Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Survey Paper On Credit Card Fraud Detection

Survey Paper On Credit Card Fraud Detection

Cargado por

Mike RomeoTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Survey Paper On Credit Card Fraud Detection

Survey Paper On Credit Card Fraud Detection

Cargado por

Mike RomeoCopyright:

Formatos disponibles

International Journal of Advanced Research in Computer Engineering & Technology (IJARCET)

Volume 3 Issue 3, March 2014

Survey Paper on Credit Card Fraud

Detection

Suman

Research Scholar,GJUS&T Hisar

HCE Sonepat

Mitali Bansal

Mtech.C.S.E,HCE Sonepat

Abstract- Banking Sector involves a lot of transactions hidden patterns and can find out the relationship

for their day to day operation and they have now between data set.

realized that their main disquietude is how to detect

fraud as early as possible. Due to fulsome advancement

in technology, it is imperative for bank to save its Fraud act as the wrongful/criminal deception

money from fraud. The primary motive of this paper is intended to result in financial or personnel gain. So,

to represent technologies that can be redounding to Credit Card Fraud is an illegal or fulsome use of card

detect credit card fraud. These technologies will help to

or unusual transaction behavior.As shown in the

diagnose the credit card fraud and give the acquiescent

result. The use of these techniques will help to figure 1 there are so many frauds detected that affect

distinguish the credit card transactions generally into the bank, merchants as well as customers. Some of

two types as legitimate and fraudulent them are listed below:

transactions.These techniques are generally based on

the Supervised and Unsupervised Learning.The

a)Inception of mails of newly issued cards.

approach on which we are working is based on

Unsupervised, in which we train our network so that it

is able to detect fraudulent transactions. b)Copying or replicating of card information through

cloned websites.

Keyword: Fraud Detection, Data Mining, Unsupervised

c) Phishing in which credit card number and

I. Introduction

password is hacked like through emails etc.

Bank is a financial institution which accepts deposit

d)Triangulation In this type of fraud, fraudster make

from public. And it become great disquietude for

an authentic looking website and advertises to sell

bank if there happens any kind of fraud in deposit.It

goods at highly lower prices. Unaware users attract to

is mentioned by K.Chan&J Stolfo et.al that there are

those sites and make online transactions. They

many kind of fraud and generally financial fraud

submit their card information to buy those goods.

much affects the bank fraud. Due to fastest growing

And then fraudsters use these card information to

online banking activities, it is found that nearly 44%

make genuine transactions.

of population of U.S using these online transactions.

According to John T.S Quah it is projected loss of

$8.2 billion in the year 2006 with $3 billion in U.S

alone.Philip K.Chan and Wei Fan et.al defines the

Data Mining is a new emerging technology that can

detect credit card fraud very effectively. As according

to them, by the help of Data Mining we can detect

ISSN: 2278 – 1323 All Rights Reserved © 2014 IJARCET 827

International Journal of Advanced Research in Computer Engineering & Technology (IJARCET)

Volume 3 Issue 3, March 2014

like feed forward neural network with back

Inception propagation have found immense application.Usually

Phishing

of mails such applications need to know previous data and on

the behalf of this previous data they detect the fraud.

Credit card Another statistically approach is feed forward

Fraud Types network in which there is certain kind of relationship

is found between user data and other parameters to

Replicating of card Triangulation get. the result. By the help of this approach or by

using SOM, data can be filter out to analyze customer

behavior (John T.S Kuah, M.Sriganesh). Another

new emerging technology of Credit card fraud

Fig: 1 General Types of Credit Card Fraud

detection is based on the genetic algorithm and

It is interesting to note that credit card fraud affect scatter search. Ekrem DuMan,M Hamdi Ozclik

owner the least and merchant the most .The existing published an approach that was base on genetic

legislation and card holder protection policies as well algorithm and scattering search. In this approach,

as insurance scheme affect most the merchant and each transaction is scored and based on these score

customer the least. Card issuer bank also has to pay transactions are divided into fraudulent or legitimate

the administrative cost and infrastructure cost transactions. They focused on a solution to minimize

.Studies show that average time lag between the the wrongly classified transactions. They merge the

fraudulent transaction date and charge back Meta heuristic approaches scatter search and genetic

notification can be high as 72 days, thereby giving algorithm.

fraudster sufficient time to cause severe damage.

Peer group analysis made by David Weston and

In this paper we address some solutions to detect Whitrow is a good solution regarding credit card

credit card fraud as early as possible. The following fraud detection. Peer group analysis is a good

section introduce some approaches on the basis of of approach that is based on unsupervised learning and

supervised and Unsupervised learning.After that we it monitors the behavior over time as well. This peer

explore the techniques that comes under the group technique can be used to find anomalous

supervised and unsupervised learning techniques transaction and help to detect the fraud in time.

before going on to result and conclusion.

