Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Money Back 165

Cargado por

Harish ChandDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Money Back 165

Cargado por

Harish ChandCopyright:

Formatos disponibles

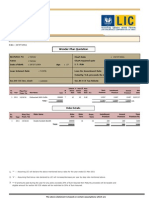

HARISH CHAND

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

Saral Moneyback Plan Money withdrawal option

Name

Mr. :Harish Chand Age : 28 years

Term :

35 Years Mode : Yearly

Premium Budget p. m. : 2750 Installment Premium : 32340

Accident Rider : 687500 Accident Rider Premium : 688

Term Rider : 0 Term Rider Premium : 0

Total Installment Premium : 33027 Total Annual Premium : 33027

Section 80 CCE Invst. Limit : 100000 Section 80 CCE Tax Savings : 33.99%

Date : 24/06/2010

Annual Premium Riskcover

Cash Amount Amount

Year Age Pre Tax Post Tax Normal Accidental Liquidity Required Provided

Accidental

2010 28 33028 21802 687500 1375000 0 0 0

2011 29 33028 21802 720500 1408000 0 0 0

2012 30 33028 21802 753500 1441000 0 0 0

2013 31 33028 21802 786500 1474000 56386 0 0

2014 32 33028 21802 819500 1507000 90239 0 0

2015 33 33028 21802 852500 1540000 130158 0 0

2016 34 33028 21802 885500 1573000 162058 0 0

2017 35 33028 21802 918500 1606000 195168 0 0

2018 36 33028 21802 951500 1639000 229873 0 0

2019 37 33028 21802 1108250 1795750 266283 0 0

2020 38 28824 19027 1008000 1608000 428753 50000 54569

2021 39 25221 16648 922950 1447950 422424 50000 52803

2022 40 21618 14270 832950 1282950 417102 50000 59586

2023 41 18616 12288 759113 1146613 407214 50000 56558

2024 42 16214 10703 702675 1040175 400908 50000 51730

2025 43 13812 9117 636813 924313 400410 50000 59320

2026 44 12010 7928 590750 840750 383974 50000 50084

2027 45 10208 6738 536775 749275 375010 50000 56252

2028 46 8407 5549 474075 649075 357119 50000 63021

2029 47 6606 4361 400400 537900 329189 50000 70541

2030 48 5404 3567 352688 465188 289223 50000 52586

2031 49 4204 2775 295575 383075 263759 50000 58613

2032 50 3002 1982 227875 290375 228148 50000 65185

2033 51 3002 1982 246188 308688 180843 0 0

2034 52 3002 1982 266375 328875 200391 0 0

2035 53 3002 1982 288438 350938 221668 0 0

2036 54 3002 1982 312375 374875 244916 0 0

2037 55 3002 1982 338188 400688 269953 0 0

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

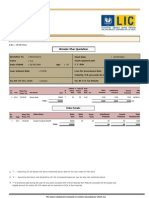

Date : 24/06/2010

Saral Moneyblack Plan Continued ... Pg. 2

Annual Premium Riskcover

Cash Amount Amount

Year Age Pre Tax Post Tax Normal Accidental Liquidity Required Provided

Accidental

2038 56 3002 1982 365875 428375 296763 0 0

2039 57 3002 1982 395438 457938 325423 0 0

2040 58 3002 1982 426875 489375 355933 0 0

2041 59 3002 1982 460188 522688 388153 0 0

2042 60 3002 1982 495375 557875 422193 0 0

2043 61 3002 1982 532438 594938 458053 0 0

2044 62 3002 1982 571375 633875 495613 0 0

2045 63 0 0 0 0 534993 0 534993

Total 540450 356751 1285841

Disclaimer & Notes :

q The figures shown in this presentation are based on the assumption that the Projected Investment Rate of Return that

LIC will be able to earn throughout the term of the Jeevan Saral policy, on the investible portion of the premium, will be

10% p.a. The investible portion of the premium is calculated as per LIC’s benefit Illustration for this plan.

q The benefits illustrated are not gauranteed and the actual results may vary depending upon LIC’s performance with

respect to this plan.

q The premium indicated above is annualised premium based on the assumption of Yearly mode of payment.

