Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Why Is It Important To Consider Uncertainty When Evaluating Supply Chain Design

Cargado por

Akshay_Raja_941Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Why Is It Important To Consider Uncertainty When Evaluating Supply Chain Design

Cargado por

Akshay_Raja_941Copyright:

Formatos disponibles

BITS PILANI Second Semester 2006-07

Birla Institute of Technology and Science, Pilani

Comprehensive Examination

Second Semester 2006-07

Supply Chain Management (ITEB G621)

Closed Book Date: 08/05/2007 (AN)

Max Mark: 40 Max. Time: 3 Hours

Q1. a) What do you understand by bullwhip effect? Also explain its impact on supply chain

performance. [2]

b) Discuss the managerial levers that help in achieving coordination in a supply chain. [3]

c) What is ERP and how did it come about? How can an organization implement ERP system? [2]

Q2. a) Most firms offer their sales force monetary incentives based on exceeding a specified target.

What are some pros and cons of this approach? How would you modify these contracts to

rectify some of the problems? [2]

b) Discuss key drivers that may be used to tailor transportation. How does tailoring help? [3]

c) Discuss the managerial levers available to lower safety inventory and improve product

availability. [2.5]

Q3. a) What is the difference between lot size-based and volume-based quantity discounts? [1]

b) Discuss the issues that should be considered when implementing aggregate planning for supply

chain in practice. [2]

c) Why is it important to consider uncertainty when evaluating supply chain design decisions? [1]

Q4. a) Give arguments to support the statement that Wal-Mart has achieved very good strategic fit

between its competitive and supply chain strategies. [2]

b) How has globalization made strategic fit even more important to a company’s success? [1.5]

Q5. The Knitting Company (TKC) planning for its four styles those are popular during Christmas. All

four styles have demand that is normally distributed. The best-selling style has an expected

demand of 30,000 and a standard deviation of 5,000. Each of the other three styles has an

expected demand of 8,000 with a standard deviation of 4,000.Currently all sweaters are produced

before the start of the season .Production cost is $20 per sweater and they are sold for whole sale

price to $35. Any unsold sweaters at the end of the season are discounted to $15 and they all sell

at that price. It costs $2 to hold the sweater in inventory for the entire season if it does not sell.

• How many sweaters of each type should TKC manufacture?

• TKC is considering the postponement of knitting and using very flexible machines. This

will require the base sweaters to be made in advance (identical for each of the four types)

and the final patterns to be knit later. This will increase production cost per sweater to

$21.40.How many sweaters should TKC manufacturer with postponement to maximize the

profit? [6]

ITEB G621 Comprehensive Examination 1

BITS PILANI Second Semester 2006-07

Q6. Books-On-Line, an on line bookseller, charges its customers a shipping charge of $4 fro the first

book and $1 for each additional book, the average customer order contains 4 books. Books-On-

Line currently has one warehouse in Seattle and ships all orders from there. For shipping purposes,

Books-On-Line divides the US in to three zones i.e. western, central and eastern. Shipping cost

incurred by Books-On-line per customer order (average 4 books) is $2 within the same Zone, $3

between adjacent Jones, and $4 between nonadjacent zones. Weekly demand from each zone is

independent and normally distributed with a mean of 50,000 and standard deviation of 25,000.

Each book costs on average $10 and the holding cost incurred by Books-On-Line is 25 percent.

Books-on-line replenishes inventory every week and aims for a 99.7 percent CSL. Assume a

replenishment lead time of one week. A warehouse is designed to carry 50 percent more than the

replenishment order +safety stock. The fixed cost of ware house is $200,000+x, where is x is the

capacity in books. The weekly operating cot of a warehouse is $0.1y, where y is the number of

books shipped. Books-On-Line is planning to centralize all demand in one warehouse. Detail all

costs involved and mention the total cost involved in this option. [6]

Q7. ABC manufacturing has decided to introduce a new line of products. The Company wants to open

one or more production facilities to serve six geographic markets. It has narrowed the set of

possible sites to five and two plant capacities are possible at set either 150,000 or 300,000 units

per year. The fixed cost of smaller plant is $ 1,500,000 per year (including amortization of initial

cost) or $2,800,000 per year. The cost per unit of production is $ 20 for small plant and $ 19 for

larger plant. Formulate the problem to determine:

• The number of plants to open.

• The location of the plants that are to be opened.

• The capacity of each plant that is to open.

• The number of units to produce at each plant and ship to each market in order to minimize

the total cost of supplying the six markets with products.