All these technologies have their pros and cons as

II. . Literature Survey in fraud detection well. As Linda Delmaire works on association rule is

a simple method that initially need large data set in

Fraud act as the wrongful or criminal deception which it can find frequent item set. As work done by

intended to result in financial or personal benefit. It is Lokeh et.al is on Neural Network that can be applied

a deliberate act that is against the law, rule or policy in Supervised as well as Unsupervised Approach. As

with a aim to attain unauthorized financial Unsupervised approach is little bit more complex but

benefit.Lokesh Sharma ans Raghavendra Patidar give more optimized results. John T.S Quah and

works on emerging technology Neural Network,that M.Sriganesh works on Real time Credit card Fraud

can be used in banking or financial areas to detect detection using computational intelligence that works

fraud. They have been successfully applied to detect on Self Organising Map. Ekrem et.al combined the

legitimate or fraudulent transactions.Association genetic algorithm and Scatter search approach that is

Rules can be applied to detect fraud.Linda Delamaire really helpful to find anomalous transcations.David

and Pointon et.al use the association rules to extract Weston provides a good solution to find credit card

knowledge so that normal behavior pattern may be fraud detection using Peer Group analysis method.

obtained in unlawful transactions.This proposed So, the main motive of our paper is to represent all

Methodology has been applied on data about credit important technologies that can detect the fraud as

card fraud of the most important retail companies in early as possible and to avoid the loss as much as

Chile. In the area of fraud detection, neural network possible.

ISSN: 2278 – 1323 All Rights Reserved © 2014 IJARCET 828

International Journal of Advanced Research in Computer Engineering & Technology (IJARCET)

Volume 3 Issue 3, March 2014

III. Various Techniques to Detect Credit intensity of pressing. These parameters can be helpful

Card Fraud to recognize suspicious behavior.

There are many emerging technologies that are able c)Online Behavior: According to Revett & Santos,

to detect credit card fraud detection. Some of condign this characteristic can be done by observing and

technologies that will work on some parameters and collecting data of user’s behavior over long period of

able to detect fraud earlier as well are listed below: time. It is observed that user’s behavior is not random

rather than it is centric.

3.1 Biometric Approach

3.1.2) Physiological Characteristics: In physiological

Kenneth Aguilar & Cesar Ponce et al. defines that all characteristics, Hernandez & Diaz defined the

human have particular characteristics in their following characteristics that are able to detect

behavior as well as in their physiological unique patterns.

characteristics as depicted in Figure 2. Here

behavioral characteristics mean any human’s voice, a) Fingerprints: As this is a biological physiological

signature, keystroke etc. And physiological characteristic in which every user has unique

characteristics means fingerprints, face image or hand fingerprints that able to identify legitimate or

geometry. Biometric Data mining is an application of fraudulent user.

knowledge discovery techniques in which we provide

biometric information with the motive to identify b) Face recognition: According to (Lovell & Chemn,

patterns. 2010), there are several application of data mining for

face recognition: 1) Person recognition and Location

3.1.1) Behavioral Characteristics: According to Services on a planetary wide sensor, 2) Searching of

Revett Henrique Santos,we can have following video in a multimedia database. In Credit card fraud

characteristics that are able to identify patterns. detection it can be used if a registered user uses its

credit card for performing transactions.

3.2)Learninig Learning is generally done with or

without the help of teacher.Generally division of

learning take place as shown in Figure3.

Characteristics

Learning

Behavioural Physiological

Characteristics Characterisics

Supervised Unsupervised

Fig: 2 Characteristics that can be recognized by Learning Learning

Biometric System.

a)KeyStroke Patterns: Revett & Henrique Santos Figure: 3

defined keystroke pattern in the term of keyboard

duration or latency. According to them, pattern of The learning that take place under the supervision of

Striking of keys of every person is unique. So it will teacher is termed as supervised learning.But In which

help to identify the legitimate or fraudulent persons. there is no guidance of teacher is termed as

Unsupervised learning.These Learning are explored

b)Mouse Movement: User identification during as:

mouse movement is done by measuring the

temperature and humidity of user’s palm and his/her

ISSN: 2278 – 1323 All Rights Reserved © 2014 IJARCET 829

International Journal of Advanced Research in Computer Engineering & Technology (IJARCET)

Volume 3 Issue 3, March 2014

3.2.1)Supervised Learning According to Patdar and

Lokesh Sharma following technologies are based on

Supervised Learning approach in which we have an Input Transaction

external teacher to check our output.

