Documentos de Académico

Documentos de Profesional

Documentos de Cultura

TR 46 For Web Final7

Cargado por

Anonymous DbmKEDxDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

TR 46 For Web Final7

Cargado por

Anonymous DbmKEDxCopyright:

Formatos disponibles

Below Rs.

(Rupees: )

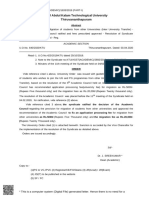

TR 46

[See Rule 164 (a) of KTC Vol.1]

BILL FOR PAY AND ALLOWANCES/LEAVE SALARY OF A GAZETTED OFFICER

Name of Treasury:

FOR TREASURY USE

Computer Sequence No./Token No. Date:

Scroll No.

SDO Code: Name:

Designation: G.E No.

Name of Office: PAN/GIR:

Head of Account Plan (P)/Non-Plan (N) Voted (V)/Charged (C)

MAJ SMJ MIN SUB SSUB

CPS/CSS Ratio

Received for the period: (From) (To)

A. Amount due Rate Amount B. Deductions Rate Amount

Pay/Duty pay GPF

Leave Salary GPF (Loan Recovery)

Special pay GPF (Arrear DA)

Personal pay GPF (ADA)

Transit pay Group Insurance

State Life Insurance

Dearness Allowances SLI (Loan Recovery)

House Rent Allowance Recoveries ordered by AG

CCA HBA-1

PTA HBA2

PCA HBA Additional

Special Allowance HBA interest

MCA

Deduct Advance drawn MCA interest

FBS

Gross claim A PLI

Total –B Rent

Net Claim = A-B Income Tax

LIC

Received Rs. (Rs. Computer Advance

only)

In CASH/TC to TSB

Total B 0

Station: Signature:

Date: Designation: Stamp

FOR TREASURY USE ONLY

Pay Rs………………………….. (Rupees …………………………………………………………………………. onl y) in CASH/Cheque

Rs……………………………………..(Rupees ……………………………………………………………………………only ) b y RBR

and Rs ……………………………….(Rupees ……………………………………………………………………………. only) by TC.

POC No. ……………………………………Date ……………………………………………….

Accountant Treasury Officer

Received Pay Order Cheque Py Order Cheque Issued by

Signature of Recipient Accountant

Note: Govt. accept no responsibility, for any fraud or misappropriation in respect of money or draft made over to messenger.

CERTIFICATE FOR CLAIMING HRA:

I certify that I did not occupy Govt. quarters during the period for which HRA is claimed in the bill.

Date: / / Signature:

LIFE CERTIFICATE referred in No.7: Sri/Smt. ……………………………………………………………………… ……………is alive

on this ……………………………………………….. (date).

Station: ………………………………………………………. Signature: ……………………………………………………..

Date: ………………………………………………………… Designation: …………………………………………………..

Space for Additional Certificates

Allotment Details (For PTA, PCA claim)

Appropriation for current year Rs.

Expenditure excluding the bill Rs.

Expenditure including the bill Rs.

Balance Rs.

Signature of Drawing Officer

DIRECTIONS FOR USE

1. A salary bill may be endorsed to a Banker or other recognized agent and submitted for collection through such Banker or Agent

if the Officer desires so.

2. An Officer appointed to the Govt. service must furnish a cert ificate that he has subm itted proposals for SLI (Official Branch ),

and applied for admission to the GPF as per rules.

3. Income Tax should be deducted as per rules.

4. Leave salary/transit pay should be claimed after getting pay slip from the AG.

5. Copy of LPC/Pay Slip should be attached with the bills as per rules.

6. The details of salary enchased should be informed to the head of office with a copy of FBS schedule.

7. An Officer who signs his own bills while absent on leave must either present it in person or furnis h the above life certificate,

signed b y a r esponsible officer of Government or some other well known and trustworth y per son known to the Treasur y

Officer.

8. If conveyance allowance is claimed in this bill, a certificate as per rules should be furnished.

FOR THE USE OF AG’S OFFICE

Classifications Details of objection

Debit Chargeable

Credit Head of Account:

Total amount of bill Payable …………………………………………………… Treasury

Admitted Passed for Rs. ……………………………………………………..