Clearly mention the decision variables and input parameters. [6]

Unit transport costs and demands for ABC manufacturing

A B C D E F

AA 11 8 12 18 10 7

BB 9 4 11 20 12 6

CC 3 12 19 27 16 5

DD 25 19 9 6 13 21

EE 26 15 7 8 9 20

EAD (000) 70 120 80 150 100 130

EAD: Expected annual demand; PS: Potential Site; M: Market

ITEB G621 Comprehensive Examination 2

BITS PILANI Second Semester 2006-07

ITEB G621 Comprehensive Examination 3

También podría gustarte

- Business Plan For Vending Machine in Ethiopia 2013 E.CDocumento28 páginasBusiness Plan For Vending Machine in Ethiopia 2013 E.CBirukee Man100% (3)

- Internal Audit Report - 2022Documento2 páginasInternal Audit Report - 2022Camila AlmeidaAún no hay calificaciones

- Flare Fragrance CaseDocumento6 páginasFlare Fragrance CaseHualu Zhao100% (1)

- Organizational ChangeDocumento18 páginasOrganizational ChangeakhilAún no hay calificaciones

- Exaim McqsDocumento17 páginasExaim McqsFazal RaheemAún no hay calificaciones

- Chopra scm5 Tif ch03Documento19 páginasChopra scm5 Tif ch03Madyoka Raimbek100% (2)

- Inventory Problems SolutionsDocumento5 páginasInventory Problems SolutionsVenkata Dinesh100% (1)

- Question Bank Rdm2020Documento18 páginasQuestion Bank Rdm2020Afad Khan100% (1)

- Training Needs Analysis Template ToolDocumento1 páginaTraining Needs Analysis Template TooluzaimyAún no hay calificaciones

- Question Paper Supply ChainDocumento6 páginasQuestion Paper Supply ChainHappy Valley Business SchoolAún no hay calificaciones

- IIM Kozhikode EPGP Operations Management End-Term Exam QuestionsDocumento5 páginasIIM Kozhikode EPGP Operations Management End-Term Exam QuestionsAkshay SinghAún no hay calificaciones

- Om0001-Model Question PaperDocumento8 páginasOm0001-Model Question PaperAshwani K SharmaAún no hay calificaciones

- Layout Strategies Powerpoint PresentationDocumento29 páginasLayout Strategies Powerpoint PresentationstanisAún no hay calificaciones

- Pricing and Revenue Management in The Supply Chain 17Documento20 páginasPricing and Revenue Management in The Supply Chain 17niruthir100% (1)

- Chapter 11 Managing Economies of Scale in A Supply ChainDocumento90 páginasChapter 11 Managing Economies of Scale in A Supply ChainM Iqbal Muttaqin100% (1)

- Bis Corporation Network Planning CaseDocumento19 páginasBis Corporation Network Planning CaseAbhishek Pratap SinghAún no hay calificaciones

- Emerging Concepts in CostDocumento66 páginasEmerging Concepts in CostShravan Kumar DevulapallyAún no hay calificaciones

- ESG Risk FrameworkDocumento15 páginasESG Risk Frameworkamoghkanade100% (1)

- Ch-10 Coordination in A Supply ChainDocumento24 páginasCh-10 Coordination in A Supply ChainDhushor KuashaAún no hay calificaciones

- MCQs of OSCM Ch. 1, OperationsDocumento6 páginasMCQs of OSCM Ch. 1, OperationsChaitali GhodkeAún no hay calificaciones

- Exam Midterm - Emad Mohamed Attia Supply ChainDocumento6 páginasExam Midterm - Emad Mohamed Attia Supply ChainEmad Attia100% (1)

- Unit4 CKNG PDFDocumento64 páginasUnit4 CKNG PDFSachin KhotAún no hay calificaciones

- Module 5 - Supply Chain ManagementDocumento9 páginasModule 5 - Supply Chain ManagementPooja ShahAún no hay calificaciones

- Determining The Optimal Level of Product AvailabilityDocumento75 páginasDetermining The Optimal Level of Product AvailabilityTakarial l0% (1)

- Chapter 8 Answers To ExercisesDocumento12 páginasChapter 8 Answers To ExercisesSaroj Kumar RaiAún no hay calificaciones

- Test Bank For Foundations of Operations Management 4th Canadian Edition by RitzmanDocumento24 páginasTest Bank For Foundations of Operations Management 4th Canadian Edition by Ritzmana531563922100% (1)

- Question Paper BSM3044 Supply Chain Strategy and CasesDocumento5 páginasQuestion Paper BSM3044 Supply Chain Strategy and Caseszukhri zaidiAún no hay calificaciones

- MCQ Supply chain management multiple choice questionsDocumento53 páginasMCQ Supply chain management multiple choice questionsmoniAún no hay calificaciones

