Documentos de Académico

Documentos de Profesional

Documentos de Cultura

DCB 240611

Cargado por

timurrsDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

DCB 240611

Cargado por

timurrsCopyright:

Formatos disponibles

Daily Currency Briefing

June 24, 2011

EU puts all its eggs into one basket

G10 Currencies

EUR-USD: The Eurozone heads of government once again put the pressure on: while on Monday the Ministers of Finance had still declared that they wanted to develop the parameters of a clear new financing strategy Greece until the beginning of July the work is now likely to be completed by that stage. Otherwise it was made clear once again during the summit of the EU heads of government that any aid payments depend on the decision of the Greek parliament. If the latter does not vote in favour of a new savings package there will be no payments from an old or new programme. Initially the euro came under increasing pressure yesterday once it became clear that the Greek opposition would vote against the savings package. The news that an agreement had been reached with the EU and IMF inspectors on a five-year savings plan then brought some support. This plan will have to be passed by parliament first. Should it not be possible to put together a new aid package Greece would default as early as Mid-July. That makes it even more important to get the opposition on side. The heads of government have been trying to achieve this by promising payments from the EU cohesion fund. The latter is actually to provide support for poor regions within the EU. Now it is to support the Greek with EUR 1bn. thus meeting the demands of the opposition. The opposition had been pointing out once again that what was required were investments to revive the Greek economy rather than further savings measures. Debt crisis: Concerns about contagion effects may be justified

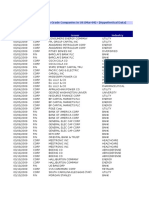

Spread between Portuguese bonds and Bunds, in percentage points

9,0

Lutz Karpowitz +49 69 136 42152 lutz.karpowitz@commerzbank.com

8,0

7,0

6,0

5,0 30. Mar.

9. Apr.

19. Apr.

29. Apr.

9. May.

19. May.

29. May.

8. Jun.

18. Jun.

Source: Bloomberg

It is this political game of pokers that is putting pressure on the euro at the moment. On the one hand the EU is bringing forward very clear cut requirements for Greece to fulfil and on the other hand even the Greek opposition is able to negotiate further concessions with its negative stance as that is what the payments from the cohesion fund are. This reflects the dilemma of the EU heads of government of what to do if the Greek government really was to refuse meeting the requirements. Even Fed president Ben Bernanke has voiced a warning. He assumes that should the negotiations fail the European (and global) financial systems and the political unity of Europe would be under threat. The political unity of Europe is not in the best of shapes anyway, but the effects on the financial markets are difficult to gauge at present. The

For important disclosure information please refer to the back pages

Daily Currency Briefing

development of the spreads of Portuguese bonds against Bunds gives reason for concern though. An aid package will not solve anything long term. Just to remind our readers: At the end of 2010 Greece had debts of 142.8% of GDP. At the end of this year these will have reached 157.7% and by the end of 2012 166.1% (EU Commissions estimates). As a result the situation remains unsustainable long term. That is exactly what makes a voluntary involvement of private banks and insurance companies in the aid package difficult. All private investors know that in the end they will not get their money back. Even if the officials keep claiming the contrary: with the (probable) further aid payments those responsible are merely buying time until a haircut will become necessary. Even if the FX markets are in the grips of the debt crisis, there are some heavyweights due for publication today. In June ifo business sentiment is likely to have been falling again. Should the result fall well below the consensus estimate of 113.4 points the euro is likely to come under further pressure as the solution of the Greek debt crisis would certainly not become any easier should the economic engine of Europe, Germany, weaken. Moreover US data might also put pressure on EUR-USD. We expect the order intake for durable goods to surprise on the upside. CHF: The Swiss franc is on the up again. Yesterday EUR-CHF fell as far as 1.1847. Following the agreement between EU, IMF and Athens on the five-year savings plan the currency pair was able to recover again slightly but continues to trade below 1.20. Not least falling prices in USD-CHF have made it clear that the franc is the last real safe haven for investors. It remains to be seen how much longer the central bank will accept that - even if deflation is not an issue at present. Until the SNB issues any warnings the franc is likely to remain in demand due to rising uncertainty.

