Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Reversal Chart Patterns: Head & Shoulders Top

Cargado por

Andrew WoolfDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Reversal Chart Patterns: Head & Shoulders Top

Cargado por

Andrew WoolfCopyright:

Formatos disponibles

REVERSAL CHART PATTERNS

Head & Shoulders Top

Head and Shoulders top pattern is a rally to a new high and weakness to intermediate support, a second rally to a higher high and decline to support, followed by a modest third rally and decline through support. Ideally, but not always, volume during the advance of the left shoulder should be higher than during the advance of the head. This decrease in volume along with new highs that form the head serve as a warning sign. The next warning sign comes when volume increases on the decline from the peak of the head. Final confirmation comes when volume further increases during the decline of the right shoulder.

Head & Shoulders Bottom

Head and Shoulders bottom pattern is a decline to a new low and rally to intermediate resistance, a second decline to a lower low and rally to resistance followed by a modest third decline and rally through resistance. Volume levels during the first half of the pattern are less important that in the second half. Volume on the decline of the left shoulder is usually pretty heavy and selling pressure quite intense. The intensity of selling can even continue during the decline that forms the low of the head. After this low, subsequent volume patterns should be watched carefully to look for expansion during the advances.

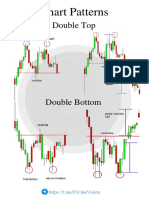

Double / Triple Tops

Double / Triple Tops - The peaks should be separated by about a month. If the peaks are too close, they could just represent normal resistance rather than a lasting change in the supply/demand picture. Ensure that the low between the peaks declines at least 10%. Declines less than 10% may not be indicative of a significant increase in selling pressure. If the trough drags on a bit and has trouble moving back up, demand could be drying up. When the security does advance, look for a contraction in volume as a further indication of weakening demand. Avoid jumping the gun. Wait for support to be broken in a convincing manner, and usually with an expansion of volume. A price or time filter can be applied to differentiate between valid and false support breaks.

Double / Triple Bottoms

Double / Triple Bottom - Volume: As the triple bottom develops, overall volume levels usually decline. Volume sometimes increases near the lows. After the third low, an expansion of volume on the advance and at the resistance breakout greatly reinforces the soundness of the pattern.

Rising Wedge

A Rising Wedge is a bearish pattern that signals that the security is likely to head in a downward direction. The trendlines of this pattern converge, with both trendlines slanted in an upward direction. the price movement is bounded by the two converging trendlines. As the price moves towards the apex of the pattern, momentum is weakening. A move below the lower support would be viewed by traders as a reversal in the upward trend. As the strength of the buyers weakens (exhibited by their inability to take the price higher), the sellers start to gain momentum. The pattern is complete, with the sellers taking control of the security, when the price falls below the supporting trendline.

Falling Wedge

The Falling Wedge is a generally bullish pattern signaling that one will likely see the price break upwards through the wedge and move into an uptrend. The trendlines of this pattern converge, with both being slanted in a downward direction as the price is trading in a downtrend. Another thing to look at in the falling wedge is that the upper (or resistance) trendline should have a sharper slope than the support level in the wedge construction. When the lower (or support) trendline is clearly flatter as the pattern forms, it signals that selling pressure is waning, as sellers have trouble pushing the price down further each time the security is under pressure. The price movement in the wedge should at minimum test both the support trendline and the resistance trendline twice during the life of the wedge. The more times it tests each level, especially on the resistance end, the higher quality the wedge pattern is thought to be. The buy signal is formed when the price breaks through the upper resistance line. This breakout move should be on heavier volume, but due to the longer-term nature of this pattern, it's important that the price has successive closes above the resistance line.

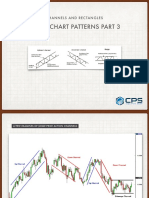

CONTINUATION CHART PATTERNS

Ascending / Descending/ Symmetrical Triangle

Ascending Triangle

Ascending Triangle - bullish chart pattern used in technical analysis that is easily recognizable by the distinct shape created by two trendlines. In an ascending triangle, one trendline is drawn horizontally at a level that has historically prevented the price from heading higher, while the second trendline connects a series of increasing troughs. Traders enter into long positions when the price of the asset breaks above the top resistance. An ascending triangle is generally considered to be a continuation pattern, meaning that it is usually found amid a period of consolidation within an uptrend. Once the breakout occurs, buyers will aggressively send the price of the asset higher, usually on high volume. The most common price target is generally set to be equal to the entry price plus the vertical height of the triangle

Descending Triangle

Descending Triangle - A bearish chart pattern used in technical analysis that is created by drawing one trendline that connects a series of lower highs and a second trendline that has historically proven to be a strong level of support. Traders watch for a move below support, as it suggests that downward momentum is building. Once the breakdown occurs, traders enter into short positions and aggressively push the price of the asset lower. This is a very popular tool among traders because it clearly shows that the demand for an asset is weakening, and when the price breaks below the lower support, it is a clear indication that downside momentum is likely to continue or become stronger. Descending triangles give technical traders the opportunity to make substantial profits over a brief period of time. The most common price targets are generally set to equal the entry price minus the vertical height between the two trendlines.

