Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Activity Based Costing With Two Activities

Cargado por

Arun JosephDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Activity Based Costing With Two Activities

Cargado por

Arun JosephCopyright:

Formatos disponibles

Activity Based Costing with Two Activities

Let’s illustrate the concept of activity based costing by looking at two common manufacturing activities: (1) the setting up of a production machine for

running batches of products, and (2) the actual production of the units of product.

We will assume that a company has annual manufacturing overhead costs of $2,000,000—of which $200,000 is directly involved in setting up the

production machines. During the year the company expects to perform 400 machine setups. Let’s also assume that the batch sizes vary

considerably, but the setup efforts for each machine are similar.

The cost per setup is calculated to be $500 ($200,000 of cost per year divided by 400 setups per year). Under activity based costing, $200,000 of the

overhead will be viewed as a batch-level cost. This means that $200,000 will first be allocated to batches of products to be manufactured (referred to

as a Stage 1 allocation), and then be assigned to the units of product in each batch (referred to as Stage 2 allocation). For example, if Batch X

consists of 5,000 units of product, the setup cost per unit is $0.10 ($500 divided by 5,000 units). If Batch Y is 50,000 units, the cost per unit for setup

will be $0.01 ($500 divided by 50,000 units). For simplicity, let’s assume that the remaining $1,800,000 of manufacturing overhead is caused by the

production activities that correlate with the company’s 100,000 machine hours.

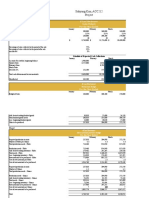

For our simple two-activity example, let's see how the rates for allocating the manufacturing overhead would look with activity based costing and

without activity based costing:

With ABC Without ABC

Mfg overhead costs assigned to setups $200,000 $–0–

Number of setups 400 Not applicable

Mfg overhead cost per setup $500 $–0–

Total manufacturing overhead costs $2,000,000 $2,000,000

Less: Cost traced to machine setups 200,000 –0–

Mfg O/H costs allocated on machine hours $1,800,000 $2,000,000

Machine hours (MH) 100,000 100,000

Mfg overhead costs per MH $18 $20

$500 setup cost per batch + $18

Mfg Overhead Cost Allocations $20 per MH

per MH

Next, let's see what impact these different allocation techniques and overhead rates would have on the per unit cost of a specific unit of output.

Assume that a company manufactures a batch of 5,000 units and it produces 50 units per machine hour, here is how the cost assigned to the units

with activity based costing and without activity based costing compares:

With ABC Without ABC

Mfg overhead for setting up machine $500 $–0–

No. of units in batch 5,000 Not applicable

Mfg O/H caused by Setup – Per Unit $0.10 Not applicable

Mfg overhead costs per machine hour $18 $20

No. of units produced per machine hour 50 50

Mfg O/H caused by Production – Per Unit $0.36 $0.40

Total Mfg O/H Allocated – Per Unit $0.46 $0.40

If a company manufactures a batch of 50,000 units and produces 50 units per machine hour, here is how the cost assigned to the units with ABC and

without ABC compares:

With ABC Without ABC

Mfg overhead for setting up machine $500 $–0–

No. of units in batch 50,000 Not applicable

Mfg O/H caused by Setup – Per Unit $0.01 Not applicable

Mfg overhead costs per machine hour $18 $20

No. of units produced per machine hour 50 50

Mfg O/H caused by Production – Per Unit $0.36 $0.40

Total Mfg O/H Allocated – Per Unit $0.37 $0.40

As the tables above illustrate, with activity based costing the cost per unit decreases from $0.46 to $0.37 because the cost of the setup activity is

spread over 50,000 units instead of 5,000 units. Without ABC, the cost per unit is $0.40 regardless of the number of units in each batch. If companies

base their selling prices on costs, a company not using an ABC approach might lose the large batch work to a competitor who bids a lower price

based on the lower, more accurate overhead cost of $0.37. It’s also possible that a company not using ABC may find itself being the low bidder for

manufacturing small batches of product, since its $0.40 is lower than the ABC model of $0.46 for a batch size of 5,000 units. With its bid price based

on manufacturing overhead of $0.40—but a true cost of $0.46—the company may end up doing lots of production for little or no profit.

Our example with just two activities (production and setup) illustrates how the cost per unit using the activity based costing method is more accurate in

reflecting the actual efforts associated with production. As companies began measuring the costs of activities (instead of focusing on the accountant’s

departmental classifications), they began using ABC cost information to practice activity based management. For example, with the cost of setting

up a machine now being measured and discussed, managers began to ask questions such as:

Why is the cost of setting up a production machine so expensive?