Emerging Market Currencies

RUB: Is a Greek-style debt crisis looming in Russia? According to Sergei Ulatov, the World Banks economist in Moscow, the country is in danger of ruining its national finances on a sustainable basis. Unless the state changes its spending patterns the situation would get out of control by 2030 at the latest. Last week Minister of Finance Alexei Kudrin had already demanded 4% spending cuts so as to stabilise public finances. The public spending patterns are likely to have been affected negatively in particular by the high oil price so far this year. Lower oil prices could easily get the finances out of balance. CNY: The Financial Times published an opinion piece by Chinese Premier Wen Jiabao. Most notably he claims that China has succeeded in getting inflation under control. He points to various policies to cap price rises. He points to abundant supply of grain and an oversupply of main industrial products. We are extremely skeptical. China faces rising inflationary pressures stemming from a shrinking labour force and excessive liquidity as a consequence of outsized FX intervention. The implications of his comments however are slower PBoC rate hikes this year despite inflation.

Ashley Davies +65 63110166 ashley.davies@commerzbank.com

24 June 2011

Daily Currency Briefing

Todays Events

Time 08:00 09:00 Region Indicator CZK GER Composite confidence indicator ifo business climate Current assessment Business expectation GDP annualized Durable Goods New Orders ex Transportation Period Jun Jun Jun Jun Q1 May May Actual Our Forecast 113,0 Survey 113,4 120,8 106,3 +1,9 +1,5 +0,9 Last +5,5 114,2 121,4 107,4 +1,8 -3,6 -1,6 Direction Cross

13:30 13:30

USA USA

qoq mom mom

+2,0 +2,5 +1,5

Important Market Data

FX Current Change (%) Last trading day's high Last trading day's low FX Current Change (%) Last trading day's high Last trading day's low FX Current Change (%) Last trading day's high Last trading day's low FX Current Change (%) Last trading day's high Last trading day's low Forwards / Options EUR-USD 3M Money Market Rate (%) Bonds / Bond Futures Yield (%), Price Equity Indices Closing Change Change (%) Oil / Prec.Metals $ per unit EUR-USD 1,4266 -1,03 1,4429 1,4127 EUR-SEK 9,1850 +0,52 9,2386 9,1215 EUR-AUD 1,3539 -0,18 1,3581 1,3505 EUR-RUB 40,2138 -0,15 40,2813 39,9375 Fwd 3M -36,2600 EURIBOR 1,53 10Y Bund 2,87 EuroStoxx50 2730,86 -64,21 -2,30 Oil, Brent 109,17 EUR-JPY 114,85 -0,59 115,77 113,85 EUR-NOK 7,7801 -0,57 7,8503 7,7925 EUR-NZD 1,7540 -0,41 1,7639 1,7458 EUR-RON 4,2332 +0,63 4,2375 4,2061 Fwd 6M -71,9600 $ LIBOR 0,25 10Y T-Note 2,94 DAX 7149,44 -128,75 -1,77 Oil, Nymex 92,19 EUR-GBP 0,8909 -0,30 0,8953 0,8850 EUR-DKK 7,4591 +0,01 7,4604 7,4567 EUR-BRL 2,2697 -0,81 2,2885 2,2478 EUR-CNY 9,2330 -0,89 9,3240 9,1374 Fwd 12M -144,3500 LIBOR 0,20 10Y JGB 1,12 Dow Jones 12050,00 -59,67 -0,49 Gold 1523,25 EUR-CHF 1,1955 -0,83 1,2072 1,1848 EUR-HUF 268,88 +0,72 269,72 266,78 EUR-MXN 16,9035 -0,39 16,9737 16,7943 EUR-SGD 1,7622 -0,64 1,7752 1,7516 Vol 1M 12,79 LIBOR 0,83 EUR-CAD 1,3961 -0,37 1,4015 1,3845 EUR-CZK 24,359 +0,23 24,414 24,263 EUR-TRY 2,3204 -0,15 2,3262 2,3065 EUR-KRW 1537,0552 -0,70 1549,5842 1521,5001 Vol 3M 13,11 $ index 75,27 +0,64 75,80 74,96 EUR-PLN 3,9902 +0,25 4,0190 3,9800 EUR-ZAR 9,7422 -0,01 9,7794 9,6743 EUR-THB 43,7253 -0,22 43,8513 43,2596 Vol 12M 13,57

