Documentos de Académico

Documentos de Profesional

Documentos de Cultura

ECE350 Excel Assign 1

Cargado por

ybrandt19Descripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

ECE350 Excel Assign 1

Cargado por

ybrandt19Copyright:

Formatos disponibles

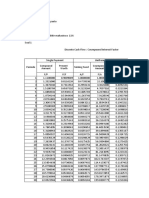

Andrew Hollowell Class ID 15

ECE350 Excel Assignment #1

Part A 4 Year Loan at 6.8% Monthly

Amount

Owed at Interest Owed at Tot Paid

Monthly Paid Total Amount

Month Start of Payment end of Toward

Payment Towards Paid

Month for Month Month Principle

Principle

1 24000 1632 25632 1704.47 72.47 72.47 1704.47

2 23927.53 1627.072 25554.602 1704.47 77.39796 144.94 3408.94

3 23850.13 1621.809 25471.941 1704.47 82.661021 222.33796 5113.41

4 23767.47 1616.188 25383.659 1704.47 88.281971 304.99898 6817.88

5 23679.19 1610.1849 25289.374 1704.47 94.285145 393.28095 8522.35

6 23584.9 1603.7735 25188.677 1704.47 100.69653 487.5661 10226.82

7 23484.21 1596.9261 25081.133 1704.47 107.5439 588.26263 11931.29

8 23376.66 1589.6131 24966.277 1704.47 114.85688 695.80653 13635.76

9 23261.81 1581.8028 24843.609 1704.47 122.66715 810.66341 15340.23

10 23139.14 1573.4615 24712.601 1704.47 131.00852 933.33057 17044.7

11 23008.13 1564.5529 24572.684 1704.47 139.9171 1064.3391 18749.17

12 22868.21 1555.0385 24423.252 1704.47 149.43146 1204.2562 20453.64

13 22718.78 1544.8772 24263.66 1704.47 159.5928 1353.6876 22158.11

14 22559.19 1534.0249 24093.214 1704.47 170.44511 1513.2804 23862.58

15 22388.74 1522.4346 23911.179 1704.47 182.03538 1683.7256 25567.05

16 22206.71 1510.0562 23716.765 1704.47 194.41378 1865.7609 27271.52

17 22012.3 1496.8361 23509.131 1704.47 207.63392 2060.1747 28975.99

18 21804.66 1482.717 23287.378 1704.47 221.75303 2267.8086 30680.46

19 21582.91 1467.6378 23050.546 1704.47 236.83223 2489.5617 32384.93

20 21346.08 1451.5332 22797.609 1704.47 252.93682 2726.3939 34089.4

21 21093.14 1434.3335 22527.473 1704.47 270.13653 2979.3307 35793.87

22 20823 1415.9642 22238.967 1704.47 288.50581 3249.4672 37498.34

23 20534.5 1396.3458 21930.843 1704.47 308.12421 3537.9731 39202.81

24 20226.37 1375.3933 21601.766 1704.47 329.07665 3846.0973 40907.28

25 19897.3 1353.0161 21250.312 1704.47 351.45387 4175.1739 42611.75

26 19545.84 1329.1173 20874.959 1704.47 375.35273 4526.6278 44316.22

27 19170.49 1303.5933 20474.083 1704.47 400.87672 4901.9805 46020.69

28 18769.61 1276.3337 20045.946 1704.47 428.13633 5302.8572 47725.16

29 18341.48 1247.2204 19588.697 1704.47 457.2496 5730.9936 49429.63

30 17884.23 1216.1274 19100.354 1704.47 488.34258 6188.2432 51134.1

31 17395.88 1182.9201 18578.804 1704.47 521.54987 6676.5857 52838.57

32 16874.33 1147.4547 18021.789 1704.47 557.01526 7198.1356 54543.04

33 16317.32 1109.5777 17426.897 1704.47 594.8923 7755.1509 56247.51

34 15722.43 1069.125 16791.552 1704.47 635.34498 8350.0432 57951.98

35 15087.08 1025.9216 16113.003 1704.47 678.54843 8985.3882 59656.45

36 14408.53 979.78027 15388.314 1704.47 724.68973 9663.9366 61360.92

37 13683.84 930.50137 14614.345 1704.47 773.96863 10388.626 63065.39

38 12909.88 877.8715 13787.747 1704.47 826.5985 11162.595 64769.86

39 12083.28 821.66281 12904.939 1704.47 882.80719 11989.193 66474.33

40 11200.47 761.63192 11962.101 1704.47 942.83808 12872.001 68178.8

41 10257.63 697.51893 10955.15 1704.47 1006.9511 13814.839 69883.27

42 9250.68 629.04625 9879.7265 1704.47 1075.4237 14821.79 71587.74

43 8175.256 555.91744 8731.1739 1704.47 1148.5526 15897.214 73292.21

44 7026.704 477.81587 7504.5198 1704.47 1226.6541 17045.766 74996.68

45 5800.05 394.40338 6194.4531 1704.47 1310.0666 18272.42 76701.15

46 4489.983 305.31885 4795.302 1704.47 1399.1511 19582.487 78405.62

47 3090.832 210.17658 3301.0086 1704.47 1494.2934 20981.638 80110.09

48 1596.539 108.56462 1705.1032 1704.47 1595.9054 22475.931 81814.56

49 0.633203 0.0430578 0.6762606 1704.47 1704.4269 24071.837 83519.03

Monthly payment is determined by the (A/P,i,n) Equation. This is not an ideal monthly

payment as following this plan will result in paying $83,000 for a $24,000 car.

If the loan had to be paid off after 3 years we would have to pay the remaining principle due

that is owed at the start of month 37. This value is $13683.84.