Decision tree

a)Bayesian Network: Baye’s theorem is derived by

Thomas Bayes. These are statistical classifier that Processing

predict class membership probabilities such that

whether a particular given tuple belongs to a

particular class.In this X is considered as “evidence”

and H will be some hypothesis such that X belongs to Fraudulent Legitimate

particular class C.In this,we have two kind of Transaction Transaction

probability:

Fig: 4 Decision Tree

In this P(Fr/X) and P(X/Fr) are posterior probability

c)Support Vector Machine: In supervised learning

conditioned on Hypothesis. And P(Fr) and P(X) are

Vapnik come with an idea of support Vector

prior probability of Hypothesis. We calculate the

Machine.Joseph King-Fun Pun approached thati in

posterior probability ,P(Fr/X),from P(Fr),P(X/Fr) and

this classification algorithm we can construct a hyper

P(X) are given

plane as a decision plane which can make distinction

𝑃

𝑋

𝑃(𝐹𝑟) between fraudulent and legitimate transaction. This

𝐹𝑟

Baye’s theorem is:P(Fr/X)= Hyper plane Separate the different class of data.

𝑃(𝑋)

Support Vector Machine can maximize the geometric

P(Fr/X) is the fraud probability given the observed margin and simultaneously it can minimize the

behavior user X.This Network can model the empirical classification. So, it is also called

behavior based on the assumption that whether the Maximum Margin classifier..The separating

user is fraudulent or legitimate. Hyperplane is a plane that exploit the distance

between the two equivalent hyper plane.

b)Decision Tree Induction Dipti Thakur & Bhatia

defined this as a type of supervised learning in which 3.2.2) Unsupervised Learning: In contrast to

we make a decision tree to reach at a particular supervised Learning, unsupervised or self organized

solution.As shown in figure4 they defined that in learning does not require an external teacher.Quah &

decision tree we have some internal nodes and each Sriganesh defined that in this during training session

node represent a test on a particular attribute and each the neural network receive a number of different

branch in decision tree represent an outcome of test input patterns, discovered significant features in these

and each leaf node will represent class label means pattern and learn how to classify input pattern into

output. Decision trees are used for classification in different categories.

which we give a new transaction for which class

label is unknown(means it is unknown whether it is a)Peer Group Analysis Approach

fraudulent or legitimate) and the transaction value is

In 2008 Watson and Whitrow et.al work on Peer

tested against the decision tree. A path is traced from

root node to output/class label for that transaction. Group Analysis in Plastic Card Fraud Detection.

They defined it as an unsupervised method that

analyzes the behavior over time by monitoring it.

This approach can be used to identify credit card

fraud detection by analyzing the fraudulent

transactions. In this those transactions deviate from

their peer group termed as anomalous/fraudulent

transactions. They defined that there are generally

two type of approach to detect fraud. One is, in which

ISSN: 2278 – 1323 All Rights Reserved © 2014 IJARCET 830

International Journal of Advanced Research in Computer Engineering & Technology (IJARCET)

Volume 3 Issue 3, March 2014

Form of the fraud is known this can be detected by 2) Unsupervised Learning

pattern matching. And when the type of fraud is not

known then we approach anomaly detection 3.3.1)Supervised Learning in Neural Network In

techniques. Peer group analysis is an anomaly Supervised Learning, Patdar and Lokesh Sharma

detection technique. Suppose we have analyze the Customer’s past behavior and on the

a1,a2……………………an-1,an time series basis of that we conclude to our result.In neural

representing the weekly amount spent on a credit network Backpropagation method works in

card for a particular account and an is the target Supervised mode.It iteratively process the data of

account. We wish to determine whether the recently training set and compare the value of each predicted

spend transaction an is fraudulent or not at time t=n. value to the target value.For each training input the

In this, in order to detect outlier transaction we can mean squared error is minimized between the

use the Mahalanobis distance of an from the centroid network’s prediction and actual target value.These all

of its peer group.As it shown in figure 5 that by the modifications are done in the backward diresction by

help of the Peer group technique anomaly input are the help of each hidden layer.Hence it is termaed as

separated. the Backpropagation method.

3.3.2)Unsupervised Learning in Neural Network

a)Self Organinsing Map In Resaerch of Kuah &

Sriganesh Self organizing Map configure its neuron

according to topological structure of input data as

shown in Figure6. This process is called Self

Organization because of iterative tuning weight of

neurons. The result is clustering of input data.In Self

Organizing map Zaslavsky and Strizhak[8] defined

Fig: 5 Peer group Analysis that we needn’t any external teacher in this mode of

learning. So,Verfication of resultant matrix will be

done on behalf of the presented past learning.As our

approach is also based on the Unsupervised

learning.There are mainly four step of processing

take place in Self organizing Map that we applied on

our inputs.