CHF LIBOR CAD LIBOR 0,18 1,18 10Y T-Note 10Y Gilt Bund Future Future 3,15 127,19 124,13 Nikkei 225 9677,46 +80,72 +0,84 Palladium 750,25 Zinc 2220,0 FTSE 100 5674,38 -98,61 -1,71 Platinum 1717,00 Tin 25105,0 1283,50 -3,64 -0,28 Silver 35,17

S&P 500

Industrial Metals Aluminium Lead Copper Nickel $ per ton 2477,0 2517,5 8978,5 21925,0 Sources: Bloomberg L.P., European Banking Federation, British Bankers Association, Dow Jones, Xetra, S&P, TSE, LSE, LME.

24 June 2011

Daily Currency Briefing

This document has been created and published by the Corporates & Markets division of Commerzbank AG, Frankfurt/Main or Commerzbanks branch offices mentioned in the document. Commerzbank Corporates & Markets is the investment banking division of Commerzbank, integrating research, debt, equities, interest rates and foreign exchange. The author(s) of this report, certify that (a) the views expressed in this report accurately reflect their personal views; and (b) no part of their compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or views expressed by them contained in this document. The analyst(s) named on this report are not registered / qualified as research analysts with FINRA and are not subject to NASD Rule 2711. Disclaimer This document is for information purposes only and does not take account of the specific circumstances of any recipient. The information contained herein does not constitute the provision of investment advice. It is not intended to be and should not be construed as a recommendation, offer or solicitation to acquire, or dispose of, any of the financial instruments mentioned in this document and will not form the basis or a part of any contract or commitment whatsoever. The information in this document is based on data obtained from sources believed by Commerzbank to be reliable and in good faith, but no representations, guarantees or warranties are made by Commerzbank with regard to accuracy, completeness or suitability of the data. The opinions and estimates contained herein reflect the current judgement of the author(s) on the data of this document and are subject to change without notice. The opinions do not necessarily correspond to the opinions of Commerzbank. Commerzbank does not have an obligation to update, modify or amend this document or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. The past performance of financial instruments is not indicative of future results. No assurance can be given that any opinion described herein would yield favourable investment results. Any forecasts discussed in this document may not be achieved due to multiple risk factors including without limitation market volatility, sector volatility, corporate actions, the unavailability of complete and accurate information and/or the subsequent transpiration that underlying assumptions made by Commerzbank or by other sources relied upon in the document were inapposite. Neither Commerzbank nor any of its respective directors, officers or employees accepts any responsibility or liability whatsoever for any expense, loss or damages arising out of or in any way connected with the use of all or any part of this document. Commerzbank may provide hyperlinks to websites of entities mentioned in this document, however the inclusion of a link does not imply that Commerzbank endorses, recommends or approves any material on the linked page or accessible from it. Commerzbank does not accept responsibility whatsoever for any such material, nor for any consequences of its use. This document is for the use of the addressees only and may not be reproduced, redistributed or passed on to any other person or published, in whole or in part, for any purpose, without the prior, written consent of Commerzbank. The manner of distributing this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves about and to observe such restrictions. By accepting this document, a recipient hereof agrees to be bound by the foregoing limitations. Additional notes to readers in the following countries: Germany: Commerzbank AG is registered in the Commercial Register at Amtsgericht Frankfurt under the