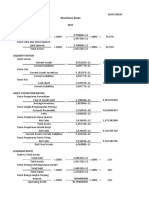

Part B 5 Year Loan $470 Monthly Payment

Amount

Owed at Interest Owed at Tot Paid

Monthly Paid Total Amount

Month Start of Payment end of Toward

Payment Towards Paid

Month for Month Month Principle

Principle

1 24000 130.8 24130.8 470 339.2 461.29886 470

2 23660.8 128.95136 23789.751 470 341.04864 802.3475 940

3 23319.75 127.09264 23446.844 470 342.90736 1145.2549 1410

4 22976.84 125.2238 23102.068 470 344.7762 1490.0311 1880

5 22632.07 123.34477 22755.413 470 346.65523 1836.6863 2350

6 22285.41 121.4555 22406.868 470 348.5445 2185.2308 2820

7 21936.87 119.55593 22056.424 470 350.44407 2535.6749 3290

8 21586.42 117.64601 21704.07 470 352.35399 2888.0289 3760

9 21234.07 115.72568 21349.796 470 354.27432 3242.3032 4230

10 20879.8 113.79489 20993.591 470 356.20511 3598.5083 4700

11 20523.59 111.85357 20635.444 470 358.14643 3956.6547 5170

12 20165.44 109.90167 20275.346 470 360.09833 4316.753 5640

13 19805.35 107.93913 19913.285 470 362.06087 4678.8139 6110

14 19443.28 105.9659 19549.251 470 364.0341 5042.848 6580

15 19079.25 103.98192 19183.233 470 366.01808 5408.8661 7050

16 18713.23 101.98712 18815.22 470 368.01288 5776.879 7520

17 18345.22 99.981448 18445.201 470 370.01855 6146.8975 7990

18 17975.2 97.964847 18073.166 470 372.03515 6518.9327 8460

19 17603.17 95.937256 17699.103 470 374.06274 6892.9954 8930

20 17229.1 93.898614 17323.002 470 376.10139 7269.0968 9400

21 16853 91.848861 16944.851 470 378.15114 7647.2479 9870

22 16474.85 89.787938 16564.639 470 380.21206 8027.46 10340

23 16094.64 87.715782 16182.355 470 382.28422 8409.7442 10810

24 15712.35 85.632333 15797.987 470 384.36767 8794.1119 11280

25 15327.99 83.537529 15411.525 470 386.46247 9180.5744 11750

26 14941.52 81.431309 15022.956 470 388.56869 9569.1431 12220

27 14552.96 79.313609 14632.269 470 390.68639 9959.8294 12690

28 14162.27 77.184368 14239.454 470 392.81563 10352.645 13160

29 13769.45 75.043523 13844.497 470 394.95648 10747.602 13630

30 13374.5 72.89101 13447.388 470 397.10899 11144.711 14100

31 12977.39 70.726766 13048.115 470 399.27323 11543.984 14570

32 12578.12 68.550727 12646.666 470 401.44927 11945.433 15040

33 12176.67 66.362829 12243.029 470 403.63717 12349.07 15510

34 11773.03 64.163006 11837.192 470 405.83699 12754.907 15980

35 11367.19 61.951194 11429.143 470 408.04881 13162.956 16450

36 10959.14 59.727329 11018.87 470 410.27267 13573.229 16920

37 10548.87 57.491342 10606.362 470 412.50866 13985.737 17390