3.3) Neural Network: Neural Network is a set of

connecting input and output units and these units are 1) Initialization : First of all we have to selected

connected with their associated weights. It used small random value for synaptic weight in

connection between units that’s why it is termed as interval[0,1] and have to assign a small positive value

connectionist learning. In this during the learning of learning parameter a.

phase, the network learn by adjusting its weight to

predict the class label of the input vector .The main y1

Output Signals

Input Signals

advantage of neural network is its high tolerance of

x1

noisy data that’s why it is more suitable for credit

card fraud detection. They can also detect those y2

patterns for which they have not been trained. Means, x2

in any new transaction of Fraud it will be applicable y3

to detect it as Legitimate or Fraudulent. According to

Patdar and Lokesh Sharma There are generally two Input Output

types of Learning take place in Neural Network: layer layer

1) Supervised Learning Fig: 6 Kohonen Network

ISSN: 2278 – 1323 All Rights Reserved © 2014 IJARCET 831

International Journal of Advanced Research in Computer Engineering & Technology (IJARCET)

Volume 3 Issue 3, March 2014

2) Activation and Similarity matching: in this step we Learning Strategy” Chemical Engineering and

activated Kohonen Network for input vector X and Applied Chemistry University of Tornto 2011.

find Winner.

[7] Kenneth Revett,Magalhaes and Hanrique

3) Learning of Adaptive: Weight are trained by Santos “Data Mining a Keystroke dynamic Based

performing many steps. Biometric Dtatabase Using Rough Set” IEEE

4) Iteration: At that point we performed iterations,till [8] Linda Delamaire ,Hussein Abdou and John

we did not get a stability in our network. Pointon, “Credit Card Fraud and Detection

technique”, Bank and Bank System,Volume 4, 2009.

IV. . Conclusion

[9] Philip K Chan,Wei Fan,Andias

Due to Fulsome advancement in technology, the use Prodromidis,J.Stolfo, “Distributed Datan Mining For

of credit card has increased and due to this, Fraud Credit Card Fraud Detection”, IEEE Intelligent

cases are affecting it directly. One of the main System,Special Issue On Data Mining, 1999.

motives of this study is to explore as many

techniques that can detect fraud effectively. If one of [10] Raghavendra Patidar,Lokesh Sharma

the above technologies is applied in bank then cases “Credit Card Fraud Detection using Neural Network”

of credit card fraud will surely minimize. Here we International journal of Soft

represent the advanced technologies that can detect Computing(IJCSE),Volume 32,38,Issue 2011.

credit card fraud and save the bank from big loss.

[11] Vladdimir Zasalavsky and Anna Strizhak,

V. Refrences “Credit Card Fraud Detection using Self Organising

Map”,Information and Security An International

[1] David J.Wetson,David J.Hand,M Journal,Vol 18,2006

Adams,Whitrow and Piotr Jusczak “Plastic Card

Fraud Detection using Peer Group Analysis” [12] V.PriyaDarshini,G.Adiline Macriga, “An

Springer, Issue 2008. Efficient dta Mining For Credit Card Fraud detection

Using finger Print Recognition”, IJACR, Vol 2, 2012.

[2] Dipti Thakur,Shalini Bhatia “Distribution

Data Mining approach to Credit card Fraud

Detection” SPIT IEEE Colloquium and International

Conference,Volume 4,48, Issue 2002.

[3] Francisca Nonyelum Ogwueleka, “Data

Mining application In Credit Card fraud Detection”

Journal of Enggineering Science and Technology,

Vol 6 No 3,Issue 2011.

[4] Hernandez,Zavala,Diaz and Ponce

“Biometric Data Mining Applied to On-Line

Regonition Systems” CIICAp, Issue 2008.

[5] John T.S Quah,M Sriganesh “Real time

Credit Card Fraud Detection using Computational

Intelligence” ELSEVIER Science Direct,35 (2008)

1721-1732.

[6] Joseph King –Fung Pun, “Improving Credit

Card Fraud Detection using a Meta Heuristic

ISSN: 2278 – 1323 All Rights Reserved © 2014 IJARCET 832

También podría gustarte

- Credit Card Fraud Detection ProjectDocumento8 páginasCredit Card Fraud Detection ProjectIJRASETPublicationsAún no hay calificaciones

- Real Time Credit Card Fraud DetectionDocumento5 páginasReal Time Credit Card Fraud DetectionInternational Journal of Innovative Science and Research TechnologyAún no hay calificaciones

- Privileged Attack Vectors: Building Effective Cyber-Defense Strategies to Protect OrganizationsDe EverandPrivileged Attack Vectors: Building Effective Cyber-Defense Strategies to Protect OrganizationsAún no hay calificaciones