What can be done to reduce the setup cost?

If the setup costs cannot be reduced, are the selling prices adequate to cover all of the company’s costs—including the setup cost that was previously

buried in the overall machine-hour overhead rate?

También podría gustarte

- UAP Chart of Accounts 070110Documento1 páginaUAP Chart of Accounts 070110chaskar1983Aún no hay calificaciones

- K1 ExpenseDocumento30 páginasK1 ExpenseKyaw Htin WinAún no hay calificaciones

- University of Exeter B.SC Hon of Mining EngineeringDocumento5 páginasUniversity of Exeter B.SC Hon of Mining Engineeringbeku_ggs_bekuAún no hay calificaciones

- Owning Operating Cost To 9000hrs: Working Hours (HM) Component Part Number DescriptionDocumento2 páginasOwning Operating Cost To 9000hrs: Working Hours (HM) Component Part Number DescriptionAnonymous Xei7J6qJyAún no hay calificaciones

- Accounting For RoyaltiesDocumento19 páginasAccounting For RoyaltieskwameAún no hay calificaciones

- Chart of AccountDocumento300 páginasChart of AccountyadadAún no hay calificaciones

- Internship Report On TESCO, WAPDADocumento52 páginasInternship Report On TESCO, WAPDANauman Fayxal67% (3)

- Mining Production and Sales, Transport and Water StatisticsDocumento5 páginasMining Production and Sales, Transport and Water StatisticsRudvanDerveenAún no hay calificaciones

- ChartOfAccount YAIN 2012Documento20 páginasChartOfAccount YAIN 2012litu84Aún no hay calificaciones

- Dec - 08 Petty CashDocumento14 páginasDec - 08 Petty CashSubhash ReddyAún no hay calificaciones

- 02 CAS-4-FormatDocumento1 página02 CAS-4-FormatMOORTHY.KEAún no hay calificaciones

- Accounting Systems and Procedures Basic Course: Download Full PDF HereDocumento6 páginasAccounting Systems and Procedures Basic Course: Download Full PDF HerePopeye AlexAún no hay calificaciones

- Petty Cash 2Documento32 páginasPetty Cash 2naveenmalapatiAún no hay calificaciones

- 5.1 Financial Accounting-15cp51t PDFDocumento22 páginas5.1 Financial Accounting-15cp51t PDFSuraj NK100% (1)

- Inter Company Process v6 SYDocumento65 páginasInter Company Process v6 SYrikizalkarnain88Aún no hay calificaciones

- Format of Financial Statements Under The Revised Schedule VIDocumento97 páginasFormat of Financial Statements Under The Revised Schedule VIDebadarshi RoyAún no hay calificaciones

- Fuel Consumption ParametersDocumento1 páginaFuel Consumption ParametershsyntsknAún no hay calificaciones

- Accounting KpisDocumento6 páginasAccounting KpisHOCINIAún no hay calificaciones

- Debit NoteDocumento1 páginaDebit NoteShaik NoorshaAún no hay calificaciones

- Cost SheetDocumento20 páginasCost SheetKeshviAún no hay calificaciones

- Advanced AccountingDocumento13 páginasAdvanced AccountingprateekfreezerAún no hay calificaciones

- TEM Reporting DashboardDocumento21 páginasTEM Reporting DashboardLawrence BrownAún no hay calificaciones

- Chapter # 2 Basic Investment Appraisal Techniques Class Lecture NotesDocumento15 páginasChapter # 2 Basic Investment Appraisal Techniques Class Lecture NotesAzeezAún no hay calificaciones

- Planning Plant ProductionDocumento10 páginasPlanning Plant ProductionjokoAún no hay calificaciones

- Budget Call Circular 2020 21Documento26 páginasBudget Call Circular 2020 21National Highway AuthorityAún no hay calificaciones

- Account CodesDocumento35 páginasAccount CodesKarenAún no hay calificaciones

- Consumer Price Inflation Detailed Reference TablesDocumento518 páginasConsumer Price Inflation Detailed Reference TablesoneoffgmxAún no hay calificaciones

- Project 1 Sukyung KimDocumento14 páginasProject 1 Sukyung Kimapi-3418701680% (1)

- MAS16Documento12 páginasMAS16Kyaw Htin Win50% (2)

- SEEP FRAME Tool, Version 2.02Documento159 páginasSEEP FRAME Tool, Version 2.02anish-kc-8151Aún no hay calificaciones

- Hospital Activity Based CostingDocumento29 páginasHospital Activity Based CostinggollasrinivasAún no hay calificaciones