38 10136.36 55.24317 10191.605 470 414.75683 14400.494 17860

39 9721.605 52.982746 9774.5874 470 417.01725 14817.511 18330

40 9304.587 50.710002 9355.2974 470 419.29 15236.801 18800

41 8885.297 48.424871 8933.7223 470 421.57513 15658.377 19270

42 8463.722 46.127287 8509.8496 470 423.87271 16082.249 19740

43 8039.85 43.81718 8083.6668 470 426.18282 16508.432 20210

44 7613.667 41.494484 7655.1613 470 428.50552 16936.938 20680

45 7185.161 39.159129 7224.3204 470 430.84087 17367.778 21150

46 6754.32 36.811046 6791.1314 470 433.18895 17800.967 21620

47 6321.131 34.450166 6355.5816 470 435.54983 18236.517 22090

48 5885.582 32.07642 5917.658 470 437.92358 18674.441 22560

49 5447.658 29.689736 5477.3478 470 440.31026 19114.751 23030

50 5007.348 27.290045 5034.6378 470 442.70995 19557.461 23500

51 4564.638 24.877276 4589.5151 470 445.12272 20002.584 23970

52 4119.515 22.451357 4141.9664 470 447.54864 20450.132 24440

53 3671.966 20.012217 3691.9786 470 449.98778 20900.12 24910

54 3221.979 17.559784 3239.5384 470 452.44022 21352.56 25380

55 2769.538 15.093984 2784.6324 470 454.90602 21807.466 25850

56 2314.632 12.614747 2327.2472 470 457.38525 22264.852 26320

57 1857.247 10.121997 1867.3692 470 459.878 22724.73 26790

58 1397.369 7.6156619 1404.9848 470 462.38434 23187.114 27260

59 934.9848 5.0956673 940.08049 470 464.90433 23652.018 27730

60 470.0805 2.5619387 472.64243 470 467.43806 24119.456 28200

The effective annual interest rate the bank is charging can be determined from the (A/P,i,n)

equation using A=$470, P=$24000, and n=60 and solving the equation for i. It turns out that

the interest in this case is i=0.545%

Again, if the loan had to be paid off after 3 years we would have to pay the remaining

principle due that is owed at the start of month 37. This value is $10548.87.

También podría gustarte

- Trig Ratios TableDocumento1 páginaTrig Ratios Tablesanjeev1000Aún no hay calificaciones

- Literature Review Foriegn ExchangeDocumento9 páginasLiterature Review Foriegn Exchangeonline free projects0% (1)

- Project Report On Financial InstitutionDocumento86 páginasProject Report On Financial Institutionarchana_anuragi83% (6)

- YONO SBI - Final QuestionnaireDocumento3 páginasYONO SBI - Final QuestionnaireMusic & Art0% (2)

- Life TableDocumento2 páginasLife TableYuriska Destania EncaAún no hay calificaciones

- Pregunta 2Documento51 páginasPregunta 2Haybi Micaela DelgadoAún no hay calificaciones