Disallowed (Rupees. …………………………………………………………….)

Objected, See details of objection.

Retrenchments slip No. GA ………………………………………… dated …………………………………….

Or objection slip No. ……………………………………………….. dated …………………………………….

Accountant/ CT

AAG

Sr. AO/AO

AAO/SO

AA Dated

AAG

También podría gustarte

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)De EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Calificación: 3.5 de 5 estrellas3.5/5 (17)

- 18 - Carvana Is A Bad BoyDocumento6 páginas18 - Carvana Is A Bad BoyAsishAún no hay calificaciones

- Opentext Vendor Invoice Management For Sap: Product Released: 2020-10-30 Release Notes RevisedDocumento46 páginasOpentext Vendor Invoice Management For Sap: Product Released: 2020-10-30 Release Notes RevisedkunalsapAún no hay calificaciones

- Gazetted Officers Salary Bill KeralaDocumento11 páginasGazetted Officers Salary Bill KeralaBinu.C.Kurian100% (1)

- Treasury Bill Rs WordsDocumento1 páginaTreasury Bill Rs WordsbcemailidAún no hay calificaciones

- Form No. 16A (See Rule31 (L) (B) )Documento4 páginasForm No. 16A (See Rule31 (L) (B) )Nirmal MalooAún no hay calificaciones

- Request For Payment (RFP) : Payee Bureau of Internal Revenue RFP NoDocumento1 páginaRequest For Payment (RFP) : Payee Bureau of Internal Revenue RFP NoGareth TiuAún no hay calificaciones

- MTC Form 75-C BillDocumento12 páginasMTC Form 75-C BillVeerapandianAún no hay calificaciones

- Annexure Ii Standardised Format For BGDocumento5 páginasAnnexure Ii Standardised Format For BGNishit Marvania100% (1)

- Transaction Form For Existing InvestorsDocumento4 páginasTransaction Form For Existing InvestorsRRKAún no hay calificaciones

- Uco Rtgs FormDocumento2 páginasUco Rtgs FormdevchandvirjiAún no hay calificaciones

- Form Refund-Transfer Request-V180903Documento1 páginaForm Refund-Transfer Request-V180903Catarina GitaAún no hay calificaciones

- Form 12 Remittance To Other Government AgenciesDocumento1 páginaForm 12 Remittance To Other Government Agenciesarfica zainal abidinAún no hay calificaciones

- Term Deposit Related Requests FormDocumento2 páginasTerm Deposit Related Requests Formmabu5Aún no hay calificaciones

- Book1Documento3 páginasBook1PearlsgodAún no hay calificaciones

- Bonk Has Revised A Single Combined Form For Remittance Through RTGS and NEFTDocumento3 páginasBonk Has Revised A Single Combined Form For Remittance Through RTGS and NEFTSteve WozniakAún no hay calificaciones

- Request For Payment (RFP) : Payee Bureau of Internal Revenue RFP NoDocumento1 páginaRequest For Payment (RFP) : Payee Bureau of Internal Revenue RFP NoGareth TiuAún no hay calificaciones

- Itns 285Documento2 páginasItns 285Anurag SharmaAún no hay calificaciones

- PF ClaimDocumento4 páginasPF ClaimAmarjeet TakAún no hay calificaciones

- Request For Payment (RFP) : Payee Bureau of Internal Revenue RFP NoDocumento1 páginaRequest For Payment (RFP) : Payee Bureau of Internal Revenue RFP NoGareth TiuAún no hay calificaciones

- Term Deposit Related RequestsDocumento2 páginasTerm Deposit Related Requestskumar281472Aún no hay calificaciones

- Requirements LUMPSUM TERMINAL Final RevisedDocumento2 páginasRequirements LUMPSUM TERMINAL Final RevisedMaridae Sales CortezAún no hay calificaciones

- Arr Bill OuterDocumento1 páginaArr Bill Outermahesh070Aún no hay calificaciones