- Credit Card Fraudulent Transaction Detection and PreventionDocumento8 páginasCredit Card Fraudulent Transaction Detection and PreventionIJRASETPublications100% (1)

- Deep Learning Methods For Credit Card Fraud DetectDocumento8 páginasDeep Learning Methods For Credit Card Fraud Detectsatyabrata mohapatraAún no hay calificaciones

- Credit Card Fraud DetectionDocumento4 páginasCredit Card Fraud DetectionEditor IJTSRDAún no hay calificaciones

- Bank Fraud Detection Using Community Detection AlgorithmDocumento5 páginasBank Fraud Detection Using Community Detection AlgorithmDisha Date100% (1)

- Credit Card Duplicity Spotting On Gaining The Knowledge On Machine LearningDocumento4 páginasCredit Card Duplicity Spotting On Gaining The Knowledge On Machine LearningInternational Journal of Innovative Science and Research TechnologyAún no hay calificaciones

- Neural Networks and Artificial Intelligence For Biomedical Engineering Ieee Press Series On Biomedical Engineering PDFDocumento314 páginasNeural Networks and Artificial Intelligence For Biomedical Engineering Ieee Press Series On Biomedical Engineering PDFAsina MilasAún no hay calificaciones

- Anti fraud for Cheques and use of AI: Next gen realtime anti fraud 4 cheque processingDe EverandAnti fraud for Cheques and use of AI: Next gen realtime anti fraud 4 cheque processingAún no hay calificaciones

- Credit Card DetectionDocumento9 páginasCredit Card DetectionAhmad WarrichAún no hay calificaciones

- Credit Card Fraud Detection UsingDocumento12 páginasCredit Card Fraud Detection UsingPatel Manish100% (1)

- Machine Learning With PythonDocumento41 páginasMachine Learning With PythonROG Nation YTAún no hay calificaciones

- Credit Card Fraud Identification Using Artificial Neural NetworksDocumento9 páginasCredit Card Fraud Identification Using Artificial Neural NetworksHarsha GuptaAún no hay calificaciones

- Can Machine:Deep Learning Classifiers Detect Zero-Day Malware With High Accuracy PDFDocumento8 páginasCan Machine:Deep Learning Classifiers Detect Zero-Day Malware With High Accuracy PDFMike RomeoAún no hay calificaciones

- 1.credit Card Fraud Detection Using Hidden Markov ModelDocumento4 páginas1.credit Card Fraud Detection Using Hidden Markov ModelsulhanAún no hay calificaciones

- Credit Card Fraud DetectionDocumento95 páginasCredit Card Fraud Detectionspatwari2967% (9)

- Machine Learning Solved Mcqs Set 1Documento6 páginasMachine Learning Solved Mcqs Set 1Yash Malpani100% (3)

- Campbell A. Python Machine Learning For Beginners. All You Need To Know... 2022Documento75 páginasCampbell A. Python Machine Learning For Beginners. All You Need To Know... 2022venkata ganga dhar gorrelaAún no hay calificaciones

- Analytix Labs Data Science CourseDocumento18 páginasAnalytix Labs Data Science CourseHonest Business Services100% (1)

- SSRN Id4135514 PDFDocumento6 páginasSSRN Id4135514 PDFInder Kumar SinghAún no hay calificaciones

- An Enlightenment To Machine LearningDocumento16 páginasAn Enlightenment To Machine LearningAnkur Singh100% (1)

- Credit Card Fraud Detection Using Hybrid Approach of Machine LearningDocumento8 páginasCredit Card Fraud Detection Using Hybrid Approach of Machine LearningIJRASETPublicationsAún no hay calificaciones

- Credit Card Fraud Detection Using Various Machine Learning AlgorithmsDocumento15 páginasCredit Card Fraud Detection Using Various Machine Learning AlgorithmsIJRASETPublicationsAún no hay calificaciones

- Credit Card Fraud Detection Using Hidden Markov ModelDocumento12 páginasCredit Card Fraud Detection Using Hidden Markov ModelSherwin PintoAún no hay calificaciones

- Review On Credit Card Fraud Detection Using Machine Learning AlgorithmsDocumento5 páginasReview On Credit Card Fraud Detection Using Machine Learning AlgorithmsGiuseppeLegrottaglieAún no hay calificaciones

- Synopsis ON "Credit Card Fraud Detection System"Documento14 páginasSynopsis ON "Credit Card Fraud Detection System"Roshan Prasad100% (1)

- Credit Card Fraud Detection Using Machine LearningDocumento6 páginasCredit Card Fraud Detection Using Machine LearningInternational Journal of Innovative Science and Research TechnologyAún no hay calificaciones

