Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Hire Purchase

Cargado por

Questionscastle FriendDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Hire Purchase

Cargado por

Questionscastle FriendCopyright:

Formatos disponibles

Subject: Financial Accounts Topic: Hire Purchase

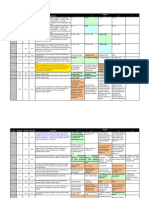

By: Questionscastle Academic Team Document Code: CA/IPCC/ACC/0008 ------------------------------------------------------------------------------------------------------------------------------------ Hire Purchase System is a system of purchasing on instalment basis. Under this system of purchase the goods are purchased by purchaser on an instalment basis. The only difference between traditional instalment system and hire purchase system is, In hire purchase system the ownership of goods does not pass to the buyer till he pay the last instalment due on him. Although the goods remain with purchaser but legal ownership is with seller. Accounting for hire purchase: The accounting for hire purchase is very easy if you take it as a concept. The following incidental concept of accounting will make it all clear to you. Suppose there is a TV shop selling TV on hire purchase and Mr. X is a customer willing to buy a TV on hire purchase. Now you look at each incident that occurs and how a accounting entry is made for it. S. No. 1 2 3 4 5 6 7 Incident When TV Sets are purchased by TV Shop from manufacturer. When TV sets are ready to be sold at the shop. Addition of profit (to be earned by shop owner) on the TV sets ready for sale. When Mr. X purchased the TV set from shop (includes profit) When instalment is due on customer at the due date (Stock becomes debtor). When instalment is paid by the customer. Accounting Entry

Shop Stock A/c Dr. To Creditor/Bank A/c Cost of Goods Sold Dr. To Shop Stock A/c Cost of Goods Sold Dr. To HP Stock Reserve A/c HP Stock A/c Dr. To Cost of Goods Sold HP Debtor A/c Dr. To HP Stock A/c Cash/Bank A/c Dr. To HP Debtor A/c When instalment is again due on HP Debtor A/c Dr. customer at the due date (Stock becomes To HP Stock A/c debtor). When profit earned on instalments HP Stock Reserve A/c Dr. received from customer is transferred to To P&L A/c P&L a/c

Ledgers to be prepared under Hire purchase accounting system Shop Stock A/c XXX By Trading A/c (Cost Price) XXX By Goods sent on HP (Cost Price) By Bal C/d XXX Goods Sent on HP A/c XXX By HP Stock A/c (Invoice Price) XXX XXX HP Stock A/c

To Bal B/d To Purchase A/c

XXX XXX XXX XXX

To Shop Stock A/c To HP Adjustment A/c (Bal. Fig)

XXX XXX

To Bal B/d To Goods sent on HP A/c (Invoice Price)

XXX XXX

By HP Debtor A/c (Instalment Due) By Goods repossessed A/c (Instalment not due on goods repossessed) By Bal C/d

XXX XXX

XXX HP Debtor A/c XXX By Cash/Bank XXX By Goods Repossessed A/c (Instalment due on goods repossessed) By Bal C/d XXX Goods Repossessed A/c XXX By Bank A/c (If goods XXX repossessed are sold) XXX By HP Adjustment A/c (Bal Fig) By Bal C/d XXX HP Adjustment A/c XXX By Stock Reserve A/c (Loading on Opening bal of HP Stock XXX A/c) XXX By Goods sent on HP XXX

XXX XXX

To Bal B/d To HP Stock A/c (Instalment Due)

XXX XXX XXX XXX

To HP Stock A/c To HP Debtor A/c To HP Adjustment A/c (Bal Fig)

XXX XXX XXX XXX

To Stock Reserve A/c (Loading on closing bal of HP Stock A/c) To P&L A/c (Bal Fig) To Goods Repossessed A/c

XXX XXX XXX

También podría gustarte

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthDe EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthAún no hay calificaciones

- Hire Purchase AccountsDocumento4 páginasHire Purchase AccountsHrishikeshAún no hay calificaciones