- Income Tax Option Cum Declaration Form (2022 2023)Documento4 páginasIncome Tax Option Cum Declaration Form (2022 2023)kkkAún no hay calificaciones

- Outer Cgegis Charanjit LalDocumento2 páginasOuter Cgegis Charanjit LalDDO Division-2Aún no hay calificaciones

- CM A50520152 11052023 PDFDocumento1 páginaCM A50520152 11052023 PDFHada ArjunAún no hay calificaciones

- It 000130629196 2021 00Documento1 páginaIt 000130629196 2021 00muhammad faiqAún no hay calificaciones

- Income Tax Payment Challan: PSID #: 145879823Documento1 páginaIncome Tax Payment Challan: PSID #: 145879823farhan aliAún no hay calificaciones

- Income Tax Payment Challan DetailsDocumento1 páginaIncome Tax Payment Challan DetailsHaseeb RazaAún no hay calificaciones

- Mushtaq & IshfaqDocumento1 páginaMushtaq & IshfaqAʌĸʌsʜ AƴʌŋAún no hay calificaciones

- FBR ITO Assing Contractor 22feb2024Documento1 páginaFBR ITO Assing Contractor 22feb2024Syed TabishAún no hay calificaciones

- One Pager AgreementDocumento2 páginasOne Pager Agreementselva9404368Aún no hay calificaciones

- Home Loan: TCHFL HL MITC Version 17Documento4 páginasHome Loan: TCHFL HL MITC Version 17Ali Khan AKAún no hay calificaciones

- Income Tax Payment Challan: PSID #: 148094666Documento1 páginaIncome Tax Payment Challan: PSID #: 148094666omer akhterAún no hay calificaciones

- GPFConversionDocumento2 páginasGPFConversionDVET IndiaAún no hay calificaciones

- Umair + Shahid PDFDocumento1 páginaUmair + Shahid PDFAyan BAún no hay calificaciones

- TA Adjestment Bill For StaffDocumento5 páginasTA Adjestment Bill For StaffAnonymous m4CnyeKpAún no hay calificaciones

- Tata Capital Financial Service Limited – Varun Agro Processing Foods Private Limited Credit Approval MemorandumDocumento22 páginasTata Capital Financial Service Limited – Varun Agro Processing Foods Private Limited Credit Approval MemorandumGAURAV NIGAM100% (1)

- Form 16Documento3 páginasForm 16ganesh_korgaonkarAún no hay calificaciones

- Salary Bill TR51Documento1 páginaSalary Bill TR51GHSS ANAPPARAAún no hay calificaciones

- BOB Foreign Inward Remittances Application Form 20 06 2020Documento6 páginasBOB Foreign Inward Remittances Application Form 20 06 2020Finance Logan MineralsAún no hay calificaciones

- Advance Salary Personal Loan CalculatorDocumento5 páginasAdvance Salary Personal Loan CalculatorTipuAún no hay calificaciones

- Advance Salary Personal Loan CalculatorDocumento4 páginasAdvance Salary Personal Loan CalculatorRajan Pur Control RoomAún no hay calificaciones

- Payment Order: Komatsu India PTV LTD Pvno: DateDocumento2 páginasPayment Order: Komatsu India PTV LTD Pvno: DateHari NarayananAún no hay calificaciones

- Collateral Release Request and Acknowledgement FormDocumento3 páginasCollateral Release Request and Acknowledgement FormLanie D LisamaAún no hay calificaciones

- Ra-09 Abstract SheetDocumento23 páginasRa-09 Abstract SheetYash DeoreAún no hay calificaciones

- It 000148938139 2024 01Documento1 páginaIt 000148938139 2024 01abdulraufattari69Aún no hay calificaciones

- Income Tax Declaration Form FY 22 23 AY 23 24Documento2 páginasIncome Tax Declaration Form FY 22 23 AY 23 24kishoreAún no hay calificaciones

- Obligation 2024Documento1 páginaObligation 2024Lovelyn SeverinoAún no hay calificaciones

- Income Tax Payment Challan: PSID #: 48978159Documento1 páginaIncome Tax Payment Challan: PSID #: 48978159Abdul SattarAún no hay calificaciones