number HRB 32000. Commerzbank AG is supervised by the German regulator Bundesanstalt fr Finanzdienstleistungsaufsicht (BaFin), Lurgiallee 12, 60439 Frankfurt am Main, Germany. United Kingdom: This document has been issued or approved for issue in the United Kingdom by Commerzbank AG London Branch. Commerzbank AG, London Branch is authorised by Bundesanstalt fr Finanzdienstleistungsaufsicht (BaFin) and subject to limited regulation by the Financial Services Authority. Details on the extent of our regulation by the Financial Services Authority are available from us on request. This document is directed exclusively to eligible counterparties and professional clients. It is not directed to retail clients. No persons other than an eligible counterparty or a professional client should read or rely on any information in this document. Commerzbank AG, London Branch does not deal for or advise or otherwise offer any investment services to retail clients. United States: This document has been approved for distribution in the US under applicable US law by Commerz Markets LLC (Commerz Markets), a wholly owned subsidiary of Commerzbank AG and a US registered broker-dealer. Any securities transaction by US persons must be effected with Commerz Markets. Under applicable US law; information regarding clients of Commerz Markets may be distributed to other companies within the Commerzbank group. This report is intended for distribution in the United States solely to institutional investors and major U.S. institutional investors, as defined in Rule 15a-6 under the Securities Exchange Act of 1934. Commerz Markets is a member of FINRA and SIPC. European Economic Area: Where this document has been produced by a legal entity outside of the EEA, the document has been re-issued by Commerzbank AG, London Branch for distribution into the EEA. Singapore: This document is furnished in Singapore by Commerzbank AG, Singapore branch. It may only be received in Singapore by an institutional investor as defined in section 4A of the Securities and Futures Act, Chapter 289 of Singapore (SFA) pursuant to section 274 of the SFA. Hong Kong: This document is furnished in Hong Kong by Commerzbank AG, Hong Kong Branch, and may only be received in Hong Kong by professional investors within the meaning of Schedule 1 of the Securities and Futures Ordinance (Cap.571) of Hong Kong and any rules made there under. Japan: Commerzbank AG, Tokyo Branch is responsible for the distribution of Research in Japan. Commerzbank AG, Tokyo Branch is regulated by the Japanese Financial Services Agency (FSA). Australia: Commerzbank AG does not hold an Australian financial services licence. This document is being distributed in Australia to wholesale customers pursuant to an Australian financial services licence exemption for Commerzbank AG under Class Order 04/1313. Commerzbank AG is regulated by Bundesanstalt fr Finanzdienstleistungsaufsicht (BaFin) under the laws of Germany which differ from Australian laws. Commerzbank AG 2011. All rights reserved. Version 9.13

Commerzbank Corporates & Markets Frankfurt London Commerzbank AG Commerzbank AG London Branch DLZ - Gebude 2, PO BOX 52715 Hndlerhaus 30 Gresham Street Mainzer Landstrae 153 London, EC2P 2XY 60327 Frankfurt Tel: + 49 69 13621200 Tel: + 44 207 623 8000

New York Commerz Markets LLC 2 World Financial Center, 31st floor New York, NY 10281 Tel: + 1 212 703 4000

Singapore Branch Commerzbank AG 8, Shenton Way, #42-01 Singapore 068811

Hong Kong Branch Commerzbank AG 29/F, Two IFC 8 Finance Street Central Hong Kong Tel: +852 3988 0988

Tel: +65 63110000

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2100)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Golffun Business PlanDocumento13 páginasGolffun Business PlanYung TanjungAún no hay calificaciones

- The State of State Enterprises 2019Documento67 páginasThe State of State Enterprises 2019anuki9premachandra100% (1)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Ultimate Business Dictionary (Team Nanban) (TPB)Documento663 páginasThe Ultimate Business Dictionary (Team Nanban) (TPB)Fred Dickson88% (8)