- Accounting EntriesDocumento9 páginasAccounting Entrieswalips1Aún no hay calificaciones

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersDe EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersCalificación: 2 de 5 estrellas2/5 (4)

- 1040 Exam Prep Module X: Small Business Income and ExpensesDe Everand1040 Exam Prep Module X: Small Business Income and ExpensesAún no hay calificaciones

- The Entrepreneur’S Dictionary of Business and Financial TermsDe EverandThe Entrepreneur’S Dictionary of Business and Financial TermsAún no hay calificaciones

- Accounting Entries in Oracle Purchasing and PayablesDocumento15 páginasAccounting Entries in Oracle Purchasing and PayablesmuradAún no hay calificaciones

- Blunders and How To Avoid Them Dunnington PDFDocumento147 páginasBlunders and How To Avoid Them Dunnington PDFrajveer404100% (2)

- Material de Referencia MMDocumento315 páginasMaterial de Referencia MMCraig GreenAún no hay calificaciones

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDe EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsCalificación: 5 de 5 estrellas5/5 (1)

- Sap Accounting EntriesDocumento8 páginasSap Accounting EntriesMuhammad Javed IqbalAún no hay calificaciones

- Accounting EntriesDocumento16 páginasAccounting EntriesphonraphatAún no hay calificaciones

- Cost & Managerial Accounting II EssentialsDe EverandCost & Managerial Accounting II EssentialsCalificación: 4 de 5 estrellas4/5 (1)

- Leverages Question BankDocumento3 páginasLeverages Question BankQuestionscastle Friend60% (5)

- Inventory Average Cost TransactionsDocumento70 páginasInventory Average Cost TransactionsMuhammad Wasim QureshiAún no hay calificaciones

- Accounting Entries in ModulesDocumento88 páginasAccounting Entries in ModulesSuresh Joshi100% (2)

- Sino-Japanese Haikai PDFDocumento240 páginasSino-Japanese Haikai PDFAlina Diana BratosinAún no hay calificaciones

- Chinese AstronomyDocumento13 páginasChinese Astronomyss13Aún no hay calificaciones

- SAP MM Inventory Accounting EntriesDocumento17 páginasSAP MM Inventory Accounting EntriesKrishna Akula100% (1)

- ACCA Advanced Corporate Reporting 2005Documento763 páginasACCA Advanced Corporate Reporting 2005Platonic100% (2)

- SAP SD Accounting EntriesDocumento3 páginasSAP SD Accounting EntriesAhmed AshrafAún no hay calificaciones

- MasterMind 1 Unit 5 Extra LifeSkills Lesson 2Documento2 páginasMasterMind 1 Unit 5 Extra LifeSkills Lesson 2Hugo A FEAún no hay calificaciones

- Q&A JurisdictionDocumento20 páginasQ&A JurisdictionlucasAún no hay calificaciones

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursDe EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursAún no hay calificaciones

- Oracle Question AnswerDocumento44 páginasOracle Question AnswerVijay PatelAún no hay calificaciones

- Dropshipping: Road to $10,000 per month of Passive Income Doesn’t Have to be Difficult! Learn more about Social Media Advertising, Facebook Advertising, Shopify Ecommerce and EbayDe EverandDropshipping: Road to $10,000 per month of Passive Income Doesn’t Have to be Difficult! Learn more about Social Media Advertising, Facebook Advertising, Shopify Ecommerce and EbayCalificación: 5 de 5 estrellas5/5 (1)

- CH 8 - Merchandising OperationsDocumento70 páginasCH 8 - Merchandising OperationsJem BobilesAún no hay calificaciones

- Single Entry SystemDocumento6 páginasSingle Entry SystemQuestionscastle Friend67% (3)

- Hercules Industries Inc. v. Secretary of Labor (1992)Documento1 páginaHercules Industries Inc. v. Secretary of Labor (1992)Vianca MiguelAún no hay calificaciones