- SBI LC Proposal ReviewDocumento5 páginasSBI LC Proposal ReviewNishit MarvaniaAún no hay calificaciones

- HQP-HLF-006 Loan Restructuring Computation SheetDocumento1 páginaHQP-HLF-006 Loan Restructuring Computation Sheetmaxx villaAún no hay calificaciones

- Partnership Accounts.Documento24 páginasPartnership Accounts.Bilal AhmedAún no hay calificaciones

- Income Tax Payment Challan: PSID #: 50454183Documento1 páginaIncome Tax Payment Challan: PSID #: 50454183Shehla FarooqAún no hay calificaciones

- T. R. Form No. 26 (T.R. 4.135 Sub-Rule (1) and Explanation 1 and T.R. 4.137)Documento5 páginasT. R. Form No. 26 (T.R. 4.135 Sub-Rule (1) and Explanation 1 and T.R. 4.137)sanat kr pratiharAún no hay calificaciones

- Employee Investment Details - Filled 2018-19Documento2 páginasEmployee Investment Details - Filled 2018-19RAVIAún no hay calificaciones

- Saeed KhanDocumento1 páginaSaeed Khanattock jadeedAún no hay calificaciones

- HIBIPL - Policy DetailsDocumento1 páginaHIBIPL - Policy DetailsRajveer AutoAún no hay calificaciones

- Form No. 16-ADocumento1 páginaForm No. 16-AJay100% (6)

- Income Tax Payment ChallanDocumento1 páginaIncome Tax Payment ChallanSyed Tahir ImamAún no hay calificaciones

- HSBC Common Transaction Form EditableDocumento2 páginasHSBC Common Transaction Form EditableadwanidsAún no hay calificaciones

- Fault Current Limiting Dynamic Voltage RestorerDocumento5 páginasFault Current Limiting Dynamic Voltage RestorerAnonymous DbmKEDxAún no hay calificaciones

- Power Management Strategy To Enhance Drive Range of Electric BicycleDocumento7 páginasPower Management Strategy To Enhance Drive Range of Electric BicycleAnonymous DbmKEDxAún no hay calificaciones

- Power Management Strategy To Enhance Drive Range of Electric BicycleDocumento7 páginasPower Management Strategy To Enhance Drive Range of Electric BicycleAnonymous DbmKEDxAún no hay calificaciones

- Notification 2019-20 PHD AdmissionDocumento34 páginasNotification 2019-20 PHD AdmissionphoenixAún no hay calificaciones

- Impact of Network Reconfiguration On Loss Allocation of Radial Distribution SystemsDocumento8 páginasImpact of Network Reconfiguration On Loss Allocation of Radial Distribution SystemsAnonymous DbmKEDxAún no hay calificaciones

- KTU PhD Regulations Amendments CircularDocumento13 páginasKTU PhD Regulations Amendments CircularAnonymous DbmKEDx100% (1)

- A Multi-Objective Method For Network ReconfigurationDocumento18 páginasA Multi-Objective Method For Network ReconfigurationAnonymous DbmKEDxAún no hay calificaciones

- Intelligent Control System For Efficient Energy Management in Commercial BuildingsDocumento6 páginasIntelligent Control System For Efficient Energy Management in Commercial BuildingsAnonymous DbmKEDxAún no hay calificaciones

- Energy Loss Allocation in Radial Distribution Systems A Comparison of Practical AlgorithmDocumento8 páginasEnergy Loss Allocation in Radial Distribution Systems A Comparison of Practical AlgorithmAnonymous DbmKEDxAún no hay calificaciones

- 10.1109@CETIC4.2018.8531024 Hari Deepa Savier Ic4 PDFDocumento6 páginas10.1109@CETIC4.2018.8531024 Hari Deepa Savier Ic4 PDFAnonymous DbmKEDxAún no hay calificaciones

- Digital Protection of Power System Series Question CETDocumento2 páginasDigital Protection of Power System Series Question CETAnonymous DbmKEDxAún no hay calificaciones