- SCM questions and supplier evaluationDocumento3 páginasSCM questions and supplier evaluationKool BhardwajAún no hay calificaciones

- Test Bank Supply Chain Management 5th Edition ChopraDocumento26 páginasTest Bank Supply Chain Management 5th Edition Choprabachababy0% (1)

- Optimal inventory order sizes and profits for four sweater stylesDocumento7 páginasOptimal inventory order sizes and profits for four sweater stylesJyothi VenuAún no hay calificaciones

- Supply Chain Analytics: Flexibility, Risks & OptimizationDocumento4 páginasSupply Chain Analytics: Flexibility, Risks & OptimizationUmamaheswar PutrevuAún no hay calificaciones

- Lecture+1 MCQDocumento5 páginasLecture+1 MCQjackywen1024100% (1)

- Inventory Management FAQDocumento5 páginasInventory Management FAQsurenAún no hay calificaciones

- SCA Week5 2020 ASSIGN-SOLDocumento4 páginasSCA Week5 2020 ASSIGN-SOLUmamaheswar PutrevuAún no hay calificaciones

- Unit 2 L2 Network DesignDocumento23 páginasUnit 2 L2 Network DesignJUILI dharmadhikariAún no hay calificaciones

- Inventory Management Just in Time and Costing Methods Multiple Choice Questions - Accounting Quiz Answers 5 PDFDocumento4 páginasInventory Management Just in Time and Costing Methods Multiple Choice Questions - Accounting Quiz Answers 5 PDFSumedha SawniAún no hay calificaciones

- Sample Test Questions For EOQDocumento5 páginasSample Test Questions For EOQSharina Mhyca SamonteAún no hay calificaciones

- Sample Quiz Operations ManagementDocumento25 páginasSample Quiz Operations Managementakamalapuri388100% (2)

- SCM For 2016 - 2017Documento7 páginasSCM For 2016 - 2017Neha JhaAún no hay calificaciones

- Multiple Choice Questions Distrubution Logistic PDFDocumento14 páginasMultiple Choice Questions Distrubution Logistic PDFYogesh Bantanur50% (2)

- Ii Bba Production and Materials Management - 416BDocumento21 páginasIi Bba Production and Materials Management - 416BponnasaikumarAún no hay calificaciones

- Design of ProcessDocumento35 páginasDesign of Processsujeetleopard100% (1)

- Mission Flow DiagramDocumento1 páginaMission Flow DiagramAnees Ethiyil KunjumuhammedAún no hay calificaciones

- JawadBhatti - 1196 - 3849 - 1-Mid Term Exam (BBA 6 A)Documento3 páginasJawadBhatti - 1196 - 3849 - 1-Mid Term Exam (BBA 6 A)Zoya RehmanAún no hay calificaciones

- ( ( (Q & A Procrument and Supply Chain Management) ) )Documento21 páginas( ( (Q & A Procrument and Supply Chain Management) ) )maxamuud xuseenAún no hay calificaciones

- CHP 5Documento11 páginasCHP 5lailanasser100% (1)

- 19 KRM Om10 Ism ch16Documento36 páginas19 KRM Om10 Ism ch16OPMANG100% (1)

- MCQ OSCM Unit 1 1 PDFDocumento21 páginasMCQ OSCM Unit 1 1 PDFbhupesh joshi100% (1)

- Warehosing and Inventory Management New - 100 Mark QuestionsDocumento5 páginasWarehosing and Inventory Management New - 100 Mark QuestionsNandhakumar S100% (1)

- EOQDocumento20 páginasEOQPavanAún no hay calificaciones

- Multiple Choice Questions MCQ On Supply Chain ManagementDocumento2 páginasMultiple Choice Questions MCQ On Supply Chain ManagementHaha1234100% (1)

- Tme 601Documento14 páginasTme 601dearsaswatAún no hay calificaciones

- Benchmarking 2Documento4 páginasBenchmarking 2PAWAN GUPTAAún no hay calificaciones

- Bba Semester Vi Core 18 - Production Management Multiple Choice QuestionsDocumento21 páginasBba Semester Vi Core 18 - Production Management Multiple Choice QuestionsRama DeviAún no hay calificaciones

- Decision PhasesDocumento2 páginasDecision Phasesdaddyaziz800% (1)

- Chapter 2.achieving Strategic Fit & ScopeDocumento42 páginasChapter 2.achieving Strategic Fit & ScopeSyed Mohammed ArfatAún no hay calificaciones

- Short Cases PDFDocumento12 páginasShort Cases PDFAnurag SharmaAún no hay calificaciones

- Operations Management: William J. StevensonDocumento35 páginasOperations Management: William J. StevensonJitesh JainAún no hay calificaciones

