Documentos de Académico

Documentos de Profesional

Documentos de Cultura

CAP's Plan For Budgeting For Growth and Prosperity

Cargado por

Center for American ProgressTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

CAP's Plan For Budgeting For Growth and Prosperity

Cargado por

Center for American ProgressCopyright:

Formatos disponibles

Budgeting for Growth and Prosperity

A Long-term Plan from the Center for American Progress

to Balance the Budget, Grow the Economy, and Strengthen

the Middle Class

Michael Ettlinger, Michael Linden, and Seth Hanlon May 2011

The highlights

• Achieves “primary balance” by 2015, with the federal budget in the black except for

payments on the national debt

• Hits full and permanent balance by 2030, and reduces the debt to just over 40 percent

of gross domestic product by 2035

• Delivers two-thirds of the deficit reduction from spending cuts, and one-third from

revenue increases

• Is the only long-term plan for sustained balanced budgets that invests in the middle

class rather than asking them to bear the brunt of deficit reduction

Our plan makes room for crucial investments, protects middle-class

services, and fights poverty

• Makes room for substantial new investments in all levels of education, renewable

and clean energy technologies, transportation and infrastructure, and basic scientific

research and development even while balancing the budget—investing an annual

average of about $70 billion above current levels

• Includes substantial, targeted boosts to successful antipoverty programs that cut the

poverty rate in half by 2030

Our plan controls health care costs for everyone, not just those in the

public programs

• Strengthens existing cost-containment measures in the Affordable Care Act

• Fully pays for a permanent “Doc Fix” for Medicare

• Builds in a cost-containment “failsafe” to slow the growth of health care costs across

the entire economy while ensuring the quality of care

1 Center for American Progress | Budgeting for Growth and Prosperity

Our plan sets “discretionary” spending at responsible levels

• Brings defense, homeland security, and the State Department into one unified budget

to better meet our 21st century national security needs

• Delivers strategic cuts to defense to bring spending down to peak Cold War levels,

adjusted for inflation

• Sets limits to nonsecurity discretionary spending that, over time, contribute to deficit

reduction, but also make room for necessary investments

Our plan delivers comprehensive income tax reform so the tax code is

simpler, fairer, and raises enough revenue

• Creates a single 15 percent income tax bracket for 80 percent of Americans

• Turns tax deductions into flat credits so that every taxpayer gets the same benefit

• Returns the top ordinary income tax rate to levels under President Clinton

• Includes a temporary 5 percent surtax for millionaires that expires in 2030 when the

budget balances

• Caps the top capital gains rate on realized investment income at the level signed into

law by President Reagan

• Eliminates or reforms dozens of “tax entitlements” such as oil and gas industry

subsidies and special benefits for hedge fund managers

• Results in 90 percent of taxpayers getting an income tax cut or no change at all in their

income tax bill

• Results in the after-tax income of the richest 1 percent of taxpayers remaining at least

46 percent higher than it was in 2001

Our plan combats climate change and reduces our dependence on

foreign oil

• Establishes a price on carbon emissions, with any higher costs for lower- and middle-

income families more than offset, on average, by our income tax cuts and rebate program

• Levies a $5 per barrel fee on foreign oil imports

Our plan improves the stability of U.S. financial markets

• Enacts a modest financial transactions tax to discourage short-term speculation and

encourage long-term investment

Read the full report, “Budgeting for Growth and Prosperity,”at our website.

2 Center for American Progress | Budgeting for Growth and Prosperity

También podría gustarte

- Aging Dams and Clogged Rivers: An Infrastructure Plan For America's WaterwaysDocumento28 páginasAging Dams and Clogged Rivers: An Infrastructure Plan For America's WaterwaysCenter for American ProgressAún no hay calificaciones

- Leveraging U.S. Power in The Middle East: A Blueprint For Strengthening Regional PartnershipsDocumento60 páginasLeveraging U.S. Power in The Middle East: A Blueprint For Strengthening Regional PartnershipsCenter for American Progress0% (1)

- Housing The Extended FamilyDocumento57 páginasHousing The Extended FamilyCenter for American Progress100% (1)

- Paid Leave Is Good For Small BusinessDocumento8 páginasPaid Leave Is Good For Small BusinessCenter for American ProgressAún no hay calificaciones

- Rhetoric vs. Reality: Child CareDocumento7 páginasRhetoric vs. Reality: Child CareCenter for American ProgressAún no hay calificaciones

- 3 Strategies For Building Equitable and Resilient CommunitiesDocumento11 páginas3 Strategies For Building Equitable and Resilient CommunitiesCenter for American ProgressAún no hay calificaciones