q The effective yield (IRR) on your investments works out to 6.62 % (pre-tax) and 10.49 % (post tax)

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

Date : 24/06/2010

Saral Moneyblack Plan Continued ... Pg. 3

Breakup of Guaranteed and Non-Guaranteed Benefits

Riskcover Cash Liquidity

Year Age Guaranteed N-Guaranteed Total Guaranteed N-Guaranteed Total

2010 28 687500 0 687500 0 0 0

2011 29 720500 0 720500 0 0 0

2012 30 753500 0 753500 0 0 0

2013 31 786500 0 786500 56386 0 56386

2014 32 819500 0 819500 90239 0 90239

2015 33 852500 0 852500 130158 0 130158

2016 34 885500 0 885500 162058 0 162058

2017 35 918500 0 918500 195168 0 195168

2018 36 951500 0 951500 229873 0 229873

2019 37 984500 123750 1108250 266283 0 266283

2020 38 888000 120000 1008000 305003 123750 428753

2021 39 802200 120750 922950 302424 120000 422424

2022 40 709200 123750 832950 296352 120750 417102

2023 41 629300 129813 759113 283464 123750 407214

2024 42 564300 138375 702675 271095 129813 400908

2025 43 494500 142313 636813 262035 138375 400410

2026 44 442000 148750 590750 241661 142313 383974

2027 45 385900 150875 536775 226260 148750 375010

2028 46 326200 147875 474075 206244 150875 357119

2029 47 262900 137500 400400 181314 147875 329189

2030 48 220500 132188 352688 151723 137500 289223

2031 49 175700 119875 295575 131571 132188 263759

2032 50 128500 99375 227875 108273 119875 228148

2033 51 131500 114688 246188 81468 99375 180843

2034 52 134500 131875 266375 85703 114688 200391

2035 53 137500 150938 288438 89793 131875 221668

2036 54 140500 171875 312375 93978 150938 244916

2037 55 143500 194688 338188 98078 171875 269953

2038 56 146500 219375 365875 102075 194688 296763

2039 57 149500 245938 395438 106048 219375 325423

2040 58 152500 274375 426875 109995 245938 355933

2041 59 155500 304688 460188 113778 274375 388153

2042 60 158500 336875 495375 117505 304688 422193

2043 61 161500 370938 532438 121178 336875 458053

2044 62 164500 406875 571375 124675 370938 495613

2045 63 0 0 0 128118 406875 534993

Note : The non-guaranteed benefits are in the form of loyalty additions and are based on the assumption that the Projected

Investment Rate of Return that LIC will be able to earn throughout the term of the Jeevan Saral policy, on the investible

portion of premium, will be 10% p. a. The investible portion of the premium is calculated as per LIC’s benefit Illustration for

this plan.

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

También podría gustarte

- Single Plan For PensionDocumento2 páginasSingle Plan For PensionHarish ChandAún no hay calificaciones

- New Jeevan Nidhi Plan Presentation: LIC DIRECT-Quick, Simple and EasyDocumento2 páginasNew Jeevan Nidhi Plan Presentation: LIC DIRECT-Quick, Simple and EasyKSAún no hay calificaciones

- Sujatha: Exclusively Prepared For: Ven DOC: 1/3/2019 - Age: 48 Plan Criteria Input Data Premium & Rider DetailsDocumento6 páginasSujatha: Exclusively Prepared For: Ven DOC: 1/3/2019 - Age: 48 Plan Criteria Input Data Premium & Rider DetailsKilli ValavanAún no hay calificaciones

- Life Goal PlannerDocumento13 páginasLife Goal PlannerRahul AnandAún no hay calificaciones

- Calculation of DataDocumento3 páginasCalculation of Datafahad fareedAún no hay calificaciones

- KVB Home Loan Premium ChartDocumento13 páginasKVB Home Loan Premium ChartNaveenprasathAún no hay calificaciones

- Term Insurance DCFDocumento2 páginasTerm Insurance DCFshreyasAún no hay calificaciones

- Personal FinanceDocumento4 páginasPersonal FinanceparambhaiofficialAún no hay calificaciones

