Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Final2011 02 16redline of Amended Complaint To Original Complaint

Cargado por

AvramDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Final2011 02 16redline of Amended Complaint To Original Complaint

Cargado por

AvramCopyright:

Formatos disponibles

IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF TEXAS DALLAS DIVISION ORIX CAPITAL MARKETS,

LLC, SPECIAL SERVICER FOR BANK OF AMERICA, NATIONAL ASSOCIATION, SUCCESSOR BY MERGER WITH LASALLE BANK NATIONAL ASSOCIATION, TRUSTEE FOR THE GS MORTGAGE SECURITIES CORPORATION II, COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 1999-C1 Plaintiff v. LIAQUAT A. PIRANI Defendant

CIVIL ACTION NO. 03:11-cv-40

PLAINTIFF'S ORIGINALFIRST AMENDED COMPLAINT TO THE UNITED STATES DISTRICT COURT: Plaintiff ORIX Capital Markets, LLC, Special Servicer for U.S. Bank, National Association, as successor-in-interest to Bank Of America, National Association, Successor By Merger With LaSalle Bank National Association, Trustee for the GS Mortgage Securities Corporation II, Commercial Mortgage Pass-through Certificates, Series 1999-C1 (hereinafter ORIX) brings suitamends its Original Complaint asserting claims against Defendant Liaquat A. Pirani (hereinafter Pirani).

PARTIES

ORIX Capital Markets, LLC (ORIX) has been appointed Special Servicer for the trust pursuant to the terms and provisions of the Pooling and Servicing Agreement governing the trust and by separately executed powers of attorney, one of which was most recently executed by the Trustee on November 4, 2009. ORIX is a Delaware limited liability company with its principal place of business in Dallas, Texas. Effective January 20, 2011 (after the Original Complaint in this action was filed) U.S. Bank, National Association succeeded Bank of America, National Association as Trustee for GS Mortgage Securities Corporation II, Commercial Mortgage PassThrough Certificates, Series 1999-C1 (hereinafter Trustee), is the trustee for a). The trust is organized under the Real Estate Mortgage Investment Conduit (REMIC) provisions of the Internal Revenue Code, 26 USC 860D. Bank of AmericanAmerica, National Association, is a national bank with its designated home office in North Carolina... U.S. Bank, National Association is a national bank with its designated home office at 425 Walnut Street, Cincinnati, Ohio 45202. U.S. Bank, National Association executed additional powers of attorney further authorizing ORIX to act as special servicer. Defendant Pirani is a citizen of a country other than the United Stated of America. Pirani conducts business within the State of Texas as described in more detail below, including but not limited to the execution of and performance of contracts within the State of Texas and which expressly provide for the submission to the jurisdiction of any court within the State of Texas. Pirani may be served by service upon his counsel, Mark Murphy with Oppenheimer, Blend, Harrison & Tate, Inc., 711 Navarro, Sixth Floor, San Antonio, Texas 78205. Pirani, by and through his counsel, Mr. Murphy, agreed to accept service of process based on representations made in open court in Bexar County, Texas, as reflected on Exhibit A attached. Alternatively, Pirani does not maintain an agent for service of process within the State of Texas, although he

Plaintiffs OriginalFirst Amended Complaint Page 2

has conducted business within the state, within the meaning of Texas Civil Practice and Remedies Code, Section 17.042. He may be served with summons and complaint pursuant to the Texas Long Arm Statute, Texas Civil Practice and Remedies Code, Sections 17.041-045, by service on the Texas Secretary of State and mailing to his last known address, the address provided in his Guaranty contract described below, 100 Villita Street, San Antonio, Texas 78205. JURISDICTION AND VENUE This Court has subject matter jurisdiction over this matter pursuant to 28 USC 1332(a) as the dispute here is between citizens of a State and citizens or subjects of a foreign state and the amount in controversy exceeds the sum or value of $75,000, exclusive of interests and costs. Venue is proper in the Northern District of Texas, Dallas Division pursuant to 28 USC 1391(d). Also, the Trustees attorney-in-fact, ORIX, and its responsible employees maintain offices and conduct business in Dallas, Texas. BACKGROUND FACTS ORIX seeks judgment against Pirani as guarantor of a real estate secured promissory note executed by La Villita Motor Inn, a Texas joint venture (La Villita) between Pirani owned and controlled entities known as Executive Motels of San Antonio and S.A. Sunvest Hotels, Inc. (collectively the La Villita Parties). A true and correct copy of the Promissory Note (the Note) is attached as Exhibit B. Pirani executed a written Guaranty of the La Villita loan, which was a condition for the lenders extension of credit to La Villita. A true and correct copy of the Guaranty is attached as Exhibit C.