- Managing Finance - Study Material (Full Permission)Documento312 páginasManaging Finance - Study Material (Full Permission)midnightblushAún no hay calificaciones

- Fmi Case StudyDocumento14 páginasFmi Case StudyTan Boon Jin100% (2)

- Internal Audit ManualDocumento92 páginasInternal Audit Manualdhuvadpratik100% (8)

- US Debt Special - Jul11Documento7 páginasUS Debt Special - Jul11timurrsAún no hay calificaciones

- Daily Market Technicals: FX OutlookDocumento13 páginasDaily Market Technicals: FX OutlooktimurrsAún no hay calificaciones

- Daily Comment RR 01aug11Documento3 páginasDaily Comment RR 01aug11timurrsAún no hay calificaciones

- Special Greece Jul11Documento6 páginasSpecial Greece Jul11timurrsAún no hay calificaciones

- Marketoutlook 29jul11Documento6 páginasMarketoutlook 29jul11timurrsAún no hay calificaciones

- Strategy 01082011Documento35 páginasStrategy 01082011timurrsAún no hay calificaciones

- FX Compass July 2011Documento7 páginasFX Compass July 2011timurrsAún no hay calificaciones

- Daily Comment RR 28jul11Documento3 páginasDaily Comment RR 28jul11timurrsAún no hay calificaciones

- Daily FX STR Europe August 2011Documento9 páginasDaily FX STR Europe August 2011timurrsAún no hay calificaciones

- Daily Currency Briefing: Agreement But No Happy EndDocumento4 páginasDaily Currency Briefing: Agreement But No Happy EndtimurrsAún no hay calificaciones

- Daily FX STR Europe 29 July 2011Documento8 páginasDaily FX STR Europe 29 July 2011timurrsAún no hay calificaciones

- Daily Comment RR 29jul11Documento3 páginasDaily Comment RR 29jul11timurrsAún no hay calificaciones

- 29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEDocumento18 páginas29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEtimurrsAún no hay calificaciones

- Z29072011Documento13 páginasZ29072011timurrsAún no hay calificaciones

- Daily Market Technicals: FX OutlookDocumento13 páginasDaily Market Technicals: FX OutlooktimurrsAún no hay calificaciones

- Daily Market Technicals: FX OutlookDocumento13 páginasDaily Market Technicals: FX OutlooktimurrsAún no hay calificaciones

- DCB 280711Documento4 páginasDCB 280711timurrsAún no hay calificaciones

- Daily FX STR Europe 28 July 2011Documento7 páginasDaily FX STR Europe 28 July 2011timurrsAún no hay calificaciones

- Daily Currency Briefing: No Light at The End of The TunnelDocumento4 páginasDaily Currency Briefing: No Light at The End of The TunneltimurrsAún no hay calificaciones

- Weekly Roundup - 07-28-11 - FinalDocumento32 páginasWeekly Roundup - 07-28-11 - FinaltimurrsAún no hay calificaciones

- WiF enDocumento19 páginasWiF entimurrsAún no hay calificaciones

- Daily Comment RR 27jul11Documento3 páginasDaily Comment RR 27jul11timurrsAún no hay calificaciones

- Daily Comment RR 20jul11Documento3 páginasDaily Comment RR 20jul11timurrsAún no hay calificaciones

- Daily Currency Briefing: Waiting For Godot?Documento4 páginasDaily Currency Briefing: Waiting For Godot?timurrsAún no hay calificaciones

- Daily FX STR Europe 27 July 2011Documento8 páginasDaily FX STR Europe 27 July 2011timurrsAún no hay calificaciones

- Daily Comment RR 21jul11Documento3 páginasDaily Comment RR 21jul11timurrsAún no hay calificaciones

- DCB 210711Documento4 páginasDCB 210711timurrsAún no hay calificaciones

- Daily Market Technicals: FX OutlookDocumento13 páginasDaily Market Technicals: FX OutlooktimurrsAún no hay calificaciones