- Tati Nomination FormsDocumento16 páginasTati Nomination FormsAl Manar PetroleumAún no hay calificaciones

- Cost AccountingDocumento12 páginasCost AccountingrehanAún no hay calificaciones

- Manufacturing SolutionsDocumento8 páginasManufacturing SolutionsMothusi M NtsholeAún no hay calificaciones

- Chap 011Documento14 páginasChap 011dbjnAún no hay calificaciones

- Micro Eportfolio Competition Spreadsheet Data-Fall 18Documento4 páginasMicro Eportfolio Competition Spreadsheet Data-Fall 18api-334921583Aún no hay calificaciones

- Excel Database TemplateDocumento5 páginasExcel Database TemplateAicha MANEAún no hay calificaciones

- J05 Materials Management Master Document en deDocumento3 páginasJ05 Materials Management Master Document en dejavaonejavaAún no hay calificaciones

- The Optimum Boardroom Composition and The Limitations of The Agency TheoryDocumento22 páginasThe Optimum Boardroom Composition and The Limitations of The Agency TheoryMohd HapiziAún no hay calificaciones

- Production Model ScenariosDocumento3 páginasProduction Model ScenariosBeybi EstebanAún no hay calificaciones

- A. Williams Module 2Documento16 páginasA. Williams Module 2awilliams2641Aún no hay calificaciones

- Budget ProjectDocumento18 páginasBudget Projectapi-318385102Aún no hay calificaciones

- Cost Sheet: Solutions To Assignment ProblemsDocumento3 páginasCost Sheet: Solutions To Assignment ProblemsNidaAún no hay calificaciones

- Review Questions Principles of Cost Accounting - 070850Documento7 páginasReview Questions Principles of Cost Accounting - 070850Daniel JuliusAún no hay calificaciones

- Consumer Behaviour PDFDocumento24 páginasConsumer Behaviour PDFMazen AlbsharaAún no hay calificaciones

- Hierarchy of VariancesDocumento1 páginaHierarchy of VariancesQaisar AbbasAún no hay calificaciones

- Accounting System For Manufacturing Company V5.1 - FilledDocumento1266 páginasAccounting System For Manufacturing Company V5.1 - FilledBagus BudionoAún no hay calificaciones

- Cost Center and GL CodeDocumento51 páginasCost Center and GL CodeHarshanand KalgeAún no hay calificaciones

- ACCT212 WorkingPapers E12-20ADocumento3 páginasACCT212 WorkingPapers E12-20AlowluderAún no hay calificaciones

- ACC 311 Final Project I Student WorkbookDocumento11 páginasACC 311 Final Project I Student Workbookdsaaaaaaa100% (1)

- Standalone Financial Results For September 30, 2016 (Result)Documento10 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Prescribed Format of Cost Sheet (For Imfl and Beer Only)Documento3 páginasPrescribed Format of Cost Sheet (For Imfl and Beer Only)sujal_shr21Aún no hay calificaciones

- Lesson 9 Problems of Transfer Pricing Practical ExerciseDocumento6 páginasLesson 9 Problems of Transfer Pricing Practical ExerciseMadhu kumarAún no hay calificaciones

- Chapter 7: Applying ExcelDocumento8 páginasChapter 7: Applying ExcelMan Tran Y NhiAún no hay calificaciones

- Schedule of Duties and Professional Charges For Quantity SurveyingDocumento4 páginasSchedule of Duties and Professional Charges For Quantity SurveyingJared MakoriAún no hay calificaciones

- Finance Process Flow v1Documento1 páginaFinance Process Flow v1oscar maradzamundaAún no hay calificaciones

- Breakeven Analysis Problems For Class Practice OM 2019Documento20 páginasBreakeven Analysis Problems For Class Practice OM 2019Aman Kumar100% (1)

- Cash Flow Forecast ADocumento7 páginasCash Flow Forecast Am qaiserAún no hay calificaciones

- Activity Based CostingDocumento9 páginasActivity Based CostingAbigielAún no hay calificaciones

- Are There Two ABC Methods in Accounting?: Introduction To Activity Based CostingDocumento24 páginasAre There Two ABC Methods in Accounting?: Introduction To Activity Based CostingHartanto_coolAún no hay calificaciones

- Production Planning and Control: G.Prabu K.Sathish BabuDocumento16 páginasProduction Planning and Control: G.Prabu K.Sathish BabuArun JosephAún no hay calificaciones

- Glossary of Theory of ConstraintsDocumento5 páginasGlossary of Theory of ConstraintsArun JosephAún no hay calificaciones