Plaintiffs OriginalFirst Amended Complaint Page 3

The La Villita Note is secured by a pledge of real estate, related items of personal property and the cash flow generated by La Villita. La Villita has conducted a hotel business in downtown San Antonio, Texas on the collateral premises. As anticipated in the loan documents, the original lender transferred the Note to the original Trustee for GSMS 1999-C1 Trust (the Trust), a REMIC trust, as a result of the following transfers: (1) on September 25, 1998, AMRESCO endorsed the Note to AMRESCO Capital Limited, Inc.; (2) AMRESCO Capital Limited, Inc. then endorsed the Note to the Trustee, LaSalle National Bank.

Accordingly, for virtually the entire duration of the loan term, the Trustee (or its predecessor) has been the owner and holder of the Note. On October 1, 2007, LaSalle National Banks holding company was acquired by Bank of America, N.A.. As a result of Bank of America became the successor trustee to the Trust. Effective January 20, 2011, U.S. Bank, National Association succeeded Bank of America as Trustee. ORIX, as the Trusts Special Servicer, is authorized to enforce the loan documents on behalf of the Trustee. La Villita defaulted in various respects on its obligations under the various loan documents effective April 16, 2008. Later, in 2009, the La Villita Parties commenced a lawsuit in state district court in San Antonio, Texas disputing the obligations under the loan documents and enjoining ORIX from foreclosing on the collateral. The trial court entered a judgment awarding certain of the relief requested by the La Villita Parties. The judgment required LaVillita to make certain monthly payments on the Note indedtedness. LaVillita made only two such monthly payments.

Plaintiffs OriginalFirst Amended Complaint Page 4

On appeal, the San Antonio Court of Appeals reversed and rendered judgment for ORIX for all amounts due and owing pursuant to the loan documents and remanding the case for determination of attorneys fees owed under the loan documents. A true copy of the opinion of the San Antonio Court of Appeals is attached as Exhibit D. On December 7, 2010, the La Villita Parties sought review of the Court of Appeals judgment by the Texas Supreme Court. The petition for review remains pending at this time. After the decision of the San Antonio Court of Appeals, but while the case was still pending in the Court of Appeals, ORIX sought the appointment of a receiver. Although the loan documents provide for an unconditional assignment of rents from the Property and permit ORIX to have a receiver appointed upon the occurrence of an event of default under the Note, the La Villita Parties opposed the appointment. But the trial court refused to appoint a receiver; causing the Court of Appeals to order the trial court to appoint a receiver. Just before the trial court was to hear the receivership matter, La Villita filed a voluntary bankruptcy petition. The collateral remains under the control of La Villita, as debtor-in-possession. Since the loan default, La Villita has failed to fully account to ORIX with respect to the rents generated by the collateral. One expenditure that was inappropriately made during this time was to have a large wall facing a neighboring parking lot painted a garish green apparently in violation of City rules or ordinances. The expenditures for this action and the cost to contest or correct the rule or ordinance violation should not have been made with the cash collateral and is in violation of various provisions of the loan documents. In June, 2010, La Villita presented its protest of the La Villita hotel property tax valuation to the Bexar Appraisal Review Board. La Villitas authorized representative protested the Bexar

Appraisal Districts valuation on the grounds that the Districts valuation was over market and

Plaintiffs OriginalFirst Amended Complaint Page 5

was unequal with others. La Villitas authorized representative, Allison Hunt, testified under oath that the value of the hotel property was $5.279 million. La Villitas authorized