- Purchase Vs Consumption Based Accounting Accounting Entries in SapDocumento10 páginasPurchase Vs Consumption Based Accounting Accounting Entries in SapAAPS ACGSAún no hay calificaciones

- ForfeitingDocumento12 páginasForfeitingjatinmundra3Aún no hay calificaciones

- Hire PurchaseDocumento6 páginasHire PurchaseHarsha ThawaniAún no hay calificaciones

- SAP Accounting EntriesDocumento7 páginasSAP Accounting EntriesJessica AlvarezAún no hay calificaciones

- Hire Purchase, Lease and Instalment PurchaseDocumento30 páginasHire Purchase, Lease and Instalment PurchaseMunmun MishraAún no hay calificaciones

- Inventory Accounting EntriesDocumento10 páginasInventory Accounting EntriesswayamAún no hay calificaciones

- Financial Statement (Without Adjustments) 03 - Class Notes - (Aarambh 11th Commerce)Documento13 páginasFinancial Statement (Without Adjustments) 03 - Class Notes - (Aarambh 11th Commerce)Keshav MarwahAún no hay calificaciones

- Account PostingDocumento16 páginasAccount Postinganiruddha_2012Aún no hay calificaciones

- Sap Accounting EntriesDocumento9 páginasSap Accounting Entriesswayam100% (1)

- Sales and Distribution Accounting EntriesDocumento4 páginasSales and Distribution Accounting EntriesshivdeepbAún no hay calificaciones

- Accounts Sem1Documento24 páginasAccounts Sem1api-3849048Aún no hay calificaciones

- Accounting EntriesDocumento5 páginasAccounting Entriesshreya9962Aún no hay calificaciones

- Chapter 6 - Accounting For MerchandiseDocumento30 páginasChapter 6 - Accounting For MerchandiseTrần Anh TuấnAún no hay calificaciones

- Payables: P2P EntiresDocumento20 páginasPayables: P2P EntiresVK SHARMAAún no hay calificaciones

- Topic 3 Special AccountsDocumento47 páginasTopic 3 Special AccountsSyahirah ZainalAún no hay calificaciones

- SAP SD Accounting EntriesDocumento4 páginasSAP SD Accounting EntriessaurabhAún no hay calificaciones

- Problem 1-2: Periodic SystemDocumento3 páginasProblem 1-2: Periodic SystemFrencess Mae MayolaAún no hay calificaciones

- Accrual ProcessDocumento12 páginasAccrual ProcessKatie RuizAún no hay calificaciones

- Inventory SystemsDocumento18 páginasInventory SystemsJuliana Silver Marie M. Apolto100% (1)

- Accounting Entries P-PDocumento14 páginasAccounting Entries P-PSudhir PatilAún no hay calificaciones

- Chapter 6-Accounting For Merchandising TransactionsDocumento30 páginasChapter 6-Accounting For Merchandising Transactions05 Phạm Hồng Diệp12.11Aún no hay calificaciones

- ACC 1101 Final MergedDocumento50 páginasACC 1101 Final MergedEmdadul HosenAún no hay calificaciones

- Amalgamation & AbsorptionDocumento11 páginasAmalgamation & AbsorptionSubhra DasAún no hay calificaciones

- Periodic and Perpetual Inventory SystemsDocumento17 páginasPeriodic and Perpetual Inventory SystemsMichael Brian TorresAún no hay calificaciones

- Profit and Loss P&L Statement StatementDocumento3 páginasProfit and Loss P&L Statement StatementShreepathi AdigaAún no hay calificaciones

- Notes For Merchandising Business - 1Documento2 páginasNotes For Merchandising Business - 1Ruab PlosAún no hay calificaciones

- Branch AccountsDocumento57 páginasBranch Accountsasadqhse50% (2)

- 1FSales and Distribution Accounting EntriesDocumento4 páginas1FSales and Distribution Accounting EntriesKunjunni MashAún no hay calificaciones