Symmetrical Triangle

Symmetrical Triangle Pause in existing trend after which the original trend is resumed.

Flag and Pennant

Flag and Pennant Most reliable of continuation patterns and rarely produce a trend reversal. Market takes a breath at this time on reduced volume.

Rectangle Continuation Pattern

A Rectangle is a continuation pattern that forms as a trading range during a pause in the trend. The pattern is easily identifiable by two comparable highs and two comparable lows. The highs and lows can be connected to form two parallel lines that make up the top and bottom of a rectangle. Rectangles are sometimes referred to as trading ranges, consolidation zones or congestion areas. There are many similarities between the rectangle and the symmetrical triangle. While both are usually continuation patterns, they can also mark trend significant tops and bottoms. As with the symmetrical triangle, the rectangle pattern is not complete until a breakout has occurred. Sometimes clues can be found, but the direction of the breakout is usually not determinable beforehand

También podría gustarte

- Chart PatternsDocumento5 páginasChart PatternsKevin Rune Nyheim100% (2)

- Charting SecretsDocumento2 páginasCharting Secretsvaldyrheim100% (2)

- Technical Analysis OverviewDocumento28 páginasTechnical Analysis Overviewpham terik86% (7)

- The Encyclopedia Of Technical Market Indicators, Second EditionDe EverandThe Encyclopedia Of Technical Market Indicators, Second EditionCalificación: 3.5 de 5 estrellas3.5/5 (9)

- CIS2103-202220-Group Project - FinalDocumento13 páginasCIS2103-202220-Group Project - FinalMd. HedaitullahAún no hay calificaciones

- Trend Lines and PatternsDocumento6 páginasTrend Lines and PatternsUpasara WulungAún no hay calificaciones

- Technical StrategiesDocumento11 páginasTechnical StrategiesJAVED PATELAún no hay calificaciones

- Chart Petterns Book EnglishDocumento37 páginasChart Petterns Book EnglishHori Da100% (2)

- Chart Formations Guide: Trendlines, Triangles & Common PatternsDocumento5 páginasChart Formations Guide: Trendlines, Triangles & Common Patternsanil_s_t100% (3)

- Trendline Analysis EbookDocumento19 páginasTrendline Analysis EbookSetyawan Adhi Nugroho100% (4)

- Chart PatternsDocumento10 páginasChart Patternsvvpvarun100% (2)

- Chart English Growth SheraDocumento38 páginasChart English Growth SheraMann MannAún no hay calificaciones

- Double Top: Chart PatternsDocumento11 páginasDouble Top: Chart PatternsKrunal Jain100% (1)

- Study of Chart PatternsDocumento60 páginasStudy of Chart Patternsrajat93% (14)

- Forex NotesDocumento9 páginasForex NotesFelix Afanam100% (2)

- Ganbare Douki Chan MALDocumento5 páginasGanbare Douki Chan MALShivam AgnihotriAún no hay calificaciones

- 341 BDocumento4 páginas341 BHomero Ruiz Hernandez0% (3)

- CSCI5273 PS3 KiranJojareDocumento11 páginasCSCI5273 PS3 KiranJojareSales TeamAún no hay calificaciones

- 132KV Siemens Breaker DrawingDocumento13 páginas132KV Siemens Breaker DrawingAnil100% (1)

- Business Law and The Regulation of Business 12th Edition Mann Test BankDocumento25 páginasBusiness Law and The Regulation of Business 12th Edition Mann Test BankElizabethRuizrxka100% (60)

- Reversal Trends-SAPMDocumento26 páginasReversal Trends-SAPMHeavy Gunner50% (2)

- 5.4 - Technical Analysis - Chart Patterns - Trading Crypto CourseDocumento22 páginas5.4 - Technical Analysis - Chart Patterns - Trading Crypto Course2f9p4bykt8Aún no hay calificaciones

- Chart Pattern Guide for Reddit TradersDocumento17 páginasChart Pattern Guide for Reddit TraderscorranAún no hay calificaciones

- Best Chart PatternsDocumento17 páginasBest Chart PatternsrenkoAún no hay calificaciones

- Triangle StrategyDocumento30 páginasTriangle Strategysuranta100% (1)

- Module 3, Day 3Documento31 páginasModule 3, Day 3pravesh100% (1)