representative testified that the hotel property for so many years it was not maintained well. Pirani is obligated by the Guaranty to maintain a certain level of assets in the United States. Pirani represented on an October 2008 financial statement that he held only one United States asset, other than his interests in the La Villita Parties. That other interest was valued by Pirani, and was and is worth, no more than $20,000. With the exception of the one other United States asset valued at $20,000, Piranis entire United States holdings are his interests in the La Villita Parties. The various loan documents and the Guaranty generally provide that ORIXs recourse for payment of the debt obligation is to the collateral. However, certain exceptions to the limited recourse nature of the debt obligation are provided for in the loan documents and the Guaranty. A number of those exceptions have been triggered and Pirani is liable under the Guaranty exceptions as outlined below. FIRST CAUSE OF ACTION Breach of Contract Section 1.2(iii) of the Guaranty provides that Pirani is liable for the unpaid balance of all amounts due and owning pursuant to the loan documents by virtue of a default under Section 3.4 of the Guaranty. Section 3.4 of the Guaranty requires Pirani to remain solvent and to maintain assets in the United States at all times equal to or greater than $7 million dollars and to keep his net worth at all times equal to or greater than $2.5 million dollars. The section also requires Pirani to immediately notify the lender (and its successors) of certain transfers, hypothecations, or pledges of assets. Pirani has provided no notification to the lender. Pirani has failed to provide

Plaintiffs OriginalFirst Amended Complaint Page 6

information to ORIX demonstrating his full and complete compliance with Section 3.4 of the Guaranty. As a result of this default, Pirani is fully liable for all amounts due and owing pursuant to the Loan Documents. In addition to full recourse under Section 3.4 of the Guaranty Agreement, Section 1.2 of the Guaranty provides for Piranis liability to the extent of any loss incurred by the lender (and its successors) arising through various prescribed conditions and circumstances. In the alternative to full recourse under the loan documents, Pirani is liable for the losses incurred as a result of these other limited recourse events as follows: Section 1.2 (c) of the Guaranty makes Pirani liable for losses airising from litigation, including a bankruptcy filing, that delays or impairs the lenders ability to enforce or foreclose its lien on the collateral. Section 1.2(e) of the Guaranty makes Pirani liable for losses arising from gross negligence and willful misconduct of La Villita and related parties. Section 1.2(g) of the Guaranty makes Pirani liable for losses arising from certain physical waste of the collateral and the failure to properly maintain, repair and restore the collateral. Section 1.2(k) of the Guaranty makes Pirani liable for misapplication of rent after default. ORIX has suffered damages for which Pirani is liable under the Guaranty as follows: (a) ORIX has incurred significant expenses in defending La Villita Parties claims in the litigation including but not limited to attorneys fees and expenses, employee travel costs, third party reports and other litigation related expenses, which exceed $ 845,000. The value of the collateral has declined during the delay caused by the La Villita Parties. The amount of the decline at this time is undetermined. La Villita blocked ORIXs effort to inspect and appraise the collateral. The collateral is believed to have suffered actual waste. The amount of the waste at this time is undetermined. La Villita blocked ORIXs effort of inspect the collateral. The LaVillita Parties have misapplied rents and made expenditures since default which are prohibited by the loan documents. The amount of the

Plaintiffs OriginalFirst Amended Complaint Page 7

misapplied rents and prohibited payments is undetermined at this time. La Villita has refused ORIXs request for documents and information about the operation of the collateral. As the La Villita parties are continuing pursuit of their lawsuit claims and have initiated a bankruptcy proceeding, ORIX will continue to incur additional damages for which Pirani will be liable pursuant to the Guaranty. Expenditures associated with painting the collaterals wall in violation of City rules or ordinances and responding to violations or remedying the violations, if paid by La Villita, have and will utilize resources which should have been paid to ORIX. ORIX reserves the right to pursue and recover all additional damages from Pirani and the right to amend this complaint to address such future damages as and when they arise.

SECOND CAUSE OF ACTION Imposition Of Trust Section 4.3 of the Guaranty provides that any funds received by Pirani contrary to the terms and provisions of the Guaranty are to be held in trust. ORIX seeks the imposition of an express trust or a constructive trust over all funds Pirani received from the La Villita and the La Villita Parties contrary to the terms and provisions of the loan documents.

ATTORNEYS FEES ORIX is entitled to recover its reasonable and necessary attorneys fees incurred in this action relating to Piranis breach of Guaranty agreement. ORIX is entitled to recover all such fees and expenses in accordance with Texas Civil Practice and Remedies Code, Chapter 38. CONDITIONS PRECEDENT All conditions precedent to ORIXs claims and right of recovery have occurred, been performed, or been waived.