- Daily Market Technicals: FX OutlookDocumento13 páginasDaily Market Technicals: FX OutlooktimurrsAún no hay calificaciones

- Daily Currency Briefing: Restraint Ahead of EU SummitDocumento4 páginasDaily Currency Briefing: Restraint Ahead of EU SummittimurrsAún no hay calificaciones

- India's BOP and Foreign ExchangeDocumento7 páginasIndia's BOP and Foreign ExchangeSuria UnnikrishnanAún no hay calificaciones

- Martinsa Fadesa Annual Report 2006Documento205 páginasMartinsa Fadesa Annual Report 2006easytouch100% (1)

- IVRCL Infra PresentationDocumento35 páginasIVRCL Infra Presentationmano984Aún no hay calificaciones

- Detecting Breakouts From Flags & PennantsDocumento9 páginasDetecting Breakouts From Flags & PennantsdrkwngAún no hay calificaciones

- Credit Requirement For Rural Non - Farm Sector09Documento13 páginasCredit Requirement For Rural Non - Farm Sector09Divesh ChandraAún no hay calificaciones

- Issue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)Documento10 páginasIssue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)ayush jainAún no hay calificaciones

- Cambodia Country PresentationDocumento31 páginasCambodia Country PresentationADBI EventsAún no hay calificaciones

- ValeoDocumento2 páginasValeoRe WindAún no hay calificaciones

- A Dissertation Report OnDocumento111 páginasA Dissertation Report OnshashankAún no hay calificaciones

- Islamic AccountingDocumento9 páginasIslamic AccountingMohamed QubatiAún no hay calificaciones

- Usgi Report A Comparative Study of Agent of BrokerDocumento53 páginasUsgi Report A Comparative Study of Agent of BrokerSonal OberoiAún no hay calificaciones

- Cash Flow and Balance SheetDocumento88 páginasCash Flow and Balance SheetHetal VisariaAún no hay calificaciones

- SM PFA 2e CH 1 Accounting in Business PDFDocumento63 páginasSM PFA 2e CH 1 Accounting in Business PDFellewinaAún no hay calificaciones

- Mr. Honey's Banking DictionaryGerman-English by Honig, WinfriedDocumento222 páginasMr. Honey's Banking DictionaryGerman-English by Honig, WinfriedGutenberg.orgAún no hay calificaciones

- Canadian Cannabis Corp - Richard Wachsberg PDFDocumento1 páginaCanadian Cannabis Corp - Richard Wachsberg PDFApollo corpAún no hay calificaciones

- Plastic Syring and Disposable Needle Making PlantDocumento25 páginasPlastic Syring and Disposable Needle Making PlantJohnAún no hay calificaciones

- ProjectDocumento7 páginasProjectfarhat514Aún no hay calificaciones

- Dividend Decisions: Meaning Types of Dividend Policies Factors Influencing Dividend Policy Forms of DividendDocumento7 páginasDividend Decisions: Meaning Types of Dividend Policies Factors Influencing Dividend Policy Forms of DividendRajyaLakshmiAún no hay calificaciones

- Daniel Ahn Speculation Commodity PricesDocumento29 páginasDaniel Ahn Speculation Commodity PricesDan DickerAún no hay calificaciones

- Airtel Case StudyDocumento6 páginasAirtel Case Studymuskan singlaAún no hay calificaciones

- Financial Markets and Financial InstrumentsDocumento80 páginasFinancial Markets and Financial Instrumentsabhijeit86100% (2)

- Definition of Elements of Financial StatementsDocumento1 páginaDefinition of Elements of Financial StatementsKc B.Aún no hay calificaciones

- All About BPIDocumento3 páginasAll About BPIJodelyn Tano JumadasAún no hay calificaciones

- A Comprehensive Study On Benefits of Mutual Fund Schemes To The Individual InvestorsDocumento23 páginasA Comprehensive Study On Benefits of Mutual Fund Schemes To The Individual InvestorsswetaleenaAún no hay calificaciones