- Inventory ManagementDocumento27 páginasInventory ManagementsaloniAún no hay calificaciones

- MRO Procurement Solutions A Complete Guide - 2020 EditionDe EverandMRO Procurement Solutions A Complete Guide - 2020 EditionAún no hay calificaciones

- 2014-2015 (L-4, T-1) - IpeDocumento18 páginas2014-2015 (L-4, T-1) - Ipeferdous98Aún no hay calificaciones

- Answer FOUR Questions Only. ALL Questions Carry EQUAL MarksDocumento7 páginasAnswer FOUR Questions Only. ALL Questions Carry EQUAL MarksChristal ChukAún no hay calificaciones

- Tutorial 11 - Inventory ManagementDocumento3 páginasTutorial 11 - Inventory ManagementIbrahim Hussain67% (3)

- IntermediateDocumento139 páginasIntermediateabdulramani mbwanaAún no hay calificaciones

- 13Documento2 páginas13itachi uchihaAún no hay calificaciones

- Brand Pipe CompanyDocumento9 páginasBrand Pipe CompanyVivekMandalAún no hay calificaciones

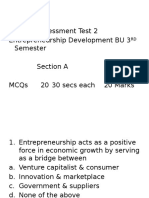

- Internal Assessment Test on Entrepreneurship ConceptsDocumento28 páginasInternal Assessment Test on Entrepreneurship ConceptsRam Krishna KrishAún no hay calificaciones

- Haramaya UniversityDocumento22 páginasHaramaya UniversityAbdulhafiz Abakemal89% (9)

- Introduction to Derivatives: Definition, Types, Traders and Key TermsDocumento24 páginasIntroduction to Derivatives: Definition, Types, Traders and Key TermsRonaldi RantelinoAún no hay calificaciones

- HRM-360 Final ReportDocumento16 páginasHRM-360 Final Reportamir hamza sajidAún no hay calificaciones

- Customer & Product AuditDocumento7 páginasCustomer & Product AuditWhenas WijayaAún no hay calificaciones

- A Presentation On Promoting Sharekhan by BNP ParibasDocumento14 páginasA Presentation On Promoting Sharekhan by BNP ParibassushmithaAún no hay calificaciones

- Article On Deposits-Vinod Kothari ConsultantsDocumento9 páginasArticle On Deposits-Vinod Kothari ConsultantsNishant JainAún no hay calificaciones

- Chowking AnalysisDocumento17 páginasChowking Analysisayanggg.2007Aún no hay calificaciones

- Inymart AcademyDocumento10 páginasInymart AcademySmash HulkAún no hay calificaciones

- Credit Risk ManagementDocumento4 páginasCredit Risk ManagementlintoAún no hay calificaciones

- Guide de ProcessusDocumento13 páginasGuide de Processusnajwa zinaouiAún no hay calificaciones

- LLPDocumento15 páginasLLPAnkit JainAún no hay calificaciones

- STFC - Public Issue of NCDs - Final Prospectus - JSA - June 16 2011 - 1Documento522 páginasSTFC - Public Issue of NCDs - Final Prospectus - JSA - June 16 2011 - 1charan6969Aún no hay calificaciones

- Importance of Performance AppraisalDocumento51 páginasImportance of Performance AppraisalRao FarhanAún no hay calificaciones

- Advance Multiple Choice QuizDocumento4 páginasAdvance Multiple Choice QuizSamuel DebebeAún no hay calificaciones

- 2021 05 EN Ulkomaalaisena Tyontekijana Suomessa PDFDocumento20 páginas2021 05 EN Ulkomaalaisena Tyontekijana Suomessa PDFSt JakobAún no hay calificaciones

- Articles of IncorporationDocumento6 páginasArticles of IncorporationKimberly GallaronAún no hay calificaciones

- New Syllabus PDFDocumento251 páginasNew Syllabus PDFsunethraa swamyAún no hay calificaciones

- 2023 07 q1-2024 Investor PresentationDocumento73 páginas2023 07 q1-2024 Investor PresentationtsasidharAún no hay calificaciones

- DNB Finance Analytics BrochureDocumento9 páginasDNB Finance Analytics Brochurenownutthamon74Aún no hay calificaciones

- Documents To Check While Buying A Property in BengaluruDocumento2 páginasDocuments To Check While Buying A Property in BengaluruSujeshAún no hay calificaciones

- CH 04Documento14 páginasCH 04Elizabeth EscobedoAún no hay calificaciones

- Working Capital and Current Assets ManagementDocumento28 páginasWorking Capital and Current Assets ManagementClivent xaverAún no hay calificaciones