Plaintiffs OriginalFirst Amended Complaint Page 8

PRAYER WHEREFORE, PREMISES CONSIDERED, Plaintiff prays that it recover a judgment against Defendant Pirani for the amounts outlined above, including but not limited to prejudgment and postjudgment interest at the rates allowed by law or as provided by the Loan Documents, whichever is greater, the imposition of an express or constructive trust, costs of court and such other relief to which it may show itself justly entitled. Respectfully submitted, /s/ Jeff Joyce Jeff Joyce Texas State Bar No. 11035400 Direct Dial: (713) 222-1113 Email: jjoyce@joyceandmcfarland.com JOYCE, MCFARLAND + MCFARLAND LLP 712 Main Street, Suite 1500 Houston, Texas 77002 Telephone: 713.222.1112 Facsimile: 713.513.5577 ATTORNEY-IN-CHARGE FOR PLAINTIFF

OF COUNSEL: Greg May State Bar No. 13264500 Amy Howell State Bar No. 24027864 ORIX USA Corporation 1717 Main Street, Suite 900 Dallas, Texas 75201 (214) 237-2000 (214) 237-2018 (fax)

Plaintiffs OriginalFirst Amended Complaint Page 9

CERTIFICATE OF SERVICE I certify that on February ___, 2011, a true and correct copy of the foregoing was served in a manner prescribed by the Texas Rules of Civil Procedure to: F. Colin Durham, Jr. Key Harrington Barnes, PC 3710 Rawlins Street Suite 950 Dallas, Texas 75219 Fax 214.615.7926 cdurham@keyharrington.com

Jeff Joyce

Plaintiffs OriginalFirst Amended Complaint Page 10

EXHIBITS

Exhibit A:

Excerpt from transcript of August 28, 2009 Hearing in Cause No. 2009-CI-07339; La Villita Motor Inns, J.V., et al vs. ORIX Capital Markets, LLC, et al., In the 150th Judicial District Court of Bexar County, Texas; Promissory Note dated September 25, 1998 executed by La Villita Motor Inn, a Texas joint venture between Executive Motels of San Antonio and S.A. Sunvest Hotels, Inc. Guaranty dated September 25, 1998 executed by Liaquat Pirani August 25, 2010 Opinion rendered by The Fourth District Court of Appeals, Texas, Case No. 04-09-00573-CV.

Exhibit B:

Exhibit C: Exhibit D:

Plaintiffs OriginalFirst Amended Complaint Page 11

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- NY FCA Complaint - ProposedDocumento14 páginasNY FCA Complaint - ProposedAvram100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- IRS Whistleblower PacketDocumento35 páginasIRS Whistleblower PacketAvramAún no hay calificaciones

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

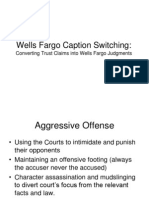

- Wells Fargo Caption Switching - Converting Trust Claims Into Wells Fargo JudgmentsDocumento40 páginasWells Fargo Caption Switching - Converting Trust Claims Into Wells Fargo JudgmentsAvramAún no hay calificaciones

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- UBS Orix Dallas Counterclaim Depos Evid 2Documento242 páginasUBS Orix Dallas Counterclaim Depos Evid 2AvramAún no hay calificaciones

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Fidelity's (LPS) Secret Deals With Mortgage Companies and Law FirmsDocumento36 páginasFidelity's (LPS) Secret Deals With Mortgage Companies and Law FirmsForeclosure Fraud100% (1)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- MP LawsuitDocumento27 páginasMP LawsuitAvramAún no hay calificaciones

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Samantha Schacher V Johnny ManzielDocumento3 páginasSamantha Schacher V Johnny ManzielDarren Adam Heitner100% (5)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Farmer VerdictDocumento7 páginasFarmer VerdictAvramAún no hay calificaciones

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Orca Share Media1579045614947Documento4 páginasOrca Share Media1579045614947Teresa Marie Yap CorderoAún no hay calificaciones

- Pronoun AntecedentDocumento4 páginasPronoun AntecedentJanna Rose AregadasAún no hay calificaciones

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Shaping School Culture Case StudyDocumento7 páginasShaping School Culture Case Studyapi-524477308Aún no hay calificaciones

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- World Price List 2014: Adventys Induction Counter TopsDocumento4 páginasWorld Price List 2014: Adventys Induction Counter TopsdiogocorollaAún no hay calificaciones