- Inverse Head and Shoulders (Head-and-Shoulders Bottom)Documento7 páginasInverse Head and Shoulders (Head-and-Shoulders Bottom)merenjithAún no hay calificaciones

- New Rich Text FormatDocumento25 páginasNew Rich Text Formatpradeephd100% (1)

- Top 10 Chart Patterns for Technical Analysis TradersDocumento8 páginasTop 10 Chart Patterns for Technical Analysis TradersP.sai.prathyusha100% (2)

- Tren Line PDFDocumento28 páginasTren Line PDFNizam Uddin100% (2)

- Cover ChartsDocumento5 páginasCover ChartsrahulAún no hay calificaciones

- Candle Stick Pattern: DojiDocumento14 páginasCandle Stick Pattern: Dojiyolo100% (1)

- How To Trade Chart Patterns With Target and SL@Documento39 páginasHow To Trade Chart Patterns With Target and SL@millat hossain100% (1)

- Major Market PatternsDocumento30 páginasMajor Market PatternsTonderai Humanikwa100% (3)

- Investment Analysis and Portfolio Management: G.Srianjaneyulu Rollno:18L31E0014 Mba-ADocumento10 páginasInvestment Analysis and Portfolio Management: G.Srianjaneyulu Rollno:18L31E0014 Mba-Analla maheshAún no hay calificaciones

- Forex Chart Patterns Part 3: Channels and RectanglesDocumento10 páginasForex Chart Patterns Part 3: Channels and RectanglesJeremy NealAún no hay calificaciones

- Learn 5 Strategies for Trading the Descending Triangle PatternDocumento11 páginasLearn 5 Strategies for Trading the Descending Triangle PatternYahya IbraheemAún no hay calificaciones

- Presented by Zonaira SarfrazDocumento19 páginasPresented by Zonaira SarfrazZunaira SarfrazAún no hay calificaciones

- Patterns PDFDocumento18 páginasPatterns PDFVICTORINE AMOSAún no hay calificaciones

- 07 KM Reversal PatternsDocumento7 páginas07 KM Reversal PatternsKumarenAún no hay calificaciones

- Daily Technical Analysis Report: Market WatchDocumento16 páginasDaily Technical Analysis Report: Market WatchSeven Star FX Limited100% (2)

- Chart PatternsDocumento17 páginasChart Patternsfxindia19100% (2)

- 6) Chart-Patterns-Cheat-SheetDocumento14 páginas6) Chart-Patterns-Cheat-SheetKumarVijayAún no hay calificaciones

- Chart Analysis Pattern - Head and ShoulderDocumento24 páginasChart Analysis Pattern - Head and ShoulderHendra Setiawan100% (2)

- Candlesticks Lesson 2: Single Candlestick PatternsDocumento10 páginasCandlesticks Lesson 2: Single Candlestick Patternssaied jaberAún no hay calificaciones

- How To Trade Chart Patterns With Target and SL - Forex GDP - Trade With ConfidenDocumento40 páginasHow To Trade Chart Patterns With Target and SL - Forex GDP - Trade With Confidenshashikant jambagi100% (4)

- CRT PatternDocumento10 páginasCRT PatternMD ASRAFUZZAMAN MAHTAF100% (1)

- 19 Chart-Patterns PDFDocumento25 páginas19 Chart-Patterns PDFMahid HasanAún no hay calificaciones

- MAEE Formula Guide to Identify Market TrendsDocumento54 páginasMAEE Formula Guide to Identify Market TrendsKalidas Sundararaman100% (1)

- GuideToClassicChartPatterns PDFDocumento1 páginaGuideToClassicChartPatterns PDFRenato100% (1)

- Reversal PatternsDocumento25 páginasReversal PatternsMunyaradzi Alka Musarurwa100% (2)

- Classic Chart Patterns: A Quick Reference Guide For TradersDocumento2 páginasClassic Chart Patterns: A Quick Reference Guide For TradersAbhay Pratap100% (1)

- Important Chart PatternsDocumento8 páginasImportant Chart Patternspradeephd100% (1)

- Symmetrical Triangles - Chart Formations That Consolidate Before BreakoutsDocumento13 páginasSymmetrical Triangles - Chart Formations That Consolidate Before BreakoutsYin Shen Goh100% (4)

- Candlestick PatternDocumento6 páginasCandlestick Patterntraining division100% (1)

- STF Pa Pin BarDocumento7 páginasSTF Pa Pin BarCandra Yuda100% (2)

- Chart Petterns Ebook EnglishDocumento48 páginasChart Petterns Ebook Englishharshmevada81133% (3)

- CandlestickDocumento31 páginasCandlestickrontungAún no hay calificaciones

- Bullish Engulfing Tutorial.Documento8 páginasBullish Engulfing Tutorial.Mwnaje Hassan100% (2)