- Payables: When We Receive The Goods in The Staging Area The Accounting Entry Would Be (MAS) / (GRN)Documento15 páginasPayables: When We Receive The Goods in The Staging Area The Accounting Entry Would Be (MAS) / (GRN)VK SHARMAAún no hay calificaciones

- BBA II Chapter 2 Sale of PartnershipDocumento19 páginasBBA II Chapter 2 Sale of PartnershipSiddharth SalgaonkarAún no hay calificaciones

- Sales and Distribution Accounting EntriesDocumento4 páginasSales and Distribution Accounting EntriesAjitabh SinghAún no hay calificaciones

- Accounting Transactions in PODocumento3 páginasAccounting Transactions in POsherif ramadanAún no hay calificaciones

- Chapter ThreeDocumento28 páginasChapter ThreeMathewos Woldemariam BirruAún no hay calificaciones

- Non-Integrated Accounting System: Class: TYBAF SEM:5 Subject Incharge: Asst - Prof.Shifa TuscanoDocumento20 páginasNon-Integrated Accounting System: Class: TYBAF SEM:5 Subject Incharge: Asst - Prof.Shifa Tuscanoleroytuscano100% (2)

- Chapter 8 InventoryDocumento11 páginasChapter 8 Inventorymarwan2004acctAún no hay calificaciones

- Self Balancing Ledger Question BankDocumento4 páginasSelf Balancing Ledger Question BankQuestionscastle Friend50% (2)

- Account Current Question BankDocumento2 páginasAccount Current Question BankQuestionscastle Friend0% (1)

- Self Balancing Ledger Question BankDocumento4 páginasSelf Balancing Ledger Question BankQuestionscastle Friend50% (2)

- Self Balancing Ledger Question BankDocumento4 páginasSelf Balancing Ledger Question BankQuestionscastle Friend50% (2)

- Average Due Date Question BankDocumento2 páginasAverage Due Date Question BankQuestionscastle Friend67% (6)

- Capital Structure Question BankDocumento5 páginasCapital Structure Question BankQuestionscastle FriendAún no hay calificaciones

- Hire PurchaseDocumento3 páginasHire PurchaseQuestionscastle FriendAún no hay calificaciones

- Investment AccountDocumento2 páginasInvestment AccountQuestionscastle Friend67% (3)

- Theory Questions 1 FMDocumento3 páginasTheory Questions 1 FMQuestionscastle Friend100% (1)

- Cost of Capital Question BankDocumento4 páginasCost of Capital Question BankQuestionscastle Friend100% (1)

- Theory Question 2 Cost AccountsDocumento2 páginasTheory Question 2 Cost AccountsQuestionscastle FriendAún no hay calificaciones

- Theory Question 1Documento2 páginasTheory Question 1Questionscastle FriendAún no hay calificaciones

- Direct Material CostDocumento4 páginasDirect Material CostQuestionscastle Friend100% (1)

- Subject: Financial Accounts: Topic: Financial Statements of Not For Profit OrganizationsDocumento5 páginasSubject: Financial Accounts: Topic: Financial Statements of Not For Profit OrganizationsQuestionscastle FriendAún no hay calificaciones

- Single Entry SystemDocumento2 páginasSingle Entry SystemQuestionscastle FriendAún no hay calificaciones

- Labour CostDocumento3 páginasLabour CostQuestionscastle FriendAún no hay calificaciones

- Reconciliation of Cost and Financial AccountsDocumento4 páginasReconciliation of Cost and Financial AccountsQuestionscastle FriendAún no hay calificaciones

- Cost SheetDocumento4 páginasCost SheetQuestionscastle FriendAún no hay calificaciones

- MaterialDocumento5 páginasMaterialQuestionscastle FriendAún no hay calificaciones

- Essay EnglishDocumento4 páginasEssay Englishkiera.kassellAún no hay calificaciones

