 24110.4 2046.6 86.3 2132.9 29.2 2103.7 842.6 (171.9) 1433.0 6426.4 2.23 314.8 49%

Year ended 31st December

2010 (Audited) 127575.3 1889.5 125685.8 957.5 (2215.6) 23168.9 38498.5 17682.8 11546.3 3251.0 153.1 20878.6 112963.6 13679.7 701.4 14381.1 81.4 14299.7 5463.8 (699.3) 9535.2 6426.4 29929.6 14.84 308.4 48%

31603.3 537.7 31065.6 366.0 (5352.0) 6086.3 13167.7 4565.6 3100.1 850.9 5419.4 27838.0 3593.6 11192.7 14786.3 16.0 14770.3 3671.8 161.7 10936.8 6426.4 17.02 308.4 48%

3 4 5 6 7 8

9 10 11 12 13

14

Nil Nil Nil 334.2 100% 52%

Nil Nil Nil 327.8 100% 51%

Nil Nil Nil 334.2 100% 52%

SEGMENTWISE REVENUE, RESULT AND CAPITAL EMPLOYED

Sl No

Particulars

a. b SEGMENT REVENUE Net Sale / Income from each Segment(Including Other operating Income and Other Income) Footwear & Accessories Investment in Joint Venture for Surplus Property Development TOTAL REVENUE SEGMENT RESULT Profit before Tax & Interest from each Segment Footwear & Accessories Investment in Joint Venture for Surplus Property Development TOTAL Less : Interest Expense Interest Income Un-allocable Expenditure Total Profit Before Tax

Quarter 1 ended 31st March

2011 2010

Year ended 31st December

2010 (Audited)

31688.8 10935.5 42624.3

26243.3 26243.3

127344.7 127344.7

2 a. b

3682.1 10935.5 14617.6 16.0 (187.7) 19.0 14770.3

2119.0 2119.0 29.2 (64.8) 50.9 2103.7

14025.3 14025.3 81.4 (605.5) 249.7 14299.7

I II III

3 a. b c

CAPITAL EMPLOYED Segment Assets - Segment Liabilites Footwear & Accessories Investment in Joint Venture for Surplus Property Development Unallocated TOTAL

49358.0 (81.9) 1089.7 50365.8

33491.3 1291.0 79.5 34861.8

36112.6 1325.8 2385.2 39823.6

Notes : 1

Net Sales for first three months of the year has increased by 19.9% over the corresponding period last year. Operating profit before tax for first three months of the year of Rs.3834.8 lacs has increased by 82% over the corresponding period last year. In addition, we also have other income of Rs. 10935.5 lacs related to Batanagar Project .

*2

In the year 2010, Company had restructured its agreements with revised terms & conditions for the development of modern integrated township project at Batanagar. The conditions precedent to recognizing sale of investment and variation of rights in the joint development agreement had crystallized in the month of March 2011, consequently gains of Rs. 10,935.5 lacs before tax arising on the said transaction have been recognized under Other Income. Further, as a part of consideration, the Company is yet to receive 324,550 sq. ft. of constructed space at no additional cost as per the terms of the agreements. Pursuant to such restructuring, the Company has disposed off its Stake in Joint Venture with RDPL at a gain of Rs. 987.0 lacs, which is included in the above Batanagar project gains. In terms of clause 41 of the listing agreement, detail of number of investor complaints for the quarter ended 31st March, 2011 : beginning - 1, received - 1, resolved - 1 and pending 1. The Company operates in two segments - i) Footwear & Accessories ii) Investment in Joint Venture for Surplus Property Development. The above results were reviewed by the Audit Committee and approved by the Board of Directors at their meeting held on 28th April, 2011. Limited Review of these results, as required under clause 41 of the Listing Agreement, has been completed by the Auditors. Figures of the previous year/ quarter have been regrouped, wherever necessary.