- 640 2020 KTUsyndicateorderonmigration PDFDocumento5 páginas640 2020 KTUsyndicateorderonmigration PDFAnonymous DbmKEDxAún no hay calificaciones

- Notification 2019-20 PHD AdmissionDocumento34 páginasNotification 2019-20 PHD AdmissionphoenixAún no hay calificaciones

- KTU ASST (ACADEMIC) 4339 2019CircularregardingQualifyingcertificatesDocumento1 páginaKTU ASST (ACADEMIC) 4339 2019CircularregardingQualifyingcertificatesAnonymous DbmKEDxAún no hay calificaciones

- GO (P) No44 2019 FinDated04 04 2019 - 83Documento7 páginasGO (P) No44 2019 FinDated04 04 2019 - 83Anonymous DbmKEDxAún no hay calificaciones

- KTU PhD Regulations Amendments CircularDocumento13 páginasKTU PhD Regulations Amendments CircularAnonymous DbmKEDx100% (1)

- GEC Thrissur KTU Results B.Tech S1 (S) Exam July 2019Documento6 páginasGEC Thrissur KTU Results B.Tech S1 (S) Exam July 2019Anonymous DbmKEDxAún no hay calificaciones

- 10 Dec 19 AebasDocumento3 páginas10 Dec 19 AebasAnonymous DbmKEDxAún no hay calificaciones

- CircularDocumento2 páginasCircularRaMeez Moh DAún no hay calificaciones

- Result GEC SreekrishnapuramDocumento7 páginasResult GEC SreekrishnapuramAnonymous DbmKEDxAún no hay calificaciones

- Regulation 2019Documento15 páginasRegulation 2019Anonymous DbmKEDxAún no hay calificaciones

- Result GEC Barton HillDocumento4 páginasResult GEC Barton HillAnonymous DbmKEDxAún no hay calificaciones

- Module 1 Synchonous Machine ModelDocumento25 páginasModule 1 Synchonous Machine ModelAnonymous DbmKEDxAún no hay calificaciones

- KTU Results B.Tech S1 (S) Exam July 2019Documento5 páginasKTU Results B.Tech S1 (S) Exam July 2019Anonymous DbmKEDxAún no hay calificaciones

- BRIDGE 2019 BrochureDocumento4 páginasBRIDGE 2019 BrochureAnonymous DbmKEDxAún no hay calificaciones

- Govt College of Eng TVM Electrical Electronics SyllabusDocumento112 páginasGovt College of Eng TVM Electrical Electronics SyllabusrenjithmukundanAún no hay calificaciones

- B.tech RegulationDocumento16 páginasB.tech RegulationAnonymous DbmKEDxAún no hay calificaciones

- Phasor Measurement Based Fault Detection and Blocking/De-Blocking of Distance Relay Under Power SwingDocumento6 páginasPhasor Measurement Based Fault Detection and Blocking/De-Blocking of Distance Relay Under Power SwingAnonymous DbmKEDxAún no hay calificaciones

- PH.D Regulations 2ndOctFinalDocumento18 páginasPH.D Regulations 2ndOctFinalAnonymous DbmKEDxAún no hay calificaciones

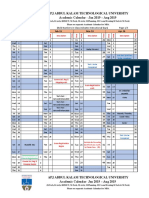

- Revised Academic Calender For Even Semester 2019Documento5 páginasRevised Academic Calender For Even Semester 2019Anonymous DbmKEDxAún no hay calificaciones

- G. M. Wagh - Property Law - Indian Trusts Act, 1882 (2021)Documento54 páginasG. M. Wagh - Property Law - Indian Trusts Act, 1882 (2021)Akshata SawantAún no hay calificaciones

- Audit Vault Admin PDFDocumento296 páginasAudit Vault Admin PDFNguyenAún no hay calificaciones

- Philippine Citizenship Denied Due to Absence After Filing PetitionDocumento6 páginasPhilippine Citizenship Denied Due to Absence After Filing Petitionalyssa bianca orbisoAún no hay calificaciones

- 2019 Graduation MessagesDocumento4 páginas2019 Graduation MessagesKevin ProvendidoAún no hay calificaciones