- BUB0910015 - Arun Joseph.ADocumento60 páginasBUB0910015 - Arun Joseph.AArun JosephAún no hay calificaciones

- Organisational Structure and Leadership StylesDocumento22 páginasOrganisational Structure and Leadership StylesArun JosephAún no hay calificaciones

- E Procurement 151027114919 Lva1 App6892Documento15 páginasE Procurement 151027114919 Lva1 App6892Priya KhareAún no hay calificaciones

- 3 PLDocumento6 páginas3 PLAbhishek7705Aún no hay calificaciones

- Q1 and Q2 - AtlanticDocumento3 páginasQ1 and Q2 - AtlanticApoorva SharmaAún no hay calificaciones

- Farm Laws Detailed Analysis-StudyDocumento5 páginasFarm Laws Detailed Analysis-StudyRakeshKulkarniAún no hay calificaciones

- Pertanyaan Dasar Price Sensitivity MeterDocumento1 páginaPertanyaan Dasar Price Sensitivity MeterAgung LaksanaAún no hay calificaciones

- Contract of Sale #66825-#66825-ANISIA HYM SRLDocumento4 páginasContract of Sale #66825-#66825-ANISIA HYM SRLcorvinmihai591Aún no hay calificaciones

- Alusaf CaseDocumento31 páginasAlusaf CaseAndrea Ning100% (18)

- Teaching PowerPoint Slides - Chapter 1Documento26 páginasTeaching PowerPoint Slides - Chapter 1Aditya Majumder100% (1)

- Inflation ArticlesDocumento6 páginasInflation ArticlesNader1113Aún no hay calificaciones

- Coke Vs PepsiDocumento21 páginasCoke Vs PepsiJon100% (1)

- 1st Prelim EconDocumento3 páginas1st Prelim Econmharjun lampaAún no hay calificaciones

- Harvey Norman AnalysisDocumento5 páginasHarvey Norman AnalysisSarah BunoAún no hay calificaciones

- Accenture Report 2010Documento12 páginasAccenture Report 2010PepeLeTvorAún no hay calificaciones

- Industry Research Template Two WheelersDocumento22 páginasIndustry Research Template Two WheelersHarvey100% (1)

- Xumit CapitalDocumento30 páginasXumit CapitalSumit SinghAún no hay calificaciones

- Cheating Is Strictly Prohibited. Violator Is Subject To The Disciplinary Action of The UniversityDocumento5 páginasCheating Is Strictly Prohibited. Violator Is Subject To The Disciplinary Action of The UniversityJohn SmithAún no hay calificaciones

- Bba 301Documento2 páginasBba 301Vaibhav Maheshwari0% (1)

- Management Accounting 12Documento4 páginasManagement Accounting 12subba1995333333Aún no hay calificaciones

- Wallstreetjournal 20180407 TheWallStreetJournalDocumento54 páginasWallstreetjournal 20180407 TheWallStreetJournalVikram JohariAún no hay calificaciones

- Recent Trends in Power SystemDocumento43 páginasRecent Trends in Power SystemSayonsom Chanda100% (1)

- Foreign Exchange Market: Presentation OnDocumento19 páginasForeign Exchange Market: Presentation OnKavya lakshmikanthAún no hay calificaciones

- Oil & Gas Hedging Mitigates Price Risk ExposureDocumento3 páginasOil & Gas Hedging Mitigates Price Risk ExposureMercatus Energy Advisors100% (2)

- 2012 HONDA INSIGHT Receipt 13955290 PDFDocumento1 página2012 HONDA INSIGHT Receipt 13955290 PDFNatalia GabrielAún no hay calificaciones

- Contract CostingDocumento8 páginasContract CostingGOVIND JANGIDAún no hay calificaciones

- Management+Consulting+Case+ Club+CompanyDocumento11 páginasManagement+Consulting+Case+ Club+CompanyThái Anh0% (1)

- Volkswagen in India Case SolutionDocumento9 páginasVolkswagen in India Case SolutionManav Lakhina100% (1)

- Quiz Results: Week 12: Standard Costing and Variance AnalysisDocumento25 páginasQuiz Results: Week 12: Standard Costing and Variance Analysismarie aniceteAún no hay calificaciones

- Assignment 3 Student Copy 3659645125042566Documento1 páginaAssignment 3 Student Copy 3659645125042566John DembaAún no hay calificaciones

- Interior Design Contract TemplateDocumento4 páginasInterior Design Contract TemplateRidha R. Swahafi100% (1)