4 5

BATA INDIA LIMITED

Gurgaon 28.04.2011 FADZILAH MOHD. HUSSEIN DIRECTOR FINANCE

MARCELO VILLAGRAN MANAGING DIRECTOR

MANY NEW STORES. NEW RANGE . GREAT PRICES

También podría gustarte

- 14 - Habeas Corpus PetitionDocumento4 páginas14 - Habeas Corpus PetitionJalaj AgarwalAún no hay calificaciones

- My Testament On The Fabiana Arejola M...Documento17 páginasMy Testament On The Fabiana Arejola M...Jaime G. Arejola100% (1)

- Shore Activities and Detachments Under The Command of Secretary of Navy and Chief of Naval OperationsDocumento53 páginasShore Activities and Detachments Under The Command of Secretary of Navy and Chief of Naval OperationskarakogluAún no hay calificaciones

- Sebi MillionsDocumento2 páginasSebi MillionsNitish GargAún no hay calificaciones

- GTL Q1 2011 ResultsDocumento4 páginasGTL Q1 2011 ResultsAnantmmAún no hay calificaciones

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Documento1 páginaUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaAún no hay calificaciones

- Q3 Results 201112Documento3 páginasQ3 Results 201112Bishwajeet Pratap SinghAún no hay calificaciones

- GUJARAT APOLLO INDUSTRIES LIMITED FINANCIAL RESULTSDocumento2 páginasGUJARAT APOLLO INDUSTRIES LIMITED FINANCIAL RESULTSTushar PatelAún no hay calificaciones

- NFL Results March 2010Documento3 páginasNFL Results March 2010Siddharth ReddyAún no hay calificaciones

- Dabur Balance SheetDocumento30 páginasDabur Balance SheetKrishan TiwariAún no hay calificaciones

- BHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Documento3 páginasBHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Shubham TrivediAún no hay calificaciones

- Segment Reporting (Rs. in Crore)Documento8 páginasSegment Reporting (Rs. in Crore)Tushar PanhaleAún no hay calificaciones

- Avt Naturals (Qtly 2011 06 30) PDFDocumento1 páginaAvt Naturals (Qtly 2011 06 30) PDFKarl_23Aún no hay calificaciones

- 2008 2009 - 31 Mar 2009Documento3 páginas2008 2009 - 31 Mar 2009Nishit PatelAún no hay calificaciones

- FY2011 ResultsDocumento1 páginaFY2011 ResultsSantosh VaishyaAún no hay calificaciones

- Userfiles Financial 6fDocumento2 páginasUserfiles Financial 6fTejaswini SkumarAún no hay calificaciones

- Avt Naturals (Qtly 2011 09 30) PDFDocumento1 páginaAvt Naturals (Qtly 2011 09 30) PDFKarl_23Aún no hay calificaciones

- BHL Fin Res 2011 12 q1 MillionDocumento2 páginasBHL Fin Res 2011 12 q1 Millionacrule07Aún no hay calificaciones

- Sebi Million Q3 1213 PDFDocumento2 páginasSebi Million Q3 1213 PDFGino SunnyAún no hay calificaciones

- MRF PNL BalanaceDocumento2 páginasMRF PNL BalanaceRupesh DhindeAún no hay calificaciones

- Balance Sheet As at 31 March, 2011: ST STDocumento14 páginasBalance Sheet As at 31 March, 2011: ST STLambourghiniAún no hay calificaciones

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Documento1 páginaPDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaAún no hay calificaciones

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Documento9 páginasStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Consolidated Balance Sheet: As at 31st December, 2011Documento21 páginasConsolidated Balance Sheet: As at 31st December, 2011salehin1969Aún no hay calificaciones

- Audited Result 2010 11Documento2 páginasAudited Result 2010 11Priya SharmaAún no hay calificaciones

- Karnataka Bank Results Sep12Documento6 páginasKarnataka Bank Results Sep12Naveen SkAún no hay calificaciones