- MPML10 2022 FRDocumento24 páginasMPML10 2022 FRMaliha MirzaAún no hay calificaciones

- Fraud Detection in Credit Cards System Using ML With AWS Stage MakerDocumento6 páginasFraud Detection in Credit Cards System Using ML With AWS Stage MakerIJRASETPublicationsAún no hay calificaciones

- Credit Card Fraud Detection TechniquesDocumento8 páginasCredit Card Fraud Detection TechniquesBokani MakoshaAún no hay calificaciones

- Srinivasulu JournalDocumento5 páginasSrinivasulu JournalLalitha PonnamAún no hay calificaciones

- Federal PolytechnicDocumento24 páginasFederal PolytechnicUzoma FrancisAún no hay calificaciones

- Malini 2017Documento4 páginasMalini 2017poojithaaalamAún no hay calificaciones

- Analysis On Credit Card Fraud Detection MethodsDocumento7 páginasAnalysis On Credit Card Fraud Detection MethodsseventhsensegroupAún no hay calificaciones

- RESEARCHINTELreDocumento8 páginasRESEARCHINTELrerosemaryjibrilAún no hay calificaciones

- Credit Card Fraud Detection by Data Analytics Using Python: Malay Joshi, Yudhishthir Bhunwal and Dr. Smita AgarwalDocumento4 páginasCredit Card Fraud Detection by Data Analytics Using Python: Malay Joshi, Yudhishthir Bhunwal and Dr. Smita AgarwalFinger igAún no hay calificaciones

- Credit Card Fraud Detection Using Hidden Markov ModelsDocumento5 páginasCredit Card Fraud Detection Using Hidden Markov ModelsNinad SamelAún no hay calificaciones

- Bansal 2021 IOP Conf. Ser. Mater. Sci. Eng. 1116 012181Documento11 páginasBansal 2021 IOP Conf. Ser. Mater. Sci. Eng. 1116 012181Samudyata SAún no hay calificaciones

- Performance Evaluation of Machine LearningDocumento5 páginasPerformance Evaluation of Machine Learningjaskeerat singhAún no hay calificaciones

- Credit Card Fraud Detection1Documento5 páginasCredit Card Fraud Detection1Yachna DharwalAún no hay calificaciones

- Analysis of Credit Card Fraud Detection Model Using Convolutional Neural NetworkDocumento8 páginasAnalysis of Credit Card Fraud Detection Model Using Convolutional Neural NetworkCentral Asian StudiesAún no hay calificaciones

- AI Based Credit Card Fraud Detection Using Machine Learning TechniqueDocumento10 páginasAI Based Credit Card Fraud Detection Using Machine Learning TechniqueWeb ResearchAún no hay calificaciones

- Doi: 10.5281/zenodo.7922883: ISSN: 1004-9037Documento18 páginasDoi: 10.5281/zenodo.7922883: ISSN: 1004-9037Chaitanya KapilaAún no hay calificaciones

- Real-Time Credit Card Fraud Detection Using Machine LearningDocumento6 páginasReal-Time Credit Card Fraud Detection Using Machine LearningFor ytAún no hay calificaciones

- Online Payment Fraud DetectionDocumento5 páginasOnline Payment Fraud DetectionInternational Journal of Innovative Science and Research TechnologyAún no hay calificaciones

- 01 - Minastireanu, MesnitaDocumento12 páginas01 - Minastireanu, Mesnitaravi prakashAún no hay calificaciones

- Statistical Fraud Detection - A ReviewDocumento21 páginasStatistical Fraud Detection - A ReviewGiuseppeLegrottaglieAún no hay calificaciones

- Fraud Detection in Credit Card System: EEE1007 - Neural Networks and Fuzzy ControlDocumento7 páginasFraud Detection in Credit Card System: EEE1007 - Neural Networks and Fuzzy ControlShabd PrakashAún no hay calificaciones

- Performance Evaluation of Machine Learning Algorithms For Credit Card Fraud DetectionDocumento7 páginasPerformance Evaluation of Machine Learning Algorithms For Credit Card Fraud DetectionGiuseppeLegrottaglieAún no hay calificaciones

- Icaicta2022 Paper 33Documento8 páginasIcaicta2022 Paper 33Vincent FebrienAún no hay calificaciones

- IJISRT20JAN493Documento4 páginasIJISRT20JAN493International Journal of Innovative Science and Research TechnologyAún no hay calificaciones

- Online Transaction Fraud Detection System Based On Machine LearningDocumento4 páginasOnline Transaction Fraud Detection System Based On Machine LearningtechieAún no hay calificaciones