- Quarter: FIRST Week: 2: Ballecer ST., Central Signal, Taguig CityDocumento2 páginasQuarter: FIRST Week: 2: Ballecer ST., Central Signal, Taguig CityIRIS JEAN BRIAGASAún no hay calificaciones

- WO 2021/158698 Al: (10) International Publication NumberDocumento234 páginasWO 2021/158698 Al: (10) International Publication Numberyoganayagi209Aún no hay calificaciones

- Affirmative (Afirmativa) Long Form Short Form PortuguêsDocumento3 páginasAffirmative (Afirmativa) Long Form Short Form PortuguêsAnitaYangAún no hay calificaciones

- Marketing Mix of Van HeusenDocumento38 páginasMarketing Mix of Van HeusenShail PatelAún no hay calificaciones

- Activity Lesson PlanDocumento2 páginasActivity Lesson PlanPsiho LoguseAún no hay calificaciones

- Creative Nonfiction 2 For Humss 12 Creative Nonfiction 2 For Humss 12Documento55 páginasCreative Nonfiction 2 For Humss 12 Creative Nonfiction 2 For Humss 12QUINTOS, JOVINCE U. G-12 HUMSS A GROUP 8Aún no hay calificaciones

- Goal Ball Lesson PlanDocumento4 páginasGoal Ball Lesson Planapi-378557749100% (1)

- 19 Amazing Benefits of Fennel Seeds For SkinDocumento9 páginas19 Amazing Benefits of Fennel Seeds For SkinnasimAún no hay calificaciones

- Enunciado de La Pregunta: Finalizado Se Puntúa 1.00 Sobre 1.00Documento9 páginasEnunciado de La Pregunta: Finalizado Se Puntúa 1.00 Sobre 1.00Samuel MojicaAún no hay calificaciones

- The Recipe For Oleander Sou1Documento4 páginasThe Recipe For Oleander Sou1Anthony SullivanAún no hay calificaciones

- GRADE 1 To 12 Daily Lesson LOG: TLE6AG-Oc-3-1.3.3Documento7 páginasGRADE 1 To 12 Daily Lesson LOG: TLE6AG-Oc-3-1.3.3Roxanne Pia FlorentinoAún no hay calificaciones

- Lesson 3 The Prodigal SonDocumento2 páginasLesson 3 The Prodigal Sonapi-241115908Aún no hay calificaciones

- Maria MakilingDocumento2 páginasMaria MakilingRommel Villaroman Esteves0% (1)

- Types of Numbers: SeriesDocumento13 páginasTypes of Numbers: SeriesAnonymous NhQAPh5toAún no hay calificaciones

- Is 13779 1999 PDFDocumento46 páginasIs 13779 1999 PDFchandranmuthuswamyAún no hay calificaciones

- Name Numerology Calculator - Chaldean Name Number PredictionsDocumento2 páginasName Numerology Calculator - Chaldean Name Number Predictionsarunamurugesan7Aún no hay calificaciones

- Sukhtankar Vaishnav Corruption IPF - Full PDFDocumento79 páginasSukhtankar Vaishnav Corruption IPF - Full PDFNikita anandAún no hay calificaciones

- Insomnii, Hipersomnii, ParasomniiDocumento26 páginasInsomnii, Hipersomnii, ParasomniiSorina TatuAún no hay calificaciones

- Joshua 24 15Documento1 páginaJoshua 24 15api-313783690Aún no hay calificaciones

- Customizable Feature Based Design Pattern Recognition Integrating Multiple TechniquesDocumento191 páginasCustomizable Feature Based Design Pattern Recognition Integrating Multiple TechniquesCalina Sechel100% (1)

- Research ProposalDocumento18 páginasResearch ProposalIsmaelAún no hay calificaciones

- Maths Lowersixth ExamsDocumento2 páginasMaths Lowersixth ExamsAlphonsius WongAún no hay calificaciones