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- HDFCDocumento60 páginasHDFCPukhraj GehlotAún no hay calificaciones

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- Robber Bridegroom Script 1 PDFDocumento110 páginasRobber Bridegroom Script 1 PDFRicardo GarciaAún no hay calificaciones

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- The Health Anxiety Inventory Development and Validation of Scales For The Measurement of Health Anxiety and HypochondriasisDocumento11 páginasThe Health Anxiety Inventory Development and Validation of Scales For The Measurement of Health Anxiety and HypochondriasisJan LAWAún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Vistas 1-7 Class - 12 Eng - NotesDocumento69 páginasVistas 1-7 Class - 12 Eng - Notesvinoth KumarAún no hay calificaciones

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- CTY1 Assessments Unit 6 Review Test 1Documento5 páginasCTY1 Assessments Unit 6 Review Test 1'Shanned Gonzalez Manzu'Aún no hay calificaciones

- Customer ExperienceDocumento9 páginasCustomer ExperienceRahul GargAún no hay calificaciones

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Pyridine Reactions: University College of Pharmaceutialsciences K.U. CampusDocumento16 páginasPyridine Reactions: University College of Pharmaceutialsciences K.U. CampusVã RãAún no hay calificaciones

- News Item GamesDocumento35 páginasNews Item GamesUmi KuswariAún no hay calificaciones

- Houses WorksheetDocumento3 páginasHouses WorksheetYeferzon Clavijo GilAún no hay calificaciones

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Blood Rage Solo Variant v1.0Documento6 páginasBlood Rage Solo Variant v1.0Jon MartinezAún no hay calificaciones

- Caterpillar Cat 304.5 Mini Hydraulic Excavator (Prefix WAK) Service Repair Manual (WAK00001 and Up)Documento23 páginasCaterpillar Cat 304.5 Mini Hydraulic Excavator (Prefix WAK) Service Repair Manual (WAK00001 and Up)kfmuseddk100% (1)

- A1 - The Canterville Ghost WorksheetsDocumento8 páginasA1 - The Canterville Ghost WorksheetsТатьяна ЩукинаAún no hay calificaciones

- 7C Environment Test 2004Documento2 páginas7C Environment Test 2004api-3698146Aún no hay calificaciones

- Minneapolis Police Department Lawsuit Settlements, 2009-2013Documento4 páginasMinneapolis Police Department Lawsuit Settlements, 2009-2013Minnesota Public Radio100% (1)

- Good Governance and Social Responsibility-Module-1-Lesson-3Documento11 páginasGood Governance and Social Responsibility-Module-1-Lesson-3Elyn PasuquinAún no hay calificaciones

- Gprs/Umts: IAB Workshop February 29 - March 2, 2000 Jonne Soininen NokiaDocumento34 páginasGprs/Umts: IAB Workshop February 29 - March 2, 2000 Jonne Soininen NokiaSajid HussainAún no hay calificaciones

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- Sajid, Aditya (Food Prossing)Documento29 páginasSajid, Aditya (Food Prossing)Asif SheikhAún no hay calificaciones

- 14 BibiliographyDocumento22 páginas14 BibiliographyvaibhavAún no hay calificaciones

- Swati Bajaj ProjDocumento88 páginasSwati Bajaj ProjSwati SoodAún no hay calificaciones

- Assignments Is M 1214Documento39 páginasAssignments Is M 1214Rohan SharmaAún no hay calificaciones

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Karla Beatriz Flores Ochoa 402-12 "C" 20 de Octubre de 2013Documento1 páginaKarla Beatriz Flores Ochoa 402-12 "C" 20 de Octubre de 2013Chabe CaraAún no hay calificaciones

- TM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Documento1 páginaTM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Nicky Galang IIAún no hay calificaciones

- Lecture 01 Overview of Business AnalyticsDocumento52 páginasLecture 01 Overview of Business Analyticsclemen_angAún no hay calificaciones

- Upload A Document To Access Your Download: Social Studies of HealthDocumento3 páginasUpload A Document To Access Your Download: Social Studies of Health1filicupEAún no hay calificaciones

- Generator Faults and RemediesDocumento7 páginasGenerator Faults and Remediesemmahenge100% (2)

- LPP-Graphical and Simplex MethodDocumento23 páginasLPP-Graphical and Simplex MethodTushar DhandeAún no hay calificaciones

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)