- VN04Documento1 páginaVN04samirAún no hay calificaciones

- Transaction Id Quantity Unit Price Amt Before Tax Tax Amt After TaxDocumento209 páginasTransaction Id Quantity Unit Price Amt Before Tax Tax Amt After TaxSuraj SinghAún no hay calificaciones

- Surveying Data Siblu Dam and ReservirosDocumento253 páginasSurveying Data Siblu Dam and ReservirosaberraAún no hay calificaciones

- Area Majoraxislength Minoraxislength Eccentricity Convexarea Extent PerimeterDocumento39 páginasArea Majoraxislength Minoraxislength Eccentricity Convexarea Extent PerimeterSAGAR MAún no hay calificaciones

- Mercury Crypto FraudDocumento157 páginasMercury Crypto Fraudmilindzerodha707Aún no hay calificaciones

- 1) Enter Equity: $10,000.00 2) Enter % To Risk 3) Estimated No. of Pips To HoldDocumento7 páginas1) Enter Equity: $10,000.00 2) Enter % To Risk 3) Estimated No. of Pips To HoldHicham HasnaouiAún no hay calificaciones

- Banco de MéxicoDocumento20 páginasBanco de MéxicoJuan José TorresAún no hay calificaciones

- Estudo Novos Setores Ytd 2022Documento1807 páginasEstudo Novos Setores Ytd 2022Diego Ramos Da SilveiraAún no hay calificaciones

- A C H B D : H (Pulg) H (M) V (m3) V (BBL) V (LTS)Documento23 páginasA C H B D : H (Pulg) H (M) V (m3) V (BBL) V (LTS)Yania Stephanie Severiche BurgosAún no hay calificaciones

- SBI Homeloan1Documento5 páginasSBI Homeloan1Ramesh GAún no hay calificaciones

- 2 Theta 2 DDocumento138 páginas2 Theta 2 DMltniceAún no hay calificaciones

- Correa Z Perfiles LlanezaDocumento1 páginaCorrea Z Perfiles LlanezaJosé GarcíaAún no hay calificaciones

- NPS V/s Ops AnalysisDocumento37 páginasNPS V/s Ops AnalysisRAGHUVEERAún no hay calificaciones

- Table of Numbers GeneratedDocumento112 páginasTable of Numbers GeneratedPunit BhudiaAún no hay calificaciones

- Flexible Loan CalDocumento20 páginasFlexible Loan Caljfl2096Aún no hay calificaciones

- GG Av Static Pressure 1Documento6 páginasGG Av Static Pressure 1RONALD CRISTOPHER ARANA RODRIGUEZAún no hay calificaciones

- Data 1Documento41 páginasData 1jorge godoyAún no hay calificaciones

- Compound Interest (SPANISH)Documento14 páginasCompound Interest (SPANISH)Jennybell SanchezAún no hay calificaciones

- Data 1Documento41 páginasData 1jorge godoyAún no hay calificaciones

- GPC 5 PFDocumento3 páginasGPC 5 PFEduardo ListikAún no hay calificaciones

- Annual Rainfall (Mothly Wise)Documento7 páginasAnnual Rainfall (Mothly Wise)Mohit SrivastavaAún no hay calificaciones

- Comp. JanuaryDocumento2 páginasComp. Januarymdfaruk2210Aún no hay calificaciones

- Gann Static Level - RevisedDocumento20 páginasGann Static Level - RevisedAjayAún no hay calificaciones

- Gann Static LevelDocumento20 páginasGann Static LevelAjayAún no hay calificaciones

- Eric Fluckiger LabDocumento98 páginasEric Fluckiger Labapi-302420928Aún no hay calificaciones

- Period Beginning Amount EMI InterestDocumento6 páginasPeriod Beginning Amount EMI InterestcoolavisAún no hay calificaciones

- PDRB Boyolali FixDocumento36 páginasPDRB Boyolali Fixalyadwicah123Aún no hay calificaciones

- Results Discussion ConclusionDocumento9 páginasResults Discussion ConclusionSyafiq FauziAún no hay calificaciones