- Notes On Technical AnalysisDocumento13 páginasNotes On Technical AnalysisDennis Chau100% (1)

- 17 CandlestickDocumento6 páginas17 CandlestickPaquiro2100% (3)

- The 40-character for the document is:Accumulation, Alpha, Ascending Triangle & More Technical Terms DefinedDocumento12 páginasThe 40-character for the document is:Accumulation, Alpha, Ascending Triangle & More Technical Terms DefinedUdit DivyanshuAún no hay calificaciones

- Technical Analysis: By: Rashmi BhandariDocumento27 páginasTechnical Analysis: By: Rashmi Bhandarirashmibhandari24100% (1)

- Trade CoinDocumento96 páginasTrade CoinvienAún no hay calificaciones

- Quotex Success Blueprint: The Ultimate Guide to Forex and QuotexDe EverandQuotex Success Blueprint: The Ultimate Guide to Forex and QuotexAún no hay calificaciones

- Supplement - 7 Procurement Manual: Democratic Socialist Republic of Sri LankaDocumento8 páginasSupplement - 7 Procurement Manual: Democratic Socialist Republic of Sri LankaDinuka MalinthaAún no hay calificaciones

- Midterm Exam SolutionsDocumento11 páginasMidterm Exam SolutionsPatrick Browne100% (1)

- COKE MidtermDocumento46 páginasCOKE MidtermKomal SharmaAún no hay calificaciones

- Habawel V Court of Tax AppealsDocumento1 páginaHabawel V Court of Tax AppealsPerry RubioAún no hay calificaciones

- 22 Caltex Philippines, Inc. vs. Commission On Audit, 208 SCRA 726, May 08, 1992Documento36 páginas22 Caltex Philippines, Inc. vs. Commission On Audit, 208 SCRA 726, May 08, 1992milkteaAún no hay calificaciones

- Solid Waste On GHG Gas in MalaysiaDocumento10 páginasSolid Waste On GHG Gas in MalaysiaOng KaiBoonAún no hay calificaciones

- Table of Forces For TrussDocumento7 páginasTable of Forces For TrussSohail KakarAún no hay calificaciones

- Analysis of Financial Ratios of Manufacturing CompaniesDocumento61 páginasAnalysis of Financial Ratios of Manufacturing CompaniesNine ZetAún no hay calificaciones

- Culture GuideDocumento44 páginasCulture GuideLeonardo TamburusAún no hay calificaciones

- HR PlanningDocumento47 páginasHR PlanningPriyanka Joshi0% (1)

- Key Payment For Japan EcomercesDocumento9 páginasKey Payment For Japan EcomercesChoo YieAún no hay calificaciones

- Soft SkillsDocumento117 páginasSoft Skillskiran100% (1)

- Transmission Line ProtectionDocumento111 páginasTransmission Line ProtectioneccabadAún no hay calificaciones

- Wasbi Bank AnalysisDocumento18 páginasWasbi Bank AnalysisHamadia KhanAún no hay calificaciones

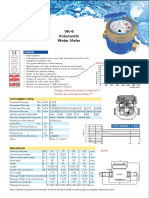

- Baylan: VK-6 Volumetric Water MeterDocumento1 páginaBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaAún no hay calificaciones

- Lunakleen: Standard Type Hepa FilterDocumento1 páginaLunakleen: Standard Type Hepa FilterRyan Au YongAún no hay calificaciones

- PH Measurement TechniqueDocumento5 páginasPH Measurement TechniquevahidAún no hay calificaciones

- GeM Bidding 2568310Documento9 páginasGeM Bidding 2568310SICURO INDIAAún no hay calificaciones

- PNB V. Se, Et Al.: 18 April 1996 G.R. No. 119231 Hermosisima, JR., J.: Special Laws - Warehouse Receipts LawDocumento3 páginasPNB V. Se, Et Al.: 18 April 1996 G.R. No. 119231 Hermosisima, JR., J.: Special Laws - Warehouse Receipts LawKelvin ZabatAún no hay calificaciones

- Sahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Documento1 páginaSahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Rohit raagAún no hay calificaciones

- ASTM Reference RadiographsDocumento3 páginasASTM Reference RadiographsAkbar ShaikAún no hay calificaciones

- Presenting India's Biggest NYE 2023 Destination PartyDocumento14 páginasPresenting India's Biggest NYE 2023 Destination PartyJadhav RamakanthAún no hay calificaciones

- CASE FLOW AT REGIONAL ARBITRATIONDocumento2 páginasCASE FLOW AT REGIONAL ARBITRATIONMichael Francis AyapanaAún no hay calificaciones

- FINAL Session 3 Specific GuidelinesDocumento54 páginasFINAL Session 3 Specific GuidelinesBovelyn Autida-masingAún no hay calificaciones