- DA Table at 22.75%, 20.06.2023Documento1 páginaDA Table at 22.75%, 20.06.2023vinner studentAún no hay calificaciones

- Penjualan Harian: Waktu Penjualan (RP.) Laba Kotor (RP.)Documento6 páginasPenjualan Harian: Waktu Penjualan (RP.) Laba Kotor (RP.)indri riyani evelinAún no hay calificaciones

- Zindagi Ka Guaranteed Plan - Fortune Guarantee PlusDocumento2 páginasZindagi Ka Guaranteed Plan - Fortune Guarantee PlusShivani raikarAún no hay calificaciones

- Zindagi Ka Guaranteed Plan - Fortune Guarantee PlusDocumento2 páginasZindagi Ka Guaranteed Plan - Fortune Guarantee PlusShivani raikarAún no hay calificaciones

- Zindagi Ka Guaranteed Plan - Fortune Guarantee PlusDocumento2 páginasZindagi Ka Guaranteed Plan - Fortune Guarantee PlusShivani raikarAún no hay calificaciones

- Zindagi Ka Guaranteed Plan - Fortune Guarantee PlusDocumento2 páginasZindagi Ka Guaranteed Plan - Fortune Guarantee PlusShivani raikarAún no hay calificaciones

- Daily Up Date Recovry SheetDocumento8 páginasDaily Up Date Recovry Sheetakhtaranees967Aún no hay calificaciones

- Book1 (Version 3)Documento4 páginasBook1 (Version 3)Benhazen Lynn DeirdreAún no hay calificaciones

- Straight Line Depreciation MethodDocumento4 páginasStraight Line Depreciation MethodMuhammad ismailAún no hay calificaciones

- Home Buying Feasibility Study Income Tax Sec 24Documento5 páginasHome Buying Feasibility Study Income Tax Sec 24NKAún no hay calificaciones

- Jeevan NidhiDocumento2 páginasJeevan NidhiAkhil RajAún no hay calificaciones

- Maxi AoDocumento13 páginasMaxi Aosasongko utomoAún no hay calificaciones

- EMI CalculatorDocumento12 páginasEMI Calculatorsarkar82722Aún no hay calificaciones

- 05 SIP CalculatorDocumento8 páginas05 SIP Calculatorlove4u1lyAún no hay calificaciones

- Assignement of IctDocumento6 páginasAssignement of IctZoya Raza KhanAún no hay calificaciones

- Saving For Retirement (Model 1) : InputsDocumento8 páginasSaving For Retirement (Model 1) : InputsZeusAún no hay calificaciones

- Mixing - 2-12-2021 4.2.31-PrintDocumento5 páginasMixing - 2-12-2021 4.2.31-PrintKumar IndravijayAún no hay calificaciones

- New Da 29.96 Ready Recokner From January-2011Documento4 páginasNew Da 29.96 Ready Recokner From January-2011Ramachandra RaoAún no hay calificaciones

- 651 - Burst Pressure Versus Casing Wear Calculation DDDocumento4 páginas651 - Burst Pressure Versus Casing Wear Calculation DDQuality controllerAún no hay calificaciones

- MathDocumento30 páginasMathRehan AhmadAún no hay calificaciones

- Ramco Cement BsDocumento6 páginasRamco Cement BsBharathAún no hay calificaciones

- Order Analysis20240314002934812Documento4 páginasOrder Analysis20240314002934812Roy SuwantoAún no hay calificaciones

- Ocean Carrier Case Study CalculationDocumento11 páginasOcean Carrier Case Study CalculationSatyajit BaruahAún no hay calificaciones

- PasfDocumento14 páginasPasfAbhishek BhatnagarAún no hay calificaciones

- Book 1Documento6 páginasBook 1ankur jainAún no hay calificaciones

- Result - PART TEST-III (JEE Advanced)Documento3 páginasResult - PART TEST-III (JEE Advanced)architAún no hay calificaciones

- NER STATES - Released Fund: SN State Financial Progress 2020-21 (Fund Released) General SC STDocumento4 páginasNER STATES - Released Fund: SN State Financial Progress 2020-21 (Fund Released) General SC STNITESH SHARMAAún no hay calificaciones