- Tablas Actuariales 1Documento12 páginasTablas Actuariales 1maria isabel quispe apazaAún no hay calificaciones

- HydrologyDocumento23 páginasHydrologyYang RhiaAún no hay calificaciones

- Occupancyrate Occupancy Rate 21 01 2022 QueryResultDocumento78 páginasOccupancyrate Occupancy Rate 21 01 2022 QueryResultGabriel ZandonadiAún no hay calificaciones

- Rabbit Growth Wolf Growth Wolf Mortality K1 K2 K3Documento18 páginasRabbit Growth Wolf Growth Wolf Mortality K1 K2 K3jessica.wijayaAún no hay calificaciones

- Year OS Loan Principal Interest EMI InterestDocumento2 páginasYear OS Loan Principal Interest EMI InterestABAún no hay calificaciones

- Period Principal ( ) Interest ( ) Payment ( ) Payment To The Principal ( ) Principal of The End Period ( )Documento4 páginasPeriod Principal ( ) Interest ( ) Payment ( ) Payment To The Principal ( ) Principal of The End Period ( )Ruina the Techno KittyAún no hay calificaciones

- HR Avg. Min Max Regularmin MaxDocumento58 páginasHR Avg. Min Max Regularmin MaxRogzJrBernzAún no hay calificaciones

- Solvent CP and LamdaDocumento28 páginasSolvent CP and Lamdamat333rAún no hay calificaciones

- ANEXEDocumento14 páginasANEXEDenis SanduAún no hay calificaciones

- Consolidated Breakout 2 Lac Se 20 CrorDocumento15 páginasConsolidated Breakout 2 Lac Se 20 CrorManoj Kumar TanwarAún no hay calificaciones

- County Year Crmrte Prbarr Prbconv Prbpris Avgsen Polpc DensityDocumento91 páginasCounty Year Crmrte Prbarr Prbconv Prbpris Avgsen Polpc DensityAnusha DenduluriAún no hay calificaciones

- Winning Scenario: No Total Balance 2,5% of Total Balance Current BalanceDocumento14 páginasWinning Scenario: No Total Balance 2,5% of Total Balance Current BalancebelegiskiAún no hay calificaciones

- Movie RevenueDocumento420 páginasMovie RevenueSrujanAún no hay calificaciones

- Water Quality Planning On Thorp and Kimball Brooks - 2010 Report, Appendix DDocumento4 páginasWater Quality Planning On Thorp and Kimball Brooks - 2010 Report, Appendix DlewiscreekAún no hay calificaciones

- SDC 3 PFDocumento3 páginasSDC 3 PFEduardo ListikAún no hay calificaciones

- Libro 2Documento46 páginasLibro 2Yuriannys Orta ProspertAún no hay calificaciones

- TUGAS EKOTEK TenikDocumento4 páginasTUGAS EKOTEK TenikHaryantoNdutCivilAún no hay calificaciones

- Acara-4 Pit Limit (Excel)Documento140 páginasAcara-4 Pit Limit (Excel)mahdum afdhaAún no hay calificaciones

- ForoDocumento27 páginasForoOscar ZatarainAún no hay calificaciones

- Dataset Lab4Documento279 páginasDataset Lab4Gaizkia AdelineAún no hay calificaciones

- Percentage CalculatorDocumento24 páginasPercentage Calculatorblack hattAún no hay calificaciones

- Raw Data 1Documento9 páginasRaw Data 1Syukri DaimonAún no hay calificaciones

- Salary Hike - TentativeDocumento8 páginasSalary Hike - TentativeParth SarthiAún no hay calificaciones

- Salary Hike - TentativeDocumento8 páginasSalary Hike - TentativeAshish MalhotraAún no hay calificaciones

- Case HDocumento11 páginasCase HPralav AgrawalAún no hay calificaciones

- TCC Number 170-6-2Documento6 páginasTCC Number 170-6-2fabiobAún no hay calificaciones