- Cambridge IGCSE™: Sociology 0495/22 October/November 2021Documento31 páginasCambridge IGCSE™: Sociology 0495/22 October/November 2021Elizabeth VargheseAún no hay calificaciones

- TDW Pipeline Pigging CatalogDocumento135 páginasTDW Pipeline Pigging CatalogShaho Abdulqader Mohamedali100% (1)

- Dissertation On BrexitDocumento37 páginasDissertation On BrexitChristopher P MurasiAún no hay calificaciones

- Indian Ethos and ManagementDocumento131 páginasIndian Ethos and ManagementdollyguptaAún no hay calificaciones

- Smart Parking BusinessDocumento19 páginasSmart Parking Businessjonathan allisonAún no hay calificaciones

- The Gazzat of PakistanDocumento236 páginasThe Gazzat of PakistanFaheem UllahAún no hay calificaciones

- Ang Mga Gabinete NG Pamahalaang Duterte 2019Documento2 páginasAng Mga Gabinete NG Pamahalaang Duterte 2019Eunice CorreaAún no hay calificaciones

- TNGST ACT 2017 (With Amendments)Documento168 páginasTNGST ACT 2017 (With Amendments)Darshni 18Aún no hay calificaciones

- Sagar Kailas Salunke Primary Account Holder Name: Your A/C StatusDocumento3 páginasSagar Kailas Salunke Primary Account Holder Name: Your A/C Statussagar_salunkeAún no hay calificaciones

- ResultGCUGAT 2018II - 19 08 2018Documento95 páginasResultGCUGAT 2018II - 19 08 2018Aman KhokharAún no hay calificaciones

- Nomination As Chairman - Haryana Biodiversity Board, Against VacancyDocumento149 páginasNomination As Chairman - Haryana Biodiversity Board, Against VacancyNaresh KadyanAún no hay calificaciones

- Bentham, Jeremy - Offences Against One's SelfDocumento25 páginasBentham, Jeremy - Offences Against One's SelfprotonpseudoAún no hay calificaciones

- Jei and Tabligh Jamaat Fundamentalisms-Observed PDFDocumento54 páginasJei and Tabligh Jamaat Fundamentalisms-Observed PDFAnonymous EFcqzrdAún no hay calificaciones

- DAC88094423Documento1 páginaDAC88094423Heemel D RigelAún no hay calificaciones

- Fraud, Internal Controls and Bank ReconciliationDocumento15 páginasFraud, Internal Controls and Bank ReconciliationSadia ShithyAún no hay calificaciones

- COMMERCIAL CORRESPONDENCE ADDRESSINGDocumento44 páginasCOMMERCIAL CORRESPONDENCE ADDRESSINGKarla RazvanAún no hay calificaciones

- 14-1 Mcdermott PDFDocumento12 páginas14-1 Mcdermott PDFDavid SousaAún no hay calificaciones

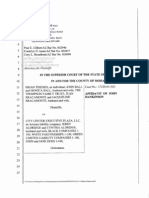

- Clem Amended ComplaintDocumento26 páginasClem Amended ComplaintstprepsAún no hay calificaciones

- Home - ECourt India Services Harpreet Singh by JN PatelDocumento2 páginasHome - ECourt India Services Harpreet Singh by JN PatelIasam Groups'sAún no hay calificaciones

- Tendernotice - 1 - 2022-02-15T184553.611Documento2 páginasTendernotice - 1 - 2022-02-15T184553.611Akhil VermaAún no hay calificaciones

- John Hankinson AffidavitDocumento16 páginasJohn Hankinson AffidavitRtrForumAún no hay calificaciones

- Resolution SEBC ReservationDocumento3 páginasResolution SEBC ReservationNishikant TeteAún no hay calificaciones

- Ublox - 2007 - ANTARIS 4 GPS Modules System Integration Manual PDFDocumento187 páginasUblox - 2007 - ANTARIS 4 GPS Modules System Integration Manual PDFCenascenascenascenasAún no hay calificaciones

- Accreditation of NGOs To BBIsDocumento26 páginasAccreditation of NGOs To BBIsMelanieParaynoDaban100% (1)