- Preventing Problems at The Polls: North CarolinaDocumento8 páginasPreventing Problems at The Polls: North CarolinaCenter for American ProgressAún no hay calificaciones

- Closed Doors: Black and Latino Students Are Excluded From Top Public UniversitiesDocumento21 páginasClosed Doors: Black and Latino Students Are Excluded From Top Public UniversitiesCenter for American ProgressAún no hay calificaciones

- An Infrastructure Plan For AmericaDocumento85 páginasAn Infrastructure Plan For AmericaCenter for American ProgressAún no hay calificaciones

- A Progressive Agenda For Inclusive and Diverse EntrepreneurshipDocumento45 páginasA Progressive Agenda For Inclusive and Diverse EntrepreneurshipCenter for American ProgressAún no hay calificaciones

- America Under Fire: An Analysis of Gun Violence in The United States and The Link To Weak Gun LawsDocumento46 páginasAmerica Under Fire: An Analysis of Gun Violence in The United States and The Link To Weak Gun LawsCenter for American Progress0% (1)

- Preventing Problems at The Polls: OhioDocumento8 páginasPreventing Problems at The Polls: OhioCenter for American ProgressAún no hay calificaciones

- Addressing Challenges To Progressive Religious Liberty in North CarolinaDocumento12 páginasAddressing Challenges To Progressive Religious Liberty in North CarolinaCenter for American ProgressAún no hay calificaciones

- Preventing Problems at The Polls: FloridaDocumento7 páginasPreventing Problems at The Polls: FloridaCenter for American ProgressAún no hay calificaciones

- How Predatory Debt Traps Threaten Vulnerable FamiliesDocumento11 páginasHow Predatory Debt Traps Threaten Vulnerable FamiliesCenter for American ProgressAún no hay calificaciones

- Fast Facts: Economic Security For New Hampshire FamiliesDocumento4 páginasFast Facts: Economic Security For New Hampshire FamiliesCenter for American ProgressAún no hay calificaciones

- A Market-Based Fix For The Federal Coal ProgramDocumento12 páginasA Market-Based Fix For The Federal Coal ProgramCenter for American ProgressAún no hay calificaciones

- Fast Facts: Economic Security For Arizona FamiliesDocumento4 páginasFast Facts: Economic Security For Arizona FamiliesCenter for American ProgressAún no hay calificaciones

- The Path To 270 in 2016, RevisitedDocumento23 páginasThe Path To 270 in 2016, RevisitedCenter for American ProgressAún no hay calificaciones

- Fast Facts: Economic Security For Wisconsin FamiliesDocumento4 páginasFast Facts: Economic Security For Wisconsin FamiliesCenter for American ProgressAún no hay calificaciones

- Fast Facts: Economic Security For Illinois FamiliesDocumento4 páginasFast Facts: Economic Security For Illinois FamiliesCenter for American ProgressAún no hay calificaciones

- Fast Facts: Economic Security For Virginia FamiliesDocumento4 páginasFast Facts: Economic Security For Virginia FamiliesCenter for American ProgressAún no hay calificaciones

- Opportunities For The Next Executive Director of The Green Climate FundDocumento7 páginasOpportunities For The Next Executive Director of The Green Climate FundCenter for American ProgressAún no hay calificaciones

- Federal Regulations Should Drive More Money To Poor SchoolsDocumento4 páginasFederal Regulations Should Drive More Money To Poor SchoolsCenter for American ProgressAún no hay calificaciones

- The Missing Conversation About Work and FamilyDocumento31 páginasThe Missing Conversation About Work and FamilyCenter for American ProgressAún no hay calificaciones

- Great Leaders For Great Schools: How Four Charter Networks Recruit, Develop, and Select PrincipalsDocumento45 páginasGreat Leaders For Great Schools: How Four Charter Networks Recruit, Develop, and Select PrincipalsCenter for American ProgressAún no hay calificaciones

- The Hyde Amendment Has Perpetuated Inequality in Abortion Access For 40 YearsDocumento10 páginasThe Hyde Amendment Has Perpetuated Inequality in Abortion Access For 40 YearsCenter for American ProgressAún no hay calificaciones

- A Quality Alternative: A New Vision For Higher Education AccreditationDocumento25 páginasA Quality Alternative: A New Vision For Higher Education AccreditationCenter for American ProgressAún no hay calificaciones

- Workin' 9 To 5: How School Schedules Make Life Harder For Working ParentsDocumento91 páginasWorkin' 9 To 5: How School Schedules Make Life Harder For Working ParentsCenter for American ProgressAún no hay calificaciones