- 2010 11 Full Year Consolidated Financial ResultsDocumento4 páginas2010 11 Full Year Consolidated Financial ResultsManita PokhrelAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento8 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Balance SheetDocumento2 páginasBalance Sheetgagandeepdb2Aún no hay calificaciones

- HCL Technologies LTD 170112Documento3 páginasHCL Technologies LTD 170112Raji_r30Aún no hay calificaciones

- Ashok Leyland Limited Regd. Office:1 Sardar Patel Road, Guindy, Chennai - 600 032Documento2 páginasAshok Leyland Limited Regd. Office:1 Sardar Patel Road, Guindy, Chennai - 600 032Kumaresh SalemAún no hay calificaciones

- Britannia Industries Q2 FY2012 Financial ResultsDocumento2 páginasBritannia Industries Q2 FY2012 Financial Resultspvenkatesh19779434Aún no hay calificaciones

- Particulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDocumento5 páginasParticulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDhanya R KarthaAún no hay calificaciones

- 2009-10 Annual ResultsDocumento1 página2009-10 Annual ResultsAshish KadianAún no hay calificaciones

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- HKSE Announcement of 2011 ResultsDocumento29 páginasHKSE Announcement of 2011 ResultsHenry KwongAún no hay calificaciones

- Results Q1FY11 12Documento1 páginaResults Q1FY11 12rao_gsv7598Aún no hay calificaciones

- Avt Naturals (Qtly 2012 12 31)Documento1 páginaAvt Naturals (Qtly 2012 12 31)Karl_23Aún no hay calificaciones

- PDF Processed With Cutepdf Evaluation EditionDocumento2 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAún no hay calificaciones

- Everest Industries Limited: Investor Presentation 29 April 2011Documento12 páginasEverest Industries Limited: Investor Presentation 29 April 2011vejendla_vinod351Aún no hay calificaciones

- Consolidated AFR 31mar2011Documento1 páginaConsolidated AFR 31mar20115vipulsAún no hay calificaciones

- SIDBI Financial Result DEC 2010 EnglishDocumento2 páginasSIDBI Financial Result DEC 2010 EnglishSunil GuptaAún no hay calificaciones

- Financial Results Q1 August 2018Documento13 páginasFinancial Results Q1 August 2018shakeelahmadjsrAún no hay calificaciones

- Financial Results For Dec 31, 2015 (Standalone) (Result)Documento4 páginasFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- IFCI Q3 FY10 financial resultsDocumento3 páginasIFCI Q3 FY10 financial resultsnitin2khAún no hay calificaciones

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento8 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Alok - Performance Report - q4 2010-11Documento24 páginasAlok - Performance Report - q4 2010-11Krishna VaniaAún no hay calificaciones

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Annual Report OfRPG Life ScienceDocumento8 páginasAnnual Report OfRPG Life ScienceRajesh KumarAún no hay calificaciones

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Audited Results 31.3.2012 TVSMDocumento2 páginasAudited Results 31.3.2012 TVSMKrishna KrishnaAún no hay calificaciones

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocumento3 páginasPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaAún no hay calificaciones

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- NTBCL Q1 FY2012 Financial ResultsDocumento4 páginasNTBCL Q1 FY2012 Financial ResultsAlok SinghalAún no hay calificaciones

- KFA Published Results March 2011Documento3 páginasKFA Published Results March 2011Abhay AgarwalAún no hay calificaciones

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Documento1 páginaIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsAún no hay calificaciones

- Avt Naturals (Qtly 2011 03 31) PDFDocumento1 páginaAvt Naturals (Qtly 2011 03 31) PDFKarl_23Aún no hay calificaciones

- Financial Results For The Quarter Ended 30 June 2012Documento2 páginasFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaAún no hay calificaciones

- Avt Naturals (Qtly 2011 12 31) PDFDocumento1 páginaAvt Naturals (Qtly 2011 12 31) PDFKarl_23Aún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Olimpiada Engleza 2017 CL A 7 A PDFDocumento4 páginasOlimpiada Engleza 2017 CL A 7 A PDFAnthony Adams100% (3)