- Analysis of Credit Card Fraud Detection Using Machine Learning Models On Balanced and Imbalanced DatasetsDocumento7 páginasAnalysis of Credit Card Fraud Detection Using Machine Learning Models On Balanced and Imbalanced DatasetsWARSE Journals100% (1)

- Use Machine Learning Techniques To Identify Credit Cards Fraud DetectionDocumento5 páginasUse Machine Learning Techniques To Identify Credit Cards Fraud DetectionInternational Journal of Innovative Science and Research TechnologyAún no hay calificaciones

- JETIR2305424Documento6 páginasJETIR2305424mahendrareddy.geddamAún no hay calificaciones

- ICNSC 04 KLSH NewDocumento6 páginasICNSC 04 KLSH NewSharmin SathiAún no hay calificaciones

- 10.1007@s41870 020 00430 y PDFDocumento9 páginas10.1007@s41870 020 00430 y PDFEdi SuwandiAún no hay calificaciones

- Credit Card Fraud DetectionDocumento95 páginasCredit Card Fraud DetectionMadhu Evuri0% (1)

- Final Year Project SynopsisDocumento9 páginasFinal Year Project SynopsisMihir DwivediAún no hay calificaciones

- Emerging Trends in Computer EngineeringDocumento20 páginasEmerging Trends in Computer Engineeringsimraapathan123Aún no hay calificaciones

- The International Journal of Engineering and Science (The IJES)Documento8 páginasThe International Journal of Engineering and Science (The IJES)theijesAún no hay calificaciones

- Paper-7 - Supervised Machine Learning Model For Credit Card Fraud DetectionDocumento7 páginasPaper-7 - Supervised Machine Learning Model For Credit Card Fraud DetectionRachel WheelerAún no hay calificaciones

- A Comparative Analysis On Credit Card Fraud Techniques Using Data MiningDocumento3 páginasA Comparative Analysis On Credit Card Fraud Techniques Using Data MiningIntegrated Intelligent ResearchAún no hay calificaciones

- Credit Fraude PDFDocumento6 páginasCredit Fraude PDFSergio NeiraAún no hay calificaciones

- Enhanced OneTime Pad Cipher With MoreArithmetic and Logical Operations With Flexible Key Generation AlgorithmDocumento9 páginasEnhanced OneTime Pad Cipher With MoreArithmetic and Logical Operations With Flexible Key Generation AlgorithmAIRCC - IJNSAAún no hay calificaciones

- A Comparative Analysis of Credit Card Fraud Detection Using Machine Learning TechniquesDocumento2 páginasA Comparative Analysis of Credit Card Fraud Detection Using Machine Learning TechniquesKhairunnisa SafiAún no hay calificaciones

- Static Malware Analysis Using Machine Learning Methods PDFDocumento11 páginasStatic Malware Analysis Using Machine Learning Methods PDFMike RomeoAún no hay calificaciones

- Combining Supervised and Unsupervised Learning For Zero-Day Malware Detection PDFDocumento9 páginasCombining Supervised and Unsupervised Learning For Zero-Day Malware Detection PDFMike RomeoAún no hay calificaciones

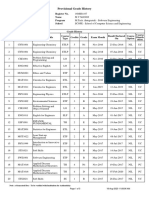

- Provisional Grade History: Register No. Name Program SchoolDocumento5 páginasProvisional Grade History: Register No. Name Program SchoolMike RomeoAún no hay calificaciones

- Integrated Malware Analysis Using Machine Learning PDFDocumento8 páginasIntegrated Malware Analysis Using Machine Learning PDFMike RomeoAún no hay calificaciones

- Challenges in Cloud Investigation Forensics NIST a2CFGHYC-2 PDFDocumento10 páginasChallenges in Cloud Investigation Forensics NIST a2CFGHYC-2 PDFMike RomeoAún no hay calificaciones

- Mat2002-Applications of Differential and Difference Equations Digital Assignment - 1 A1 SlotDocumento1 páginaMat2002-Applications of Differential and Difference Equations Digital Assignment - 1 A1 SlotMike RomeoAún no hay calificaciones

- Executive Director: Email - PhoneDocumento1 páginaExecutive Director: Email - PhoneMike RomeoAún no hay calificaciones

- Vellore Institute of Technology (VIT) PDFDocumento1 páginaVellore Institute of Technology (VIT) PDFMike RomeoAún no hay calificaciones

- Digital Assignment IDocumento1 páginaDigital Assignment IMike RomeoAún no hay calificaciones

- Online Assignment No.1 Indian Law Institute By: Sadhvi Gaur (16022 - Sadhvi)Documento12 páginasOnline Assignment No.1 Indian Law Institute By: Sadhvi Gaur (16022 - Sadhvi)Mike RomeoAún no hay calificaciones