- New India All Mediclaim Policy Premium Chart-1Documento1 páginaNew India All Mediclaim Policy Premium Chart-1anand sharmaAún no hay calificaciones

- Emi Cal With Irregular PaymentsDocumento12 páginasEmi Cal With Irregular PaymentsKrishnanmoorthy SureshAún no hay calificaciones

- Jlakshya - 2-8-2023 9.7.27Documento9 páginasJlakshya - 2-8-2023 9.7.27Navin kumarAún no hay calificaciones

- Harish Chand: Magic Yield PresentationDocumento6 páginasHarish Chand: Magic Yield PresentationHarish ChandAún no hay calificaciones

- Modern DairiesDocumento4 páginasModern Dairiessurprise MFAún no hay calificaciones

- Machine A Cash FlowsDocumento1 páginaMachine A Cash FlowsRadhakrishna IndalkarAún no hay calificaciones

- Updated PPF Calculator-Monthly, Quarterly Etc.Documento4 páginasUpdated PPF Calculator-Monthly, Quarterly Etc.Ganeshan SekarAún no hay calificaciones

- PRC Calculation 2021 NewDocumento3 páginasPRC Calculation 2021 NewPraneeth SarkarAún no hay calificaciones

- PRC Calculation 2021 NewDocumento3 páginasPRC Calculation 2021 NewPraneeth SarkarAún no hay calificaciones

- Employees' Provident Fund Organisation, India Ministry of Labour & Employment, Government of IndiaDocumento20 páginasEmployees' Provident Fund Organisation, India Ministry of Labour & Employment, Government of IndiaSanjeev ThadaniAún no hay calificaciones

- Sworojgar Laghu Bitta Bikas Bank Limited Valid/Invalid Applicants List (Kitta Wise)Documento30 páginasSworojgar Laghu Bitta Bikas Bank Limited Valid/Invalid Applicants List (Kitta Wise)Sahil NepaliAún no hay calificaciones

- Aibea Cir 68.10Documento2 páginasAibea Cir 68.10aatishsutardasAún no hay calificaciones

- Assignment - Dam - Recent Workouts - Service - FINALDocumento77 páginasAssignment - Dam - Recent Workouts - Service - FINALBinaya Raj PandeyAún no hay calificaciones

- PAGE No:3 Income and Expenditure Statement Cash Flow Chart in Respect of Muhammad Musa S/o Muhammad SharifDocumento2 páginasPAGE No:3 Income and Expenditure Statement Cash Flow Chart in Respect of Muhammad Musa S/o Muhammad SharifSafdar AbbasAún no hay calificaciones

- Loan Amortization CalculatorDocumento12 páginasLoan Amortization CalculatorHemant Singh TanwarAún no hay calificaciones

- Result of DNB Post Diploma Cet, January 2019 Admission SessionDocumento1 páginaResult of DNB Post Diploma Cet, January 2019 Admission Sessiongautham kabilanAún no hay calificaciones

- Using Cashprojection 1752 1752 14200 9.5 9.5 3550 21300 2641 2641 4500 2336 2336 6150 1358 1358 30750 82 82 2900 2900 514 50 3422 - 700Documento5 páginasUsing Cashprojection 1752 1752 14200 9.5 9.5 3550 21300 2641 2641 4500 2336 2336 6150 1358 1358 30750 82 82 2900 2900 514 50 3422 - 700Janani ParameswaranAún no hay calificaciones

- 12% Hra Rps 2021 R.reckoner by SJDocumento2 páginas12% Hra Rps 2021 R.reckoner by SJRaviKumarAún no hay calificaciones

- Cash FLWDocumento12 páginasCash FLWAzeri AliyevAún no hay calificaciones

- Teuer Furniture Case AnalysisDocumento3 páginasTeuer Furniture Case AnalysisPankaj Kumar0% (1)

- Teuer Furniture Case AnalysisDocumento3 páginasTeuer Furniture Case AnalysisPankaj KumarAún no hay calificaciones

- Vincent Guimba Activity 1 FBA FV 1Documento4 páginasVincent Guimba Activity 1 FBA FV 1MJ NuarinAún no hay calificaciones