- Analyzing Evidence of College Readiness: A Tri-Level Empirical & Conceptual FrameworkDocumento66 páginasAnalyzing Evidence of College Readiness: A Tri-Level Empirical & Conceptual FrameworkJinky RegonayAún no hay calificaciones

- Eng Listening Integrated Hkdse2022 UmayDocumento21 páginasEng Listening Integrated Hkdse2022 UmayHoi TungAún no hay calificaciones

- Veerabhadra Swamy MantrasDocumento6 páginasVeerabhadra Swamy Mantrasगणेश पराजुलीAún no hay calificaciones

- p240 MemristorDocumento5 páginasp240 MemristorGopi ChannagiriAún no hay calificaciones

- Challengue 2 Simpe P.P TenseDocumento7 páginasChallengue 2 Simpe P.P TenseAngel AngelAún no hay calificaciones

- DocuCentre IV C4470 3370 2270 BrochureDocumento8 páginasDocuCentre IV C4470 3370 2270 BrochureRumen StoychevAún no hay calificaciones

- ME Flowchart 2014 2015Documento2 páginasME Flowchart 2014 2015Mario ManciaAún no hay calificaciones

- AREVA Directional Over Current Relay MiCOM P12x en TechDataDocumento28 páginasAREVA Directional Over Current Relay MiCOM P12x en TechDatadeccanelecAún no hay calificaciones

- Converting Units of Measure PDFDocumento23 páginasConverting Units of Measure PDFM Faisal ChAún no hay calificaciones

- Corneal Ulcers: What Is The Cornea?Documento1 páginaCorneal Ulcers: What Is The Cornea?me2_howardAún no hay calificaciones

- Hem Tiwari Vs Nidhi Tiwari Mutual Divorce - Revised VersionDocumento33 páginasHem Tiwari Vs Nidhi Tiwari Mutual Divorce - Revised VersionKesar Singh SawhneyAún no hay calificaciones

- Chapter 1 Introduction To Management and OrganisationDocumento34 páginasChapter 1 Introduction To Management and Organisationsahil malhotraAún no hay calificaciones

- Net Ionic EquationsDocumento8 páginasNet Ionic EquationsCarl Agape DavisAún no hay calificaciones

- Dark Matter and Energy ExplainedDocumento3 páginasDark Matter and Energy ExplainedLouise YongcoAún no hay calificaciones

- Course Outline IST110Documento4 páginasCourse Outline IST110zaotrAún no hay calificaciones

- Statistics Machine Learning Python DraftDocumento319 páginasStatistics Machine Learning Python DraftnagAún no hay calificaciones

- LP Moral Decision Making EditedDocumento3 páginasLP Moral Decision Making EditedCiana SacdalanAún no hay calificaciones

- New Manual of Fiber Science Revised (Tet)Documento43 páginasNew Manual of Fiber Science Revised (Tet)RAZA Khn100% (1)

- Signal WordsDocumento2 páginasSignal WordsJaol1976Aún no hay calificaciones

- Araminta Spook My Haunted House ExtractDocumento14 páginasAraminta Spook My Haunted House Extractsenuthmi dihansaAún no hay calificaciones

- Mpeg-1 11172-1Documento46 páginasMpeg-1 11172-1Hana HoubaAún no hay calificaciones

- Social Media Marketing - AssignmentDocumento8 páginasSocial Media Marketing - AssignmentAllen RodaAún no hay calificaciones

- Ghana Constitution 1996Documento155 páginasGhana Constitution 1996manyin1Aún no hay calificaciones

- Integrating GrammarDocumento8 páginasIntegrating GrammarMaría Perez CastañoAún no hay calificaciones

- Normal Distribution: X e X FDocumento30 páginasNormal Distribution: X e X FNilesh DhakeAún no hay calificaciones

- DU - BSC (H) CS BookletDocumento121 páginasDU - BSC (H) CS BookletNagendra DuhanAún no hay calificaciones