- The A.P. Police Manual, Part - I, Volume - Iii ODocumento2 páginasThe A.P. Police Manual, Part - I, Volume - Iii OMike RomeoAún no hay calificaciones

- Application For Issue of Identity Card For Ex-ServicemenDocumento2 páginasApplication For Issue of Identity Card For Ex-ServicemenMike RomeoAún no hay calificaciones

- The A.P. Police Manual, Part - I, Volume - Iii ODocumento2 páginasThe A.P. Police Manual, Part - I, Volume - Iii OMike RomeoAún no hay calificaciones

- Design PatternsDocumento7 páginasDesign PatternsMike RomeoAún no hay calificaciones

- Heart Disease Prediction Using Machine LearningDocumento11 páginasHeart Disease Prediction Using Machine LearningdataprodcsAún no hay calificaciones

- MLT Unit-1Documento19 páginasMLT Unit-1Son IshAún no hay calificaciones

- Data Science & Machine Learning by Using R ProgrammingDocumento6 páginasData Science & Machine Learning by Using R ProgrammingVikram SinghAún no hay calificaciones

- Dip Assignment 1Documento20 páginasDip Assignment 1api-287017021Aún no hay calificaciones

- PyBrain SlidesDocumento20 páginasPyBrain SlidesPablo Loste RamosAún no hay calificaciones

- FinalDocumento17 páginasFinalakhilAún no hay calificaciones

- Linear Regression ReportDocumento15 páginasLinear Regression Reportdodla.naiduAún no hay calificaciones

- UNIT-IV NotesDocumento42 páginasUNIT-IV NotesHatersAún no hay calificaciones

- CS194 Fall 2011 Lecture 01Documento88 páginasCS194 Fall 2011 Lecture 01hanamachi09Aún no hay calificaciones

- Machine Learning in Additive Manufacturing A ReviewDocumento15 páginasMachine Learning in Additive Manufacturing A ReviewcimsanthoshAún no hay calificaciones

- Introduction To AI - MBA 2nd Sem 26-02-2024Documento65 páginasIntroduction To AI - MBA 2nd Sem 26-02-2024sahil9mohd2013Aún no hay calificaciones

- QuePaper-OCT2018-M.E (Computer) - Sem-IIDocumento7 páginasQuePaper-OCT2018-M.E (Computer) - Sem-IIpravinhmoreAún no hay calificaciones

- MSc. GEM Thesis - Benjamin Adjah TorgborDocumento100 páginasMSc. GEM Thesis - Benjamin Adjah TorgborNii Ampao TorgborAún no hay calificaciones

- ENGO 659-Report Project2Documento16 páginasENGO 659-Report Project2sree vishnupriyqAún no hay calificaciones

- Nptel: NOC:Introduction To Data Analytics - Video CourseDocumento2 páginasNptel: NOC:Introduction To Data Analytics - Video CourseKanhaAún no hay calificaciones

- Raju Internship ReportDocumento27 páginasRaju Internship ReportAltaf SMTAún no hay calificaciones

- Fraud Detection and Analysis For Insurance Claim Using Machine LearningDocumento9 páginasFraud Detection and Analysis For Insurance Claim Using Machine LearningIJRASETPublicationsAún no hay calificaciones

- Machine Learning: Algorithms TypesDocumento27 páginasMachine Learning: Algorithms TypesRaviprakash TripathyAún no hay calificaciones

- Analysis and Classification of Intrusion Detection For Synthetic Neural Networks Using Machine Language StrategiesDocumento5 páginasAnalysis and Classification of Intrusion Detection For Synthetic Neural Networks Using Machine Language StrategiesInternational Journal of Application or Innovation in Engineering & ManagementAún no hay calificaciones

- MSC - Thesis - Erfan Khalaji - OpenMETUDocumento108 páginasMSC - Thesis - Erfan Khalaji - OpenMETUAbdullah ShabbirAún no hay calificaciones

- ML Toppers Solutions 2019Documento105 páginasML Toppers Solutions 2019RockyAún no hay calificaciones

- International Journal of Production Economics: Mehrdokht Pournader, Hadi Ghaderi, Amir Hassanzadegan, Behnam FahimniaDocumento16 páginasInternational Journal of Production Economics: Mehrdokht Pournader, Hadi Ghaderi, Amir Hassanzadegan, Behnam FahimniaThảo Trần Thị Thu100% (2)

- Caixinha 2016Documento16 páginasCaixinha 201611Dewi Meiliyan Ningrum dewimeiliyan.2020Aún no hay calificaciones

- 3 Unit - DspuDocumento23 páginas3 Unit - Dspusuryashiva422Aún no hay calificaciones