- Christ University Christ UniversityDocumento7 páginasChrist University Christ UniversityBharathAún no hay calificaciones

- United States Census Figures Back to 1630De EverandUnited States Census Figures Back to 1630Aún no hay calificaciones

- Jeevan Anand: Harish ChandDocumento4 páginasJeevan Anand: Harish ChandHarish ChandAún no hay calificaciones

- Corporate AgentsDocumento1023 páginasCorporate AgentsVivek Thota0% (1)

- Multi - Plan Chart: Harish ChandDocumento3 páginasMulti - Plan Chart: Harish ChandHarish ChandAún no hay calificaciones

- 16 Year at 41 AgeDocumento4 páginas16 Year at 41 AgeHarish ChandAún no hay calificaciones

- Rad 28 E72Documento1 páginaRad 28 E72Harish ChandAún no hay calificaciones

- Agency Presentation - ZTCDocumento24 páginasAgency Presentation - ZTCHarish ChandAún no hay calificaciones

- Mr. Harish Chand: Presentation Specially Prepared ForDocumento4 páginasMr. Harish Chand: Presentation Specially Prepared ForHarish ChandAún no hay calificaciones

- Anmol Jeevan - 9811896425Documento1 páginaAnmol Jeevan - 9811896425Harish ChandAún no hay calificaciones

- Harish Chand: Jeevan Anand Plan PresentationDocumento4 páginasHarish Chand: Jeevan Anand Plan PresentationHarish ChandAún no hay calificaciones

- Jeevan Anand: Harish ChandDocumento4 páginasJeevan Anand: Harish ChandHarish ChandAún no hay calificaciones

- Mr. Gupta: Insurance Proposal ForDocumento8 páginasMr. Gupta: Insurance Proposal ForHarish ChandAún no hay calificaciones

- All Illustration of LICDocumento6 páginasAll Illustration of LICHarish ChandAún no hay calificaciones

- Mrs. Nirali Mehta: Insurance Proposal ForDocumento5 páginasMrs. Nirali Mehta: Insurance Proposal ForHarish ChandAún no hay calificaciones

- Mr. Gupta: Harish ChandDocumento4 páginasMr. Gupta: Harish ChandHarish ChandAún no hay calificaciones

- Jeevan Anand: Harish ChandDocumento4 páginasJeevan Anand: Harish ChandHarish ChandAún no hay calificaciones

- Jeevan AkshayDocumento1 páginaJeevan AkshayHarish ChandAún no hay calificaciones

- Rad 211 D0Documento1 páginaRad 211 D0Harish ChandAún no hay calificaciones

- Rad 09206Documento3 páginasRad 09206Harish ChandAún no hay calificaciones

- Rad 1 FDF9Documento2 páginasRad 1 FDF9Harish ChandAún no hay calificaciones

- Rad 20356Documento1 páginaRad 20356Harish ChandAún no hay calificaciones

- Jeevan Anand: Harish ChandDocumento4 páginasJeevan Anand: Harish ChandHarish ChandAún no hay calificaciones

- Premiums Due Statement: Harish ChandDocumento1 páginaPremiums Due Statement: Harish ChandHarish ChandAún no hay calificaciones

- Rad 09206Documento3 páginasRad 09206Harish ChandAún no hay calificaciones

- All Illustration of LICDocumento6 páginasAll Illustration of LICHarish ChandAún no hay calificaciones

- Rad 1 F405Documento3 páginasRad 1 F405Harish ChandAún no hay calificaciones

- Rad 1 F405Documento3 páginasRad 1 F405Harish ChandAún no hay calificaciones

- Multi - Plan Chart: Harish ChandDocumento3 páginasMulti - Plan Chart: Harish ChandHarish ChandAún no hay calificaciones

- Jeevan Saral IllustrationDocumento3 páginasJeevan Saral IllustrationHarish ChandAún no hay calificaciones

- Harish Chand: Multi - Plan ChartDocumento4 páginasHarish Chand: Multi - Plan ChartHarish ChandAún no hay calificaciones

- Rad 09206Documento3 páginasRad 09206Harish ChandAún no hay calificaciones