- A Clean Energy Action Plan For The United StatesDocumento49 páginasA Clean Energy Action Plan For The United StatesCenter for American ProgressAún no hay calificaciones

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (120)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2101)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Pre-Week Batch 90 (TAX)Documento12 páginasPre-Week Batch 90 (TAX)Elaine Joyce GarciaAún no hay calificaciones

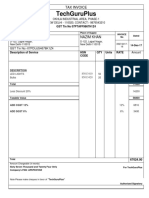

- GST Invoice Format No. 5Documento1 páginaGST Invoice Format No. 5Jugaadi BahmanAún no hay calificaciones

- ACC 143 Quiz 2Documento9 páginasACC 143 Quiz 2Riezel PepitoAún no hay calificaciones

- Modal Verbs - Questões Com GabaritoDocumento5 páginasModal Verbs - Questões Com GabaritoRenata SaraivaAún no hay calificaciones

- RMO No 19-2015 PDFDocumento10 páginasRMO No 19-2015 PDFEcarg EtrofnomAún no hay calificaciones

- The Public Finance Management ACT 2018Documento60 páginasThe Public Finance Management ACT 2018Thomas YobeAún no hay calificaciones

- Denis Martin Jacobo - RESEARCHDocumento73 páginasDenis Martin Jacobo - RESEARCHjupiter stationeryAún no hay calificaciones

- Chapter 10 Compensation IncomeDocumento4 páginasChapter 10 Compensation IncomeJason MablesAún no hay calificaciones

- Balibago WaterDocumento9 páginasBalibago WaterJeffrey MacalinoAún no hay calificaciones

- Sample IRSTax Return TranscriptDocumento6 páginasSample IRSTax Return TranscriptnowayAún no hay calificaciones

- Tax Formula and Tax Determination An Overview of Property TransactionsDocumento23 páginasTax Formula and Tax Determination An Overview of Property TransactionsJames Riley Case100% (1)

- Group 1 - Chapter 16Documento8 páginasGroup 1 - Chapter 16Cherie Soriano AnanayoAún no hay calificaciones

- GEM Goela Expense ManagerDocumento8 páginasGEM Goela Expense ManagerSachin PocoAún no hay calificaciones

- Dictionar de Termeni Economici (Engleza)Documento5 páginasDictionar de Termeni Economici (Engleza)maria_alexandra1987100% (2)

- City Treasury Office: Togan, Juliet PDocumento1 páginaCity Treasury Office: Togan, Juliet PJerik ElesioAún no hay calificaciones

- Steps On How To Register Your Laundry BusinessDocumento1 páginaSteps On How To Register Your Laundry BusinessJoseph GutierrezAún no hay calificaciones

- Vardhman ComputerDocumento1 páginaVardhman ComputerVinay vibhuti YadavAún no hay calificaciones

- Wat Flat#95Documento1 páginaWat Flat#95Peer MohideenAún no hay calificaciones

- Topic 9 Employment Income (Derivation & Exemption)Documento42 páginasTopic 9 Employment Income (Derivation & Exemption)Rico YongAún no hay calificaciones

- Bhushan Chandrashekhar KolapkarDocumento2 páginasBhushan Chandrashekhar KolapkarAditya PLAún no hay calificaciones

- Unit 2 Public Revenue 2Documento19 páginasUnit 2 Public Revenue 2Queenie SpotlightAún no hay calificaciones

- Ohio Charitable Trust Act Information SheetDocumento1 páginaOhio Charitable Trust Act Information SheetMary GallagherAún no hay calificaciones

- Sample Format of Laundry BillDocumento1 páginaSample Format of Laundry BillShiva RajAún no hay calificaciones

- Practice Activity - SolvedDocumento1 páginaPractice Activity - SolvedanzarAún no hay calificaciones

- Registered Account PresentationDocumento20 páginasRegistered Account PresentationNicolas CostaAún no hay calificaciones

- Profile Assignment 1-2021Documento2 páginasProfile Assignment 1-2021Sumaya AhmedAún no hay calificaciones

- Md. Jehad Uddin Deputy Secretary Financial Institutions Division Ministry of FinanceDocumento75 páginasMd. Jehad Uddin Deputy Secretary Financial Institutions Division Ministry of FinanceKhadeeza ShammeeAún no hay calificaciones

- Report 01Documento94 páginasReport 01Waseem AnsariAún no hay calificaciones

- Samarth Hardware 3673Documento3 páginasSamarth Hardware 3673NATIONAL onlineservicesAún no hay calificaciones

- Anju Sharma U1 283 Grange Road, Ormond VIC 3204Documento1 páginaAnju Sharma U1 283 Grange Road, Ormond VIC 3204Aksh GillAún no hay calificaciones