- 4.1 (LN)Documento6 páginas4.1 (LN)SalsabilaAún no hay calificaciones

- United States Census Figures Back to 1630De EverandUnited States Census Figures Back to 1630Aún no hay calificaciones

- Date: 12.03.2023 Invoice Number: 340267Documento1 páginaDate: 12.03.2023 Invoice Number: 340267Gabriela TudorAún no hay calificaciones

- Ccris BNM BookletDocumento11 páginasCcris BNM BookletMuhamad AzmirAún no hay calificaciones

- Ole of Management Information System in Banking Sector IndustryDocumento3 páginasOle of Management Information System in Banking Sector IndustryArijit sahaAún no hay calificaciones

- Financial Statements, Taxes, and Cash Flows: Mcgraw-Hill/IrwinDocumento36 páginasFinancial Statements, Taxes, and Cash Flows: Mcgraw-Hill/IrwinHaniZahirahHalimAún no hay calificaciones

- Finable 23Documento45 páginasFinable 23Manisha PandaAún no hay calificaciones

- Factors Affecting Non-Performing Loans of Joint Stock Commercial Banks in VietnamDocumento9 páginasFactors Affecting Non-Performing Loans of Joint Stock Commercial Banks in Vietnamhuy anh leAún no hay calificaciones

- LCC PDFDocumento79 páginasLCC PDFSyikin RadziAún no hay calificaciones

- CCE - ClassificationDocumento20 páginasCCE - ClassificationCatherine CaleroAún no hay calificaciones

- "Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or ProfessionDocumento5 páginas"Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or Professionas2207530Aún no hay calificaciones

- General Mathematics: Second Quarter Module 3: Simple and General AnnuitiesDocumento15 páginasGeneral Mathematics: Second Quarter Module 3: Simple and General AnnuitiesJelrose SumalpongAún no hay calificaciones

- Managing Personal FinanceDocumento39 páginasManaging Personal FinanceBeverly EroyAún no hay calificaciones

- 3.1 Reviewer in Partnership Operations and DissolutionDocumento33 páginas3.1 Reviewer in Partnership Operations and Dissolutionlavender hazeAún no hay calificaciones

- Comparison Between Non - Convertible Debentures and Fixed DepositsDocumento1 páginaComparison Between Non - Convertible Debentures and Fixed DepositsKomal RajaAún no hay calificaciones

- Problemset2 PDFDocumento4 páginasProblemset2 PDFAbhishekKumarAún no hay calificaciones

- Cert Pro Forma Accountant PDFDocumento1 páginaCert Pro Forma Accountant PDFsamthimer23Aún no hay calificaciones

- DepreciationDocumento21 páginasDepreciationluxman_sharma1189Aún no hay calificaciones

- Ab PDFDocumento5 páginasAb PDFIdrus FahrezaAún no hay calificaciones

- Nabard Act 1981Documento37 páginasNabard Act 1981Sai harshaAún no hay calificaciones

- How Securities Are TradedDocumento15 páginasHow Securities Are TradedRazafinandrasanaAún no hay calificaciones

- Macroeconomics: Principles ofDocumento56 páginasMacroeconomics: Principles ofKogo VickAún no hay calificaciones

- Fintech RegulatoryDocumento39 páginasFintech RegulatoryOlegAún no hay calificaciones

- Lecture 1. Introduction: Financial Risk ManagementDocumento44 páginasLecture 1. Introduction: Financial Risk Managementsnehachandan91Aún no hay calificaciones

- Fullerton Problem Solving 101 Pre ReadingDocumento3 páginasFullerton Problem Solving 101 Pre ReadingSowmya KartikAún no hay calificaciones

- Part 4 Capital BudgetingDocumento5 páginasPart 4 Capital BudgetingToulouse18Aún no hay calificaciones

- Basic Format Published AccountDocumento4 páginasBasic Format Published AccountNur Fatin Fasihah Sa'at100% (1)

- TISS BronchureDocumento1 páginaTISS BronchureMwaiya TwahaAún no hay calificaciones

- Financial AssetDocumento2 páginasFinancial Assetgabby209Aún no hay calificaciones